سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا، حسب النوع (أفلام معدنية غير منسوجة، أفلام شفافة، أفلام طلاء عضوية، أفلام طلاء أكسيد غير عضوي ، أخرى)، المادة (البلاستيك، الألومنيوم، أكاسيد، أخرى)، نوع التغليف (الأكياس، الأكياس، الأغطية، أفلام الانكماش، الأنابيب المصفحة، أخرى)، المستخدم النهائي (الأغذية، المشروبات، الأدوية، الأجهزة الإلكترونية، الأجهزة الطبية، الزراعة ، المواد الكيميائية، أخرى) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والرؤى

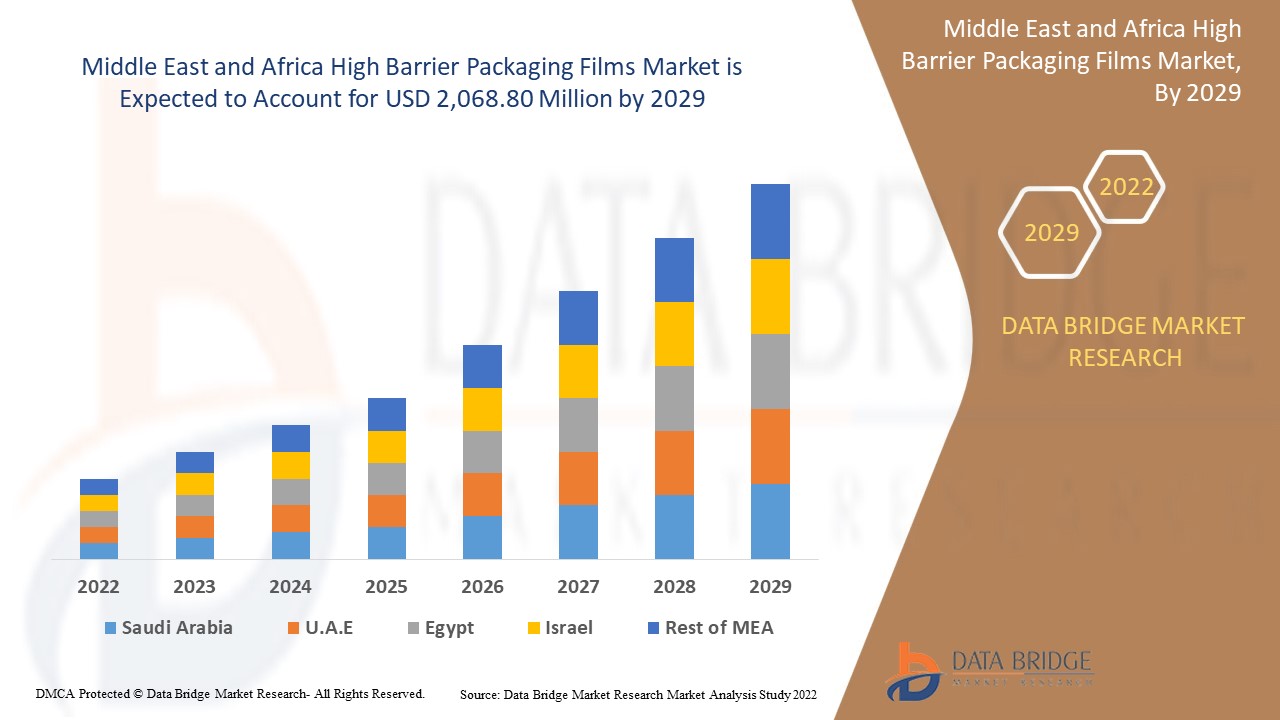

من المتوقع أن يكتسب سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا نموًا كبيرًا في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 6.8٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 2068.80 مليون دولار أمريكي بحلول عام 2029. العامل الأساسي الذي يحرك نمو سوق أفلام التغليف ذات الحاجز العالي هو الطلب المتزايد على التغليف متعدد الطبقات لمنع نفاذية الأكسجين والماء، والحاجة المتزايدة لأفلام التغليف ذات الحاجز العالي لعمر تخزين أطول، وتحول تفضيل المستهلك نحو الأغذية المعبأة، والاعتماد المتزايد لأفلام التغليف ذات الحاجز العالي في صناعة الأدوية والزراعة.

