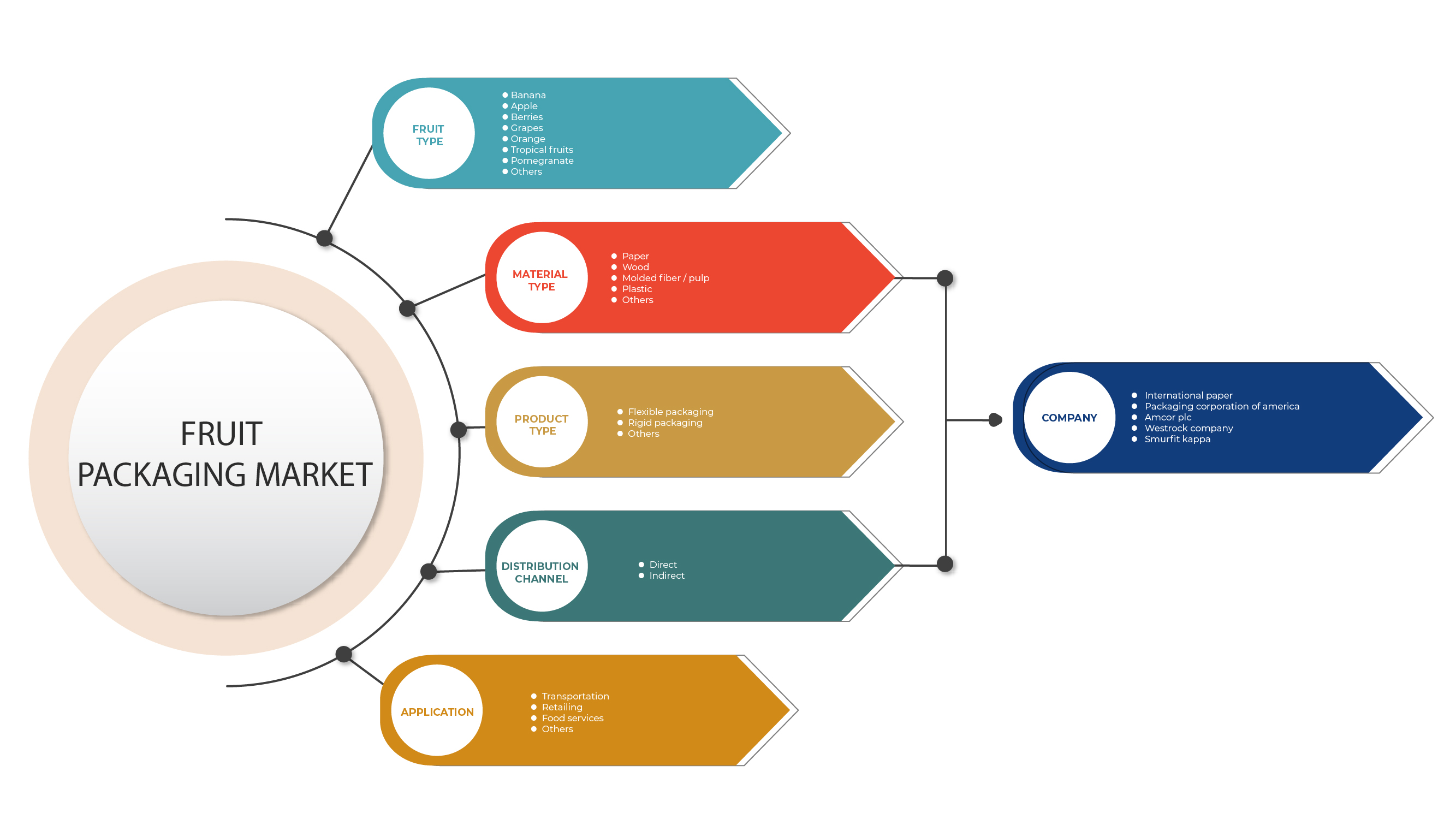

سوق تغليف الفاكهة في المكسيك، حسب نوع الفاكهة (الموز، التفاح، التوت، العنب، البرتقال، الفاكهة الاستوائية، الرمان وغيرها)، نوع المادة (البلاستيك، الورق، الألياف/اللب المصبوب، الخشب وغيرها)، نوع المنتج ( التغليف الصلب ، التغليف المرن وغيرها)، التطبيق (التجزئة، النقل، خدمات الأغذية وغيرها)، قناة التوزيع (المباشرة وغير المباشرة)، اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والحجم

