Global Lidar Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

3.83 Billion

USD

17.60 Billion

2024

2032

USD

3.83 Billion

USD

17.60 Billion

2024

2032

| 2025 –2032 | |

| USD 3.83 Billion | |

| USD 17.60 Billion | |

|

|

|

|

تجزئة سوق الليدار العالمية، حسب النوع (الليدار الثابت والليدار الدوار)، والتطبيق (المركبات ذاتية القيادة، والتفتيش الجوي، والروبوتات، والمسح والرسم الخرائطي، والغابات وإدارة الأراضي، والطاقة المتجددة، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2032

تحليل سوق الليدار

يتضمن تحليل LiDAR (كشف الضوء وتحديد المدى) استخدام ضوء الليزر لقياس المسافات إلى سطح الأرض، مما ينتج نماذج ثلاثية الأبعاد عالية الدقة للبيئات. تصدر أنظمة LiDAR نبضات ليزر وتقيس الوقت الذي تستغرقه للعودة بعد انعكاسها عن الأجسام. تساعد هذه البيانات في إنشاء خرائط طبوغرافية مفصلة وتحديد الغطاء النباتي ونمذجة البنية الأساسية ومراقبة التغيرات البيئية. يستخدم LiDAR على نطاق واسع في تطبيقات مثل الغابات والتخطيط الحضري وعلم الآثار وإدارة الكوارث. من خلال معالجة الإشارات المنعكسة، يولد تحليل LiDAR سحبًا نقطية عالية الدقة، والتي يمكن استخدامها لنمذجة التضاريس ورسم الخرائط الكنتورية وتصنيف الغطاء النباتي.

حجم سوق الليدار

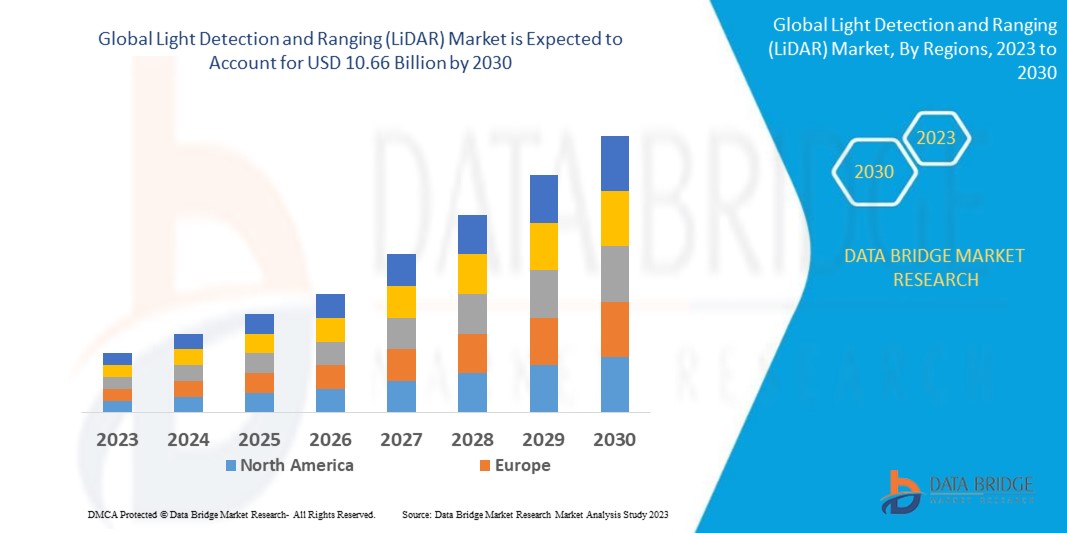

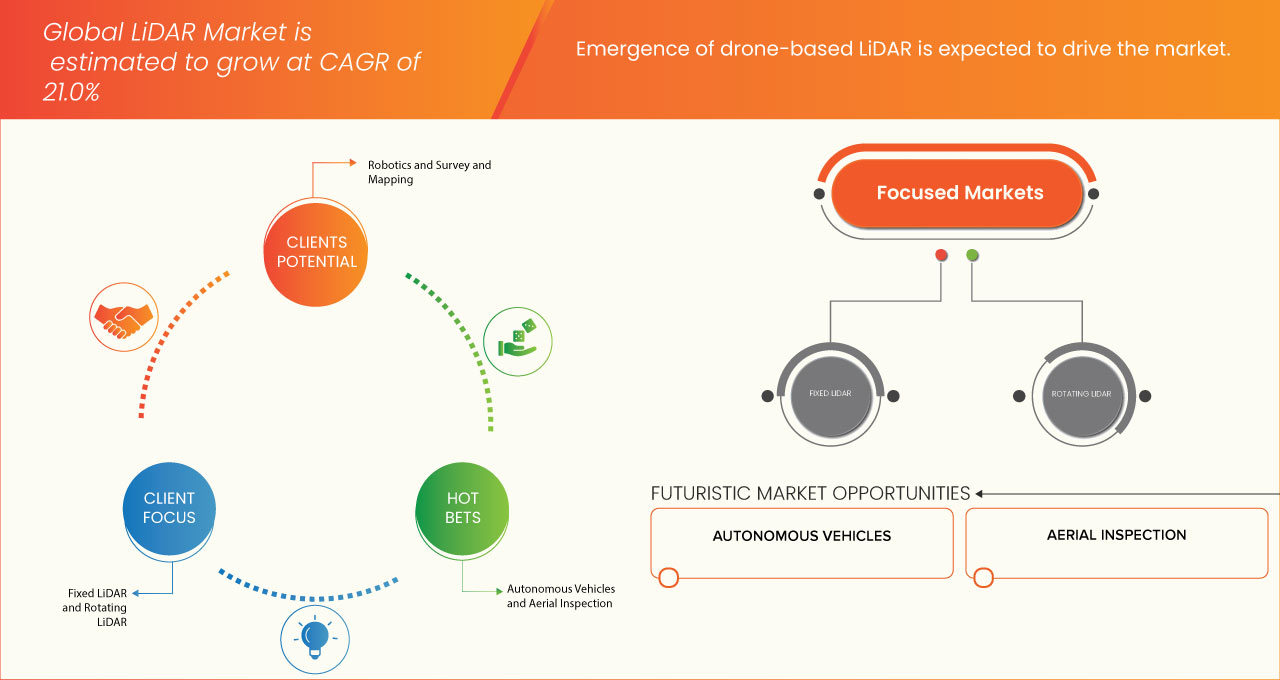

تم تقييم حجم سوق LiDAR العالمي بـ 3.83 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 17.60 مليار دولار أمريكي بحلول عام 2032، مع معدل نمو سنوي مركب بنسبة 21.0٪ خلال الفترة المتوقعة من 2025 إلى 2032. بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي.

