سوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا، حسب الخدمات (قياسات تخطيط القلب/هولتر، قياسات ضغط الدم ، خدمات تقييم سلامة القلب في المختبر، التصوير القلبي الوعائي، مراقبة القياس عن بعد في الوقت الحقيقي، القراءة المركزية لتخطيط كهربية القلب، التصوير القلبي غير الجراحي، اختبار الإجهاد الفسيولوجي، دراسات QT الشاملة، QT ونمذجة استجابة التعرض، تجمع الصفائح الدموية وغيرها من الخدمات)، المرحلة (المرحلة 1 والمرحلة 2 والمرحلة 3)، النوع (الخدمات المتكاملة والخدمات المستقلة)، المستخدم النهائي ( شركات الأدوية والمستحضرات الصيدلانية الحيوية، منظمات البحوث التعاقدية والمعاهد الأكاديمية والبحثية) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والرؤى

إن سوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا مدفوع بعوامل مثل زيادة عدد التجارب السريرية، وعدد متزايد من اللاعبين الرئيسيين في السوق والابتكار في التكنولوجيا، مما يعزز الطلب عليها، فضلاً عن زيادة الاستثمار في البحث والتطوير، مما يؤدي إلى نمو السوق. حاليًا، تجري دراسات بحثية مختلفة، ومن المتوقع أن تخلق ميزة تنافسية للشركات المصنعة لتطوير أنظمة خدمات سلامة القلب الجديدة والمبتكرة، والتي من المتوقع أن توفر فرصًا أخرى مختلفة في سوق خدمات سلامة القلب. ومع ذلك، من المتوقع أن تعيق اللوائح الحكومية الصارمة بشأن الموافقة النمو.

يقدم تقرير سوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل لتأثير الإيرادات لتحقيق هدفك المنشود. إن قابلية التوسع وتوسع أعمال وحدات البيع بالتجزئة في البلدان النامية في مختلف المناطق والشراكة مع الموردين للتوزيع الآمن لمنتجات الآلات والأدوية هي المحركات الرئيسية التي دفعت الطلب في السوق في فترة التنبؤ.

