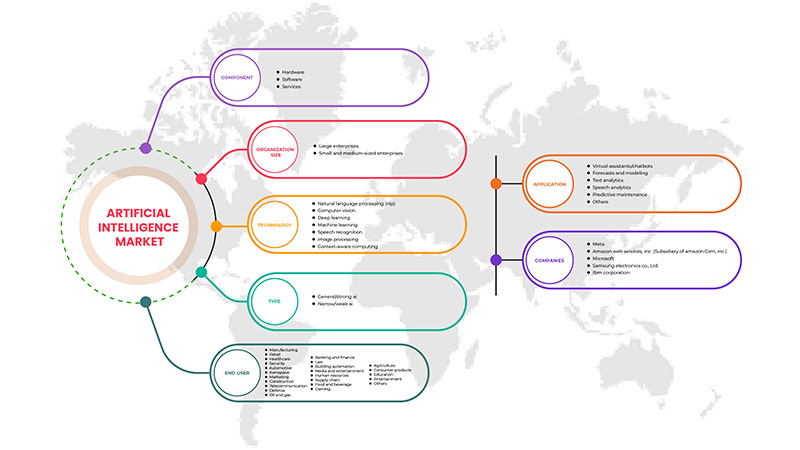

سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي، حسب المكون (الأجهزة والبرامج والخدمات)، النوع (الذكاء الاصطناعي العام/القوي، الذكاء الاصطناعي الضيق/الضعيف)، حجم المنظمة (الشركات الكبيرة، الشركات الصغيرة والمتوسطة)، التكنولوجيا (التعلم الآلي، التعلم العميق، الرؤية الحاسوبية، معالجة اللغة الطبيعية (NLP)، التعرف على الكلام، معالجة الصور، الحوسبة الواعية للسياق)، التطبيق (المساعدون الافتراضيون/روبوتات الدردشة، التوقعات والنمذجة، تحليلات النصوص، تحليلات الكلام، الصيانة التنبؤية، وغيرها)، المستخدم النهائي (التصنيع، التجزئة، الرعاية الصحية، الأمن، السيارات، الفضاء، التسويق، البناء، الاتصالات، الدفاع، النفط والغاز، الخدمات المصرفية والمالية، القانون، أتمتة البناء، وسائل الإعلام والترفيه، الموارد البشرية، سلسلة التوريد، الأغذية والمشروبات، الألعاب، الزراعة، المنتجات الاستهلاكية، التعليم، الترفيه، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل حجم سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي

يتم استخدام الذكاء الاصطناعي لإدارة البيانات والتدفق السلس والأمان من خلال ضمان عمل جميع الموارد بشكل صحيح وفي الموقع الصحيح. تعد التنبؤ والجدولة وإدارة المهارات وإدارة الموارد والمعالجة والحوسبة وتصنيف البيانات كلها جوانب مشتركة للذكاء الاصطناعي. مع التقدم في تكنولوجيا الذكاء الاصطناعي والتحول التدريجي نحو الأنظمة الذكية، سيزدهر سوق الذكاء الاصطناعي في العراق في المستقبل. إن الاستثمارات المتزايدة في أنظمة الذكاء الاصطناعي تدفع سوق الذكاء الاصطناعي في العراق في المقام الأول. بالإضافة إلى ذلك، فإن ارتفاع الطلب على الأنظمة الذكية يغذي السوق للنمو بمعدل سريع. ومع ذلك، فإن التكلفة العالية لتنفيذ حلول الذكاء الاصطناعي هي العامل المقيد الرئيسي الذي يؤثر على نمو السوق. علاوة على ذلك، توفر اتجاهات الصناعة 4.0 المتزايدة فرصًا مربحة لسوق الذكاء الاصطناعي في العراق.

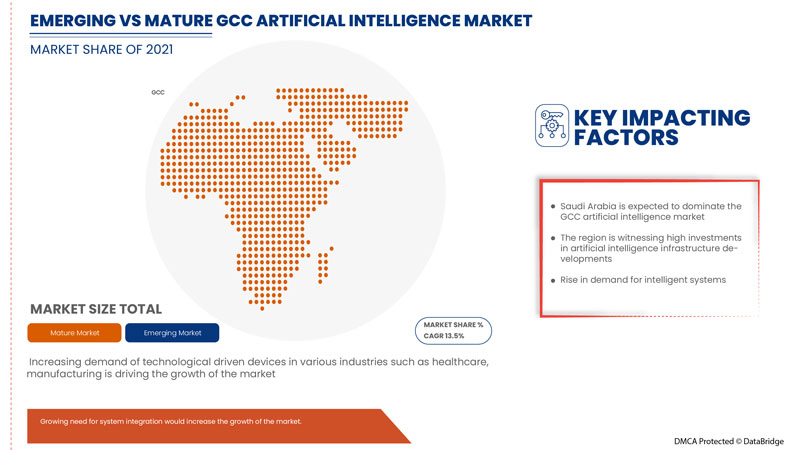

وتشير تحليلات شركة Data Bridge Market Research إلى أن سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي من المتوقع أن يصل إلى 16,391.66 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 13.5% خلال الفترة المتوقعة. وتمثل "الأجهزة" أكبر شريحة مكونات في الذكاء الاصطناعي وتوفر مرافق أساسية ومجموعة واسعة من الميزات مع منصات مختلفة.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

