Asia Pacific Interventional Cardiology Peripheral Vascular Devices Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

2.92 Billion

USD

5.59 Billion

2024

2032

USD

2.92 Billion

USD

5.59 Billion

2024

2032

| 2025 –2032 | |

| USD 2.92 Billion | |

| USD 5.59 Billion | |

|

|

|

تجزئة سوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ، حسب المنتج (بالونات قسطرة الأوعية الدموية، والدعامات، والقسطرات، ومنتجات إصلاح تمدد الأوعية الدموية، وغيرها والملحقات)، والنوع (التقليدي والقياسي)، والإجراء (قسطرة الأوعية الدموية الطرفية، والتدخل الحرقفي، والتدخلات الظنبوبية (تحت الركبة)، واستئصال الخثرة الشريانية، واستئصال اللويحات الطرفية، والتدخلات الفخذية الرضفية)، والمؤشر (مرض الشرايين الطرفية والتدخل التاجي)، والفئة العمرية (كبار السن، والبالغين، والأطفال) والمستخدم النهائي (المستشفيات، ومراكز الجراحة الخارجية، ومرافق التمريض، والعيادات وغيرها)، وقناة التوزيع (الموزعون الخارجيون، والعطاء المباشر، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2031

تحليل سوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ

مصطلح طب القلب التدخلي هو مجال من مجالات الطب ضمن التخصص الفرعي لأمراض القلب وأجهزة الأوعية الدموية الطرفية التي تستخدم تقنيات تشخيصية متقدمة وتقليدية ومتقدمة وغيرها لتقييم تدفق الدم والضغط في الشرايين التاجية وحجرات القلب، بالإضافة إلى الإجراءات والأدوية الفنية لعلاج التشوهات التي تضعف وظيفة الجهاز القلبي الوعائي. تُستخدم أجهزة طب القلب التدخلي والأوعية الدموية الطرفية، حيث تعمل هذه الأجهزة على إحداث تغييرات في نمط الحياة المستقر. كما أنها تقلل من مضاعفات أمراض القلب المزمنة، مثل مرض الشريان التاجي ومرض القلب الإقفاري وأمراض الأوعية الدموية. يشهد سوق أجهزة طب القلب التدخلي والأوعية الدموية الطرفية في منطقة آسيا والمحيط الهادئ نموًا قويًا مدفوعًا بشيخوخة السكان وارتفاع معدلات أمراض القلب والأوعية الدموية والتقدم في التقنيات الأقل توغلاً. فيما يلي تحليل مفصل:

حجم سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية

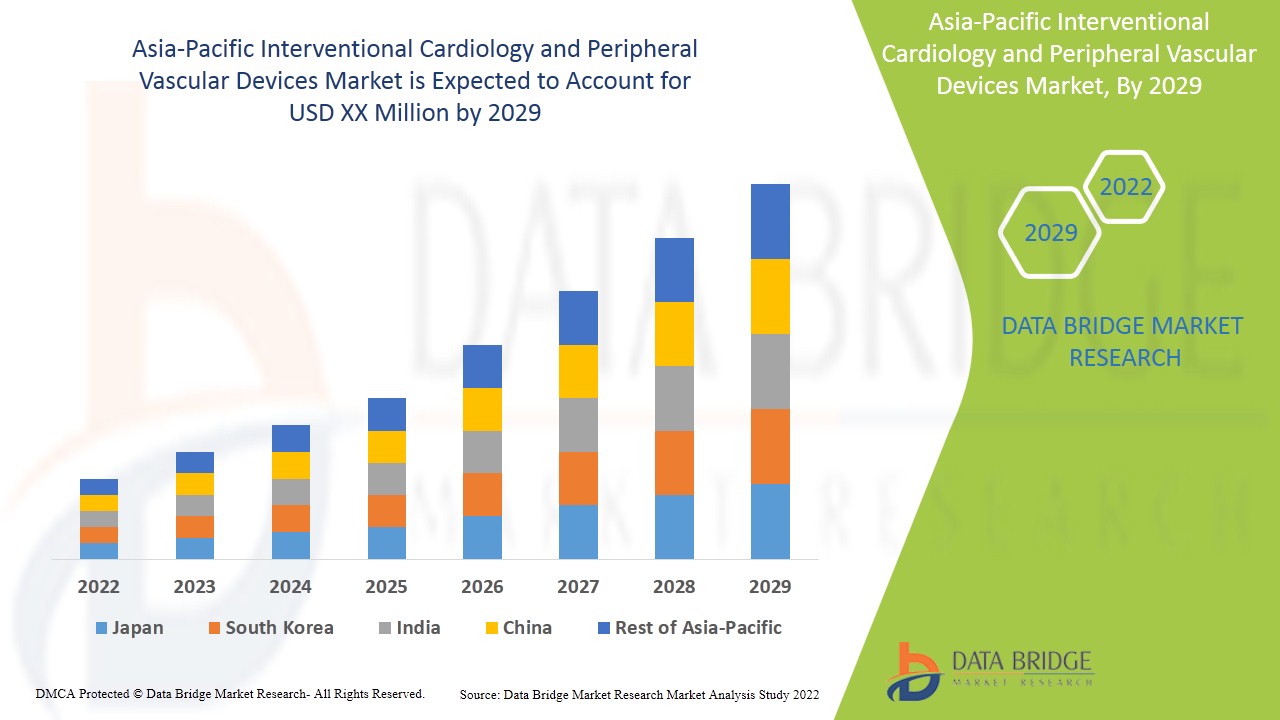

تم تقييم حجم سوق أجهزة أمراض القلب والأوعية الدموية الطرفية والتدخلية في منطقة آسيا والمحيط الهادئ بنحو 2.70 مليار دولار أمريكي في عام 2023 ومن المتوقع أن يصل إلى 5.16 مليار دولار أمريكي بحلول عام 2031، مع معدل نمو سنوي مركب بنسبة 8.4٪ خلال الفترة المتوقعة من 2024 إلى 2031. بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي أعدتها Data Bridge Market Research أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي.

اتجاهات سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية

"الوعي المتزايد بصحة القلب والأوعية الدموية والتوافر المتزايد لخيارات العلاج"

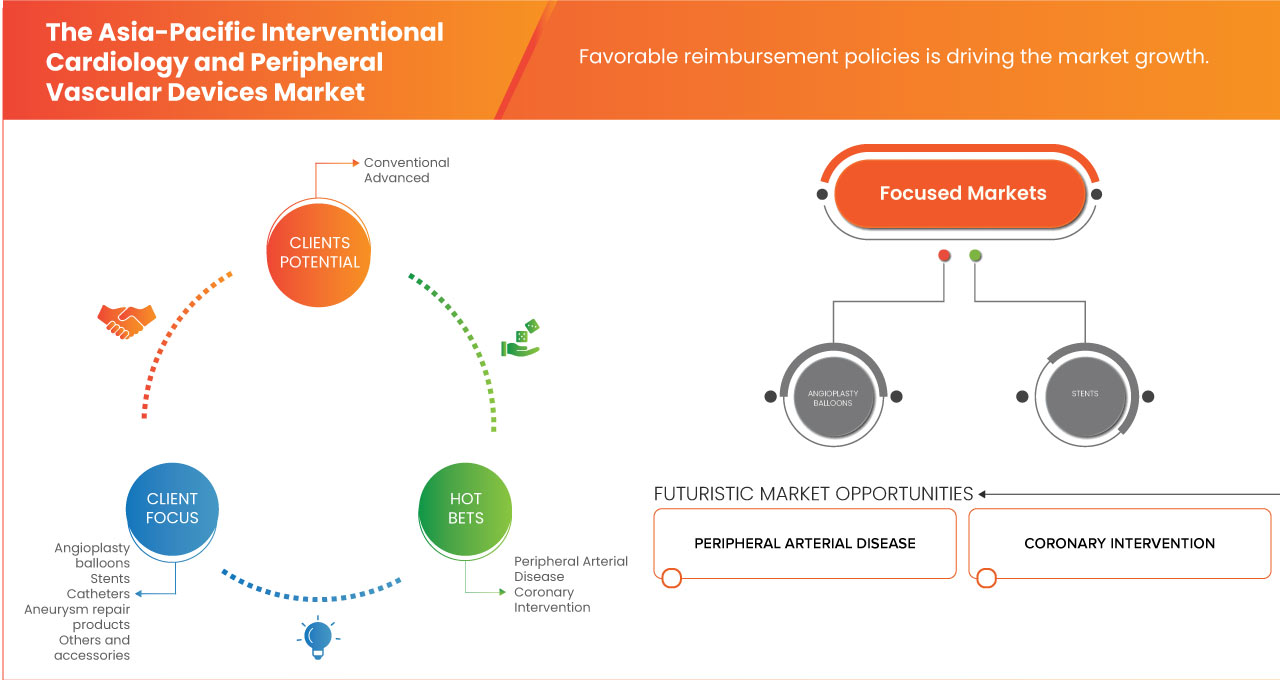

إن الوعي المتزايد بصحة القلب والأوعية الدموية وزيادة خيارات العلاج هي المحركات الرئيسية لسوق أجهزة أمراض القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ. ومع نمو الفهم العام لأمراض القلب والأوعية الدموية، يدرك المزيد من الأفراد أهمية صحة القلب والمخاطر المرتبطة بهذه الحالات، مما يؤدي إلى زيادة الطلب على التدابير الوقائية والفحوصات المنتظمة والعلاجات الفعالة. تعمل المبادرات التعليمية التي تقوم بها الحكومات ومنظمات الرعاية الصحية والمنظمات غير الربحية على تعزيز الوعي بعوامل خطر أمراض القلب والأوعية الدموية، وتشجيع السلوكيات الصحية الاستباقية. يعمل هذا التحول الثقافي على تعزيز الطلب على الأجهزة التدخلية مثل الدعامات والقسطرة والبالونات الضرورية لتشخيص وعلاج مشاكل القلب والأوعية الدموية.