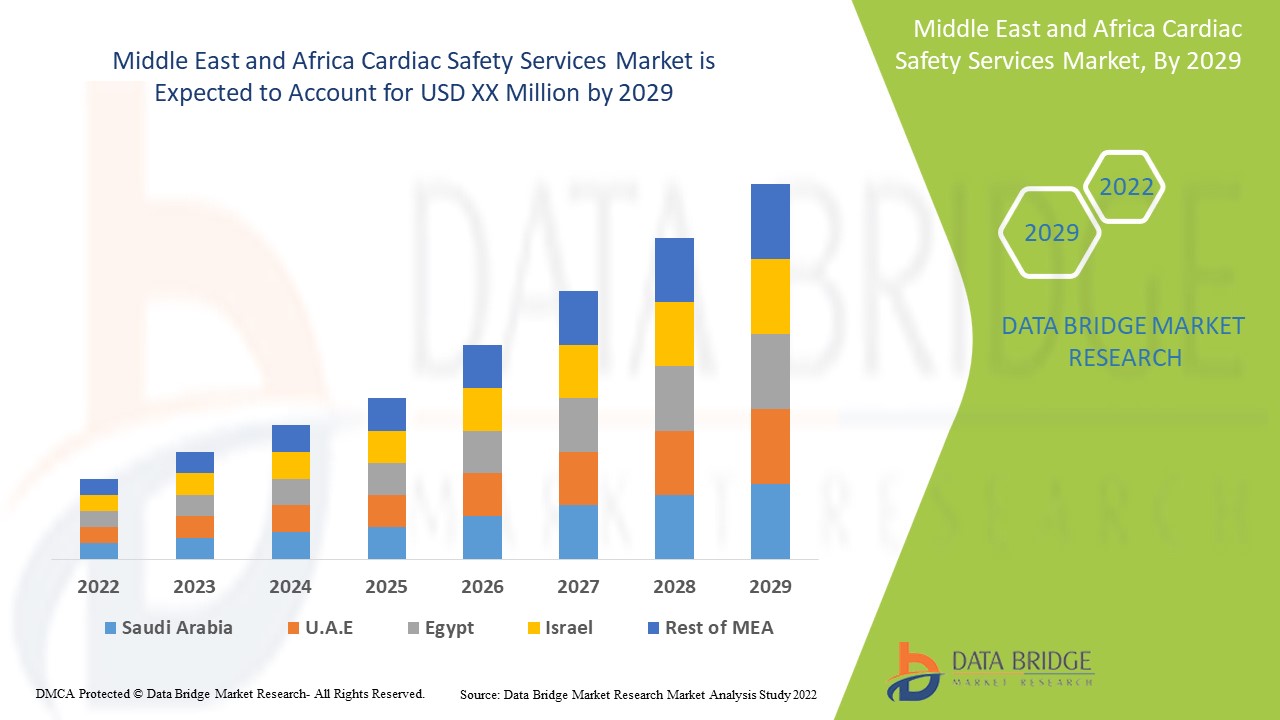

يعتبر سوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا داعمًا ويهدف إلى الحد من تطور المرض. تحلل شركة Data Bridge Market Research أن سوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا سينمو بمعدل نمو سنوي مركب قدره 13.7٪ خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب الخدمات (قياسات تخطيط كهربية القلب/هولتر، قياسات ضغط الدم، خدمات تقييم سلامة القلب في المختبر، التصوير القلبي الوعائي، مراقبة القياس عن بعد في الوقت الفعلي، القراءة المركزية لتخطيط كهربية القلب، التصوير القلبي غير الجراحي، اختبار الإجهاد الفسيولوجي، دراسات QT الشاملة، QT ونمذجة استجابة التعرض، تجميع الصفائح الدموية والخدمات الأخرى)، المرحلة (المرحلة 1 والمرحلة 2 والمرحلة 3)، النوع (الخدمات المتكاملة والخدمات المستقلة)، المستخدم النهائي (شركات الأدوية والمستحضرات الصيدلانية الحيوية، منظمات البحوث التعاقدية والمعاهد الأكاديمية والبحثية) |

|

الدول المغطاة |

جنوب أفريقيا، المملكة العربية السعودية، الإمارات العربية المتحدة، إسرائيل، مصر وبقية دول الشرق الأوسط |

|

الجهات الفاعلة في السوق المشمولة |

Koninklijke Philips NV، وLaborator Corporation of America Holdings، وIQVIA، وMedpace، وNcardia، وCertara، وEurofins Scientific، وSGS SA وغيرها. |

تعريف السوق:

تساعد خدمات سلامة القلب بشكل عام في دعم وتصميم التجارب السريرية وغيرها من الأبحاث اللازمة لمراقبة سلامة القلب. وقد زاد الطلب على سوق خدمات سلامة القلب في كل من البلدان المتقدمة والنامية والسبب وراء ذلك هو العدد المتزايد من التجارب السريرية وإطلاق المنتجات. ينمو سوق خدمات سلامة القلب بسبب إدخال المنتجات المبتكرة وزيادة المنتجات التكنولوجية وارتفاع الدخل المتاح. سينمو السوق في الفترة المتوقعة بسبب استكشاف الأسواق الناشئة والمبادرات الاستراتيجية من قبل اللاعبين في السوق وزيادة الإنفاق على الرعاية الصحية.

ديناميكيات سوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا

السائقين

- زيادة في عدد التجارب السريرية

إن التجارب السريرية عبارة عن نظام جيد التنظيم يعود تاريخه إلى مئات السنين ولا يزال يشكل العمود الفقري للمتطلبات التنظيمية المطلوبة للموافقة على أي دواء. وقد حدث مؤخرًا تقدم كبير في مجال التجارب السريرية، مما أدى إلى زيادة عدد التجارب السريرية ومن المتوقع أن يؤدي ذلك إلى تعزيز نمو السوق.