تغليف الفاكهة والخضروات هو ممارسة زراعية تتضمن نقل المحاصيل الطازجة من الحقل إلى العميل. نظرًا لأن جميع الفواكه والخضروات محاصيل قابلة للتلف، فإن اختيار التغليف المناسب للفواكه والخضروات أمر بالغ الأهمية للمزارعين للبقاء في السوق. الوظيفة الرئيسية للتغليف هي الحفاظ على الفواكه والخضروات من أجل الحفاظ على جودتها وإطالة مدة تخزينها

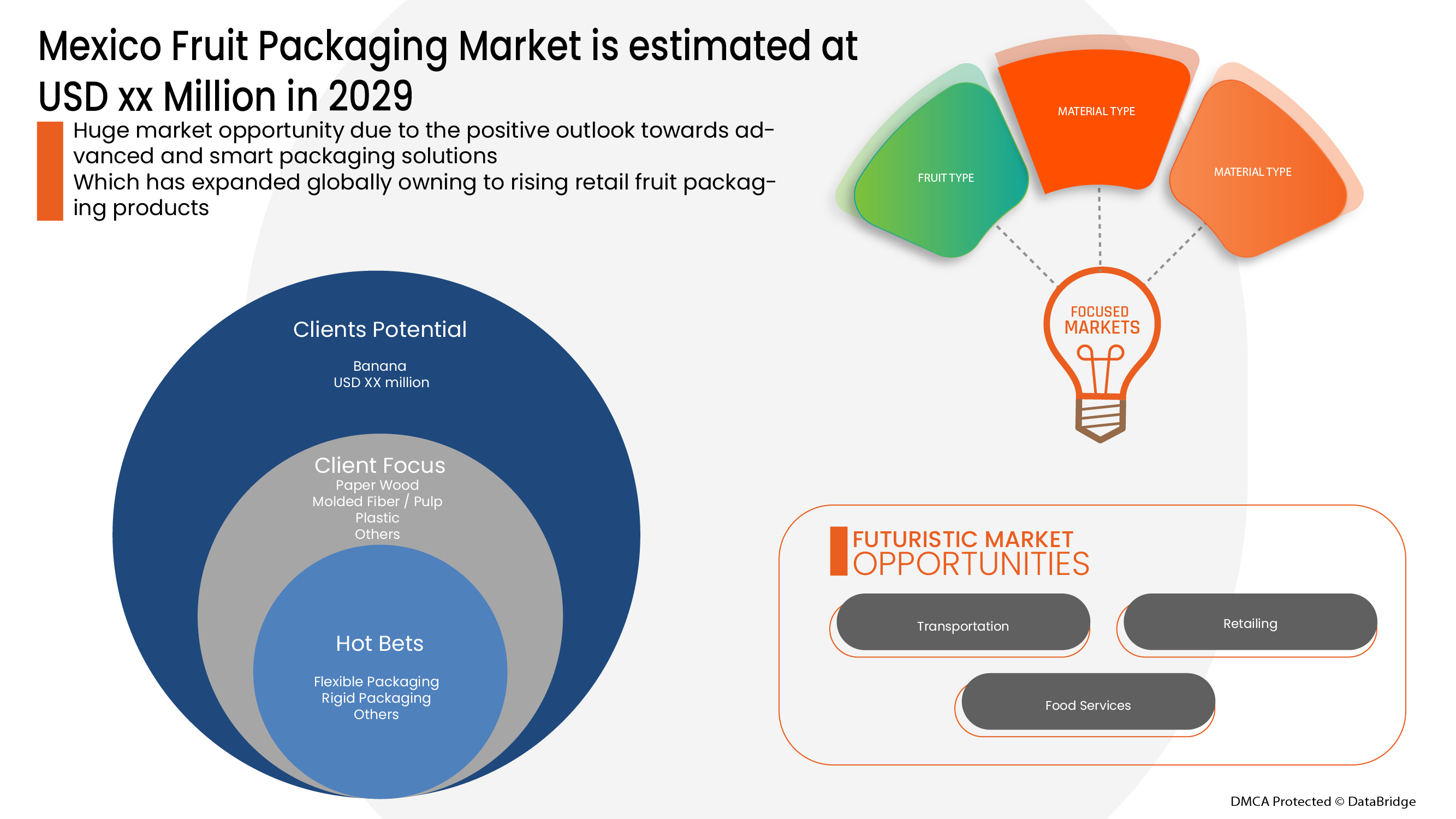

تُستخدم عبوات الفاكهة بشكل كبير في التغليف المريح والمرن . تحلل شركة Data Bridge Market Research أن عبوات الفاكهة من المتوقع أن تصل قيمتها إلى 3،932.63 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 1.4٪ خلال الفترة المتوقعة. تمثل الموز شريحة الفاكهة الأكثر بروزًا في السوق المعنية بسبب ارتفاع التجارة الإلكترونية وخدمات البريد السريع وتوصيل الفاكهة. يتضمن تقرير السوق الذي أعده فريق Data Bridge Market Research تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وسيناريو سلسلة المناخ.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، الأحجام بالملايين من الوحدات، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب نوع الفاكهة (الموز، التفاح، التوت، العنب، البرتقال، الفواكه الاستوائية، الرمان وغيرها)، نوع المادة (البلاستيك، الورق، الألياف/اللب المصبوب، الخشب وغيرها)، نوع المنتج (التغليف الصلب، التغليف المرن وغيرها)، التطبيق (التجزئة، النقل، خدمات الأغذية وغيرها)، قناة التوزيع (المباشرة وغير المباشرة) |

|

البلد المغطى |

المكسيك |

|

الجهات الفاعلة في السوق المشمولة |

Mondi، وDS Smith، وAmcor plc، وPackaging Corporation of America، وInternational Paper، وSmurfit Kappa، وSealed Air، وSonoco Products Company، وWestRock Company، وHuhtamaki وغيرها |

تعريف السوق

