Europe Industrial Metrology Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

3.38 Billion

USD

5.43 Billion

2024

2032

USD

3.38 Billion

USD

5.43 Billion

2024

2032

| 2025 –2032 | |

| USD 3.38 Billion | |

| USD 5.43 Billion | |

|

|

|

|

تجزئة سوق القياس الصناعي في أوروبا، حسب العرض (الأجهزة، والبرمجيات، والخدمات)، والمعدات (آلات قياس الإحداثيات، وأنظمة المواد الضوئية، والأشعة السينية، والتصوير المقطعي المحوسب)، والتطبيقات (مراقبة الجودة والتفتيش، والهندسة العكسية، والرسم الخرائطي والنمذجة، وغيرها)، والمستخدم النهائي (السيارات، والتصنيع، والفضاء والدفاع، وأشباه الموصلات، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق القياس الصناعي في أوروبا

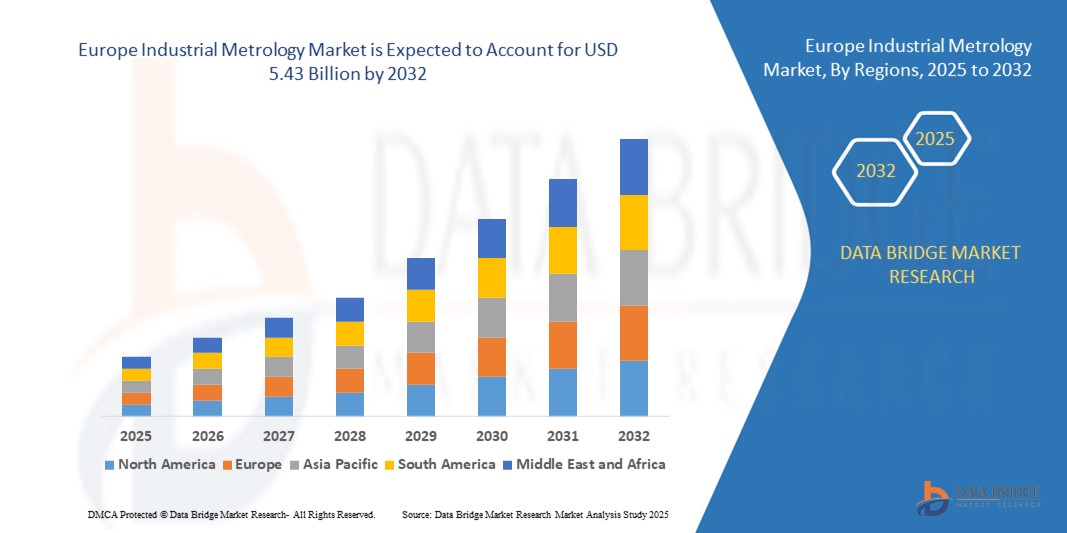

- تم تقييم حجم سوق القياس الصناعي في أوروبا بـ 3.38 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 5.43 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 6.1٪ خلال الفترة المتوقعة

- يتم دعم نمو السوق إلى حد كبير من خلال التبني المتزايد لتقنيات القياس الدقيق في صناعات السيارات والفضاء وأشباه الموصلات والتصنيع، مدفوعًا بالطلب على الدقة وضمان الجودة والامتثال للمعايير الدولية

- علاوة على ذلك، فإن التكامل المتزايد للحلول المتقدمة مثل المسح ثلاثي الأبعاد وأنظمة أجهزة الاستشعار المتعددة والتفتيش الآلي في خطوط الإنتاج يعمل على تسريع الكفاءة وتقليل العيوب وتعزيز القدرة التنافسية، وبالتالي تعزيز نمو الصناعة بشكل كبير.

تحليل سوق القياس الصناعي في أوروبا

- يشير علم القياس الصناعي إلى تطبيق تقنيات القياس الدقيقة، بما في ذلك آلات القياس الإحداثية (CMM)، والمحولات الضوئية، والماسحات الضوئية، وأنظمة الاستشعار المتعددة، لضمان دقة الأبعاد، وموثوقية المنتج، وتحسين العمليات عبر الصناعات.