لقد حدثت تغييرات مختلفة في تنظيم التجارب السريرية، مما أدى إلى زيادة عدد التجارب السريرية ونتائجها الإيجابية-

على سبيل المثال،

- وفقًا للمقال الذي نشرته Medical News، فقد حدثت زيادة كبيرة في عدد التجارب بسبب ارتفاع جودة التجارب السريرية، مثل التدريب الإلزامي لجميع الموظفين. كما صرح المعهد الوطني للصحة في عام 2017 أنه يجب تدريب جميع الباحثين والموظفين على الممارسات السريرية الجيدة (GCP) في التجارب التي يمولها المعهد الوطني للصحة

زيادة في الإنفاق على الرعاية الصحية والتمويل

إن حجم الأموال التي تستخدمها دولة ما في الرعاية الصحية ومعدل نموها بمرور الوقت يتأثر بمجموعة واسعة من العوامل الاقتصادية والاجتماعية، بما في ذلك ترتيبات التمويل وبنية تنظيم النظام الصحي.

لقد زادت نفقات الرعاية الصحية في البلدان المتقدمة والاقتصادات الناشئة مع نمو الدخل المتاح للأفراد. وكلما زاد الإنفاق على الرعاية الصحية، كلما كان سكان البلد أكثر صحة.

فرصة

- زيادة في تطوير الأدوية الجديدة

تُعَد التجارب السريرية أمرًا بالغ الأهمية لاكتشاف وتطوير أدوية جديدة لعلاج الأمراض. وهي أفضل طريقة يمكن للباحثين من خلالها معرفة العلاجات التي تنجح أو لا تنجح مع البشر. ويتميز تطوير الأدوية بأنه ابتكار علاج جديد كأدوية أو أجهزة لعلاج أمراض مختلفة مثل السرطان والغدد الصماء والتمثيل الغذائي وغيرها.

- وبالتالي، فإن التجارب السريرية هي الطريقة الأكثر فعالية لضمان سلامة وفعالية الدواء العلاجي قبل طرحه في السوق والاستهلاك البشري، بما في ذلك تقييم سلامة القلب وهو جزء أساسي قبل طرح أي منتج طبي في السوق.

ضبط النفس/التحدي

إن التقييم والإبلاغ المناسبين لبيانات سلامة القلب السريرية أمر ضروري. إن الموافقة على أي منتج طبي وسحبه من السوق يعتمدان على تقييم سلامة القلب. لذا فمن الضروري توفير وإجراء تقييم سلامة القلب وفقًا للإجراءات القانونية، وإلا فإن ذلك يؤدي إلى تأخير الموافقة على المنتج وهو ما من المتوقع أن يكبح نمو السوق.

على سبيل المثال،

- وفقًا للمقال الذي نشرته IQVIA، كان هناك 47 حالة سحب للأدوية بعد التسويق بين عامي 1957 و2007، وكان 45% منها بسبب مخاوف بشأن السمية القلبية الوعائية. وعلى نحو مماثل، فإن 27% من جزيئات الأدوية الجديدة المحتملة التي فشلت في المرحلة ما قبل السريرية في العقدين الماضيين كانت بسبب السمية القلبية الوعائية لأنها لم تستوفِ المتطلبات التنظيمية المطلوبة.

تجزئة سوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا

يتم تصنيف سوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا إلى نوع وخدمات ومرحلة ومستخدم نهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية لديك والاختلاف في أسواقك المستهدفة.

