سوق التأمين الطبي العالمي، حسب النوع (المنتجات، الحلول)، الخدمات (العلاج الداخلي، العلاج الخارجي، المساعدة الطبية، خدمات أخرى)، مستوى التغطية (برونزية، فضية، ذهبية، بلاتينية)، مقدمو الخدمات (مقدمو خدمات التأمين الصحي العام، مقدمو خدمات التأمين الصحي الخاص)، خطط التأمين الصحي (نقطة الخدمة (POS)، منظمة المزود الحصري (EPOS)، تأمين صحي تعويضي، حساب التوفير الصحي (HSA)، ترتيبات تعويض الصحة لأصحاب العمل الصغار المؤهلين (QSEHRAS)، منظمة المزود المفضل (PPO)، منظمة صيانة الصحة (HMO)، خدمات أخرى)، التركيبة السكانية (البالغون، القُصّر، كبار السن)، نوع التغطية (تغطية مدى الحياة، تغطية مؤقتة)، المستخدم النهائي (الشركات، الأفراد، خدمات أخرى)، قنوات التوزيع (المبيعات المباشرة، المؤسسات المالية، التجارة الإلكترونية، المستشفيات، العيادات، خدمات أخرى)، الدولة (الولايات المتحدة الأمريكية، كندا، المكسيك، ألمانيا، إيطاليا، المملكة المتحدة، فرنسا، إسبانيا، هولندا، بلجيكا، سويسرا، تركيا، روسيا، بقية أوروبا). اتجاهات الصناعة وتوقعاتها حتى عام 2029 (اليابان، الصين، الهند، كوريا الجنوبية، أستراليا، سنغافورة، ماليزيا، تايلاند، إندونيسيا، الفلبين، بقية دول آسيا والمحيط الهادئ، البرازيل، الأرجنتين، بقية دول أمريكا الجنوبية، جنوب أفريقيا، المملكة العربية السعودية، الإمارات العربية المتحدة، مصر، إسرائيل، بقية دول الشرق الأوسط وأفريقيا)

