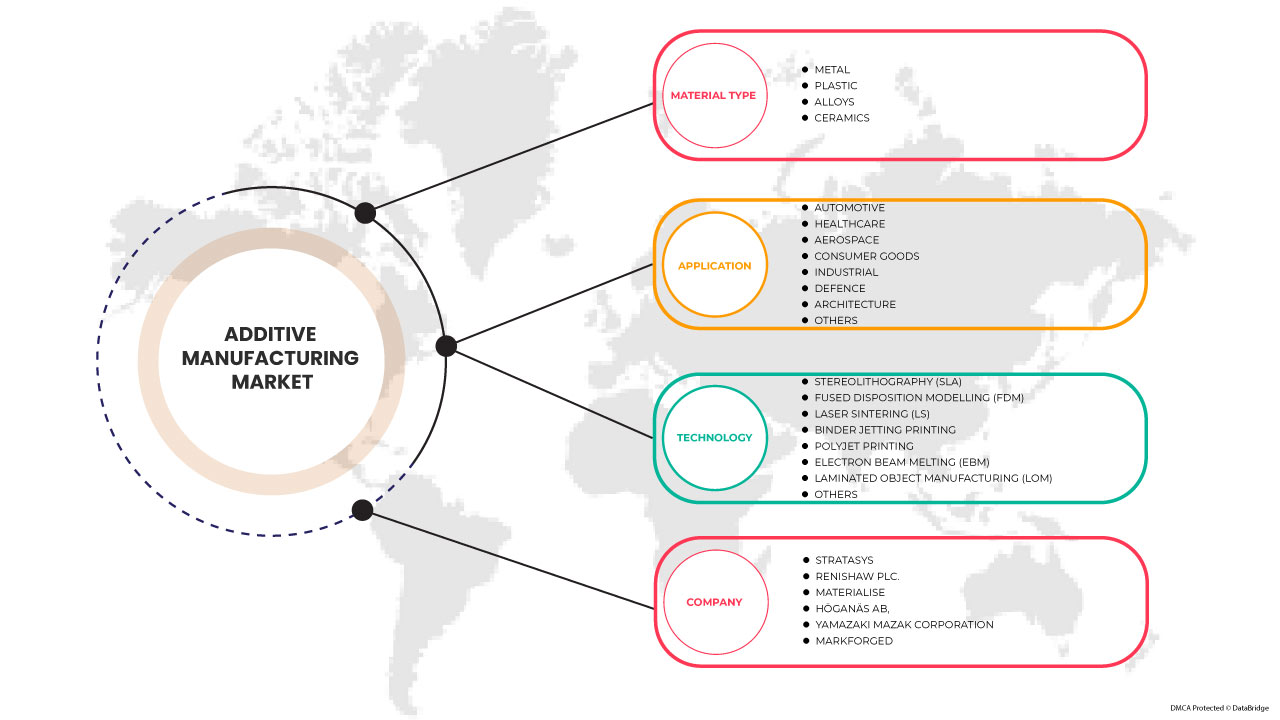

سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا، حسب نوع المادة (المعدن والبلاستيك والسبائك والسيراميك)، والتكنولوجيا (الطباعة المجسمة (SLA)، ونمذجة التصرف المندمج (FDM)، والتلبيد بالليزر (LS)، وطباعة نفث المادة الرابطة، والطباعة باستخدام البولي جيت، وصهر الحزمة الإلكترونية (EBM)، وتصنيع الكائنات الرقائقية (LOM)، وغيرها)، والتطبيق (السيارات والرعاية الصحية والفضاء والسلع الاستهلاكية والصناعية والدفاع والهندسة المعمارية وغيرها)، واتجاهات السوق والتوقعات حتى عام 2030.

