سوق أجهزة المسالك البولية في أوروبا، حسب نوع المنتج (معدات غسيل الكلى، أجهزة علاج حصوات البول، أجهزة التنظير الداخلي، أجهزة علاج تضخم البروستاتا الحميد، سلس البول وهبوط الأعضاء الحوضية وغيرها من المنتجات)، النوع (الأدوات والمواد الاستهلاكية والملحقات)، المؤشرات (أمراض الكلى، فرط نشاط المثانة، البول الدموي، عدوى المسالك البولية، حصوات الكلى، القذف المبكر، تضخم البروستاتا الحميد، سرطان المسالك البولية، هبوط الأعضاء الحوضية، استئصال مجرى البول، تضيق مجرى البول وأمراض أخرى)، التكنولوجيا (الجراحة الأقل توغلاً، الجراحة الروبوتية وغيرها)، المستخدم النهائي (المستشفيات والعيادات ومراكز غسيل الكلى ومختبرات الأبحاث السريرية والمعاهد الأكاديمية وغيرها)، قناة التوزيع (العطاءات المباشرة، التوزيع من قبل أطراف ثالثة وغيرها)، الدولة (ألمانيا والمملكة المتحدة وفرنسا وإيطاليا وإسبانيا وهولندا وروسيا وتركيا وسويسرا وبقية أوروبا) الصناعة الاتجاهات والتوقعات حتى عام 2029.