اتجاهات سوق الليدار

"تزايد الطلب على تقنيات رسم الخرائط ثلاثية الأبعاد الدقيقة"

الطلب المتزايد على تقنيات رسم الخرائط ثلاثية الأبعاد الدقيقة هو محرك رئيسي في سوق LiDAR العالمي. تتطلب الصناعات مثل التخطيط الحضري والبناء والزراعة ومراقبة البيئة بيانات طبوغرافية دقيقة لتحسين عملية اتخاذ القرار والكفاءة. يوفر LiDAR نماذج ثلاثية الأبعاد عالية الدقة تمكن من رسم خرائط مفصلة للتضاريس والبنية التحتية والنباتات. هذا الاتجاه المتزايد في التكنولوجيا قيم بشكل خاص لتطبيقات مثل نمذجة الفيضانات والمركبات ذاتية القيادة والمسوحات الجيولوجية، حيث تكون الدقة بالغة الأهمية. مع اعتماد الصناعات بشكل متزايد على تقنيات التوأم الرقمي ومبادرات المدينة الذكية، تستمر الحاجة إلى حلول رسم الخرائط ثلاثية الأبعاد الدقيقة والفعالة في النمو، مما يغذي اتجاه سوق LiDAR.

نطاق التقرير وتقسيم السوق

|

صفات |

رؤى السوق الرئيسية لـ LiDAR |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

الولايات المتحدة الأمريكية، كندا، المكسيك، الصين، اليابان، كوريا الجنوبية، الهند، تايلاند، ماليزيا، إندونيسيا، فيتنام، تايوان، الفلبين، سنغافورة، أستراليا، بقية دول آسيا والمحيط الهادئ، ألمانيا، فرنسا، المملكة المتحدة، إيطاليا، إسبانيا، روسيا، تركيا، هولندا، بلجيكا، السويد، بولندا، سويسرا، بقية دول أوروبا، البرازيل، الأرجنتين، بقية دول أمريكا الجنوبية، المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل، وبقية دول الشرق الأوسط وأفريقيا |

|

اللاعبون الرئيسيون في السوق |

Innoviz Technologies Ltd (إسرائيل)، SICK AG (ألمانيا)، Hesai Group. (الصين)، Quanergy Solutions, Inc. (الولايات المتحدة)، Cepton, Inc. (الولايات المتحدة)، Génération Robots (فرنسا)، Teledyne Optech China)، Aeva Inc. (الولايات المتحدة)، AEye, Inc. (الولايات المتحدة)، Trimble Inc. (الولايات المتحدة) |

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

تعريف سوق الليدار

LiDAR (Light Detection and Ranging) هي تقنية استشعار عن بعد تستخدم نبضات الليزر لقياس المسافات بين المستشعر والأشياء على سطح الأرض. من خلال إصدار أشعة الليزر السريعة وتسجيل الوقت الذي تستغرقه النبضات للانعكاس، يولد LiDAR بيانات ثلاثية الأبعاد دقيقة للغاية ومفصلة. توفر هذه البيانات، المعروفة باسم سحابة النقاط، قياسات دقيقة لتضاريس السطح والنباتات والبنية الأساسية والمزيد. يستخدم LiDAR على نطاق واسع في الصناعات مثل رسم الخرائط والغابات والآثار ومراقبة البيئة نظرًا لقدرته على التقاط بيانات مكانية عالية الدقة في مجموعة متنوعة من الإعدادات، بما في ذلك المسوحات الأرضية والجوية.

ديناميكيات سوق الليدار

السائقين

- الطلب المتزايد على المركبات ذاتية القيادة

إن الطلب المتزايد على المركبات ذاتية القيادة هو أحد العوامل الرئيسية التي تدفع إلى زيادة اعتماد تقنية LiDAR. تلعب تقنية LiDAR دورًا حاسمًا في تمكين المركبات ذاتية القيادة من إدراك بيئتها بدقة، مما يجعلها مكونًا أساسيًا لأنظمة المركبات ذاتية القيادة. مع تحرك صناعة السيارات نحو النقل المستقل بالكامل، فإن قدرة LiDAR على توفير رسم خرائط ثلاثية الأبعاد عالية الدقة بزاوية 360 درجة وبيانات بيئية في الوقت الفعلي أمر بالغ الأهمية لضمان السلامة والموثوقية.

تصدر أجهزة استشعار الليدار نبضات ليزر لقياس المسافات وإنشاء خرائط ثلاثية الأبعاد دقيقة للمحيط، مما يسمح للمركبات ذاتية القيادة باكتشاف العوائق وعلامات الطرق والمشاة والمركبات الأخرى، حتى في الظروف الصعبة مثل الإضاءة المنخفضة أو سوء الأحوال الجوية. يساعد هذا المستوى من الدقة وإدراك العمق الأنظمة ذاتية القيادة على التنقل في البيئات المعقدة بأمان، مما يجعل الليدار خيارًا مفضلًا لمصنعي السيارات ذاتية القيادة. وعلى النقيض من أجهزة الاستشعار التقليدية القائمة على الكاميرات أو الرادار، يوفر الليدار معلومات مكانية أكثر تفصيلاً ودقة، وهو أمر بالغ الأهمية لاتخاذ قرارات في جزء من الثانية في البيئات الديناميكية.

كما أن الطلب المتزايد على المركبات ذاتية القيادة يدفع الابتكار في تكنولوجيا الليدار. ولتلبية احتياجات قطاع السيارات، كان هناك تقدم كبير في تقليل حجم وتكلفة وتعقيد أنظمة الليدار. على سبيل المثال، يوفر الليدار ذو الحالة الصلبة بديلاً أكثر تكلفة ومتانة لأنظمة الليدار الدوارة التقليدية، وهو أمر بالغ الأهمية للتبني الواسع النطاق في المركبات الاستهلاكية. بالإضافة إلى ذلك، فإن التطورات في تكامل الليدار مع أجهزة استشعار أخرى، مثل الرادار والكاميرات، تمكن من تحقيق أداء أفضل وتشغيل أكثر سلاسة في الأنظمة ذاتية القيادة.

