سوق اختبارات مسببات الحساسية الغذائية وعدم تحملها في الشرق الأوسط وأفريقيا، حسب نوع الاختبار ( اختبار مسببات الحساسية ، اختبار عدم تحمل الطعام)، الطريقة (داخل المختبر، داخل الجسم الحي)، المستخدم النهائي (المستخدم النهائي لاختبار مسببات الحساسية، المستخدم النهائي لاختبار عدم تحمل الطعام) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والرؤى

تعتبر سلامة وجودة الغذاء من الشواغل الرئيسية لتصنيع الأغذية وصناعة التجزئة والضيافة. ولها تأثير على الإنتاجية. تتزايد حساسية الطعام على مستوى العالم، بما في ذلك عدد المواد المسببة للحساسية ومعدل التحسس ومعدل الانتشار. لحماية الأفراد الذين يعانون من حساسية الطعام في المجتمع، يجب إدارة حساسية الطعام بشكل مناسب واختبارها في الأطعمة المصنعة ووضع العلامات عليها بشكل صحيح. زاد وجود اختبار المواد المسببة للحساسية مؤخرًا، ويمكن لمختبرات الاختبار المساعدة في الكشف عن هذه المواد المسببة للحساسية. تتمثل الوظيفة الأكثر أهمية لمختبرات مسببات الحساسية الغذائية في اختبار الأطعمة بحثًا عن وجود مسببات الحساسية مثل فول الصويا ومنتجات الألبان والفول السوداني والمكسرات الشجرية وغيرها.

يتزايد الطلب على اختبار الأغذية، وهو ما يجعل الشركات المصنعة تشارك في إطلاق المنتجات الجديدة والعروض الترويجية والجوائز والشهادات والمشاركة في الفعاليات في السوق. وتؤدي هذه القرارات في نهاية المطاف إلى تعزيز نمو السوق.

يقدم تقرير سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل لتأثير الإيرادات لتحقيق هدفك المنشود. المبادرات الاستراتيجية مثل التعاون والاتفاق وتوقيع اتفاقيات المبيعات لاختراع وابتكار العلاجات الدوائية هي المحركات الرئيسية التي دفعت الطلب على السوق في فترة التنبؤ.

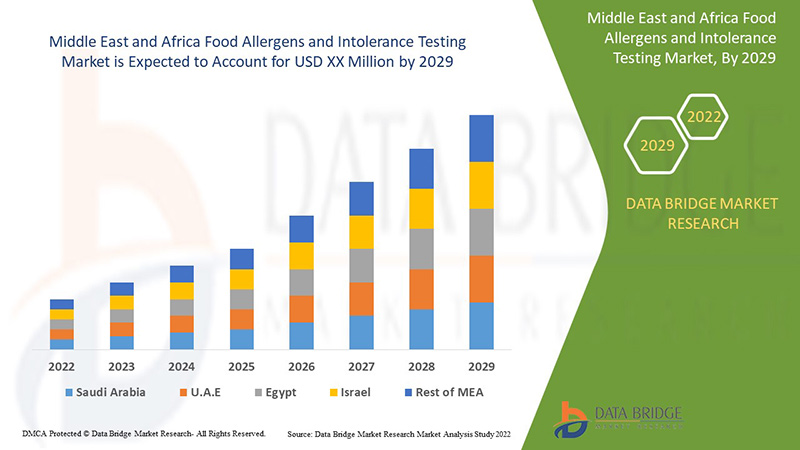

إن سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام داعم ويهدف إلى الحد من تطور المرض. وتشير تحليلات Data Bridge Market Research إلى أن سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام سينمو بمعدل نمو سنوي مركب يبلغ 5.8% خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب نوع الاختبار (اختبار المواد المسببة للحساسية، اختبار عدم التحمل)، الطريقة (داخل المختبر، داخل الجسم الحي)، المستخدم النهائي (المستخدم النهائي لاختبار المواد المسببة للحساسية، المستخدم النهائي لاختبار عدم التحمل) |

|

الدول المغطاة |

المملكة العربية السعودية، جنوب أفريقيا، الإمارات العربية المتحدة، عمان، قطر، الكويت، بقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

