سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا، حسب النوع (التغليف بمحتوى معاد تدويره، التغليف القابل لإعادة الاستخدام، التغليف القابل للتحلل)، نوع المادة (الورق والكرتون الورقي، البلاستيك، المعدن، الزجاج، المواد القائمة على النشا، وغيرها)، نوع المنتج (الحقائب والأكياس والأكياس الصغيرة والصناديق والحاويات والأفلام والصواني والأنابيب والزجاجات والبرطمانات والعلب وغيرها)، التقنية (التغليف النشط، التغليف المصبوب، التغليف بالألياف البديلة، وغيرها)، الطبقة (التغليف الأساسي، التغليف الثانوي، التغليف الثالثي)، التطبيق (الأغذية والمشروبات والأدوية والعناية الشخصية والعناية المنزلية وغيرها)، الدولة (الإمارات العربية المتحدة والمملكة العربية السعودية ومصر وإسرائيل وجنوب إفريقيا)، اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والرؤى : سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا

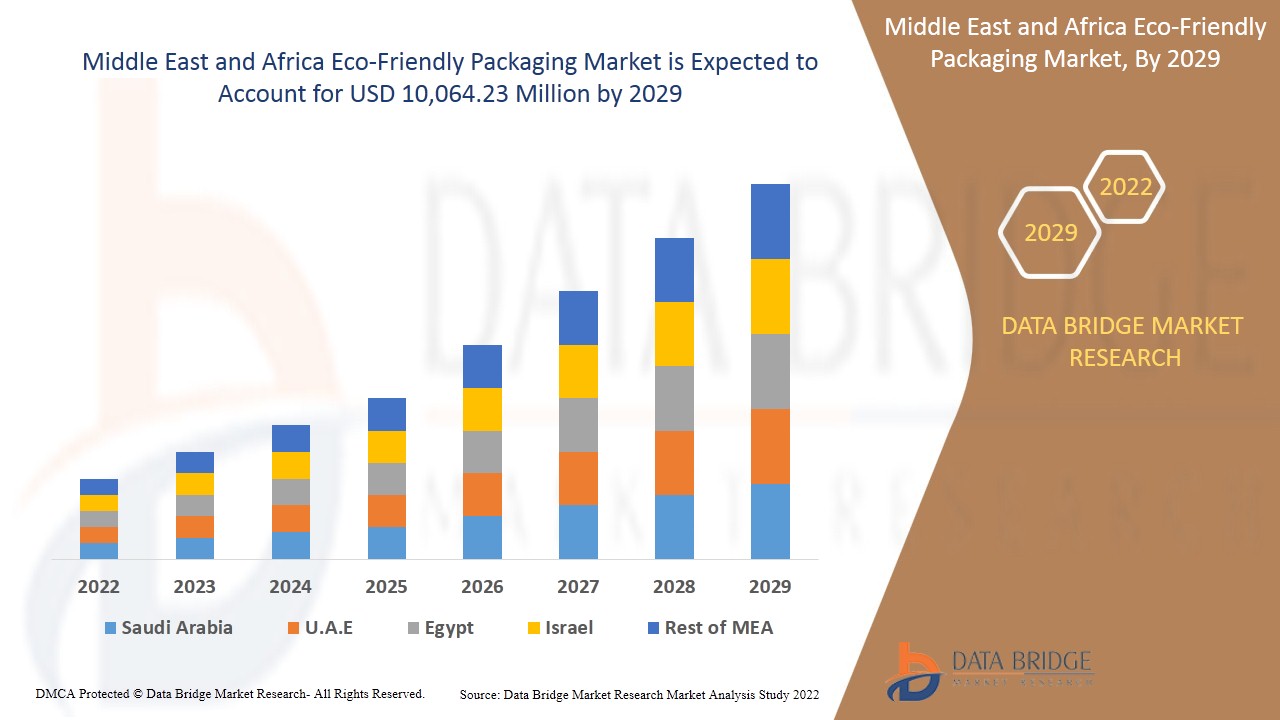

من المتوقع أن يحقق سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب قدره 3.4٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 10،064.23 مليون دولار أمريكي بحلول عام 2029.