تحليل وحجم سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا

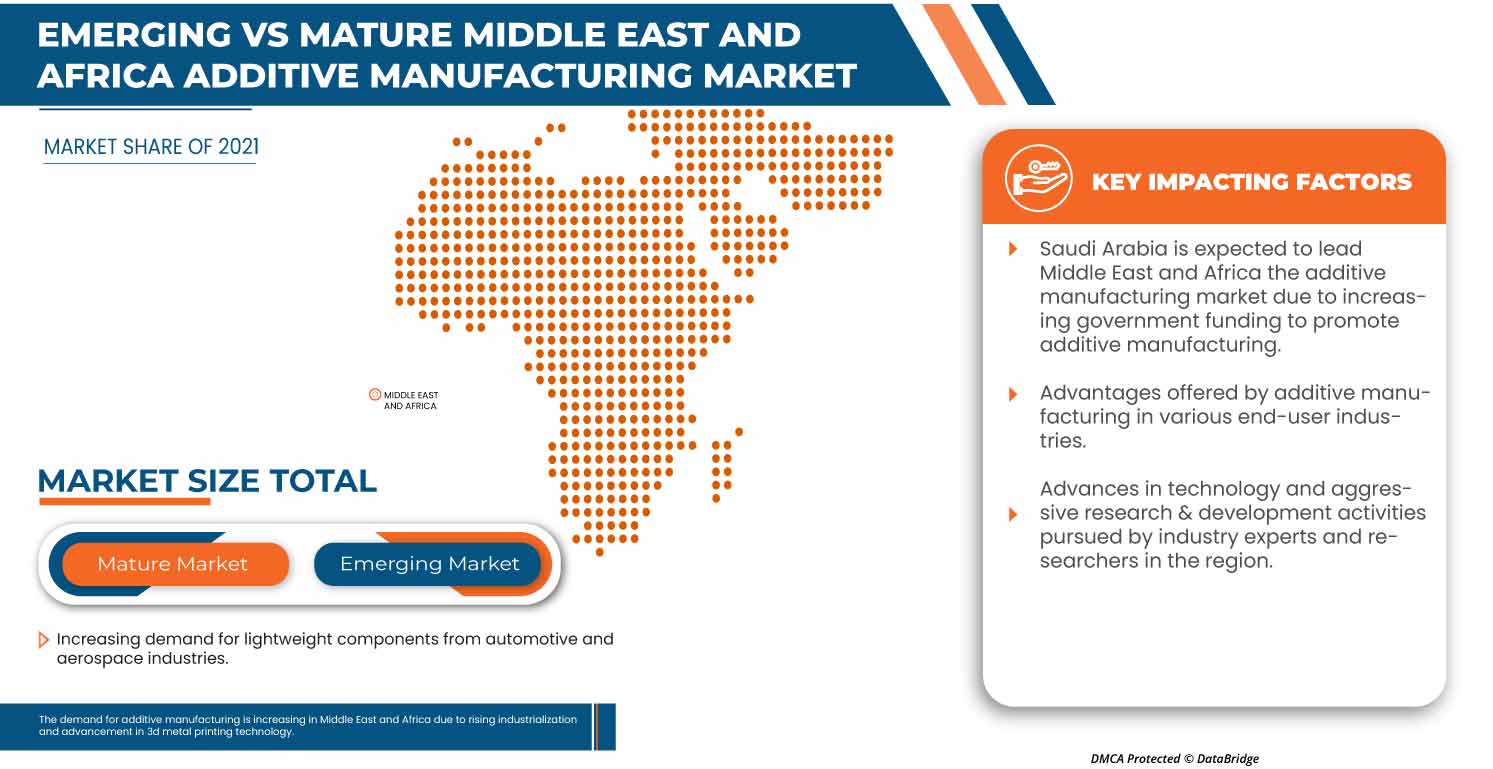

تهتم صناعة سوق التصنيع الإضافي بتصميم وإنتاج وتوزيع الخيوط والأقمشة والملابس والملابس الجاهزة. قد تكون المواد الخام عبارة عن معادن أو بلاستيك أو سبائك أو سيراميك. تساهم صناعات التصنيع الإضافي بشكل كبير في الاقتصاد الوطني للعديد من البلدان. أدى الطلب المتزايد على المكونات خفيفة الوزن من فئات السيارات والفضاء والتقدم في تقنيات الطباعة المعدنية ثلاثية الأبعاد إلى زيادة الطلب بشكل كبير في سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا.