تحليل السوق ورؤى سوق التأمين الطبي

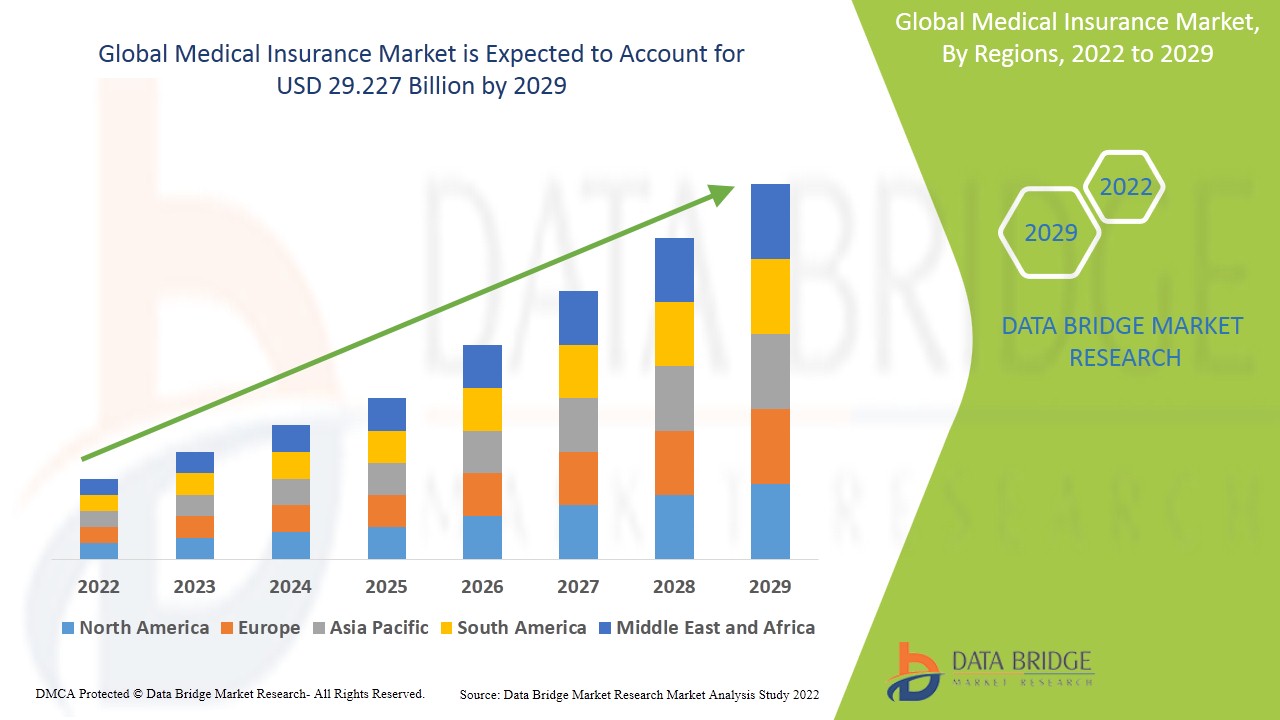

تشير تحليلات شركة داتا بريدج لأبحاث السوق إلى أن سوق التأمين الطبي سيبلغ 29.227 مليار دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 10.30% خلال الفترة المتوقعة 2022-2029. وستساهم التكلفة المتزايدة للرعاية الصحية، والحاجة إلى سير إجراءات سلس وفعال دون أي صعوبات ناجمة عن إجراءات الدفع، في دفع عجلة نمو سوق التأمين الصحي.

يغطي التأمين الصحي النفقات الطبية المتكبدة أثناء علاج أي مرض أو إصابة أو أي إعاقة عقلية أو بدنية أخرى. ويوفر مزايا الرعاية الصحية مقابل قسط شهري/نصف سنوي/سنوي أو ضريبة على الراتب. ويلتزم المؤمّن بتغطية النفقات الطبية لحامل الوثيقة طوال مدة الوثيقة وتغطيتها. وقد تختلف التغطية باختلاف نوع الوثيقة، وذلك لعوامل متعددة، مثل الأمراض والفئة العمرية والسياسات الحكومية وغيرها.

يُعتقد أن زيادة حالات الإصابة بأمراض عديدة، مثل السرطان وحمى الضنك والسكري، خلال جائحة كوفيد-19، تُعدّ عاملاً رئيسياً في نمو سوق التأمين الصحي العالمي. علاوة على ذلك، يُعدّ تحسين خدمات إدارة المطالبات وزيادة الوعي بالتأمين الصحي في المناطق الريفية من العوامل الرئيسية الدافعة لنمو السوق. علاوة على ذلك، من المتوقع أن يؤدي تزايد استخدام المتخصصين في الرعاية الصحية للتقنيات المتقدمة لعلاج الأمراض المزمنة، مثل السرطان وأمراض القلب والأوعية الدموية، إلى زيادة تكلفة العلاج الطبي. ونتيجةً لارتفاع تكاليف العلاج، والتي أصبحت بعيدة المنال بالنسبة للمستهلكين، من المتوقع أن يشهد اعتماد التأمين الصحي ارتفاعاً هائلاً في السنوات القادمة.

ومع ذلك، يُعدّ نقص المعرفة بالتغطيات المشمولة في بوالص التأمين الصحي، بالإضافة إلى ارتفاع تكلفة أقساط التأمين الصحي، من العوامل التي تحد من فرص سوق التأمين الصحي. ومن المرجح أن تُعيق اللوائح التنظيمية الصارمة وطول فترات سداد المطالبات نمو سوق التأمين الصحي خلال فترة التوقعات.

يقدم تقرير سوق التأمين الطبي هذا تفاصيل عن أحدث التطورات، ولوائح التجارة، وتحليل الاستيراد والتصدير، وتحليل الإنتاج، وتحسين سلسلة القيمة، وحصة السوق، وتأثير الجهات الفاعلة في السوق المحلية والمحلية، ويحلل الفرص من حيث مصادر الإيرادات الناشئة، والتغيرات في لوائح السوق، وتحليل النمو الاستراتيجي للسوق، وحجم السوق، ونمو فئات السوق، ومجالات التطبيق والهيمنة، وموافقات المنتجات، وإطلاق المنتجات، والتوسعات الجغرافية، والابتكارات التكنولوجية في السوق. لمزيد من المعلومات حول سوق التأمين الطبي، تواصلوا مع شركة داتا بريدج لأبحاث السوق للحصول على موجز محلل ، وسيساعدكم فريقنا في اتخاذ قرار مدروس لتحقيق نمو السوق.

نطاق سوق التأمين الطبي العالمي وحجم السوق

يُقسّم سوق التأمين الطبي بناءً على النوع، والخدمات، ومستوى التغطية، ومقدمي الخدمات، وخطط التأمين الصحي، والتركيبة السكانية، ونوع التغطية، والمستخدم النهائي، وقنوات التوزيع. سيساعدك نمو هذه القطاعات على تحليل قطاعات النمو المتواضعة في هذه القطاعات، ويزود المستخدمين بنظرة عامة قيّمة على السوق ورؤى ثاقبة تُساعدهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الرئيسية.

- اعتمادًا على النوع، يتم تقسيم سوق التأمين الطبي إلى منتجات وحلول.

- على أساس الخدمات، يتم تقسيم سوق التأمين الطبي إلى العلاج الداخلي، والعلاج الخارجي، والمساعدة الطبية وغيرها.