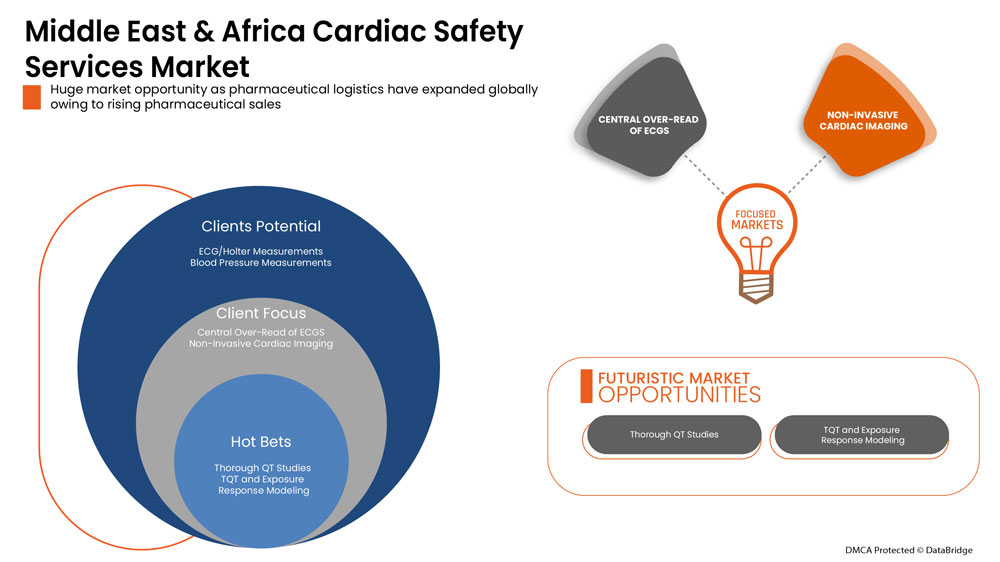

خدمات

- قياسات تخطيط القلب/هولتر

- قياس ضغط الدم

- خدمات تقييم سلامة القلب في المختبر

- تصوير القلب والأوعية الدموية

- مراقبة القياس عن بعد في الوقت الحقيقي

- القراءة المركزية لتخطيط كهربية القلب

- التصوير القلبي غير الجراحي

- اختبار الإجهاد الفسيولوجي

- دراسات QT الشاملة

- نمذجة استجابة التعرض وTQT

- تجمع الصفائح الدموية

- خدمات أخرى

على أساس الخدمات، يتم تقسيم سوق خدمات سلامة القلب إلى قياسات تخطيط كهربية القلب/هولتر، وقياسات ضغط الدم، وخدمات تقييم سلامة القلب في المختبر، والتصوير القلبي الوعائي، ومراقبة القياس عن بعد في الوقت الفعلي، والقراءة المركزية لتخطيط كهربية القلب، والتصوير القلبي غير الجراحي، واختبار الإجهاد الفسيولوجي، ودراسات QT الشاملة، ونمذجة استجابة QT والتعرض، وتجمع الصفائح الدموية وغيرها من الخدمات

مرحلة

- المرحلة 1

- المرحلة الثانية

- المرحلة 3

على أساس المراحل، يتم تقسيم سوق خدمات سلامة القلب إلى المرحلة 1 والمرحلة 2 والمرحلة 3.

يكتب

- الخدمات المتكاملة

- خدمات مستقلة

على أساس النوع، يتم تقسيم سوق خدمات سلامة القلب إلى خدمات متكاملة وخدمات مستقلة.

المستخدم النهائي

- شركات الأدوية والمستحضرات الصيدلانية الحيوية

- منظمات البحوث التعاقدية

- المعهد الأكاديمي والبحثي

على أساس المستخدم النهائي، يتم تقسيم سوق خدمات سلامة القلب إلى شركات الأدوية والمستحضرات الصيدلانية الحيوية، ومنظمات البحوث التعاقدية، والمعاهد الأكاديمية والبحثية.

تحليل/رؤى إقليمية لخدمات سلامة القلب

يتم تحليل خدمات سلامة القلب وتوفير رؤى حول حجم السوق والاتجاهات حسب النوع والخدمات والمرحلة والمستخدم النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير خدمات سلامة القلب هي جنوب أفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة وإسرائيل ومصر وبقية دول الشرق الأوسط.