تُعد الأكياس والحاويات والصناديق المصنوعة من الخشب والبلاستيك والورق وغيرها من المواد السائدة في تغليف الفواكه والخضروات للمستهلكين . بالإضافة إلى تكاليف المواد المنخفضة للغاية، تعمل آلات التعبئة الآلية على تقليل تكاليف التعبئة بشكل أكبر. تتميز الأكياس المصنوعة من الفيلم بأنها شفافة، مما يسمح بفحص المحتويات بسهولة، وتقبل الرسومات عالية الجودة بسهولة.

الإطار التنظيمي

- وفقًا لقانون التعبئة والتغليف العادل الصادر عن إدارة الغذاء والدواء، تتناول صفحات الويب الخاصة بوضع العلامات على الأغذية متطلبات وضع العلامات على الأغذية بموجب قانون الغذاء والدواء ومستحضرات التجميل الفيدرالي وتعديلاته. يُعد وضع العلامات على الأغذية أمرًا مطلوبًا بالنسبة لمعظم الأطعمة المحضرة والنيئة بما في ذلك الفواكه والخضروات. أصدر هذا القانون لوائح تتطلب وضع علامات على جميع "السلع الاستهلاكية" للكشف عن المحتويات الصافية وهوية السلعة واسم ومكان عمل المنتجات

- وفقًا لإدارة الغذاء والدواء الأمريكية، يجب أن تكون كل حاوية يتم فيها تعبئة أي منتج فاكهة مغلقة بإحكام بحيث لا يمكن فتحها دون تدمير رقم الترخيص وعلامة التعريف الخاصة بالشركة المصنعة التي يجب عرضها على الجزء العلوي أو عنق الزجاجة. بالنسبة للفواكه المعلبة، يجب استخدام علب صحية علوية مكونة من أنواع مناسبة من ألواح الصفيح، بينما بالنسبة للفواكه المعبأة، يجب استخدام الزجاجات/البرطمانات القادرة على إعطاء ختم محكم فقط. يمكن تعبئة الفواكه المسكرة والقشور والفواكه المجففة في أكياس ورقية أو صناديق من الورق المقوى أو الخشب أو علب جديدة أو زجاجات أو برطمانات أو ألومنيوم أو غيرها من الحاويات المناسبة المعتمدة. يمكن أيضًا تعبئة منتجات الفواكه والخضروات في مواد تغليف معقمة ومرنة ذات جودة جيدة تتوافق مع المعايير المطلوبة التي وضعتها الحكومة الفيدرالية

توفر هذه المعايير التأهيل لإنتاج تغليف الفاكهة والبروتوكولات والمبادئ التوجيهية التي تضمن مستوى عالٍ من الأمان وتصدق على المواد للاستخدام.