نطاق التقرير وتقسيم سوق أجهزة القلب والأوعية الدموية الطرفية التدخلية

|

صفات |

رؤى أساسية حول سوق اختبار الأجسام المضادة النووية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

الصين والهند واليابان وكوريا الجنوبية وأستراليا وسنغافورة وإندونيسيا وتايلاند وماليزيا والفلبين وبقية دول آسيا والمحيط الهادئ |

|

اللاعبون الرئيسيون في السوق |

Abbott (الولايات المتحدة)، Boston Scientific Corporation (الولايات المتحدة)، BD (الولايات المتحدة)، Medtronic (الولايات المتحدة)، Terumo Corporation (اليابان)، B.Braun SE (ألمانيا)، ENDOCOR GmbH & CO. KG (ألمانيا)، Teleflex Incorporated (الولايات المتحدة)، Lepu Medical Technology (بكين) المحدودة (الصين)، MicroPort Scientific Corporation (الصين)، Koninklijke Philips NV (هولندا)، Biotronik (ألمانيا)، SMT (الصين)، OrbusNeich Medical Group Holdings Limited (الصين)، Biosensors International Group, Ltd. (سنغافورة)، Edwards Lifesciences Corporation (الولايات المتحدة)، AngioDynamics (الولايات المتحدة)، Alvimedica (تركيا)، Cook (الولايات المتحدة)، Cordis (الولايات المتحدة)، Palex (إسبانيا)، و WL Gore & Associates (الولايات المتحدة)، Inc. |

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

تعريف سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية

طب القلب التداخلي هو فرع من فروع طب القلب يتعامل مع العلاج القائم على القسطرة لأمراض القلب، مثل مرض الشريان التاجي وأمراض صمام القلب ومشاكل القلب البنيوية. تُستخدم الأجهزة الوعائية الطرفية لعلاج أمراض الشرايين الطرفية وتمدد الأوعية الدموية والاضطرابات الوعائية الأخرى خارج القلب، والتي تؤثر عادةً على الشرايين والأوردة والأنظمة اللمفاوية في مناطق مثل الساقين والذراعين.

ديناميكيات سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية

السائقين

- تزايد انتشار أمراض المناعة الذاتية في جميع أنحاء العالم

تشهد منطقة آسيا والمحيط الهادئ زيادة حادة في أمراض القلب والأوعية الدموية، بسبب تحولات نمط الحياة والتحضر وتزايد عدد كبار السن. تساهم السلوكيات المستقرة المتزايدة والأنظمة الغذائية السيئة والتدخين وتعاطي الكحول والإجهاد في ارتفاع معدلات السمنة وحالات مثل ارتفاع ضغط الدم والسكري وخلل شحميات الدم، وكلها تزيد من خطر الإصابة بأمراض القلب والأوعية الدموية. بالإضافة إلى ذلك، مع وجود أحد أسرع سكان العالم شيخوخة، فإن نقاط الضعف المرتبطة بالعمر لأمراض القلب أكثر شيوعًا. تعمل هذه الاتجاهات على تحويل احتياجات الرعاية الصحية ودفع الطلب على أجهزة القلب والأوعية الدموية التدخلية لإدارة وعلاج أمراض القلب والأوعية الدموية بشكل فعال.

على سبيل المثال،

في أغسطس 2024، وفقًا لمقال نشرته مجلة لانسيت، من المتوقع أن يرتفع معدل الوفيات القلبية الوعائية الخام بين عامي 2025 و2050 بنسبة 91.2٪، على الرغم من انخفاض معدل الوفيات الموحد حسب العمر بنسبة 23٪. ستظل أمراض القلب الإقفارية والسكتة الدماغية من الأسباب الرئيسية، حيث يصل معدل الوفيات الموحد حسب العمر في آسيا الوسطى إلى 676 حالة وفاة لكل 100000، وهو أعلى بكثير من متوسط آسيا البالغ 186، وآسيا ذات الدخل المرتفع عند 22 فقط. سيقود ارتفاع ضغط الدم الانقباضي أسباب الوفيات الموحد حسب العمر في جميع أنحاء آسيا، بينما يهيمن ارتفاع نسبة الجلوكوز في البلازما أثناء الصيام في آسيا الوسطى، مما يساهم في 546 حالة وفاة لكل 100000. تسلط هذه الاتجاهات الضوء على الحاجة إلى التدخل، مما يغذي الطلب على أجهزة القلب والأوعية الدموية التدخلية في جميع أنحاء منطقة آسيا والمحيط الهادئ