المكون (الأجهزة والبرامج والخدمات)، النوع (الذكاء الاصطناعي العام/القوي، الذكاء الاصطناعي الضيق/الضعيف)، حجم المنظمة (المؤسسات الكبيرة، المؤسسات الصغيرة والمتوسطة الحجم)، التكنولوجيا (التعلم الآلي، التعلم العميق ، الرؤية الحاسوبية، معالجة اللغة الطبيعية (NLP)، التعرف على الكلام، معالجة الصور، الحوسبة الواعية للسياق)، التطبيق (المساعدون الافتراضيون/روبوتات الدردشة، التوقعات والنمذجة، تحليلات النصوص ، تحليلات الكلام، الصيانة التنبؤية، وغيرها)، المستخدم النهائي (التصنيع، التجزئة، الرعاية الصحية، الأمن، السيارات، الفضاء، التسويق، البناء، الاتصالات، الدفاع، النفط والغاز، الخدمات المصرفية والمالية، القانون، أتمتة المباني، وسائل الإعلام والترفيه، الموارد البشرية، سلسلة التوريد، الأغذية والمشروبات، الألعاب، الزراعة، المنتجات الاستهلاكية، التعليم، الترفيه، وغيرها) |

|

الدول المغطاة |

الإمارات العربية المتحدة، المملكة العربية السعودية، قطر، عمان، الكويت، البحرين |

|

الجهات الفاعلة في السوق المشمولة |

NVIDIA Corporation، Intel Corporation، IBM Corporation، Cisco Systems، Inc.، Amazon Web Services، Inc. (شركة تابعة لشركة Amazon.com، Inc.)، Google (شركة تابعة لشركة Alphabet Inc.)، QlikTech International AB، MICROSTRATEGY INCORPORATED، Twerlo، CBOT، WideBot، Inc، DilenyTech، Siemens، SAMSUNG ELECTRONICS CO.، LTD.، Meta، Oracle، SAP SE، Salesforce، Inc.، SAS Institute Inc.، Baidu، Inc.، Hyperlink InfoSystem، CSP Solution، DECE Software Inc.، Rockwell Automation، Inc.، Yesil Science Teknoloji Ltd. Sti.، Microsoft، Huawei Technologies Co.، Ltd.، من بين شركات أخرى |

تعريف السوق

الذكاء الاصطناعي هو مجال يجمع بين علوم الكمبيوتر ومجموعات البيانات القوية لتمكين حل المشكلات. ويشمل أيضًا مجالات فرعية للتعلم الآلي والتعلم العميق، والتي يتم ذكرها كثيرًا بالاقتران بالذكاء الاصطناعي. تتكون هذه التخصصات من خوارزميات الذكاء الاصطناعي التي تسعى إلى إنشاء أنظمة خبيرة تقوم بالتنبؤات أو التصنيفات بناءً على بيانات الإدخال.

يمكن تصنيف الذكاء الاصطناعي إلى ذكاء اصطناعي ضعيف وقوي. الذكاء الاصطناعي الضعيف، والذي يُسمى أيضًا الذكاء الاصطناعي الضيق أو الذكاء الاصطناعي الضيق (ANI)، هو الذكاء الاصطناعي المدرب والمُركز على أداء مهام محددة. يحرك الذكاء الاصطناعي الضعيف معظم الذكاء الاصطناعي الذي يحيط بنا اليوم. قد يكون "الضيق" وصفًا أكثر دقة لهذا النوع من الذكاء الاصطناعي لأنه بعيد كل البعد عن الضعف؛ فهو يمكّن بعض التطبيقات القوية للغاية، مثل Siri من Apple وAmazon's Alexa وIBM Watson والمركبات ذاتية القيادة. يتكون الذكاء الاصطناعي القوي من الذكاء الاصطناعي العام (AGI) والذكاء الاصطناعي الفائق (ASI). الذكاء الاصطناعي العام (AGI)، أو الذكاء الاصطناعي العام، هو شكل نظري للذكاء الاصطناعي حيث يكون للآلة ذكاء مكافئ للبشر؛ سيكون لديها وعي ذاتي يمكنه حل المشكلات والتعلم والتخطيط للمستقبل.

