السوق العالمية للوقود الجوي المستدام، حسب نوع الوقود (الوقود الحيوي، وقود الهيدروجين، والطاقة إلى الوقود السائل)، تكنولوجيا التصنيع (إسترات الأحماض الدهنية المعالجة بالهيدروجين والأحماض الدهنية - الكيروسين البارافيني الاصطناعي (HEFA-SPK)، الكيروسين البارافيني الاصطناعي من فيشر تروبش (FT-SPK)، البارافين الاصطناعي ISO من السكر المعالج بالهيدروجين المخمر (HFS-SIP)، الكيروسين البارافيني الاصطناعي من فيشر تروبش (FT) مع العطريات (FT-SPK / A)، الكحول إلى Jet SPK (ATJ-SPK) و Jet التحلل الحراري المائي التحفيزي (CHJ))، قدرة المزج (أقل من 30٪، 30٪ إلى 50٪ وفوق 50٪)، منصة المزج (الطيران التجاري، الطيران العسكري، الطيران التجاري والعام، والمركبات الجوية بدون طيار ) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل وحجم السوق العالمية للوقود المستدام للطيران

تحرص صناعة الطيران على تقليل البصمة الكربونية لتحقيق بيئة مستدامة وتلبية المعايير التنظيمية الصارمة للانبعاثات. يتم اعتماد حلول بديلة، مثل تحسين كفاءة محركات الطائرات من خلال تعديلات التصميم، والطائرات الكهربائية الهجينة والكهربائية بالكامل، ووقود الطائرات المتجدد، وما إلى ذلك، من قبل مختلف أصحاب المصلحة في صناعة الطيران. ومع ذلك، من بين هذه الحلول، فإن اعتماد وقود الطائرات المستدام مثل الوقود الإلكتروني والوقود الاصطناعي ووقود الطائرات الأخضر ووقود الطائرات الحيوي ووقود الهيدروجين هو أحد أكثر الحلول البديلة جدوى فيما يتعلق بالفوائد الاجتماعية والاقتصادية مقارنة بالآخرين، مما يساهم بشكل كبير في التخفيف من التأثيرات البيئية الحالية والمتوقعة في المستقبل للطيران.

تشكل الوقود المستدام للطائرات عنصراً أساسياً في الوفاء بالتزامات صناعة الطيران بفصل الزيادة في انبعاثات الكربون عن نمو حركة المرور. وتكمل عوامل مثل زيادة عدد ركاب الطائرات، ونمو الدخل المتاح، وزيادة النقل الجوي، وزيادة استهلاك زيوت التشحيم الاصطناعية نمو سوق الوقود المستدام للطائرات العالمية. ومع ذلك، فإن الافتقار إلى البنية الأساسية يعمل كعامل مقيد للسوق.

