Global Core Banking Solutions Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

16.71 Billion

USD

37.42 Billion

2024

2032

USD

16.71 Billion

USD

37.42 Billion

2024

2032

| 2025 –2032 | |

| USD 16.71 Billion | |

| USD 37.42 Billion | |

|

|

|

|

السوق العالمية لحلول الخدمات المصرفية الأساسية، حسب النوع (حلول عملاء المؤسسات، الودائع، القروض، الرهن العقاري، التحويلات، المدفوعات والسحب، صرف العملات، وغيرها)، العرض (البرمجيات والخدمات)، وضع النشر (السحابة وفي الموقع)، حجم المؤسسة (المؤسسات الكبيرة والصغيرة والمتوسطة) القناة (أجهزة الصراف الآلي، الخدمات المصرفية عبر الإنترنت، الخدمات المصرفية عبر الهاتف المحمول، فروع البنوك، وغيرها)، الوظيفة (إدارة الحسابات، معالجة المعاملات، إدارة المخاطر، إدارة علاقات العملاء، التقارير والتحليلات، إدارة المنتجات، إدارة القروض، إدارة الامتثال، وغيرها)، والمستخدم النهائي (البنوك، اتحادات الائتمان والبنوك المجتمعية، والمؤسسات المالية الأخرى) - اتجاهات الصناعة والتوقعات حتى عام 2032.

حجم سوق حلول الخدمات المصرفية الأساسية

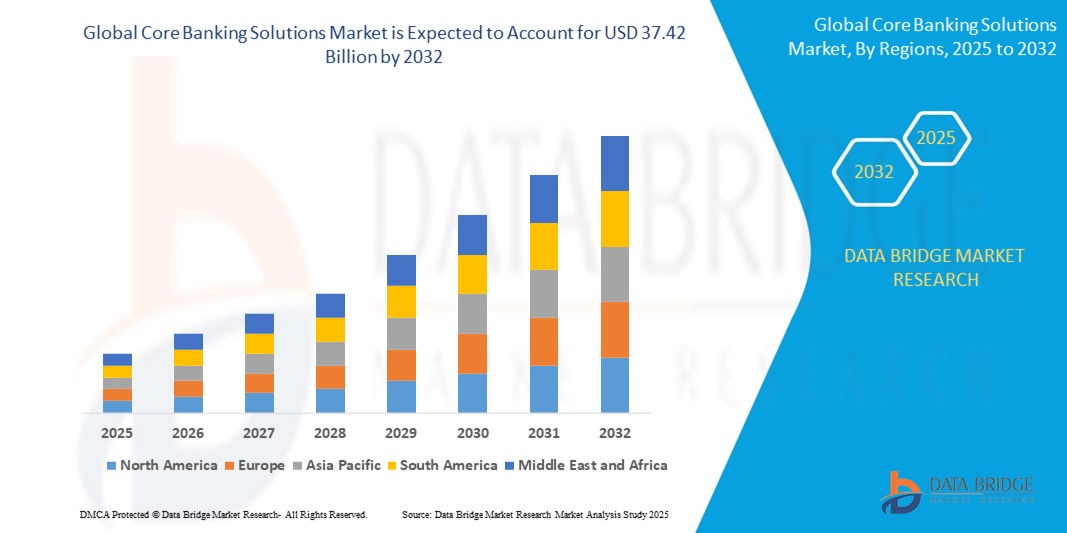

- تم تقييم حجم سوق حلول الخدمات المصرفية الأساسية العالمية بـ 16.71 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 37.42 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 10.6٪ خلال الفترة المتوقعة.

- ينشأ نمو السوق من خلال التبني المتزايد للخدمات المصرفية الرقمية والتقدم في التقنيات القائمة على السحابة والحاجة إلى البنية التحتية المصرفية الحديثة لتعزيز الكفاءة التشغيلية وتجربة العملاء

- إن الطلب المتزايد على الحلول المصرفية السلسة والآمنة والمتكاملة، إلى جانب المتطلبات التنظيمية للامتثال وإدارة المخاطر، يضع حلول الخدمات المصرفية الأساسية كمكونات أساسية لاستراتيجيات التحول الرقمي للمؤسسات المالية.