كان لـ COVID-19 تأثير ضئيل على سوق تغليف الفاكهة في المكسيك

أثرت جائحة كوفيد-19 على العديد من الصناعات التحويلية في عام 2020-2021 حيث أدت إلى إغلاق أماكن العمل وتعطل سلاسل التوريد والقيود المفروضة على النقل. ومع ذلك، لوحظ تأثير كبير على سوق تغليف الفاكهة. كانت عمليات وسلسلة توريد تغليف الفاكهة، مع مرافق تصنيع متعددة، لا تزال تعمل في المنطقة. واصل مقدمو الخدمة تقديم تغليف الفاكهة باتباع تدابير النظافة والسلامة في سيناريو ما بعد كوفيد.

تتضمن ديناميكيات السوق لسوق تغليف الفاكهة في المكسيك ما يلي:

العوامل/الفرص التي تواجهها صناعة تغليف الفاكهة في المكسيك

- الطلب المتزايد على التغليف المريح والمرن

إن ميزات التغليف المرن تجعل الحياة أكثر راحة. فهو سهل التخزين، وسهل إعادة الغلق، وسهل الفتح، ويطيل عمر المنتج، وسهل الحمل. إن ارتفاع الدخل المتاح وتحسين مستويات المعيشة بين المستهلكين في البلدان النامية من العوامل التي تساهم بشكل كبير في ارتفاع الطلب على الأطعمة المعبأة بما في ذلك الفاكهة، وهذا يدفع الطلب على حلول التغليف والمواد الأكثر ملاءمة للاستخدام. وفي الختام، فإن الطلب المتزايد من كبار تجار التجزئة على إطالة العمر الافتراضي، ومن المستهلكين على منتجات الراحة، يدفع أيضًا الطلب على التغليف المرن وبالتالي يساهم في نمو سوق تغليف الفاكهة في المكسيك.

- ارتفاع في خدمات التجارة الإلكترونية والتوصيل والتوصيل للفاكهة

لقد غيرت التجارة الإلكترونية طريقة العمل في جميع أنحاء العالم. وقد نتج جزء كبير من النمو في هذه الصناعة عن زيادة انتشار الإنترنت والهواتف الذكية. كما أن التقدم في التكنولوجيا ونمو الأسواق المتاحة جعل من السهل شراء وبيع السلع من خلال البوابات الإلكترونية. ويستمر التجار وخدمات التوصيل في متابعة طلب المستهلكين في المنصات الإلكترونية، حيث يتدفقون إلى التجارة الإلكترونية بأعداد قياسية. وعلاوة على ذلك، كان هناك ارتفاع مستمر في الطلب على احتياجات التعبئة والتغليف الموحدة وإعدادات التوصيل المرطبة الهوائية لإطالة مدة الصلاحية أثناء نقل المواد القابلة للتلف مثل الفواكه والخضروات. وهذا بدوره يزيد من الطلب على تغليف الفاكهة وبالتالي دفع نمو سوق تغليف الفاكهة في المكسيك

- نظرة إيجابية نحو حلول التغليف المتقدمة والذكية

إن الهدف من تكنولوجيا التغليف الذكية هو الحفاظ على جودة المنتج وإطالة العمر الافتراضي للمنتج. حيث تستجيب التغليف النشط لحدث محفز (مثل التعرض للأشعة فوق البنفسجية أو انخفاض الضغط) بإطلاق أو امتصاص مواد من أو إلى المنتج المعبأ أو البيئة المحيطة به. وعادة ما يتضمن ذلك تضمين مكونات مختلفة، مثل مزيلات الرطوبة أو الغازات أو الأفلام المضادة للميكروبات، في التغليف نفسه. وعلاوة على ذلك، يتزايد اعتماد تقنيات التغليف المتقدمة من أجل تقديم حلول تغليف مخصصة للمستهلكين. وهذا بدوره يزيد من الطلب على تغليف الفاكهة وبالتالي خلق فرصة لسوق تغليف الفاكهة في المكسيك.

القيود/التحديات التي تواجه سوق تغليف الفاكهة في المكسيك

- قواعد وأنظمة حكومية صارمة فيما يتعلق بمواد التعبئة والتغليف

تلعب اللوائح التي تفرضها الحكومات دورًا مهمًا في التأثير على تصميم العبوات للعديد من الشركات المصنعة في السوق. هناك العديد من اللوائح والسياسات الصارمة التي يجب على مصنعي منتجات التعبئة والتغليف الالتزام بها. تنظم المنظمات الحكومية وتراقب منتجات التعبئة والتغليف للأغذية والأدوية ومستحضرات التجميل واستخدام المواد الخام، من أجل حماية البيئة وضمان سلامة المستهلك وثقته. في الختام، أثرت القواعد واللوائح المتزايدة تجاه إنتاج منتجات التعبئة والتغليف في جميع المناطق على الطلب على منتجات التعبئة والتغليف. وهذا بدوره يقلل من الطلب على عبوات الفاكهة وبالتالي يحد من نمو سوق عبوات الفاكهة في المكسيك.

