سوق أنظمة الترميز والوسم في الشرق الأوسط وأفريقيا، حسب نوع التكنولوجيا (نفث الحبر المستمر، الترميز بالليزر، نفث الحبر الحراري، بيزو، أخرى)، النوع (طابعات نفث الحبر الصغيرة، طابعات نفث الحبر عالية الدقة، طابعات نفث الحبر الكبيرة، أنظمة الليزر، وأنظمة سوق الرش)، التطبيق (ثانوي، ثالثي، أولي)، المادة (البلاستيك والورق والكرتون والمعادن والخشب والمنسوجات (باستثناء السجاد والصوف)، الرقائق، الأسطح العضوية، المطاط والسجاد والصوف وغيرها)، عدد الفوهات (فوهة واحدة، فوهات متعددة)، الاستخدام النهائي (الأغذية والمشروبات والأدوية والكهرباء والإلكترونيات والسيارات والفضاء والعناية الشخصية والبناء والتصنيع الكيميائي وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2030.

تحليل وحجم سوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا

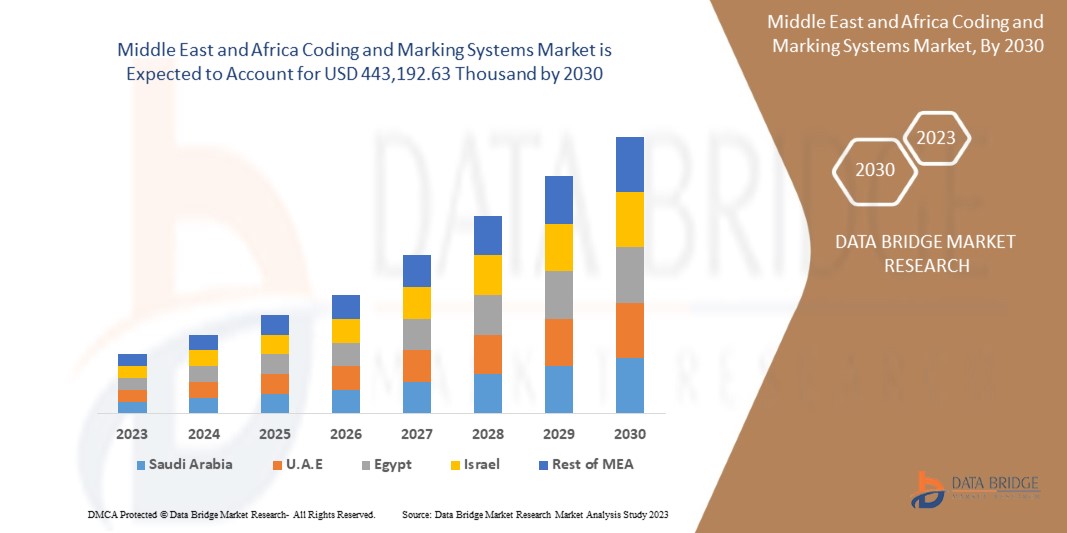

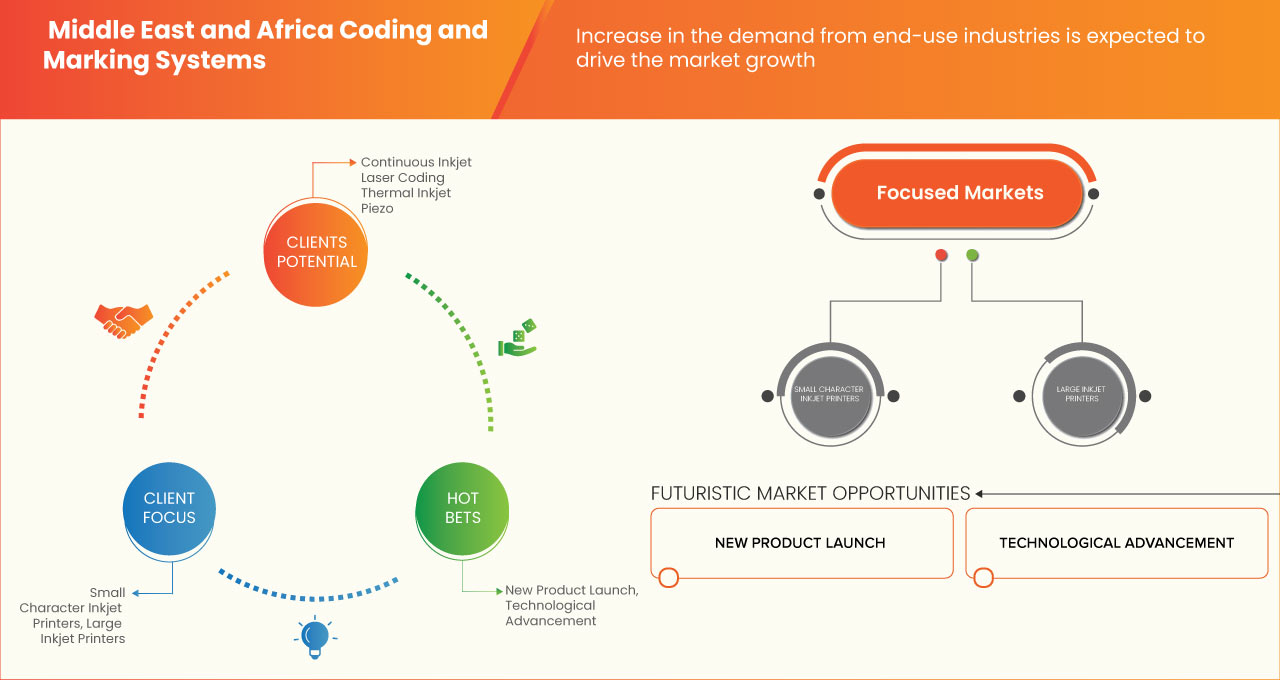

من المتوقع أن ينمو سوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا بشكل كبير في الفترة المتوقعة من 2023 إلى 2030. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 5.2٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 443،192.63 ألف دولار أمريكي بحلول عام 2030. كان الاستخدام المتزايد لأنظمة الترميز والعلامات في مختلف الصناعات هو المحرك الرئيسي لسوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا.

يقدم تقرير سوق أنظمة الترميز والعلامات تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2015) |

|

وحدات كمية |

الإيرادات بالألف دولار أمريكي |

|

القطاعات المغطاة |