تحليل سوق حلول الخدمات المصرفية الأساسية

- تعتبر حلول الخدمات المصرفية الأساسية، التي تشمل البرامج والخدمات التي تدير العمليات المصرفية المهمة مثل الودائع والقروض والمدفوعات، محورية في تحديث المؤسسات المالية من خلال تمكين معالجة المعاملات في الوقت الفعلي وتحسين خدمة العملاء والتكامل مع قنوات الخدمات المصرفية الرقمية.

- إن الارتفاع في الطلب مدفوع بالاعتماد المتزايد على الخدمات المصرفية عبر الهاتف المحمول والإنترنت، والضغوط التنظيمية المتزايدة، والحاجة إلى أنظمة مرنة وقابلة للتطوير لتلبية توقعات العملاء المتطورة.

- سيطرت أمريكا الشمالية على سوق حلول الخدمات المصرفية الأساسية بأكبر حصة إيرادات بلغت 42.5% في عام 2024، مدفوعة بالتبني المبكر لتقنيات الخدمات المصرفية الرقمية، والاستثمار المرتفع في البنية التحتية لتكنولوجيا المعلومات، ووجود لاعبين رئيسيين في السوق.

- من المتوقع أن تكون منطقة آسيا والمحيط الهادئ أسرع المناطق نموًا خلال فترة التوقعات، مدفوعة بالتحول الرقمي السريع، والشمول المالي المتزايد، والاعتماد المتزايد على الخدمات المصرفية عبر الهاتف المحمول في دول مثل الهند والصين.

- سيطرت شريحة حلول عملاء المؤسسات على أكبر حصة من إيرادات السوق بنسبة 38% في عام 2024، مدفوعة بالطلب المتزايد على المنصات المتكاملة التي تعمل على تبسيط إدارة العملاء وخدمات الحسابات والتجارب المصرفية الشخصية للمؤسسات المالية الكبيرة.

نطاق التقرير وتجزئة سوق حلول الخدمات المصرفية الأساسية

|

صفات |

حلول الخدمات المصرفية الأساسية - رؤى السوق الرئيسية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أمريكا الشمالية

أوروبا

آسيا والمحيط الهادئ

الشرق الأوسط وأفريقيا

أمريكا الجنوبية

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم إعدادها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء والإنتاج والقدرة التمثيلية الجغرافية للشركة وتخطيطات الشبكة للموزعين والشركاء وتحليل اتجاهات الأسعار التفصيلية والمحدثة وتحليل العجز في سلسلة التوريد والطلب. |

اتجاهات سوق حلول الخدمات المصرفية الأساسية

"زيادة تكامل الذكاء الاصطناعي والتحليلات المتقدمة"

- يشهد سوق حلول الخدمات المصرفية الأساسية العالمي اتجاهًا كبيرًا نحو دمج الذكاء الاصطناعي والتحليلات المتقدمة

- تتيح هذه التقنيات معالجة البيانات المتطورة، مما يوفر رؤى أعمق حول سلوك العملاء وأنماط المعاملات والكفاءة التشغيلية

- تسهل حلول الخدمات المصرفية الأساسية المدعومة بالذكاء الاصطناعي اتخاذ القرارات الاستباقية، مثل تحديد الاحتيال المحتمل، وتحسين الموافقات على القروض، والتنبؤ باحتياجات العملاء

- على سبيل المثال، يقوم العديد من مقدمي الخدمات بتطوير منصات تعتمد على الذكاء الاصطناعي لتخصيص المنتجات المالية وتبسيط عمليات الامتثال وتعزيز إدارة المخاطر استنادًا إلى تحليل البيانات في الوقت الفعلي

- يؤدي هذا الاتجاه إلى زيادة جاذبية حلول الخدمات المصرفية الأساسية للمؤسسات المالية، وتحسين رضا العملاء والمرونة التشغيلية