التغليف الصديق للبيئة هو أي تغليف سهل إعادة تدويره وآمن على الأفراد والبيئة ومصنوع من مواد معاد تدويرها. يستخدم مواد وممارسات تصنيع ذات تأثير ضئيل على استهلاك الطاقة والموارد الطبيعية. يشعر المستهلكون بقلق متزايد بشأن العواقب البيئية للتغليف. تتعرض الشركات لضغوط من المستهلكين والحكومات لاستخدام تغليف صديق للبيئة لمنتجاتها.

تهدف حلول التغليف الصديقة للبيئة إلى: تقليل كمية تغليف المنتج، وتعزيز استخدام المواد المتجددة/القابلة لإعادة الاستخدام، وخفض النفقات المتعلقة بالتغليف، والقضاء على استخدام المواد السامة في إنتاج التغليف وتوفير خيارات لإعادة تدوير التغليف بسهولة.

أدى تزايد الوعي العام بالمخاوف البيئية والتلوث الناجم عن التغليف التقليدي مثل البلاستيك إلى زيادة الطلب على التغليف الصديق للبيئة، ومن المتوقع إلى حد كبير أن يعزز هذا من النمو في سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا. يمكن أن يكون القيد الرئيسي هو الافتقار إلى الوعي بشأن فوائد منتجات التغليف الصديقة للبيئة. ومن المتوقع أن توفر الابتكارات الكبيرة في منتجات التغليف فرصًا في السوق. قد تشكل التكلفة العالية والبنية التحتية الرديئة لعمليات إعادة التدوير تحديًا لسوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا.

يقدم تقرير سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل؛ سيساعدك فريقنا في إنشاء حل لتأثير الإيرادات لتحقيق هدفك المنشود.

نطاق وحجم سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا

تنقسم سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا إلى ستة قطاعات بارزة، بناءً على النوع ونوع المادة ونوع المنتج والتقنية والطبقة والتطبيق. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في أسواقك المستهدفة.

- على أساس النوع، يتم تقسيم سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا إلى تغليف المحتوى المعاد تدويره، والتغليف القابل لإعادة الاستخدام، والتغليف القابل للتحلل. في عام 2022، من المتوقع أن تهيمن شريحة التغليف القابلة لإعادة الاستخدام على السوق بسبب طبيعتها المتمثلة في استخدامها مرارًا وتكرارًا دون أي خسارة في خصائصها.

- على أساس نوع المادة، يتم تقسيم سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا إلى الورق والكرتون والبلاستيك والمعادن والزجاج والمواد القائمة على النشا وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة الورق والكرتون على سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا، حيث إنها خاصية قابلة للتحلل بشكل طبيعي بنسبة 100% لحلول التغليف ذات التأثير المنخفض على البيئة.

- على أساس نوع المنتج، يتم تقسيم سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا إلى أكياس وأكياس صغيرة وصناديق وحاويات وأفلام وصواني وأنابيب وزجاجات وبرطمانات وعلب وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة الصناديق على سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا حيث تحمي الصناديق المواد المعبأة بكفاءة عالية ولديها قوة جيدة لتحمل الأوزان الثقيلة.

- على أساس التقنية، يتم تقسيم سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا إلى التغليف النشط، والتغليف المصبوب، والتغليف بالألياف البديلة، وغيرها. في عام 2022، من المتوقع أن تهيمن التغليف بالألياف البديلة على سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا، مما يثبت أنه بديل صديق للبيئة للورق. كما أنه يوفر بديلاً ضروريًا للغاية للبوليسترين، والذي يضر بالبيئة وصحة الإنسان.

- على أساس الطبقة، يتم تقسيم سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا إلى تغليف أولي وتغليف ثانوي وتغليف ثالثي. في عام 2022، من المتوقع أن يهيمن قطاع التغليف الأولي على سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا، لأنه يسمح بالحفاظ على المنتج بنفس الطريقة التي هو عليها دون تغييره بسبب الظروف البيئية الخارجية.

- على أساس التطبيق، يتم تقسيم سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا إلى الأغذية والمشروبات والأدوية والعناية الشخصية والعناية المنزلية وغيرها. في عام 2022، من المتوقع أن يهيمن قطاع الأغذية على سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا، وذلك بسبب صناعة الأغذية سريعة النمو في المنطقة والاستخدام المتزايد للتغليف القابل للتصرف الصديق للبيئة في صناعة الأغذية.