- بناءً على مستوى التغطية، يتم تقسيم سوق التأمين الطبي إلى البرونزي والفضي والذهبي والبلاتيني.

- على أساس مقدمي الخدمات، يتم تقسيم سوق التأمين الطبي إلى مقدمي التأمين الصحي العام ومقدمي التأمين الصحي الخاص.

- بناءً على خطط التأمين الصحي، يتم تقسيم سوق التأمين الطبي إلى نقطة الخدمة (POS)، ومنظمة المزود الحصري (EPOS)، والتأمين الصحي التعويضي، وحساب التوفير الصحي (HSA)، وترتيبات سداد تكاليف الرعاية الصحية لأصحاب العمل الصغار المؤهلين (QSEHRAS)، ومنظمة المزود المفضل (PPO)، ومنظمة صيانة الصحة (HMO) وغيرها.

- على أساس التركيبة السكانية، يتم تقسيم سوق التأمين الطبي إلى البالغين والقصر وكبار السن.

- اعتمادًا على نوع التغطية، يتم تقسيم سوق التأمين الطبي إلى تغطية مدى الحياة وتغطية مؤقتة.

- كما تم تقسيم سوق التأمين الطبي أيضًا بناءً على المستخدم النهائي إلى الشركات والأفراد وغيرهم.

- بناءً على قناة التوزيع، يتم تقسيم سوق التأمين الطبي إلى المبيعات المباشرة والمؤسسات المالية والتجارة الإلكترونية والمستشفيات والعيادات وغيرها.

تحليل سوق التأمين الطبي على مستوى الدولة

يتم تقسيم سوق التأمين الطبي على أساس النوع والخدمات ومستوى التغطية ومقدمي الخدمات وخطط التأمين الصحي والتركيبة السكانية ونوع التغطية والمستخدم النهائي وقناة التوزيع.

الدول التي يغطيها تقرير سوق التأمين الطبي هي الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية وألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية أوروبا في أوروبا والصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC) والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب إفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA) والبرازيل والأرجنتين وبقية دول أمريكا الجنوبية كجزء من أمريكا الجنوبية.

تسيطر أمريكا الشمالية على سوق التأمين الطبي بسبب توافر سياسات التأمين الصحي متعددة القيم وبيئة التأمين الصحي المواتية في الولايات المتحدة، في حين من المتوقع أن تنمو منطقة آسيا والمحيط الهادئ بأسرع معدل من عام 2022 إلى عام 2029 بسبب توافر المرافق الصحية باهظة الثمن وزيادة الطلب على سياسات التأمين الصحي في البلدان ذات الكثافة السكانية العالية مثل الهند والصين.

يقدم قسم الدولة في تقرير سوق التأمين الطبي أيضًا العوامل المؤثرة على السوق المحلي والتغيرات في اللوائح التنظيمية، والتي تؤثر على اتجاهاته الحالية والمستقبلية. وتُعدّ بيانات مثل أحجام الاستهلاك، ومواقع الإنتاج، وتحليل الصادرات والواردات، وتحليل اتجاهات الأسعار، وتكلفة المواد الخام، وتحليل سلسلة القيمة النهائية والنهائية من أهم المؤشرات المستخدمة للتنبؤ بسوق كل دولة. كما يُؤخذ في الاعتبار وجود العلامات التجارية العالمية وتوافرها، والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة، عند تقديم تحليل تنبؤي لبيانات الدولة.

نمو البنية التحتية للرعاية الصحية والقاعدة المركبة وانتشار التكنولوجيا الجديدة

يوفر سوق التأمين الطبي تحليلاً مفصلاً لنمو الإنفاق الصحي على المعدات الرأسمالية في كل دولة، والقاعدة المُركّبة لمختلف أنواع منتجات التأمين الطبي، وتأثير التكنولوجيا باستخدام منحنيات خط الحياة، والتغيرات في سيناريوهات تنظيم الرعاية الصحية وتأثيرها على سوق التأمين الطبي. البيانات متاحة للفترة التاريخية من 2010 إلى 2020.

تحليل المشهد التنافسي وحصة سوق التأمين الطبي

يقدم المشهد التنافسي لسوق التأمين الطبي تفاصيل لكل منافس. تشمل هذه التفاصيل لمحة عامة عن الشركة، وبياناتها المالية، وإيراداتها المحققة، وإمكانياتها السوقية، والاستثمار في البحث والتطوير، ومبادراتها التسويقية الجديدة، وحضورها العالمي، ومواقع ومرافق الإنتاج، وقدراتها الإنتاجية، ونقاط قوتها وضعفها، وإطلاق المنتجات، ونطاقها، وهيمنة تطبيقاتها. تتعلق البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق التأمين الطبي.

