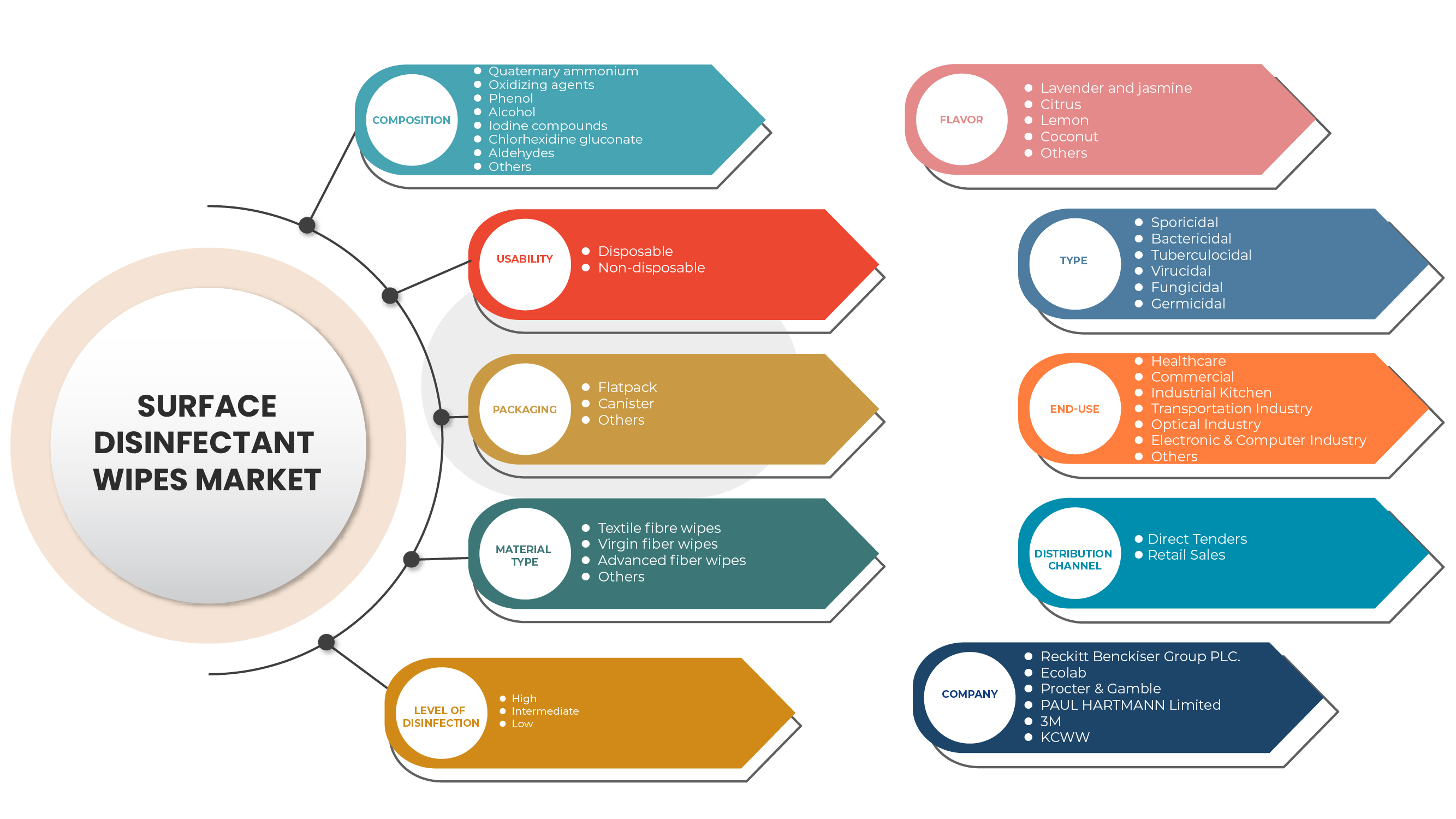

سوق مناديل تطهير الأسطح في أوروبا، حسب التركيب (رباعي الأمونيوم، عوامل الأكسدة، الفينول، الكحول، مركبات الكلور، مركبات اليود، جلوكونات الكلورهيكسيدين، الألدهيدات ، وغيرها)، قابلية الاستخدام ( للتخلص منها وغير للتخلص منها)، التغليف (عبوة مسطحة، علبة وغيرها)، نوع المادة (مناديل الألياف النسيجية، مناديل الألياف البكر، مناديل الألياف المتقدمة وغيرها)، مستويات التطهير (عالية ومتوسطة ومنخفضة)، النكهة (الخزامى والياسمين والحمضيات والليمون وجوز الهند وغيرها)، النوع (مبيد للجراثيم، مبيد للجراثيم، مبيد للفيروسات، مبيد للفطريات ومبيد للجراثيم)، الاستخدام النهائي (الرعاية الصحية، التجارية، المطبخ الصناعي، صناعة النقل، الصناعة البصرية، الصناعة الإلكترونية والكمبيوتر وغيرها)، قناة التوزيع (العطاءات المباشرة ومبيعات التجزئة)، اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والرؤى