- تقوم خوارزميات الذكاء الاصطناعي بتحليل مجموعات البيانات الضخمة، بما في ذلك سجلات المعاملات، وتفاعلات العملاء، واتجاهات السوق، لتقديم خدمات مخصصة ورؤى تنبؤية

ديناميكيات سوق حلول الخدمات المصرفية الأساسية

سائق

"الطلب المتزايد على الخدمات المصرفية الرقمية وتحسين تجربة العملاء"

- إن الطلب المتزايد من جانب المستهلكين على الخدمات المصرفية الرقمية السلسة، مثل الخدمات المصرفية عبر الهاتف المحمول، والمدفوعات في الوقت الفعلي، والمنتجات المالية المخصصة، يعد محركًا رئيسيًا لسوق حلول الخدمات المصرفية الأساسية العالمية.

- تعمل أنظمة الخدمات المصرفية الأساسية على تعزيز تجربة العملاء من خلال تقديم ميزات مثل معالجة المعاملات الفورية والوصول إلى الحساب على مدار الساعة طوال أيام الأسبوع وأدوات الإدارة المالية المتكاملة

- إن المتطلبات التنظيمية في مناطق مثل أمريكا الشمالية، التي تهيمن على السوق، تدفع البنوك إلى اعتماد حلول مصرفية أساسية متقدمة للامتثال لمعايير الشفافية والأمان.

- إن انتشار الحوسبة السحابية وتقنية الجيل الخامس يتيح معالجة البيانات بشكل أسرع ووقت وصول أقل، مما يدعم الخدمات المصرفية المبتكرة مثل صرف العملات في الوقت الفعلي والخدمات المصرفية التي تركز على الهاتف المحمول

- تتبنى المؤسسات المالية بشكل متزايد منصات الخدمات المصرفية الأساسية الحديثة كعروض قياسية لتلبية توقعات العملاء والحفاظ على القدرة التنافسية

ضبط النفس/التحدي

"تكاليف التنفيذ المرتفعة ومخاوف أمن البيانات"

- يشكل الاستثمار الأولي الكبير المطلوب لنشر نظام الخدمات المصرفية الأساسية، بما في ذلك الأجهزة والبرامج والتكامل، عائقًا أمام التبني، وخاصة بالنسبة للشركات الصغيرة والمتوسطة والمؤسسات في الأسواق الناشئة.

- يمكن أن يكون دمج حلول الخدمات المصرفية الأساسية الحديثة مع الأنظمة القديمة معقدًا ومكلفًا، ويتطلب تخصيصًا واختبارًا مكثفًا

- تشكل مخاوف أمن البيانات والخصوصية تحديات رئيسية، حيث تتعامل أنظمة الخدمات المصرفية الأساسية مع بيانات العملاء والمعاملات الحساسة، مما يزيد من مخاطر الاختراقات أو سوء الاستخدام أو عدم الامتثال للوائح مثل GDPR وCCPA

- إن المشهد التنظيمي المجزأ عبر البلدان، وخاصة في منطقة آسيا والمحيط الهادئ سريعة النمو، يعقد الامتثال لمقدمي الخدمات العالميين، مما يضيف تحديات تشغيلية

- يمكن أن تؤدي هذه العوامل إلى ردع التبني، وخاصة في المناطق ذات الحساسية العالية للتكلفة أو الوعي الصارم بخصوصية البيانات

نطاق سوق حلول الخدمات المصرفية الأساسية

يتم تقسيم السوق على أساس النوع والعرض وطريقة النشر وحجم المؤسسة والقناة والوظيفة والمستخدم النهائي.