مع تكثيف الجهود العالمية نحو المركبات ذاتية القيادة، مدفوعة بوعد تعزيز السلامة والكفاءة والراحة، ستظل تقنية LiDAR في طليعة تطوير السيارات ذاتية القيادة، مما يساعد على تسريع تحقيق مستقبل النقل المستقل بالكامل.

على سبيل المثال،

- في أكتوبر 2024، وفقًا لمقال نشرته Medium، فإن قدرة LiDAR على إنشاء خرائط ثلاثية الأبعاد دقيقة واكتشاف العوائق في الوقت الفعلي أمر ضروري للتشغيل الآمن للمركبات ذاتية القيادة. مع تقدم تكنولوجيا المركبات ذاتية القيادة، أصبح LiDAR أمرًا بالغ الأهمية للملاحة واتخاذ القرار وتجنب الاصطدام، مما يجعله عامل تمكين رئيسي لأنظمة النقل ذاتية القيادة بالكامل

الاستخدام المتزايد للـ LiDAR في مراقبة البيئة والتطبيقات

إن الاستخدام المتزايد لتكنولوجيا LiDAR في مراقبة البيئة وتطبيقاتها يحول الطريقة التي نفهم بها وندير بها الموارد الطبيعية والنظم البيئية والمخاطر البيئية. إن قدرة LiDAR على التقاط بيانات ثلاثية الأبعاد عالية الدقة تجعلها ذات قيمة لا تقدر بثمن لمجموعة واسعة من التطبيقات البيئية، بما في ذلك إدارة الغابات، ونمذجة الفيضانات، ومراقبة السواحل، ورسم خرائط الموائل.

يعد استخدام تقنية LiDAR في مراقبة البيئة من أهم التطبيقات التي تستخدمها تقنية LiDAR في إدارة الغابات. حيث تتيح تقنية LiDAR رسم خرائط دقيقة لغطاء الغابات وارتفاع الأشجار وكثافتها والكتلة الحيوية، مما يساعد خبراء الغابات على تقييم صحة الغابات وإدارة موارد الأخشاب بشكل أكثر فعالية. كما يمكن استخدام تقنية LiDAR لإنشاء خرائط طبوغرافية مفصلة للمناطق الحرجية، وتحديد المخاطر المحتملة مثل الانهيارات الأرضية أو التآكل، ودعم جهود الحفاظ على البيئة من خلال رسم خرائط لموائل الحياة البرية.

في إدارة مخاطر الفيضانات، يوفر LiDAR بيانات عالية الدقة تساعد في إنشاء نماذج دقيقة للفيضانات. من خلال التقاط بيانات الارتفاع التفصيلية، يسمح LiDAR للعلماء بالتنبؤ بأنماط الفيضانات وتقييم مناطق الفيضانات المحتملة وتطوير استراتيجيات التخفيف من حدة الفيضانات. وهو مفيد بشكل خاص في المناطق ذات التضاريس المعقدة، حيث قد تكافح الطرق التقليدية للحصول على بيانات دقيقة.

كما يستخدم الليدار بشكل متزايد في الدراسات الساحلية والبحرية. ويمكنه المساعدة في رسم خرائط الخطوط الساحلية، ومراقبة تآكل السواحل، وتقييم صحة النظم البيئية البحرية مثل الشعاب المرجانية. إن القدرة على التقاط بيانات مفصلة تحت الماء وعلى طول السواحل أمر ضروري لفهم وحماية هذه البيئات المعرضة للخطر. بالإضافة إلى ذلك، يعد الليدار قيماً في أبحاث تغير المناخ، حيث يساعد في مراقبة التغيرات البيئية بمرور الوقت، مثل ذوبان الجليد في المناطق القطبية أو إزالة الغابات في الغابات الاستوائية.

مع استمرار تزايد المخاوف البيئية، فإن قدرة LiDAR على توفير بيانات دقيقة في الوقت الفعلي أمر بالغ الأهمية لمراقبة البيئة والحفاظ عليها وإدارتها، مما يجعلها أداة أساسية في إدارة الموارد المستدامة وحماية البيئة.

على سبيل المثال،

- في أبريل 2023، وفقًا لمقال نشرته Neuvition, Inc.، تم تسليط الضوء على الاستخدام المتزايد لتقنية LiDAR في مراقبة البيئة وإدارتها. تتيح خرائط LiDAR ثلاثية الأبعاد عالية الدقة تحليلًا تفصيليًا للمناظر الطبيعية والنباتات والتضاريس، مما يجعلها ضرورية لتتبع الصحة البيئية واكتشاف التغيرات البيئية وإدارة الموارد الطبيعية، مما يجعلها أداة رئيسية للممارسات المستدامة.

فرص

- التوسع الحضري وتنمية البنية التحتية في جميع أنحاء العالم

إن الاتجاه المتسارع للتحضر وتطوير البنية التحتية في جميع أنحاء العالم يقدم ثروة من الفرص لسوق LiDAR (Light Detection and Ranging) العالمي. ومع استمرار المدن في النمو والتطور والتحديث، فإن الحاجة إلى حلول دقيقة وفعالة وقابلة للتطوير لمراقبة وإدارة البيئات الحضرية لم تكن أكبر من أي وقت مضى. إن تقنية LiDAR، بقدرتها على التقاط بيانات ثلاثية الأبعاد عالية الدقة للمناظر الطبيعية والبنية التحتية والمباني، تبرز كعامل تمكين رئيسي في التخطيط الحضري والبناء وإدارة البنية التحتية.