SGS SA، Agilent Technologies, Inc.، NEOGEN Corporation، ALS Limited، Mérieux NutriSciences، Eurofins Scientific، Intertek Group plc، TÜV SÜD، Bureau Veritas، Symbio Laboratories، RJ Hill Laboratories Limited، NSF International، Healthy Stuff Online Limited، QIMA، IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH، ADPEN LABORATORIES, INC.، AsureQuality، Microbac Laboratories, Inc، Romer Labs Division Holding GmbH، FOOD SAFETY NET SERVICES، PCAS Labs، Element Materials Technology، OMIC USA Inc، وغيرها. |

تعريف السوق

حساسية الطعام هي رد فعل مناعي يحدث بعد تناول طعام معين. حتى كمية ضئيلة من الطعام المسبب للحساسية يمكن أن تؤدي إلى ظهور علامات وأعراض مثل مشاكل الجهاز الهضمي أو الشرى أو تورم مجاري الهواء. في بعض الأشخاص، يمكن أن تسبب حساسية الطعام أعراضًا شديدة أو حتى رد فعل يهدد الحياة يُعرف باسم الحساسية المفرطة. من ناحية أخرى، يحدث عدم تحمل الطعام عندما يواجه الشخص صعوبة في هضم طعام معين. يمكن أن يؤدي هذا إلى أعراض مثل الغازات المعوية أو آلام البطن أو الإسهال. اختبار المواد المسببة للحساسية وعدم تحمل الطعام هو التحليل العلمي للطعام ومحتوياته للكشف عن المواد المسببة للحساسية. يتم ذلك لتوفير معلومات حول المكونات المسببة للحساسية المختلفة للطعام، بما في ذلك البنية والتكوين والخصائص الفيزيائية والكيميائية للطعام. يمكن إجراء اختبار المنتجات الغذائية باستخدام العديد من الطرق المتقدمة للغاية لتوفير معلومات دقيقة حول القيمة الغذائية وسلامة الطعام.

إن اختبار الأغذية وتحليلها أمر ضروري لضمان سلامة الأغذية وضمان سلامتها للاستهلاك. ويشمل ذلك تعزيز شبكة مختبرات اختبار الأغذية، وضمان جودة اختبار الأغذية، والاستثمار في الموارد البشرية، وتنفيذ أنشطة المراقبة، وتثقيف المستهلكين.

ديناميكيات سوق اختبارات مسببات الحساسية الغذائية وعدم تحملها

السائقين

- تزايد انتشار حساسية الطعام وعدم تحمله

وفقاً لمنظمة الصحة العالمية، تؤثر الحساسية على ما يصل إلى 40% من سكان العالم، وتتزايد نسبة المصابين بها في المدن الكبرى والبلدان الصناعية. ويمكن أن تسبب الحساسية أمراضاً مزمنة، وفي حالة بعض أنواع الحساسية الغذائية، يمكن أن تكون قاتلة. وقد برزت حساسية الطعام كمشكلة صحية عامة خطيرة. ويقدر انتشار حساسية الطعام بنحو 2-4% لدى البالغين و6-8% لدى الأطفال. وفي الدول الغربية، أفادت التقارير أن حساسية الطعام التي يتم تشخيصها عن طريق التحدي تصل إلى 10%، مع ملاحظة أعلى انتشار بين الأطفال الأصغر سناً. وهناك أيضاً أدلة متزايدة على زيادة انتشار الحساسية في الدول النامية، حيث أفادت التقارير أن معدلات حساسية الطعام التي يتم تشخيصها عن طريق التحدي في الصين وأفريقيا مماثلة لتلك الموجودة في الدول الغربية. ومن الملاحظات المثيرة للاهتمام أن الأطفال من أصل شرق آسيوي أو أفريقي المولودين في بيئة غربية هم أكثر عرضة لحساسية الطعام مقارنة بالأطفال القوقازيين؛ ويؤكد هذا الاكتشاف المثير للاهتمام على أهمية التفاعلات بين الجينوم والبيئة ويتنبأ بزيادات مستقبلية في حساسية الطعام في آسيا وأفريقيا مع استمرار النمو الاقتصادي في هذه المناطق. في حين أن حساسية حليب البقر والبيض من أكثر أنواع حساسية الطعام شيوعًا في معظم البلدان، إلا أنه يمكن ملاحظة أنماط مختلفة من حساسية الطعام في مناطق جغرافية فردية تحددها أنماط التغذية في كل بلد. وعلاوة على ذلك، مع ردود الفعل السلبية غير السامة (فرط الحساسية)، فإن معدل انتشار حساسية الطعام يتزايد بشكل كبير. وقد دفع العدد المتزايد من حالات حساسية الطعام السلطات الصحية العامة في جميع أنحاء العالم إلى اتخاذ تدابير كبيرة للحد من ردود فعل الحساسية وعواقبها.