تساعد أغشية التغليف ذات الحاجز العالي على منع ملامسة الأكسجين أو ثاني أكسيد الكربون أو الرطوبة مع الحد من تأثير الزيوت المعدنية والأشعة فوق البنفسجية. كما أن الحاجز القوي الذي تم إنشاؤه باستخدام المواد الوظيفية المستخدمة في غشاء التغليف يحمل أيضًا صفات الطعام مثل اللون والطعم والملمس والرائحة والنكهة. تلعب أغشية الحاجز العالي دورًا مهمًا في تزويد المنتجات بالخصائص المطلوبة وتساعد في إطالة عمر المنتج. كما أنها تساعد في جعل الهيكل قابلاً لإعادة التدوير مع جميع الطبقات المتعلقة بنفس عائلة البوليمرات. علاوة على ذلك، تتميز أغشية الحاجز العالي ببنية غير منفذة ومضغوطة ومرنة. إنها خالية من المذيبات وعادة لا تتفاعل مع الأطعمة المعبأة.

علاوة على ذلك، تؤثر الشعبية المتزايدة للأطعمة الجاهزة للأكل على تحول المستهلك نحو المنتجات المعبأة. كما يساهم التوازن المحموم بين العمل والحياة وزيادة عبء العمل في زيادة الطلب على الأطعمة المعبأة من قبل المهنيين العاملين. وبالتالي، مع الطلب المتزايد على الأطعمة المعبأة، من المتوقع أن يعمل سوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا على دفع نمو السوق.

يقدم تقرير سوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنة تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب النوع (أفلام معدنية غير منسوجة، أفلام شفافة، أفلام طلاء عضوية، أفلام طلاء أكسيد غير عضوي، أخرى)، المادة (بلاستيك، ألومنيوم، أكاسيد، أخرى)، نوع التغليف (أكياس، أكياس، أغطية، أفلام انكماش، أنابيب مغلفة، أخرى)، المستخدم النهائي (الأغذية، المشروبات، الأدوية، الأجهزة الإلكترونية، الأجهزة الطبية، الزراعة، المواد الكيميائية). |

|

الدول المغطاة |

مصر والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا وإسرائيل وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

Advanced Converting Works، Constantia Flexibles، HPM MIDDLE EAST & AFRICA INC، FLAIR Flexible Packaging Corporation، ClearBags، Perlen Packaging، OLIVER، Celplast Metallized Products، Toray Plastics (America)، Inc. (شركة تابعة لشركة Toray Industries Inc)، ISOFlex Packaging، KREHALON، MULTIVAC، BERNHARDT Packaging & Process، Sonoco Products Company، Sealed Air، WINPAL LTD.، Schur Flexibles Holding GesmbH، Amcor Ltd. |

تعريف السوق

تتضمن حلول التغليف المرنة لأغشية التغليف ذات الحاجز العالي الأكياس والحقائب والأغطية والأغشية المنكمشة والأنابيب المغلفة وما إلى ذلك. يمكن إعادة إغلاق الأكياس بسحّابات واستبدال تصميمات العبوات الصلبة، مثل البرطمانات الزجاجية والعلب المعدنية، حيث تشجع متطلبات العملاء المتزايدة لسلامة المنتج وراحته الأكياس في أنواع التغليف ذات الحاجز العالي. كما تحمي الأكياس المنتج من التأثيرات الخارجية، مثل الرطوبة والضوء والتلوث البيولوجي والغازات والأضرار الميكانيكية، مما يؤثر على جودته أو فعاليته.

ديناميكيات سوق أغشية التغليف عالية الحاجز في الشرق الأوسط وأفريقيا

السائقين

- تزايد الطلب على التغليف متعدد الطبقات لمنع الأكسجين والماء

تساعد الطبقات المتعددة الموجودة في أغشية التغليف ذات الحاجز العالي على منع ملامسة الأكسجين والرطوبة والغازات الأخرى مثل ثاني أكسيد الكربون وتقييد تأثير الزيوت المعدنية والأشعة فوق البنفسجية. يساعد هذا الحاجز القوي الذي تم إنشاؤه باستخدام مواد وظيفية في الحفاظ على سلامة المواد المخزنة فيها، مثل جودة الطعام، مثل لونه وطعمه وملمسه ورائحته ونكهته. للحفاظ على سلامة المنتج، من المهم جدًا تزويده بخصائص الحاجز المهمة للغاية مثل الرطوبة والغاز والرائحة. تلعب أغشية الحاجز العالي دورًا رئيسيًا في تزويد المنتجات بهذه الخصائص المطلوبة. علاوة على ذلك، تتميز أغشية الحاجز العالي ببنية غير منفذة ومرنة، مما يجعلها خالية من المذيبات ولا تتفاعل مع العناصر المعبأة مثل الأدوية والأطعمة وغيرها.