مع تكثيف التحضر، أصبحت المدن أكثر تعقيدًا، مع زيادة الطلب على حلول أكثر ذكاءً وكفاءة لمعالجة التحديات مثل الازدحام المروري وإدارة النفايات واستهلاك الطاقة. تلعب تقنية LiDAR دورًا محوريًا في التخطيط الحضري من خلال توفير نماذج ثلاثية الأبعاد عالية الدقة والتفصيل للمدن. تساعد هذه النماذج مخططي المدن على تصور البنية التحتية الحالية والتخطيط للتطورات الجديدة وتحسين استخدام المساحة. في سياق المدن الذكية، يمكن أن تساعد تقنية LiDAR في إنشاء أنظمة ذكية تراقب كل شيء من تدفقات النقل إلى المرافق العامة، مما يساهم في بيئات حضرية أكثر استدامة وقابلية للعيش.

إن تطوير البنية الأساسية يشكل جانباً بالغ الأهمية من جوانب التحضر، حيث تستثمر الحكومات والكيانات الخاصة بكثافة في بناء وصيانة الطرق والجسور والمباني والمرافق. وتعتبر تقنية الليدار ضرورية في هذا الصدد، حيث توفر بيانات دقيقة وعالية الدقة لمسوحات المواقع ورسم الخرائط الطبوغرافية وعمليات التفتيش الهيكلية. على سبيل المثال، يمكن للطائرات بدون طيار المجهزة بتقنية الليدار رسم خرائط سريعة ودقيقة لمواقع البناء، مما يسمح بتخطيط المشاريع بكفاءة أكبر، وخفض التكاليف، وتقليل الأخطاء. بالإضافة إلى ذلك، تسمح قدرة الليدار على اكتشاف التغييرات الهيكلية والمخاطر المحتملة في البنية الأساسية القائمة بالصيانة والإصلاحات الاستباقية، مما يضمن بقاء الأصول الحيوية آمنة وفعّالة.

مع تزايد الطلب على البيانات الدقيقة في الوقت الفعلي، من المتوقع أن ينمو سوق LiDAR العالمي بشكل كبير. إن دمج LiDAR مع الذكاء الاصطناعي والتعلم الآلي والتقنيات المستقلة من شأنه أن يوسع نطاق تطبيقاته بشكل أكبر، مما يدفع تبني السوق عبر قطاعات مثل النقل والبناء والطاقة. يقدم هذا الاتجاه فرصًا كبيرة للشركات التي تقدم حلولًا تعتمد على LiDAR، من مصنعي الأجهزة إلى مطوري البرامج.

على سبيل المثال،

- في يونيو 2024، وفقًا لمقال صادر عن شركة ResearchGate GmbH، تُستخدم تقنية LiDAR في المسوحات الجيوفيزيائية الحضرية، مثل رسم خرائط المرافق تحت الأرض ومراقبة سلامة الهياكل. تساعد في إنشاء نماذج ثلاثية الأبعاد مفصلة للمناظر الطبيعية الحضرية، والتي تساعد في تخطيط البنية التحتية، ونمذجة الفيضانات، والتنمية الحضرية، مما يضمن اتخاذ قرارات أكثر دقة وكفاءة في إدارة المدينة.

ظهور تقنية الليدار المعتمدة على الطائرات بدون طيار

لقد أدى ظهور تقنية LiDAR القائمة على الطائرات بدون طيار، إلى جانب الاتجاهات المتسارعة للتحضر وتطوير البنية التحتية العالمية، إلى خلق فرص هائلة لسوق LiDAR العالمية. ومع توسع المدن ونمو مشاريع البنية التحتية من حيث الحجم والتعقيد، يتزايد الطلب على حلول جمع البيانات الدقيقة والفعالة والفعّالة من حيث التكلفة. تعمل تقنية LiDAR القائمة على الطائرات بدون طيار على وضع نفسها كأداة تحويلية عبر مختلف القطاعات، بما في ذلك تطوير البنية التحتية والمسح ومراقبة البيئة والزراعة.

في مشهد البنية التحتية العالمي سريع التطور، تلعب طائرات الليدار التي تعمل بالطائرات بدون طيار دورًا محوريًا من خلال توفير رسم خرائط ثلاثية الأبعاد عالية الدقة في الوقت الفعلي. أثناء البناء، يمكن للطائرات بدون طيار المجهزة بالليدار التقاط البيانات الطبوغرافية، مما يضمن التخطيط للمشاريع بدقة. وهذا يقلل من احتمالية حدوث أخطاء أثناء البناء، ويحسن استخدام المواد، ويساعد في الالتزام بالجداول الزمنية الصارمة. بالإضافة إلى ذلك، تدعم طائرات الليدار بدون طيار مراقبة البنية التحتية من خلال مسح الأصول بانتظام مثل الطرق والجسور وخطوط الأنابيب. يمكنها اكتشاف المشكلات الهيكلية، مثل الشقوق أو التشوهات، قبل أن تصبح حرجة، مما يتيح الصيانة الوقائية وتوفير تكاليف إصلاح كبيرة. في المناطق ذات البنية التحتية المعقدة أو التي يصعب الوصول إليها، تجعل الطائرات بدون طيار من الممكن جمع البيانات بسرعة، مما يقلل من الحاجة إلى عمليات التفتيش اليدوية.

كما تعمل الطائرات بدون طيار المجهزة بتقنية ليدار على تحويل أساليب المسح التقليدية. فالمسوح الأرضية التي كانت تستغرق أيامًا أو أسابيع في الماضي يمكن الآن إكمالها في جزء بسيط من الوقت. ويمكن للطائرات بدون طيار تغطية مناطق شاسعة، وجمع بيانات دقيقة تتطلب بخلاف ذلك قوة بشرية مكثفة ومعدات باهظة الثمن. على سبيل المثال، في التعدين أو البناء، تولد الطائرات بدون طيار نماذج ثلاثية الأبعاد دقيقة لتخطيط الموقع وقياس الحجم، مما يضمن بقاء المشاريع على المسار الصحيح. وفي مجال مراقبة البيئة، يسمح ليدار القائم على الطائرات بدون طيار بتتبع فعال للتغيرات في المناظر الطبيعية، مثل التآكل أو إزالة الغابات أو تحولات استخدام الأراضي. كما يساعد في تقييم مخاطر الفيضانات وجهود الحفاظ من خلال توفير بيانات الارتفاع التفصيلية، وهو أمر بالغ الأهمية لفهم تدفق المياه وصحة النظام البيئي.