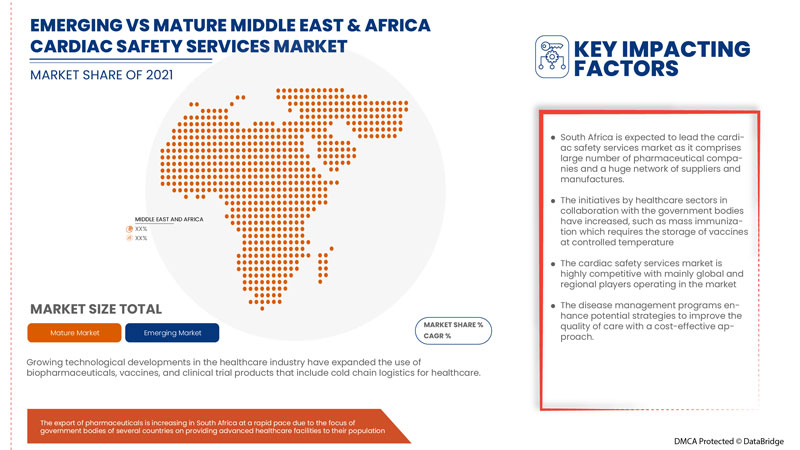

ومن المتوقع أن تهيمن جنوب أفريقيا على السوق بسبب زيادة الإنفاق على الرعاية الصحية والدخل المتاح.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وخدمات السلامة القلبية

يقدم المشهد التنافسي لسوق خدمات سلامة القلب في الشرق الأوسط وأفريقيا تفاصيل عن المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. تتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق خدمات سلامة القلب.

بعض اللاعبين الرئيسيين في السوق هم Koninklijke Philips NV، وLaboratory Corporation of America Holdings، وIQVIA، وMedpace، وNcardia، وCertara، وEurofins Scientific، وSGS SA وغيرها.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين، وتحليل الخط الزمني للسوق، ونظرة عامة على السوق والدليل، وشبكة وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل الشرق الأوسط وأفريقيا مقابل المنطقة وحصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

5 EPIDEMIOLOGY

5.1 INCIDENCE OF ALL BY GENDER

5.2 TREATMENT RATE

5.3 MORTALITY RATE

5.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6 INDUSTRY INSIGHT

6.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.2 PATENT ANALYSIS

6.3 PATENT FLOW DIAGRAM

6.4 KEY PATIENT ENROLLMENT STRATEGIES

6.5 PRICING STRATEGY

7 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASE IN THE NUMBER OF CLINICAL TRIALS

8.1.2 INCREASE IN HEALTHCARE EXPENDITURE AND FUNDING

8.1.3 INCREASE IN STRATEGIC INITIATIVES BY MAJOR MARKET PLAYERS

8.1.4 INCREASE IN R&D ACTIVITIES

8.2 RESTRAINTS

8.2.1 HIGH COST OF CARDIAC SAFETY EVALUATION

8.2.2 STRICT REGULATORY

8.3 OPPORTUNITIES:

8.3.1 INCREASE IN NEW DRUG DEVELOPMENT

8.3.2 RISE IN THE EXPANSION OF THE CARDIAC SAFETY SERVICES

8.4 CHALLENGES

8.4.1 TIME-CONSUMING PROCEDURE

8.4.2 LACK OF SKILLED PERSON TO OPERATE DEVICES DURING CARDIAC SAFETY EVALUATION

9 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES

9.1 OVERVIEW

9.2 ECG/HOLTER MEASUREMENTS

9.3 BLOOD PRESSURE MEASUREMENTS

9.4 IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES

9.4.1 HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS

9.4.1.1 1 CONCENTRATIONS

9.4.1.2 4 CONCENTRATIONS

9.4.2 COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA)

9.4.2.1 3 CONCENTRATIONS

9.4.2.2 5 CONCENTRATIONS

9.4.3 IN VITRO HERG ASSAY

9.4.4 OTHERS

9.5 CARDIOVASCULAR IMAGING

9.6 REAL TIME TELEMETRY MONITORING

9.7 CENTRAL OVER-READ OF ECGS

9.8 NON-INVASIVE CARDIAC IMAGING

9.9 PHYSIOLOGIC STRESS TESTING

9.1 THOROUGH QT STUDIES

9.11 TQT AND EXPOSURE RESPONSE MODELLING

9.12 PLATELET AGGREGATION

9.13 OTHERS

10 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE

10.1 OVERVIEW

10.2 PHASE I

10.3 PHASE II

10.4 PHASE III

11 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE

11.1 OVERVIEW

11.2 INTEGRATED SERVICES

11.3 STANDALONE SERVICES

12 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 PHARMACEUTICALS & BIOPHARMACEUTICALS COMPANIES

12.3 CONTRACT RESEARCH ORGANIZATIONS

12.4 ACADEMIC AND RESEARCH INSTITUTE

13 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 COMPANY PROFILE

15.1 EUROFINS SCIENTIFIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.1.5.1 AGREEMENTS

15.1.5.2 ACQUISITION

15.2 PPD INC. (SUBSIDIARY OF THERMO FISHER SCIENTIFIC INC)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 INVESTMENT