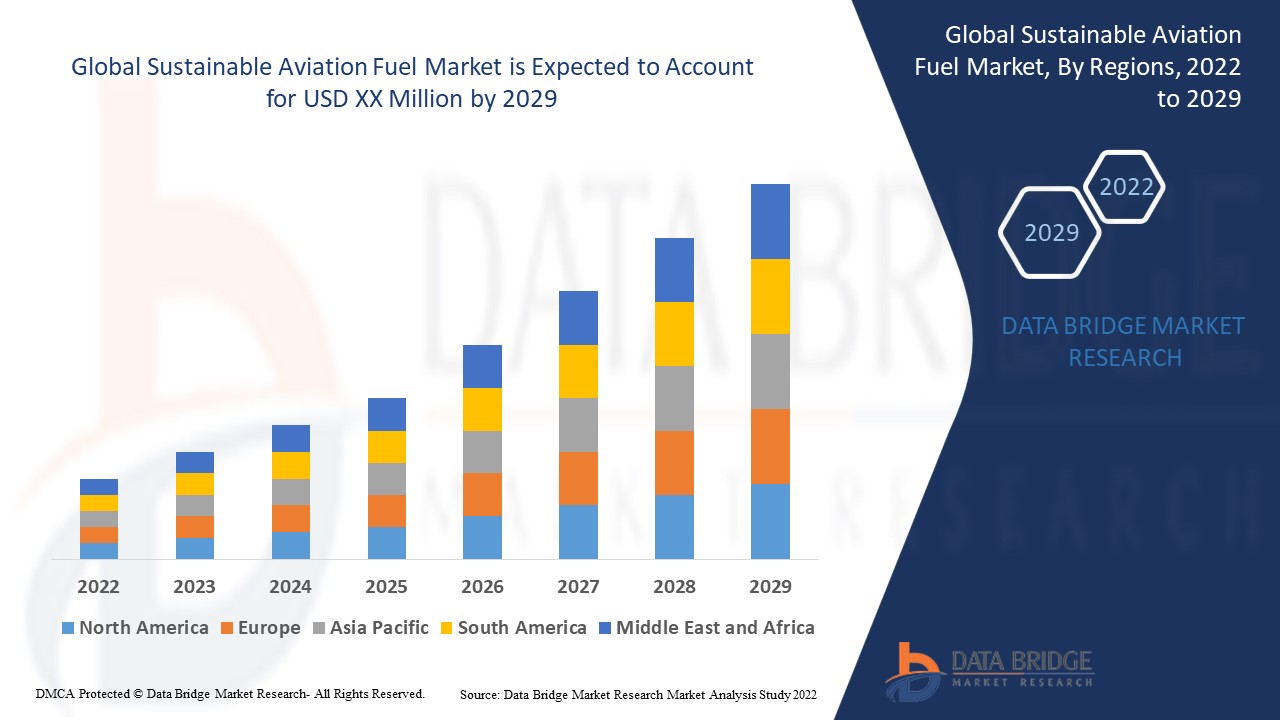

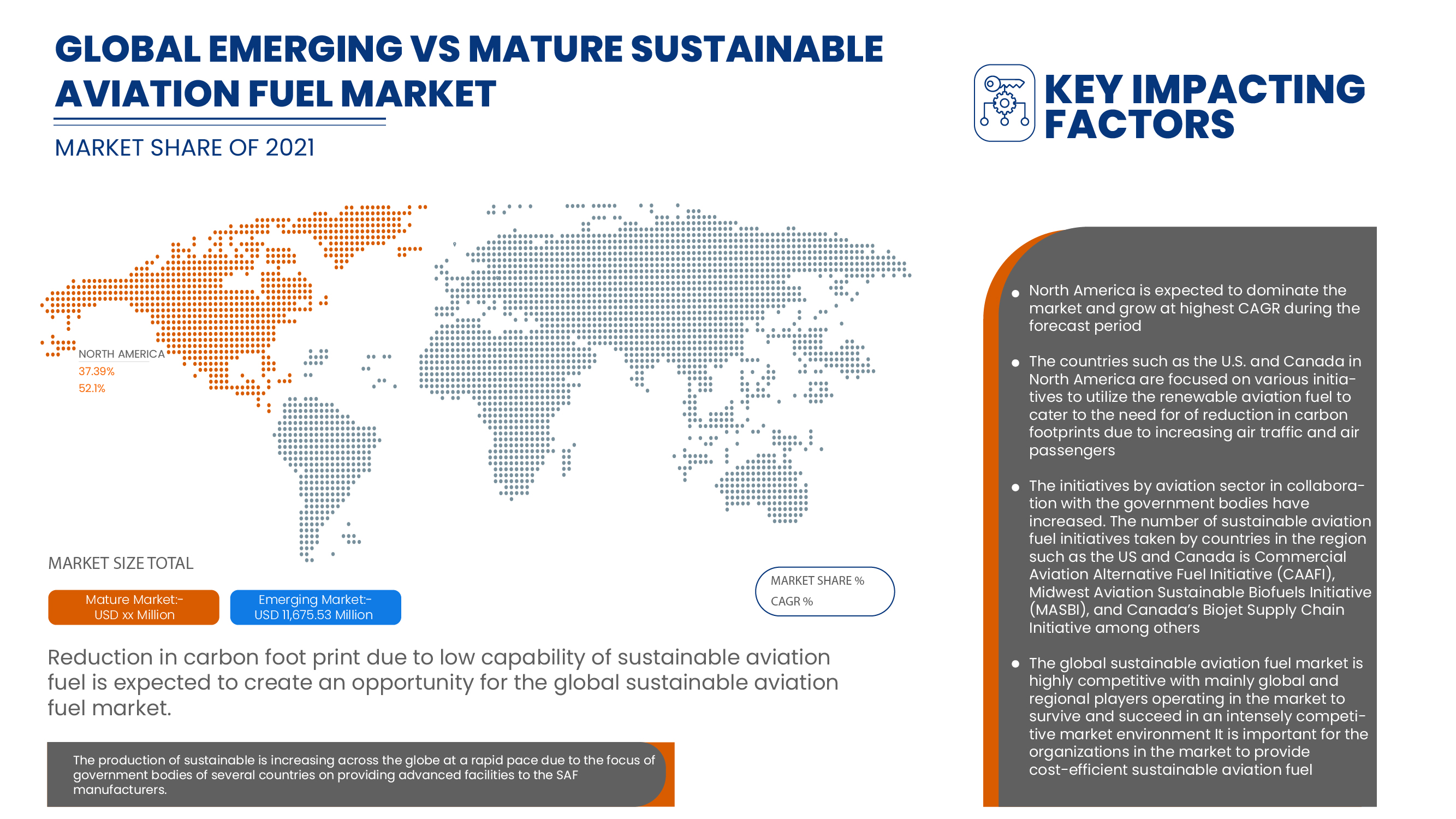

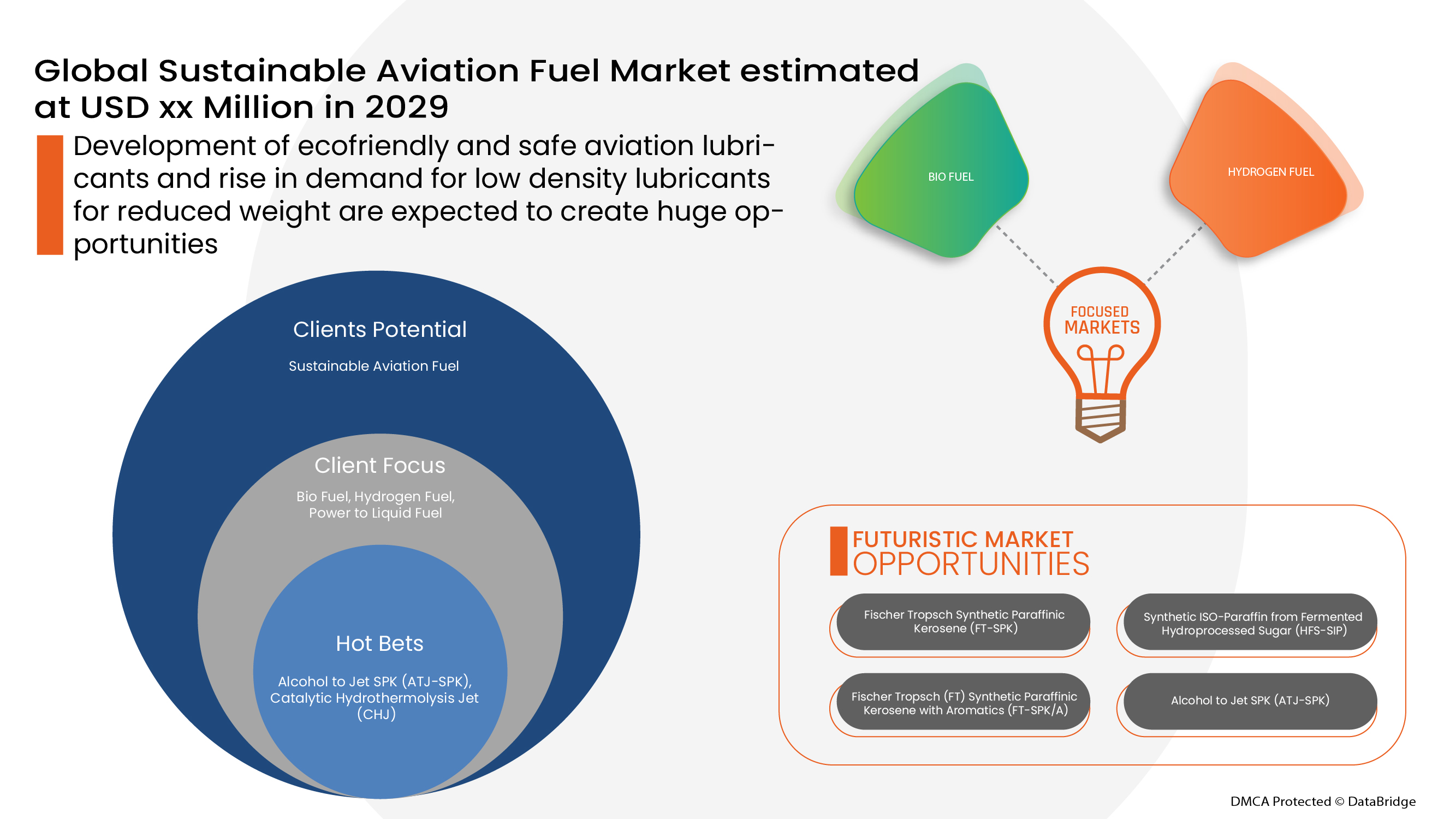

تحلل شركة Data Bridge Market Research أن سوق وقود الطيران المستدام من المتوقع أن تصل قيمته إلى 11,675.53 مليون يورو بحلول عام 2029، بمعدل نمو سنوي مركب يبلغ 47.9% خلال الفترة المتوقعة. يشكل "الوقود الحيوي" أكبر شريحة تقنية في سوق وقود الطيران المستدام بسبب التطورات السريعة في المسارات التكنولوجية لتسويق استخدام وقود الطائرات البديل. يغطي تقرير سوق وقود الطيران المستدام أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنة تاريخية |