ديناميكيات سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- تزايد الاستثمارات في أنظمة الذكاء الاصطناعي

بدأت الحكومات والشركات في مختلف أنحاء الشرق الأوسط تدرك التحول نحو الذكاء الاصطناعي والتقنيات المتقدمة. ويمتلك الذكاء الاصطناعي القدرة على إحداث تغيير جذري في الأسواق في الشرق الأوسط من خلال إنشاء خدمات جديدة مبتكرة ونماذج أعمال جديدة تمامًا. وبدأت الشركات في مختلف أنحاء الشرق الأوسط في تحويل تركيزها نحو التقنيات الناشئة والمطلوبة مثل الذكاء الاصطناعي.

- أغلب تطبيقات الذكاء الاصطناعي عبر قطاعات مختلفة مثل الرعاية الصحية والخدمات المصرفية والمالية والتأمين والتجارة الإلكترونية والتجزئة

لقد أصبح الذكاء الاصطناعي ضروريًا لأتمتة العديد من المهام المؤسسية والصناعية. يمكن للذكاء الاصطناعي تحسين كفاءة وحدة التصنيع. في الوقت نفسه، يمكنه جعل إدارة الموارد البشرية والتحليل المالي وعمليات اتخاذ القرارات التجارية الأخرى دقيقة. كما يعمل تنفيذ هذه التكنولوجيا على أتمتة العديد من المهام التجارية. بدون تدخل بشري، يمكن للشركات إدارة العديد من المهام من خلال الذكاء الاصطناعي أو التعلم الآلي.

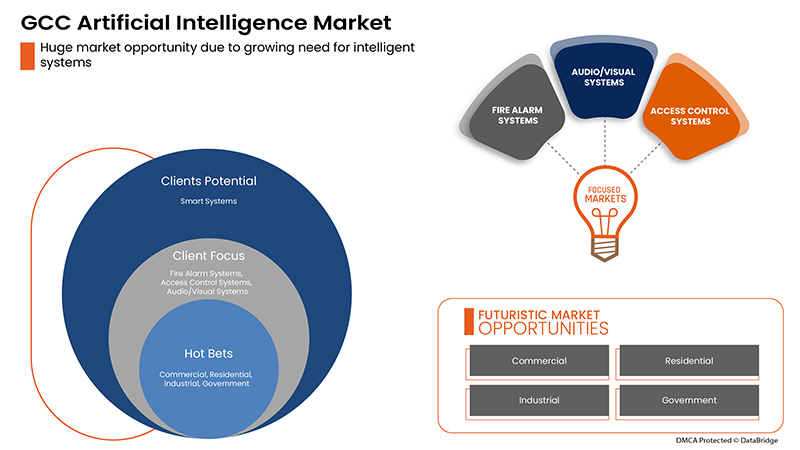

- ارتفاع الطلب على الأنظمة الذكية

الأنظمة الذكية هي آلات متقدمة تكنولوجياً تدرك وتستجيب للعالم من حولها. تشير الأنظمة الذكية إلى أدوات برمجية مختلفة تمكن صناع القرار من الاستفادة من معرفة الخبراء وعمليات اتخاذ القرار في اتخاذ القرارات. يستخدم المصنعون تقنية الذكاء الاصطناعي لجعل الأنظمة ذكية. يثبت الذكاء الآلي أنه أكثر كفاءة من الذكاء البشري في بعض الحالات. لذلك، يمكن للشركات زيادة الإنتاجية من خلال دمج الذكاء الاصطناعي مع أنظمتها.

- تزايد اعتماد تقنية الحوسبة السحابية

في الوقت الحاضر، أصبحت الحوسبة السحابية نموذجًا جديدًا لتقديم الحوسبة كأداة مساعدة. كانت المنظمات تتكيف وتعيد تشكيل نفسها لتلبية متطلبات المستهلكين المتزايدة والمتغيرة باستخدام التكنولوجيا والابتكار والرقمنة. تعمل الخدمات السحابية على إحداث ثورة في العمليات التجارية من خلال الخدمات المدارة. تتبنى الشركات تقنيات الحوسبة السحابية لإدارة ومعالجة البيانات للحصول على رؤى في الوقت الفعلي بشكل فعال. يمكن أن يؤدي استخدام الذكاء الاصطناعي في الحوسبة السحابية إلى تحسين الأداء والكفاءة مع دفع التحول الرقمي للمؤسسة. تعد قدرات الذكاء الاصطناعي في بيئة الحوسبة السحابية أمرًا بالغ الأهمية لجعل العمليات التجارية أكثر كفاءة واستراتيجية ومدفوعة بالرؤى مع توفير المزيد من المرونة والرشاقة وتوفير التكاليف.

القيود

- ارتفاع تكلفة تنفيذ حلول الذكاء الاصطناعي

يشمل الذكاء الاصطناعي كل شيء من برامج الدردشة إلى أنظمة تحليل البيانات، مما يساعد الشركات في جميع أنحاء العالم على إنشاء تجارب مخصصة لتعزيز المبيعات للمستهلكين والمشترين من الشركات. يتطلب تنفيذ وتثبيت نظام الذكاء الاصطناعي بشكل فعال تكلفة عالية ووقتًا طويلاً. يمكن أن تكون التكلفة الحقيقية للذكاء الاصطناعي أكثر تعقيدًا بناءً على الميزات المطلوبة وخط العمل؛ في بعض الأحيان، قد تتجاوز الميزانية تلك المقررة.