- حسب النوع

يُقسّم سوق حلول الخدمات المصرفية الأساسية العالمية، حسب نوعها، إلى حلول عملاء المؤسسات، والودائع، والقروض، والرهون العقارية، والتحويلات، والمدفوعات والسحب، وصرف العملات، وغيرها. وسيستحوذ قطاع حلول عملاء المؤسسات على أكبر حصة من إيرادات السوق بنسبة 38% في عام 2024، مدفوعًا بالطلب المتزايد على المنصات المتكاملة التي تُبسّط إدارة العملاء، وخدمات الحسابات، والتجارب المصرفية المُخصّصة للمؤسسات المالية الكبيرة.

من المتوقع أن يشهد قطاع المدفوعات والسحب أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالاعتماد المتزايد على أنظمة الدفع الرقمية، ومعالجة المعاملات الفورية، وطلب المستهلكين على حلول دفع سلسة وآمنة وفورية. كما أن التطورات في تقنيات التكنولوجيا المالية والخدمات المصرفية عبر الهاتف المحمول تُسرّع هذا النمو.

- عن طريق العرض

بناءً على العروض، يُقسّم سوق حلول الخدمات المصرفية الأساسية العالمية إلى برمجيات وخدمات. ومن المتوقع أن يستحوذ قطاع البرمجيات على أكبر حصة من إيرادات السوق، بنسبة 62% في عام 2024، مدفوعًا بالدور المحوري لبرمجيات الخدمات المصرفية الأساسية في تمكين معالجة المعاملات بكفاءة، وإدارة الحسابات، والامتثال للمتطلبات التنظيمية. وتعتمد المؤسسات المالية بشكل متزايد على حلول برمجية قابلة للتطوير لتحديث أنظمتها القديمة.

من المتوقع أن يشهد قطاع الخدمات أسرع معدل نمو بنسبة 18.5% بين عامي 2025 و2032، مدفوعًا بالحاجة المتزايدة لخدمات التنفيذ والاستشارات والصيانة لدعم عمليات نشر برمجيات الخدمات المصرفية الأساسية المعقدة. ويعزز الطلب على الحلول المخصصة والدعم المستمر من اعتماد هذه الحلول.

- حسب وضع النشر

بناءً على طريقة النشر، يُقسّم سوق حلول الخدمات المصرفية الأساسية العالمية إلى سحابية ومحلية. ومن المتوقع أن يستحوذ قطاع السحابة على أكبر حصة من إيرادات السوق بنسبة 58% في عام 2024، بفضل مرونته وقابليته للتوسع وفعاليته من حيث التكلفة، مما يُمكّن المؤسسات المالية من التكيف مع متطلبات السوق المتغيرة وخفض تكاليف البنية التحتية.

ومن المتوقع أيضًا أن يشهد قطاع الحوسبة السحابية أسرع نمو في الفترة من 2025 إلى 2032، مدفوعًا بالاعتماد المتزايد على الحلول المستندة إلى الحوسبة السحابية في منطقة آسيا والمحيط الهادئ ومناطق أخرى، حيث تسعى البنوك إلى الاستفادة من التقنيات المتقدمة مثل الذكاء الاصطناعي والتعلم الآلي لتحسين الكفاءة التشغيلية وتجربة العملاء.

- حسب حجم المؤسسة

بناءً على حجم المؤسسة، يُقسّم سوق حلول الخدمات المصرفية الأساسية العالمي إلى شركات كبيرة وأخرى صغيرة ومتوسطة. وسيستحوذ قطاع الشركات الكبيرة على حصة سوقية تبلغ 70% من الإيرادات بحلول عام 2024، مدفوعةً بالحاجة إلى أنظمة مصرفية أساسية متينة وقابلة للتطوير وآمنة لإدارة أحجام المعاملات الكبيرة والعمليات المعقدة في المؤسسات المالية الكبرى.

ومن المتوقع أن يشهد قطاع الشركات الصغيرة والمتوسطة نمواً سريعاً بنسبة 20.2% في الفترة من 2025 إلى 2032، مدفوعاً بالتحول الرقمي المتزايد واعتماد حلول الخدمات المصرفية الأساسية القائمة على السحابة والفعالة من حيث التكلفة والمصممة خصيصاً لتلبية احتياجات المؤسسات الأصغر، وخاصة في الأسواق الناشئة مثل منطقة آسيا والمحيط الهادئ.