حسب نوع التكنولوجيا (نفث الحبر المستمر، الترميز بالليزر، نفث الحبر الحراري، بيزو، أخرى)، النوع (طابعات نفث الحبر الصغيرة، طابعات نفث الحبر عالية الدقة، طابعات نفث الحبر الكبيرة، أنظمة الليزر، وأنظمة سوق الرش)، التطبيق (ثانوي، ثالثي، أولي)، المادة (البلاستيك، الورق والكرتون، المعادن، الخشب، المنسوجات (باستثناء السجاد والصوف)، الرقائق، الأسطح العضوية، المطاط، السجاد، الصوف، وغيرها)، عدد الفوهات (فوهة واحدة، فوهات متعددة)، الاستخدام النهائي (الأغذية والمشروبات، الأدوية، الكهرباء والإلكترونيات، السيارات والفضاء، العناية الشخصية، البناء، التصنيع الكيميائي، وغيرها) |

|

الدول المغطاة |

جنوب أفريقيا، الإمارات العربية المتحدة، المملكة العربية السعودية، عُمان، قطر، الكويت وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

Danaher، وWeber Marking Systems GmbH، وDover Corporation، وREA Elektronik GmbH، وLeibinger Group، وHitachi, Ltd.، وIllinois Tool Works Inc.، وMatthews International Corporation، وBrother Industries, Ltd.، وHSA Systems A/S وغيرها |

تعريف السوق

تُستخدم أنظمة الترميز والوسم على نطاق واسع في ترميز السيارات. تُستخدم الترميز والوسم لطباعة أرقام الأجزاء أو ملصقات مكافحة التزييف على أجزاء السيارات لمنع بيع الأجزاء المقلدة. تُستخدم أجهزة الترميز والوسم لطباعة تفاصيل المنتج المحددة على غلاف المنتج. تهدف هذه المعلومات إلى تزويد المستخدمين النهائيين والمصنعين بمعلومات موثوقة حول منتجاتهم. يتضمن الترميز، من بين أمور أخرى، طباعة تاريخ التصنيع وتاريخ انتهاء الصلاحية وحجم دفعة التعبئة. من خلال طباعة الرموز أو الملصقات على المنتجات، يمكن للمصنعين تقليل مخاطر التزييف وحماية صورة العلامة التجارية للمستهلك النهائي.