- الافتقار إلى الخبرة الفنية

إن التقدم التكنولوجي المتزايد والابتكارات ورقمنة العمليات التجارية تجعل من الصعب على العمال والموظفين والعاملين مطابقة مجموعات مهاراتهم مع احتياجات العمليات المتنامية والمحدثة تكنولوجيًا. وهذا يخلق فجوة في المهارات بين الموظفين والأعمال. هناك نقص في الخبرة الفنية الماهرة مع المؤهلات والمعرفة ذات الصلة مع تحديث التكنولوجيا يوميًا.

تأثير ما بعد كوفيد-19 على الذكاء الاصطناعي

أحدثت جائحة كوفيد-19 تأثيرًا كبيرًا على الذكاء الاصطناعي حيث اختارت كل دولة تقريبًا إغلاق جميع مرافق الإنتاج باستثناء تلك التي تتعامل مع إنتاج السلع الأساسية. اتخذت الحكومة إجراءات صارمة مثل إيقاف إنتاج وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير لمنع انتشار كوفيد-19. كانت الشركات الوحيدة التي تتعامل مع هذا الوباء هي الخدمات الأساسية المسموح لها بالفتح وتشغيل العمليات.

أعاقت تكاليف الاستثمار المحدودة ونقص الموظفين مبيعات مراكز البيانات والإنتاج. ومع ذلك، اعتمدت الحكومة والجهات الفاعلة الرئيسية في السوق تدابير أمان جديدة لتطوير الممارسات. ساهم التقدم التكنولوجي في تصعيد معدل نمو الذكاء الاصطناعي حيث استهدف الجمهور المناسب. ومن المتوقع أن يستعيد سوق بناء مراكز البيانات وتيرته خلال سيناريو ما بعد الوباء بسبب تخفيف القيود.

التطورات الأخيرة

- في ديسمبر 2020، أعلنت شركة Twerlo عن إطلاق حل دعم العملاء المستند إلى واجهة برمجة تطبيقات WhatsApp. تعمل المنتجات على تعزيز تجربة العملاء من خلال بناء حلول تسهل رحلة العميل. لدى Twerlo رؤية تتمثل في تحويل الطرق التي تتواصل بها الشركات مع عملائها. بدأت Twerlo بالفعل في جذب انتباه عمالقة الأعمال في المملكة العربية السعودية. وقد أدى هذا إلى تعزيز عروض الشركة في المنطقة

- في مارس 2022، أعلنت شركة SAP SE عن افتتاح SAP Labs Singapore، وهو مركز للابتكار الرقمي من شأنه أن يعزز المواهب الرقمية المحلية، ويعزز مشاركة النظام البيئي والمجتمع، ويقود ريادة المنتجات. ومن أجل تعزيز سلسلة التوريد الرقمية الثورية، وشبكة الأعمال الذكية، وحلول الاستدامة، سيكون هذا هو الأول من نوعه لشركة SAP في منطقة جنوب شرق آسيا. كما سيتم تحفيز التقنيات العميقة مثل الذكاء الاصطناعي والتعلم الآلي. سيعزز هذا التطور من حضور SAP في المنطقة

نطاق سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي

يتم تقسيم سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي إلى مكون ونوع وحجم منظمة وتكنولوجيا وتطبيق ومستخدم نهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

عنصر

- الأجهزة

- برمجة

- خدمات

على أساس المكون، يتم تقسيم سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي إلى أجهزة وبرامج وخدمات.

يكتب

- الذكاء الاصطناعي العام/القوي،

- الذكاء الاصطناعي الضيق/الضعيف

على أساس النوع، يتم تقسيم سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي إلى الذكاء الاصطناعي العام/القوي، والذكاء الاصطناعي الضيق/الضعيف.

حجم المنظمة

- الشركات الكبيرة

- الشركات الصغيرة

- الشركات المتوسطة الحجم

على أساس حجم المنظمة، يتم تقسيم سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي إلى شركات كبيرة وشركات صغيرة ومتوسطة الحجم.

تكنولوجيا

- التعلم الآلي

- التعلم العميق

- رؤية الكمبيوتر

- معالجة اللغة الطبيعية

- التعرف على الكلام

- معالجة الصور

- الحوسبة الواعية بالسياق

على أساس التكنولوجيا، يتم تقسيم سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي إلى التعلم الآلي، والتعلم العميق، والرؤية الحاسوبية، ومعالجة اللغة الطبيعية (NLP)، والتعرف على الكلام، ومعالجة الصور، والحوسبة الواعية للسياق.