تحليل على مستوى الدولة لسوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا

يتم تحليل سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا، ويتم توفير معلومات حجم السوق حسب البلد والنوع ونوع المادة ونوع المنتج والتقنية والطبقة والتطبيق.

الدول التي يغطيها تقرير سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا هي جنوب أفريقيا ومصر والمملكة العربية السعودية والإمارات العربية المتحدة وإسرائيل وبقية دول الشرق الأوسط وأفريقيا. في عام 2022، من المتوقع أن تهيمن الإمارات العربية المتحدة على سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا بسبب زيادة النمو في التغليف الصديق للبيئة في المنطقة بسبب الطلب المرتفع على السلع الاستهلاكية سريعة الحركة وميل المستهلكين إلى تفضيل التغليف الأخضر. ومن المتوقع أن تنمو جنوب إفريقيا بسبب المخاوف البيئية المتزايدة والوعي العام المتزايد بالمنتجات الصديقة للبيئة. ومن المتوقع أن تنمو المملكة العربية السعودية في سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا بسبب اللوائح الصارمة التي تنفذها معظم الحكومات بشأن الأكياس البلاستيكية.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

النمو في سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا

كما يوفر لك سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا تحليلاً تفصيلياً للسوق لنمو كل دولة في القاعدة المثبتة من أنواع مختلفة من المنتجات للسوق، وتأثير التكنولوجيا باستخدام منحنيات شريان الحياة والتغييرات في سيناريوهات تنظيم حليب الأطفال، وتأثيرها على سوق التغليف الصديق للبيئة. تتوفر البيانات للفترة التاريخية من 2011 إلى 2019.

تحليل المشهد التنافسي وحصة سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وخطوط أنابيب التجارب السريرية، وتحليل العلامة التجارية، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة على سوق التغليف الصديق للبيئة في الشرق الأوسط وأفريقيا.

بعض اللاعبين الرئيسيين الذين تم تغطيتهم في تقرير التعبئة والتغليف الصديق للبيئة في الشرق الأوسط وأفريقيا هم Mondi وSealed Air وCrown Holdings, Inc. وTetra Pak وHuhtamaki وBerry Global Inc. وAmcor plc وBall Corporation وPactiv Evergreen Inc. وPlastipak Holdings, Inc. وNampak Ltd. وElopak وUFlex Limited وغيرها. يفهم محللو DBMR نقاط القوة التنافسية ويوفرون تحليلًا تنافسيًا لكل منافس على حدة.

على سبيل المثال،

- في أكتوبر 2021، بدأت شركة Mondi في توريد مجموعة من عبوات أغذية الحيوانات الأليفة أحادية المادة القابلة لإعادة التدوير لشركة Hau-Hau Champion، إحدى العلامات التجارية الأكثر شهرة في فنلندا في قطاع أغذية الكلاب الفاخرة. سيساعد هذا التطور شركة Mondi في الاستحواذ على المزيد من شركات أغذية الحيوانات الأليفة لحلول التعبئة والتغليف الخاصة بها

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SINGLE-USE PLASTIC BAN HAS HEIGHTENED DEMAND FOR ECO-FRIENDLY PACKAGING