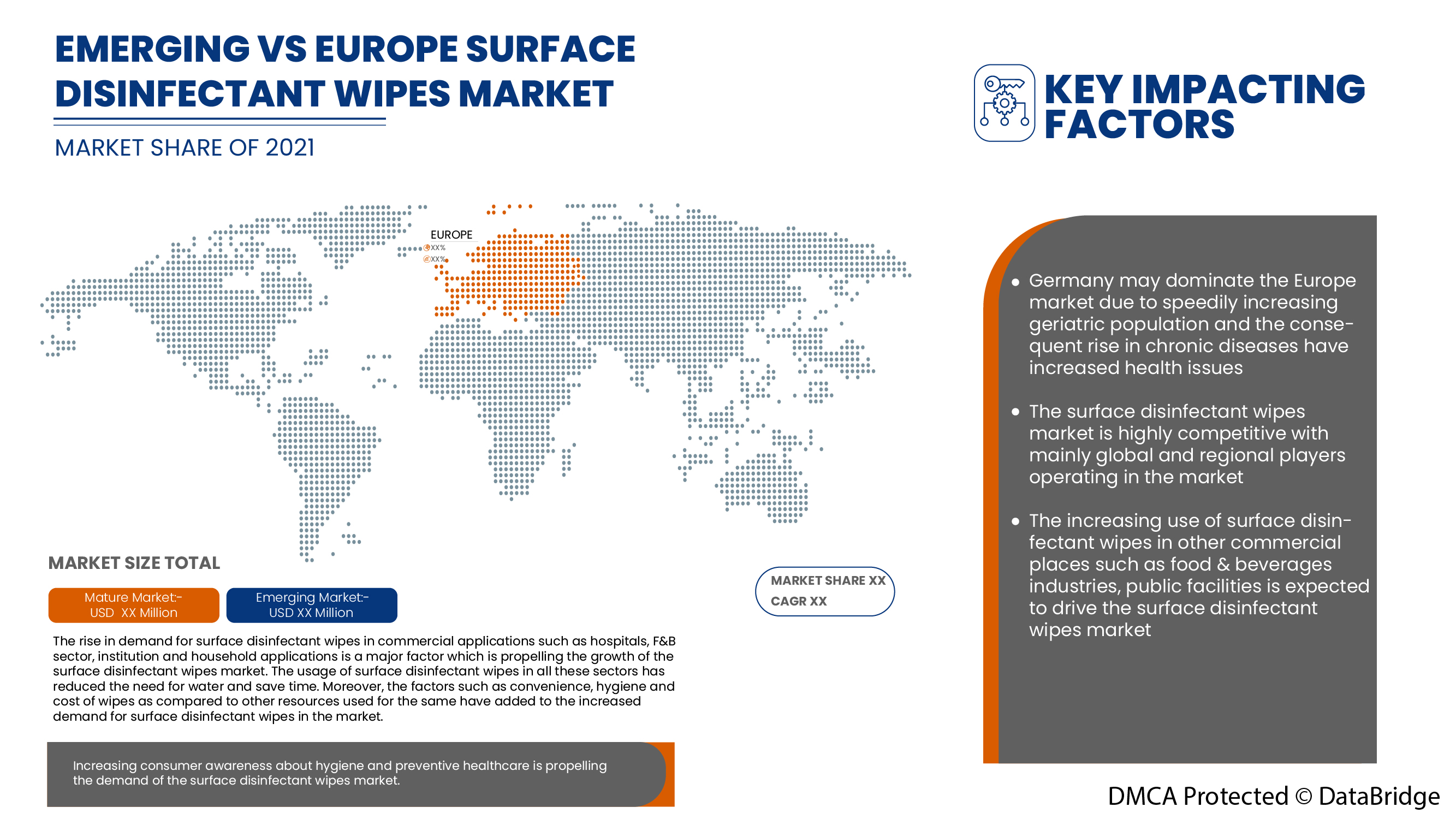

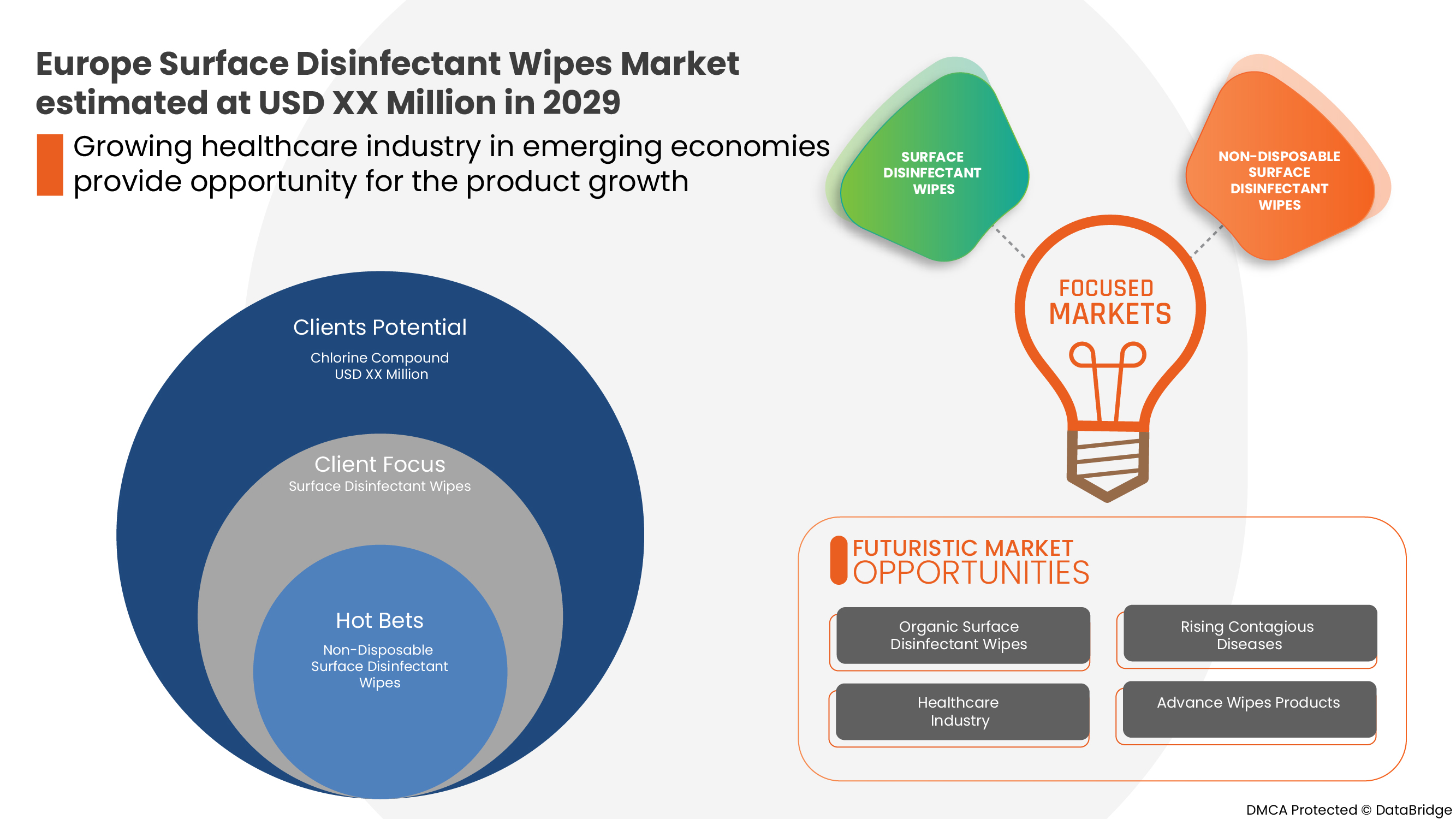

يشهد سوق مناديل تطهير الأسطح في أوروبا نموًا كبيرًا بسبب نمو صناعة الرعاية الصحية والطلب على مناديل تطهير الأسطح المنكهة. كما أن زيادة الطلب على أنواع مختلفة من مناديل تطهير الأسطح بسبب زيادة الأمراض المعدية تعمل أيضًا على تعزيز نمو سوق مناديل تطهير الأسطح في أوروبا.