طلب

- المساعدون الافتراضيون/روبوتات الدردشة

- التوقعات والنمذجة

- تحليلات النصوص

- تحليلات الكلام

- الصيانة التنبؤية

- آحرون

على أساس التطبيق، يتم تقسيم سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي إلى مساعدين افتراضيين/روبوتات محادثة، وتوقعات ونمذجة، وتحليلات نصية، وتحليلات كلامية، وصيانة تنبؤية، وغيرها.

المستخدم النهائي

- تصنيع

- بيع بالتجزئة

- الرعاية الصحية

- حماية

- السيارات

- الفضاء الجوي

- تسويق

- بناء

- اتصالات

- الدفاع

- النفط والغاز

- الخدمات المصرفية والمالية

- قانون

- أتمتة المباني

- الإعلام والترفيه

- الموارد البشرية

- الموردين

- الأطعمة والمشروبات

- الألعاب

- زراعة

- المنتجات الاستهلاكية

- تعليم

- ترفيه

- آحرون

على أساس المستخدم النهائي، يتم تقسيم سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي إلى التصنيع، والتجزئة، والرعاية الصحية، والأمن، والسيارات، والفضاء، والتسويق، والبناء، والاتصالات، والدفاع، والنفط والغاز، والخدمات المصرفية والتمويل، والقانون، وأتمتة البناء، والإعلام والترفيه، والموارد البشرية، وسلسلة التوريد، والأغذية والمشروبات، والألعاب، والزراعة، والمنتجات الاستهلاكية، والتعليم، والترفيه، وغيرها.

تحليل/رؤى إقليمية لسوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي

يتم تحليل سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والمكون والنوع وحجم المنظمة والتكنولوجيا والتطبيق والمستخدم النهائي كما هو مذكور أعلاه.

وتشمل بعض الدول التي يغطيها سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي الإمارات العربية المتحدة والمملكة العربية السعودية وقطر وعمان والكويت والبحرين.

ومن المتوقع أن تهيمن المملكة العربية السعودية على سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي بفضل الشركات الكبرى وحجم البيانات الكبير المتدفق عبر المنطقة.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في دول مجلس التعاون الخليجي والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي

يقدم المشهد التنافسي لسوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي تفاصيل حسب المنافس. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والتواجد في المنطقة، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي.

بعض اللاعبين الرئيسيين العاملين في سوق الذكاء الاصطناعي في دول مجلس التعاون الخليجي هم NVIDIA Corporation و Intel Corporation و IBM Corporation و Cisco Systems، Inc. و Amazon Web Services، Inc. (شركة تابعة لشركة Amazon.com، Inc.) و Google (شركة تابعة لشركة Alphabet Inc.) و QlikTech International AB و MICROSTRATEGY INCORPORATED و Twerlo و CBOT و WideBot، Inc و DilenyTech و Siemens و SAMSUNG ELECTRONICS CO.، LTD. و Meta و Oracle و SAP SE و Salesforce، Inc. و SAS Institute Inc. و Baidu، Inc. و Hyperlink InfoSystem و CSP Solution و DECE Software Inc. و Rockwell Automation، Inc. و Yesil Science Teknoloji Ltd. Sti. و Microsoft و Huawei Technologies Co.، Ltd. وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GCC ARTIFICIAL INTELLIGENCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENTS CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 REGULATORY STANDARD

4.3 PESTEL ANALYSIS

4.3.1 POLITICAL FACTORS:

4.3.2 ECONOMIC FACTORS:

4.3.3 SOCIAL FACTORS:

4.3.4 TECHNOLOGICAL FACTORS:

4.3.5 ENVIRONMENTAL FACTORS:

4.3.6 LEGAL FACTORS:

4.4 CASE STUDY

4.4.1 AI/ML ENGINE THAT PREDICTS SPOT-MARKET BROKING RELATED MARKET PRICE FOR TRANSPORTATION AND LOGISTICS LEADER

4.4.2 INTELLIGENT GASOLINE DEMAND ANALYTICS: A CASE STUDY OF SAUDI ARABIA

4.4.3 RELIABILITY AND SECURITY ANALYSIS OF ARTIFICIAL INTELLIGENCE-BASED SELF-DRIVING TECHNOLOGIES IN SAUDI ARABIA: A CASE STUDY OF OPENPILOT

4.5 INVESTMENT POLICY

5 SUMMARY WRITE-UP (GCC)

5.1 OVERVIEW

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING INVESTMENTS IN ARTIFICIAL INTELLIGENCE SYSTEMS

6.1.2 MAJORITY OF APPLICATIONS OF ARTIFICIAL INTELLIGENCE ACROSS DIFFERENT SECTORS SUCH AS HEALTHCARE, BFSI, ECOMMERCE, AND RETAIL