- الطلب المتزايد على أغشية التغليف ذات الحاجز العالي للحصول على عمر تخزين أطول

كما تشهد مبيعات الأطعمة المعالجة والمجمدة ارتفاعًا مع ابتعاد العديد من المستهلكين عن الأطعمة الطازجة لصالح تخزين الأطعمة ذات مدة الصلاحية الأطول. إن نمط الحياة المزدحم للمستهلكين والطلب الناتج عن ذلك على تغليف الأطعمة المريح يدفع الحاجة إلى أفلام ذات حاجز عالٍ في السوق. ومع تزايد وعي المستهلكين بتأثير سلوكهم على البيئة، فإنهم مهتمون بشكل متزايد بطرق ملموسة لتقليل بصمتهم البيئية. والآن أكثر من أي وقت مضى، يسعى المستهلكون إلى شراء المنتجات التي تعكس قيمهم والتي يتم الحصول عليها وإنتاجها وتعبئتها بشكل مستدام قدر الإمكان. يعد طول مدة الصلاحية العامل الرئيسي الذي يضعه المستهلكون في اعتبارهم هذه الأيام.

- تحول تفضيلات المستهلكين نحو الأغذية المعبأة

تشهد أفلام التغليف ذات الحاجز العالي طلبًا كبيرًا من صناعة الأغذية والمشروبات مع زيادة الاستهلاك والطلب على الأطعمة المعبأة الجاهزة للأكل. علاوة على ذلك، مع ارتفاع الدخل المتاح، أصبح المهنيون العاملون والطلاب على استعداد لإنفاق المزيد من الأموال على الأطعمة المعبأة والمنتجات المريحة الجاهزة للأكل، مما يجعل سوق أفلام التغليف ذات الحاجز العالي ينمو في المستقبل القريب. هناك طلب كبير على الأطعمة الجاهزة للطهي والأكل، والأطعمة المجمدة إلى الميكروويف، والوجبات الجاهزة المعبأة، والأطعمة المصنعة، والتي يسهل حملها وفتحها وتتطلب وقتًا أقل للتحضير.

- زيادة استخدام أغشية التغليف ذات الحاجز العالي في صناعة الأدوية والزراعة

يفرض قطاع الأدوية مطالب مختلفة على حلول التغليف، مثل العزل عن البيئة الخارجية، ومستويات عالية من الحماية، والفعالية من حيث التكلفة، وسهولة المناولة. وبالتالي، تُستخدم أغشية التغليف ذات الحاجز العالي على نطاق واسع لأن هذه الأغشية لا تسمح بتبادل الغازات عبر العبوة وتتحكم في درجة الحرارة داخل العبوة، وبالتالي زيادة نمو السوق. المواد الأساسية للتغليف هي البلاستيك لأنها تحمي المنتج الصيدلاني من الأكسجين والرائحة، وانتقال بخار الماء، والرطوبة، والتلوث، والبكتيريا. تجعل هذه الخصائص مادة البولي بروبيلين خيارًا جيدًا للتغليف عالي الحاجز. تتميز أغشية البولي بروبيلين عالية الحاجز بنقطة انصهار عالية، مما يجعلها مناسبة للعبوات القابلة للغليان والمنتجات القابلة للتسلسل.