في أغسطس 2024، وفقًا لمقال نشرته مجلة لانسيت، فإن وباء أمراض القلب والأوعية الدموية (CVD) شديد بشكل خاص في آسيا، حيث يمثل 60٪ من 18.6 مليون حالة وفاة بأمراض القلب والأوعية الدموية على مستوى العالم في عام 2019. وبحلول عام 2050، من المتوقع أن يرتفع انتشار أمراض القلب والأوعية الدموية في المنطقة بنسبة 109٪ عن عام 2025، ليصل إلى 729.5 مليون حالة. سيشكل مرض القلب الإقفاري ومرض الشرايين الطرفية والسكتة الدماغية 86.8٪ من الحالات، مع إصابة 74.5 مليون شخص بقصور القلب. يؤكد هذا الارتفاع على الحاجة الملحة للعلاج الفعال ومن المتوقع أن يعزز الطلب على أجهزة القلب والأوعية الدموية التدخلية في أنظمة الرعاية الصحية في منطقة آسيا والمحيط الهادئ

ومن المتوقع أن يؤدي التفاعل بين تغيرات نمط الحياة، وشيخوخة السكان، والوعي المتزايد، والابتكارات التكنولوجية إلى دعم وتعزيز الطلب على الأجهزة التدخلية. ومع استمرار مقدمي الرعاية الصحية في إعطاء الأولوية لصحة القلب والأوعية الدموية والاستثمار في حلول العلاج المتقدمة، من المتوقع أن ينمو سوق أجهزة القلب والأوعية الدموية الطرفية بشكل كبير، مما يعالج الاحتياجات الصحية العاجلة التي يفرضها العبء المتزايد لأمراض القلب والأوعية الدموية في المنطقة.

- توسيع مراكز التشخيص والمختبرات

إن النمو السكاني لكبار السن في منطقة آسيا والمحيط الهادئ يشكل محركًا مهمًا لسوق أجهزة القلب والأوعية الدموية الطرفية. ومع تقدم كبار السن في السن، يرتفع معدل انتشار أمراض القلب والأوعية الدموية، مما يستلزم أجهزة طبية متخصصة لتلبية احتياجاتهم الفريدة. وكبار السن معرضون بشكل خاص لأمراض القلب والأوعية الدموية بسبب التغيرات المرتبطة بالعمر وعوامل الخطر مثل ارتفاع ضغط الدم والسكري وفرط شحميات الدم، مما يزيد الطلب على الأجهزة التدخلية مثل الدعامات والقسطرة. وعلاوة على ذلك، يؤدي نمو عدد كبار السن إلى زيادة الطلب على الإجراءات الجراحية والنهج الاستباقي لصحة القلب والأوعية الدموية، مما يعزز استخدام الأجهزة التشخيصية والعلاجية ويدفع توسع السوق.

على سبيل المثال،

وفقًا لمقال نشره بنك التنمية الآسيوي، من المتوقع أن يتضاعف عدد السكان الذين تبلغ أعمارهم 60 عامًا أو أكثر في منطقة آسيا والمحيط الهادئ النامية إلى 1.2 مليار بحلول عام 2050 في مايو 2024. يسلط هذا الارتفاع الكبير في عدد السكان المسنين الضوء على الحاجة المتزايدة إلى خدمات الرعاية الصحية المتخصصة لمعالجة المشكلات الصحية المرتبطة بالعمر. مع توسع عدد السكان المسنين، من المتوقع أن يؤدي ذلك إلى دفع النمو بشكل كبير في سوق أجهزة القلب والأوعية الدموية الطرفية والتدخلية في منطقة آسيا والمحيط الهادئ، حيث تركز أنظمة الرعاية الصحية على تقديم علاجات فعالة للحالات السائدة بين كبار السن، وخاصة أمراض القلب والأوعية الدموية.

في سبتمبر/أيلول 2023، وفقًا لمقال نشرته صحيفة The Hindu، سينمو عدد كبار السن في الهند بمعدل عقدي يبلغ 41%، ومن المتوقع أن تتضاعف حصة كبار السن إلى أكثر من 20% من إجمالي السكان بحلول عام 2050.

مع زيادة عدد كبار السن، يزداد انتشار أمراض القلب والأوعية الدموية، مما يؤدي إلى زيادة الطلب على الأجهزة الطبية المتخصصة والإجراءات التدخلية. مع التركيز على الرعاية الصحية الوقائية والابتكارات التكنولوجية المستمرة، من المتوقع أن يشهد السوق نموًا كبيرًا، ومعالجة الاحتياجات الصحية الفريدة للسكان المسنين بشكل فعال وتحسين نتائج المرضى في رعاية القلب والأوعية الدموية.