يقدم تقرير سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

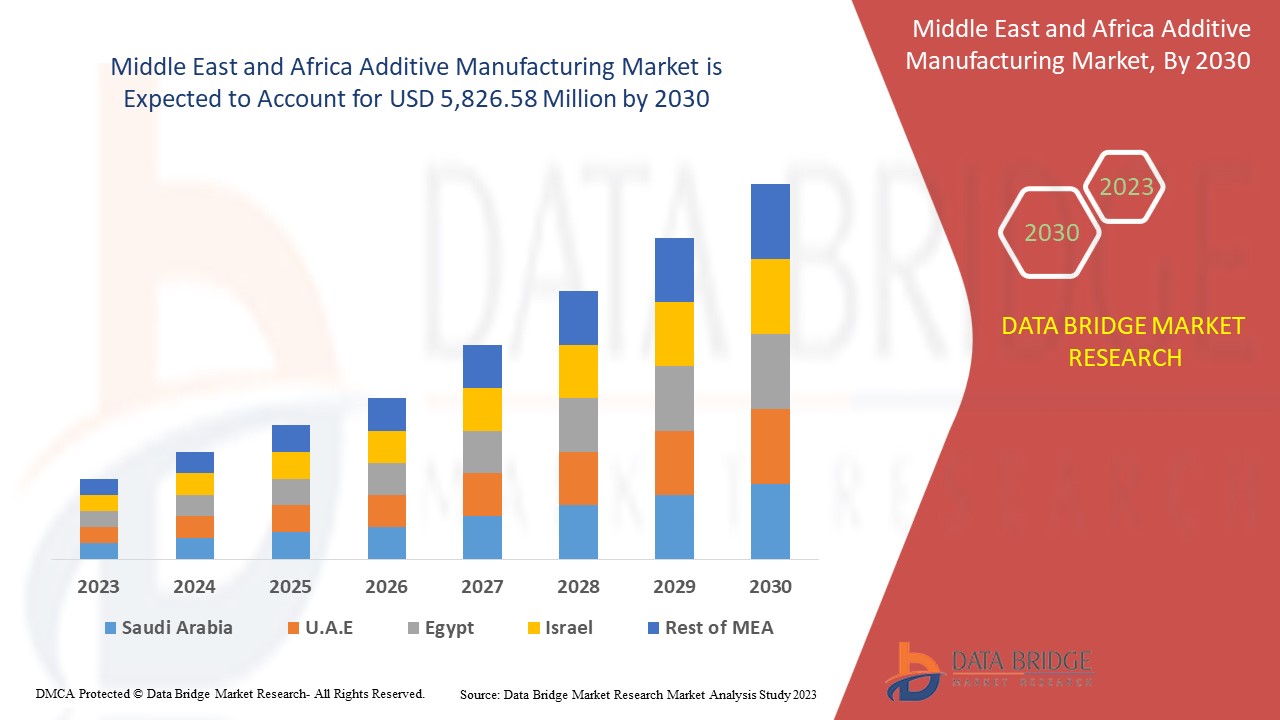

من المتوقع أن يحقق سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا نموًا كبيرًا في الفترة المتوقعة من 2023 إلى 2030. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 20.0٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 5،826.58 مليون دولار أمريكي بحلول عام 2030. العامل الرئيسي الذي يدفع نمو سوق التصنيع الإضافي هو الطلب المتزايد على المكونات خفيفة الوزن من صناعات السيارات والفضاء.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب نوع المادة (المعدن والبلاستيك والسبائك والسيراميك ) ، والتكنولوجيا (الطباعة المجسمة (SLA)، ونمذجة التوزيع المندمج (FDM)، والتلبيد بالليزر (LS)، وطباعة نفث المادة اللاصقة، والطباعة باستخدام البولي جيت، والصهر باستخدام حزمة الإلكترونات (EBM)، وتصنيع الأشياء الرقائقية (LOM)، وغيرها)، والتطبيق (السيارات، والرعاية الصحية، والفضاء، والسلع الاستهلاكية، والصناعة، والدفاع، والهندسة المعمارية، وغيرها). |

|

الدول المغطاة |

مصر والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا وإسرائيل وبقية دول الشرق الأوسط وأفريقيا. |

|

الجهات الفاعلة في السوق المشمولة |

ANSYS, Inc.، Höganäs AB، EOS، ARBURG GmbH + Co KG، Stratasys، Renishaw plc.، YAMAZAKI MAZAK CORPORATION، Materialise، Markforged، Titomic Limited.، SLM Solutions، Proto Labs، ENVISIONTEC US LLC، Ultimaker BV، American Additive Manufacturing LLC، Optomec, Inc.، 3D system Inc.، وExOne. (شركة تابعة لشركة Desktop Metal, Inc.)، وغيرها. |

تعريف السوق

تختلف التصنيع الإضافي عن طريقة الإنتاج الطرحية، والتي تتضمن طحن المواد غير الضرورية من كتلة من المواد. يشير استخدام التصنيع الإضافي في التطبيقات الصناعية عادةً إلى الطباعة ثلاثية الأبعاد. يتضمن التصنيع الإضافي إضافة طبقة تلو الأخرى من المواد لتشكيل كائن مع الإشارة إلى ملف ثلاثي الأبعاد بمساعدة طابعة ثلاثية الأبعاد وبرنامج طابعة ثلاثية الأبعاد. يتم اختيار تقنية التصنيع الإضافي المناسبة من مجموعة التقنيات المتاحة حسب التطبيق

ديناميكيات سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا

السائقين

- تزايد الطلب على المكونات خفيفة الوزن من صناعات السيارات والطيران

يتطلب قطاع السيارات والفضاء العديد من الأهداف الفنية والاقتصادية المتفاعلة للأداء الوظيفي، وتقليص وقت التسليم، وخفة الوزن، وإدارة التكاليف وتسليم المكونات الحرجة للسلامة. لتلبية الطلب والتعويض عن استهلاك الوقود وإدارة التكاليف لتعزيز الأداء الفني والسماح بصنع هيكل أخف وزنًا يرتبط بشكل مباشر بتعزيز الأداء الاقتصادي والفني والذي سيساعد صناعة الطيران على حمل المزيد من الحمولة، مما سيحسن إيراداتها بشكل مباشر. تستخدم تقنيات التصنيع الإضافي، على عكس التصنيع التقليدي التقليدي، تصنيعًا طبقة تلو الأخرى بناءً على مسحوق أو سلك نموذجي ومواد مثل البوليمر البلاستيكي، وهو خفيف الوزن.