- إن تنوع الأطعمة المعرضة للحساسية يخلق الحاجة إلى إجراء الاختبار

بدءًا من أغذية الأطفال إلى المخبوزات والحلويات ومنتجات الألبان والمشروبات والسلع الغذائية ومنتجات اللحوم، كلها عرضة للتسبب في الحساسية، مما يخلق سوقًا كبيرًا لاختبار المواد المسببة للحساسية الغذائية. علاوة على ذلك، نظرًا لسوء جودة الأعلاف الحيوانية، هناك دائمًا احتمال أن تتسبب اللحوم في حدوث حساسية لدى البشر. على الرغم من أن صناعة الأغذية والمشروبات تلاحظ زيادة في الطلب على إضافات الأعلاف الحيوانية القادرة على تحسين جودة الأعلاف، إلا أن سوق اختبار عدم تحمل الطعام لا يزال له أهمية في تخفيف الحساسية الناجمة عن اللحوم.

على الرغم من أن أكثر من 170 طعامًا تم تحديدها على أنها تسبب الحساسية الغذائية لدى المستهلكين الحساسين، فقد حددت وزارة الزراعة الأمريكية وإدارة الغذاء والدواء ثمانية أطعمة رئيسية مسببة للحساسية، استنادًا إلى قانون وضع العلامات على المواد المسببة للحساسية الغذائية وحماية المستهلك لعام 2004.

فرصة

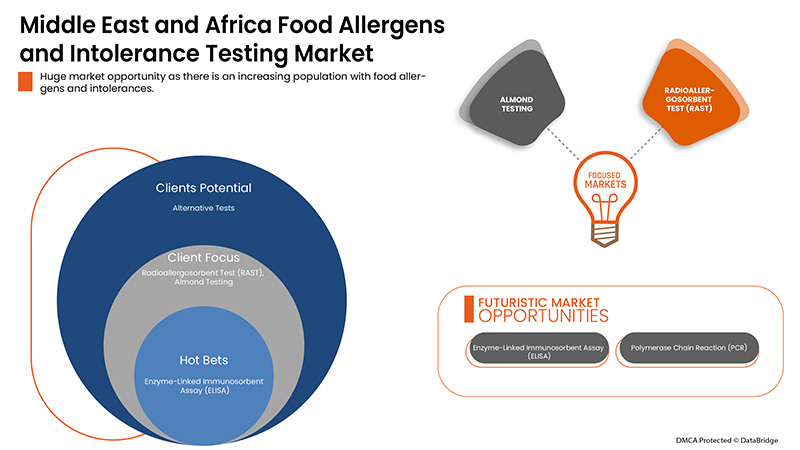

- اختبار المواد المسببة للحساسية الغذائية في الأسواق الناشئة

وفقًا لمنظمة الحساسية العالمية (WAO)، تراوحت حالات الحساسية المفرطة في غرف الطوارئ من 222 و300-350 و3000 حالة سنويًا في المجر واليابان والصين على التوالي. وعلاوة على ذلك، تقدر المنظمة معدل انتشار الحساسية المفرطة بنحو 2% و0.1% و0.6-1% من السكان في الولايات المتحدة وكوريا وأستراليا. وقد جعلت إدارة الغذاء والدواء سلامة الغذاء جانبًا ضروريًا لصناعة الأغذية، وهو ما يعمل كعامل محرك للسوق. وعلاوة على ذلك، كانت هناك زيادة ملحوظة في عدد الأشخاص الذين يعانون من الحساسية الغذائية منذ التسعينيات، مما يجعل سوق اختبار المواد المسببة للحساسية الغذائية قطاعًا مهمًا في دول مثل أوروبا والولايات المتحدة وغيرها.