- الطلب المتزايد على القياسات الصناعية مدفوع في المقام الأول بالتركيز المتزايد على مراقبة الجودة، والتعقيد المتزايد للمكونات المصنعة، والتحول نحو التصنيع الرقمي ومبادرات الصناعة 4.0 التي تتطلب قدرات فحص وقياس متقدمة.

- سيطرت ألمانيا على سوق القياس الصناعي في عام 2024، وذلك بفضل قطاعات السيارات والتصنيع القوية، وخبرتها الهندسية المتقدمة، والتبني الواسع النطاق لأنظمة القياس الدقيقة عبر خطوط الإنتاج.

- من المتوقع أن تكون المملكة المتحدة أسرع دولة نموًا في سوق القياس الصناعي خلال فترة التنبؤ بسبب الطلب المتزايد من قطاعات الطيران والدفاع وأشباه الموصلات

- هيمن قطاع الأجهزة على السوق بحصة سوقية بلغت 59.5% في عام 2024، بفضل الانتشار الواسع لآلات قياس الإحداثيات، والمحولات الضوئية الرقمية، والماسحات الضوئية، وغيرها من الأدوات الدقيقة في مختلف الصناعات. تُعتبر الأجهزة ركيزة علم القياس، إذ تُمكّن من إجراء قياسات دقيقة ضرورية لضمان الجودة والتحقق من صحة المنتج. وقد أدى التطور المستمر في تكنولوجيا المستشعرات، والدقة المُحسّنة، وأجهزة القياس المحمولة إلى زيادة الطلب على الأجهزة، لا سيما في قطاعي السيارات والفضاء، حيث تُعدّ دقة التفاوت أمرًا بالغ الأهمية.

نطاق التقرير وتقسيم سوق القياس الصناعي في أوروبا

|

صفات |

رؤى رئيسية حول سوق القياس الصناعي في أوروبا |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أوروبا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية واللاعبين في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث السوق في Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل المدقة. |

اتجاهات سوق القياس الصناعي في أوروبا

دمج القياسات الصناعية مع الصناعة 4.0 والتصنيع الذكي

- يُعد دمج القياسات الصناعية مع الصناعة 4.0 والتصنيع الذكي توجهًا رئيسيًا يدفع عجلة تطور السوق. ويتبنى المصنعون أنظمة قياس متقدمة كجزء من مبادرات التحول الرقمي لضمان الدقة والكفاءة والأتمتة في بيئات الإنتاج.

- على سبيل المثال، طورت شركة Hexagon AB حلول قياس ذكية مدمجة مع منصات رقمية، مما يتيح جمع البيانات وتحليلها بسلاسة وبشكل آني لمراقبة جودة التصنيع. وبالمثل، تقدم ZEISS أنظمة قياس مزودة بإمكانيات اتصال وتكامل برمجي متقدمة تدعم سير عمل التفتيش الآلي داخل المصانع الذكية.

- أدى التحول نحو الصناعة 4.0 إلى زيادة الطلب على حلول القياس المتصلة التي تُغذي بيانات القياس مباشرةً في أنظمة التصنيع، مما يُقلل الأخطاء ويُمكّن من مراقبة الجودة التنبؤية. يُحسّن هذا التكامل شفافية العمليات، ويُسرّع عملية اتخاذ القرارات، ويضمن اتساقًا أعلى في الإنتاج.

- أصبحت أدوات القياس، مثل آلات قياس الإحداثيات (CMMs)، والماسحات الضوئية، وأنظمة الليزر ثلاثية الأبعاد، مزودةً بأنظمة مراقبة وتحليلات قائمة على الذكاء الاصطناعي، مدعومة بإنترنت الأشياء، بما يتماشى مع منظومات التصنيع الرقمي الأوسع. تتيح هذه الحلول الذكية للشركات الانتقال من التفتيش القائم على أخذ العينات إلى ضمان الجودة المستمر والمستمر.

