Asia Pacific Skin Packaging For Fresh Meat Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

390.25 Million

USD

559.25 Million

2025

2033

USD

390.25 Million

USD

559.25 Million

2025

2033

| 2026 –2033 | |

| USD 390.25 Million | |

| USD 559.25 Million | |

|

|

|

|

اتجاهات صناعة التغليف الجلدي في منطقة آسيا والمحيط الهادئ للحوم الطازجة، حسب النوع (التغليف الجلدي المشكل بالحرارة، التغليف الجلدي المشكل بالحرارة غير المشكل بالحرارة)، المادة (البلاستيك والورق والكرتون، وغيرها)، طلاء الختم الحراري (القائم على الماء، القائم على المذيبات، وغيرها)، التعبئة الهوائية (التغليف بالتفريغ، التعبئة غير المفرغة)، الوظيفة (الحفاظ والحماية، الملاءمة للغرض، الملصقات التنظيمية، العرض، وغيرها)، الطبيعة (قابلة للتسخين في الميكروويف، غير قابلة للتسخين في الميكروويف)، الاستخدام النهائي (اللحوم والدواجن والمأكولات البحرية)، الدولة (الصين والهند واليابان وأستراليا وكوريا الجنوبية وفيتنام والفلبين وإندونيسيا وتايلاند وماليزيا ونيوزيلندا وسنغافورة وبقية دول آسيا والمحيط الهادئ) والتوقعات حتى عام 2028.

تحليل السوق والرؤى: سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ

تحليل السوق والرؤى: سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ

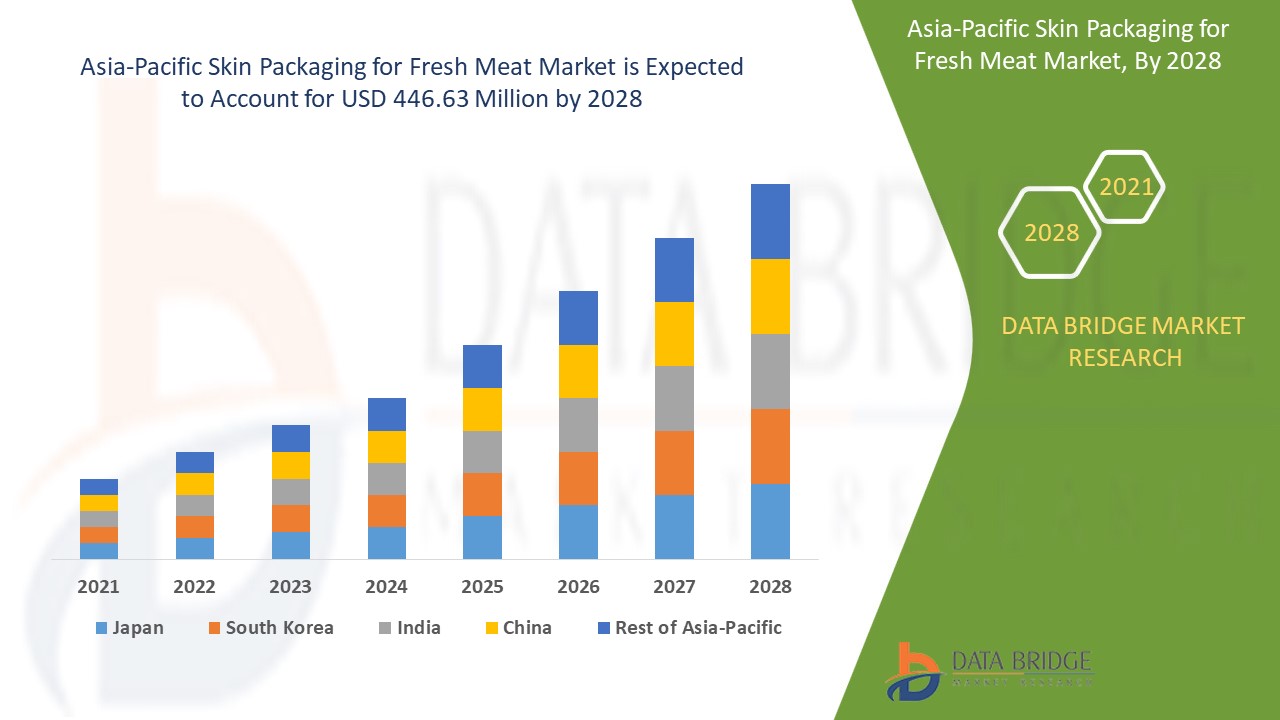

من المتوقع أن يكتسب سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ نموًا كبيرًا في الفترة المتوقعة من 2021 إلى 2028. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 4.6٪ في الفترة المتوقعة من 2021 إلى 2028 ومن المتوقع أن يصل إلى 446.63 مليون دولار أمريكي بحلول عام 2028. ستؤدي التطورات والاتجاهات الجديدة في تقنيات التغليف الجلدي وزيادة استهلاك اللحوم الطازجة مع التغليف المتميز إلى دفع نمو السوق. تخلق الابتكارات الحديثة وإطلاق المنتجات الجديدة فرصًا جديدة للسوق. ومع ذلك، فإن توافر البدائل في السوق يمثل تحديًا كبيرًا للسوق.