- حسب القناة

بناءً على قنوات التوزيع، يُقسّم سوق حلول الخدمات المصرفية الأساسية العالمية إلى أجهزة الصراف الآلي، والخدمات المصرفية عبر الإنترنت، والخدمات المصرفية عبر الهاتف المحمول، وفروع البنوك، وغيرها. ومن المتوقع أن يستحوذ قطاع الخدمات المصرفية عبر الهاتف المحمول على أكبر حصة من إيرادات السوق بنسبة 45% في عام 2024، مدفوعًا بالانتشار الواسع للهواتف الذكية وتفضيل المستهلكين للخدمات المصرفية المريحة والسهلة أثناء التنقل.

ومن المتوقع أن يشهد قطاع الخدمات المصرفية عبر الإنترنت نمواً كبيراً في الفترة من 2025 إلى 2032، حيث تستثمر المؤسسات المالية في منصات عبر الإنترنت سهلة الاستخدام لتعزيز مشاركة العملاء وتوفير وصول سلس إلى الخدمات المصرفية، وخاصة في المناطق التي تتميز بالذكاء التكنولوجي مثل أمريكا الشمالية ومنطقة آسيا والمحيط الهادئ.

- حسب الوظيفة

بناءً على وظائفها، تُقسّم سوق حلول الخدمات المصرفية الأساسية العالمية إلى إدارة الحسابات، ومعالجة المعاملات، وإدارة المخاطر، وإدارة علاقات العملاء، وإعداد التقارير والتحليلات، وإدارة المنتجات، وإدارة القروض، وإدارة الامتثال، وغيرها. ومن المتوقع أن يستحوذ قطاع معالجة المعاملات على أكبر حصة من إيرادات السوق بنسبة 40% في عام 2024، مدفوعًا بدوره المحوري في تمكين معالجة المعاملات المالية بشكل آني وآمن وفعال عبر قنوات متعددة.

من المتوقع أن يشهد قطاع التقارير والتحليلات أسرع نمو بين عامي 2025 و2032، مدفوعًا بالطلب المتزايد على الرؤى المستندة إلى البيانات لتعزيز عملية اتخاذ القرار، وتحسين العمليات، وتلبية متطلبات التقارير التنظيمية. ويعزز دمج الذكاء الاصطناعي والتحليلات المتقدمة من اعتماد هذه التقنيات.

- حسب المستخدم النهائي

بناءً على المستخدم النهائي، يُقسّم سوق حلول الخدمات المصرفية الأساسية العالمية إلى بنوك، واتحادات ائتمانية، وبنوك مجتمعية، ومؤسسات مالية أخرى. وسيستحوذ قطاع البنوك على حصة سوقية من الإيرادات بنسبة 73% في عام 2024، بفضل حجم المعاملات الكبير، وشبكات الفروع الواسعة، والحاجة إلى أنظمة مصرفية أساسية متطورة لدعم الخدمات المتنوعة.

ومن المتوقع أن يشهد قطاع اتحادات الائتمان والبنوك المجتمعية نمواً سريعاً بنسبة 19.8% في الفترة من 2025 إلى 2032، مدفوعاً بالاعتماد المتزايد على حلول الخدمات المصرفية الأساسية الحديثة لتعزيز الكفاءة التشغيلية وتحسين تجربة العملاء والتنافس مع المؤسسات المالية الأكبر حجماً، وخاصة في مناطق مثل آسيا والمحيط الهادئ.

تحليل إقليمي لسوق حلول الخدمات المصرفية الأساسية

- سيطرت أمريكا الشمالية على سوق حلول الخدمات المصرفية الأساسية بأكبر حصة إيرادات بلغت 42.5% في عام 2024، مدفوعة بالتبني المبكر لتقنيات الخدمات المصرفية الرقمية، والاستثمار المرتفع في البنية التحتية لتكنولوجيا المعلومات، ووجود لاعبين رئيسيين في السوق.