ديناميكيات سوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا

يتناول هذا القسم فهم محركات السوق والفرص والتحديات والقيود. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- ارتفاع الطلب في صناعة السيارات

لقد زاد الطلب المتزايد على أنظمة الترميز والوسم في صناعة السيارات بسبب زيادة مبيعات المنتجات المقلدة. لذلك، يستخدم المصنعون أنظمة الترميز والوسم لتقليل استخدام المنتجات المقلدة في السوق ويستخدمون بشكل متكرر أنظمة الترميز والوسم لترميز ملصقات أرقام الأجزاء على آلات المركبات. يجب أن تكون معدات الترميز والوسم قادرة على تلبية المتطلبات المعقدة لمصنعي السيارات بشكل مريح في صناعة تتطلب طباعة المعلومات على المكونات الفردية في مراحل مختلفة من عملية التصنيع. يجب أن توفر أجهزة الترميز القوية تكاملاً خاليًا من المتاعب في العمليات الحالية ثم تعمل باستمرار في بيئات الإنتاج الصعبة. يبحث المصنعون عن حلول التتبع والاحتواء في الشرق الأوسط وأفريقيا، بالإضافة إلى القدرة على طباعة شعارهم وتاريخ الإنتاج وتاريخ انتهاء الصلاحية ورقم الدفعة وأرقام الأجزاء وغيرها من المعلومات على منتجاتهم.

- الاستخدام المتزايد لأنظمة الترميز والعلامات في مختلف الصناعات

تستخدم العديد من الصناعات تقنيات الترميز والوسم، مثل صناعة السلع الاستهلاكية سريعة الاستهلاك، والأغذية والمشروبات، والمنتجات الإلكترونية، والمعادن، والمطاط، والمنسوجات، والمواد الكيميائية والزراعية ، والبذور، والبناء، والرعاية الصحية، والمستحضرات الصيدلانية. إن الطلب المتزايد على الأغذية المعبأة، والأغذية المعبأة الصحية، وزيادة التحضر يزيد من استهلاك هذه المنتجات، مما يزيد من الطلب على أنظمة الترميز والوسم. تعد صناعات الأغذية والأدوية من بين أكثر الصناعات تنظيماً من حيث إمكانية تتبع سلسلة التوريد. يساهم ترميز المنتجات ووضع العلامات عليها في إمكانية التتبع الكامل، وحماية كل من المستهلكين والشركات باستخدام أرقام الدفعات والرموز الشريطية وتواريخ انتهاء الصلاحية. مع تطور تقنيات الترميز مع التقارير والتحليلات في الوقت الفعلي، سيتمكن المستهلكون من اكتساب رؤى أكثر شفافية حول أصول المكونات التي يتكون منها المنتج.

فرص

- قواعد حكومية صارمة لأنظمة الترميز والعلامات

لقد قامت الحكومات في جميع أنحاء العالم بتنفيذ لوائح جديدة للتغليف والوسم. وتضطر العديد من شركات التغليف إلى القيام باستثمارات كبيرة في معدات الترميز والوسم من أجل الامتثال للوائح وتجنب العقوبات. وتستخدم العديد من الشركات تقنيات متقدمة مثل مجموعة البيانات لتحديد وتتبع المنتجات في الصناعات مثل الأغذية والمشروبات والرعاية الصحية والأدوية وغيرها. وتفرض العديد من الحكومات في جميع أنحاء العالم لوائح صارمة للتغليف والوسم. وتتطلب هذه اللوائح ترميزًا باللون الأحمر على جوانب ملصقات العبوات الخاصة بمنتجات الأغذية المعبأة ذات المحتوى العالي من الدهون والسكر والملح. ونتيجة لذلك، أصبح الترميز أكثر شيوعًا في جميع أنحاء العالم.