التغليف الجلدي ، وهي تقنية جديدة نسبيًا مستمدة من التغليف المفرغ من الهواء ، تم تطويرها بهدف بيع واستيراد وتصدير أجزاء صغيرة من اللحوم الطازجة أو اللحم المفروم أو مستحضرات اللحوم. يساعد هذا التغليف الجلدي اللحوم الطازجة على الحفاظ على الجودة وإطالة عمرها الافتراضي وحماية اللحوم الطازجة من التلوث. وبالتالي، فإن التغليف الجلدي مفيد من حيث الحفاظ على جودة اللحوم وإطالة عمرها الافتراضي وتحسين استقرار المنتجات. هناك أنواع مختلفة من التغليف الجلدي، مثل التغليف المموج وغير المموج، والتي لها عوامل علاجية مختلفة وتقنيات إنتاج مختلفة، وبالتالي، فإن تنوع التغليف الجلدي ينمو في السوق بسرعة.

يشير الاتجاه الأخير إلى زيادة الطلب على تغليف الجلد للحوم الطازجة مع استمرار زيادة الاستثمارات في صناعات الأغذية العامة والخاصة. العوامل التي تدفع نمو السوق هي زيادة الوعي الصحي بين عامة السكان والتقدم التكنولوجي المستمر في تغليف الجلد. مع النمو السريع للعولمة وزيادة تفويضات الأغذية والمشروبات من قبل مختلف البلدان والمناطق، سيشهد سوق تغليف الجلد للحوم الطازجة مسارًا متزايدًا في السنوات القادمة. التطورات والاتجاهات الجديدة في تقنيات تغليف الجلد وزيادة استهلاك اللحوم الطازجة مع التغليف المتميز من شأنها أن تدفع نمو السوق بشكل أكبر.

ومع ذلك، فإن التكلفة العالية للتعبئة والتغليف في قطاع التعبئة والتغليف الجلدي العالمي للحوم الطازجة وتوافر البدائل في السوق سوف يحد من نمو السوق.

يقدم تقرير سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو سوق التغليف الجلدي للحوم الطازجة، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق سوق التغليف الجلدي للحوم الطازجة وحجم السوق

نطاق سوق التغليف الجلدي للحوم الطازجة وحجم السوق

يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى سبعة قطاعات بناءً على النوع والمادة وطلاء الختم الحراري والحشو الهوائي والوظيفة والطبيعة والاستخدام النهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

- على أساس النوع، يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى تغليف جلدي مقوى بالحرارة وتغليف جلدي غير مقوى بالحرارة. في عام 2021، من المتوقع أن تهيمن شريحة التغليف الجلدي غير المقوى بالحرارة على السوق حيث تتطلب غالبية منتجات اللحوم الطازجة تغليف جلدي غير مقوى بالحرارة.

- على أساس المواد، يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى البلاستيك والورق والكرتون وغيرها. في عام 2021، من المتوقع أن تهيمن شريحة البلاستيك على السوق بسبب المرونة العالية للبلاستيك، والتي يمكن تشكيلها بأي شكل أو حجم.

- على أساس طلاء الختم الحراري، يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى تغليف قائم على الماء وتغليف قائم على المذيبات وغيرها. في عام 2021، من المتوقع أن يهيمن قطاع التغليف القائم على الماء على السوق بسبب الطبيعة الصديقة للبيئة لهذا القطاع.

- على أساس التعبئة بالهواء، يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى تعبئة مفرغه من الهواء وتعبئة غير مفرغه من الهواء. في عام 2021، من المتوقع أن تهيمن شريحة التعبئة المفرغه من الهواء على السوق حيث تتطلب التعبئة المفرغه من الهواء الحد الأدنى من المواد الحافظة الكيميائية.

- على أساس الوظيفة، يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى الحفظ والحماية، والملاءمة للغرض، والتصنيف التنظيمي، والعرض وغيرها. في عام 2021، من المتوقع أن تهيمن شريحة الحفظ والحماية على السوق للحفاظ على جودة المنتج وسلامة اللحوم الطازجة.

