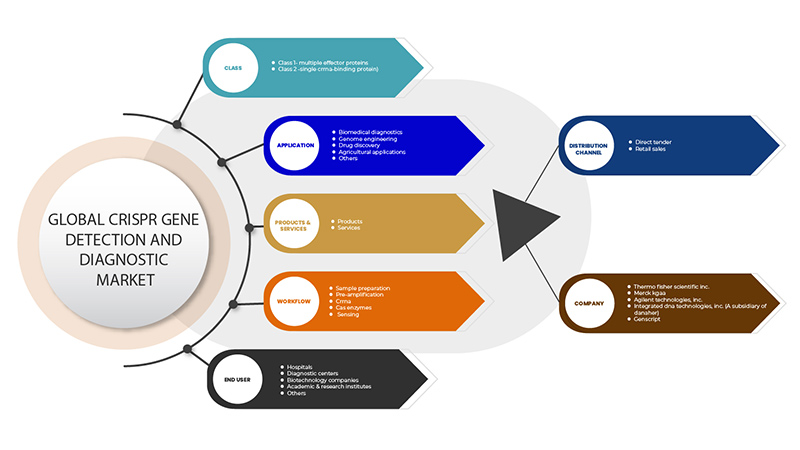

سوق الكشف عن الجينات وتشخيصها باستخدام تقنية كريسبر في الشرق الأوسط وأفريقيا، حسب الفئة (الفئة 1 - بروتينات متعددة التأثير والفئة 2 - بروتين رابط CrRNA واحد)، المنتجات والخدمات (المنتجات والخدمات)، التطبيق (التشخيص الطبي الحيوي، هندسة الجينوم، اكتشاف الأدوية، التطبيقات الزراعية وغيرها)، سير العمل (إعداد العينة، التضخيم المسبق، CrRNA، إنزيمات كاس والاستشعار)، المستخدم النهائي (المستشفيات ومراكز التشخيص وشركات التكنولوجيا الحيوية والمعاهد الأكاديمية والبحثية وغيرها)، قناة التوزيع (العطاء المباشر، مبيعات التجزئة) اتجاهات الصناعة والتوقعات حتى عام 2029.

تعريف السوق ورؤيته

إن تقنية كريسبر عبارة عن تكرارات قصيرة متناوبة منتظمة التباعد وهي أداة لتحرير الجينوم، فهي تسمح للباحثين بتغيير تسلسلات الحمض النووي وتعديل وظيفة الجينات بسهولة. ولديها العديد من التطبيقات المحتملة، بما في ذلك تصحيح العيوب الجينية وعلاج الأمراض ومنع انتشارها. وقد تم استخدام التشخيصات القائمة على كريسبر في العديد من التطبيقات الطبية الحيوية، مثل استشعار المؤشرات الحيوية القائمة على الأحماض النووية للأمراض المعدية وغير المعدية والكشف عن الأمراض الوراثية. تتكون مجموعات التحليل في كريسبر من مكونين: بروتين يسمى Cas9 وRNA دليل، وهو سلسلة من جزيئات الأحماض النووية ذات شفرة وراثية معينة.

تم تعديل نظام CRISPR-Cas9 هذا لاستخدامه في الخلايا الثديية. يمكننا إما تعطيل جينات معينة عن طريق إدخال تسلسل دليل (sgRNA) خاص بالجين الذي يهمنا عن طريق إدخال طفرات إطارية عبر الانضمام النهائي غير المتجانس (NHEJ) أو توليد طفرات إدخال.

لقد وسعت أنظمة CRISPR-Cas 9 نطاق التشخيص والخدمات في علاجات الجينات والخلايا. وتستثمر شركات الأدوية بكثافة في البحث والتطوير لتطوير منتجات جديدة، مع زيادة كبيرة في عوامل علاج الجينات والخلايا التي تدخل مرحلة التطوير المبكر. ومن شأن استثمار اللاعبين في السوق أن يسمح بإنتاج علاجات آمنة وفعالة للمرضى الذين هم في حاجة ماسة إليها.