- زيادة استخدام الترميز بالليزر

لقد زاد الطلب على تقنية الترميز بالليزر بشكل كبير، ويرجع ذلك أساسًا إلى خصائصها وقابليتها للتطبيق في التطبيقات الصناعية المختلفة من قبل المستخدمين النهائيين. على سبيل المثال، تكتسب حلول الترميز بالليزر شعبية في السلع الاستهلاكية مثل مستحضرات التجميل والعناية الشخصية وخدمة الأغذية والسيارات. تمثل آلات الترميز بالليزر أحدث التطورات في تكنولوجيا الترميز والوسم وتستخدم لطباعة الرموز على الأجسام المعدنية أو المعدنية وغيرها من العناصر. مع زيادة طلب العملاء على التكنولوجيا المتقدمة، يتجه مصنعو المستخدم النهائي إلى تقنية الليزر. توفر أجهزة الترميز بالليزر علامات مستمرة عالية السرعة والقدرة على تقديم أكواد أو شعارات عالية الدقة لحماية العلامة التجارية. إنها توفر قدرات وسم حادة ومفصلة، وهو أمر مفيد في العديد من الصناعات النهائية. بالإضافة إلى ذلك، يركز مصنعو أنظمة الترميز والوسم على توفير حلول صديقة للبيئة لتلبية الطلب المتزايد من مختلف قطاعات الاستخدام النهائي، مثل الأطعمة ومظاريف التعبئة والتغليف.

ضبط النفس

- ارتفاع تكلفة معدات الترميز والعلامات والرموز المطبوعة بشكل غير صحيح

لقد ظهرت معدات جديدة لتقنيات الطباعة الصناعية، مثل الترميز والعلامات التجارية، والتي تعد بتحسين كفاءة هذه العمليات. ومع ذلك، فقد تطور تطوير وتطبيق معدات الترميز والعلامات التجارية نتيجة لتغير أشكال التعبئة والتغليف وتعقيدات التصميم. إن الرموز الشريطية التي لا تُطبع بشكل صحيح، والعلامات التجارية التالفة، والمعلومات التي يجب استخدامها قبل تاريخ انتهاء الصلاحية والتي تُفقد بسبب بهتان الحبر المطبوع، كلها يمكن أن تؤدي إلى سوء الفهم بين الشركات والعملاء. إن الافتقار إلى الرموز المناسبة يمكن أن يتسبب في فقدان المنتجات لشعبيتها، وقد يعاني المصنعون من عدم القدرة على التتبع بشكل فعال.

تحدي

- تكلفة التركيب العالية والأخطاء التشغيلية

غالبًا ما يؤدي الإهمال والخطأ البشري إلى الإضرار بمصالح صناع السوق والبائعين. وهذا يمثل تحديًا كبيرًا في صناعة الاستخدام النهائي التي يركز عليها المصنعون باستمرار. في شركات التصنيع الكبيرة، يعمل العمال عادةً بنظام المناوبات، مما يزيد من التفاعل بين الإنسان والآلة. يميل هذا إلى زيادة هامش الخطأ حيث تستغرق عملية الطباعة وقتًا أطول للتعلم. علاوة على ذلك، فإنه يستهلك الوقت والموارد من الشركات التي يمكن استخدامها في مكان آخر.

تميل معدات الترميز والوسم إلى أن تكون باهظة الثمن للغاية. لذلك، فإن تركيب أنظمة الترميز والوسم يمثل تحديًا. قد لا يكون لدى جميع المشاركين في سلسلة التوريد، وخاصة الشركات الصغيرة، الموارد المالية لبناء البنية الأساسية اللازمة لتنفيذ أنظمة الترميز والوسم. ستكون تكاليف التشغيل المرتفعة تحديًا كبيرًا للسوق خلال فترة التنبؤ.

التطورات الأخيرة

- في ديسمبر 2021، قدمت شركة Koenig & Bauer عبوات خاصة لأوراق التبغ الفاخرة مع علامات الليزر. سيتم تنفيذ هذه المهمة في الموقع في المستقبل بواسطة نظام الترميز udaFORMAXX Offline شبه التلقائي، والذي تم تجهيزه بليزر تحديد ثاني أكسيد الكربون للعلامات الدائمة دون تلطيخ

- في يونيو 2022، أطلقت شركة CONTROL PRINT LTD. منتجًا جديدًا وهو Pench، وهي طابعة نفث حبر مستمرة. تُستخدم بشكل أساسي في قطاعات مثل الكابلات والأسلاك والصلب وغيرها من التطبيقات فائقة السرعة، حيث يمكنها الطباعة بسرعة تصل إلى 700 متر/دقيقة. سيساعد إطلاق المنتج الشركة على توسيع محفظة منتجاتها وقاعدة عملائها في مختلف الصناعات النهائية

نطاق سوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا

يتم تصنيف سوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا بناءً على نوع التكنولوجيا والنوع والتطبيق وعدد الفوهات والمواد والاستخدام النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع التكنولوجيا

- نفث الحبر المستمر

- الترميز بالليزر

- الترميز الحراري

- بيزو

- آحرون

على أساس نوع التكنولوجيا، يتم تقسيم سوق أنظمة الترميز والعلامات إلى نفث الحبر المستمر، والترميز بالليزر، ونفث الحبر الحراري، والبيزو، وغيرها.