تحليل السوق والرؤى : سوق أجهزة المسالك البولية في أوروبا

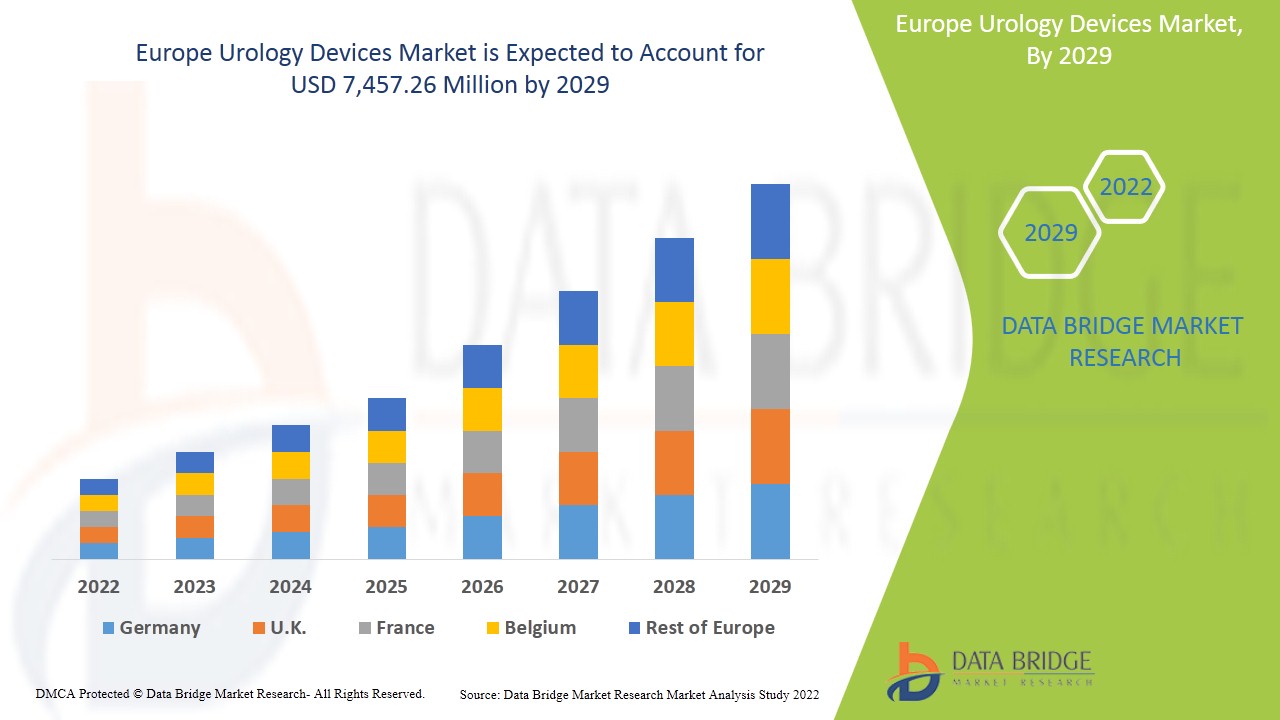

من المتوقع أن يحقق سوق أجهزة المسالك البولية في أوروبا نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 7.8٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 7457.26 مليون دولار أمريكي بحلول عام 2029. تعمل نفقات الرعاية الصحية المتزايدة والاهتمام المتزايد بالجراحة الأقل توغلاً كمحرك لنمو سوق أجهزة المسالك البولية.

أجهزة ومستلزمات المسالك البولية هي منتجات مصممة للأشخاص الذين يعانون من أمراض المسالك البولية واحتباس البول ويحتاجون إلى المساعدة في إخراج البول من الجسم. تشمل أمراض المسالك البولية أو الحالات التهابات المسالك البولية وحصوات الكلى ومشاكل التحكم في المثانة ومشاكل البروستاتا والمزيد. تشمل أجهزة المسالك البولية مجموعة واسعة من المنتجات مثل طاولات العمليات في المسالك البولية وطاولات الفحص البولي والكراسي وأنظمة التصوير بالموجات فوق الصوتية للمسالك البولية وماسحات المثانة وأنظمة الديناميكية البولية وأجهزة قياس تدفق البول وأجهزة تفتيت الحصى داخل الجسم وأجهزة تفتيت الحصى خارج الجسم وأجهزة الليزر البولية وملقط المسالك البولية وإبر خزعة البروستاتا والشبكات والدعامات والقسطرة ومجموعات وأكياس الصرف والمحفزات والمجسات ومجموعات اختبار السرطان والغرسات. تُستخدم هذه الأجهزة في كل من إجراءات التشخيص وعلاج المسالك البولية. تشمل إجراءات المسالك البولية الشائعة التي يتم إجراؤها قطع القناة المنوية وعكس قطع القناة المنوية وتنظير المثانة وإجراء البروستاتا وتفتيت الحصى وغير ذلك الكثير. تستمر بعض حالات المسالك البولية لفترة قصيرة فقط بينما تستمر حالات أخرى لفترة طويلة. الأعراض الشائعة لمشاكل المسالك البولية هي صعوبة التبول، والألم أو الحرقان أثناء التبول، والدم أو إفرازات أخرى في البول، والحمى، والقشعريرة، وآلام أسفل الظهر، وألم في الأعضاء التناسلية.

يشهد سوق أجهزة المسالك البولية في أوروبا نموًا في عام التوقعات بسبب زيادة عدد اللاعبين في السوق وتوافر المنتجات المتقدمة بسبب زيادة حالات أمراض المسالك البولية. إلى جانب ذلك، يشارك المصنعون في أنشطة البحث والتطوير لإطلاق منتجات جديدة في السوق مع موافقات ناجحة على المنتجات. ومع ذلك، فإن التكلفة العالية لأجهزة المسالك البولية والافتقار إلى الوعي بعلاج المسالك البولية والأجهزة التي تم سحب منتجاتها قد تعيق نمو سوق أجهزة المسالك البولية في أوروبا في فترة التوقعات.

إن ارتفاع الإنفاق على الرعاية الصحية والاهتمام المتزايد بالجراحة الأقل توغلاً يشكلان فرصًا لنمو السوق. كما أن المبادرات الاستراتيجية التي يتخذها اللاعبون في السوق تمنح السوق المزيد من الفرص لتحسين العلاج. ومع ذلك، فإن الافتقار إلى المهنيين المهرة والإطار التنظيمي الصارم يشكلان تحديًا لنمو السوق.

يقدم تقرير سوق أجهزة المسالك البولية تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو سوق أجهزة المسالك البولية، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق سوق أجهزة المسالك البولية وحجم السوق

يتم تصنيف سوق أجهزة المسالك البولية في أوروبا إلى ستة قطاعات بارزة بناءً على نوع المنتج والنوع والمؤشر والتكنولوجيا والمستخدم النهائي وقناة التوزيع. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في أسواقك المستهدفة.