القيود/التحديات

هناك العديد من العوائق التي تعيق التشخيص الصحيح لحساسية الطعام في العالم النامي، حيث توجد أدلة على أن المعرفة بحساسية الطعام لدى الآباء والعاملين في مجال الرعاية الصحية غير كافية، ولا يمكن الوصول بسهولة إلى اختبارات التشخيص المختبرية. يعد التشخيص المبكر لحساسية الطعام مهمًا للتنبؤ والإدارة الغذائية المناسبة. ومع ذلك، حتى في البلدان المتقدمة، يتم الإبلاغ عن تأخر التشخيص لمدة 4 أشهر خاصة عند الرضع الذين يعانون من مظاهر أقل حدة لحساسية الحليب غير الوسيطة بـ IgE. ربما يكون هذا الوضع أسوأ في البلدان النامية؛ وجد Aguilar-Jasso وآخرون تأخرًا لمدة 38 شهرًا في تشخيص حساسية الطعام في شمال غرب المكسيك.

من المتوقع أن يعيق نقص البنية الأساسية والموارد لمراقبة الأغذية في البلدان النامية والصعوبات الفنية أثناء أخذ العينات والاختبار وتحديد البروتين نمو السوق. تظل دول الشرق الأوسط وأفريقيا وغيرها من البلدان ذات الدخل المنخفض مقيدة حاليًا بسبب انخفاض الوعي باختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام. إن الافتقار إلى المبادرة الحكومية وضعف الاقتصاد وفوق كل ذلك الافتقار إلى الوعي بين الأفراد فيما يتعلق بالحساسية المرتبطة بالطعام من شأنه أن يعيق السوق

ومع ذلك، فإن كل بلد يحده المبادئ التوجيهية التي تنظمها سلطات مختلفة والتي من المتوقع أن تعمل بمثابة تحدي لنمو سوق اختبارات المواد المسببة للحساسية الغذائية وعدم تحمل الطعام.

التطورات الأخيرة

- في ديسمبر 2020، أطلقت شركة Eurofins Scientific مجموعة منتجات SENSI Strip Allergen للكشف عن مسببات الحساسية الغذائية في المنتجات الغذائية المعبأة. ساعد إطلاق هذا المنتج الجديد الشركة في تعزيز مجموعة منتجاتها

- في أكتوبر 2020، أطلقت شركة NEOGEN Corporation طريقة جديدة لاستخراج الطعام لتوسيع قدرات اختبارات مسببات الحساسية الغذائية Reveal 3-D للاختبار المباشر للمنتجات الغذائية. يسمح منتج Reveal 3-D الجديد بالفحص السريع لعينات الطعام والمكونات. يتوفر المخزن المؤقت لاختبارات البيض وجوز الهند والبندق وفول الصويا والفول السوداني واللوز. ساعد إطلاق هذا المنتج الجديد الشركة في توسيع مجموعة منتجات سلامة الغذاء الخاصة بها

انقسام سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام

يتم تصنيف سوق اختبارات مسببات الحساسية الغذائية وعدم تحملها إلى ثلاثة قطاعات بارزة تعتمد على نوع الاختبار والطريقة والمستخدم النهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

نوع المادة المسببة للحساسية

- اختبار المواد المسببة للحساسية

- اختبار عدم التحمل

على أساس نوع الاختبار، يتم تقسيم سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام إلى اختبار مسببات الحساسية واختبار عدم تحمل الطعام.