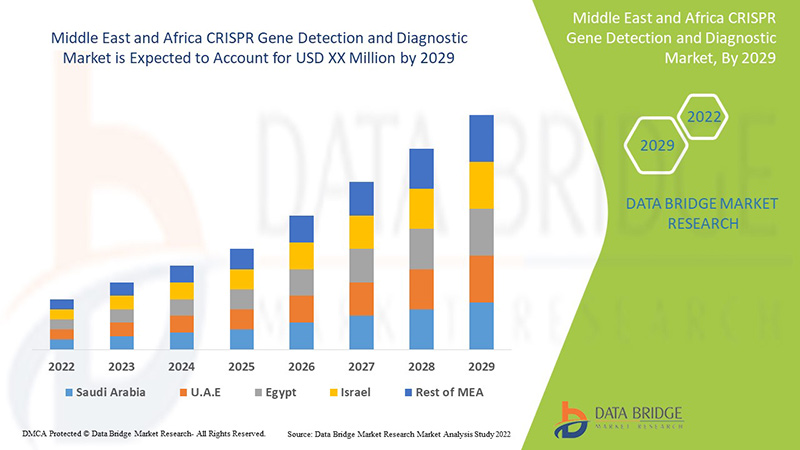

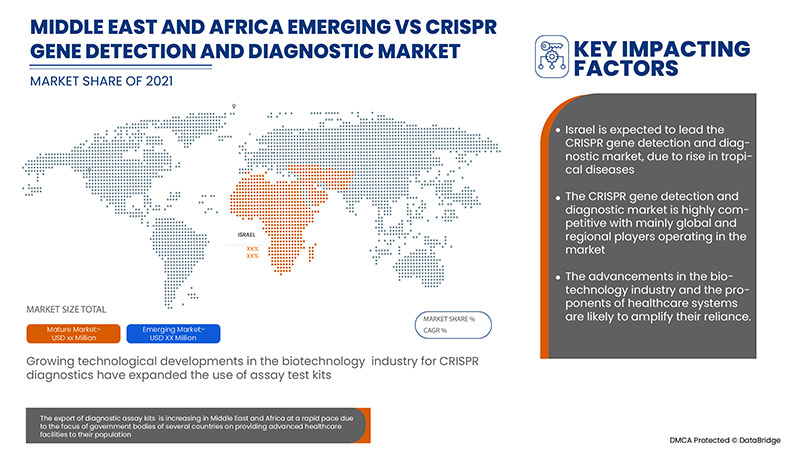

إن الكشف عن جينات CRISPR وتشخيصها في الشرق الأوسط وأفريقيا داعم ويهدف إلى تقليل شدة الأعراض. وتشير تحليلات Data Bridge Market Research إلى أن سوق الكشف عن جينات CRISPR وتشخيصها سينمو بمعدل نمو سنوي مركب يبلغ 8.8% خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب الفئة (الفئة 1 - بروتينات متعددة الفعالية والفئة 2 - بروتين رابط CrRNA واحد)، المنتجات والخدمات (المنتجات والخدمات)، التطبيق (التشخيصات الطبية الحيوية، هندسة الجينوم، اكتشاف الأدوية، التطبيقات الزراعية وغيرها)، سير العمل (إعداد العينة، التضخيم المسبق، CrRNA، إنزيمات Cas والاستشعار)، المستخدم النهائي (المستشفيات ومراكز التشخيص وشركات التكنولوجيا الحيوية والمعاهد الأكاديمية والبحثية وغيرها) قناة التوزيع (العطاء المباشر، مبيعات التجزئة) |

|

الدول المغطاة |

جنوب أفريقيا، المملكة العربية السعودية، الإمارات العربية المتحدة، مصر، إسرائيل وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

GenScript، وTakara Bio Inc.، وAgilent Technologies, Inc.، وMerck KGaA، وIntegrated DNA Technologies, Inc. (شركة تابعة لشركة Danaher) وThermo Fisher Scientific Inc. وغيرها |

ديناميكيات سوق الكشف عن الجينات وتشخيصها باستخدام تقنية كريسبر في الشرق الأوسط وأفريقيا

السائقين

- ارتفاع معدل انتشار الأمراض المزمنة

الأمراض المزمنة هي حالات صحية شائعة، حيث يعاني واحد من كل ثلاثة بالغين من حالات مزمنة. وقد أثرت الأمراض المزمنة على صحة ونوعية حياة العديد من المواطنين.