5.1.2 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS

5.1.3 RISE IN AWARENESS REGARDING ENVIRONMENTAL CONSERVATION AND SUSTAINABLE LIVING

5.1.4 STRINGENT GOVERNMENT REGULATIONS REGARDING ENVIRONMENTAL SUSTAINABILITY

5.2 RESTRAINTS

5.2.1 PRICE VOLATILITY OF RAW MATERIALS

5.2.2 CONSTRAINT IN PRODUCTION CAPACITIES

5.2.3 LACK OF KNOWLEDGE AND LOW ACCEPTANCE FOR SUSTAINABLE PACKAGING IN DEVELOPING ECONOMIES

5.3 OPPORTUNITIES

5.3.1 CONSIDERABLE INNOVATIONS IN PACKAGING PRODUCTS

5.3.2 SIGNIFICANT GOVERNMENT INITIATIVES TO PROMOTE USE OF ECO-FRIENDLY PACKAGING

5.3.3 INCREASE IN GROWTH POTENTIAL IN PACKAGING MARKET AND RISING R&D ACTIVITIES

5.4 CHALLENGES

5.4.1 HIGH COST OF ECO-FRIENDLY PACKAGING AS COMPARED TO CONVENTIONAL PRODUCTS

5.4.2 HIGH COST AND POOR INFRASTRUCTURE FOR RECYCLING PROCESSES

6 COVID 19 IMPACT ON THE MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 REUSABLE PACKAGING

7.3 RECYCLED CONTENT PACKAGING

7.4 DEGRADABLE PACKAGING

8 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER & PAPER BOARD

8.2.1 PAPER & PAPER BOARD, BY MATERIAL TYPE

8.2.1.1 RECYCLED (COATED AND UNCOATED)

8.2.1.2 SOLID BLEACH SULFATE (SBS)

8.2.1.3 COATED UNBLEACHED KRAFT (CUK)

8.2.1.4 OTHERS

8.3 PLASTIC

8.3.1 PLASTIC, BY MATERIAL TYPE

8.3.1.1 BIO-BASED PLASTIC

8.3.1.2 BIODEGRADABLE PLASTIC

8.3.1.3 OTHERS

8.4 GLASS

8.4.1 GLASS, BY MATERIAL TYPE

8.4.1.1 SODA ASH

8.4.1.2 SAND

8.4.1.3 LIMESTONE

8.5 METAL

8.5.1 METAL, BY MATERIAL TYPE

8.5.1.1 ALUMINIUM

8.5.1.2 STEEL

8.5.1.3 OTHER

8.6 STARCH-BASED MATERIALS

8.7 OTHERS

9 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 BOXES

9.3 BAGS

9.4 POUCHES & SACHETS

9.5 CONTAINERS

9.6 BOTTLES & JARS

9.7 CANS

9.8 FILMS

9.9 TUBES

9.1 TRAYS

9.11 OTHERS

10 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 ALTERNATE FIBER PACKAGING

10.2.1 ALTERNATE FIBER PACKAGING, BY TECHNIQUE

10.2.1.1 BAMBOO FIBER

10.2.1.2 MUSHROOM PACKAGING

10.2.1.3 OTHERS

10.3 MOLDED PACKAGING

10.3.1 MOLDED PACKAGING, BY TECHNIQUE

10.3.1.1 TRANSFER MOLDED PULP PACKAGING

10.3.1.2 THICK WALL PULP PACKAGING

10.3.1.3 THERMOFORMED PULP PACKAGING

10.3.1.4 PROCESSED PULP PACKAGING

10.4 ACTIVE PACKAGING

10.4.1 ACTIVE PACKAGING, BY TECHNIQUE

10.4.1.1 MODIFIED ATMOSPHERE PACKAGING (MAP)

10.4.1.2 ANTIMICROBIAL PACKAGING

10.4.1.3 BARRIER PACKAGING

10.5 OTHERS

11 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 FOOD, BY APPLICATION

12.2.1.1 BAKERY & CONFECTIONARY

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 READY TO EAT FOOD

12.2.1.4 FROZEN FOOD

12.2.1.5 FRUITS & VEGETABLES

12.2.1.6 MEAT PRODUCTS

12.2.1.7 OTHERS

12.2.2 FOOD, BY TYPE

12.2.2.1 REUSABLE PACKAGING

12.2.2.2 RECYCLED CONTENT PACKAGING

12.2.2.3 DEGRADABLE PACKAGING

12.3 BEVERAGES

12.3.1 BEVERAGES, BY APPLICATION

12.3.1.1 NON-ALCOHOLIC

12.3.1.2 ALCOHOLIC

12.3.2 BEVERAGES, BY TYPE

12.3.2.1 REUSABLE PACKAGING

12.3.2.2 RECYCLED CONTENT PACKAGING

12.3.2.3 DEGRADABLE PACKAGING

12.4 PHARMACEUTICALS

12.4.1 PHARMACEUTICALS, BY TYPE

12.4.1.1 REUSABLE PACKAGING

12.4.1.2 RECYCLED CONTENT PACKAGING

12.4.1.3 DEGRADABLE PACKAGING

12.5 PERSONAL CARE

12.5.1 PERSONAL CARE, BY TYPE

12.5.1.1 REUSABLE PACKAGING

12.5.1.2 RECYCLED CONTENT PACKAGING

12.5.1.3 DEGRADABLE PACKAGING

12.6 HOME CARE

12.6.1 HOME CARE, BY TYPE

12.6.1.1 REUSABLE PACKAGING

12.6.1.2 RECYCLED CONTENT PACKAGING

12.6.1.3 DEGRADABLE PACKAGING

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1 REUSABLE PACKAGING

12.7.1.2 RECYCLED CONTENT PACKAGING

12.7.1.3 DEGRADABLE PACKAGING

13 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 UNITED ARAB EMIRATE

13.1.2 SAUDI ARABIA

13.1.3 SOUTH AFRICA

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 AWARD

14.6 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 WEST ROCK COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT UPDATES