يكتب

- طابعات نفث الحبر ذات الأحرف الصغيرة

- طابعات نفث الحبر عالية الدقة

- الطابعات النافثة للحبر الكبيرة

- أنظمة الليزر وأنظمة الرش

على أساس النوع، يتم تقسيم سوق أنظمة الترميز والعلامات إلى طابعات نفث الحبر ذات الأحرف الصغيرة، وطابعات نفث الحبر عالية الدقة، وطابعات نفث الحبر الكبيرة، وأنظمة الليزر وأنظمة السوق للرش.

طلب

- أساسي

- ثانوي

- ثالثي

على أساس التطبيق، يتم تقسيم سوق أنظمة الترميز والعلامات إلى أولية وثانوية وثالثية.

عدد الفوهات

- فوهة واحدة

- فوهات متعددة

على أساس عدد الفوهات، يتم تقسيم سوق أنظمة الترميز والعلامات إلى فوهة واحدة وفوهات متعددة.

مادة

- البلاستيك

- الورق والكرتون

- معدن

- خشب

- المنسوجات (باستثناء السجاد والصوف)

- رقائق معدنية

- الأسطح العضوية

- ممحاة

- السجادة

- الصوف

- آحرون

على أساس المادة، يتم تقسيم سوق أنظمة الترميز والعلامات إلى البلاستيك والورق والكرتون والمعادن والخشب والمنسوجات (باستثناء السجاد والصوف) والرقائق والأسطح العضوية والمطاط والسجاد والصوف وغيرها.

الاستخدام النهائي

- الأطعمة والمشروبات

- المستحضرات الصيدلانية

- الكهرباء والالكترونيات

- السيارات والفضاء

- العناية الشخصية

- بناء

- التصنيع الكيميائي

- آحرون

على أساس الاستخدام النهائي، يتم تقسيم سوق أنظمة الترميز والعلامات إلى الأغذية والمشروبات، والأدوية، والكهرباء والإلكترونيات، والسيارات والفضاء، والعناية الشخصية، والبناء، والتصنيع الكيميائي، وغيرها.

تحليل/رؤى إقليمية لسوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا

يتم تقسيم سوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا على أساس نوع التكنولوجيا والنوع والتطبيق وعدد الفوهات والمواد والاستخدام النهائي.

الدول الموجودة في سوق أنظمة الترميز والعلامات هي جنوب أفريقيا والإمارات العربية المتحدة والمملكة العربية السعودية وعمان وقطر والكويت وبقية دول الشرق الأوسط وأفريقيا.

ومن المتوقع أن تهيمن جنوب أفريقيا على سوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا بسبب الطلب المتزايد على أنظمة الترميز والعلامات بالليزر في مختلف الصناعات.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. وتشير البيانات إلى تحليل سلسلة القيمة في المصب والمصب، وتحليل الاتجاهات الفنية لقوى بورتر الخمس، ودراسات الحالة، وهي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق أنظمة الترميز والعلامات في الشرق الأوسط وأفريقيا.

بعض اللاعبين الرئيسيين في السوق الذين يعملون في سوق الشرق الأوسط وأفريقيا هم Danaher و Weber Marking Systems GmbH و Dover Corporation و REA Elektronik GmbH و Leibinger Group و Hitachi، Ltd. و Illinois Tool Works Inc. و Matthews International Corporation و Brother Industries، Ltd. و HSA Systems A/S وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TECHNOLOGY TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 OVERVIEW ON NEW MACHINES V/S CONSUMBALES SOLD