6.1.3 RISE IN DEMAND FOR INTELLIGENT SYSTEMS

6.1.4 RISING ADOPTION OF CLOUD TECHNOLOGY

6.1.5 INCREASING DIGITIZATION AND AUTOMATION OF BUSINESS PROCESSES

6.2 RESTRAINTS

6.2.1 HIGH IMPLEMENTATION COST OF ARTIFICIAL INTELLIGENCE (AI) SOLUTIONS

6.2.2 LACK OF TECHNICAL EXPERTISE

6.3 OPPORTUNITIES

6.3.1 INCREASING INDUSTRY 4.0 TRENDS

6.3.2 GROWING USAGE OF THE INTERNET OF THINGS (IOT)

6.3.3 HEAVY INVESTMENTS BY THE TECH GIANTS IN THE RESEARCH AND DEVELOPMENT

6.3.4 INCREASING GROWTH IN EXPANSION AND STRATEGIC DECISIONS MADE BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DATA SECURITY AND PRIVACY CONCERNS

6.4.2 STRINGENT DATA REGULATION IMPOSED BY GOVERNMENT

7 GCC ARTIFICIAL INTELLIGENCE MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 PROCESSOR

7.3 SOFTWARE

7.3.1 PLATFORM

7.4 SERVICES

7.4.1 PROFESSIONAL SERVICES

8 GCC ARTIFICIAL INTELLIGENCE MARKET, BY TYPE

8.1 OVERVIEW

8.2 GENERAL/STRONG AI

8.3 NARROW/WEEK AI

9 GCC ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM ENTERPRISES

10 GCC ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 MACHINE LEARNING

10.3 DEEP LEARNING

10.4 COMPUTER VISION

10.5 NATURAL LANGUAGE PROCESSING (NLP)

10.6 SPEECH RECOGNITION

10.7 IMAGE PROCESSING

10.8 CONTEXT-AWARE COMPUTING

11 GCC ARTIFICIAL INTELLIGENCE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 VIRTUAL ASSISTANTS/CHABOT'S

11.3 FORECASTS AND MODELLING

11.4 TEXT ANALYTICS

11.5 SPEECH ANALYTICS

11.6 PREDICTIVE MAINTENANCE

11.7 OTHERS

12 GCC ARTIFICIAL INTELLIGENCE MARKET, BY END USER

12.1 OVERVIEW

12.2 MANUFACTURING

12.3 RETAIL

12.4 HEALTHCARE

12.5 SECURITY

12.6 AUTOMOTIVE

12.7 AEROSPACE

12.8 MARKETING

12.9 CONSTRUCTION

12.1 TELECOMMUNICATION

12.11 DEFENSE

12.12 OIL AND GAS

12.13 BANKING AND FINANCE

12.14 LAW

12.15 BUILDING AUTOMATION

12.16 MEDIA AND ENTERTAINMENT

12.17 HUMAN RESOURCE

12.18 SUPPLY CHAIN

12.19 FOOD AND BEVERAGE

12.2 GAMING

12.21 AGRICULTURE

12.22 CONSUMER PRODUCTS

12.23 EDUCATION

12.24 ENTERTAINMENT

12.25 OTHERS

13 GCC ARTIFICIAL INTELLIGENCE MARKET, BY COUNTRY

13.1 SAUDI ARABIA

13.2 U.A.E.

13.3 KUWAIT

13.4 OMAN

13.5 QATAR

13.6 BAHRAIN

14 GCC ARTIFICIAL INTELLIGENCE MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GCC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 META

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 AMAZON WEB SERVICES, INC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 MICROSOFT

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 SAMSUNG ELECTRONICS CO., LTD.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 IBM CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCTS PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BAIDU, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 CBOT

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CISCO SYSTEMS, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SOLUTION PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 CSP SOLUTION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCTS PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 DECE SOFTWARE INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 SOLUTION PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 DILENYTECH

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 HUAWEI TECHNOLOGIES CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 HYPERLINK INFOSYSTEM

16.14.1 COMPANY SNAPSHOT

16.14.2 SERVICE PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 INTEL CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SOLUTION PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 MICROSTRATEGY INCORPORATED

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NUANCE COMMUNICATIONS, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 NVIDIA CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 SOLUTION PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ORACLE

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 SERVICE PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 QLIKTECH INTERNATIONAL AB

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 ROCKWELL AUTOMATION, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SALESFORCE, INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SAP SE

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 SAS INSTITUTE INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 SOLUTION PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SIEMENS

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENTS

16.26 TWERLO

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 WIDEBOT, INC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 YESIL SCIENCE TEKNOLOJI LTD. STI.