في مجال الزراعة، تعمل تقنية الليدار المستندة إلى الطائرات بدون طيار على إحداث ثورة في إدارة الأراضي. تساعد الطائرات بدون طيار المجهزة بتقنية الليدار في مراقبة صحة المحاصيل، وتقييم احتياجات الري، واكتشاف العلامات المبكرة للإصابة بالآفات. توفر هذه التقنية بيانات مفصلة وعالية الدقة عن تضاريس التربة وبنية مظلة المحاصيل، مما يمكن المزارعين من اتخاذ قرارات أفضل وتحسين ممارساتهم الزراعية. يمكن أن تساعد تقنية الليدار أيضًا في الزراعة الدقيقة من خلال تحديد الاستخدام الأكثر كفاءة للموارد، والحد من النفايات، وتعزيز غلة المحاصيل.

على سبيل المثال،

- في أغسطس 2023، وفقًا لمقال صادر عن MDPI، يتم استخدام LiDAR المستند إلى الطائرات بدون طيار لرسم خرائط ومراقبة مظلات الغابات، مما يوفر بيانات دقيقة عن ارتفاع الأشجار وبنية المظلة وكثافة الغطاء النباتي. تساعد هذه التكنولوجيا في الدراسات البيئية وإدارة الغابات وجهود الحفاظ عليها، مما يوفر رؤى مهمة حول التنوع البيولوجي وتقدير الكتلة الحيوية وصحة الغابات

القيود/التحديات

- ارتفاع تكاليف أنظمة الليدار

تشكل التكاليف المرتفعة لأنظمة LiDAR (Light Detection and Ranging) عائقًا كبيرًا أمام تبنيها على نطاق واسع، على الرغم من تطبيقاتها العديدة في الصناعات مثل المركبات ذاتية القيادة والبناء والزراعة ومراقبة البيئة. تشتهر هذه الأنظمة بتوفير خرائط ثلاثية الأبعاد عالية الدقة وعالية الدقة، لكن تكلفتها تظل تحديًا للعديد من الشركات والمؤسسات التي تسعى إلى دمج LiDAR في عملياتها.

هناك عدة أسباب للتكاليف المرتفعة المرتبطة بأنظمة الليدار. أولاً، تتطلب التكنولوجيا نفسها مكونات متخصصة مثل الماسحات الضوئية بالليزر ووحدات نظام تحديد المواقع العالمي وأجهزة الاستشعار عالية الأداء، والتي تعد مكلفة في التصنيع. تستخدم أجهزة استشعار الليدار أشعة الليزر المتقدمة لقياس المسافات والتقاط البيانات، والدقة المطلوبة للحصول على نتائج دقيقة تزيد من تعقيد الإنتاج. بالإضافة إلى ذلك، يؤدي دمج هذه المستشعرات مع البرامج المتقدمة لمعالجة البيانات وتحليلها إلى زيادة التكلفة الإجمالية للنظام.

وثانياً، تساهم عمليات البحث والتطوير اللازمة لتحسين تقنية الليدار أيضاً في ارتفاع سعرها. وتستثمر الشركات بكثافة في تطوير أنظمة أكثر إحكاما وكفاءة ودقة، وهو ما يتطلب في كثير من الأحيان رأس مال أولي كبير. وفي حين من المتوقع أن تعمل تقنيات الليدار الأحدث، مثل الليدار ذي الحالة الصلبة، على خفض التكاليف بمرور الوقت، فإن الاستثمار الأولي في التكنولوجيا المتطورة يظل مرتفعاً.

وعلاوة على ذلك، فإن التكاليف التشغيلية المرتبطة بأنظمة الليدار، مثل تدريب الموظفين على تشغيل المعدات ومعالجة كميات كبيرة من البيانات الناتجة، تضاف إلى إجمالي النفقات. ويمكن لمهمة مسح واحدة باستخدام الليدار أن تولد تيرابايتات من البيانات، وهو ما يتطلب برامج متخصصة وقوة حوسبة للتحليل، مما يؤدي إلى زيادة التكاليف.

وعلى الرغم من هذه التحديات، فإن أسعار أنظمة الليدار تتناقص تدريجيًا مع التقدم التكنولوجي الذي يجعل مكوناتها أكثر بأسعار معقولة. ومع زيادة المنافسة داخل السوق وارتفاع الطلب، فمن المتوقع أن يصبح الليدار أكثر سهولة في الوصول إليه، مما يتيح استخدامه على نطاق أوسع عبر الصناعات.

على سبيل المثال

- في مارس 2022، وفقًا لمدونة نشرتها Queensland Drones، فإن رسم خرائط LiDAR، على الرغم من أنه يوفر مزايا مقارنة بالتصوير الفوتوغرامتري، إلا أنه يظل مكلفًا بسبب ارتفاع تكاليف المعدات والبرامج. تبلغ تكلفة أنظمة LiDAR المثبتة على الطائرات بدون طيار حوالي 2500 دولار أمريكي يوميًا، مقارنة بـ 30000 دولار أمريكي لأنظمة الطائرات المأهولة

اللوائح الصارمة لعمليات الليدار المعتمدة على الطائرات بدون طيار ومخاوف الخصوصية

تلعب خصائص المواد، وخاصة اللزوجة، دورًا حاسمًا في تحديد كفاءة وجودة عملية البثق. اللزوجة، وهي مقياس لمقاومة المادة للتدفق، تؤثر بشكل مباشر على كيفية تصرف المواد في ظل ظروف الضغط العالي ودرجات الحرارة العالية النموذجية للبثق. يعد فهم اللزوجة والتحكم فيها أمرًا ضروريًا لتحسين عملية البثق، وضمان جودة المنتج المتسقة، وتحقيق الخصائص الميكانيكية المرغوبة.

في سياق بثق البوليمر، تؤثر اللزوجة على معدل تدفق وتوحيد المادة المنصهرة أثناء دفعها عبر القالب. تتطلب المواد ذات اللزوجة العالية قوة أكبر للدفع عبر القالب، مما قد يزيد من استهلاك الطاقة والتآكل في آلات البثق. وعلى العكس من ذلك، تتدفق المواد ذات اللزوجة المنخفضة بسهولة أكبر ولكنها قد لا توفر السلامة الهيكلية اللازمة لتطبيقات معينة. لذلك، فإن تحقيق اللزوجة المثلى أمر بالغ الأهمية لتحقيق التوازن بين كفاءة المعالجة وأداء المنتج.