بعض اللاعبين الرئيسيين العاملين في سوق التأمين الطبي هم Unitedhealth Group وAnthem Insurance Companies, Inc. وAetna Inc. وCentene Corporation وCigna وAllianz Care وAxa وAssicurazioni Generali SPA وBupa وAIA Group Limited وAviva وBMI Healthcare وBroadstone Corporate Benefits Limited وHBF Health Limited وHealthcare International Global Network Ltd. وInternational Medical Group, Inc. وMapfre وNow Health International وOracle وVHI Group وVitality Corporate Services Limited وغيرها.

التطورات الرئيسية

- في أغسطس 2020، أكدت شركة باكستر الدولية أن إدارة الغذاء والدواء الأمريكية قد منحت طلبًا جديدًا لـTheranova، غشاء غسيل الكلى الجديد الخاص بها.

- في أغسطس 2020، حصلت شركة سترايكر على موافقة إدارة الغذاء والدواء الأمريكية لتمديد فترة استخدام نظام الدعامة Neuroform Atlas.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEDICAL INSURANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MEDICAL INSURANCE MARKETSIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL MEDICAL INSURANCE MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 PORTER’S FIVE FORCES

5.3 VENDOR SELECTION CRITERIA

5.4 PESTEL ANALYSIS

6. GLOBAL MEDICAL INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029, (USD MILLION)

6.1 OVERVIEW

6.2 BRONZE

6.3 SILVER

6.4 GOLD

6.5 PLATINUM

7. GLOBAL MEDICAL INSURANCE MARKET , BY AGE GROUP, 2020-2029, (USD MILLION)

7.1 OVERVIEW

7.2 SENIOR CITIZENS

7.3 ADULTS

7.4 MINORS

8. GLOBAL MEDICAL INSURANCE MARKET, BY SERVICE, 2020-2029, (USD MILLION)

8.1 OVERVIEW

8.2 PROFESSIONAL

8.2.1 SUPPORT AND MAINTENANCE

8.2.2 TRAINING AND CONSULTING

8.2.3 IMPLEMENTATION

8.3 MANAGED

9. GLOBAL MEDICAL INSURANCE MARKET , BY TIME PERIOD, 2020-2029, (USD MILLION)

9.1 OVERVIEW

9.2 TERM INSURANCE

9.3 LIFE INSURANCE

10. GLOBAL MEDICAL INSURANCE MARKET , BY SERVICE PROVIDER, 2020-2029, (USD MILLION)

10.1 OVERVIEW

10.2 PUBLIC

10.3 PRIVATE

11. GLOBAL MEDICAL INSURANCE MARKET , BY END USER, 2020-2029, (USD MILLION)

11.1 OVERVIEW

11.2 CORPORATES

11.3 INDIVIDUALS

11.4 OTHERS

12. GLOBAL MEDICAL INSURANCE MARKET , BY DISTRIBUTION CHANNEL, 2020-2029, (USD MILLION)

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 FINANCIAL INSTITUTIONS

12.4 E-COMMERCE

12.5 HOSPITALS

12.6 CLINICS

12.7 OTHERS

13. GLOBAL MEDICAL INSURANCE MARKET, BY GEOGRAPHY

13.1 GLOBAL CONSUMER ELECTRONICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 ITALY

13.3.4 FRANCE

13.3.5 SPAIN

13.3.6 SWITZERLAND

13.3.7 RUSSIA

13.3.8 TURKEY

13.3.9 BELGIUM

13.3.10 NETHERLANDS

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 SINGAPORE

13.4.6 THAILAND

13.4.7 INDONESIA

13.4.8 MALAYSIA

13.4.9 PHILIPPINES

13.4.10 AUSTRALIA & NEW ZEALAND

13.4.11 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 EGYPT

13.6.3 SAUDI ARABIA

13.6.4 UNITED ARAB EMIRATES

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AMERICA

14. GLOBAL MEDICAL INSURANCE MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15. SWOT ANALYSIS

16. GLOBAL MEDICAL INSURANCE MARKET– COMPANY PROFILES

16.1 ALLIANZ GROUP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 AETNA INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 CIGNA

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 ANTHEM INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 UNITED HEALTH GROUP

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 BAYZAT

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 METLIFE

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 AXA INSURANCE

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 ADNIC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.10 OMAN INSURANCE

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 NATIONAL TAKAFUL COMPANY PJSC

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 EXPATICA

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 BERKSHIRE HATHAWAY

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 EMIRATES INSURANCE CO.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 DAMAN HEALTH INSURANCE

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 CIGNA

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT UPDATES

16.17 AVIVA

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT UPDATES

16.18 ZURICH

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 ASSICURAZIONI GENERALI S.P.A.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.20 UNITEDHEALTH GROUP

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17. QUESTIONNAIRE

18. RELATED REPORTS

19. ABOUT DATA BRIDGE MARKET RESEARCH

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.