4.4.1 END USER INDUSTRIES

4.4.2 PRODUCT AND BATCH SIZE

4.4.3 TYPE OF PRINTING

4.4.4 TECHNOLOGICAL ADVANCEMENTS

4.5 LIST OF KEY BUYERS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE AUTOMOTIVE INDUSTRY

6.1.2 INCREASING USE OF CODING AND MARKING SYSTEMS IN VARIOUS INDUSTRIES

6.2 RESTRAINT

6.2.1 HIGH COST OF CODING AND MARKING EQUIPMENT AND IMPROPER PRINTED CODES

6.3 OPPORTUNITIES

6.3.1 STRINGENT GOVERNMENT RULES FOR CODING AND MARKING SYSTEMS

6.3.2 INCREASING USE OF LASER CODING

6.4 CHALLENGES

6.4.1 HIGH INSTALLATION COST AND OPERATIONAL ERRORS

7 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE

7.1 OVERVIEW

7.2 CONTINUOUS INKJET

7.3 LASER CODING

7.4 THERMAL INKJET

7.5 PIEZO

7.6 OTHERS

8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE

8.1 OVERVIEW

8.2 SMALL CHARACTER INKJET PRINTERS

8.3 HIGH RESOLUTION INKJET PRINTERS

8.4 LARGE INKJET PRINTERS

8.5 LASER SYSTEMS AND SPRAY MARKET SYSTEMS

9 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SECONDARY

9.3 TERTIARY

9.4 PRIMARY

10 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 PLASTICS

10.3 PAPER & CARDBOARD

10.4 METAL

10.5 WOOD

10.6 TEXTILES (EXCLUDING CARPET AND FLEECE)

10.7 FOILS

10.8 ORGANIC SURFACES

10.9 RUBBER

10.1 CARPET

10.11 FLEECE

10.12 OTHERS

11 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES

11.1 OVERVIEW

11.2 SINGLE NOZZLE

11.3 MULTIPLE NOZZLES

12 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE

12.1 OVERVIEW

12.2 FOOD & BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 PACKAGED FOOD

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 MEAT & POULTRY

12.2.1.4 FRUITS & VEGETABLES

12.2.1.5 PET FOOD & ANIMAL FEED

12.2.1.6 OTHERS

12.2.2 FOOD & BEVERAGE, BY TECHNOLOGY TYPE

12.2.2.1 THERMAL INKJET

12.2.2.2 CONTINUOUS INKJET

12.2.2.3 LASER CODING

12.2.2.4 PIEZO

12.2.2.5 OTHERS

12.2.3 FOOD & BEVERAGE, BY MATERIAL

12.2.3.1 PLASTICS

12.2.3.2 FOILS

12.2.3.3 PAPER & CARDBOARD

12.2.3.4 METAL

12.2.3.5 WOOD

12.2.3.6 RUBBER

12.2.3.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.2.3.8 ORGANIC SURFACES