- على أساس نوع المنتج، يتم تقسيم سوق أجهزة المسالك البولية في أوروبا إلى معدات غسيل الكلى، وأجهزة علاج حصوات البول، وأجهزة التنظير الداخلي، وأجهزة علاج تضخم البروستاتا الحميد، وسلس البول وهبوط الأعضاء الحوضية وغيرها من المنتجات. في عام 2022، من المتوقع أن تهيمن شريحة معدات غسيل الكلى على السوق بسبب زيادة أمراض الكلى والعدد الكبير من السكان المستهدفين.

- على أساس النوع، يتم تقسيم سوق أجهزة المسالك البولية في أوروبا إلى أدوات ومواد استهلاكية وملحقات. في عام 2022، من المتوقع أن تهيمن شريحة الأدوات على السوق بسبب الموافقات العالية للمنتجات في المنطقة للاعبين في السوق.

- على أساس المؤشرات، يتم تقسيم سوق أجهزة المسالك البولية في أوروبا إلى أمراض الكلى، وفرط نشاط المثانة، وبيلة دموية، والتهابات المسالك البولية، وحصوات الكلى، والقذف المبكر، وفرط تنسج البروستاتا الحميد، وسرطان المسالك البولية، وهبوط الأعضاء الحوضية، واستئصال مجرى البول، وتضيق مجرى البول وأمراض أخرى. في عام 2022، من المتوقع أن تهيمن شريحة أمراض الكلى على السوق بسبب عادات الأكل غير السليمة وارتفاع الأمراض المرتبطة بنمط الحياة.

- على أساس التكنولوجيا، يتم تقسيم سوق أجهزة المسالك البولية في أوروبا إلى الجراحة الأقل توغلاً والجراحة الروبوتية وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة الجراحة الأقل توغلاً على السوق بسبب التقدم التكنولوجي العالي في شريحة الجراحة الأقل توغلاً من أجل راحة أفضل للمرضى.

- على أساس المستخدم النهائي، يتم تقسيم سوق أجهزة المسالك البولية في أوروبا إلى المستشفيات والعيادات ومراكز غسيل الكلى ومختبرات الأبحاث السريرية والمعاهد الأكاديمية وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة المستشفيات والعيادات على السوق بسبب التمويل الحكومي المرتفع لمرافق المعدات الأفضل في المستشفيات.

- على أساس قناة التوزيع، يتم تقسيم سوق أجهزة المسالك البولية في أوروبا إلى عطاءات مباشرة وتوزيع من قبل أطراف ثالثة وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة العطاءات المباشرة على السوق لأنها توفر منتجات أفضل بجودة جيدة.

تحليل سوق أجهزة المسالك البولية على مستوى الدولة

يتم تصنيف سوق أجهزة المسالك البولية في أوروبا إلى ستة قطاعات بارزة بناءً على نوع المنتج والنوع والمؤشر والتكنولوجيا والمستخدم النهائي وقناة التوزيع.

الدول التي يغطيها تقرير سوق أجهزة المسالك البولية هي ألمانيا والمملكة المتحدة وإيطاليا وفرنسا وإسبانيا وسويسرا وروسيا وتركيا وهولندا وبقية أوروبا.