فرص

- زيادة التعاون والشراكات

إن زيادة التعاون والشراكات بين الشركات في سوق أجهزة القلب والأوعية الدموية الطرفية في منطقة آسيا والمحيط الهادئ تخلق فرصًا كبيرة للنمو والابتكار. ومن خلال تشكيل تحالفات استراتيجية، يمكن لمصنعي الأجهزة الطبية تحسين قنوات التوزيع والوصول إلى السوق، مما يسمح بتقديم أسرع للمنتجات المبتكرة في البيئات السريرية. تساعد هذه التعاونات الشركات على فهم الاحتياجات المحددة لمقدمي الرعاية الصحية والمرضى، وتمكينهم من تصميم منتجاتهم وفقًا لديناميكيات السوق المحلية والمتطلبات التنظيمية. بالإضافة إلى ذلك، يمكن أن تؤدي الجهود المشتركة إلى مبادرات التطوير المشترك، وتعزيز الابتكار وتسريع وقت طرح التقنيات الجديدة في السوق.

على سبيل المثال،

في سبتمبر 2021، أعلنت شركة ميدترونيك أن الشركة تعاونت مع شركة Mpirik، المعروفة بتوفير مجموعة من مسارات الفحص والرعاية الآلية المستندة إلى السحابة للمرضى لأمراض القلب والأوعية الدموية. يساعد هذا التعاون الشركة على معالجة التفاوتات في الرعاية المرتبطة بالوقاية من السكتة القلبية المفاجئة من خلال منصة الذكاء الاصطناعي المتقدمة، وبالتالي مساعدة الشركة على تحسين ريادتها في السوق بشكل أكبر.

إن الاتجاه نحو زيادة التعاون والشراكات، إلى جانب التركيز على إطلاق المنتجات في الوقت المناسب، يوفر فرصًا كبيرة للنمو في سوق أجهزة القلب والأوعية الدموية الطرفية التدخلية في منطقة آسيا والمحيط الهادئ. ومن خلال الاستفادة من هذه القسطرات، يمكن للشركات تحسين رعاية المرضى وتحسين النتائج السريرية وتعزيز مواقعها التنافسية في بيئة الرعاية الصحية سريعة التطور.

- زيادة الاستثمار في البحث والتطوير

توفر الاستثمارات المتزايدة في البحث والتطوير فرص نمو حاسمة لسوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ. ومع انتشار أمراض القلب والأوعية الدموية بشكل متزايد، يتزايد الطلب على حلول العلاج المبتكرة. من خلال التركيز على البحث والتطوير، يمكن للشركات تطوير تقنيات متقدمة، مثل المواد القابلة للتحلل الحيوي والأجهزة الأقل توغلاً، وتحسين نتائج المرضى ومعالجة فجوات العلاج الحالية. علاوة على ذلك، يعزز الاستثمار في البحث والتطوير التعاون مع المؤسسات الأكاديمية والبحثية، مما يسرع من ترجمة الابتكارات إلى الاستخدام السريري. لا تعمل هذه التطورات على تعزيز كفاءة تقديم الرعاية الصحية فحسب، بل تعمل أيضًا على تعزيز القدرة التنافسية في السوق من خلال تلبية الاحتياجات المتطورة للمقدمين والمرضى.

على سبيل المثال،

في يوليو 2021، أعلنت شركة أبوت أن الشركة تؤكد استثمار 41.19 مليون دولار أمريكي في البحث والتطوير لمشاريع تركز على الدعامات من الجيل التالي بالإضافة إلى تقنيات البالونات التاجية والوعائية لعلاجات أمراض القلب التداخلية. تم توفير هذا الاستثمار خصيصًا لمنشأتها في كلونميل في أيرلندا، وهو برنامج بحث وتطوير جديد في مجال أجهزة القلب والأوعية الدموية.

ومن خلال إعطاء الأولوية للبحث والابتكار، تستطيع الشركات تطوير منتجات رائدة لا تعالج التحديات التي تفرضها أمراض القلب والأوعية الدموية فحسب، بل تعمل أيضًا على تحسين رعاية المرضى. ومع استمرار نمو السوق، سيكون التركيز على البحث والتطوير أمرًا بالغ الأهمية لأصحاب المصلحة الذين يتطلعون إلى الاستفادة من الاتجاهات الناشئة، مما يؤدي في نهاية المطاف إلى تحسين النتائج الصحية وزيادة القدرة التنافسية في السوق في المنطقة.

القيود/التحديات

- التكلفة العالية للحاجز

إن التكلفة المرتفعة للأجهزة التدخلية المتقدمة تقيد بشكل كبير سوق الأجهزة التدخلية لأمراض القلب والأوعية الدموية الطرفية في منطقة آسيا والمحيط الهادئ. وفي حين تعمل هذه الابتكارات على تحسين نتائج المرضى، فإن أسعارها المرتفعة تحد من إمكانية الوصول إليها، وخاصة في المناطق ذات الدخل المنخفض.

إن ميزانيات الرعاية الصحية المحدودة تجعل من الصعب على الأنظمة العامة تمويل التقنيات الباهظة الثمن، مما يدفع المستشفيات إلى اختيار بدائل أرخص، وخاصة في المناطق الريفية. ويؤدي هذا إلى تأخير التدخلات ونتائج صحية أسوأ. بالإضافة إلى ذلك، فإن التكاليف المرتفعة تمنع مقدمي الخدمات من الاستثمار في التدريب والبنية الأساسية اللازمة، مما يحد من رعاية القلب والأوعية الدموية المتقدمة ويقلل الطلب على هذه العلاجات، مما يعيق نمو السوق.