12.2.3.9 CARPET

12.2.3.10 FLEECE

12.2.3.11 OTHERS

12.3 PHARMACEUTICALS

12.3.1 PHARMACEUTICALS, BY TECHNOLOGY TYPE

12.3.1.1 THERMAL INKJET

12.3.1.2 CONTINUOUS INKJET

12.3.1.3 LASER CODING

12.3.1.4 PIEZO

12.3.1.5 OTHERS

12.3.2 PHARMACEUTICALS, BY MATERIAL

12.3.2.1 PAPER & CARDBOARD

12.3.2.2 PLASTICS

12.3.2.3 FOILS

12.3.2.4 METAL

12.3.2.5 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.3.2.6 RUBBER

12.3.2.7 WOOD

12.3.2.8 ORGANIC SURFACES

12.3.2.9 CARPET

12.3.2.10 FLEECE

12.3.2.11 OTHERS

12.4 ELECTRICAL & ELECTRONICS

12.4.1 ELECTRICAL & ELECTRONICS, BY TECHNOLOGY TYPE

12.4.1.1 CONTINUOUS INKJET

12.4.1.2 THERMAL INKJET

12.4.1.3 LASER CODING

12.4.1.4 PIEZO

12.4.1.5 OTHERS

12.4.2 ELECTRICAL & ELECTRONICS, BY MATERIAL

12.4.2.1 PLASTICS

12.4.2.2 METAL

12.4.2.3 RUBBER

12.4.2.4 FOILS

12.4.2.5 WOOD

12.4.2.6 PAPER & CARDBOARD

12.4.2.7 ORGANIC SURFACES

12.4.2.8 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.4.2.9 CARPET

12.4.2.10 FLEECE

12.4.2.11 OTHERS

12.5 AUTOMOTIVE & AEROSPACE

12.5.1 AUTOMOTIVE & AEROSPACE, BY TECHNOLOGY TYPE

12.5.1.1 CONTINUOUS INKJET

12.5.1.2 LASER CODING

12.5.1.3 THERMAL INKJET

12.5.1.4 PIEZO

12.5.1.5 OTHERS

12.5.2 AUTOMOTIVE & AEROSPACE, BY MATERIAL

12.5.2.1 RUBBER

12.5.2.2 METAL

12.5.2.3 PLASTICS

12.5.2.4 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.5.2.5 CARPET

12.5.2.6 FLEECE

12.5.2.7 FOILS

12.5.2.8 PAPER & CARDBOARD

12.5.2.9 WOOD

12.5.2.10 ORGANIC SURFACES

12.5.2.11 OTHERS

12.6 PERSONAL CARE

12.6.1 PERSONAL CARE, BY TECHNOLOGY TYPE

12.6.1.1 CONTINUOUS INKJET

12.6.1.2 THERMAL INKJET

12.6.1.3 LASER CODING

12.6.1.4 PIEZO

12.6.1.5 OTHERS

12.6.2 PERSONAL CARE, BY MATERIAL

12.6.2.1 PLASTICS

12.6.2.2 PAPER & CARDBOARD

12.6.2.3 FOILS

12.6.2.4 METAL

12.6.2.5 RUBBER

12.6.2.6 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.6.2.7 ORGANIC SURFACES

12.6.2.8 WOOD

12.6.2.9 CARPET

12.6.2.10 FLEECE

12.6.2.11 OTHERS

12.7 CONSTRUCTION

12.7.1 CONSTRUCTION, BY TECHNOLOGY TYPE

12.7.1.1 CONTINUOUS INKJET

12.7.1.2 LASER CODING

12.7.1.3 PIEZO

12.7.1.4 THERMAL INKJET

12.7.1.5 OTHERS

12.7.2 CONSTRUCTION, BY MATERIAL

12.7.2.1 METAL

12.7.2.2 WOOD

12.7.2.3 CARPET

12.7.2.4 PLASTICS

12.7.2.5 PAPER & CARDBOARD

12.7.2.6 RUBBER

12.7.2.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.7.2.8 FOILS

12.7.2.9 FLEECE

12.7.2.10 ORGANIC SURFACES

12.7.2.11 OTHERS

12.8 CHEMICAL MANUFACTURING

12.8.1 CHEMICAL MANUFACTURING, BY TECHNOLOGY TYPE

12.8.1.1 CONTINUOUS INKJET

12.8.1.2 LASER CODING

12.8.1.3 THERMAL INKJET

12.8.1.4 PIEZO

12.8.1.5 OTHERS

12.8.2 CHEMICAL MANUFACTURING, BY MATERIAL

12.8.2.1 PLASTICS

12.8.2.2 RUBBER

12.8.2.3 METAL

12.8.2.4 PAPER & CARDBOARD

12.8.2.5 WOOD

12.8.2.6 FOILS

12.8.2.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.8.2.8 ORGANIC SURFACES

12.8.2.9 CARPET

12.8.2.10 FLEECE

12.8.2.11 OTHERS

12.9 OTHERS

13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY REGION

13.1 MIDDLE EAST & AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 UNITED ARAB EMIRATES

13.1.4 QATAR

13.1.5 KUWAIT

13.1.6 OMAN

13.1.7 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14.2 ACQUISITION

14.3 PRODUCT LAUNCH

14.4 CERTIFICATION

15 COMPANY PROFILES

15.1 ILLINOIS TOOL WORKS INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SWOT ANALYSIS

15.1.5 PRODUCT PORTFOLIO

15.1.6 RECENT DEVELOPMENTS

15.2 HITACHI, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SWOT ANALYSIS

15.2.5 PRODUCT PORTFOLIO

15.2.6 RECENT DEVELOPMENTS

15.3 DANAHER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SWOT ANALYSIS

15.3.5 PRODUCT PORTFOLIO

15.3.6 RECENT DEVELOPMENTS

15.4 BROTHER INDUSTRIES, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SWOT ANALYSIS

15.4.5 PRODUCT PORTFOLIO

15.4.6 RECENT DEVELOPMENTS

15.5 DOVER CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SWOT ANALYSIS

15.5.5 PRODUCT PORTFOLIO

15.5.6 RECENT DEVELOPMENTS

15.6 ATD UK

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CODELINE AUTOMATION

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONTROL PRINT LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SWOT ANALYSIS

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 HSA SYSTEMS A/S

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 LEIBINGER GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 SWOT ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 MATTHEWS INTERNATIONAL CORPORATION

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SWOT ANALYSIS

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 NOVANTA INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SWOT ANALYSIS

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 OVERPRINT LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 SWOT ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 PAK-TEC

15.14.1 COMPANY SNAPSHOT

15.14.2 SWOT ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 PROMACH INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 SWOT ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 REA ELEKTRONIK GMBH.