2020 |

|

وحدات كمية |

الإيرادات بمليون يورو، الأحجام بالوحدات، التسعير باليورو |

|

القطاعات المغطاة |

حسب نوع الوقود (الوقود الحيوي ووقود الهيدروجين والطاقة إلى وقود سائل)، حسب تكنولوجيا التصنيع (إسترات الأحماض الدهنية المعالجة بالهيدروجين والأحماض الدهنية - الكيروسين البارافيني الصناعي (Hefa-Spk)، الكيروسين البارافيني الصناعي من فيشر تروبش (FT-SPK)، إيزوبارافين صناعي من سكر معالج بالهيدروجين المخمر (Hfs-Sip)، الكيروسين البارافيني الصناعي من فيشر تروبش (Ft) مع المواد العطرية (FT-SPK/A)، الكحول إلى جيت سبي (ATJ-SPK) وجيت التحليل الحراري المائي التحفيزي (CHJ))، حسب سعة المزج (أقل من 30%، 30% إلى 50% وأعلى من 50%)، حسب منصة المزج (الطيران التجاري، الطيران العسكري، الطيران التجاري والعام، والطائرات بدون طيار) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية والمملكة المتحدة وألمانيا وفرنسا وإسبانيا وإيطاليا وهولندا وسويسرا وروسيا وبلجيكا وتركيا وبقية أوروبا والصين وكوريا الجنوبية واليابان والهند وأستراليا وسنغافورة وماليزيا وإندونيسيا وتايلاند والفلبين وبقية دول آسيا والمحيط الهادئ في منطقة آسيا والمحيط الهادئ وجنوب أفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة وإسرائيل ومصر وبقية دول الشرق الأوسط وأفريقيا كجزء من منطقة الشرق الأوسط وأفريقيا والبرازيل والأرجنتين ومنطقة البحر الكاريبي وكولومبيا وبيرو وتشيلي وبنما وفنزويلا وبقية دول أمريكا الجنوبية كجزء من أمريكا الجنوبية. |

|

الجهات الفاعلة في السوق المشمولة |

Neste، Gevo، VELOCYS، Fulcrum BioEnergy، SkyNRG، Prometheus Fuels، World Energy، Avfuel Corporation، LanzaTech، Preem AB، Eni، Sasol Ltd، BP plc، Cepsa، Honeywell International Inc، Chevron Corporation، TotalEnergies، Exxon Mobil Corporation، Johnson Matthey، VIRENT، INC.، HyPoint Inc.، ZeroAvia، Inc. وغيرها. |

تعريف السوق

الوقود المستدام للطائرات هو شكل فريد من أشكال الوقود المصمم للاستخدام في الطائرات وفي نفس الوقت يزيد من أداء الطائرات. يتم استخلاص الوقود المستدام للطائرات من مواد خام مستدامة ويمكن مقارنته في تركيبته الكيميائية بالوقود الأحفوري القياسي للطائرات. يؤدي زيادة فائدة الوقود المستدام للطائرات إلى انخفاض انبعاثات الكربون مقارنة بالوقود النفاث التقليدي لأنه يحل محل دورة حياة الوقود.

ترغب مؤسسة الطيران في تقليل البصمة الكربونية للحصول على بيئة مستدامة

وتلبية المتطلبات التنظيمية الصارمة بشأن الانبعاثات. وعلاوة على ذلك، يتم اعتماد تحسين أداء محركات الطائرات من خلال تعديلات التصميم والطائرات الهجينة الكهربائية والكهربائية بالكامل ووقود الطائرات المتجدد من قبل العديد من أصحاب المصلحة في صناعة الطيران، ومع ذلك فإن اعتماد وقود الطيران المستدام يعتبر من أكثر الحلول الموثوقة والقابلة للتطبيق فيما يتعلق بالمزايا الاجتماعية والاقتصادية مقارنة بالآخرين، مما يساهم بشكل كبير في التخفيف من التأثيرات البيئية الحديثة والمتوقعة في المستقبل للطيران.

ديناميكيات سوق وقود الطيران المستدام

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

- الحاجة المتزايدة إلى الحد من انبعاثات غازات الاحتباس الحراري في صناعة الطيران

إن انبعاثات الغازات المسببة للاحتباس الحراري الناتجة عن الأنشطة البشرية تعمل على تضخيم تأثير الاحتباس الحراري، مما يتسبب في تغير المناخ. ينبعث ثاني أكسيد الكربون في المقام الأول من خلال احتراق الوقود الأحفوري مثل الفحم والنفط والغاز الطبيعي. تعد الصين وروسيا من أكبر الملوثين على مستوى العالم. تحدث هذه التلوثات في الغالب بسبب شركات الفحم والنفط والغاز المملوكة لمنظمة أوبك. لقد زادت مستويات ثاني أكسيد الكربون في الغلاف الجوي بنحو 50٪ عن أوقات ما قبل الصناعة بسبب الانبعاثات الناجمة عن الأنشطة البشرية.

إن الملوثات المنبعثة من محركات الطائرات تعادل تلك المنبعثة من احتراق الوقود الأحفوري. وعلى ارتفاعات أعلى، تحتوي انبعاثات الطائرات على تركيز أكبر من الملوثات. وتخلق هذه الانبعاثات مشاكل بيئية خطيرة، سواء من حيث تأثيرها العالمي أو تأثيرها على جودة الهواء المحلي.

- زيادة النقل الجوي وزيادة استهلاك زيوت التشحيم الاصطناعية

إن السفر الجوي يشكل عنصراً بالغ الأهمية في تحقيق النمو الاقتصادي والتنمية. وعلى المستوى الوطني والإقليمي والعالمي، يعزز السفر الجوي التكامل في الاقتصاد العالمي ويوفر روابط حيوية. كما يساهم في نمو التجارة والسياحة وفرص العمل. إن نظام الطيران يتطور وسوف يستمر في التطور. ولكن في الأمد البعيد، سيكون من الصعب على نظام النقل الجوي التكيف بسرعة كافية لتلبية الاحتياجات المتغيرة من حيث القدرة والتأثير البيئي وسعادة المستهلك والسلامة والأمن، كل ذلك مع الحفاظ على الجدوى الاقتصادية لمقدمي الخدمات.

لقد أدى جائحة كوفيد-19، إلى جانب الدعم الحكومي والاكتشافات التكنولوجية، وخاصة في مجال تكنولوجيا الوقود، إلى تسريع انتقال صناعة الطيران إلى وقود الطيران المستدام. وفي حين يتزايد استخدام وقود الطيران المستدام، فإن زيوت التشحيم غير الاصطناعية آخذة في الانحدار. ومن المتوقع أن تستفيد زيوت التشحيم الاصطناعية وشبه الاصطناعية من هذا التحول لأن معظم الطائرات تستخدم زيوت تشحيم من الدرجة المتقدمة. ومن المتوقع أن يكون سوق وقود الطيران المستدام العالمي مدفوعًا بهذا العامل.

- زيادة الطلب على وقود الطيران المستدام من قبل شركات الطيران

يتبنى قطاع الطيران "إجراءات عاجلة" لتحقيق هدف المناخ العالمي، والذي يتضمن الحد من نمو السفر الجوي والتوسع السريع في استخدام الوقود المستدام للطائرات. والغرض من الوقود المستدام للطائرات هو إعادة تدوير الكربون من الكتلة الحيوية المستدامة الحالية أو الغازات إلى وقود الطائرات كبديل للوقود الأحفوري للطائرات المكرر من النفط الخام البترولي. والغرض من الوقود المستدام للطائرات هو إعادة تدوير الكربون من الكتلة الحيوية المستدامة الحالية أو الغازات إلى وقود الطائرات كبديل للوقود الأحفوري للطائرات المكرر من النفط الخام البترولي. ويلتزم قطاع الطيران ككل، وكذلك شركات الطيران الأعضاء في اتحاد النقل الجوي الدولي، بتحقيق أهداف خفض الانبعاثات العدوانية. وقد تم تسليط الضوء على الوقود المستدام للطائرات كمكون رئيسي في تحقيق هذه الأهداف. وسوف يتطلب الأمر دعمًا حكوميًا لاستخدام الوقود المستدام للطائرات لتلبية أهداف المناخ في الصناعة

وبما أن اللاعبين الرئيسيين في الصناعة يدركون الحاجة إلى وقود الطيران المستدام، فقد بدأ مزودو الخدمة في تبني العديد من بدائل وقود الطيران المستدام في العديد من شركات الطيران، وهو ما من المتوقع أن يدفع نمو وقود الطيران المستدام بشكل كبير.