يُختصر مصطلح CRISPR على أنه تكرارات قصيرة منتظمة متباعدة. وفي السنوات الأخيرة، أصبح CRISPR أداة قيادية لتحرير الجينات، والتي تُستخدم لتغيير تسلسلات معينة من الحمض النووي في الخلية. ولـ CRISPR استخدام مهم في البحث عن وعلاج مرض هنتنغتون، وضمور العضلات، والسرطان، وارتفاع نسبة الكوليسترول.

على سبيل المثال،

- في عام 2021، ذكرت بيانات منظمة NORD - المنظمة الوطنية للاضطرابات النادرة، أن معدل الإصابة بضمور العضلات دوشين (DMD) هو حالة وراثية شائعة، تؤثر على 1 من كل 3500 مولود ذكر في جميع أنحاء العالم.

- ارتفاع الاستثمار في البحث والتطوير

لقد أدت تقنيات تحرير الجينات، مثل نظام CRISPR-Cas 9، إلى توسيع نطاق التشخيص والخدمات في مجال علاجات الجينات والخلايا. وتستثمر شركات الأدوية بكثافة في البحث والتطوير لتطوير منتجات جديدة، مع زيادة كبيرة في عوامل علاج الجينات والخلايا التي تدخل مرحلة التطوير المبكر. ومن شأن استثمار اللاعبين في السوق أن يسمح بتحقيق هدف إنتاج علاجات آمنة وفعالة للمرضى المحتاجين بشدة.

على سبيل المثال،

- في فبراير 2022، جمعت شركة سينثيغو 200 مليون دولار أمريكي كاستثمار للبحث والتطوير لتعزيز تطوير الأدوية القائمة على تقنية كريسبر من مرحلة البحث المبكرة إلى العيادة. ستستخدم سينثيغو مبلغ الاستثمار من تمويل السلسلة E لتسريع إنشاء تشخيصات وخدمات كريسبر

توفر التمويل لتشخيص جين CRISPR

يتم تمويل تشخيص وأبحاث جينات CRISPR من ميزانية المعهد الوطني للصحة (NIH). يمول القطاع الخاص أيضًا اكتشاف جينات CRISPR والبحث عنها، ولكن مثل هذا الاستثمار يحدث عمومًا في وقت لاحق، أثناء مرحلة الاختبار والتطوير، ثم أثناء البحث الأساسي الأولي. نظرًا لأن تحرير الجينوم هو مجال جديد، فيجب أن تشرف عليه هيئة حكومية غير متحيزة؛ إدارة الغذاء والدواء حذرة ودقيقة، لكنها تكافح بلا نهاية للحصول على التمويل، مما يجعل الاستثمار طويل الأجل الذي يتماشى مع الدفع للمستفيدين المحتملين في المستقبل، سيعزز بشكل أكبر نمو سوق اكتشاف وتشخيص جينات CRISPR.