ومع ذلك، من المتوقع أن تعمل اللوائح الحكومية الصارمة المرتبطة بتقلب أسعار المواد الخام على كبح نمو سوق مناديل تطهير الأسطح خلال الفترة المتوقعة.

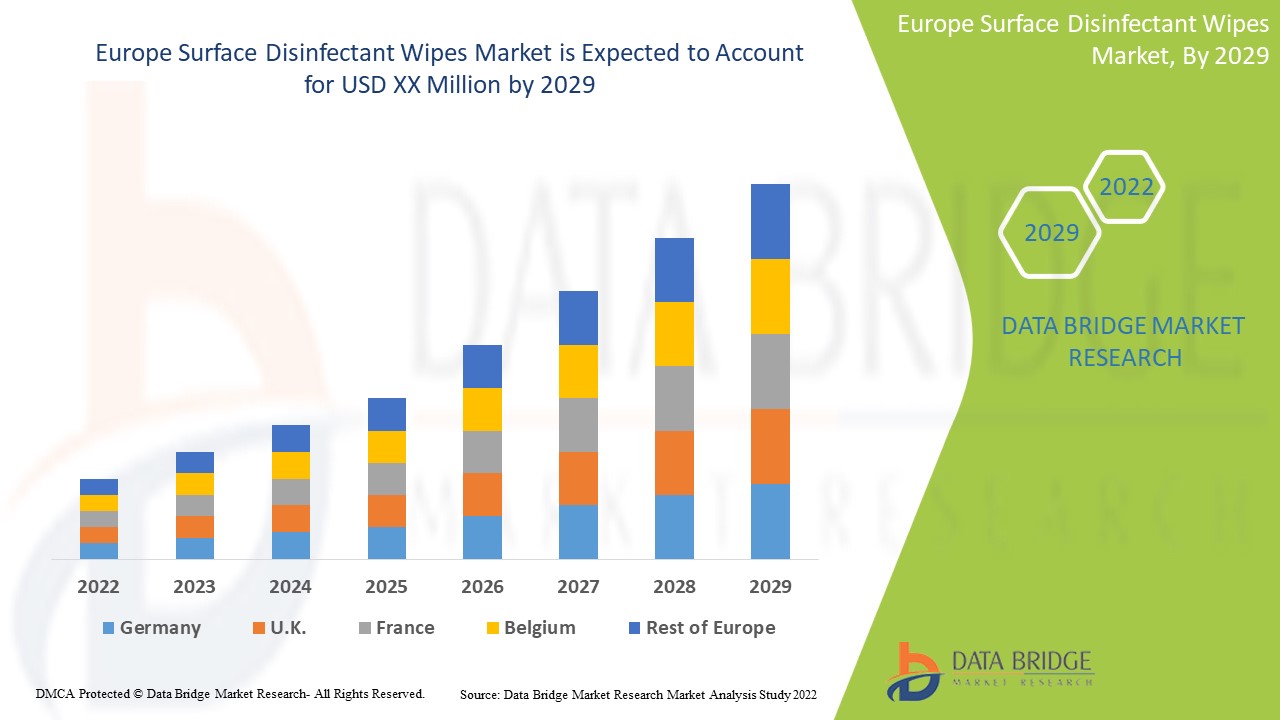

تشير تحليلات Data Bridge Market Research إلى أن سوق مناديل تطهير الأسطح في أوروبا سينمو بمعدل نمو سنوي مركب قدره 6.5٪ خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنة تاريخية |