على سبيل المثال،

وفقًا لـ IndiaMART، فإن قسطرة البالون AngioSculpt RX PTCA تقدم حلاً تحويليًا لعلاج مرض الشريان التاجي، كونها جهاز التسجيل المتخصص الوحيد المعتمد لعلاج ISR والآفات المعقدة من النوع C. بسعر 4.81 دولارًا أمريكيًا، تمثل خيارًا متميزًا في السوق.

يسلط هذا الضوء على "التكلفة العالية لقسطرة البالون"، والتي تشكل قيدًا على سوق أجهزة القلب والأوعية الدموية الطرفية التدخلية في منطقة آسيا والمحيط الهادئ، حيث قد تحد مثل هذه الأسعار المرتفعة من إمكانية الوصول والاستخدام الأوسع، وخاصة في بيئات الرعاية الصحية الحساسة للتكلفة.

- المخاطر المرتبطة بتدخلات طب القلب والأجهزة الوعائية الطرفية

إن أجهزة القلب والأوعية الدموية الطرفية التداخلية تأتي مع مخاطر مثل العدوى والنزيف وتلف الأوعية الدموية وردود الفعل التحسسية، إلى جانب الأعطال المحتملة في الأجهزة والمضاعفات مثل الجلطات أو إعادة تضيق الأوعية الدموية، والتي قد تتطلب المزيد من التدخلات الطبية. يمكن أن تعيق هذه المخاطر مقدمي الرعاية الصحية من تبني التقنيات الجديدة، وخاصة في المناطق ذات الخبرة السريرية المحدودة. إن منحنى التعلم للأجهزة المتقدمة مثل الموجات فوق الصوتية داخل الأوعية الدموية (IVUS) والتصوير المقطعي البصري (OCT) حاد، والتدريب غير الكافي يزيد من فرصة حدوث أخطاء إجرائية، مما يثبط من عزيمة التبني. بالإضافة إلى ذلك، فإن المخاوف بشأن المسؤوليات القانونية وقضايا سلامة المرضى تبطئ دمج هذه التقنيات في الممارسة العملية.

على سبيل المثال،

في فبراير 2021، وفقًا لمقال نُشر في PubMed Central، أشارت التجارب العلاجية الأخيرة المضادة للتخثر إلى أن المرضى في منطقة آسيا والمحيط الهادئ أكثر عرضة لمضاعفات النزيف، مثل النزيف المعوي والسكتة الدماغية النزفية. تشكل هذه المخاطر المتزايدة تحديًا لأمراض القلب التداخلية وأجهزة الأوعية الدموية الطرفية، حيث تثير ضرورة استخدام مضادات التخثر أثناء الإجراءات مخاوف تتعلق بالسلامة. وبالتالي، قد يتردد كل من الأطباء والمرضى في تبني هذه العلاجات المتقدمة، مما يعيق تبني الأجهزة المبتكرة ويبطئ نمو السوق في المنطقة.

تشكل المخاطر المرتبطة باستخدام أجهزة القلب التداخلية والأوعية الدموية الطرفية قيدًا كبيرًا على سوق منطقة آسيا والمحيط الهادئ من خلال إبطاء تبني الحلول المبتكرة. وتجعل المخاوف بشأن السلامة والقيود التدريبية والمسؤوليات القانونية المحتملة مقدمي الرعاية الصحية مترددين، مما يعيق نمو السوق على الرغم من التقدم في تكنولوجيا الأجهزة.