15.3 KONINKLIJKE PHILIPS N.V.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.3.5.1 ACQUISITION

15.4 IQVIA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.4.5.1 ACQUISITION

15.5 LABORATORY CORPORATION OF AMERICA HOLDINGS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 NEW LABORATORY

15.5.5.2 ACQUISITION

15.6 BANOOK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.6.3.1 AGREEMENT

15.7 BIOTRIAL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.7.3.1 NEW CENTER OPENING

15.8 CELERION

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.8.3.1 NEW CENTER OPENING

15.9 CERTARA

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 CONTRACT

15.9.4.2 ACQUISITION

15.1 CLARIO

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 PRODUCT EXPANSION

15.11 MEDPACE

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.11.4.1 ACQUISITION

15.12 NCARDIA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.12.3.1 PARTNERSHIP

15.13 NEXEL CO., LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.13.3.1 JOINT VENTURE

15.13.3.2 PARTNERSHIP

15.14 PHYSIOSTIM

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 PARTNERSHIP

15.15 RICHMOND PHARMACOLOGY

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 EVENT

15.16 SGS SA

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.16.4.1 ACQUISITION

15.17 SHANGHAI MEDICILON INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.17.3.1 PARTNERSHIP

15.17.3.2 PARTNERSHIP

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 PROPORTION OF WOMEN IN CLINICAL STUDIES, ACCORDING TO DEVELOPMENT PHASE

TABLE 2 PROBABILITY OF SUCCESS BY CLINICAL TRIAL PHASE TO THERAPEUTIC AREA

TABLE 3 MORTALITY RATES FROM CLINICAL TRIALS AND EUROPEAN SAFETY AND EXPOSURE SURVEY (ESES), DEATHS PER 100 (PYE)

TABLE 4 ADHERENCE RATE TO COMMON CARDIOVASCULAR MEDICATION

TABLE 5 PROPORTION OF WOMEN IN CLINICAL STUDIES, ACCORDING TO DEVELOPMENT PHASE

TABLE 6 INITIATIVES TO INCREASE ENROLLMENT IN CLINICAL TRIALS AMONG UNDERREPRESENTED POPULATIONS

TABLE 7 ESTIMATED COST OF CARDIAC SAFETY EVALUATION DEVICES

TABLE 8 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ECG/HOLTER MEASUREMENTS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BLOOD PRESSURE MEASUREMENTS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CARDIOVASCULAR IMAGING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA REAL TIME TELEMETRY MONITORING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CENTRAL OVER-READ OF ECGS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA NON-INVASIVE CARDIAC IMAGING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PHYSIOLOGIC STRESS TESTING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA THOROUGH QT STUDIES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA TQT AND EXPOSURE RESPONSE MODELLING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PLATELET AGGREGATION IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PHASE I IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PHASE II IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PHASE III IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA INTEGRATED SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA STANDALONE SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA PHARMACEUTICALS & BIOPHARMACEUTICALS COMPANIES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA CONTRACT RESEARCH ORGANIZATIONS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ACADEMIC AND RESEARCH INSTITUTE IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 68 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 69 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 EGYPT CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 72 EGYPT IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 73 EGYPT HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 74 EGYPT COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 75 EGYPT CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 76 EGYPT CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 EGYPT CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 REST OF MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: MIDDLE EAST & AFRICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: MARKET END USER GRID

FIGURE 9 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN DEMAND FOR CARDIAC SAFETY SERVICES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ECG/HOLTER MEASUREMENTS SUBSTITUTE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET IN 2022 & 2029

FIGURE 13 PATIENT FLOW DIAGRAM FOR ANY RANDOM DRUG

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET

FIGURE 15 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, 2021

FIGURE 16 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, 2021

FIGURE 20 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, 2021

FIGURE 24 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: SNAPSHOT (2021)

FIGURE 32 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2021)

FIGURE 33 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES (2022-2029)

FIGURE 36 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.