- علاوة على ذلك، فإن الصناعات مثل صناعة الطيران والسيارات والإلكترونيات، والتي تتطلب تحمُّلات عالية الدقة للغاية، تدمج بشكل متزايد حلول القياس مع الأتمتة الروبوتية، مما يدعم التجميع الخالي من الأخطاء ويقلل من وقت التوقف التشغيلي.

- باختصار، يُمثل دمج القياس الصناعي مع الصناعة 4.0 والتصنيع الذكي توجهًا رئيسيًا يُشكل السوق. يُؤكد هذا التحول نحو القياس الدقيق الرقمي أهمية القياس كعامل تمكين رئيسي لأنظمة الإنتاج الصناعي الفعالة والقائمة على البيانات.

ديناميكيات سوق القياس الصناعي في أوروبا

سائق

تزايد الطلب على حلول القياس عالية الدقة

- تُعدّ الحاجة المتزايدة لضمان الجودة الدقيقة في صناعات السيارات والفضاء والإلكترونيات والأجهزة الطبية محركًا أساسيًا لسوق القياس الصناعي. ومع تزايد تعقيد التصنيع، تسعى الشركات إلى حلول قياس قادرة على اكتشاف الانحرافات الدقيقة لضمان موثوقية المنتج وامتثاله لمعايير الصناعة الصارمة.

- على سبيل المثال، وسّعت شركة نيكون مترولوجي أنظمة الفحص الضوئية والأشعة السينية لتطبيقات الإلكترونيات وأشباه الموصلات، مما يُمكّن المصنّعين من تحقيق دقة متسقة على نطاقات دقيقة. وبالمثل، تُقدّم شركة ميتوتويو آلات قياس ثلاثية الأبعاد متطورة تُوفّر إمكانية تكرار عالية ودقة عالية، وهي مطلوبة في إنتاج محركات السيارات وفحص مكونات الطيران.

- تزداد أهمية القياس الدقيق في الصناعات التي قد تؤدي فيها حتى العيوب البسيطة إلى مشاكل كبيرة في السلامة والأداء. ويكتسب هذا أهمية بالغة في قطاعات مثل الطيران والرعاية الصحية، حيث تُعدّ موثوقية المنتج أمرًا لا غنى عنه.

- يُعزز الاعتماد المتزايد على التصنيع الإضافي الحاجة إلى القياس الدقيق، إذ تتطلب الأشكال الهندسية المعقدة والمواد المتقدمة فحصًا دقيقًا للتحقق من جودة الإنتاج. كما يُعزز الاستخدام الموسع لتكنولوجيا النانو والإلكترونيات المصغرة الطلب على أنظمة القياس المتقدمة للغاية.

- في الختام، يشهد السوق نموًا قويًا بفضل الصناعات التي لا تتنازل عن الدقة أو الضبط أو الجودة. ويضمن هذا الطلب أهميةً طويلة الأمد وتوسعًا في حلول القياس عالية الدقة عالميًا.

ضبط النفس/التحدي

استثمار أولي مرتفع

- من أهم التحديات التي تواجه سوق القياس الصناعي التكلفة الأولية المرتفعة المرتبطة بشراء معدات القياس المتطورة. تتطلب الأنظمة المتطورة، مثل الماسحات الضوئية الليزرية ثلاثية الأبعاد، وآلات قياس الإحداثيات، وأدوات الفحص بالأشعة السينية، استثمارات رأسمالية ضخمة، مما يحد من إمكانية وصول الشركات الصغيرة والمتوسطة إليها.

- على سبيل المثال، غالبًا ما تمثل حلول القياس المتقدمة التي تقدمها ZEISS وHexagon نفقات رأسمالية كبيرة بالنسبة للمصنعين، مما يجعل التبني أكثر جدوى للشركات الكبيرة مقارنة بالشركات الصغيرة التي تعمل في ظل قيود ميزانية صارمة.