- إدارة نفايات التغليف أمر صعب

توفر عبوات الأطعمة الحديثة طريقة لجعل الطعام آمنًا وموثوقًا به وصالحًا للاستخدام على الرفوف ونظيفًا. لسوء الحظ، تم تصميم معظم عبوات الأطعمة للاستخدام مرة واحدة ولا يتم إعادة تدويرها. بدلاً من ذلك، يتم التخلص من العبوات وغالبًا ما تتناثر في مجاري المياه لدينا. وبالتالي، فإن هذه مشكلة لا تقتصر على البشر فحسب، بل وأيضًا على جميع أشكال الحياة المائية. هناك أيضًا تأثيرات بيئية أخرى ناجمة عن عبوات الأطعمة، بما في ذلك على الهواء والتربة. في الختام، فإن تصنيع العبوات البلاستيكية مسؤول عن كمية كبيرة من انبعاثات الغازات المسببة للانحباس الحراري وبالتالي يؤثر على هواء البيئة. وهذا بدوره يقلل من الطلب على منتجات تغليف الفاكهة وبالتالي يشكل تحديًا لنمو سوق تغليف الفاكهة في المكسيك.

يقدم تقرير سوق تغليف الفاكهة في المكسيك هذا تفاصيل عن التطورات الحديثة الجديدة، واللوائح التجارية، وتحليل الاستيراد والتصدير، وتحليل الإنتاج، وتحسين سلسلة القيمة، وحصة السوق، وتأثير اللاعبين المحليين والمحليين في السوق، وتحليل الفرص من حيث جيوب الإيرادات الناشئة، والتغيرات في لوائح السوق، وتحليل نمو السوق الاستراتيجي، وحجم السوق، ونمو سوق الفئات، ومنافذ التطبيق والهيمنة، وموافقات المنتجات، وإطلاق المنتجات، والتوسعات الجغرافية، والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول سوق مبيدات القوارض، اتصل بـ Data Bridge Market Research للحصول على موجز محلل. سيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

التطورات الأخيرة

- في مارس 2021، أعلنت شركة إنترناشيونال بيبر عن استحواذها على مصنعين متطورين لإنتاج الصناديق المموجة في إسبانيا. وقد مكن هذا الشركة من تعزيز قدراتها في مدريد وكاتالونيا. وقد أدى ذلك إلى تعزيز حلول التعبئة والتغليف التي تقدمها الشركة في القطاعات الصناعية والفواكه والخضروات الطازجة والتجارة الإلكترونية.

- في مارس 2021، أعلنت شركة Packaging Corporation of America عن خطط لإطلاق مشاريع مدتها ثلاث سنوات بقيمة 440 مليون دولار أمريكي لتحويل آلة ورق بشكل دائم في مصنعها في مقاطعة كلارك لإنتاج الورق المقوى المستخدم في التغليف المموج. ستقوم الشركة بتثبيت مصنع OCC لإعادة تدوير الحاويات المموجة القديمة وتعديلات مختلفة على مصنع اللب. أدى هذا إلى تطوير منتجات جديدة من قبل الشركة.

- في مارس 2022، حصلت شركة Amcor plc على ثلاث جوائز إنجازات التغليف المرن لعام 2022، حيث فازت في فئات متعددة من بين عدد قياسي من المشاركات. وقد أشادت الجوائز بشركة Amcor لحلها تحديات العملاء المعقدة، وتعزيز الاستدامة ورفع المساهمة الإجمالية للتغليف المرن.

تحليل/رؤى إقليمية لسوق تغليف الفاكهة في المكسيك

يتم تقسيم سوق تغليف الفاكهة في المكسيك إلى خمسة قطاعات بارزة تعتمد على نوع الفاكهة ونوع المادة ونوع المنتج والتطبيق وقناة التوزيع.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

نطاق سوق تغليف الفاكهة في المكسيك

يتم تقسيم سوق تغليف الفاكهة في المكسيك على أساس نوع الفاكهة ونوع المادة ونوع المنتج والتطبيق وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع الفاكهة

- موز

- تفاحة

- التوت

- العنب

- البرتقالي

- الفواكه الاستوائية

- رمان

- آحرون

على أساس نوع الفاكهة، يتم تقسيم سوق تغليف الفاكهة في المكسيك إلى الموز والتفاح والتوت والعنب والبرتقال والفواكه الاستوائية والرمان وغيرها.