- تعطي المؤسسات المالية الأولوية لحلول الخدمات المصرفية الأساسية لتعزيز الكفاءة التشغيلية وتحسين تجربة العملاء وضمان الامتثال للمتطلبات التنظيمية، وخاصة في المناطق ذات الظروف الاقتصادية المتنوعة

- يتم دعم النمو من خلال التقدم في برامج الخدمات المصرفية، بما في ذلك المنصات المستندة إلى السحابة والتحليلات التي تعتمد على الذكاء الاصطناعي، إلى جانب زيادة التبني في كل من الشركات الكبيرة والشركات الصغيرة والمتوسطة (SMEs).

نظرة عامة على سوق حلول الخدمات المصرفية الأساسية في الولايات المتحدة

استحوذ سوق حلول الخدمات المصرفية الأساسية في الولايات المتحدة على أكبر حصة من الإيرادات، بنسبة 84.8% في عام 2024، في أمريكا الشمالية، مدفوعًا بالطلب القوي على التحول الرقمي في الخدمات المصرفية والوعي المتزايد بفوائد منصات الخدمات المصرفية المتكاملة. ويعزز التوجه نحو الخدمات المصرفية الشخصية والمعايير التنظيمية الصارمة توسع السوق. ويُكمل اعتماد المؤسسات المالية المتزايد للحلول السحابية عمليات النشر التقليدية المحلية، مما يخلق منظومة منتجات متنوعة.

نظرة عامة على سوق حلول الخدمات المصرفية الأساسية في أوروبا

من المتوقع أن يشهد سوق حلول الخدمات المصرفية الأساسية في أوروبا نموًا ملحوظًا، مدعومًا بتركيز الجهات التنظيمية على الشفافية المالية والخدمات المصرفية التي تركز على العملاء. تسعى البنوك والمؤسسات المالية إلى حلول تُحسّن معالجة المعاملات وإدارة المخاطر وإدارة علاقات العملاء. ويتجلى النمو بشكل واضح في كلٍّ من تطبيقات الأنظمة الجديدة وترقيات الأنظمة القديمة، حيث تُظهر دول مثل ألمانيا وفرنسا تبنّيًا كبيرًا لهذه الحلول بفضل تنامي اتجاهات الخدمات المصرفية الرقمية والاستقرار الاقتصادي.

نظرة عامة على سوق حلول الخدمات المصرفية الأساسية في المملكة المتحدة

من المتوقع أن يشهد سوق حلول الخدمات المصرفية الأساسية في المملكة المتحدة نموًا سريعًا، مدفوعًا بالطلب على تجارب عملاء مُحسّنة وخدمات مصرفية رقمية سلسة في المناطق الحضرية والضواحي. ويشجع الاهتمام المتزايد بالخدمات المصرفية عبر الهاتف المحمول والإنترنت، إلى جانب الوعي المتزايد بمزايا أمن البيانات والامتثال، على تبني هذه الخدمات. كما تؤثر اللوائح المالية المتطورة على الخيارات المصرفية، حيث توازن بين الابتكار والامتثال التنظيمي.

نظرة عامة على سوق حلول الخدمات المصرفية الأساسية في ألمانيا

من المتوقع أن تشهد ألمانيا نموًا سريعًا في سوق حلول الخدمات المصرفية الأساسية، بفضل قطاع الخدمات المالية المتطور فيها وتركيزها الكبير على الكفاءة التشغيلية ورضا العملاء. تُفضل البنوك الألمانية الحلول المتقدمة تكنولوجيًا التي تُبسط إدارة الحسابات، ومعالجة المعاملات، وإدارة الامتثال. ويدعم دمج هذه الحلول في الشركات الكبيرة والصغيرة والمتوسطة نموًا مستدامًا في السوق.