- بالإضافة إلى تكاليف المعدات، يتطلب التنفيذ كوادر ماهرة، وتدريبًا متخصصًا، وتكاملًا مع أنظمة التصنيع الحالية، مما يزيد من إجمالي التكاليف. هذه العوامل تُثني الشركات الحساسة للتكلفة عن الاستثمار في حلول القياس المتقدمة رغم فوائدها طويلة الأجل.

- كما أن الوتيرة السريعة لترقيات التكنولوجيا تثير أيضًا مخاوف مالية، حيث قد يواجه المصنعون صعوبة في تبرير الاستثمارات المتكررة من أجل الحفاظ على تحديث الأنظمة مع الاتجاهات الرقمية والأتمتة المتطورة.

- نتيجةً لذلك، لا تزال تكاليف الاستثمار الأولية المرتفعة تُشكّل عائقًا كبيرًا في سوق القياس الصناعي، لا سيما للشركات الصغيرة والمتوسطة التي تسعى إلى تحقيق التوازن بين كفاءة التكلفة واحتياجات الدقة. ولمعالجة هذا الأمر، يُقدّم المُورّدون بشكل متزايد حلولًا معيارية، وخيارات تأجير، وخدمات قياس قائمة على الحوسبة السحابية، لتخفيف عوائق القدرة على تحمل التكاليف وتشجيع التوسع في استخدامها.

نطاق سوق القياس الصناعي في أوروبا

يتم تقسيم السوق على أساس العرض والمعدات والتطبيق والمستخدم النهائي.

- عن طريق العرض

بناءً على العرض، يُقسّم سوق القياس الصناعي إلى أجهزة، وبرمجيات، وخدمات. وقد هيمن قطاع الأجهزة على أكبر حصة من إيرادات السوق بنسبة 59.5% في عام 2024، مدعومًا بالانتشار الواسع لآلات قياس الإحداثيات، والمحوّلات الضوئية الرقمية، والماسحات الضوئية، وغيرها من الأدوات الدقيقة في مختلف الصناعات. وتُعدّ الأجهزة ركيزة أساسية في القياس، إذ تُمكّن من إجراء قياسات دقيقة ضرورية لضمان الجودة والتحقق من صحة المنتجات. وقد ساهم التطور المستمر في تكنولوجيا المستشعرات، والدقة المُحسّنة، وأجهزة القياس المحمولة في زيادة الطلب على الأجهزة، لا سيما في قطاعي السيارات والفضاء، حيث تُعدّ دقة التفاوتات أمرًا بالغ الأهمية.

من المتوقع أن يشهد قطاع الخدمات أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالطلب المتزايد على خدمات المعايرة والصيانة والقياس المُستعان بمصادر خارجية. وفي ظل سعي الشركات إلى تحسين الكفاءة التشغيلية وتقليل فترات التوقف، يتزايد الاعتماد على مزودي الخدمات الخارجيين للحصول على الخبرات المتخصصة. كما أن التوجه المتزايد نحو القياس كخدمة، بدعم من المنصات الرقمية، يُوسّع نطاق تبني هذه الخدمات، لا سيما بين الشركات الصغيرة والمتوسطة التي تفتقر إلى بنية تحتية داخلية للقياس.

- حسب المعدات

بناءً على المعدات، يُقسّم سوق القياس الصناعي إلى آلات القياس الإحداثية (CMM)، وأجهزة التحويل الرقمي والماسحات الضوئية (ODS)، والأشعة السينية، والتصوير المقطعي المحوسب (CT). هيمن قطاع آلات القياس الإحداثية على حصة السوق من الإيرادات في عام 2024، ويعود ذلك أساسًا إلى دوره الراسخ في قياس الأبعاد عالي الدقة في تطبيقات التصنيع والسيارات. تحظى آلات القياس الإحداثي بثقة واسعة لقدرتها على توفير بيانات دقيقة وقابلة للتكرار للأجزاء المعقدة، ودعم عمليات الفحص المباشر وغير المباشر. كما أن تعدد استخداماتها في تقنيات الفحص وتكاملها مع أنظمة الأتمتة يعزز ريادتها في فئة المعدات.