- عدم كفاية توافر المواد الخام والمصافي لتلبية الطلب المستدام على إنتاج وقود الطيران

تشكل الوقود المستدام للطائرات، المصنوع من مواد خام بيولوجية، جزءًا مهمًا من الخطة الرامية إلى تقليل البصمة الكربونية للطيران. ومن الناحية الفنية، من الممكن استبدال الوقود المستدام للطائرات وخلطه بالوقود النفاث؛ والواقع أن صناعة الطيران تستخدم الوقود المستدام للطائرات منذ أكثر من عقد من الزمان. ومع ذلك، وبسبب قيود العرض والطلب، تظل مستويات الاستهلاك منخفضة للغاية.

المحاصيل الزيتية، ومحاصيل السكر، والطحالب، والزيوت المستعملة، وغيرها من الموارد البيولوجية وغير البيولوجية هي المواد الخام التي تلعب دورًا أساسيًا في سلسلة الإنتاج الكاملة للوقود البديل للطيران مثل الوقود الاصطناعي، والوقود الإلكتروني، ووقود الطائرات الحيوي. قد تتوقف الحاجة إلى وقود الطيران المستدام بسبب ندرة المواد الخام اللازمة للتصنيع. وبسبب ندرة المواد الخام اللازمة لتصنيعه، قد يتوقف الطلب على وقود الطيران المستدام. وعلاوة على ذلك، فإن القيود المفروضة على التكرير، والتي تلعب دورًا حاسمًا في الاستغلال الأمثل لهذه المواد الخام، تضيف إلى العملية الإجمالية لتصنيع وقود الطيران المستدام. كما يفرض انخفاض إمدادات الوقود ضغطًا على قدرة خلط الوقود، مما يؤدي إلى انخفاض الكفاءة.

عندما تتزايد المنافسة من قطاع البنزين على الطرق للحصول على المواد الخام التي تلبي معايير الاستدامة، يصبح توافر المواد الخام بمثابة عنق زجاجة. تشكل تكاليف المواد الخام جزءًا كبيرًا من تكلفة وقود الطائرات المستدام، ويمكن أن يتسبب تقلب الأسعار في حدوث مشكلات في العرض لمنتجي الوقود. وبالتالي، فإن زيادة رسوم الوقود من قبل شركة النقل تعيق نمو السوق إلى حد ما.

- التقلبات في أسعار النفط الخام وتلوث مواد التشحيم

إن المنافسة العالمية المتزايدة وضغوط التكلفة تجبر الشركات وسلاسل التوريد على اكتشاف إمكانات غير مكتشفة لتوفير التكاليف. وعلى وجه الخصوص، تشكل الواجهات مع سوق النفط الخام مجالاً واعداً للتحسين. وفي بيئة الأعمال اليوم، تواجه كل منظمة بعض مخاطر التقلب في أسعار النفط الخام والسلع الأساسية للتشحيم. وفي الإنتاج، قد يعتمد المصنعون على كمية كبيرة من السلع الأساسية النفطية، ونتيجة لهذا يمكن أن يتأثروا بشكل خاص بتقلبات الأسعار في المنتجات النفطية التي يشترونها بشكل مباشر وغير مباشر من خلال المكونات والتجميعات الفرعية. إن الأسواق العالمية المتقلبة وغير المستقرة لها آثار واسعة النطاق على منظمات التصنيع. من ارتفاع تكاليف الطاقة إلى التقلبات غير المتوقعة في تكاليف تصنيع النفط الخام، تعمل العقبات غير المتوقعة على زعزعة استقرار سلاسل التوريد وتجعل من الصعب على المصنعين البقاء في الربح. ومع صعوبة تأمين إمدادات العديد من المواد الخام، فإن تقلب أسعار السلع الأساسية قد لا يكون مجرد ظاهرة مؤقتة، ويتعين على المصنعين إما امتصاص التكاليف الإضافية، أو إيجاد طرق جديدة للتخفيف من النفقات، أو تمرير زيادات الأسعار إلى العملاء الذين يترددون بالفعل في الإنفاق. وبما أن الأسعار تتأثر بتضييق أسواق العرض، فإن هذا الاتجاه لا يظهر أي مؤشر على تغيره في أي وقت قريب. وبالتالي، فإن تقلبات أسعار النفط الخام وغيره من مواد التشحيم تعمل كعائق رئيسي أمام سوق الوقود المستدام للطيران على مستوى العالم.

إن شظايا الكربون ليست صلبة أو كبيرة بالقدر الكافي للتسبب في فشل المضخة. ومع ذلك، قد تكون كبيرة بالقدر الكافي لسد المرشحات أو الفوهات الصغيرة. وهناك سبب آخر للتلوث التشغيلي وهو وجود الرمال والحصى والجسيمات المعدنية في نظام التزييت. وهو ما يعمل كعامل مقيد لسوق الوقود المستدام للطيران العالمي.

- انخفاض البصمة الكربونية بسبب انخفاض قدرة وقود الطيران المستدام

إن الوقود المستدام للطائرات يقلل من انبعاثات الكربون على مدى عمر الوقود مقارنة بالوقود النفاث التقليدي الذي يحل محله. ومن بين المواد الخام الشائعة زيت الطهي وغيره من زيوت النفايات الحيوانية أو النباتية غير النخيلية، وكذلك النفايات الصلبة من المنازل والشركات، مثل مواد التغليف والورق والمنسوجات وبقايا الطعام التي كان من الممكن التخلص منها في مكبات النفايات أو حرقها. كما تعد حطام الغابات، مثل نفايات الخشب، والمحاصيل الطاقية، مثل النباتات والطحالب سريعة النمو، مصادر محتملة أيضًا.

اعتمادًا على المواد الخام المستدامة المستخدمة، وعملية الإنتاج، وسلسلة التوريد إلى المطار، يمكن للوقود المستدام أن يقلل انبعاثات الكربون بنسبة تصل إلى 80% خلال عمر الوقود مقارنة بالوقود النفاث التقليدي الذي يحل محله.

يمكن خلط الوقود المستدام للطائرات بنسبة تصل إلى 50% مع وقود الطائرات القياسي، ويخضع لنفس اختبارات الجودة التي يخضع لها وقود الطائرات التقليدي. بعد ذلك، يتم إعادة اعتماد الخليط باعتباره Jet A أو Jet A-1. ويمكن التعامل معه بنفس الطريقة التي يتم بها التعامل مع وقود الطائرات القياسي، وبالتالي لا يلزم إجراء أي تغييرات على البنية الأساسية للتزويد بالوقود أو الطائرات التي ترغب في استخدام الوقود المستدام للطائرات، مما يخلق فرصة لنمو سوق وقود الطائرات المستدام العالمي.

- تطوير زيوت التشحيم للطيران الصديقة للبيئة والآمنة

في عالم اليوم، تشهد صناعة الطيران ازدهارًا كبيرًا، مما يؤدي إلى زيادة المنافسة بين منتجي وقود الطائرات في جميع المجالات. ومن المتوقع أن يكون للمصادر البديلة الصديقة للبيئة لإنتاج وقود الطائرات على المدى الطويل تأثير مستقبلي على قطاع وقود الطائرات. لقد نما سوق وقود الطائرات المستدام بشكل كبير على مر السنين، وذلك بسبب الاتجاه المتزايد لاستخدام الوقود المتقدم في الطائرات في جميع أنحاء العالم.