2020 (قابلة للتخصيص حتى 2019-2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب التركيب (أمونيوم رباعي، عوامل مؤكسدة، فينول، كحول، مركبات الكلور، مركبات اليود، جلوكونات الكلورهيكسيدين، ألدهيدات، وغيرها)، قابلية الاستخدام (للاستخدام مرة واحدة وغير مرة واحدة)، التغليف (عبوة مسطحة، علبة وغيرها)، نوع المادة (مناديل الألياف النسيجية، مناديل الألياف البكر، مناديل الألياف المتقدمة وغيرها)، مستويات التطهير (عالية ومتوسطة ومنخفضة)، النكهة (الخزامى والياسمين والحمضيات والليمون وجوز الهند وغيرها)، النوع (قاتل للجراثيم، قاتل للجراثيم السلية، قاتل للفيروسات، قاتل للفطريات ومبيد للجراثيم)، الاستخدام النهائي (الرعاية الصحية، التجارية، المطبخ الصناعي، صناعة النقل، الصناعة البصرية، الصناعة الإلكترونية والكمبيوتر وغيرها)، قناة التوزيع (العطاءات المباشرة ومبيعات التجزئة)، اتجاهات الصناعة والتوقعات حتى عام 2029 |

|

الدول المغطاة |

ألمانيا، المملكة المتحدة، فرنسا، إيطاليا، إسبانيا، روسيا، هولندا، سويسرا، بلجيكا، تركيا وبقية أوروبا |

|

الجهات الفاعلة في السوق المشمولة |

Parker Laboratories, Inc، GOJO Industries, Inc.، PDI, Inc.، Metrex Research, LLC، Ecolab، 3M، Cantel Medical، Contec, Inc.، KCWW، Pal International، Reckitt Benckiser Group plc، Diversey Holdings LTD، Dreumex USA Inc.، Medline Industries, LP، Spartan Chemical Company, Inc.، Procter & Gamble، STERIS، Johnson & Son Inc.، Colgate-Palmolive Company، Zep Inc. وPAUL HARTMANN Limited |

تعريف السوق

تُستخدم المناشف الصغيرة المبللة مسبقًا أو المناديل المبللة لتنظيف الأسطح لإزالة الأوساخ والميكروبات، على سبيل المثال، المكورات العنقودية والسالمونيلا، وقد توضع على السطح المصاب من الأطعمة أو الأشخاص أو الحيوانات. غالبًا ما تكون معطرة برائحة لطيفة، على سبيل المثال، الحمضيات أو الصنوبر، وتُعرف باسم المناديل.

توفر مناديل تطهير الأسطح طريقة بسيطة للحفاظ على أي نوع من الأسطح الصلبة غير القابلة للنفاذ نظيفة للاستخدام، وتعقيمها ومسحها، والسماح للمنطقة التي تم فركها بالبقاء رطبة لمدة 30 ثانية تقريبًا قبل التجفيف. تعتبر الحواف والأجهزة والمصارف والتركيبات (الضوء والماء) ومقابض الأبواب ومقابض الأبواب والدرابزين والبلاط والصخور وإنتاج الفخار والهواتف والألعاب ووحدات التحكم من الأشياء أو المناطق العادية حيث يمكن استخدام مناديل تطهير الأسطح للتنظيف والتعقيم .

تتوفر مناديل تطهير الأسطح بأحجام وسمك مختلفين. قد تحتاج المناديل الأرق أحيانًا إلى قوة عند استخدامها لمواصلة التنظيف عبر الأسطح أو على الأسطح القاسية. بشكل عام، تكون المناديل قوية حقًا وتوفر القوة اللازمة لتنظيف السطح أو الشيء بالكامل.

ديناميكيات سوق مناديل تطهير الأسطح في أوروبا

السائقين

-

زيادة استخدام مناديل تطهير الأسطح للتطبيقات التجارية

المطهرات السطحية هي مركبات كيميائية تستخدم لتدمير مسببات الأمراض والكائنات الحية الدقيقة الأخرى عن طريق التطهير. تساعد مناديل تطهير الأسطح في تثبيط نمو مسببات الأمراض مثل البكتيريا والفيروسات والفطريات، من بين أمور أخرى، مما يؤدي إلى أشكال مختلفة من التلوث والعدوى. تتكون مطهرات الأسطح هذه من مركبات كيميائية مختلفة مثل رباعي الأمونيوم أو رباعيات، ومركبات الكلور، والمركبات الفينولية، وعوامل الأكسدة، والكحول، والمركبات الأمفوتيرية، وحتى تركيباتها. لمنع التلوث، يُرى ارتفاع في مناديل تطهير الأسطح في تطبيقات تجارية مختلفة، وهي المنزل والمطبخ والأغذية والزراعة والضيافة.

-

زيادة وعي المستهلك بشأن النظافة والرعاية الصحية الوقائية

يمكن أن تؤثر العديد من الحالات الصحية على الشخص، لكن معرفته المسبقة وإجراءاته الوقائية تساعد في تقليل شدة المرض أو الوقاية منه تمامًا. النظافة ذات أهمية قصوى للأشخاص من جميع الأعمار. تؤدي الممارسات غير الصحية المختلفة إلى إصابة الأشخاص بعدوى معدية أو عدوى داخل المستشفيات، ومع ظهور جائحة كوفيد-19، أصبحت أهمية النظافة مساوية للبقاء على قيد الحياة. يلعب التعليم دورًا حيويًا في خلق الوعي بين عامة الناس من جميع الفئات العمرية حول الصحة والنظافة والرعاية الوقائية. يلعب هذا الفهم دورًا حاسمًا في منع المخاطر الصحية المختلفة. أطلقت الحكومة والمنظمات غير الحكومية حملات متعددة لسد فجوة المعرفة حول نفس الموضوع.