من المتوقع أن يشهد قطاع أنظمة ODS أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالطلب المتزايد على حلول القياس غير التلامسية والرقمنة السريعة في سير عمل التصنيع. تتميز أنظمة ODS بالسرعة والمرونة وقدرات المسح ثلاثي الأبعاد عالية الدقة، مما يجعلها جذابة بشكل خاص للهندسة العكسية، والتحقق من صحة التصميم، والنماذج الأولية. كما أن سهولة حملها واستخدامها يعززان من اعتمادها، لا سيما في صناعات الطيران والفضاء وأشباه الموصلات حيث تتطلب الهندسة المعقدة تقنيات مسح متقدمة.

- حسب الطلب

بناءً على التطبيق، يُقسّم سوق القياس الصناعي إلى مراقبة الجودة والتفتيش، والهندسة العكسية، والرسم والنمذجة، وغيرها. وقد هيمن قطاع مراقبة الجودة والتفتيش على أكبر حصة من إيرادات السوق في عام 2024، مدفوعًا بدوره المحوري في ضمان امتثال المنتجات لمعايير الصناعة الصارمة. ويعتمد المصنعون في قطاعات السيارات والفضاء والإلكترونيات بشكل كبير على الفحص الدقيق لتقليل العيوب، وتقليل عمليات الاستدعاء، والحفاظ على سمعة العلامة التجارية. كما أن دمج أنظمة القياس المتقدمة في خطوط الإنتاج يُعزز الكفاءة، مما يُسهم في ريادة هذا القطاع.

من المتوقع أن يُسجل قطاع الهندسة العكسية أسرع نمو بين عامي 2025 و2032، مدفوعًا بتزايد الطلب على تطوير المنتجات، وتحسين التصاميم، وإعادة إنتاج القطع القديمة. ومع تحول الصناعات نحو التخصيص والتصنيع الرقمي، تُوفر أدوات الهندسة العكسية الأساس للنماذج الأولية السريعة والابتكار. وتُعدّ قدرة أنظمة القياس على التقاط نماذج ثلاثية الأبعاد دقيقة للمنتجات الحالية ذات قيمة خاصة في قطاعي الطيران والسيارات، حيث غالبًا ما يكون إعادة تصميم القطع الأساسية دون توثيق أصلي أمرًا ضروريًا.

- حسب المستخدم النهائي

بناءً على المستخدم النهائي، يُقسّم سوق القياس الصناعي إلى قطاعات السيارات، والتصنيع، والفضاء والدفاع، وأشباه الموصلات، وغيرها. وقد هيمن قطاع السيارات على حصة إيرادات السوق في عام 2024، بفضل اعتماده الكبير على القياس الدقيق لتجميع المركبات، واختبار مكوناتها، والامتثال لمعايير السلامة. وقد أدى التوجه المتزايد نحو المركبات الكهربائية إلى تكثيف الطلب على حلول القياس، حيث يحتاج المصنعون إلى التحقق من صحة أنظمة البطاريات المعقدة، وأنظمة الدفع، والمواد خفيفة الوزن بدقة متناهية. ويضمن وجود شركات تصنيع أصلية راسخة وخطوط إنتاج واسعة النطاق اعتماداً مستمراً لمعدات القياس المتقدمة.

من المتوقع أن يشهد قطاع أشباه الموصلات أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالتوسع المتزايد في تصغير المكونات الإلكترونية والحاجة الماسة إلى دقة قياسات النانو. يتطلب تعقيد عمليات تصنيع أشباه الموصلات أنظمة قياس متطورة قادرة على تحليل الأنماط المجهرية وضمان إنتاج خالٍ من العيوب. ومع استمرار ارتفاع الطلب على الرقائق في الإلكترونيات الاستهلاكية، والبنية التحتية لشبكات الجيل الخامس، وتطبيقات الذكاء الاصطناعي، تبرز صناعة أشباه الموصلات كمحرك رئيسي للابتكار في مجال القياسات وتبنيها السريع.