- طريقة

- في المختبر

- في الجسم الحي

على أساس الطريقة، يتم تقسيم سوق اختبارات مسببات الحساسية الغذائية وعدم تحملها إلى اختبارات داخل المختبر واختبارات داخل الجسم الحي

المستخدم النهائي

- اختبار المواد المسببة للحساسية للمستخدم النهائي

- اختبار عدم تحمل المستخدم النهائي

على أساس المستخدم النهائي، يتم تقسيم سوق اختبار المواد المسببة للحساسية الغذائية وعدم تحملها إلى المستخدم النهائي لاختبار المواد المسببة للحساسية والمستخدم النهائي لاختبار عدم تحمل الطعام.

تحليل/رؤى إقليمية لسوق اختبارات مسببات الحساسية الغذائية وعدم تحملها

يتم تحليل سوق اختبارات المواد المسببة للحساسية الغذائية وعدم تحملها ويتم توفير رؤى حجم السوق والاتجاهات حسب نوع الاختبار والطريقة والمستخدم النهائي كما هو مذكور أعلاه.

المناطق التي يغطيها تقرير سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام هي المملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

تسيطر جنوب أفريقيا على سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام في الشرق الأوسط وأفريقيا من حيث حصة السوق وإيرادات السوق وستستمر في تعزيز هيمنتها خلال الفترة المتوقعة بسبب زيادة الاستثمار في البحث والتطوير في هذه المنطقة.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل حصة السوق التنافسية واختبارات مسببات الحساسية الغذائية وعدم تحملها

يوفر المشهد التنافسي لسوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام تفاصيل عن المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والمالية، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام.

بعض اللاعبين الرئيسيين العاملين في سوق اختبارات مسببات الحساسية الغذائية وعدم تحمل الطعام هم SGS SA و Agilent Technologies، Inc. و NEOGEN Corporation و ALS Limited و Mérieux NutriSciences و Eurofins Scientific و Intertek Group plc و TÜV SÜD و Bureau Veritas و Symbio Laboratories و RJ Hill Laboratories Limited و NSF International و Healthy Stuff Online Limited و QIMA و IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH و ADPEN LABORATORIES، INC. و AsureQuality و Microbac Laboratories، Inc و Romer Labs Division Holding GmbH و FOOD SAFETY NET SERVICES و PCAS Labs و Element Materials Technology و OMIC USA Inc. وغيرها.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين، وتحليل الخط الزمني للسوق، ونظرة عامة على السوق والدليل، وشبكة وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل الشرق الأوسط وأفريقيا مقابل المنطقة وحصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS-

4.1.1 BARGAINING POWER OF CUSTOMERS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 THE THREAT OF NEW ENTRANTS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 RIVALRY AMONG EXISTING COMPETITORS

4.2 VALUE CHAIN ANALYSIS

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 TECHNOLOGY INNOVATIONS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASING DECISION OF END-USERS