فرص

- اعتماد متزايد على أغشية التغليف عالية الحاجز القابلة للتحلل البيولوجي

بسبب قضايا إعادة التدوير وحلول التغليف المبتكرة القابلة للتحلل البيولوجي، من المتوقع أن ينمو سوق أفلام التغليف ذات الحاجز العالي في المستقبل القريب مع استمرار منتجي المواد في تطوير أفلام بلاستيكية ومواد مضافة جديدة ومحسنة لإنتاج التغليف. وتشمل هذه الأفلام ذات الحاجز العالي وأفلام الاستبدال بالرقائق، وأفلام مانعة للتسرب وأفلام قابلة لإعادة التدوير والتحلل بشكل طبيعي بسهولة أكبر. يعد تقليل استخدام المواد اتجاهًا رئيسيًا آخر في جميع أنحاء صناعة التغليف وصنع الأكياس، إما من خلال أفلام أرق أو طبقات فيلم أقل.

- ارتفاع الطلب على التغليف الصديق للعملاء

هناك بعض النقاط الرئيسية التي يبحث عنها المستهلكون قبل اختيار أفلام التغليف. بعضها يتعلق بالنظافة وسلامة الغذاء، ومدة الصلاحية، وسهولة الاستخدام، والمتانة، والمعلومات الموجودة على الملصق، والمظهر، والتأثيرات البيئية. يهتم المستهلكون أكثر بالتغليف القائم على الألياف الموجود في البلاستيك المعاد تدويره والقابل لإعادة التدوير. لذلك، مع الاتجاه المتزايد والطلب على التغليف الصديق للعملاء، هناك فرصة كبيرة لسوق أفلام التغليف ذات الحاجز العالي للاستفادة منها لتسجيل نمو كبير في المستقبل. يمكن القيام بذلك من خلال إطلاق المزيد من المنتجات المطلوبة من العملاء والتي تكون مريحة في الاستخدام ومستدامة وصديقة للبيئة.

القيود/التحديات

- قابلية التدهور

عند تعرضها للحرارة، يمكن أن تغير آلية أكسدة الأغشية البلاستيكية. ومع ذلك، لا يمكن تحقيق التحلل الكامل للبوليمرات القابلة للتحلل البيولوجي إلا في ظل ظروف خاضعة للرقابة مثل ارتفاع درجة الحرارة والضغط، والتي لا توجد في البيئة الطبيعية مثل الموائل المائية والبحرية. لذلك، عندما لا تكون في ظروف مثالية، من المتوقع أن تتحلل أغشية التغليف ذات الحاجز العالي وتدمر خصائص هذه الأغشية. قد يحد هذا من نمو سوق أغشية التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا.

- تقلبات أسعار المواد الخام

يتم تصنيع أفلام التغليف ذات الحاجز العالي المختلفة باستخدام مجموعة متنوعة من المواد الخام. بعض هذه المواد الخام هي مواد بلاستيكية مثل البولي إيثيلين والبولي بروبيلين، والمعادن مثل الألومنيوم، من بين العديد من المواد الأخرى. هذه المواد غير قابلة للتحلل البيولوجي، ويصعب إعادة تدويرها، وهي ضارة بالبيئة، بما في ذلك المياه والأرض. يعتمد اختيار المواد الخام في المقام الأول على الاستخدام النهائي لأفلام الحاجز. بعض المواد الخام الرئيسية المستخدمة في أفلام التغليف تشمل LDPE وLLDPE وHDPE وBOPP وCPP وBOPET وPVC وEVOH وPLA وPVDC وPVOH وغيرها الكثير.

- قضية تتعلق بإعادة تدوير الأفلام متعددة الطبقات

عند النظر في التأثيرات البيئية، فإن حلول التغليف هذه فعالة للغاية، لكن المشكلة هي أنها نادراً ما يتم إعادة تدويرها في البنية التحتية لإدارة النفايات الحالية. كما هو الحال في أوروبا، تعتمد وحدات إعادة التدوير على نطاق واسع على الأساليب التقليدية لإعادة التدوير الميكانيكي في عمليات إزالة الحبيبات، والتي تقوم بمعالجة مشتركة للمواد. يعد عدم التوافق الحراري للمواد المركبة المتنوعة عقبة رئيسية في إعادة المعالجة. ومع ذلك، تتوفر تقنيات جديدة مثل إعادة التدوير الكيميائي، بنتائج واعدة، لكنها تحتاج إلى مزيد من التحقيق العميق والارتقاء، الأمر الذي سيستغرق وقتًا واستثمارات رأسمالية ضخمة. وهذا بدوره يشكل تحديًا كبيرًا في مسار تطوير ونمو سوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا.