تحليل إقليمي لسوق القياس الصناعي في أوروبا

- سيطرت ألمانيا على سوق القياس الصناعي بأكبر حصة من الإيرادات في عام 2024، مدفوعة بقطاعي السيارات والتصنيع القويين، وخبرتها الهندسية المتقدمة، والتبني الواسع النطاق لأنظمة القياس الدقيقة عبر خطوط الإنتاج.

- تتعزز ريادة ألمانيا بفضل مكانتها كمركز لمصنعي السيارات الفاخرة وشركات الطيران، حيث تعد أدوات القياس عالية الدقة ضرورية لضمان الامتثال ومعايير الجودة.

- تُسهم القاعدة الصناعية القوية في البلاد، وشبكة موردي معدات القياس القوية، والاستثمارات الكبيرة في البحث والتطوير في تقنيات القياس المتقدمة، مثل المسح ثلاثي الأبعاد وآلات قياس الإحداثيات الآلية، في تعزيز النمو. ويواصل دمج حلول القياس الرقمي مع مبادرات الصناعة 4.0 تعزيز هيمنة ألمانيا في السوق الإقليمية.

نظرة ثاقبة على سوق القياس الصناعي في المملكة المتحدة

من المتوقع أن يُسجل سوق المملكة المتحدة أسرع معدل نمو سنوي مركب في أوروبا خلال الفترة 2025-2032، مدفوعًا بالطلب المتزايد من قطاعات الطيران والدفاع وأشباه الموصلات. ويُعزز الاعتماد المتزايد على حلول القياس المحمولة وغير التلامسية كفاءة عمليات التصنيع المعقدة، بينما يُسرّع تركيز البلاد على التحول الرقمي والمصانع الذكية من انتشار السوق. وتُسهم المبادرات الحكومية لدعم التصنيع المتقدم، إلى جانب التعاون الاستراتيجي بين الجامعات ومصنعي المعدات الأصلية ومقدمي خدمات القياس، في توسيع الفرص المتاحة. كما يُعزز الاعتماد المتزايد على الفحص عالي الدقة لإنتاج المركبات الكهربائية والابتكار القائم على البحث والتطوير سوق القياس الصناعي في المملكة المتحدة.

نظرة عامة على سوق القياس الصناعي في فرنسا

من المتوقع أن تشهد فرنسا نموًا مطردًا خلال الفترة 2025-2032، مدعومةً بصناعتي السيارات والفضاء الراسختين، إلى جانب الانتشار المتزايد للمركبات الهجينة والكهربائية التي تتطلب أنظمة قياس متطورة. وتشهد البلاد اعتمادًا متزايدًا على المحولات الضوئية الرقمية، وأجهزة التصوير المقطعي المحوسب، وأدوات الفحص الآلية لتحسين الدقة والإنتاجية. ويعزز الدعم الحكومي القوي لمبادرات التصنيع الرقمي والاستدامة، إلى جانب استثمارات البحث والتطوير من قِبل الشركات المحلية، اعتماد حلول القياس الصناعي. كما تُسهم الشراكات مع مصنعي المعدات الأصلية الأوروبيين، ودمج أنظمة مراقبة الجودة من الجيل التالي، والتركيز على تقليل الأخطاء وتحسين تكاليف الإنتاج، في نمو السوق الفرنسية.

حصة سوق القياس الصناعي في أوروبا

وتدار صناعة القياس الصناعي بشكل أساسي من قبل شركات راسخة، بما في ذلك:

- بروكر (الولايات المتحدة)

- شركة بيكر هيوز (الولايات المتحدة)

- Hexagon AB (السويد)

- شركة كينس (اليابان)

- شركة المواد التطبيقية (الولايات المتحدة)

- SGS الشركة العامة للمراقبة (سويسرا)

- فارو (الولايات المتحدة)

- مجموعة إنترتك بي إل سي (المملكة المتحدة)

- كريفورم (كندا)