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 GCC ARTIFICIAL INTELLIGENCE MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 2 GCC HARDWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 GCC PROCESSOR IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 GCC SOFTWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 GCC PLATFORM IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 GCC SOLUTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 GCC SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 GCC PROFESSIONAL SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 GCC ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 GCC ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 11 GCC ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 GCC MACHINE LEARNING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 GCC ARTIFICIAL INTELLIGENCE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 GCC ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 15 GCC MANUFACTURING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 GCC RETAIL IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 GCC HEALTHCARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 GCC SECURITY IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 GCC AUTOMOTIVE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 GCC AEROSPACE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 21 GCC MARKETING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 GCC CONSTRUCTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 GCC TELECOMMUNICATION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 GCC DEFENSE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 GCC OIL AND GAS IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 GCC BANKING AND FINANCE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 GCC LAW IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 GCC HUMAN RESOURCES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 GCC SUPPLY CHAIN IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 GCC AGRICULTURE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 GCC ARTIFICIAL INTELLIGENCE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 SAUDI ARABIA ARTIFICIAL INTELLIGENCE MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 33 SAUDI ARABIA HARDWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 SAUDI ARABIA PROCESSOR IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 SAUDI ARABIA SOFTWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 SAUDI ARABIA PLATFORM IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 SAUDI ARABIA SOLUTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 SAUDI ARABIA SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 SAUDI ARABIA PROFESSIONAL SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 SAUDI ARABIA ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 SAUDI ARABIA ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 42 SAUDI ARABIA ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 SAUDI ARABIA MACHINE LEARNING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 SAUDI ARABIA ARTIFICIAL INTELLIGENCE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 SAUDI ARABIA ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 SAUDI ARABIA ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 SAUDI ARABIA MANUFACTURING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 SAUDI ARABIA RETAIL IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA HEALTHCARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA SECURITY IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA AUTOMOTIVE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA AEROSPACE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA MARKETING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA CONSTRUCTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA TELECOMMUNICATION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA DEFENSE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA OIL AND GAS IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA BANKING AND FINANCE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA LAW IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA HUMAN RESOURCES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA SUPPLY CHAIN IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA AGRICULTURE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. ARTIFICIAL INTELLIGENCE MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. HARDWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. PROCESSOR IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. SOFTWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. PLATFORM IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. SOLUTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. PROFESSIONAL SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. MACHINE LEARNING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. ARTIFICIAL INTELLIGENCE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 U.A.E. ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 U.A.E. MANUFACTURING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.A.E. RETAIL IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.A.E. HEALTHCARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E. SECURITY IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E. AUTOMOTIVE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.A.E. AEROSPACE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.A.E. MARKETING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. CONSTRUCTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.A.E. TELECOMMUNICATION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.A.E. DEFENSE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.A.E. OIL AND GAS IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E. BANKING AND FINANCE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.A.E. LAW IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.A.E. HUMAN RESOURCES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.A.E. SUPPLY CHAIN IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. AGRICULTURE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 KUWAIT ARTIFICIAL INTELLIGENCE MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 94 KUWAIT HARDWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 KUWAIT PROCESSOR IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 KUWAIT SOFTWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 KUWAIT PLATFORM IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 KUWAIT SOLUTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 KUWAIT SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 KUWAIT PROFESSIONAL SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 KUWAIT ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 KUWAIT ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 103 KUWAIT ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 KUWAIT MACHINE LEARNING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 KUWAIT ARTIFICIAL INTELLIGENCE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 KUWAIT ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 KUWAIT MANUFACTURING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 KUWAIT RETAIL IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 KUWAIT HEALTHCARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 KUWAIT SECURITY IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 KUWAIT AUTOMOTIVE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 KUWAIT AEROSPACE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 KUWAIT MARKETING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 KUWAIT CONSTRUCTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 KUWAIT TELECOMMUNICATION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 KUWAIT DEFENSE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 KUWAIT OIL AND GAS IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 KUWAIT BANKING AND FINANCE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 KUWAIT LAW IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 KUWAIT HUMAN RESOURCES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 KUWAIT SUPPLY CHAIN IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 KUWAIT AGRICULTURE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 OMAN ARTIFICIAL INTELLIGENCE MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 124 OMAN HARDWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 OMAN PROCESSOR IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 OMAN SOFTWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 OMAN PLATFORM IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 OMAN SOLUTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 OMAN SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 OMAN PROFESSIONAL SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 OMAN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 OMAN ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 133 OMAN ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 134 OMAN MACHINE LEARNING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 OMAN ARTIFICIAL INTELLIGENCE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 OMAN ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 OMAN MANUFACTURING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 OMAN RETAIL IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 OMAN HEALTHCARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 OMAN SECURITY IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 OMAN AUTOMOTIVE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 OMAN AEROSPACE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 OMAN MARKETING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 OMAN CONSTRUCTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 OMAN TELECOMMUNICATION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 OMAN DEFENSE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 OMAN OIL AND GAS IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 OMAN BANKING AND FINANCE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 OMAN LAW IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 OMAN HUMAN RESOURCES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 OMAN SUPPLY CHAIN IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 OMAN AGRICULTURE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 QATAR ARTIFICIAL INTELLIGENCE MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 154 QATAR HARDWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 QATAR PROCESSOR IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 QATAR SOFTWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 QATAR PLATFORM IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 QATAR SOLUTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 QATAR SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 QATAR PROFESSIONAL SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 QATAR ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 QATAR ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 163 QATAR ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 164 QATAR MACHINE LEARNING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 QATAR COMMERCIAL IN ARTIFICIAL INTELLIGENCE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 QATAR ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 167 QATAR MANUFACTURING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 QATAR RETAIL IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 QATAR HEALTHCARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 QATAR SECURITY IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 QATAR AUTOMOTIVE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 QATAR AEROSPACE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 QATAR MARKETING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 QATAR CONSTRUCTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 QATAR TELECOMMUNICATION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 QATAR DEFENSE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 QATAR OIL AND GAS IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 QATAR BANKING AND FINANCE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 QATAR LAW IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 QATAR HUMAN RESOURCES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 QATAR SUPPLY CHAIN IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 QATAR AGRICULTURE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 BAHRAIN ARTIFICIAL INTELLIGENCE MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 184 BAHRAIN HARDWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 BAHRAIN PROCESSOR IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 BAHRAIN SOFTWARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 BAHRAIN PLATFORM IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 BAHRAIN SOLUTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 BAHRAIN SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 BAHRAIN PROFESSIONAL SERVICES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 BAHRAIN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 BAHRAIN ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 193 BAHRAIN ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 194 BAHRAIN MACHINE LEARNING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 BAHRAIN ARTIFICIAL INTELLIGENCE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 BAHRAIN ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 197 BAHRAIN MANUFACTURING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 BAHRAIN RETAIL IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 BAHRAIN HEALTHCARE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 BAHRAIN SECURITY IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 BAHRAIN AUTOMOTIVE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 BAHRAIN AEROSPACE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 BAHRAIN MARKETING IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 BAHRAIN CONSTRUCTION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 BAHRAIN TELECOMMUNICATION IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 BAHRAIN DEFENSE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 BAHRAIN OIL AND GAS IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 BAHRAIN BANKING AND FINANCE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 BAHRAIN LAW IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 BAHRAIN HUMAN RESOURCES IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 BAHRAIN SUPPLY CHAIN IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 BAHRAIN AGRICULTURE IN ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 GCC ARTIFICIAL INTELLIGENCE MARKET: SEGMENTATION