- المزايا التي توفرها التصنيع الإضافي في مختلف الصناعات التي يستخدمها المستخدم النهائي

الصناعات مثل صناعة الطيران هي بعض الصناعات التي تستخدم منتجات التصنيع الإضافي لتحسين أدائها، وتستخدم أجزاء الطائرات في منتجات التصنيع الإضافي التي تتميز بأنها خفيفة الوزن ويمكنها تحمل الظروف البيئية القاسية بسبب قلة المواد المطلوبة ومن خلال عملية تشكيل طبقات المواد، وتستخدمها صناعات الطيران كميزة لتقليل الوزن وتقليل النفايات، وهو أمر مهم للغاية لتصنيع أجزاء الطيران للشركات الكبرى.

في الصناعات الطبية سريعة الابتكار، يعد استخدام منتجات التصنيع الإضافي ميزة كبيرة للأطباء والمرضى ومؤسسات البحث. من خلال تصميم النماذج الأولية الوظيفية التي توفرها تقنيات التصنيع الإضافي، كان من المفيد جدًا إنشاء تصميم مرن لأدوات إنقاذ الحياة المختلفة اللازمة للأغراض الجراحية والدراسية، والأدوات المستخدمة في إجراءات طب الأسنان، ونماذج ما قبل الجراحة لفحوصات التصوير المقطعي المحوسب، وأدلة المنشار والحفر المخصصة، والغطاء والأجهزة المتخصصة.

- سهولة التخصيص والإنتاج بالجملة باستخدام التصنيع الإضافي

إن التصنيع الإضافي المخصص، على عكس التصنيع التقليدي، لا يضيف تكلفة إضافية للتخصيص ولا يتطلب أي قالب أو أدوات معينة للتصميم، بل يحتاج فقط إلى نموذج أولي لتصميم ثلاثي الأبعاد ويمكن للعميل نفسه إنشاؤه نظرًا لسهولة التخصيص والإنتاج السريع، وهناك طلب مرتفع، ويمكننا إنتاج أي تصميم فريد بكميات كبيرة دون إعاقة التكلفة والوقت عند استخدام الطابعات ثلاثية الأبعاد. إنه لا يوفر إنتاجًا مخصصًا بكميات كبيرة فحسب، بل إنه يمنح المستهلك أيضًا تجربة فريدة من نوعها للمشتري والمستهلك حيث يمنحهم شعورًا بالانتماء ورضا المستهلك مقارنة بالنظير الذي لا يقدم تصميمًا مخصصًا. كما يسمح للمستهلك بشراء التصميم الذي يختاره. على سبيل المثال، يبيع مصنعو أحذية NIKE الأحذية على موقعهم على الويب بتصميم ثلاثي الأبعاد حيث يمكن للمستهلك إضافة اختيار اللون الخاص به بمفرده دون تردد كبير. سيضيف هذا ميزة للمنافسة في السوق لأنه من خلال هذا النظام، يتيح للشركة المصنعة معرفة عملائها.

- ارتفاع التصنيع والتقدم في تكنولوجيا الطباعة المعدنية ثلاثية الأبعاد

مع ارتفاع وتيرة التصنيع، هناك طلب كبير على منتجات الطباعة المعدنية ثلاثية الأبعاد في صناعات مثل صناعة الطيران والسيارات والرعاية الصحية وغيرها من الصناعات. ومع الطلب من مختلف المجالات على أجزاء في صناعة الطيران لمحركات الطائرات النفاثة والأجزاء الهيكلية الأخرى لتخصيص الأجزاء في صناعات السيارات لتخصيص تصميم الأحذية والأدوات الإلكترونية الأخرى، هناك طلب على التطوير الدقيق لتقنيات الطباعة ثلاثية الأبعاد، والتي ستعمل بكفاءة أكبر ويمكنها إنتاج المنتج بمعدل أسرع بكثير وبدقة أكبر. لذا فإن الطلب على تقدم وراحة تقنيات التصنيع الإضافي يؤدي إلى زيادة الطلب على تقنيات الطباعة المعدنية ثلاثية الأبعاد.