يؤثر السلوك الرومولوجي للمواد، بما في ذلك اللزوجة، أيضًا على الخصائص الحرارية والميكانيكية للمنتجات المبثوقة. على سبيل المثال، يمكن أن تؤدي الاختلافات في اللزوجة إلى سماكة جدار غير متسقة وعيوب سطحية وإجهادات داخلية داخل المقاطع المبثوقة. يمكن أن تؤثر هذه العيوب على قوة المنتج النهائي ومتانته وخصائصه الجمالية. من خلال التحكم الدقيق في اللزوجة، يمكن للمصنعين تحسين دقة الأبعاد واللمسة النهائية للسطح للمواد المبثوقة، مما يؤدي إلى منتجات ذات جودة أعلى.

علاوة على ذلك، تؤثر اللزوجة على خلط ومزج المواد المضافة والحشوات داخل المادة الأساسية. في التطبيقات التي يتم فيها دمج مكونات متعددة لتحقيق خصائص محددة، مثل المركبات المقواة أو الهياكل متعددة الطبقات، فإن توافق وتشتت هذه المكونات يعتمد على لزوجة المادة. تضمن اللزوجة المُدارة بشكل صحيح خليطًا متجانسًا، مما يمنع حدوث مشكلات مثل فصل الطور أو التوزيع غير المتساوي للحشوات، والتي يمكن أن تؤدي إلى تدهور الأداء العام للمادة.

غالبًا ما تتضمن تقنيات البثق المتقدمة أنظمة مراقبة وتحكم في الوقت الفعلي لإدارة اللزوجة وغيرها من المعلمات الحرجة. تتيح هذه الأنظمة إجراء تعديلات ديناميكية على ظروف المعالجة، مثل درجة الحرارة وسرعة اللولب، للحفاظ على اللزوجة المثالية طوال عملية البثق. يعزز هذا المستوى من التحكم الإنتاجية ويقلل من هدر المواد ويضمن الجودة الثابتة.

على سبيل المثال،

- في يوليو 2021، وفقًا لمقال نشره مركز فيدي، فإن المخاوف المتعلقة بالخصوصية تحيط بعمليات الطائرات بدون طيار في الهند، مما يسلط الضوء على تحديات جمع البيانات الحساسة من خلال المراقبة الجوية. ويؤكد على الحاجة إلى لوائح أكثر صرامة لحماية خصوصية الأفراد مع موازنة فوائد تكنولوجيا الطائرات بدون طيار، وخاصة في قطاعات مثل رسم الخرائط والزراعة وتطوير البنية التحتية.

تأثير وسيناريو السوق الحالي لنقص المواد الخام وتأخيرات الشحن

تقدم Data Bridge Market Research تحليلاً عالي المستوى للسوق وتقدم معلومات من خلال مراعاة تأثير وبيئة السوق الحالية لنقص المواد الخام وتأخيرات الشحن. ويترجم هذا إلى تقييم الاحتمالات الاستراتيجية وإنشاء خطط عمل فعالة ومساعدة الشركات في اتخاذ القرارات المهمة.

بالإضافة إلى التقرير القياسي، فإننا نقدم أيضًا تحليلًا متعمقًا لمستوى المشتريات من تأخيرات الشحن المتوقعة، ورسم خريطة الموزع حسب المنطقة، وتحليل السلع، وتحليل الإنتاج، واتجاهات رسم الخرائط السعرية، والتوريد، وتحليل أداء الفئة، وحلول إدارة مخاطر سلسلة التوريد، والمقارنة المتقدمة، وغيرها من الخدمات للشراء والدعم الاستراتيجي.

التأثير المتوقع للتباطؤ الاقتصادي على تسعير المنتجات وتوافرها

عندما يتباطأ النشاط الاقتصادي، تبدأ الصناعات في المعاناة. يتم أخذ التأثيرات المتوقعة للركود الاقتصادي على تسعير المنتجات وإمكانية الوصول إليها في الاعتبار في تقارير رؤى السوق وخدمات الاستخبارات التي تقدمها DBMR. بفضل هذا، يمكن لعملائنا عادةً أن يظلوا متقدمين بخطوة واحدة على منافسيهم، وأن يتوقعوا مبيعاتهم وإيراداتهم، وأن يقدروا نفقاتهم على الأرباح والخسائر.

نطاق سوق الليدار

يتم تقسيم السوق على أساس النوع والتطبيق. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- ليدار ثابت

- ليدار دوار

- آخر

طلب

- المركبات ذاتية القيادة

- التفتيش الجوي

- الروبوتات

- المسح والرسم الخرائطي

- إدارة الغابات والأراضي

- الطاقة المتجددة

- آحرون

تحليل إقليمي لسوق الليدار

يتم تحليل السوق وتوفير رؤى حول حجم السوق والاتجاهات حسب النوع والتطبيق.

الدول التي يغطيها السوق هي الولايات المتحدة وكندا والمكسيك والصين واليابان وكوريا الجنوبية والهند وتايلاند وماليزيا وإندونيسيا وفيتنام وتايوان والفلبين وسنغافورة وأستراليا وبقية دول آسيا والمحيط الهادئ وألمانيا وفرنسا والمملكة المتحدة وإيطاليا وإسبانيا وروسيا وتركيا وهولندا وبلجيكا والسويد وبولندا وسويسرا وبقية دول أوروبا والبرازيل والأرجنتين وبقية دول أمريكا الجنوبية والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب إفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

تهيمن أمريكا الشمالية على سوق LiDAR العالمي بفضل البنية التحتية التكنولوجية المتقدمة، والتبني العالي في الصناعات مثل الفضاء والدفاع والسيارات، والاستثمارات القوية في المركبات ذاتية القيادة وأنظمة المعلومات الجغرافية (GIS).

تبرز منطقة آسيا والمحيط الهادئ في سوق LiDAR العالمي بسبب التصنيع السريع والاستثمارات المتزايدة في المدن الذكية والمركبات ذاتية القيادة وتطوير البنية التحتية والطلب المتزايد على حلول رسم الخرائط الدقيقة ومراقبة البيئة.