FIGURE 2 GCC ARTIFICIAL INTELLIGENCE MARKET: DATA TRIANGULATION

FIGURE 3 GCC ARTIFICIAL INTELLIGENCE MARKET: DROC ANALYSIS

FIGURE 4 GCC ARTIFICIAL INTELLIGENCE MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 GCC ARTIFICIAL INTELLIGENCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GCC ARTIFICIAL INTELLIGENCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GCC ARTIFICIAL INTELLIGENCE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GCC ARTIFICIAL INTELLIGENCE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GCC ARTIFICIAL INTELLIGENCE MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 GCC ARTIFICIAL INTELLIGENCE MARKET: SEGMENTATION

FIGURE 11 RISING INFRASTRUCTURE DEVELOPMENT IS EXPECTED TO BE A KEY DRIVER OF THE MARKET FOR GCC ARTIFICIAL INTELLIGENCE MARKET IN THE FORECAST PERIOD

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GCC ARTIFICIAL INTELLIGENCE MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GCC ARTIFICIAL INTELLIGENCE MARKET

FIGURE 14 CONTRIBUTION OF AI TO MIDDLE EAST GDP BY INDUSTRY, FORECASTED 2030

FIGURE 15 R&D INVESTMENT EXPENDITURE, 2020

FIGURE 16 GCC ARTIFICIAL INTELLIGENCE MARKET: BY COMPONENT, 2021

FIGURE 17 GCC ARTIFICIAL INTELLIGENCE MARKET: BY TYPE, 2021

FIGURE 18 GCC ARTIFICIAL INTELLIGENCE MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 GCC ARTIFICIAL INTELLIGENCE MARKET: BY TECHNOLOGY, 2021

FIGURE 20 GCC ARTIFICIAL INTELLIGENCE MARKET: BY APPLICATION, 2021

FIGURE 21 GCC ARTIFICIAL INTELLIGENCE MARKET: BY END USER, 2021

FIGURE 22 GCC ARTIFICIAL INTELLIGENCE MARKET: SNAPSHOT (2021)

FIGURE 23 GCC ARTIFICIAL INTELLIGENCE MARKET: BY COUNTRY (2021)

FIGURE 24 GCC ARTIFICIAL INTELLIGENCE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 GCC ARTIFICIAL INTELLIGENCE MARKET : BY COUNTRY (2021 & 2029)

FIGURE 26 GCC ARTIFICIAL INTELLIGENCE MARKET : BY OFFERING (2022-2029)

FIGURE 27 GCC ARTIFICIAL INTELLIGENCE MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.