نظرة عامة على سوق حلول الخدمات المصرفية الأساسية في منطقة آسيا والمحيط الهادئ

من المتوقع أن تشهد منطقة آسيا والمحيط الهادئ أسرع معدل نمو، مدفوعًا بتوسع قطاعات الخدمات المالية وتزايد اعتماد الخدمات الرقمية في دول مثل الصين والهند واليابان. ويعزز الوعي المتزايد بحلول إدارة علاقات العملاء وإدارة المخاطر ومعالجة المعاملات الطلب. كما تشجع المبادرات الحكومية التي تعزز الشمول المالي والخدمات المصرفية الرقمية على اعتماد حلول مصرفية أساسية متقدمة.

نظرة عامة على سوق حلول الخدمات المصرفية الأساسية في اليابان

من المتوقع أن يشهد سوق حلول الخدمات المصرفية الأساسية في اليابان نموًا سريعًا بفضل تفضيل المستهلكين القوي للمنصات المصرفية عالية الجودة والمتطورة تقنيًا، والتي تُعزز الكفاءة التشغيلية ورضا العملاء. ويساهم وجود المؤسسات المالية الكبرى ودمج حلول الخدمات المصرفية الأساسية في أنظمة المؤسسات في تسريع انتشار السوق. كما يُسهم الاهتمام المتزايد بالخدمات المصرفية عبر الهاتف المحمول والإنترنت في هذا النمو.

نظرة عامة على سوق حلول الخدمات المصرفية الأساسية في الصين

تستحوذ الصين على الحصة الأكبر من سوق حلول الخدمات المصرفية الأساسية في منطقة آسيا والمحيط الهادئ، مدفوعةً بالتوسع الحضري السريع، وتنامي حضور المؤسسات المالية، والطلب المتزايد على حلول الخدمات المصرفية الرقمية. ويدعم نمو الطبقة المتوسطة في البلاد والتركيز على الخدمات المالية الذكية اعتماد منصات الخدمات المصرفية الأساسية المتقدمة. كما تُعزز قدرات تطوير البرمجيات المحلية القوية والأسعار التنافسية سهولة الوصول إلى السوق.

حصة سوق حلول الخدمات المصرفية الأساسية

إن صناعة حلول الخدمات المصرفية الأساسية يقودها في المقام الأول شركات راسخة، بما في ذلك:

- شركة فيديليتي لخدمات المعلومات الوطنية (FIS) (الولايات المتحدة الأمريكية)

- بريكنود (السويد)

- حلول جايام (الهند)

- فوربيس (ليتوانيا)

- شركة NCR VOYIX (الولايات المتحدة الأمريكية)

- شركة إتش سي إل تكنولوجيز المحدودة (الهند)

- يونيسيس (الولايات المتحدة الأمريكية)

- إنفوسيس المحدودة (الهند)

- شركة تاتا للخدمات الاستشارية المحدودة (الهند)

- جاك هنري وشركاه، المحدودة (الولايات المتحدة الأمريكية)

- SAP (ألمانيا)

- أوراكل (الولايات المتحدة الأمريكية)

- كابجيميني (فرنسا)

- نسينو (الولايات المتحدة الأمريكية)

- فيناسترا (المملكة المتحدة)

ما هي التطورات الأخيرة في سوق حلول الخدمات المصرفية الأساسية العالمية؟

- في يوليو 2025، كشفت 10x Banking عن Meta Core، وهي منصة مصرفية سحابية رائدة مصممة لتسريع التحول الرقمي للمؤسسات المالية. تُبسط Meta Core تطوير التطبيقات المصرفية من خلال تجريد عناصر المنتج الشائعة وسجل الحسابات الأساسي، مما يسمح للبنوك ببناء منتجات مخصصة باستخدام 2000 سطر فقط من التعليمات البرمجية. هذا يُقلل بشكل كبير من التعقيد والمخاطر مقارنةً بالأنظمة القديمة. توفر المنصة أمانًا على مستوى المؤسسات، وبنية بيانات جاهزة للذكاء الاصطناعي، وقابلية توسع غير محدودة، مما يُمكّن البنوك من الابتكار بشكل أسرع وخدمة العملاء بفعالية أكبر. تُمثل Meta Core قفزة نوعية نحو تحديث السحابة في القطاع المصرفي.