فرص

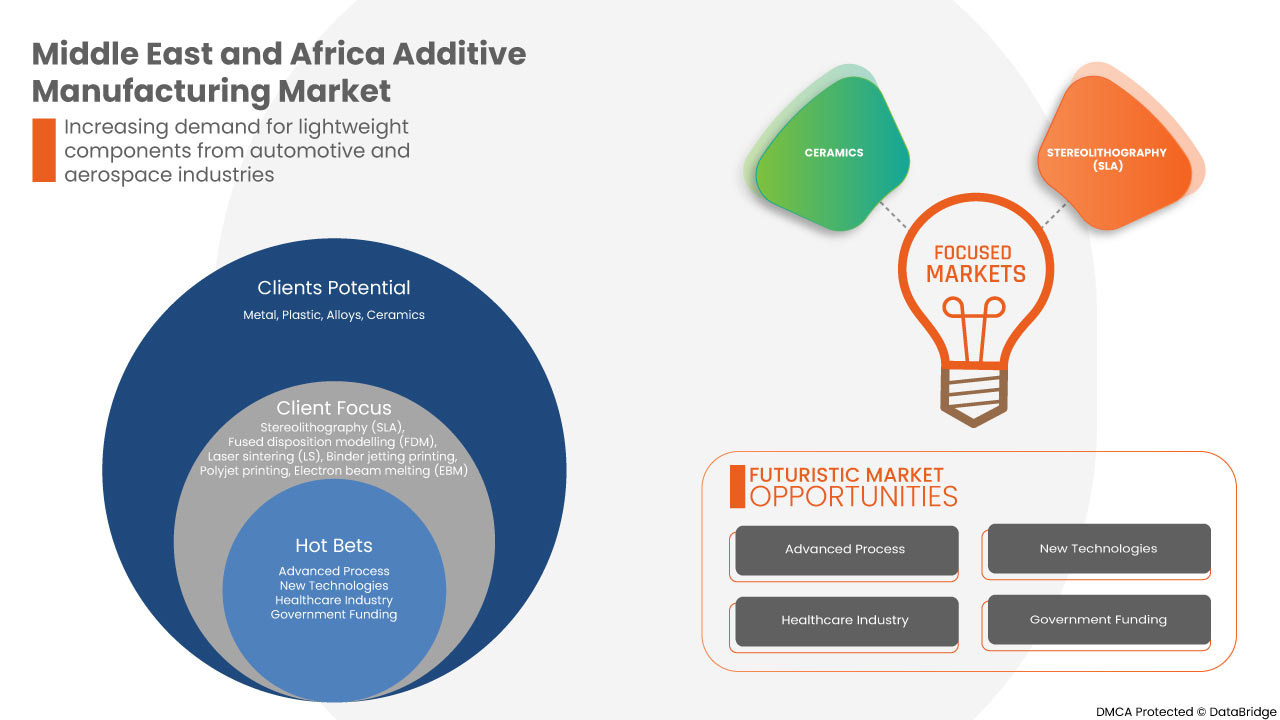

- التقدم في قطاع الرعاية الصحية

في المجال الطبي، كل مريض فريد من نوعه، وبالتالي فإن التصنيع الإضافي لديه إمكانات عالية للاستخدام في التطبيقات الطبية الشخصية والمخصصة. أكثر الاستخدامات الطبية السريرية شيوعًا هي الغرسات الشخصية ومناشير النماذج الطبية الإرشادية. في مجالات طب الأسنان، تُستخدم منتجات التصنيع الإضافي في الجبائر والأجهزة التقويمية والنماذج السنية وأدلة الحفر. ومع ذلك، تُستخدم منتجات التصنيع الإضافي أيضًا لصنع الأنسجة والأعضاء الاصطناعية، والتي يمكن استخدامها لأغراض الدراسة في معهد بحثي أو بين استشارة الطبيب والمريض. مع تطور التصوير الطبي الرقمي، يسمح هذا التحول الرقمي بإعادة بناء نماذج ثلاثية الأبعاد من تشريح المرضى. يبدأ سير العمل النموذجي للجهاز الطبي الشخصي بتصوير أو التقاط هندسة تشريح المريض باستخدام طرق المسح ثلاثي الأبعاد المحوسبة. يمكن الاستفادة من هذه البيانات لطباعة نماذج ثلاثية الأبعاد لتشريح المريض أو يمكن استخدامها لإنشاء أجهزة أو غرسات شخصية.

- زيادة التمويل الحكومي لتشجيع التصنيع الإضافي

تتمتع التصنيع الإضافي بإمكانات هائلة لإحداث ثورة في مجال التصنيع والإنتاج الصناعي من خلال العمليات الرقمية والاتصالات والتصوير. التصنيع الإضافي هو عمل تجاري رائج يحظى بطلب كبير من مختلف الصناعات مثل صناعة الطيران والسيارات والقطاع الطبي والإلكترونيات والأزياء وما إلى ذلك. نظرًا لإمكانية مساهمة هذا القطاع في اقتصاد الدولة، فإن حكومات البلدان المختلفة تتوصل إلى استراتيجية مختلفة لدعم وتعزيز هذه الصناعة.