لقد أدى هذا الوعي بالصحة والنظافة إلى زيادة الطلب على مناديل تطهير الأسطح في مختلف الصناعات الغذائية والمشروبات والرعاية الصحية والأدوية وغيرها من التطبيقات. بالإضافة إلى ذلك، تقوم العديد من الشركات والحكومات أيضًا بإطلاق حملات مختلفة وبرامج توعية مختلفة تساعد السوق على النمو في السنوات القادمة.

فرص

-

استراتيجيات اللاعبين الرئيسيين في السوق

لقد زاد الطلب على مناديل تطهير الأسطح على نطاق واسع في جميع أنحاء العالم بسبب زيادة وعي المستهلكين بالنظافة والرعاية الصحية الوقائية. في الآونة الأخيرة، شهدت السوق العالمية لمناديل تطهير الأسطح ارتفاعًا حادًا بسبب تفشي جائحة كوفيد-19. علاوة على ذلك، تعمل العديد من المستشفيات في جميع أنحاء العالم على زيادة الحاجة إلى مناديل تطهير الأسطح بشكل كبير. تعمل هذه العوامل الإيجابية على تعزيز الطلب على مناديل تطهير الأسطح وتلبية طلب السوق. يستخدم اللاعبون الصغار والكبار في السوق استراتيجيات مختلفة.

إن المبادرات الاستراتيجية مثل الاستحواذ والشراكة واتفاقية العقد والمشاركة في المؤتمرات توفر فرصة لتنمية قاعدة عملائها جغرافيًا. وعلاوة على ذلك، من خلال استراتيجيات المبادرة هذه، يمكن للشركات توسيع نطاق وصولها من خلال أسواق جغرافية أو صناعية جديدة، أو الوصول إلى منتجات أو خدمات جديدة، أو أنواع جديدة من العملاء. يفتح كل من اللاعبين في السوق الباب أمام موارد إضافية أو جديدة مثل التكنولوجيا والمواهب.

القيود/التحديات

- تصاعد في نفايات الرعاية الصحية

النفايات الصحية هي النفايات الناتجة عن أنشطة الرعاية الصحية، بما في ذلك النفايات المعدية وغير المعدية مثل الأدوات الحادة وغير الحادة والدم وأجزاء الجسم والمواد الكيميائية ومناديل التطهير السطحية التي تستخدم لمرة واحدة وغير المستخدمة والأدوية والأجهزة الطبية والمواد المشعة. 10-25٪ من نفايات الرعاية الصحية معدية وتحتاج إلى معالجة خاصة ويشار إليها باسم نفايات مخاطر الرعاية الصحية. أدى تفشي جائحة كوفيد-19 إلى تصعيد استخدام مناديل التطهير السطحية التي تستخدم لمرة واحدة، مما أدى إلى توليد نفايات رعاية صحية ضخمة.

إن المصادر الرئيسية للنفايات الطبية هي المستشفيات وغيرها من المرافق الصحية والمختبرات ومراكز الأبحاث ومختبرات البحوث والاختبارات الحيوانية وبنوك الدم وخدمات جمعها ودور رعاية المسنين، حيث تُستخدم أنواع مختلفة من مناديل التطهير على نطاق واسع. وتولد البلدان ذات الدخل المرتفع نفايات عالية لكل سرير مستشفى يوميًا مقارنة بالبلدان ذات الدخل المنخفض.

ومن الآن فصاعدًا، قد يشكل نمو النفايات الصحية تحديًا كبيرًا في نمو سوق مناديل تطهير الأسطح العالمية.

- تقلبات في أسعار المواد الخام

يواجه اللاعبون في سوق مناديل تطهير الأسطح صعوبة في توقع خطر التقلبات الكبيرة في تكلفة المواد الخام. غالبًا ما تؤثر تكلفة المواد الخام المتزايدة بشكل كبير على مبيعات المنتج حيث يتعطل التصنيع بشكل مباشر بسبب ارتفاع تكلفة المواد الخام. وبالتالي، فإن نجاح المنتج أو الشركة معرض للخطر بشكل كبير بسبب تقلب تكاليف المواد الخام وإدارة أسعارها المعدية. تتبنى الشركات المنافسة استراتيجيات مختلفة للتعامل مع التقلبات في سعر المواد الخام، بما في ذلك استبدال المكون بأي مكون آخر، من بين أمور أخرى.

تأثير ما بعد كوفيد-19 على سوق مناديل تطهير الأسطح في أوروبا

بعد انتشار فيروس كورونا المستجد، زاد الطلب على مناديل تطهير الأسطح في منطقة أوروبا بسبب زيادة الوعي بصحة ونظافة المستهلكين والتحول التدريجي نحو زيادة الطلب على مناديل تطهير الأسطح بين مختلف المستخدمين النهائيين مثل الأغذية والمشروبات والسيارات وغيرها. أدى ظهور فيروس كورونا المستجد إلى فرض العديد من البلدان للإغلاق، وإلغاء الرحلات الجوية، وتعطل سلسلة التوريد، والمنافسة على المواد الخام بين مختلف الصناعات. وقد أدى هذا إلى تقلب الأسعار. ومع ذلك، يتعامل المصنعون الآن مع الموقف، وزاد الطلب على مناديل تطهير الأسطح، مما ساعد السوق على النمو.

التطورات الأخيرة

- في شهر مارس، أعلنت شركة CleanWell, LLC. أنها استحوذت عليها شركة Pinstripe Capital, LLC، وهي شركة استشارية عقارية. أدى هذا الاستحواذ على الشركة إلى توسيع قنوات التوزيع، بما في ذلك مجموعة أوسع من القنوات الطبيعية، وتطوير أعمال المكونات الداعمة. وبالتالي، أدى هذا إلى زيادة نمو الشركة في السوق.