- في مايو 2025، أطلقت تيمينوس حلاً متطوراً للذكاء الاصطناعي التوليدي، مصمماً لإحداث ثورة في كيفية تعامل البنوك مع بياناتها وتعزيز الكفاءة التشغيلية. بتكامله مع منصتي تيمينوس كور و"التخفيف من الجرائم المالية" (FCM)، يُمكّن هذا الحل المستخدمين من التفاعل مع بيانات مصرفية معقدة من خلال استعلامات باللغة الطبيعية، مما يوفر رؤى فورية ويُسهّل عملية اتخاذ القرارات. يدعم الحل ممارسات ذكاء اصطناعي آمنة وقابلة للتفسير والتدقيق، مما يُساعد البنوك على تعزيز الإنتاجية والامتثال والربحية. يعكس هذا الابتكار التزام تيمينوس بالذكاء الاصطناعي المسؤول، ويُمكّن المؤسسات المالية من إنشاء خدمات فائقة التخصيص وتحسين الأداء في جميع العمليات.

- في أبريل 2025، أعلن بنك زاند، أول بنك رقمي بالكامل في الإمارات العربية المتحدة، عن اعتماده حزمة حلول إنفوسيس فيناكل لتعزيز خدماته المصرفية للشركات. تُمكّن هذه المنصة السحابية، المُستضافة على مايكروسوفت أزور، زاند من تقديم تجربة مصرفية مُركزة على العملاء وجاهزة للمستقبل، مع إمكانيات متقدمة في الذكاء الاصطناعي والتحليلات التنبؤية وتكامل تقنية البلوك تشين. تُسرّع البنية المعيارية وواجهات برمجة التطبيقات المفتوحة لـ فيناكل الابتكار، وتُحسّن قابلية التوسع، وتُبسّط العمليات. تُرسّخ هذه الخطوة الاستراتيجية زاند في طليعة التمويل الرقمي، مما يُمكّنها من تقديم خدمات آمنة ومُخصّصة وفعّالة لعملائها من الشركات.

- في يناير 2025، أقامت 10x Banking وDLT Apps شراكة استراتيجية لإحداث نقلة نوعية في بيانات المؤسسات المالية. من خلال دمج منصة 10x المصرفية السحابية الأساسية مع أدوات TerraAi وMigratIO المدعمة بالذكاء الاصطناعي من DLT Apps، يوفر هذا التعاون مسار نقل سريع وآمن وقابل للتدقيق من الأنظمة القديمة والحديثة. يُمكّن هذا الحل المشترك البنوك من تحميل البيانات بأي تسلسل، والتحقق من صحتها في بيئة مُتحكم بها، والحفاظ على مسارات تدقيق كاملة، مما يضمن سلامة البيانات وجودتها وتقليل وقت التوقف. تُمكّن هذه الشراكة المؤسسات من التحديث بثقة وتسريع رحلة التحول الرقمي.

- في يناير 2025، أعلنت تيمينوس وديلويت عن شراكة استراتيجية لمساعدة المؤسسات المالية الأمريكية على تحديث أنظمتها المصرفية وأنظمة الدفع الأساسية من خلال حلول سحابية. من خلال الجمع بين خبرة ديلويت الاستشارية العميقة ومنصة تيمينوس المصرفية القابلة للتركيب، يهدف هذا التعاون إلى تسريع تقديم تجارب رقمية حديثة مع تقليل التكاليف ومخاطر النشر. كما تدعم الشراكة نماذج الأعمال الناشئة مثل الخدمات المصرفية كخدمة (BaaS) والمدفوعات الفورية، مما يُمكّن البنوك من تعزيز مرونتها التشغيلية وتفاعلها مع العملاء. تُعزز هذه الاستراتيجية المشتركة للتسويق حضور تيمينوس في الولايات المتحدة، وتُمكّن البنوك من تبني التحول الرقمي.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.