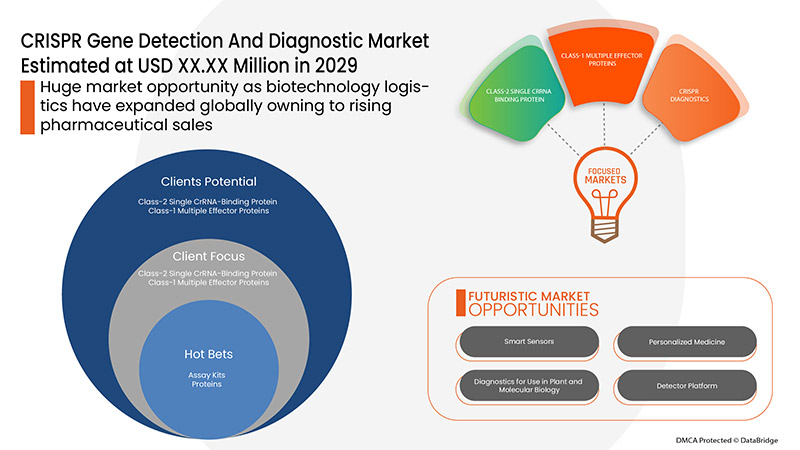

علاوة على ذلك، فإن التقدم في تشخيص جينات CRISPR، والمبادرات المتزايدة من قبل المنظمات العامة والخاصة لنشر الوعي والتمويل الحكومي المتزايد هي العوامل التي ستوسع سوق اكتشاف جينات CRISPR. عوامل أخرى مثل زيادة الطلب على العلاجات الفعالة وزيادة الوعي بالتشخيص في الوقت المناسب ستؤثر بشكل إيجابي على معدل نمو سوق اكتشاف جينات CRISPR والتشخيص. بالإضافة إلى ذلك، فإن الدخل المرتفع المتاح، والعدد المتزايد من الأمراض المزمنة، وتغيير نمط الحياة سيؤدي إلى توسع سوق اكتشاف جينات CRISPR والتشخيص.

فرص

- ارتفاع الإنفاق على الرعاية الصحية

علاوة على ذلك، فإن زيادة أنشطة البحث والتطوير وزيادة الاستثمارات من قبل الحكومة والمنظمات الخاصة من شأنها أن تعزز فرصًا جديدة لمعدل نمو السوق.

- المبادرة الاستراتيجية من قبل اللاعبين في السوق

لقد زاد الطلب على اكتشاف جين CRISPR وتشخيصه في الولايات المتحدة الأمريكية، وذلك بفضل العلاج في الوقت المناسب للحالات المزمنة. تعمل هذه العوامل المواتية على تعزيز الحاجة إلى الأدوية، ولتحقيق الطلب في السوق، يستخدم اللاعبون الصغار والكبار في السوق استراتيجيات مختلفة.

ويحاول اللاعبون الرئيسيون أيضًا ابتكار استراتيجيات محددة، مثل إطلاق المنتجات، والاستحواذات، والموافقات، والتوسعات، والشراكات، لضمان حسن سير الأعمال، وتجنب المخاطر، وزيادة النمو طويل الأجل في مبيعات السوق.

على سبيل المثال،

- في مايو 2021، قامت شركة Horizon Discovery Ltd. بتوسيع محفظة تعديل الجينات من خلال أول دليل RNA اصطناعي أحادي ومثبط dcas9 قيد براءة اختراع للتدخل في CRISPR في Waltham. أدى توسيع المحفظة إلى زيادة مبيعات وإيرادات محفظة الدليل RNA الاصطناعي في جميع أنحاء الولايات المتحدة ومنطقة المملكة المتحدة وزاد من التعاون مع اللاعبين في السوق

كما أن إطلاق العلاجات الفعالة والتجارب السريرية المستمرة من شأنه أن يوفر فرصًا مفيدة لسوق الكشف عن جينات CRISPR وتشخيصها في الفترة المتوقعة 2022-2029. كما أن الحاجة العالية غير الملباة للتطورات الحالية في تكنولوجيا الرعاية الصحية من شأنها أن تزيد من معدل نمو سوق الكشف عن جينات CRISPR وتشخيصها في المستقبل.

القيود/التحديات

ومع ذلك، فإن التكلفة العالية لتشخيصات CRISPR والمخاطر التي تواجهها أثناء استخدام تشخيصات CRISPR ستعيق معدل نمو سوق الكشف عن جينات CRISPR والتشخيص. بالإضافة إلى ذلك، فإن المخاطر التي تحدث أثناء استخدام أجهزة التصوير بالرنين المغناطيسي ستعيق نمو سوق الكشف عن جينات CRISPR والتشخيص. إن الافتقار إلى الخبرة الماهرة واللوائح من شأنه أن يشكل تحديًا أكبر للسوق في فترة التنبؤ المذكورة أعلاه.