يقدم قسم الدولة في التقرير أيضًا عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. أيضًا، يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

حصة سوق الليدار

يوفر المشهد التنافسي للسوق تفاصيل حسب المنافسين. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بالسوق.

الشركات الرائدة في سوق LiDAR العاملة في السوق هي:

- شركة إنوفيز للتكنولوجيا المحدودة (إسرائيل)

- شركة سيك ايه جي (ألمانيا)

- مجموعة هيساي. (الصين)

- شركة Quanergy Solutions, Inc. (الولايات المتحدة)

- شركة سيبتون (الولايات المتحدة)

- جيل الروبوتات (فرنسا)

- تيليداين اوبتك الصين

- شركة ايفا (الولايات المتحدة)

- شركة AEye, Inc. (الولايات المتحدة)

- شركة تريمبل (الولايات المتحدة)

أحدث التطورات في سوق الليدار العالمي

- في يوليو 2024، أعلنت شركة Cepton, Inc. عن اتفاقية نهائية للاستحواذ عليها من قبل شركة Koito Manufacturing Co., Ltd.، وهي شركة تعاونية وشريكة استراتيجية منذ فترة طويلة. بعد اكتمال عملية الاستحواذ، ستعمل Cepton كشركة تابعة غير مباشرة مملوكة للقطاع الخاص لشركة Koito، مع الحفاظ على مقرها الرئيسي في سان خوسيه، كاليفورنيا. تعتمد هذه الشراكة على تاريخها في تطوير حلول LiDAR عالية الأداء لتطبيقات السيارات والبنية التحتية الذكية. ومن المتوقع أن يعزز الاستحواذ من اعتماد LiDAR في تطبيقات السوق الشامل، والاستفادة من قدرات التصنيع الخاصة بشركة Koito والخبرة التكنولوجية لشركة Cepton

- في مايو 2024، قدمت شركة Cepton, Inc. برنامج StudioViz، وهو عبارة عن منصة محاكاة LiDAR شاملة ومسجلة الملكية، تهدف إلى تسريع تطوير أنظمة مساعدة السائق المتقدمة (ADAS) والمركبات ذاتية القيادة (AVs). يتيح برنامج StudioViz لمصنعي المعدات الأصلية والمطورين محاكاة سيناريوهات تكامل LiDAR واختبار مواضع المستشعرات وتحسين خوارزميات الإدراك دون الحاجة إلى اختبارات مادية مكثفة. توفر هذه الأداة تصورات سحابة النقاط ثلاثية الأبعاد عالية الدقة وقدرات بناء السيناريوهات، مما يقلل التكاليف والتعقيد في الاختبارات في العالم الحقيقي من خلال إعادة إنشاء الظروف البيئية المتنوعة افتراضيًا

- في يونيو 2021، أعلنت شركتا eledyne Optech وTeledyne CARIS، وهما شركتان تابعتان لشركة Teledyne Technologies، عن إطلاق الجيل التالي من أجهزة قياس الأعماق بالليدار، CZMIL SuperNova. يوفر هذا النظام المبتكر أداءً لا مثيل له في العمق وأعلى كثافة لنقاط الليزر الأخضر في فئته، ويتميز بتقنية SmartSpacing لتوزيع النقاط بكفاءة، والمعالجة في الوقت الفعلي لتقليل وقت المعالجة اللاحقة، والأوضاع القابلة للتكوين المصممة خصيصًا لبيئات المياه المختلفة

- في نوفمبر 2023، حصلت شركة Aeva على عقد إنتاج مع شركة Nikon Corporation لتوريد تقنية LiDAR-on-Chip الدقيقة بالميكرون لمنتجات القياس الصناعي ومراقبة الجودة من Nikon. ستدمج الاتفاقية متعددة السنوات تقنية Aeva في حلول التفتيش الآلية من Nikon لقطاعات السيارات والفضاء والطاقة المتجددة، مع بدء الإنتاج في أواخر عام 2024 وتوافر المنتج في عام 2025

- في يونيو 2024، دخلت Innoviz Technologies في شراكة مع إحدى شركات تصنيع المعدات الأصلية الكبرى لتطوير حل جديد لليدار قصير المدى للمركبات ذاتية القيادة من المستوى 4 (L4). يركز هذا التعاون على تعزيز قدرة المركبة على إدراك بيئتها من مسافات قريبة، مما يساهم في الملاحة الأكثر دقة وموثوقية للقيادة الذاتية الكاملة

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 CONTINUOUS INNOVATIONS AND ADVANCEMENTS IN LIDAR TECHNOLOGY

5.1.2 INCREASING ADOPTION OF SURVEYING AND MAPPING

5.1.3 GROWING DEMAND FOR AUTONOMOUS VEHICLES

5.1.4 INCREASING USAGE OF LIDAR IN ENVIRONMENTAL MONITORING AND APPLICATIONS

5.2 RESTRAINTS

5.2.1 HIGH COSTS OF LIDAR SYSTEMS

5.2.2 STIFF COMPETITION FROM ALTERNATIVE TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 EXPANDING URBANIZATION AND INFRASTRUCTURE DEVELOPMENT ACROSS THE GLOBE