16.2 CROWN HOLDING, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 AMCOR PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 TETRA PAK

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 BERRY MIDDLE EAST & AFRICA INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT UPDATES

16.6 SMUFIT KAPPA

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 DS SMITH

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 MONDI

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 ARDAGH GROUP S.A.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 BALL CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 ELOPAK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATES

16.12 EMERALD PACKAGING

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATES

16.13 HUHTAMAKI

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NAMPAK LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 PACTIV EVERGREEN INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 PLASTIPAK HOLDINGS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATES

16.17 PRINTPACK

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 SEALED AIR

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SONOCO PRODUCTS COMPANY

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.2 UFLEX LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE - 4819 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE – 4819 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 5 MIDDLE EAST & AFRICA REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 7 MIDDLE EAST & AFRICA RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 9 MIDDLE EAST & AFRICA DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 11 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA STARCH-BASED MATERIALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BOXES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA BAGS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA POUCHES & SACHETS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA CONTAINERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA BOTTLES & JARS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CANS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA FILMS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA TUBES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA TRAYS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PRIMARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA SECONDARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA TERTIARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 62 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 64 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 86 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 87 UNITED ARAB EMIRATE PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 UNITED ARAB EMIRATE PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 89 UNITED ARAB EMIRATE METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 90 UNITED ARAB EMIRATE GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 91 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 93 UNITED ARAB EMIRATE ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 94 UNITED ARAB EMIRATE MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 95 UNITED ARAB EMIRATE ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 97 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 UNITED ARAB EMIRATE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 UNITED ARAB EMIRATE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 UNITED ARAB EMIRATE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 UNITED ARAB EMIRATE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 UNITED ARAB EMIRATE PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 UNITED ARAB EMIRATE PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 UNITED ARAB EMIRATE HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 UNITED ARAB EMIRATE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 108 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 109 SAUDI ARABIA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 110 SAUDI ARABIA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 111 SAUDI ARABIA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 113 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 115 SAUDI ARABIA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 116 SAUDI ARABIA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 117 SAUDI ARABIA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 118 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 119 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 SAUDI ARABIA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 SAUDI ARABIA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 SAUDI ARABIA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 130 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 131 SOUTH AFRICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 132 SOUTH AFRICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 133 SOUTH AFRICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 134 SOUTH AFRICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 135 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 137 SOUTH AFRICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 138 SOUTH AFRICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 139 SOUTH AFRICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 140 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 141 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 SOUTH AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 SOUTH AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 SOUTH AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 SOUTH AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SOUTH AFRICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SOUTH AFRICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SOUTH AFRICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SOUTH AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 152 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 153 EGYPT PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 154 EGYPT PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 155 EGYPT METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 156 EGYPT GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 157 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 159 EGYPT ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 160 EGYPT MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 161 EGYPT ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 162 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 163 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 EGYPT FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 EGYPT FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 EGYPT BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 EGYPT BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 EGYPT PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 EGYPT PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 EGYPT HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 EGYPT OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 174 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 175 ISRAEL PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 176 ISRAEL PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 177 ISRAEL METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 178 ISRAEL GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 179 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 180 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 181 ISRAEL ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 182 ISRAEL MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 183 ISRAEL ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 184 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 185 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 ISRAEL FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 187 ISRAEL FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 ISRAEL BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 ISRAEL BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 ISRAEL PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 ISRAEL PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 ISRAEL HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 ISRAEL OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 REST OF MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 REST OF MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

FIGURE 2 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS IS DRIVING MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 REUSABLE PACKAGING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

FIGURE 18 PLASTIC WASTE GENERATED BY KEY COUNTRIES, 2021

FIGURE 19 CARDBOARD COSTS IN MONTH OF MAY 2020 & 2021

FIGURE 20 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2021

FIGURE 22 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2021

FIGURE 24 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2021

FIGURE 25 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 26 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: BY TYPE (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.