- ارتفاع تكلفة التشخيصات القائمة على تقنية كريسبر

إن الإمكانات الهائلة للعلاجات القائمة على تقنية كريسبر تأتي مصحوبة بتكلفة باهظة. حيث تتطلب علاجات تحرير الجينوم القصوى قدرًا متزايدًا من الوقت للتطوير والإنتاج، ومن ثم تحدث زيادة في التكلفة. علاوة على ذلك، فإن مجموعات التحليل والأدوية المتعلقة باكتشاف جينات كريسبر وتشخيصها قابلة للتطبيق على شريحة كبيرة من السكان. ويتم فرض هذه التكاليف على المرضى. لذلك، من المتوقع أن تظهر التكلفة المرتفعة الحالية اتجاهًا تنازليًا في المستقبل.

على سبيل المثال،

- في يوليو 2021، وفقًا لشركة Integrated DNA Technologies, Inc.، فإن أول اختبار تشخيصي قائم على CRISPR متاح تجاريًا لفيروس SARS-CoV-2 بما في ذلك LAMP النسخ العكسي (RT-LAMP) كتضخيم مسبق متاح حاليًا بسعر 30.15 دولارًا أمريكيًا لكل تفاعل

يقدم تقرير سوق الكشف عن جينات CRISPR والتشخيص تفاصيل عن التطورات الحديثة الجديدة واللوائح التجارية وتحليل الاستيراد والتصدير وتحليل الإنتاج وتحسين سلسلة القيمة وحصة السوق وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغيرات في لوائح السوق وتحليل نمو السوق الاستراتيجي وحجم السوق ونمو سوق الفئات ومنافذ التطبيق والهيمنة وموافقات المنتجات وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول سوق الكشف عن جينات CRISPR والتشخيص، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

تحليل وبائيات المرضى

وفقًا لدراسة أجرتها شركة غلوبوكان، في عام 2020، كان سرطان الثدي هو الأكثر انتشارًا بين المصابين، بنحو 11.7%، يليه سرطان الرئة بنسبة 11.40%، وسرطان القولون والمستقيم بنسبة 10.00%، وسرطان عنق الرحم والمريء بنسبة أقل من حالات الإصابة.

كما يوفر لك سوق الكشف عن جينات CRISPR والتشخيص تحليلًا تفصيليًا للسوق لتحليل المرضى والتشخيص والعلاج. الانتشار، والوقوع، والوفيات، ومعدلات الالتزام هي بعض متغيرات البيانات المتوفرة في التقرير. يتم تحليل تحليلات التأثير المباشر أو غير المباشر لعلم الأوبئة على نمو السوق لإنشاء نموذج إحصائي متعدد المتغيرات أكثر قوة وشمولاً للتنبؤ بالسوق في فترة النمو.

تأثير COVID-19 على سوق الكشف عن الجينات وتشخيصها باستخدام CRISPR

لقد أثر فيروس كورونا المستجد سلبًا على السوق. حيث تعمل عمليات الإغلاق والعزلة أثناء الأوبئة على تعقيد إدارة التشخيص والعلاج. كما أن الافتقار إلى الوصول إلى مرافق الرعاية الصحية لإدارة الرعاية الروتينية والأدوية سيؤثر بشكل أكبر على السوق. كما أن العزلة الاجتماعية تزيد من التوتر واليأس والدعم الاجتماعي، وكل هذا قد يتسبب في انخفاض الالتزام بأدوية مضادات الاختلاج أثناء الوباء.

التطورات الأخيرة

- في أغسطس 2020، أعلنت شركة SHERLOCK BIOSCIENCES عن تعاونها مع شركة Dartmouth-Hitchcock Health لإجراء التجربة السريرية لمجموعة SHERLOCK التشخيصية لفيروس سارس-كوف-2. حصلت المجموعة على موافقة طارئة من إدارة الغذاء والدواء الأمريكية (FDA) للحصول على ترخيص الاستخدام الطارئ.