- التنظيم الحكومي الصارم والمخاوف البيئية

تُصنع أغشية التغليف عالية الحاجز بشكل أساسي من مواد بلاستيكية، مثل البولي إيثيلين والبولي بروبيلين وما إلى ذلك. هذه المواد غير قابلة للتحلل البيولوجي، ويصعب إعادة تدويرها، وهي ضارة بالبيئة، بما في ذلك المياه والأرض. لذلك، عملت الحكومات والهيئات التنظيمية والمدافعون عن البيئة على نشر الوعي بشأن مخاطر استخدام مثل هذه الأغشية. في قطاع التغليف، هناك أكثر من 40% من استخدام البلاستيك. يستغرق البلاستيك سنوات حتى يتحلل، وبالتالي، لا تفضل العديد من البلدان استهلاكه واستخدامه في أي صناعة.

كان لـ COVID-19 تأثير ضئيل على سوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا

أثرت جائحة كوفيد-19 على العديد من الصناعات التحويلية في عام 2020-2021 حيث أدت إلى إغلاق أماكن العمل وتعطيل سلاسل التوريد والقيود المفروضة على النقل. ومع ذلك، لوحظ تأثير كبير على سوق أفلام التغليف ذات الحاجز العالي. كانت عمليات وسلسلة توريد أفلام التغليف ذات الحاجز العالي، مع مرافق تصنيع متعددة، لا تزال تعمل في المنطقة. واصل مقدمو الخدمة تقديم أفلام التغليف ذات الحاجز العالي باتباع تدابير التعقيم والسلامة في سيناريو ما بعد كوفيد.

التطورات الأخيرة

- في مايو 2021، استثمر قسم التنقل والمواد في شركة دوبونت 5 ملايين دولار أمريكي في رأس المال والموارد التشغيلية في منشآت التصنيع التابعة لها في ألمانيا وسويسرا لزيادة قدرتها.

نطاق سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا

يتم تصنيف سوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا على أساس النوع والمادة ونوع التغليف والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعة وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- أفلام معدنية غير منسوجة

- أفلام شفافة

- أفلام الطلاء العضوية

- أفلام طلاء أكسيد غير عضوي

- آحرون

وفقًا للنوع، يتم تصنيف سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا إلى خمسة قطاعات: الأفلام المعدنية غير المنسوجة، والأفلام الشفافة، وأفلام الطلاء العضوي، وأفلام طلاء الأكسيد غير العضوي، وغيرها.

مادة

- بلاستيك

- الألومنيوم

- أكاسيد

- آحرون

وفقًا للمادة، يتم تصنيف سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا إلى أربعة قطاعات: البلاستيك والألمنيوم والأكاسيد وغيرها.

نوع التغليف

- الأكياس

- أكياس

- الأغطية

- أفلام الانكماش

- الأنابيب المصفحة

- آحرون

بناءً على نوع التغليف، يتم تصنيف سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا إلى ستة قطاعات: الأكياس، والحقائب، والأغطية، والأغشية المنكمشة، والأنابيب المغلفة، وغيرها.

المستخدم النهائي

- طعام

- المشروبات

- المستحضرات الصيدلانية

- الأجهزة الإلكترونية

- الأجهزة الطبية

- زراعة

- المواد الكيميائية

- آحرون

بناءً على المستخدم النهائي، يتم تقسيم سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا إلى الأغذية والمشروبات والأدوية والأجهزة الإلكترونية والأجهزة الطبية والزراعة والمواد الكيميائية وغيرها.

تحليل/رؤى إقليمية لسوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا

يتم تقسيم سوق أغشية التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا على أساس النوع والمادة ونوع التغليف والمستخدم النهائي.

الدول التي تتواجد فيها أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا هي مصر والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا وإسرائيل وبقية دول الشرق الأوسط وأفريقيا. تهيمن جنوب أفريقيا على سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا من حيث حصة السوق وإيرادات السوق وستستمر في تعزيز هيمنتها خلال فترة التوقعات. ويرجع هذا إلى زيادة عدد الزوار في المستشفيات ومراكز التشخيص.

كما يقدم قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات وتحليل سلسلة القيمة المصب والمصب والاختبار الفني وتحليل قوى بورتر الخمس ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق أفلام التغليف عالية الحاجز في الشرق الأوسط وأفريقيا.