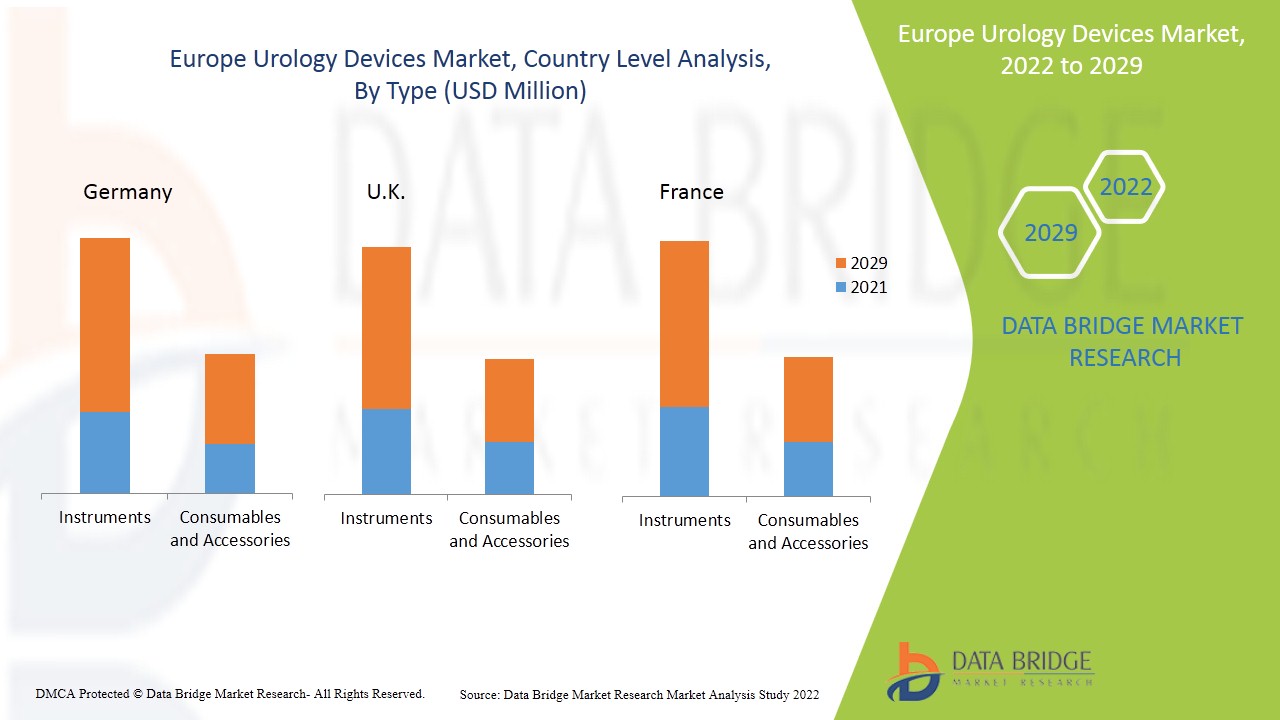

من المتوقع أن ينمو قطاع الأدوات في ألمانيا بأعلى معدل نمو في الفترة المتوقعة من 2022 إلى 2029 بسبب زيادة انتشار أمراض المسالك البولية. يحتل قطاع الأدوات في المملكة المتحدة المرتبة الثانية في الهيمنة على السوق الأوروبية بسبب زيادة حالات أمراض الكلى وأنشطة البحث والتطوير العالية. تحتل فرنسا المرتبة الثالثة في نمو السوق الأوروبية ويهيمن قطاع الأدوات في هذا البلد بسبب زيادة عدد مراكز التكنولوجيا الحيوية وأنشطة البحث.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية الأوروبية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل توقعات لبيانات الدولة.

إن الأنشطة الاستراتيجية المتنامية التي يقوم بها كبار اللاعبين في السوق لتعزيز الوعي بعلاج أجهزة المسالك البولية، تعمل على تعزيز نمو سوق أجهزة المسالك البولية.

يوفر لك سوق أجهزة المسالك البولية أيضًا تحليلًا تفصيليًا للسوق لكل نمو في سوق معين. بالإضافة إلى ذلك، يوفر معلومات تفصيلية حول استراتيجية اللاعبين في السوق ووجودهم الجغرافي. البيانات متاحة للفترة التاريخية من 2011 إلى 2020.

تحليل المنافسة وحصة سوق أجهزة المسالك البولية

يوفر المشهد التنافسي لسوق أجهزة المسالك البولية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة فيما يتعلق بسوق أجهزة المسالك البولية.

الشركات الكبرى التي تتعامل في أجهزة المسالك البولية هي Medtronic وSiemens وCooperSurgical, Inc. وGeneral Electric وBD وStryker وBoston Scientific Corporation وCardinal Health. وIntuitive Surgical. وCook وOlympus Corporation وMed pro Medical BV وFresenius Medical Care AG & Co. KGaA وBaxter. وRichard Wolf GmbH. وDornier MedTech. وKARL STORZ SE & Co. Kg وDale Medical Products, Inc. وHealthtronics, Inc. وMedi Tech Devices Pvt. Ltd. وColoplast Corp. وRemington MEDICAL وMedi-Globe GmbH وNikkiso Co., Ltd. وB. Braun Melsungen AG وLumenis Be Ltd. وTeleflex Incorporated وUrocare Products, Inc. وDynarex Corporation ومن بين اللاعبين المحليين الآخرين. يفهم محللو DBMR نقاط القوة التنافسية ويقدمون تحليلًا تنافسيًا لكل منافس على حدة.