5.3.2 EMERGENCE OF DRONE-BASED LIDAR

5.3.3 INTEGRATION OF LIDAR WITH AI AND MACHINE LEARNING

5.4 CHALLENGES

5.4.1 STRINGENT REGULATIONS FOR DRONE-BASED LIDAR OPERATIONS AND PRIVACY CONCERNS

5.4.2 DATA PROCESSING, MANAGEMENT AND COMPUTATIONAL CHALLENGES

6 GLOBAL LIDAR MARKET, BY TYPE

6.1 OVERVIEW

6.2 FIXED LIDAR

6.3 ROTATING LIDAR

7 GLOBAL LIDAR MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 AUTONOMOUS VEHICLES

7.3 AERIAL INSPECTION

7.4 ROBOTICS

7.5 SURVEY AND MAPPING

7.6 FORESTRY AND LAND MANAGEMENT

7.7 RENEWABLE ENERGY

7.8 OTHERS

8 GLOBAL LIDAR MARKET, BY REGION

8.1 OVERVIEW

8.2 GLOBAL

8.3 NORTH AMERICA

8.3.1 U.S.

8.3.2 CANADA

8.3.3 MEXICO

8.4 ASIA-PACIFIC

8.4.1 CHINA

8.4.2 JAPAN

8.4.3 SOUTH KOREA

8.4.4 INDIA

8.4.5 THAILAND

8.4.6 MALAYSIA

8.4.7 INDONESIA

8.4.8 VIETNAM

8.4.9 TAIWAN

8.4.10 PHILIPPINES

8.4.11 SINGAPORE

8.4.12 AUSTRALIA

8.4.13 REST OF ASIA-PACIFIC

8.5 EUROPE

8.5.1 GERMANY

8.5.2 FRANCE

8.5.3 U.K.

8.5.4 ITALY

8.5.5 SPAIN

8.5.6 RUSSIA

8.5.7 TURKEY

8.5.8 NETHERLANDS

8.5.9 BELGIUM

8.5.10 SWEDEN

8.5.11 POLAND

8.5.12 SWITZERLAND

8.5.13 REST OF EUROPE

8.6 MIDDLE EAST AND AFRICA

8.6.1 SAUDI ARABIA

8.6.2 U.A.E.

8.6.3 SOUTH AFRICA

8.6.4 EGYPT

8.6.5 ISRAEL

8.6.6 REST OF MIDDLE EAST AND AFRICA

8.7 SOUTH AMERICA

8.7.1 BRAZIL

8.7.2 ARGENTINA

8.7.3 REST OF SOUTH AMERICA

9 GLOBAL LIDAR MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: GLOBAL

9.2 COMPANY SHARE ANALYSIS: EUROPE

9.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

9.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 TELEDYNE GEOSPATIAL

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENT

11.2 TRIMBLE INC

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENT

11.3 SICK AG

11.3.1 COMPANY SNAPSHOT

11.3.2 COMPANY SHARE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 HESAI GROUP

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT DEVELOPMENT

11.5 AEVA INC

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 AEYE, INC.

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 CEPTON, INC.

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENT

11.8 GÉNÉRATION ROBOTS

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 INNOVIZ TECHNOLOGIES LTD

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENT

11.1 QUSNERGY SOLUTIONS, INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 GLOBAL LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 GLOBAL FIXED LIDAR IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL ROTATING LIDAR IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL LIDAR MARKET, BY APPLICATION, 2024, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL AUTONOMOUS VEHICLES IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL AERIAL INSPECTION IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL ROBOTICS IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL SURVEY AND MAPPING IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL FORESTRY AND LAND MANAGEMENT IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL RENEWABLE ENERGY IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL OTHERS IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 CANADA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 CANADA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 MEXICO LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MEXICO LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 CHINA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 CHINA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 JAPAN LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 SOUTH KOREA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 SOUTH KOREA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 INDIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 INDIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 33 THAILAND LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 THAILAND LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 MALAYSIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MALAYSIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 INDONESIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 INDONESIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 VIETNAM LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 VIETNAM LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 TAIWAN LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 TAIWAN LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 PHILIPPINES LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 PHILIPPINES LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 45 SINGAPORE LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 SINGAPORE LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 AUSTRALIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 49 REST OF ASIA-PACIFIC LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 53 GERMANY LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 GERMANY LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 FRANCE LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 FRANCE LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 U.K. LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.K. LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 ITALY LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ITALY LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 61 SPAIN LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SPAIN LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 63 RUSSIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 RUSSIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 TURKEY LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 TURKEY LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 NETHERLANDS LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NETHERLANDS LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 69 BELGIUM LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 BELGIUM LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 SWEDEN LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SWEDEN LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 POLAND LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 POLAND LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 SWITZERLAND LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SWITZERLAND LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 REST OF EUROPE LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 SAUDI ARABIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SAUDI ARABIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 U.A.E. LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.A.E. LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH AFRICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 EGYPT LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 EGYPT LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 89 ISRAEL LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 ISRAEL LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 REST OF MIDDLE EAST AND AFRICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH AMERICA LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AMERICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH AMERICA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 BRAZIL LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 BRAZIL LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 ARGENTINA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 ARGENTINA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 REST OF SOUTH AMERICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 GLOBAL LIDAR MARKET

FIGURE 2 GLOBAL LIDAR MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL LIDAR MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL LIDAR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL LIDAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL LIDAR MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL LIDAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL LIDAR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL LIDAR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL LIDAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL LIDAR MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE GLOBAL LIDAR MARKET, BY TYPE

FIGURE 13 GLOBAL LIDAR MARKET:-STRATEGIC DECISIONS

FIGURE 14 GLOBAL LIDAR MARKET EXECUTIVE SUMMARY

FIGURE 15 CONTINUOUS INNOVATIONS AND ADVANCEMENTS IN LIDAR TECHNOLOGY ARE EXPECTED TO DRIVE THE GLOBAL LIDAR MARKET IN THE FORECAST PERIOD

FIGURE 16 THE FIXED LIDAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL LIDAR MARKET IN 2025 AND 2032

FIGURE 17 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL LIDAR MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GLOBAL LIDAR MARKET

FIGURE 19 GLOBAL LIDAR MARKET: BY TYPE, 2024

FIGURE 20 GLOBAL LIDAR MARKET: BY APPLICATION, 2024

FIGURE 21 GLOBAL LIDAR MARKET: SNAPSHOT (2024)

FIGURE 22 NORTH AMERICA LIDAR MARKET: SNAPSHOT (2024)

FIGURE 23 ASIA-PACIFIC LIDAR MARKET: SNAPSHOT (2024)

FIGURE 24 EUROPE LIDAR MARKET: SNAPSHOT (2024)

FIGURE 25 MIDDLE EAST AND AFRICA LIDAR MARKET: SNAPSHOT (2024)

FIGURE 26 SOUTH AMERICA LIDAR MARKET: SNAPSHOT (2024)

FIGURE 27 GLOBAL LIDAR MARKET: COMPANY SHARE 2024 (%)

FIGURE 28 EUROPE LIDAR MARKET: COMPANY SHARE 2024 (%)

FIGURE 29 ASIA-PACIFC LIDAR MARKET: COMPANY SHARE 2024 (%)

FIGURE 30 NORTH AMERICA LIDAR MARKET: COMPANY SHARE 2024 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.