القيود/التحديات

- ارتفاع تكاليف المعدات والآلات ونقص الكوادر المهنية الماهرة

لقد فتحت الفوائد التي توفرها التصنيع الإضافي آفاقًا واسعة لإنشاء أي أشكال ومكونات ثلاثية الأبعاد على الإطلاق. ولكن ليس كل شركة لا تمتلك القدرة على دمج هذا النوع من النشاط في عملياتها التجارية بتكلفة معقولة. ومن بين الأسباب الأكثر شيوعًا التي تعيق مستقبل التصنيع الإضافي التكلفة العالية للمعدات ونقص المتخصصين في هذه الصناعة.

يتراوح متوسط سعر معدات التصنيع الإضافي بين 300 ألف دولار إلى 1.5 مليون دولار. وتتراوح تكلفة المواد الاستهلاكية الصناعية بين 100 إلى 150 دولارًا أمريكيًا للقطعة الواحدة. على الرغم من أن السعر النهائي يعتمد على المادة المختارة، مثل البلاستيك، الذي يُعتبر الخيار الأكثر ملاءمة للميزانية بين جميع المواد الأخرى المتاحة. كما أن الوقت المطلوب مرتفع للغاية حيث يستغرق الأمر أكثر من ساعة لطباعة كائن يبلغ طوله 40 سم.

- عدم كفاءة البرمجيات

تتمتع عملية التصنيع الإضافي باستخدام عملية دمج مسحوق الليزر (PBF) بالقدرة على بناء أشكال معقدة ومتشابكة جنبًا إلى جنب مع الهياكل العضوية التي كانت مكلفة للغاية أو معقدة للغاية في السابق لصنعها باستخدام عمليات التصنيع التقليدية. على سبيل المثال، يمكن استغلال حريات التصميم التي تحققت بواسطة عملية دمج مسحوق الليزر (PBF) للمكونات خفيفة الوزن لبناء أكثر الهياكل الشبكية تعقيدًا لاستخدام المواد بكفاءة أكبر. ولكن عملية دمج مسحوق الليزر (PBF) لها عيوبها. فهي تتضمن أجزاء ذات جدران رقيقة / نسبة عرض إلى ارتفاع عالية قد تفشل أثناء البناء، وهياكل دعم يصعب إزالتها، وتأثيرات الطبقات على خشونة السطح وإعدادات معلمات العملية المختلفة مثل إعدادات الليزر للأسطح ذات الطبقة العلوية مقابل الطبقة السفلية.

التطورات الأخيرة

- في فبراير، أطلقت شركة SLM Solutions برنامج SLM.Quality. وهو حل برمجي لضمان الجودة يتيح للعملاء إجراء تقييمات وظائف البناء وتأهيل العمليات وشهادات الأجزاء بكفاءة أكبر. سواء كان الأمر يتعلق بإنتاج جزء واحد أو سلسلة، يمكن لحلول SLM.Quality دعم العملاء الصناعيين أثناء عملية التأهيل، وتحسين إمكانية تتبع وتوثيق بيانات العملية الرئيسية. سيساعد هذا التطور الشركة على جذب المزيد من العملاء.

- في فبراير، أعلنت SLM Solutions وAssembrix عن التكامل الناجح لبرنامج Assembrix VMS مع آلات SLM Solutions في جميع أنحاء العالم. ستلبي هذه الشراكة الجديدة الطلب المتزايد من قبل الشركات المصنعة للمعدات الأصلية على التصنيع الإضافي الموزع الآمن وتمكين إنشاء نظام بيئي دولي موثوق للتصنيع الإضافي.

نطاق سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا

يتم تصنيف أسواق التصنيع الإضافي في الشرق الأوسط وأفريقيا بناءً على نوع المادة والتكنولوجيا والتطبيق. سيساعدك النمو بين هذه القطاعات في تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع المادة

- المعادن

- البلاستيك

- سبائك

- السيراميك

على أساس نوع المادة، يتم تصنيف سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا إلى خمسة قطاعات المعادن والبلاستيك والسبائك والسيراميك.

تكنولوجيا

- الطباعة النمطية المجسمة (SLA)

- نمذجة التصرف المندمج (FDM)

- التلبيد بالليزر (LS)

- طباعة نفث المجلدات

- طباعة بولي جيت

- ذوبان حزمة الإلكترونات (EBM)

- تصنيع الأشياء الرقائقية (LOM)

- آحرون

على أساس التكنولوجيا، يتم تصنيف سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا إلى ثمانية قطاعات: الطباعة النمطية (SLA)، ونمذجة الترتيب المندمج (FDM)، والتلبيد بالليزر (LS)، وطباعة نفث الموثق، وطباعة البولي جيت، وصهر الحزمة الإلكترونية (EBM)، وتصنيع الكائنات الرقائقية (LOM)، وغيرها.