كما يتم أيضًا إبرام العديد من العقود والاتفاقيات من قبل الشركات في جميع أنحاء العالم والتي تعمل أيضًا على تسريع سوق أجهزة المسالك البولية.

على سبيل المثال،

- في يناير 2022، استحوذت شركة سترايكر (الولايات المتحدة) على شركة فوسيرا كوميونيكيشنز (الولايات المتحدة) وهي شركة رائدة في فئة تنسيق الرعاية الرقمية والاتصالات. ساعد هذا الاستحواذ الشركة في توسيع المحفظة المبتكرة لقسم سترايكر الطبي مما دفع نمو السوق

- في أكتوبر 2021، أعلنت شركة ميدترونيك أن الشركة حصلت على علامة CE لمنتجها "نظام الجراحة بمساعدة الروبوت هوغو" الذي تم ترخيصه للبيع في أوروبا. أدى اعتماد علامة CE إلى زيادة جودة المنتجات في الإجراءات البولية وأمراض النساء التي تشكل حوالي نصف جميع الإجراءات الروبوتية التي يتم إجراؤها اليوم. أدى هذا إلى تحسين موقف الشركة في السوق

- في نوفمبر 2020، أعلنت شركة Coloplast Corp. أنها استحوذت على شركة Nine Continents Medical, Inc. وهي شركة في مرحلة مبكرة رائدة في علاج تحفيز العصب الظنبوبي القابل للزرع للمثانة المفرطة النشاط. ساعد هذا الاستحواذ الشركة في تحسين الفرص في مجال طب المسالك البولية التدخلي لتقديم حلول مبتكرة للسوق

إن التعاون وإطلاق المنتج وتوسيع الأعمال والجوائز والتقدير والمشاريع المشتركة والاستراتيجيات الأخرى التي يتبعها اللاعب في السوق تعمل على تعزيز بصمة الشركة في سوق مضخات التسريب البيطرية مما يوفر أيضًا فائدة لنمو أرباح المنظمة.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE UROLOGY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET INDICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GLOBAL MEDICAL DEVICES GROWTH TRENDS - OVERVIEW

4.2 PESTEL

4.3 PORTER'S FIVE FORCES MODEL

5 EUROPE UROLOGY DEVICES MARKET: REGULATIONS

5.1 U.S.

5.2 EUROPE

5.3 GERMANY

5.4 ITALY

5.5 SPAIN

5.6 RUSSIA

5.7 NETHERLANDS

5.8 SWITZERLAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN RESEARCH AND DEVELOPMENT OF UROLOGY MEDICAL DEVICES

6.1.2 RISE IN INCIDENCE OF UROLOGY CONDITIONS IN EUROPE

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN UROLOGICAL DEVICES

6.1.4 RISE IN GERIATRIC POPULATION

6.1.5 RISE IN PRODUCT APPROVALS

6.2 RESTRAINTS

6.2.1 RISE IN COST OF UROLOGY DEVICES AND TREATMENT OF UROLOGICAL CONDITIONS

6.2.2 RISKS OBSERVED WHILE USING UROLOGICAL DEVICES

6.2.3 RISE IN PRODUCT RECALL

6.2.4 LACK OF AWARENESS ABOUT TREATMENT FOR UROLOGICAL CONDITIONS

6.3 OPPORTUNITIES/

6.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.3.3 INCREASED USE OF MINIMALLY INVASIVE SURGICAL DEVICES

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS REQUIRED FOR USE OF UROLOGY DEVICES