- في شهر مايو، أعلنت شركة GOJO Industries, Inc. أنها أطلقت منتجاتها الجديدة من العلامة التجارية PURELL لتطهير وتعقيم الأسطح في كندا. وقد أدت هذه المنتجات الجديدة التي أطلقتها الشركة إلى زيادة مبيعاتها والطلب عليها، مما أدى إلى زيادة الإيرادات في المستقبل.

- في فبراير 2020، أعلنت شركة GAMA Healthcare Ltd. عن فعالية مناديل Clinell Universal Wipes ضد فيروس كورونا المسبب لمرض كوفيد-19 في غضون 30 ثانية من وقت التلامس. كما أعلنت الشركة عن التحقق من فعالية مناديلها من قبل مختبر Microbac، وهو مختبر تابع لجهة خارجية للسلامة البيولوجية من المستوى 3. وقد أدى هذا الإعلان الذي قامت به الشركة إلى زيادة الطلب عليها ومصداقيتها في السوق.

نطاق سوق مناديل تطهير الأسطح في أوروبا

يتم تقسيم سوق مناديل التطهير السطحي في أوروبا إلى تسعة قطاعات بناءً على التركيب، وسهولة الاستخدام، والتغليف، ونوع المادة، ومستوى التطهير، والنكهة، والنوع، والاستخدام النهائي، وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعة وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

تعبير

- مركبات الكلور

- رباعي الأمونيوم

- عوامل مؤكسدة

- الفينول

- الكحول

- مركبات اليود

- غلوكونات الكلورهيكسيدين

- الألدهيدات

- آحرون

بناءً على التركيب، يتم تقسيم سوق مناديل تطهير السطح في أوروبا إلى رباعي الأمونيوم، وعوامل الأكسدة، والفينول، والكحول، ومركبات الكلور، ومركبات اليود، وجلوكونات الكلورهيكسيدين، والألدهيدات، وغيرها.

قابلية الاستخدام

- يمكن التخلص منه

- غير قابل للاستخدام مرة واحدة

بناءً على قابلية الاستخدام، يتم تقسيم سوق مناديل تطهير الأسطح الأوروبية إلى مناديل يمكن التخلص منها ومناديل غير يمكن التخلص منها.

التغليف

- حزمة مسطحة

- علبة

- آحرون

بناءً على التعبئة والتغليف، يتم تقسيم سوق مناديل تطهير الأسطح في أوروبا إلى عبوات مسطحة وعلب وغيرها.

نوع المادة

- مناديل الألياف النسيجية

- مناديل الألياف البكر

- مناديل الألياف المتقدمة

- آحرون

بناءً على نوع المادة، يتم تقسيم سوق مناديل تطهير السطح في أوروبا إلى مناديل الألياف النسيجية، ومناديل الألياف البكر، ومناديل الألياف المتقدمة وغيرها.

مستوى التطهير

- عالي

- متوسط

- قليل

بناءً على مستوى التطهير، يتم تقسيم سوق مناديل تطهير السطح في أوروبا إلى مرتفع ومتوسط ومنخفض.

نكهة

- الخزامى والياسمين

- الحمضيات

- ليمون

- جوزة الهند

- آحرون

على أساس النكهة، يتم تقسيم سوق مناديل تطهير السطح في أوروبا إلى اللافندر والياسمين والحمضيات والليمون وجوز الهند وغيرها.

يكتب

- مبيد للجراثيم

- مبيد للجراثيم

- مبيد السل

- قاتل للفيروسات

- مبيد للفطريات

- مبيد للجراثيم

بناءً على النوع، يتم تقسيم سوق مناديل تطهير الأسطح الأوروبية إلى مبيدة للجراثيم، ومبيدة للجراثيم، ومبيدة للسل، ومبيدة للفيروسات، ومبيدة للفطريات ومبيدة للجراثيم.

الاستخدام النهائي

- الرعاية الصحية

- تجاري

- مطبخ صناعي

- صناعة النقل

- صناعة البصريات

- الصناعة الالكترونية والكمبيوترية

- آحرون

على أساس الاستخدام النهائي، يتم تقسيم سوق مناديل تطهير السطح في أوروبا إلى الرعاية الصحية، والتجارة، والمطبخ الصناعي، وصناعة النقل، والصناعة البصرية، والصناعة الإلكترونية والكمبيوتر، وغيرها.

قناة التوزيع

- العطاءات المباشرة

- مبيعات التجزئة

بناءً على قناة التوزيع، يتم تقسيم سوق مناديل تطهير الأسطح الأوروبية إلى العطاءات المباشرة ومبيعات التجزئة.

تحليل/رؤى إقليمية لسوق مناديل تطهير الأسطح في أوروبا

يتم تحليل سوق مناديل تطهير السطح في أوروبا ، ويتم توفير رؤى حجم السوق والاتجاهات من خلال التركيب، وسهولة الاستخدام، والتعبئة والتغليف، ونوع المادة، ومستويات التطهير، والنكهة، والنوع، والاستخدام النهائي، وقناة التوزيع.

الدول التي يغطيها تقرير سوق مناديل تطهير الأسطح في أوروبا هي ألمانيا والمملكة المتحدة وفرنسا وإيطاليا وإسبانيا وروسيا وهولندا وسويسرا وبلجيكا وتركيا وبقية أوروبا.

تسيطر ألمانيا على سوق مناديل تطهير الأسطح في أوروبا من حيث حصة السوق والإيرادات وستواصل هيمنتها خلال فترة التوقعات. ويرجع هذا إلى الطلب المتزايد على مناديل تطهير الأسطح من مختلف الصناعات.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في اللوائح في السوق والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات، مثل المبيعات الجديدة والاستبدالية، والتركيبة السكانية للدولة، وعلم الأوبئة المرضية، ورسوم الاستيراد والتصدير، من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. بالإضافة إلى ذلك، يتم النظر في وجود وتوافر العلامات التجارية الأوروبية والتحديات التي تواجهها بسبب المنافسة الشديدة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المنافسة وحصة سوق مناديل تطهير الأسطح في أوروبا

يوفر المشهد التنافسي لسوق مناديل التطهير السطحي في أوروبا تفاصيل حول المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أوروبا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق مناديل التطهير السطحي في أوروبا.