نطاق سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية

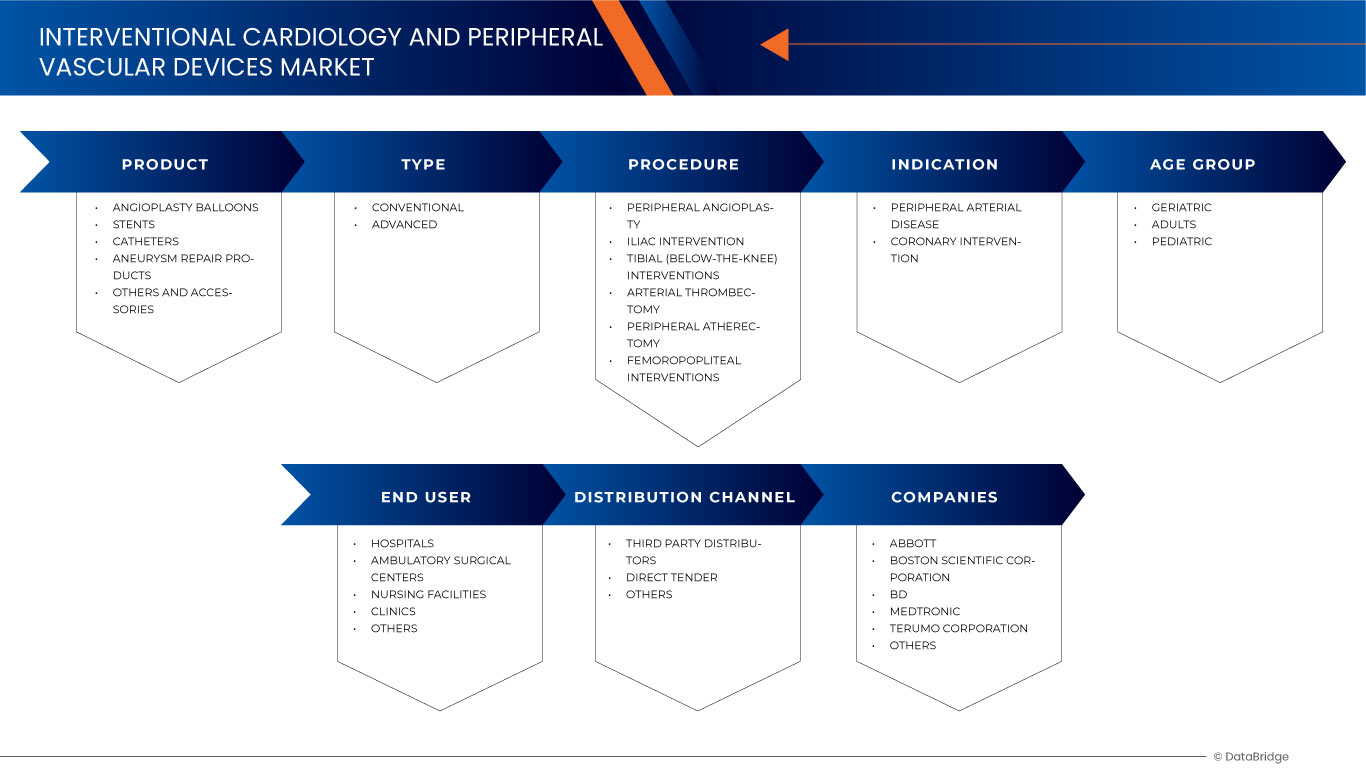

يتم تقسيم السوق على أساس المنتج والنوع والإجراء والمؤشر والفئة العمرية والمستخدم النهائي وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

منتج

- بالونات توسيع الأوعية الدموية

- البالونات القديمة/العادية

- بالونات تفرز الأدوية

- قطع ونقش البالونات

- الدعامات

- دعامات توسيع الأوعية الدموية

- الدعامات التاجية

- الدعامات المعدنية العارية

- الدعامات المطلية بالأدوية

- الدعامات القابلة للامتصاص البيولوجي

- الدعامات الطرفية

- آحرون

- القسطرة

- منتج

- قسطرة التوجيه

- قسطرة دقيقة

- قسطرة CTO

- التخصص

- قسطرة تصوير الأوعية الدموية

- قسطرة شفط الشريان التاجي

- آحرون

- منتج

- منتجات إصلاح تمدد الأوعية الدموية

- تمدد الأوعية الدموية العصبية (الالتواء)

- آحرون

- أخرى واكسسوارات

- أسلاك التوجيه

- أغماد المقدمة

- أجهزة نفخ البالونات

- أجهزة إغلاق الأوعية الدموية

- آحرون

- أخرى واكسسوارات

يكتب

- عادي

- الدعامات

- القسطرة

- أسلاك التوجيه

- أجهزة إغلاق الأوعية الدموية (VCDS)

- آحرون

- متقدم

- قسطرة البالون

- دعامات القسطرة

إجراء

- قسطرة الشرايين الطرفية

- بالونات توسيع الأوعية الدموية

- الدعامة

- القسطرة

- منتجات إصلاح تمدد الأوعية الدموية

- أخرى واكسسوارات

إشارة

- مرض الشرايين الطرفية

- Atherosclerosis

- Neuro Aneurysm (Coiling)

- Lower Extremity Peripheral Arterial Disease

- Supra-Inguinal Arterial Disease

- Infra-Inguinal Arterial Disease

- Infra-Popliteal Disease

- Upper Extremity Occlusive Disease

- Carotid Artery Disease

- Others

- Coronary Intervention

- Ischemic Heart Disease

- Thoracic Aortic Aneurysm

- Valve Disease

- Percutaneous Valve Repair or Replacement

- Congenital Heart Abnormalities

- Others

Age Group

- Geriatric

- Adults

- Pediatric

End User

- Hospitals

- Private

- Public

- Ambulatory Surgery Centers

- Nursing Facilities

- Clinics

- Others

Distribution Channel

- Third Party Distributors

- Direct Tender

- Others

Interventional Cardiology and Peripheral Vascular Devices Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product, type, procedure, indication, age group, end user, and distribution channel as referenced above.