نوع المادة

- ورق

- خشب

- الألياف المصبوبة / اللب

- بلاستيك

- آحرون

على أساس نوع المادة، يتم تقسيم سوق تغليف الفاكهة في المكسيك إلى البلاستيك والورق والألياف/اللب المصبوب والخشب وغيرها.

نوع المنتج

- التغليف المرن

- التغليف الصلب

- آحرون

على أساس نوع المنتج، يتم تقسيم سوق تغليف الفاكهة في المكسيك إلى تغليف صلب وتغليف مرن وغيرها.

طلب

- مواصلات

- البيع بالتجزئة

- خدمات الطعام

- آحرون

على أساس التطبيق، يتم تقسيم سوق تغليف الفاكهة في المكسيك إلى تجارة التجزئة والنقل والخدمات الغذائية وغيرها.

قناة التوزيع

- مباشر

- غير مباشر

على أساس قناة التوزيع، يتم تقسيم سوق تغليف الفاكهة في المكسيك إلى مباشرة وغير مباشرة.

تحليل المشهد التنافسي وحصة سوق تغليف الفاكهة في المكسيك

يوفر المشهد التنافسي لسوق تغليف الفاكهة في المكسيك تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق تغليف الفاكهة في المكسيك.

اللاعبون العاملون في سوق تغليف الفاكهة في المكسيك هم Mondi وDS Smith وAmcor plc وPackaging Corporation of America وInternational Paper وSmurfit Kappa وSealed Air وSonoco Products Company وWestRock Company وHuhtamaki وغيرهم.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MEXICO FRUIT PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.2 LABELING AND CLAIMS

4.3 REVENUE OF SUPPLIERS

4.4 SUPPLY CHAIN ANALYSIS:

4.5 VALUE CHAIN ANALYSIS:

4.6 MARKET SHARE OF MOLDED FIBER VS OTHER SUBSTRATES AND ITS PROJECTION

4.7 MEXICO FRUIT PACKAGING MARKET, NEW PRODUCT LAUNCH STRATEGY

4.7.1 OVERVIEW

4.7.2 NUMBER OF PRODUCT LAUNCHES

4.7.2.1 LINE EXTENSION

4.7.2.2 NEW PACKAGING

4.7.2.3 RE-LAUNCHED

4.7.2.4 NEW FORMULATION

4.7.3 DIFFERENTIAL PRODUCT OFFERING

4.7.4 MEETING CONSUMER REQUIREMENT

4.7.5 PACKAGE DESIGNING

4.7.6 PRICING ANALYSIS

4.7.7 PRODUCT POSITIONING

4.7.8 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING

6.1.2 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PRODUCTS FOR FRUIT PACKAGING