6.4.2 STRINGENT REGULATIONS

7 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS/ SERVICE PROVIDERS

7.5 CONCLUSION

8 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIALYSIS EQUIPMENT

8.3 URINARY STONE TREATMENT DEVICES

8.4 ENDOSCOPY DEVICES

8.5 URINARY INCONTINENCE & PELVIC ORGAN PROLAPSED

8.6 BENIGN PROSTATIC HYPERPLASIA TREATMENT DEVICES

8.7 OTHER PRODUCTS

9 EUROPE UROLOGY DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 INSTRUMENTS

9.2.1 DIALYSIS DEVICES

9.2.1.1 CENTER-USE HEMODIALYSIS MACHINES

9.2.1.2 HOME-USE HEMODIALYSIS MACHINES

9.2.2 LASERS AND LITHOTRIPSY DEVICES

9.2.2.1 UROLOGY LASERS

9.2.2.2 LITHOTRIPTERS

9.2.2.2.1 INTRACORPOREAL LITHOTRIPTERS

9.2.2.2.2 EXTRACORPOREAL LITHOTRIPTERS

9.2.3 ENDOSCOPES AND ENDOVISION SYSTEMS

9.2.4 OTHER INSTRUMENT

9.3 CONSUMABLES AND ACCESSORIES

9.3.1 DIALYSIS CONSUMABLES

9.3.1.1 DIALYZERS

9.3.1.2 HEMODIALYSIS CONCENTRATES

9.3.1.2.1 ACIDIC

9.3.1.2.2 ALKALINE

9.3.1.3 BLOODLINES

9.3.1.4 OTHERS

9.3.2 GUIDEWIRES AND CATHETERS

9.3.2.1 URETERAL CATHETERES

9.3.2.2 NEPHROSTOMY CATHETERES

9.3.2.3 VESICAL CATHETERES

9.3.2.4 CYSTOMETRY CATHETERES

9.3.2.5 RECTAL PRESSURE MONITORING CATHETERS

9.3.2.6 OTHER CATHETERS

9.3.3 STENTS

9.3.3.1 URETHRAL STENTS

9.3.3.2 URETERAL STENTS

9.3.3.3 PROSTATIC STENTS

9.3.4 ENDOSCOPIC BASKETS

9.3.5 BIOPSY DEVICES

9.3.5.1 PROSTATE BIOPSY NEEDLES

9.3.5.2 OTHERS

9.3.6 PELVIC IMPLANTS

9.3.7 MESHES

9.3.8 MORCELLATORS

9.3.9 OTHER CONSUMABLES AND ACCESSORIES

10 EUROPE UROLOGY DEVICES MARKET, BY INDICATION

10.1 OVERVIEW

10.2 KIDNEY DISEASES

10.3 KIDNEY STONES

10.4 UROLOGICAL CANCER

10.5 PELVIC ORGAN PROLAPSE

10.6 BENIGN PROSTATIC HYPERPLASIA

10.7 HEMATURIA

10.8 URINARY TRACT INFECTIONS

10.9 URETHROTOMIES

10.1 OVERACTIVE BLADDER

10.11 PREMATURE EJACULATION

10.12 URETHRAL STRICTURE

10.13 OTHER DISEASE

11 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 MINIMALLY INVASIVE SURGERY

11.3 ROBOTIC SURGERY

11.4 OTHERS

12 EUROPE UROLOGY DEVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS & CLINICS

12.3 DIALYSIS CENTERS

12.4 CLINICAL RESEARCH LABORATORIES

12.5 ACADEMIC INSTITUTES

12.6 OTHERS

13 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 THIRD PARTY DISTRIBUTORS

13.4 OTHERS

14 EUROPE UROLOGY DEVICES MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 SPAIN

14.1.6 RUSSIA

14.1.7 SWITZERLAND

14.1.8 NETHERLANDS

14.1.9 TURKEY

14.1.10 REST OF EUROPE

15 EUROPE UROLOGY DEVICES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 FRESENIUS SE & CO. KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 BAXTER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 BOSTON SCIENTIFIC CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 OLYMPUS CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 B. BRAUN MELSUNGEN AG

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 BD

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 MEDTRONIC

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 COOPERSURGICAL INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 COLOPLAST CORP

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.9.5 ACQUISITION

17.1 CARDINAL HEALTH

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 COOK

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 DORNIER MEDTECH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 DALE MEDICAL PRODUCTS, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.13.4 DEVELOPMENT

17.14 DYNAREX CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GENERAL ELECTRIC

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.15.5 ACQUISITION

17.16 HEALTHTRONICS, INC

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.16.4 ACQUISITION

17.17 INTUITIVE SURGICAL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 KARL STORZ SE & CO KG,TUTTLINGEN

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 LUMENIS BE LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.19.4 PRODUCT LAUNCHES

17.2 MEDI GLOBE GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 MEDI TECH DEVICES PVT. LTD.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 MED PRO MEDICAL B.V.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 NIKKISO CO., LTD.