بعض اللاعبين الرئيسيين العاملين في سوق مناديل تطهير الأسطح في أوروبا هم Parker Laboratories, Inc، وGOJO Industries, Inc.، وPDI, Inc.، وMetrex Research, LLC، وEcolab، و3M، وCantel Medical، وContec, Inc.، وKCWW، وPal International، وReckitt Benckiser Group plc، وDiversey Holdings LTD، وDreumex USA Inc.، وMedline Industries, LP، وSpartan Chemical Company, Inc.، وProcter & Gamble، وSTERIS، وJohnson & Son Inc.، وColgate-Palmolive Company، وZep Inc.، وPAUL HARTMANN Limited

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاه الأساسي من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الأساسية التي يستخدمها فريق البحث في DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكات وضع البائعين وتحليل الخط الزمني للسوق ونظرة عامة على السوق والدليل وشبكة وضع الشركة وتحليل حصة الشركة في السوق ومعايير القياس وتحليل أوروبا مقابل المنطقة وحصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE SURFACE DISINFECTANT WIPES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 COMPOSITION LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET PRODUCT TYPE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.1.1 POLITICS:

4.1.2 ECONOMIC:

4.1.3 SOCIAL:

4.1.4 TECHNOLOGY:

4.1.5 ENVIRONMENTAL:

4.1.6 LEGAL:

4.2 PORTER ANALYSIS

4.2.1 THREATS OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREATS OF SUBSTITUTE PRODUCTS

4.2.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.3 INDUSTRIAL INSIGHTS:

4.3.1 KEY PRICING STRATEGIES:

4.3.2 PRICES OF RAW MATERIALS:

4.3.3 FLUCTUATION IN DEMAND AND SUPPLY

4.3.4 LEVELS OF DISINFECTION

4.3.5 QUALITY:

4.3.6 CONCLUSION:

4.4 SURFACE DISINFECTANT WIPES ANALYSIS: BY USABILITY

5 EUROPE SURFACE DISINFECTANT WIPES MARKET: REGULATIONS

6 EPIDERMIOLOGY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF SURFACE DISINFECTANT WIPES FOR COMMERCIAL APPLICATIONS

7.1.2 INCREASING CONSUMER AWARENESS ABOUT HYGIENE AND PREVENTIVE HEALTHCARE

7.1.3 EMERGENCE OF COVID-19

7.1.4 HIGH PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS (HAIS)

7.1.5 HIGH DEMAND FOR QUICK AND CONVENIENT DISINFECTION OPTIONS

7.2 RESTRAINTS

7.2.1 SIDE EFFECTS OF USING SURFACE DISINFECTANT WIPES

7.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIAL

7.2.3 EMERGING ALTERNATIVE TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 STRATEGIES BY MAJOR MARKET PLAYERS

7.3.2 INCREASING NUMBER OF PRODUCT APPROVAL AND LAUNCHES

7.3.3 GROWING HEALTHCARE EXPENDITURE

7.3.4 INCREASING CHRONIC AND CONTAGIOUS DISEASES

7.4 CHALLENGES

7.4.1 LACK OF ACCESSIBILITY

7.4.2 ESCALATION IN HEALTHCARE WASTE

8 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION

8.1 OVERVIEW

8.2 CHLORINE COMPOUNDS

8.3 QUATERNARY AMMONIUM

8.4 OXIDIZING AGENTS

8.5 PHENOL

8.6 ALCOHOL

8.7 IODINE COMPOUNDS

8.8 CHLORHEXIDINE GLUCONATE

8.9 ALDEHYDES

8.1 OTHERS

9 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY USABILITY

9.1 OVERVIEW

9.2 DISPOSABLE

9.3 NON-DISPOSABLE

10 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 FLATPACK

10.3 CANISTER

10.4 OTHERS

11 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE

11.1 OVERVIEW

11.2 TEXTILE FIBER WIPES

11.3 VIRGIN FIBER WIPES

11.4 ADVANCED FIBER WIPES

11.5 OTHERS

12 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY LEVEL OF DISINFECTION

12.1 OVERVIEW

12.2 HIGH

12.3 INTERMEDIATE

12.4 LOW

13 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 LAVENDER & JASMINE

13.3 LEMON

13.4 CITRUS

13.5 COCONUT

13.6 OTHERS

14 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY TYPE

14.1 OVERVIEW

14.2 BACTERICIDAL

14.3 VIRUCIDAL

14.4 SPORICIDAL

14.5 TUBERCULOCIDAL

14.6 FUNGICIDAL

14.7 GERMICIDAL

15 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY END USE

15.1 OVERVIEW

15.2 HEALTHCARE

15.3 COMMERCIAL

15.4 INDUSTRIAL KITCHEN

15.5 TRANSPORTATION INDUSTRY

15.6 OPTICAL INDUSTRY

15.7 ELECTRONIC & COMPUTER INDUSTRY

15.8 OTHERS

16 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDERS

16.3 RETAIL SALES

17 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY REGION

17.1 EUROPE

17.1.1 GERMANY

17.1.2 U.K.

17.1.3 FRANCE

17.1.4 ITALY

17.1.5 SPAIN

17.1.6 RUSSIA

17.1.7 NETHERLANDS

17.1.8 SWITZERLAND

17.1.9 BELGIUM

17.1.10 TURKEY

17.1.11 REST OF EUROPE

18 EUROPE SURFACE DISINFECTANT WIPES MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: EUROPE

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 RECKITT BENCKISER GROUP PLC