بعض المشاركين البارزين الذين يعملون في سوق أفلام التغليف ذات الحاجز العالي في الشرق الأوسط وأفريقيا هم Advanced Converting Works و Constantia Flexibles و HPM MIDDLE EAST & AFRICA INC و FLAIR Flexible Packaging Corporation و ClearBags و Perlen Packaging و OLIVER و Celplast Metallized Products و Toray Plastics (America)، Inc. (شركة تابعة لشركة Toray Industries Inc) و ISOFlex Packaging و KREHALON و MULTIVAC و BERNHARDT Packaging & Process و Sonoco Products Company و Sealed Air و WINPAL LTD. و Schur Flexibles Holding GesmbH و Amcor Ltd.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق البحث في DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكات وضع البائعين، وتحليل الخط الزمني للسوق، ونظرة عامة على السوق والدليل، وشبكات وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، والشرق الأوسط وأفريقيا مقابل المنطقة، وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 KEY PATENT LAUNCHED

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGY ADVANCEMENTS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATORY COVERAGE

5 REGIONAL SUMMARY

5.1 MIDDLE EAST & AFRICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR MULTI-LAYER PACKAGING FOR PREVENTING OXYGEN AND WATER

6.1.2 GROW IN DEMAND FOR HIGH BARRIER PACKAGING FILMS FOR LONGER SHELF-LIFE

6.1.3 SHIFTING CONSUMER PREFERENCE TOWARD THE PACKAGED FOOD

6.1.4 RISE IN ADOPTION OF HIGH BARRIER PACKAGING FILMS IN PHARMACEUTICAL AND AGRICULTURE INDUSTRY

6.2 RESTRAINTS

6.2.1 SUSCEPTIBILITY TO DEGRADATION

6.2.2 FLUCTUATION IN PRICES OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROW IN ADOPTION OF BIODEGRADABLE HIGH BARRIER PACKAGING FILMS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.4 CHALLENGES

6.4.1 ISSUE RELATED TO RECYCLING OF MULTI-LAYER FILMS

6.4.2 STRICT GOVERNMENT REGULATION AND ENVIRONMENTAL CONCERNS

7 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-WOVEN METALIZED FILMS

7.3 CLEAR FILMS

7.4 ORGANIC COATING FILMS

7.5 INORGANIC OXIDE COATING FILMS

7.6 OTHERS

7.6.1 ALUMINIUM FOIL

7.6.2 REST OF OTHERS

8 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE (PE)

8.2.2 POLYPROPYLENE (PP)

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.4 ETHYLENE VINYL ALCOHOL (EVOH)

8.2.5 POLYETHYLENE NAPHTHALATE (PEN)

8.2.6 POLYVINYLIDENE CHLORIDE (PVDC)

8.2.7 POLYAMIDE (NYLON)

8.2.8 OTHERS (LCD, PS, PVC, PLA, PA)

8.3 ALUMINIUM

8.4 OXIDES

8.4.1 SILICON OXIDE

8.4.2 ALUMINUM OXIDE

8.5 OTHERS

9 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES

9.3 BAGS

9.4 LIDS

9.5 SHRINK FILMS

9.6 LAMINATED TUBES

9.7 OTHERS

10 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD

10.2.1 MEAT, SEA FOOD & POULTRY

10.2.2 READY TO EAT MEALS

10.2.3 SNACKS

10.2.4 DAIRY FOODS

10.2.5 BAKERY & CONFECTIONARY

10.2.6 BABY FOOD

10.2.7 PET FOOD

10.2.8 OTHER FOOD

10.3 BEVERAGES

10.3.1 NON-ALCOHOLIC BEVERAGES

10.3.2 ALCOHOLIC BEVERAGES

10.4 PHARMACEUTICALS

10.5 ELECTRONIC DEVICES

10.6 MEDICAL DEVICES

10.7 AGRICULTURE

10.8 CHEMICALS

10.9 OTHERS

11 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 EGYPT

11.1.3 SAUDI ARABIA

11.1.4 UNITED ARAB EMIRATES

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 ACQUISITION

12.3 PRODUCT LAUNCH

12.4 AWARD

12.5 CONFERENCE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AMCOR PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 DUPONT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 SONOCO PRODUCTS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 BERRY MIDDLE EAST & AFRICA INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 SEALED AIR