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 REMINGTON MEDICAL

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 RICHARD WOLF GMBH

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 STRYKER

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENTS

17.26.5 ACQUISITION

17.27 SIEMENS HEALTHCARE GMBH

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT DEVELOPMENTS

17.27.5 ACQUISITION

17.28 TELEFLEX INCORPORATED.

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENTS

17.28.5 PRODUCT LAUNCH

17.29 UROCARE PRODUCTS, INC.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE GUIDEWIRES AND CATHETERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 16 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 EUROPE UROLOGY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 EUROPE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 33 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 GERMANY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 GERMANY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 GERMANY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 GERMANY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 GERMANY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 GERMANY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 GERMANY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 GERMANY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 47 GERMANY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 GERMANY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 GERMANY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 U.K. UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.K. INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.K. LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.K. CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.K. HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.K. UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 63 U.K. UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 U.K. UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 U.K. UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 FRANCE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 FRANCE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 FRANCE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 79 FRANCE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 80 FRANCE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 FRANCE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 ITALY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 ITALY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 ITALY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 ITALY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ITALY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 ITALY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ITALY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 ITALY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 ITALY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 95 ITALY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 ITALY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 97 ITALY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 SPAIN UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SPAIN CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SPAIN DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SPAIN HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SPAIN GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SPAIN STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SPAIN BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SPAIN UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 111 SPAIN UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 SPAIN UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 113 SPAIN UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 RUSSIA DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 RUSSIA GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 RUSSIA BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 RUSSIA UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 127 RUSSIA UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 SWITZERLAND LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 SWITZERLAND CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SWITZERLAND DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 SWITZERLAND HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SWITZERLAND GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 SWITZERLAND STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 SWITZERLAND BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 SWITZERLAND UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 143 SWITZERLAND UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 SWITZERLAND UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 NETHERLANDS UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 NETHERLANDS DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 NETHERLANDS CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 NETHERLANDS HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 NETHERLANDS STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 NETHERLANDS UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 159 NETHERLANDS UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 NETHERLANDS UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 162 TURKEY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 TURKEY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 TURKEY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 TURKEY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 TURKEY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 TURKEY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 TURKEY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 TURKEY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 TURKEY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 TURKEY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 175 TURKEY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 176 TURKEY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 TURKEY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 REST OF EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE UROLOGY DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE UROLOGY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE UROLOGY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE UROLOGY DEVICES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE UROLOGY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE UROLOGY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE UROLOGY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE UROLOGY DEVICES MARKET: INDICATION COVERAGE GRID

FIGURE 9 EUROPE UROLOGY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE UROLOGY DEVICES MARKET: SEGMENTATION

FIGURE 11 RISING PREVALENCE OF UROLOGICAL DISORDERS IS EXPECTED TO DRIVE THE EUROPE UROLOGY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DIALYSIS EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE UROLOGY DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE UROLOGY DEVICES MARKET

FIGURE 14 ESTIMATED COUNT OF WOMEN SUFFERING FROM URINARY INCONTINENCE IN 2021 IN THE U.S.

FIGURE 15 PROSTATE CANCER INCIDENCE IN EUROPEAN REGION IN 2021

FIGURE 16 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 18 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 19 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 EUROPE UROLOGY DEVICES MARKET: BY TYPE, 2021

FIGURE 21 EUROPE UROLOGY DEVICES MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 22 EUROPE UROLOGY DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 EUROPE UROLOGY DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, 2021

FIGURE 25 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 26 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 27 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 28 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, 2021

FIGURE 29 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 30 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 31 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 32 EUROPE UROLOGY DEVICES MARKET: BY END USER, 2021

FIGURE 33 EUROPE UROLOGY DEVICES MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 34 EUROPE UROLOGY DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 35 EUROPE UROLOGY DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 37 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 38 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 39 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 EUROPE UROLOGY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 41 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 42 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 45 EUROPE UROLOGY DEVICES MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.