طلب

- السيارات

- الرعاية الصحية

- الفضاء الجوي

- السلع الاستهلاكية

- صناعي

- الدفاع

- بنيان

- آحرون

على أساس التطبيق، يتم تصنيف أسواق التصنيع الإضافي في الشرق الأوسط وأفريقيا إلى ثمانية قطاعات وهي السيارات والرعاية الصحية والفضاء والسلع الاستهلاكية والصناعة والدفاع والهندسة المعمارية وغيرها.

تحليل/رؤى إقليمية لسوق التصنيع الإضافي في الشرق الأوسط وأفريقيا

يتم تقسيم أسواق التصنيع الإضافي في الشرق الأوسط وأفريقيا على أساس نوع المادة والتكنولوجيا والتطبيقات.

الدول في سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا هي مصر والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

تسيطر دولة الإمارات العربية المتحدة على سوق التصنيع الإضافي في منطقة الشرق الأوسط وأفريقيا بفضل التطور المتقدم في التكنولوجيا.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. وتشير البيانات إلى تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة، وهي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق التصنيع الإضافي في الشرق الأوسط وأفريقيا تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. تتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا.

بعض المشاركين البارزين الذين يعملون في سوق التصنيع الإضافي في الشرق الأوسط وأفريقيا هم SLM Solutions و Proto Labs و Stratasys و Renishaw plc. و Materialise و Titomic Limited. و Höganäs AB و YAMAZAKI MAZAK CORPORATION و Markforged و Ultimaker BV و Optomec، Inc. و ExOne. (شركة تابعة لـ Desktop Metal، Inc.) و American Additive Manufacturing LLC و ANSYS، Inc. و ARBURG GmbH + Co KG و ENVISIONTEC US LLC و EOS و 3D Systems، Inc. وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4 SUPPLY CHAIN ANALYSIS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS FROM THE AUTOMOTIVE AND AEROSPACE INDUSTRIES

6.1.2 ADVANTAGES OFFERED BY ADDITIVE MANUFACTURING IN VARIOUS END-USER INDUSTRIES

6.1.3 EASY CUSTOMIZATION AND BULK PRODUCTION USING ADDITIVE MANUFACTURING

6.1.4 RISE IN INDUSTRIALIZATION AND ADVANCEMENT IN 3D METAL PRINTING TECHNOLOGY

6.2 RESTRAINTS

6.2.1 HIGH COSTS OF EQUIPMENT, MACHINERY AND LACK OF SKILLED PROFESSIONAL

6.2.2 LACK OF SOFTWARE EFFICIENCY

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENT IN THE HEALTHCARE SECTOR

6.3.2 INCREASING GOVERNMENT FUNDING TO PROMOTE ADDITIVE MANUFACTURING

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO MATERIAL AVAILABILITY, DEVELOPMENT, VALIDATION, AND STANDARDIZATION

6.4.2 MISCONCEPTIONS AMONG SMALL AND MEDIUM-SCALE MANUFACTURERS ABOUT THE PROTOTYPING PROCESS

7 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 METAL

7.2.1 METAL, BY MATERIAL TYPE

7.2.1.1 STEEL

7.2.1.2 ALUMINUM (ALUMIDE)

7.2.1.3 TITANIUM

7.2.1.4 SILVER

7.2.1.5 GOLD

7.2.1.6 OTHERS

7.3 PLASTIC

7.3.1 PLASTIC, BY MATERIAL TYPE

7.3.1.1 ACRYLONITRILE BUTADIENE STYRENE

7.3.1.2 POLYLACTIC ACID (PLA)

7.3.1.3 NYLON

7.3.1.4 PHOTOPOLYMERS

7.3.1.5 OTHERS

7.3.2 OTHERS, BY MATERIAL TYPE

7.3.2.1 POLYPROPYLENE

7.3.2.2 HIGH DENSITY POLYETHYLENE

7.3.2.3 POLYCARBONATE

7.3.2.4 POLYVINYL ALCOHOL

7.4 ALLOYS

7.4.1 ALLOYS, BY MATERIAL TYPE

7.4.1.1 TOOL STEELS AND MARAGING STEELS

7.4.1.2 COMMERCIALLY PURE TITANIUM AND ALLOYS

7.4.1.3 ALUMINUM ALLOYS

7.4.1.4 NICKEL-BASED ALLOYS

7.4.1.5 COBALT-CHROMIUM ALLOYS

7.4.1.6 COPPER-BASED ALLOYS

7.5 CERAMICS

7.5.1 CERAMICS, BY MATERIAL TYPE

7.5.1.1 GLASS

7.5.1.2 SILICA

7.5.1.3 QUARTZ

7.5.1.4 OTHERS

8 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 STEREOLITHOGRAPHY (SLA)