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADVANCED CONVERTING WORKS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BERNHARDT PACKAGING & PROCESS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELPLAST METALLIZED PRODUCTS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CLEARBAGS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONSTANTIA FLEXIBLES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 FLAIR FLEXIBLE PACKAGING CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 HPM MIDDLE EAST & AFRICA INC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 ISOFLEX PACKAGING

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 KREHALON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT UPDATES

14.15 MULTIVAC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 OLIVER

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 PERLEN PACKAGING

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATE

14.18 SCHUR FLEXIBLES HOLDING GESMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 TORAY PLASTICS (AMERICA), INC. (SUBSIDIARY OF TORAY INDUSTRIES INC)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT UPDATES

14.2 WINPAK LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 5 MIDDLE EAST & AFRICA NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 MIDDLE EAST & AFRICA CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 MIDDLE EAST & AFRICA ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 MIDDLE EAST & AFRICA INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 17 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 19 MIDDLE EAST & AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 MIDDLE EAST & AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 23 MIDDLE EAST & AFRICA ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 MIDDLE EAST & AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 27 MIDDLE EAST & AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 31 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 33 MIDDLE EAST & AFRICA POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS )

TABLE 35 MIDDLE EAST & AFRICA BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 MIDDLE EAST & AFRICA LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 MIDDLE EAST & AFRICA SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 MIDDLE EAST & AFRICA LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 47 MIDDLE EAST & AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 MIDDLE EAST & AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 51 MIDDLE EAST & AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 53 MIDDLE EAST & AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 55 MIDDLE EAST & AFRICA PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 57 MIDDLE EAST & AFRICA ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 59 MIDDLE EAST & AFRICA MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 61 MIDDLE EAST & AFRICA AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 63 MIDDLE EAST & AFRICA CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 65 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 67 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 69 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 MIDDLE EAST AND AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 75 MIDDLE EAST AND AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 77 MIDDLE EAST AND AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 79 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 81 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 83 MIDDLE EAST AND AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 85 MIDDLE EAST AND AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 87 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 89 SOUTH AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 93 SOUTH AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SOUTH AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 95 SOUTH AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 99 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 101 SOUTH AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 103 SOUTH AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 105 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 107 EGYPT OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 EGYPT OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 109 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 110 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 111 EGYPT PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 EGYPT PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 113 EGYPT OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 EGYPT OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 116 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 117 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 119 EGYPT FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 EGYPT FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 121 EGYPT BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 EGYPT BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 123 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 125 SAUDI ARABIA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 127 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 129 SAUDI ARABIA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 131 SAUDI ARABIA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SAUDI ARABIA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 135 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 137 SAUDI ARABIA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 SAUDI ARABIA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 139 SAUDI ARABIA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 SAUDI ARABIA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 141 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 143 UNITED ARAB EMIRATES OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 UNITED ARAB EMIRATES OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 145 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 146 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 147 UNITED ARAB EMIRATES PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 UNITED ARAB EMIRATES PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 149 UNITED ARAB EMIRATES OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 UNITED ARAB EMIRATES OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 151 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 152 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 153 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 154 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 155 UNITED ARAB EMIRATES FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 156 UNITED ARAB EMIRATES FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 157 UNITED ARAB EMIRATES BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 UNITED ARAB EMIRATES BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 159 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 161 ISRAEL OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 ISRAEL OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 163 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 164 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 165 ISRAEL PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 ISRAEL PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 167 ISRAEL OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 ISRAEL OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 169 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 170 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 171 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 173 ISRAEL FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 ISRAEL FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 175 ISRAEL BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 ISRAEL BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 177 REST OF MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 2 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SHIFTING CONSUMER PREFERENCE TOWARDS THE PACKAGED FOOD IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET FROM 2022 TO 2029

FIGURE 16 NON-WOVEN METALIZED FILMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET IN 2022 & 2029

FIGURE 17 SUPPLY CHAIN ANALYSIS- MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 20 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY MATERIAL, 2021

FIGURE 22 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY PACKAGING TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY END USER, 2021

FIGURE 24 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE (2022 - 2029)

FIGURE 29 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.