15.16.1 COMPANY SNAPSHOT

15.16.2 SWOT ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 WEBER MARKING SYSTEMS GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 SWOT ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA CONTINUOUS INKJET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA LASER CODING IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA THERMAL INKJET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA PIEZO IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA SMALL CHARACTER INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA HIGH RESOLUTION INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA LARGE INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA LASER SYSTEMS AND SPRAY MARKET SYSTEMS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA SECONDARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA TERTIARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA PRIMARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA PLASTICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA PAPER & CARDBOARD IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA METAL IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA WOOD IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA TEXTILES (EXCLUDING CARPET AND FLEECE) CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA FOILS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA ORGANIC SURFACES IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA RUBBER IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA CARPET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA FLEECE IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA SINGLE NOZZLE IN CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA MULTIPLE NOZZLES IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 78 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 91 SOUTH AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 SOUTH AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 93 SOUTH AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 SOUTH AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 95 SOUTH AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 SOUTH AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 97 SOUTH AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 SOUTH AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 99 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 102 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 103 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 104 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 105 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 108 SAUDI ARABIA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 SAUDI ARABIA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 110 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 112 SAUDI ARABIA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 SAUDI ARABIA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 114 SAUDI ARABIA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 SAUDI ARABIA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 116 SAUDI ARABIA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 SAUDI ARABIA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 118 SAUDI ARABIA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 SAUDI ARABIA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 120 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 123 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 124 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 125 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 126 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 129 UNITED EMIRATES ARAB PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 UNITED EMIRATES ARAB PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 131 UNITED EMIRATES ARAB ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 UNITED EMIRATES ARAB ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 133 UNITED EMIRATES ARAB AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 UNITED EMIRATES ARAB AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 135 UNITED EMIRATES ARAB PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 UNITED EMIRATES ARAB PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 137 UNITED EMIRATES ARAB CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 UNITED EMIRATES ARAB CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 139 UNITED EMIRATES ARAB CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 UNITED EMIRATES ARAB CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 141 QATAR CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 QATAR CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 QATAR CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 144 QATAR CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 145 QATAR CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 146 QATAR CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 147 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 150 QATAR PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 QATAR PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 152 QATAR ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 QATAR ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 154 QATAR AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 QATAR AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 156 QATAR PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 QATAR PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 158 QATAR CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 QATAR CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 160 QATAR CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 QATAR CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 162 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 164 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 165 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 166 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 167 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 168 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 171 KUWAIT PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 KUWAIT PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 173 KUWAIT ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 KUWAIT ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 175 KUWAIT AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 KUWAIT AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 177 KUWAIT PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 KUWAIT PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 179 KUWAIT CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 KUWAIT CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 181 KUWAIT CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 182 KUWAIT CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 183 OMAN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 OMAN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 OMAN CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 186 OMAN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 187 OMAN CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 188 OMAN CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 189 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 192 OMAN PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 OMAN PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 194 OMAN ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 OMAN ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 196 OMAN AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 OMAN AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 198 OMAN PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 OMAN PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 200 OMAN CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 201 OMAN CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 202 OMAN CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 OMAN CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 204 REST OF MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

FIGURE 2 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: THE TECHNOLOGY TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MARKET END – USE COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: SEGMENTATION

FIGURE 14 THE GROWING USE OF CODING AND MARKING SYSTEMS IN VARIOUS INDUSTRIES IS ONE OF THE DRIVING FACTORS FOR THR MARKET GROWTH

FIGURE 15 CONTINUOUS INKJET IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET IN 2023 & 2030

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

FIGURE 18 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE, 2022

FIGURE 19 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2022

FIGURE 20 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY MATERIAL, 2022

FIGURE 22 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY NUMBER OF NOZZLES, 2022

FIGURE 23 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY END USE, 2022

FIGURE 24 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.