6.1.3 RISING E-COMMERCE, COURIER, AND FRUIT DELIVERY SERVICES

6.1.4 GAINING POPULARITY OF FRUITS IN PREVENTING CHRONIC DISEASES

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT RULES AND REGULATIONS REGARDING PACKAGING MATERIALS

6.2.2 USE OF HARMFUL ADDITIVES FOR WATER/OIL RESISTANCE IN FOOD PACKAGING

6.3 OPPORTUNITIES

6.3.1 POSITIVE OUTLOOK TOWARD ADVANCED AND SMART PACKAGING SOLUTIONS

6.3.2 RISING DEMAND FOR MODIFIED ATMOSPHERE PACKAGING (MAP)

6.4 CHALLENGES

6.4.1 MANAGING PACKAGING WASTE IS DIFFICULT

6.4.2 MAINTAINING STANDARD QUALITY OF PACKAGING PRODUCT

7 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE

7.1 OVERVIEW

7.2 BANANA

7.3 APPLE

7.4 BERRIES

7.4.1 STRAWBERRY

7.4.2 BLUEBERRY

7.4.3 RASPBERRY

7.4.4 BLACKBERRY

7.4.5 CRANBERRY

7.4.6 OTHERS

7.5 GRAPES

7.6 ORANGE

7.7 TROPICAL FRUITS

7.7.1 MANGO

7.7.2 PAPAYA

7.7.3 PASSION FRUIT

7.7.4 DRAGON FRUIT

7.7.5 JACKFRUIT

7.7.6 OTHERS

7.8 POMEGRANATE

7.9 OTHERS

8 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER

8.3 WOOD

8.4 MOLDED FIBER / PULP

8.4.1 CARDBOARD

8.4.2 RECYCLED PAPER

8.4.3 NATURAL FIBER

8.4.3.1 SUGARCANE

8.4.3.2 BAMBOO

8.4.3.3 WHEAT STRAW

8.4.3.4 OTHERS

8.4.4 OTHERS

8.5 PLASTIC

8.5.1 POLYETHYLENE TEREPHTHALATE

8.5.2 POLYPROPYLENE (PP)

8.5.3 POLY-VINYL CHLORIDE (PVC)

8.5.4 POLYSTYRENE

8.5.5 ETHYL VINYL ACETATE (EVA)

8.5.6 OTHERS

8.6 OTHERS

9 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FLEXIBLE PACKAGING

9.2.1 CORRUGATED

9.2.2 LAMINATED FOIL

9.2.3 OTHERS

9.3 RIGID PACKAGING

9.3.1 BOXBOARD

9.3.2 TRAYS

9.3.3 CONTAINERS

9.3.4 OTHERS

9.4 OTHERS

10 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TRANSPORTATION

10.2.1 TRANSPORTATION, BY MATERIAL TYPE

10.2.1.1 PAPER

10.2.1.2 WOOD

10.2.1.3 MOLDED FIBER / PULP

10.2.1.3.1 CARDBOARD

10.2.1.3.2 RECYCLED PAPER

10.2.1.3.3 NATURAL FIBER

10.2.1.3.3.1 SUGARCANE

10.2.1.3.3.2 BAMBOO

10.2.1.3.3.3 WHEAT STRAW

10.2.1.3.3.4 OTHERS

10.2.1.3.4 OTHERS

10.2.1.4 PLASTIC

10.2.1.4.1 POLYETHYLENE TEREPHTHALATE

10.2.1.4.2 POLYPROPYLENE (PP)

10.2.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.2.1.4.4 POLYSTYRENE

10.2.1.4.5 ETHYL VINYL ACETATE (EVA)

10.2.1.4.6 OTHERS

10.2.1.5 OTHERS

10.3 RETAILING

10.3.1 RETAILING, BY MATERIAL TYPE

10.3.1.1 PAPER

10.3.1.2 WOOD

10.3.1.3 MOLDED FIBER / PULP

10.3.1.3.1 CARDBOARD

10.3.1.3.2 RECYCLED PAPER

10.3.1.3.3 NATURAL FIBER

10.3.1.3.3.1 SUGARCANE

10.3.1.3.3.2 BAMBOO

10.3.1.3.3.3 WHEAT STRAW

10.3.1.3.3.4 OTHERS

10.3.1.3.4 OTHERS

10.3.1.4 PLASTIC

10.3.1.4.1 POLYETHYLENE TEREPHTHALATE

10.3.1.4.2 POLYPROPYLENE (PP)

10.3.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.3.1.4.4 POLYSTYRENE

10.3.1.4.5 ETHYL VINYL ACETATE (EVA)

10.3.1.4.6 OTHERS

10.3.1.5 OTHERS

10.4 FOOD SERVICES

10.4.1 FOOD SERVICES, BY MATERIAL TYPE

10.4.1.1 PAPER

10.4.1.2 WOOD

10.4.1.3 MOLDED FIBER / PULP

10.4.1.3.1 CARDBOARD

10.4.1.3.2 RECYCLED PAPER

10.4.1.3.3 NATURAL FIBER

10.4.1.3.3.1 SUGARCANE

10.4.1.3.3.2 BAMBOO

10.4.1.3.3.3 WHEAT STRAW

10.4.1.3.3.4 OTHERS

10.4.1.3.4 OTHERS

10.4.1.4 PLASTIC

10.4.1.4.1 POLYETHYLENE TEREPHTHALATE

10.4.1.4.2 POLYPROPYLENE (PP)

10.4.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.4.1.4.4 POLYSTYRENE

10.4.1.4.5 ETHYL VINYL ACETATE (EVA)

10.4.1.4.6 OTHERS

10.4.1.5 OTHERS

10.5 OTHERS

10.5.1 OTHERS, BY MATERIAL TYPE

10.5.1.1 PAPER

10.5.1.2 WOOD

10.5.1.3 MOLDED FIBER / PULP

10.5.1.3.1 CARDBOARD

10.5.1.3.2 RECYCLED PAPER

10.5.1.3.3 NATURAL FIBER

10.5.1.3.3.1 SUGARCANE

10.5.1.3.3.2 BAMBOO

10.5.1.3.3.3 WHEAT STRAW

10.5.1.3.3.4 OTHERS

10.5.1.3.4 OTHERS

10.5.1.4 PLASTIC

10.5.1.4.1 POLYETHYLENE TEREPHTHALATE

10.5.1.4.2 POLYPROPYLENE (PP)

10.5.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.5.1.4.4 POLYSTYRENE

10.5.1.4.5 ETHYL VINYL ACETATE (EVA)

10.5.1.4.6 OTHERS

10.5.1.5 OTHERS

11 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 MEXICO FRUIT PACKAGING MARKET, BY COUNTRY

12.1 MEXICO

13 MEXICO FRUIT PACKAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MEXICO

13.1.1 MERGERS & ACQUISITIONS

13.1.2 EXPANSIONS

13.1.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 PACKAGING CORPORATION OF AMERICA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 AMCOR PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 WESTROCK COMPANY

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 SMURFIT KAPPA

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 DS SMITH

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 HUHTAMAKI

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 MONDI

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 SEALED AIR

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 SONOCO PRODUCTS COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD MILLION)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD MILLION)