كما أن زراعة محاصيل الكتلة الحيوية لإنتاج وقود الطيران المستدام تسمح للمزارعين بكسب المزيد من المال في غير موسم الزراعة من خلال المساهمة في توفير المواد الخام لهذه الصناعة الجديدة، وفي الوقت نفسه تأمين مزايا زراعية مثل الحد من فقدان العناصر الغذائية وتحسين جودة التربة. وبالتالي، خلق فرصة لنمو سوق وقود الطيران المستدام العالمي.

- ارتفاع تكلفة الوقود المستدام للطيران يزيد من تكاليف تشغيل شركات الطيران

إن نفقات العمالة والوقود هما أهم النفقات التي تواجهها شركات الطيران. ففي الأمد القريب، تكون نفقات العمالة مستقرة عادة، ولكن أسعار الوقود تتقلب بشكل كبير اعتمادًا على سعر النفط. ويشكل الوقود جزءًا كبيرًا من تكلفة تشغيل شركة طيران، حيث يمثل 20-30% من إجمالي النفقات. وكانت ارتفاعات أسعار النفط من أصعب اللحظات التي مرت بها شركات الطيران. ويمكن لشركات الطيران الاستعداد للارتفاع التدريجي للأسعار من خلال رفع أسعار التذاكر أو خفض عدد الرحلات، ولكن الزيادات غير المتوقعة في الأسعار تتسبب في خسارة العديد من شركات الطيران للأموال.

إن الأهداف المتعلقة باستخدام وقود الطيران المستدام سوف تبدأ في إضافة تكاليف الوقود هذا العام، مما يجعل الأمور أكثر صعوبة بالنسبة لشركات الطيران. فوفقًا لاتحاد النقل الجوي الدولي (IATA)، فإن إنتاج وقود الطيران المستدام العالمي لا يتجاوز 100 مليون لتر سنويًا، أو 0.1% من إجمالي وقود الطيران المستخدم. ومن ناحية أخرى، تعهدت شركات الطيران المختلفة بزيادة هذه النسبة إلى 10% بحلول عام 2030، وهو هدف نبيل حقًا.

ولكن من المؤسف أن التكلفة باهظة أيضاً بسبب حجم التصنيع المحدود. وتقدر تكلفة وقود الطائرات المستدام بما يتراوح بين ضعفي وأربعة أمثال تكلفة الوقود الأحفوري وفقاً لتقديرات اتحاد النقل الجوي الدولي، في حين أشارت إفصاحات حديثة لشركة الخطوط الجوية الفرنسية ـ كيه إل إم إلى أن الفارق في التكلفة ربما يكون أقرب إلى أربعة إلى ثمانية أمثال الفارق في تكلفة الكيروسين.

وقد حثت رابطة النقل الجوي الدولي (IATA) وغيرها من الهيئات الحكومات على تشجيع تطوير وقود الطيران المستدام، ولكن في شكل تحفيز اقتصادي. وهذا يمهد الطريق لزيادة أسعار وقود الطيران المستدام، وبالتالي يشكل تحديًا لسوق وقود الطيران المستدام العالمي.

تأثير ما بعد كوفيد-19 على سوق وقود الطيران المستدام

أحدثت جائحة كوفيد-19 تأثيرًا كبيرًا على سوق وقود الطيران المستدام حيث اختارت كل دولة تقريبًا إغلاق جميع مرافق الإنتاج باستثناء تلك التي تتعامل مع إنتاج السلع الأساسية. اتخذت الحكومة بعض الإجراءات الصارمة مثل إغلاق إنتاج وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير لمنع انتشار كوفيد-19. العمل الوحيد الذي يتعامل في هذا الوضع الوبائي هو الخدمات الأساسية المسموح لها بالفتح وتشغيل العمليات.

يتزايد نمو سوق وقود الطيران المستدام بسبب الحاجة إلى تقليل انبعاثات غازات الاحتباس الحراري في صناعة الطيران. ومع ذلك، فإن عوامل مثل عدم كفاية توافر المواد الخام والمصافي لتلبية الطلب على إنتاج وقود الطيران المستدام تعمل على تقييد نمو السوق. كان لإغلاق مرافق الإنتاج أثناء حالة الوباء تأثير كبير على السوق.

يتخذ المصنعون قرارات استراتيجية مختلفة للتعافي بعد جائحة كوفيد-19. ويجري اللاعبون أنشطة بحث وتطوير متعددة لتحسين التكنولوجيا المستخدمة في وقود الطيران المستدام. وبهذا، ستجلب الشركات أجهزة تحكم متقدمة ودقيقة إلى السوق. بالإضافة إلى ذلك، أدى استخدام السلطات الحكومية لوقود الطيران المستدام في الشحن الجوي إلى نمو السوق.

التطورات الأخيرة

- في مارس 2022، أعلنت Neste بالتعاون مع DHL Express عن واحدة من أكبر صفقات الوقود المستدام للطائرات على الإطلاق. هذه الاتفاقية هي الأكبر من نوعها لشركة Neste للوقود المستدام للطائرات (SAF) حتى الآن وواحدة من أكبر اتفاقيات الوقود المستدام للطائرات في صناعة الطيران. سيعمل هذا التعاون على تعزيز شبكة Neste الحالية من خلال تقديم اتصال سلس في جميع أنحاء العالم

- في مارس 2022، قامت شركة BP ventures باستثمار 3 ملايين جنيه إسترليني في شركة Flylogix - وهي شركة رائدة في مجال الطائرات بدون طيار (UAV) تستخدم الطائرات بدون طيار للمساعدة في اكتشاف غاز الميثان. تركز مشاريع BP هذه على ربط وتنمية أعمال الطاقة الجديدة والشبكة الحالية من خلال تقديم اتصال سلس في جميع أنحاء العالم

نطاق سوق وقود الطيران المستدام العالمي

يتم تقسيم سوق وقود الطيران المستدام على أساس نوع الوقود وتكنولوجيا التصنيع وسعة المزج ومنصة المزج. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع الوقود

- الوقود الحيوي

- وقود الهيدروجين

- الطاقة إلى الوقود السائل

On the basis of fuel type, the global sustainable aviation fuel market is segmented into bio fuel, hydrogen fuel and power to liquid fuel

Manufacturing Technology

- Hydroprocessed Fatty Acid Esters and Fatty Acids - Synthetic Paraffinic Kerosene (HEFA-SPK)

- Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK)

- Synthetic Iso-Paraffin from Fermented Hydroprocessed Sugar (HFS-SIP)

- Fischer Tropsch (FT) Synthetic Paraffinic Kerosene with Aromatics (FT-SPK/A)

- Alcohol to Jet Spk (ATJ-SPK)

- Catalytic Hydrothermolysis Jet (CHJ)

On the basis of manufacturing technology, the global sustainable aviation fuel market has been segmented into hydroprocessed fatty acid esters and fatty acids - synthetic paraffinic kerosene (HEFA-SPK), fischer tropsch synthetic paraffinic kerosene (FT-SPK), synthetic Iso-paraffin from fermented hydroprocessed sugar (HFS-SIP), fischer tropsch (FT) synthetic paraffinic kerosene with aromatics (FT-SPK/A), alcohol to jet SPK (ATJ-SPK) and catalytic hydrothermolysis jet (CHJ).