The countries covered in the market are China, India, Japan, South Korea, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines, and rest of Asia-Pacific.

China is expected to dominate the market due to the region's advanced healthcare infrastructure, high prevalence of cardiac diseases, and increasing adoption of early treatment devices.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Interventional Cardiology and Peripheral Vascular Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Interventional Cardiology and Peripheral Vascular Devices Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- BD (U.S.)

- Medtronic (U.S.)

- Terumo Corporation (Japan)

- B.Braun SE (Germany)

- ENDOCOR GmbH & CO. KG (Germany)

- Teleflex Incorporated (U.S.)

- Lepu Medical Technology (Beijing)Co.,Ltd. (China)

- MicroPort Scientific Corporation (China)

- Koninklijke Philips N.V. (Netherlands)

- Biotronik (Germany)

- SMT (China)

- OrbusNeich Medical Group Holdings Limited (China)

- Biosensors International Group, Ltd. (Singapore)

- شركة إدواردز للعلوم الحياتية (الولايات المتحدة)

- أنجيودايناميكس (الولايات المتحدة)

- ألفي ميديكا (تركيا)

- كوك (الولايات المتحدة)

- كورديس (الولايات المتحدة)

- باليكس (أسبانيا)

- دبليو إل جور وشركاؤه (الولايات المتحدة)

أحدث التطورات في سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية

- في سبتمبر 2024، تتعاون شركة أبوت وسيد جلوبال هيلث لتعزيز الرعاية الصحية للأمهات والأطفال في ملاوي. وتتضمن مبادرتهما إنشاء مركز متميز لصحة الأم في مستشفى كوين إليزابيث المركزي، مع التركيز على تدريب العاملين الصحيين لتحسين جودة الرعاية واستدامتها

- في سبتمبر 2024، أكملت شركة BD استحواذها على مجموعة منتجات العناية الحرجة التابعة لشركة Edwards Lifesciences، وأعادت تسميتها إلى BD Advanced Patient Monitoring. وقد أدت هذه الخطوة إلى توسيع محفظة BD بتقنيات المراقبة المتقدمة والأدوات السريرية المدعومة بالذكاء الاصطناعي، مما أدى إلى تعزيز حلول الرعاية الذكية المتصلة ودعم الابتكارات المستقبلية في رعاية المرضى.

- في مارس 2024، حصلت شركة Medtronic على موافقة إدارة الغذاء والدواء الأمريكية على أحدث نظام Evolut FX+ TAVR، المصمم لعلاج تضيق الأبهر الشديد المصحوب بأعراض. يتميز هذا الجيل الجديد بإطار معدّل على شكل ماسة يوفر نوافذ وصول أكبر للشرايين التاجية، مما يعزز من قدرة القسطرة على المناورة مع الحفاظ على أداء الصمام الاستثنائي والقوة المرتبطة بمنصة Evolut

- في مارس 2024، مددت شركة أبوت شراكتها مع ريال مدريد ومؤسسة ريال مدريد حتى موسم 2026-2027، مع التركيز على مكافحة سوء التغذية لدى الأطفال وتعزيز العادات الصحية. وقد وفر التعاون تعليمًا وفحصًا غذائيًا مكثفًا لملايين الأطفال في جميع أنحاء العالم

- في نوفمبر 2023، اختتمت شركة Boston Scientific Corporation استحواذها على شركة Relievant Medsystems في 17 نوفمبر 2023، مضيفة بذلك نظام Intraosseous Nerve Ablation System إلى محفظة علاج الألم المزمن الخاصة بها. ويؤدي الاستحواذ، الذي تبلغ تكلفته 850 مليون دولار أمريكي مقدمًا بالإضافة إلى المدفوعات غير المباشرة، إلى توسيع نطاق الوصول إلى علاج آلام العمود الفقري من خلال التغطية الوطنية، مما يعود بالنفع على أكثر من 150 مليون شخص

- في نوفمبر 2023، وقعت شركة BD وشركة Bio Farma مذكرة تفاهم لمكافحة مرض السل في إندونيسيا من خلال توفير إمكانية الوصول إلى تشخيصات مرض السل من شركة BD. ويهدف هذا التعاون إلى تحسين سلسلة التوريد وتعزيز تشخيص مرض السل، بما يتماشى مع هدف إندونيسيا للقضاء على المرض بحلول عام 2030

- في سبتمبر 2023، أعلنت شركة Boston Scientific Corporation أنها أبرمت اتفاقية لشراء شركة Relievant Medsystems، Inc. مقابل 850 مليون دولار أمريكي مقدمًا، بالإضافة إلى المدفوعات المشروطة. وكان الهدف من عملية الاستحواذ، التي من المتوقع أن يتم الانتهاء منها في أوائل عام 2024، هو تعزيز محفظة علاج آلام أسفل الظهر المزمنة لشركة Boston Scientific باستخدام نظام Intracept.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.