- على أساس الطبيعة، يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى قابل للاستخدام في الميكروويف وغير قابل للاستخدام في الميكروويف. في عام 2021، من المتوقع أن تهيمن شريحة التغليف القابل للاستخدام في الميكروويف على السوق بسبب سهولة استخدام وتخزين التغليف القابل للاستخدام في الميكروويف.

- على أساس الاستخدام النهائي، يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى اللحوم والدواجن والمأكولات البحرية. في عام 2021، من المتوقع أن يهيمن قطاع اللحوم على السوق بسبب الواردات والصادرات المتزايدة لمنتجات اللحوم.

تحليل على مستوى الدولة لسوق التغليف الجلدي للحوم الطازجة

يتم تقسيم سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ إلى سبعة قطاعات بناءً على النوع والمادة وطلاء الختم الحراري وملء الهواء والوظيفة والطبيعة والاستخدام النهائي.

الدول التي يغطيها تقرير سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ هي الصين والهند واليابان وأستراليا وكوريا الجنوبية وفيتنام والفلبين وإندونيسيا وتايلاند وماليزيا ونيوزيلندا وسنغافورة وبقية دول آسيا والمحيط الهادئ.

من المتوقع أن ينمو قطاع التغليف الجلدي غير المقوى بالحرارة في الصين بأعلى معدل نمو في الفترة المتوقعة من 2021 إلى 2028 بسبب استهلاك وإنتاج اللحوم الطازجة. ينمو قطاع التغليف الجلدي غير المقوى بالحرارة في الهند بمعدل كبير بسبب زيادة استيراد وتصدير اللحوم الطازجة في الهند. تعد اليابان أسرع دولة نموًا في سوق آسيا والمحيط الهادئ، ويهيمن قطاع التغليف الجلدي غير المقوى بالحرارة في هذا البلد بسبب زيادة البحث والتطوير للتغليف الجلدي للحوم الطازجة.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في منطقة آسيا والمحيط الهادئ والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل توقعات لبيانات الدولة.

تزايد الأنشطة الاستراتيجية من قبل كبار اللاعبين في السوق لتعزيز الوعي بتغليف اللحوم الطازجة، وتعزيز نمو سوق تغليف اللحوم الطازجة

كما يوفر لك سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ تحليلاً تفصيلياً للسوق لكل نمو في سوق معينة. بالإضافة إلى ذلك، يوفر معلومات تفصيلية حول استراتيجية اللاعبين في السوق ووجودهم الجغرافي. تتوفر البيانات للفترة التاريخية من 2010 إلى 2019.

تحليل حصة السوق التنافسية والتغليف الجلدي للحوم الطازجة

يوفر المشهد التنافسي لسوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ.

الشركات الكبرى التي تتعامل في سوق التغليف الجلدي للحوم الطازجة في منطقة آسيا والمحيط الهادئ هي Caspak Australia و Promivision Packaging (China) Co., Ltd. و Plantic و Green Packaging Material (Jiangyin) Co.,Ltd و MULTIVAC و Dow و Klöckner Pentaplast و Amcor plc و FLEXOPACK SA و Windmöller & Hölscher و ULMA Packaging و Sealed Air و KM Packaging Services Ltd و Bliston Packaging BV و Sealpac International bv و PLASTOPIL و Berry Global Inc. و Graphic Packaging International, LLC و Schur Flexibles Holding GesmbH و WINPAK LTD. من بين اللاعبين المحليين الآخرين. يفهم محللو DBMR نقاط القوة التنافسية ويوفرون تحليلًا تنافسيًا لكل منافس على حدة.

كما تقوم الشركات في جميع أنحاء العالم بتوقيع عقود واتفاقيات مختلفة، مما يساهم أيضًا في تسريع نمو سوق التغليف الجلدي للحوم الطازجة.

على سبيل المثال،

- في فبراير 2019، أطلقت شركة JASA Packaging Solutions منتج Bag-2-Paper للتغليف القابل لإعادة التدوير بنسبة 100%. ولا تستخدم الشركة أي حرارة لإغلاق العبوات، مما يزيد من كفاءة الطاقة ويقلل من تكاليف التصنيع. ومن المتوقع أن يؤدي هذا الإطلاق إلى زيادة قاعدة عملاء الشركة.

- في أبريل 2019، أطلقت شركة Amcor Plc عبوات جديدة قابلة لإعادة التدوير لتقليل البصمة الكربونية للعبوة بنسبة تصل إلى 64%. ساعد إطلاق هذا المنتج الشركة على زيادة محفظة منتجاتها وزيادة مبيعاتها

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.