Blending Capacity

- Below 30 %

- 30 % To 50 %

- Above 50%

On the basis of blending capacity, the global sustainable aviation fuel market has been segmented into below 30 %, 30 % to 50 % and above 50%.

Blending Platform

- Commercial Aviation

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicle

On the basis of blending platform, the global sustainable aviation fuel market has been segmented into commercial aviation, military aviation, business & general aviation, and unmanned aerial vehicle

Sustainable Aviation Fuel Market Regional Analysis/Insights

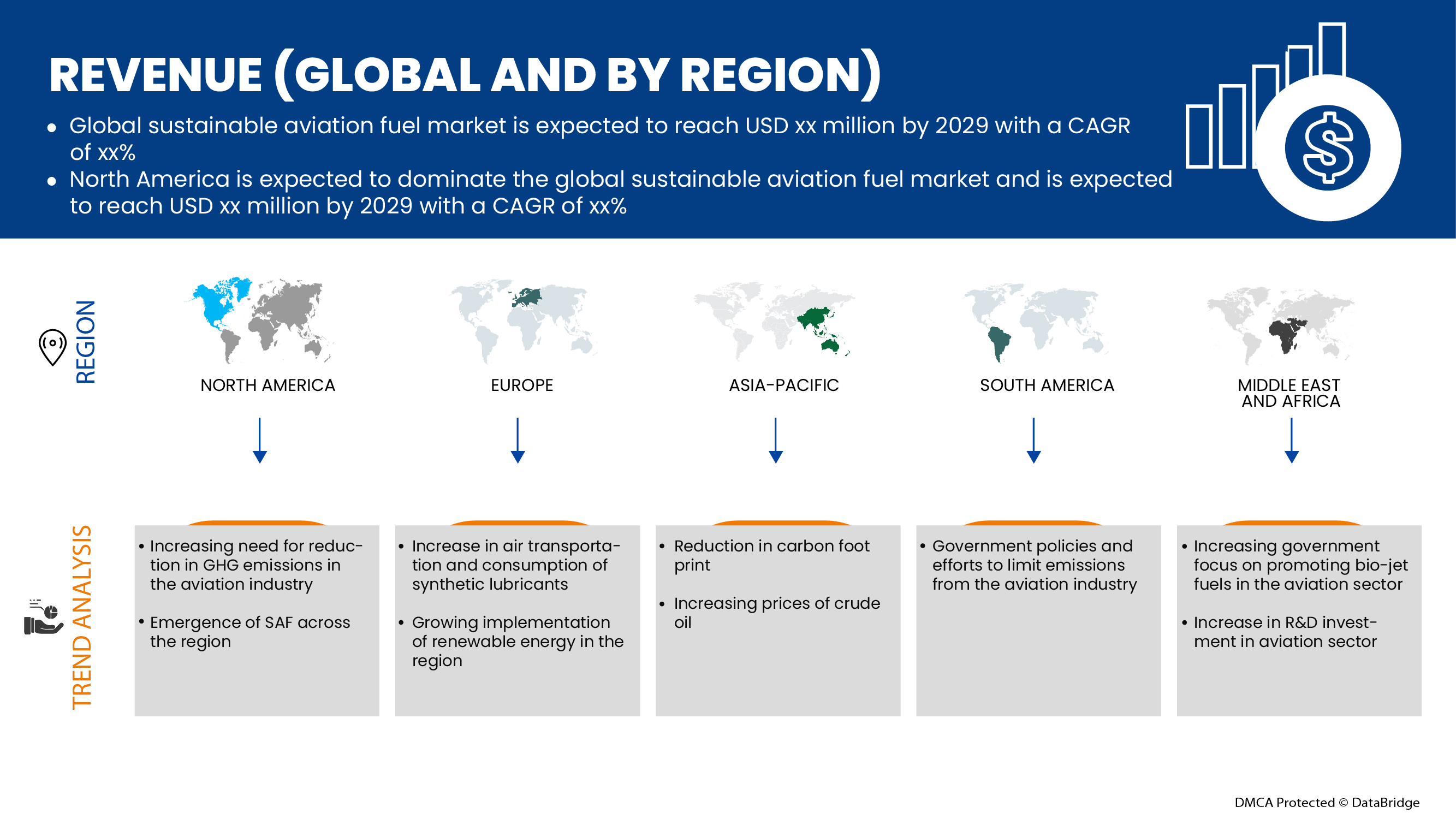

The sustainable aviation fuel market is analysed and market size insights and trends are provided by country, fuel type, manufacturing technology, blending capacity, and blending platform industry as referenced above.

The countries covered in the Sustainable aviation fuel market report are U.S., Canada and Mexico in North America, U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, and the rest of Europe in Europe, China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, and the rest of Asia-Pacific in the Asia-Pacific (APAC), South Africa, Saudi Arabia, U.A.E., Israel, Egypt, and the rest of the Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina, Caribbean, Colombia, Peru, Chille, Panama, Venezuela and rest of South America as part of South America.

يعود الفضل في هيمنة السوق إلى ارتفاع البنية التحتية والتطورات التجارية والصناعية للطيران في البلدان الناشئة مثل الولايات المتحدة وكندا والمكسيك. تهيمن الولايات المتحدة على منطقة أمريكا الشمالية بسبب البدائل الرائدة للوقود النفاث التقليدي. تهيمن المملكة المتحدة على سوق وقود الطيران المستدام في أوروبا، بسبب زيادة الاستثمارات في نمو الطائرات التجارية. تهيمن الصين على سوق وقود الطيران المستدام في منطقة آسيا والمحيط الهادئ. ومن المتوقع أن يكون الطلب في هذه المنطقة مدفوعًا بزيادة الطلب على وقود الطيران المستدام من قبل شركات الطيران.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق وقود الطيران المستدام

يوفر المشهد التنافسي لسوق وقود الطيران المستدام تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق وقود الطيران المستدام.

بعض اللاعبين الرئيسيين العاملين في سوق وقود الطيران المستدام هم Neste و Gevo و VELOCYS و Fulcrum BioEnergy و SkyNRG و Prometheus Fuels و World Energy و Avfuel Corporation و LanzaTech و Preem AB و Eni و Sasol Ltd و BP plc و Cepsa و Honeywell International Inc و Chevron Corporation و TotalEnergies و Exxon Mobil Corporation و Johnson Matthey و VIRENT، INC. و HyPoint Inc. و ZeroAvia، Inc. وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL SUSTAINABLE AVIATION FUEL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FUEL TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF FUTURE APPLICATIONS

4.2 ADVANCING SUSTAINABILITY WITHIN AVIATION

4.3 ORGANIZATIONS INVOLVED IN SUSTAINABLE AVIATION FUEL PROGRAMS

4.4 RESEARCH & INNOVATION ROADMAP FOR AVIATION HYDROGEN TECHNOLOGY

4.5 RECENT SUPPLY CONTRACTS BY SHELL

4.6 STANDARDS

4.6.1 OVERVIEW

4.6.2 INTERNATIONAL CIVIL AVIATION ORGANIZATION (ICAO)

4.6.3 INTERNATIONAL AIR TRANSPORT ASSOCIATION (IATA)

4.6.4 BUREAU OF CIVIL AVIATION SECURITY

4.6.5 FEDERAL AVIATION ADMINISTRATION

4.6.6 EUROPEAN UNION AVIATION SAFETY AGENCY (EASA)

4.6.7 CIVIL AVIATION ADMINISTRATION OF CHINA (CAAC)

4.6.8 UAE GENERAL CIVIL AVIATION AUTHORITY (GCAA)

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF SUSTAINABLE AVIATION FUEL MARKET