- شركة أوتوميتد بريسيشن (API) (الولايات المتحدة)

- مجموعة مترولوجيك (فرنسا)

أحدث التطورات في سوق القياس الصناعي في أوروبا

- في سبتمبر 2024، أطلقت شركة Hexagon AB جهاز Leica Absolute Tracker ATS800، الذي يجمع بين وظائف التتبع بالليزر والرادار لمعالجة اختناقات التفتيش في عمليات التصنيع واسعة النطاق. بفضل تمكينه قياسًا دقيقًا وبعيد المدى للخصائص ودعمه لتفاوتات تجميع دقيقة، عزز النظام الكفاءة في خطوط إنتاج صناعتي الطيران والسيارات. عزز هذا الابتكار المكانة التنافسية لشركة Hexagon AB في سوق القياسات الصناعية، مؤكدًا التزامها بتطوير تقنيات التفتيش الآلي وتلبية الطلب المتزايد على حلول أسرع وأكثر موثوقية لمراقبة الجودة.

- في يوليو 2024، مُنح البروفيسوران أندرو ويب وبرنهارد بلوميش جائزة ريتشارد ر. إرنست في مؤتمر يورومار 2024 لمساهماتهما القيّمة في مجال الرنين المغناطيسي النووي (NMR) وأبحاث الرنين المغناطيسي. يُبرز هذا التكريم الدور المتنامي للبحث العلمي المتقدم في دفع عجلة الابتكار في مجال القياس الصناعي، وخاصةً في الاختبارات غير الإتلافية وتوصيف المواد. يعكس هذا الإنجاز كيف يُسرّع التقدم الأكاديمي تطوير تطبيقات جديدة في القياس، ويُعزز الصلة بين التميز البحثي وتقدم الصناعة.

- في مارس 2023، طرحت شركة KEYENCE نظام القياس متعدد المستشعرات LM-X، وهو منصة عالية الدقة تجمع بين القياسات البصرية والليزرية واللمسية في وحدة واحدة. صُمم النظام لتبسيط سير العمل وتقليل وقت تحديد المواقع، مما مكّن المصنّعين من الحصول على تقارير فحص موثوقة ودقيقة بكفاءة أكبر. عزز هذا الإطلاق مكانة KEYENCE في السوق من خلال تلبية الطلب المتزايد على حلول المستشعرات المتعددة التي تُحسّن الإنتاجية وتُبسط مراقبة الجودة وتُقلل الأخطاء في البيئات الصناعية المتنوعة.

- في يونيو 2022، استحوذت شركة Applied Materials, Inc. على شركة Picosun Oy لتعزيز محفظة منتجاتها في مجالات ICAPS (إنترنت الأشياء، والاتصالات، والسيارات، والطاقة، وأجهزة الاستشعار) من خلال خبرة Picosun في تقنية ترسيب الطبقات الذرية. مكّن هذا الاستحواذ شركة Applied Materials من تلبية الطلب المتزايد على أشباه الموصلات المتخصصة بشكل أفضل، وتوسيع نطاقها ليشمل الصناعات التي تتطلب طلاءات فائقة الرقة ودقة النانو. عززت هذه الخطوة قدرات الشركة في مجال القياس والتفتيش، مما عزز مكانتها كلاعب رئيسي في منظومة تصنيع أشباه الموصلات.

- في فبراير 2021، استحوذت شركة بيكر هيوز على شركة ARMS Reliability لتوسيع محفظة إدارة أداء الأصول (APM) ودمج حلول الموثوقية المتقدمة في منصة Bently Nevada. عزز هذا الاستحواذ قدرة بيكر هيوز على تقديم حلول دقيقة لمراقبة الأصول، وإدارة دورة حياتها، والصيانة التنبؤية في قطاعات مثل التعدين والطاقة والمرافق. ودعمت هذه الخطوة التزام الشركة بالتحول الرقمي في مجال القياس الصناعي، مما حسّن الكفاءة التشغيلية والإنتاجية لقاعدة عملائها العالمية.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.