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ECOLAB

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROCTER & GAMBLE

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 PAUL HARTMANN LIMITED

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 3M

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 BETCO

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 CANTEL MEDICAL

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.8 CLEANWELL, LLC.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 COLGATE-PALMOLIVE COMPANY

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 CONTEC, INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DIVERSEY HOLDINGS LTD (2021)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 DREUMEX

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 GOJO INDUSTRIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 KCWW

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 MEDLINE INDUSTRIES, LP

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENTS

20.16 METREX RESEARCH, LLC.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PAL INTERNATIONAL

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 PARKER LABORATORIES, INC

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 1.18.3 RECENT DEVELOPMENT

20.19 PDI, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.2 JOHNSON & SON INC.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 SEVENTH GENERATION INC.

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 SPARTAN CHEMICAL COMPANY, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

20.23 STERIS

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENTS

20.24 THE CLAIRE MANUFACTURING COMPANY

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT UPDATE

20.25 WHITELEY

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT UPDATE

20.26 WIPESPLUS

20.26.1 COMPANY SNAPSHOT

20.26.2 PRODUCT PORTFOLIO

20.26.3 RECENT DEVELOPMENT

20.27 ZEP INC.

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 COMPARATIVE TABLE OF THE IDENTIFIED KEY ASPECTS OF SURFACE DISINFECTANTS THROUGHOUT THE REGULATORY FRAMEWORK

TABLE 2 REGULATIONS SET BY THE U.K. GOVERNMENT FOR THE IMPROVEMENT OF DISINFECTANT WIPES

TABLE 3 TESTS ASSOCIATED WITH DISINFECTANT WIPES

TABLE 4 PREVALENCE OF DIABETES

TABLE 5 POVERTY RATES IN ENGLAND, WALES, SCOTLAND, AND NORTHERN IRELAND AFTER HOUSING COSTS (AHC)

TABLE 6 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE CHLORINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE QUATERNARY AMMONIUM IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE OXIDIZING AGENTS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE PHENOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ALCOHOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE IODINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE ALDEHYDES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 17 EUROPE DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE NON-DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 EUROPE FLATPACK IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE CANISTER IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE TEXTILE FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE VIRGIN FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ADVANCED FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE HIGH IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE INTERMEDIATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE LOW IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 33 EUROPE LAVENDER & JASMINE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE LEMON IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE CITRUS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE COCONUT IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE BACTERICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE VIRUCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE SPORICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE TUBERCULOCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE FUNGICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE GERMICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE HEALTHCARE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE COMMERCIAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE INDUSTRIAL KITCHEN IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE TRANSPORTATION INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE OPTICAL INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE ELECTRONIC & COMPUTER INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 EUROPE DIRECT TENDERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 EUROPE RETAIL SALES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 57 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 58 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 59 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 60 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 62 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 67 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 68 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 69 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 71 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 72 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 GERMANY SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 U.K. SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 76 U.K. SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 77 U.K. SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 78 U.K. SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.K. SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 80 U.K. SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 U.K. SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.K. SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 83 U.K. SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 85 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 86 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 87 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 89 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 90 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 FRANCE SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 ITALY SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 94 ITALY SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 95 ITALY SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 96 ITALY SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 97 ITALY SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 98 ITALY SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 ITALY SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 ITALY SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 101 ITALY SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 103 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 104 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 105 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 106 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 107 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 108 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 110 SPAIN SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 112 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 113 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 121 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 122 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 123 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 124 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 125 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 126 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 128 NETHERLANDS SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 135 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 137 SWITZERLAND SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 141 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 144 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 146 BELGIUM SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 147 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 148 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 149 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 150 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 151 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 152 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 153 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 155 TURKEY SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 156 REST OF EUROPE SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 2 EUROPE SURFACE DISINFECTANT WIPES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE SURFACE DISINFECTANT WIPES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SURFACE DISINFECTANT WIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE SURFACE DISINFECTANT WIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE SURFACE DISINFECTANT WIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE SURFACE DISINFECTANT WIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE SURFACE DISINFECTANT WIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE SURFACE DISINFECTANT WIPES MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 EUROPE SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE EUROPE SURFACE DISINFECTANT WIPES MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AN INCREASE IN THE PREVALENCE OF HOSPITAL ACQUIRED INFECTIONS (HAIS) LEADS TO INCREASED ADOPTION OF DISINFECTANT WIPES TO DRIVE THE EUROPE SURFACE DISINFECTANT WIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 CHLORINE COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE SURFACE DISINFECTANT WIPES MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE SURFACE DISINFECTANT WIPES MARKET

FIGURE 15 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE PROVIDERS IN THE U.K. IN 2018

FIGURE 16 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE FUNCTIONS IN THE U.K. IN 2018

FIGURE 17 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION, 2021

FIGURE 18 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY USABILITY, 2021

FIGURE 19 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY PACKAGING, 2021

FIGURE 20 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY MATERIAL TYPE, 2021

FIGURE 21 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY LEVEL OF INDISFECTION, 2021

FIGURE 22 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2021

FIGURE 23 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2021

FIGURE 24 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2021

FIGURE 25 EUROPE SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020

FIGURE 26 EUROPE SURFACE DISINFECTANT WIPES MARKET: SNAPSHOT (2021)

FIGURE 27 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021)

FIGURE 28 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 EUROPE SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION (2022 & 2029)

FIGURE 31 EUROPE SURFACE DISINFECTANT WIPES MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.