نطاق سوق الكشف عن الجينات وتشخيصها باستخدام تقنية كريسبر في الشرق الأوسط وأفريقيا

يتم تقسيم سوق الكشف عن جينات CRISPR وتشخيصها على أساس ستة قطاعات: الفئة، والمنتجات والخدمات، والتطبيق، وسير العمل، والمستخدم النهائي، وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

فصل

- الفئة 1 - البروتينات متعددة التأثير

- الفئة 2 - بروتين ربط CrRNA المفرد

على أساس الفئة، يتم تقسيم سوق الكشف عن جينات CRISPR وتشخيصها إلى الفئة 1 - بروتينات متعددة التأثير والفئة 2 - بروتين ربط CrRNA الفردي.

المنتجات والخدمات

- منتجات

- خدمات

على أساس المنتجات والخدمات، يتم تقسيم سوق الكشف عن جينات CRISPR وتشخيصها إلى منتجات وخدمات.

طلب

- التشخيصات الطبية الحيوية

- هندسة الجينوم

- اكتشاف الأدوية

- التطبيقات الزراعية

- آحرون

على أساس التطبيق، يتم تقسيم سوق الكشف عن جينات CRISPR وتشخيصها إلى التشخيصات الطبية الحيوية، وهندسة الجينوم، واكتشاف الأدوية، والتطبيقات الزراعية وغيرها.

سير العمل

- إعداد العينة

- التضخيم المسبق

- الحمض النووي الريبوزي منقوص الأكسجين

- إنزيمات كاس

- الاستشعار

على أساس سير العمل، يتم تقسيم سوق الكشف عن جين CRISPR وتشخيصه إلى تحضير العينة، والتضخيم المسبق، وCrRNA، وإنزيمات Cas والاستشعار.

المستخدم النهائي

- المستشفيات

- مراكز التشخيص

- شركات التكنولوجيا الحيوية

- المؤسسات الأكاديمية والبحثية

- آحرون

على أساس المستخدم النهائي، يتم تقسيم سوق الكشف عن جينات CRISPR وتشخيصها إلى المستشفيات ومراكز التشخيص وشركات التكنولوجيا الحيوية والمعاهد الأكاديمية والبحثية وغيرها.

قناة التوزيع

- العطاءات المباشرة

- مبيعات التجزئة

على أساس قناة التوزيع، يتم تقسيم سوق الكشف عن جين CRISPR وتشخيصه إلى العطاءات المباشرة ومبيعات التجزئة.

تحليل/رؤى إقليمية لسوق الكشف عن الجينات وتشخيصها باستخدام تقنية CRISPR

يتم تحليل سوق الكشف عن الجينات وتشخيصها باستخدام CRISPR في الشرق الأوسط وأفريقيا، ويتم توفير رؤى حجم السوق والاتجاهات حسب المناطق والفئة والمنتجات والخدمات والتطبيق وسير العمل والمستخدم النهائي وقناة التوزيع كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق الكشف عن الجينات وتشخيصها باستخدام تقنية CRISPR هي جنوب أفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

تسيطر إسرائيل على سوق الكشف عن الجينات وتشخيصها باستخدام تقنية CRISPR بفضل المبادرات الاستراتيجية التي يتخذها اللاعبون في السوق.

كما يقدم قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في اللوائح في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة وعلم الأوبئة المرضية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المنافسة وحصة سوق الكشف عن الجينات وتشخيصها باستخدام تقنية CRISPR

يقدم المشهد التنافسي لسوق الكشف عن جينات CRISPR وتشخيصها في الشرق الأوسط وأفريقيا تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الكشف عن جينات CRISPR وتشخيصها.