4.8 TECHNOLOGY TRENDS

4.8.1 OVERVIEW

4.8.2 HYDROTHERMAL LIQUEFACTION (HTL)

4.8.3 PYROLYSIS PATHWAYS OR PYROLYSIS-TO-JET (PTJ)

4.8.4 TECHNOLOGICAL MATURITY - FUEL READINESS LEVEL AND FEEDSTOCK READINESS LEVEL

4.9 IMPACT OF MEGATREND

4.1 INNOVATION AND PATENT ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY

5.1.2 INCREASE IN AIR TRANSPORTATION CONSUMPTION OF SYNTHETIC LUBRICANTS

5.1.3 INCREASE IN DEMAND FOR SUSTAINABLE AVIATION FUEL BY AIRLINES

5.1.4 INCREASE IN INVESTMENTS FOR THE GROWTH OF COMMERCIAL AIRCRAFTS

5.2 RESTRAINTS

5.2.1 INADEQUATE AVAILABILITY OF FEEDSTOCK AND REFINERIES TO MEET SUSTAINABLE AVIATION FUEL PRODUCTION DEMAND

5.2.2 FLUCTUATIONS IN CRUDE OIL PRICES AND CONTAMINATION OF LUBRICANTS

5.3 OPPORTUNITIES

5.3.1 REDUCTION IN CARBON FOOTPRINT DUE TO LOW CAPABILITY OF SUSTAINABLE AVIATION FUEL

5.3.2 DEVELOPMENT OF ECO-FRIENDLY AND SAFE AVIATION LUBRICANTS

5.3.3 RISE IN DEMAND FOR LOW-DENSITY LUBRICANTS FOR REDUCED WEIGHT

5.3.4 RISE IN SAFETY REGULATIONS FOR AIRCRAFTS

5.4 CHALLENGE

5.4.1 THE HIGH COST OF SUSTAINABLE AVIATION FUEL INCREASES THE OPERATING COST OF AIRLINES

6 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE

6.1 OVERVIEW

6.2 BIOFUEL

6.3 HYDROGEN FUEL

6.4 POWER TO LIQUID FUEL

7 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK)

7.3 FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK)

7.4 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP)

7.5 FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A)

7.6 ALCOHOL TO JET SPK (ATJ-SPK)

7.7 CATALYTIC HYDROTHERMOLYSIS JET (CHJ)

8 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY

8.1 OVERVIEW

8.2 BELOW 30%

8.3 30% TO 50%

8.4 ABOVE 50%

9 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM

9.1 OVERVIEW

9.2 COMMERCIAL AVIATION

9.2.1 BY TYPE

9.2.1.1 NARROW BODY AIRCRAFT

9.2.1.2 WIDE-BODY AIRCRAFT (WBA)

9.2.1.3 VERY LARGE AIRCRAFT (VLA)

9.2.1.4 REGIONAL TRANSPORT AIRCRAFT (RTA)

9.2.2 BY FUEL TYPE

9.2.2.1 BIOFUEL

9.2.2.2 HYDROGEN

9.2.2.3 POWER TO LIQUID FUEL

9.3 BUSINESS & GENERAL AVIATION

9.3.1 BIOFUEL

9.3.2 HYDROGEN

9.3.3 POWER TO LIQUID FUEL

9.4 MILITARY AVIATION

9.4.1 BIOFUEL

9.4.2 HYDROGEN

9.4.3 POWER TO LIQUID FUEL

9.5 UNMANNED AERIAL VEHICLE

9.5.1 BIOFUEL

9.5.2 HYDROGEN

9.5.3 POWER TO LIQUID FUEL

10 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY REGION

10.1 OVERVIEW

10.2 NORTH AMERICA

10.2.1 U.S.

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 U.K.

10.3.2 GERMANY

10.3.3 FRANCE

10.3.4 SPAIN

10.3.5 ITALY

10.3.6 RUSSIA

10.3.7 NETHERLANDS

10.3.8 SWITZERLAND

10.3.9 TURKEY

10.3.10 BELGIUM

10.3.11 REST OF EUROPE

10.4 ASIA-PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 SINGAPORE

10.4.4 AUSTRALIA

10.4.5 INDIA

10.4.6 SOUTH KOREA

10.4.7 THAILAND

10.4.8 MALAYSIA

10.4.9 INDONESIA

10.4.10 PHILIPPINES

10.4.11 REST OF ASIA-PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 SOUTH AFRICA

10.5.2 SAUDI ARABIA

10.5.3 ISRAEL

10.5.4 EGYPT

10.5.5 REST OF MIDDLE EAST AND AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.2 ARGENTINA

10.6.3 CARIBBEAN

10.6.4 COLOMBIA

10.6.5 PERU

10.6.6 CHILE

10.6.7 PANAMA

10.6.8 VENEZUELA

10.6.9 REST OF SOUTH AMERICA

11 GLOBAL SUSTAINABLE AVIATION FUEL MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 NESTE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 BP P.L.C.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 PREEM AB.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 CEPSA

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 CHEVRON CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AVFUEL CORPORATION

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ENI

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EXXON MOBIL CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FULCRUM BIOENERGY

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GEVO

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HONEYWELL INTERNATIONAL INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 HYPOINT INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOHNSON MATTHEY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 LANZATECH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PROMETHEUS FUELS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SKYNRG

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SASOL

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 TOTALENERGIES

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 VELOCYS

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 VIRENT, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 WORLD ENERGY

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 ZEROAVIA, INC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 2 GLOBAL BIOFUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 GLOBAL HYDROGEN IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 4 GLOBAL POWER TO LIQUID FUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 5 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 6 GLOBAL HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 7 GLOBAL FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 GLOBAL SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 9 GLOBAL FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 10 GLOBAL ALCOHOL TO JET SPK (ATJ-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 11 GLOBAL CATALYTIC HYDROTHERMOLYSIS JET (CHJ) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 12 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 13 GLOBAL BELOW 30% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 GLOBAL 30% TO 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 GLOBAL ABOVE 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 16 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 17 GLOBAL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 GLOBAL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 19 GLOBAL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 20 GLOBAL BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 21 GLOBAL BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 22 GLOBAL MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 GLOBAL MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 24 GLOBAL UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 25 GLOBAL UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 26 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 27 GLOBAL SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (METRIC TONNES)