TABLE 3 REVENUE OF SUPPLIERS (USD MILLION) (2021)

TABLE 4 MOLDED FIBER MARKET SHARE, BY MATERIAL TYPE (2022 AND 2029) (IN %)

TABLE 5 MOLDED FIBER MARKET SHARE, BY APPLICATIONS (2022 AND 2029) (IN %)

TABLE 6 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (USD MILLION)

TABLE 7 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (MILLION UNITS)

TABLE 8 MEXICO BERRIES IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MEXICO TROPICAL FRUITS IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 11 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 12 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 13 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 15 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 17 MEXICO FLEXIBLE PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 MEXICO RIGID PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 21 MEXICO TRANSPORTATION IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 23 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 25 MEXICO RETAILING IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 26 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 27 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 28 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 29 MEXICO FOOD SERVICES IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 30 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 31 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 32 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 33 MEXICO OTHERS IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 34 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 35 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 36 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 37 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 39 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (MILLION UNITS)

TABLE 41 MEXICO BERRIES IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MEXICO TROPICAL FRUITS IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 45 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 46 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE , 2020-2029 (USD MILLION)

TABLE 47 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 48 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 MEXICO FLEXIBLE PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MEXICO RIGID PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 54 MEXICO TRANSPORTATION IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 55 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 56 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 57 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 58 MEXICO RETAILING IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 59 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO FOOD SERVICES IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO OTHERS IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

List of Figure

FIGURE 1 MEXICO FRUIT PACKAGING MARKET: SEGMENTATION

FIGURE 2 MEXICO FRUIT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO FRUIT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MEXICO FRUIT PACKAGING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO FRUIT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO FRUIT PACKAGING MARKET: MATERIAL TYPE LIFE LINE CURVE

FIGURE 7 MEXICO FRUIT PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MEXICO FRUIT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MEXICO FRUIT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MEXICO FRUIT PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MEXICO FRUIT PACKAGING MARKET: CHALLENGE MATRIX

FIGURE 12 MEXICO FRUIT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MEXICO FRUIT PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING IS DRIVING THE MEXICO FRUIT PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 15 BANANA IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO FRUIT PACKAGING MARKET IN 2022 & 2029

FIGURE 16 MEXICO FRUIT PACKAGING MARKET- SUPPLY CHAIN ANALYSIS

FIGURE 17 MEXICO FRUIT PACKAGING MARKET- VALUE CHAIN ANALYSIS

FIGURE 18 MEXICO FRUIT PACKAGING MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO FRUIT PACKAGING MARKET

FIGURE 20 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 21 WASTE GENERATION BY PACKAGING MATERIAL IN 2019 IN EUROPE

FIGURE 22 MEXICO FRUIT PACKAGING MARKET: BY FRUIT TYPE, 2021

FIGURE 23 MEXICO FRUIT PACKAGING MARKET: BY MATERIAL TYPE, 2021

FIGURE 24 MEXICO FRUIT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 25 MEXICO FRUIT PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 26 MEXICO FRUIT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 MEXICO FRUIT PACKAGING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.