بعض اللاعبين الرئيسيين العاملين في سوق الكشف عن جين CRISPR وتشخيصه هم GenScript وTakara Bio Inc. وAgilent Technologies، Inc. وMerck KGaA وIntegrated DNA Technologies، Inc. (شركة تابعة لشركة Danaher) وThermo Fisher Scientific Inc. وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 CLASS SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 INTELLECTUAL PROPERTY LANDSCAPE (PATENT LANDSCAPE)

6 EPIDEMIOLOGY

7 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: REGULATORY SCENARIO

8 PIPELINE ANALYSIS FOR MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, OF CRISPR DIAGNOSTICS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISE IN PREVALENCE AND INCIDENCE OF CHRONIC DISEASES

9.1.2 RISE IN INVESTMENT IN RESEARCH AND DEVELOPMENT

9.1.3 AVAILABILITY OF FUNDING FOR CRISPR GENE DIAGNOSTICS

9.1.4 RISE IN GMP-CERTIFICATION APPROVALS FOR CRISPR GENE DIAGNOSTIC

9.1.5 RISE IN CLINICAL TRIALS FOR CRISPR BASED DIAGNOSTICS

9.2 RESTRAINTS

9.2.1 RISE IN COST OF CRISPR BASED DIAGNOSTICS

9.2.2 RISKS FACED WHILE USING CRISPR DIAGNOSIS

9.2.3 ETHICAL CONCERNS RELATED TO CRISPR GENE DETECTION AND DIAGNOSTIC RESEARCH

9.2.4 AVAILABILITY OF ALTERNATIVES

9.3 OPPORTUNITIES

9.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

9.3.2 RISE IN HEALTHCARE EXPENDITURE

9.3.3 EMERGENCE OF TECHNOLOGICAL ADVANCEMENTS IN CRISPR BASED DIAGNOSTICS

9.4 CHALLENGES

9.4.1 LACK OF SKILLED PROFESSIONALS REQUIRED FOR CRISPR DIAGNOSTICS

9.4.2 STRINGENT REGULATIONS

10 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS

10.1 OVERVIEW

10.2 CLASS-2 SINGLE CRRNA-BINDING PROTEIN

10.2.1 BIOMEDICAL DIAGNOSTICS

10.2.2 AGRICULTURAL APPLICATIONS

10.2.3 GENOME ENGINEERING

10.2.4 DRUG DISCOVERY

10.2.5 OTHERS

10.3 CLASS-1 MULTIPLE EFFECTOR PROTEINS

11 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES

11.1 OVERVIEW

11.2 PRODUCTS

11.2.1 ASSAY KITS

11.2.1.1 SGRNA KIT

11.2.1.2 GENOMIC DETECTION KIT

11.2.1.3 OTHERS

11.2.2 PROTEINS

11.2.2.1 CAS9

11.2.2.2 CPF1

11.2.2.3 OTHERS

11.2.3 PLASMID AND VECTOR

11.2.4 LIBRARY

11.2.5 CONTROL KITS

11.2.6 DELIVERY SYSTEM PRODUCTS

11.2.7 DESIGN TOOLS

11.2.8 GENOMIC RNA

11.2.9 HDR BLOCKERS

11.2.9.1 AZIDOTHYMIDINE

11.2.9.2 TRIFLUOROTHYMIDINE

11.2.9.3 OTHERS

11.2.9.4 OTHERS

11.3 SERVICES

11.3.1 G-RNA DESIGN

11.3.2 CELL LINE ENGINEERING

11.3.3 MICROBIAL GENE EDITING

11.3.4 DNA SYNTHESIS

11.3.5 OTHERS

12 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BIOMEDICAL DIAGNOSTICS

12.2.1 CANCER

12.2.2 BLOOD DISORDERS

12.2.3 HEREDITARY DISORDERS

12.2.4 MUSCULAR DYSTROPHY

12.2.5 AIDS

12.2.6 NEURODEGENERATIVE CONDITION

12.2.7 OTHERS

12.3 AGRICULTURAL APPLICATIONS

12.4 GENOME ENGINEERING

12.4.1 CELL LINE ENGINEERING

12.4.2 HUMAN STEM CELLS

12.5 DRUG DISCOVERY

12.6 OTHERS

13 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW

13.1 OVERVIEW

13.2 CRRNA

13.3 CAS ENZYME

13.4 PRE-AMPLIFICATION

13.4.1 PCR

13.4.2 LAMP

13.4.3 RPA

13.5 SAMPLE PREPARATION

13.6 SENSING

13.6.1 FLUORESCENT PROBES

13.6.2 COLORIMETRIC

14 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER

14.1 OVERVIEW

14.2 BIOTECHNOLOGY COMPANIES

14.3 ACADEMIC AND RESEARCH INSTITUTES

14.4 DIAGNOSTIC CENTERS

14.5 HOSPITALS

14.6 OTHERS

15 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 RETAIL SALES

16 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION

16.1 MIDDLE EAST AND AFRICA

16.1.1 ISRAEL

16.1.2 SOUTH AFRICA

16.1.3 U.A.E

16.1.4 EGYPT

16.1.5 SAUDI ARABIA

16.1.6 REST OF MIDDLE EAST AND AFRICA

17 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 THERMO FISHER SCIENTIFIC INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 MERCK KGA

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 AGILENT TECHNILOGIES, INC

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 INTEGRATED DNA TECHNOLOGIES, INC. (A SUBSIDIARY OF DANAHER)

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 GENSCRIPT

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 10 X GENOMICS

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 APPLIED STEM CELL

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 ADDGENE

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 BIOVISION INC.

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 CELLECTA, INC

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 CAS TAG BIOSCIENCES

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 GENECOPOEIA, INC.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 HORIZON DISCOVERY LTD

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 HERA BIOLABS

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 NEW ENGLAND BIOLABS

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 ORIGENE TECHNOLOGIES, INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SYNTHEGO