TABLE 28 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 29 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 30 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 31 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 32 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 33 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 34 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 35 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 36 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 37 NORTH AMERICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 38 NORTH AMERICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 39 NORTH AMERICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 40 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 41 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 42 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 43 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 44 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 45 U.S. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 46 U.S. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 47 U.S. BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 48 U.S. MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 49 U.S. UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 50 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 51 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 52 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 53 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 54 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 55 CANADA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 56 CANADA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 57 CANADA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 58 CANADA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 59 CANADA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 60 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 61 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 62 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 63 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 64 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 65 MEXICO COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 66 MEXICO COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 67 MEXICO BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 68 MEXICO MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 69 MEXICO UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 70 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 71 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 72 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 73 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 74 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 75 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 76 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 77 EUROPE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 78 EUROPE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 79 EUROPE BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 80 EUROPE MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 81 EUROPE UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 82 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 83 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 84 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 85 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 86 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 87 U.K. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 88 U.K. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 89 U.K. BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 90 U.K. MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 91 U.K. UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 92 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 93 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 94 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 95 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 96 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 97 GERMANY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 98 GERMANY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 99 GERMANY BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 100 GERMANY MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 101 GERMANY UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 102 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 103 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 104 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 105 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 106 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 107 FRANCE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 108 FRANCE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 109 FRANCE BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 110 FRANCE MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 111 FRANCE UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 112 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 113 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 114 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 115 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 116 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 117 SPAIN COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 118 SPAIN COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 119 SPAIN BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 120 SPAIN MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 121 SPAIN UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 122 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 123 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 124 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 125 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 126 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 127 ITALY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 128 ITALY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 129 ITALY BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 130 ITALY MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 131 ITALY UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 132 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 133 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 134 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 135 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 136 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 137 RUSSIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 138 RUSSIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 139 RUSSIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 140 RUSSIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 141 RUSSIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 142 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 143 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 144 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 145 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 146 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 147 NETHERLANDS COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 148 NETHERLANDS COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 149 NETHERLANDS BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 150 NETHERLANDS MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 151 NETHERLANDS UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 152 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 153 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 154 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 155 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 156 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 157 SWITZERLAND COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 158 SWITZERLAND COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 159 SWITZERLAND BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 160 SWITZERLAND MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 161 SWITZERLAND UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 162 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 163 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 164 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 165 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 166 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 167 TURKEY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 168 TURKEY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 169 TURKEY BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 170 TURKEY MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 171 TURKEY UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 172 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 173 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 174 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 175 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 176 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 177 BELGIUM COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 178 BELGIUM COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 179 BELGIUM BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 180 BELGIUM MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 181 BELGIUM UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 182 REST OF EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 183 REST OF EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 184 ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 185 ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 186 ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 187 ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 188 ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 189 ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 190 ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 191 ASIA-PACIFIC COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 192 ASIA-PACIFIC COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 193 ASIA-PACIFIC BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 194 ASIA-PACIFIC MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 195 ASIA-PACIFIC UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 196 CHINA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 197 CHINA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 198 CHINA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 199 CHINA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 200 CHINA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 201 CHINA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 202 CHINA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 203 CHINA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 204 CHINA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 205 CHINA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 206 JAPAN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 207 JAPAN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 208 JAPAN SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 209 JAPAN SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 210 JAPAN SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 211 JAPAN COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 212 JAPAN COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 213 JAPAN BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 214 JAPAN MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 215 JAPAN UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 216 SINGAPORE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 217 SINGAPORE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 218 SINGAPORE SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 219 SINGAPORE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 220 SINGAPORE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 221 SINGAPORE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 222 SINGAPORE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 223 SINGAPORE BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 224 SINGAPORE MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 225 SINGAPORE UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 226 AUSTRALIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 227 AUSTRALIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 228 AUSTRALIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 229 AUSTRALIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 230 AUSTRALIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 231 AUSTRALIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 232 AUSTRALIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 233 AUSTRALIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 234 AUSTRALIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 235 AUSTRALIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 236 INDIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 237 INDIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 238 INDIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 239 INDIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 240 INDIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 241 INDIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 242 INDIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 243 INDIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 244 INDIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 245 INDIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 246 SOUTH KOREA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 247 SOUTH KOREA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 248 SOUTH KOREA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 249 SOUTH KOREA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 250 SOUTH KOREA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 251 SOUTH KOREA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 252 SOUTH KOREA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 253 SOUTH KOREA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 254 SOUTH KOREA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 255 SOUTH KOREA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 256 THAILAND SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 257 THAILAND SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 258 THAILAND SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 259 THAILAND SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 260 THAILAND SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 261 THAILAND COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 262 THAILAND COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 263 THAILAND BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 264 THAILAND MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 265 THAILAND UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 266 MALAYSIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 267 MALAYSIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 268 MALAYSIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 269 MALAYSIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 270 MALAYSIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 271 MALAYSIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 272 MALAYSIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 273 MALAYSIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 274 MALAYSIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 275 MALAYSIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 276 INDONESIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 277 INDONESIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 278 INDONESIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 279 INDONESIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 280 INDONESIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 281 INDONESIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 282 INDONESIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 283 INDONESIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 284 INDONESIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 285 INDONESIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 286 PHILIPPINES SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 287 PHILIPPINES SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 288 PHILIPPINES SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 289 PHILIPPINES SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 290 PHILIPPINES SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 291 PHILIPPINES COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 292 PHILIPPINES COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 293 PHILIPPINES BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 294 PHILIPPINES MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 295 PHILIPPINES UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 296 REST OF ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 297 REST OF ASIA-PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 298 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 299 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 300 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 301 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 302 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 303 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 304 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 305 MIDDLE EAST AND AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 306 MIDDLE EAST AND AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 307 MIDDLE EAST AND AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 308 MIDDLE EAST AND AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 309 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 310 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 311 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 312 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 313 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 314 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 315 SOUTH AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 316 SOUTH AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 317 SOUTH AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 318 SOUTH AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 319 SOUTH AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 320 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 321 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 322 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 323 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 324 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 325 SAUDI ARABIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 326 SAUDI ARABIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 327 SAUDI ARABIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 328 SAUDI ARABIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 329 SAUDI ARABIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 330 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 331 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 332 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 333 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 334 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 335 ISRAEL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 336 ISRAEL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 337 ISRAEL BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 338 ISRAEL MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 339 ISRAEL UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 340 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 341 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 342 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 343 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 344 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 345 EGYPT COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 346 EGYPT COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 347 EGYPT BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 348 EGYPT MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 349 EGYPT UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 350 REST OF MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 351 REST OF MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 352 SOUTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 353 SOUTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 354 SOUTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 355 SOUTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 356 SOUTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 357 SOUTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 358 SOUTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 359 SOUTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 360 SOUTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 361 SOUTH AMERICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 362 SOUTH AMERICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 363 SOUTH AMERICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 364 BRAZIL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 365 BRAZIL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 366 BRAZIL SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 367 BRAZIL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 368 BRAZIL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 369 BRAZIL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 370 BRAZIL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 371 BRAZIL BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 372 BRAZIL MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 373 BRAZIL UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 374 ARGENTINA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 375 ARGENTINA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 376 ARGENTINA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 377 ARGENTINA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 378 ARGENTINA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 379 ARGENTINA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 380 ARGENTINA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 381 ARGENTINA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 382 ARGENTINA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 383 ARGENTINA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 384 CARIBBEAN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 385 CARIBBEAN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 386 CARIBBEAN SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 387 CARIBBEAN SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 388 CARIBBEAN SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 389 CARIBBEAN COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 390 CARIBBEAN COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 391 CARIBBEAN BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 392 CARIBBEAN MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 393 CARIBBEAN UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 394 COLOMBIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 395 COLOMBIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 396 COLOMBIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 397 COLOMBIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 398 COLOMBIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 399 COLOMBIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 400 COLOMBIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 401 COLOMBIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 402 COLOMBIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 403 COLOMBIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 404 PERU SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 405 PERU SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 406 PERU SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 407 PERU SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 408 PERU SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 409 PERU COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 410 PERU COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 411 PERU BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 412 PERU MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 413 PERU UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 414 CHILE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 415 CHILE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 416 CHILE SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 417 CHILE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 418 CHILE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 419 CHILE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 420 CHILE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 421 CHILE BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 422 CHILE MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 423 CHILE UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 424 PANAMA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 425 PANAMA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 426 PANAMA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 427 PANAMA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 428 PANAMA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 429 PANAMA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 430 PANAMA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)