4.6.1 QUALITY OF THE PRODUCTS:

4.6.2 AVAILABILITY OF A VARIETY OF TESTING TYPES:

4.6.3 WIDE USE IN VARIOUS INDUSTRIES:

4.7 UPCOMING TESTING TECHNOLOGIES

5 REGULATORY FRAMEWORK

5.1 MIDDLE EAST & AFRICA FOOD SAFETY INITIATIVE

5.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

5.3 FEDERAL LEGISLATION

5.3.1 EUROPEAN UNION

5.3.2 THE U.S.

5.3.3 CANADA

5.3.4 AUSTRALIA

5.4 FDA FOOD SAFETY MODERNIZATION ACT

5.5 FOOD SAFETY ON TRACEABILITY SYSTEMS AND FOOD DIAGNOSTICS

5.6 THE TOXIC SUBSTANCES CONTROL ACT OF 1976

5.7 REGULATORY IMPOSITIONS ON GM LABELING

5.8 RAPID ALERT SYSTEM FOR FOOD AND FEED (RASFF) TO REPORT FOOD SAFETY ISSUES

5.9 OTHERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF FOOD ALLERGIES AND INTOLERANCE

6.1.2 INCREASED HEALTH CARE EXPENDITURE WORLDWIDE

6.1.3 A VARIETY OF FOODS SUSCEPTIBLE TO ALLERGENS CREATES A NEED FOR TESTING

6.1.4 GROWING AWARENESS OF FOOD ALLERGENS

6.1.5 LABELING COMPLIANCE IN SEVERAL FOOD INDUSTRIES

6.2 RESTRAINTS

6.2.1 UNAVAILABILITY OF FOOD CONTROL INFRASTRUCTURE & RESOURCES

6.2.2 LACK OF AWARENESS ABOUT LABELLING REGULATION

6.2.3 HIGH COST OF TREATMENT

6.3 OPPORTUNITIES

6.3.1 FOOD ALLERGEN TESTING IN EMERGING MARKETS

6.3.2 USE OF HEALTH IN ALLERGY DIAGNOSIS

6.4 CHALLENGES

6.4.1 DIAGNOSTIC CHALLENGES IN DEVELOPING WORLD

6.4.2 LACK OF STANDARDIZATION IN ALLERGEN TESTING PRACTICES

7 POST COVID-19 IMPACT ON FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

8 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 ALLERGEN TESTING

8.3 INTOLERANCE TESTING

9 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY METHOD

9.1 OVERVIEW

9.2 IN-VITRO

9.3 IN-VIVO

10 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY END USER

10.1 OVERVIEW

10.2 ALLERGEN TESTING END USER

10.3 INTOLERANCE TESTING END USER

11 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E

11.1.4 OMAN

11.1.5 QATAR

11.1.6 KUWAIT

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA INHERITED RETINAL DISEASES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT

14 COMPANY PROFILE

14.1 EUROFINS SCIENTIFIC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.5.1 ACQUISITION

14.1.5.2 LAUNCH

14.2 SGS SA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SERVICES PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.5.1 BUISNESS EXPANSION

14.2.5.2 ACQUISITION

14.3 BUREAU VERITAS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.5.1 AGREEMENTS

14.3.5.2 AWARD

14.4 TÜV SÜD

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 SERVICE PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.4.4.1 EVENT

14.4.4.2 PATNERSHIP

14.5 ALS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.5.5.1 ACQUISITION

14.5.5.2 AWARDS

14.6 NEOGEN CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICE PORTFOLIO

14.6.4 RECENT DEVELOPMENS

14.6.4.1 PRODUCT DEVELOPMENTS

14.6.4.2 AGREEMENT

14.7 INTERTEK GROUP PLC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 SERVICE PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.7.4.1 AWARD

14.7.5 ACQUISITION

14.8 ROMER LABS DIVISION HOLDING GMBH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 QIMA

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICES PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 MÉRIEUX NUTRISCIENCES

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICES PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 MICROBAC LABORATORIES, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 FOOD SAFETY NET SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICES PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ADPEN LABORATORIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICES PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 ASUREQUALITY

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICES PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ELEMENT MATERIALS TECHNOLOGY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 HEALTHY STUFF ONLINE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICES PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 NSF INTERNATIONAL

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.18.3.1 RELOCATION

14.19 OMIC USA INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 SERVICE PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 PCAS LABS

14.20.1 COMPANY SNAPSHOT

14.20.2 SERVICES PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 R J HILL LABORATORIES LIMITED

14.21.1 COMPANY SNAPSHOT

14.21.2 SERVICE PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.21.3.1 LAUNCH

14.22 SYMBIO LABORATORIES

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.22.3.1 EXPANSION

14.22.3.2 ACQUISITION

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING CASES OF FOOD ALLERGIES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN THE FORECAST PERIOD

FIGURE 13 ALLERGEN TESTING IN TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN 2022 & 2029

FIGURE 14 VALUE CHAIN OF MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 16 SELF-REPORTED PREVALENCE OF FOOD ALLERGY IN THE UNITED STATES

FIGURE 17 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 19 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 20 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 21 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2021

FIGURE 22 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 23 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, LIFELINE CURVE

FIGURE 25 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2021

FIGURE 26 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 27 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 28 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 30 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 31 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.