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 TAKARA BIO INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 TOOLGEN, INC.

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 PIPELINE ANALYSIS FOR MIDDLE EAST & AFRICA CRISPR GENE THERAPEUTICS

TABLE 2 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CLASS-1 MULTIPLE EFFECTOR PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA AGRICULTURAL APPLICATIONS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA DRUG DISCOVERYIN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CRRNA IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CAS ENZYME IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PRE-AMPLIFICATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PRE-AMPLIFICATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA SAMPLE PREPARATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SENSING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SENSING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA BIOTECHNOLOGY COMPANIES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ACADEMIC AND RESEARCH INSTITUTES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA DIAGNOSTIC CENTERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA HOSPITALS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA DIRECT TENDER IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA RETAIL SALES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 57 ISRAEL CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 59 ISRAEL PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 68 ISRAEL PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 69 ISRAEL SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 89 U.A.E CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 91 U.A.E PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.A.E PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 U.A.E GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 U.A.E BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 100 U.A.E PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 101 U.A.E SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 102 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 105 EGYPT CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 107 EGYPT PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 EGYPT ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 EGYPT HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 EGYPT PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 EGYPT SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 EGYPT GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 EGYPT BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 116 EGYPT PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 117 EGYPT SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 118 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 121 SAUDI ARABIA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 SAUDI ARABIA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 132 SAUDI ARABIA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 133 SAUDI ARABIA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF CHRONIC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN CRISPR DIAGNOSTICS, AND GOVERNMENT FUNDING FOR THE DEVELOPMENT OF CRISPR DETECTION KITS ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET FROM 2022 TO 2029

FIGURE 13 CLASS SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET FROM 2022 & 2029

FIGURE 14 MIDDLE EAST & AFRICA CRISPR GENE PATENT SCENARIO, BY APPLICATION

FIGURE 15 CRISPR PATENT LANDSCAPE AND NUMBER OF APPLICATIONS OF NEW PATENT FAMILIES FILED WORLDWIDE, 2001 TO 2019

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET

FIGURE 17 INCIDENCE OF VARIOUS TYPES OF CANCER IN 2020

FIGURE 18 PREVALENCE OF HUNTINGTON’S DISEASE IN 2019

FIGURE 19 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, 2021

FIGURE 20 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, 2021

FIGURE 24 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, 2021

FIGURE 28 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, 2021

FIGURE 32 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, 2021

FIGURE 36 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 40 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 41 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 42 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SNAPSHOT (2021)

FIGURE 44 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2021)

FIGURE 45 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS (2022-2029)

FIGURE 48 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.