8.3 FUSED DISPOSITION MODELLING (FDM)

8.4 LASER SINTERING (LS)

8.4.1 LASER SINTERING (LS), BY TECHNOLOGY

8.4.1.1 SELECTIVE LASER MELTING (SLM)

8.4.1.2 SELECTIVE LASER SINTERING (SLS)

8.4.1.3 DIRECT METAL LASER SINTERING

8.5 BINDER JETTING PRINTING

8.6 POLYJET PRINTING

8.7 ELECTRON BEAM MELTING (EBM)

8.8 LAMINATED OBJECT MANUFACTURING (LOM)

8.9 OTHERS

9 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.3 HEALTHCARE

9.4 AEROSPACE

9.5 CONSUMER GOODS

9.6 INDUSTRIAL

9.7 DEFENCE

9.8 ARCHITECTURE

9.9 OTHERS

10 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 U.A.E.

10.1.2 SAUDI ARABIA

10.1.3 EGYPT

10.1.4 SOUTH AFRICA

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST & AFRICA

11 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11.2 CERTIFICATION

11.3 ACHIEVEMENT

11.4 LAUNCH

11.5 MERGER

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ANSYS, INC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 HÖGANÄS AB

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATE

13.3 EOS

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 ARBURG GMBH + CO KG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATE

13.5 STRATASYS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 AMERICAN ADDITIVE MANUFACTURING LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 ENVISIONTEC US LLC

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

13.8 EXONE. (A SUBSIDIARY OF DESKTOP METAL, INC.)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 MATERIALISE

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 MARKFORGED

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 OPTOMEC, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 PROTO LABS

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 ANNUAL REPORTS, AND SEC FILINGRECENT UPDATES

13.13 RENISHAW PLC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 SLM SOLUTIONS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATES

13.15 TITOMIC LIMITED.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT UPDATES

13.16 ULTIMAKER BV

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT UPDATE

13.17 YAMAZAKI MAZAK CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATES

13.18 3D SYSTEM, INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA METAL IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA STEREOLITHOGRAPHY (SLA) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA FUSED DISPOSITION MODELLING (FDM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA BINDER JETTING PRINTING IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA POLYJET PRINTING IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ELECTRON BEAM MELTING (EBM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA LAMINATED OBJECT MANUFACTURING (LOM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA AUTOMOTIVE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA HEALTHCARE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA AEROSPACE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA CONSUMER GOODS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA INDUSTRIAL IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA DEFENCE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA ARCHITECTURE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 U.A.E. ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.A.E. METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.A.E. PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.A.E. OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.A.E. ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.A.E. CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.A.E. ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 48 U.A.E. LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 U.A.E. ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 50 SAUDI ARABIA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 51 SAUDI ARABIA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 52 SAUDI ARABIA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 54 SAUDI ARABIA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 56 SAUDI ARABIA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 57 SAUDI ARABIA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 58 SAUDI ARABIA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 59 EGYPT ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 60 EGYPT METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 61 EGYPT PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 62 EGYPT OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 63 EGYPT ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 64 EGYPT CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 65 EGYPT ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 EGYPT LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 67 EGYPT ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 SOUTH AFRICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 69 SOUTH AFRICA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 70 SOUTH AFRICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 71 SOUTH AFRICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 72 SOUTH AFRICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 73 SOUTH AFRICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 74 SOUTH AFRICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 75 SOUTH AFRICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 76 SOUTH AFRICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 ISRAEL ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 78 ISRAEL METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 79 ISRAEL PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 80 OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 81 ISRAEL ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 82 ISRAEL CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 83 ISRAEL ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 84 ISRAEL LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 85 ISRAEL ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 REST OF MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET

FIGURE 2 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS FROM THE AUTOMOTIVE AND AEROSPACE INDUSTRIES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE METAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET

FIGURE 17 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: BY MATERIAL TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: BY TECHNOLOGY, 2022

FIGURE 19 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: BY APPLICATION, 2022

FIGURE 20 MIDDLE EAST AND AFRICA ADDITIVE MANUFACTURING MARKET: SNAPSHOT (2022)

FIGURE 21 MIDDLE EAST AND AFRICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2022)

FIGURE 22 MIDDLE EAST AND AFRICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 MIDDLE EAST AND AFRICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA ADDITIVE MANUFACTURING MARKET: BY MATERIAL TYPE (2023-2030)

FIGURE 25 MIDDLE EAST & AFRICA ADDITIVE MANUFACTURING MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.