Asia Pacific Cooling System For Edge Computing Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

361.33 Million

USD

814.87 Million

2024

2032

USD

361.33 Million

USD

814.87 Million

2024

2032

| 2025 –2032 | |

| USD 361.33 Million | |

| USD 814.87 Million | |

|

|

|

|

تقسيم سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ، حسب نوع أنظمة التبريد (الهواءية، السائلة، والهجينة)، سعة التبريد (أنظمة التبريد متوسطة الحجم، صغيرة الحجم، وكبيرة الحجم (أكثر من 200 كيلوواط))، نوع النشر (وحدات التبريد داخل الغرفة، وحدات التبريد داخل الرفوف، وحدات التبريد الخارجية، وحدات التبريد السائلة المباشرة إلى الشريحة، وحدات التبريد المحمولة، ووحدات التبريد بالغمر)، نظام إدارة التبريد (أنظمة إدارة التبريد المتكاملة وأنظمة إدارة التبريد المستقلة)، طريقة التبريد (التبريد بالماء المبرد، التبريد بالتمدد المباشر (DX)، التبريد السائل، وغيرها)، القطاعات الرأسية (تكنولوجيا المعلومات والاتصالات، التصنيع، الحكومة والقطاع العام، الرعاية الصحية، النقل والخدمات اللوجستية، التجزئة والسلع الاستهلاكية، وغيرها) - اتجاهات الصناعة وتوقعاتها 2032

حجم سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ

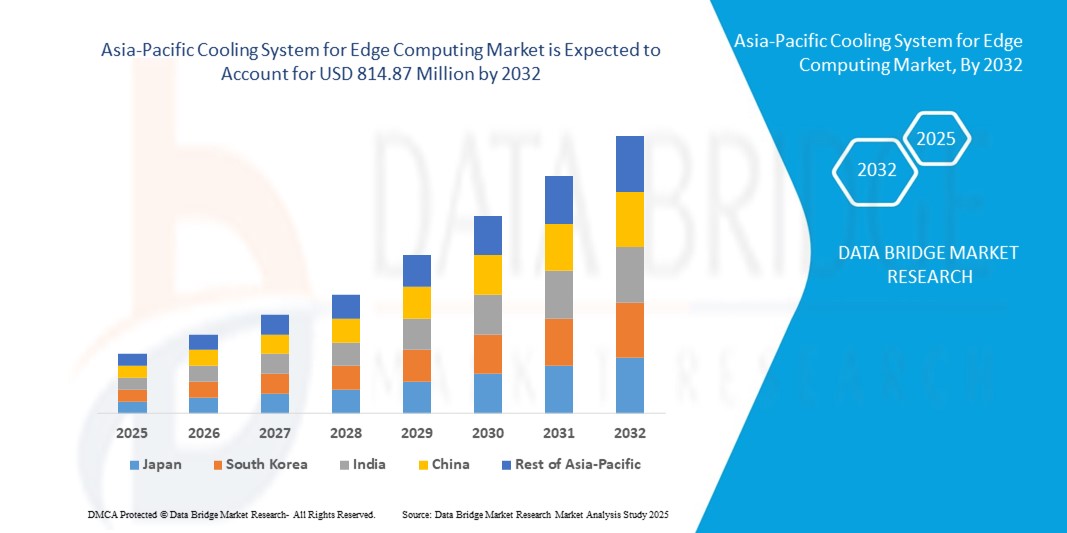

- تم تقييم حجم سوق نظام التبريد للحوسبة الحافة في منطقة آسيا والمحيط الهادئ بـ 361.33 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 814.87 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 10.70٪ خلال الفترة المتوقعة

- يتم دعم نمو السوق إلى حد كبير من خلال التبني المتزايد للحوسبة الحافة عبر الصناعات، والطلب المتزايد على تقنيات التبريد الفعالة والمستدامة، والحاجة المتزايدة لإدارة الحرارة في بيئات الحوسبة عالية الكثافة

- تساهم التطورات في حلول التبريد السائل والتبريد بالغمر، إلى جانب الاستثمارات المتزايدة في مراكز البيانات الأقرب إلى المستخدمين النهائيين، في توسيع السوق بشكل أكبر

تحليل سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ

- يشهد سوق نظام التبريد للحوسبة الحافة في منطقة آسيا والمحيط الهادئ زخمًا كبيرًا مع قيام الشركات بتسريع التحول الرقمي ونشر البنية التحتية للحافة لمعالجة البيانات بشكل أسرع

- أدى التركيز المتزايد على تقليل زمن الوصول وضمان أداء النظام دون انقطاع إلى زيادة الحاجة إلى تقنيات التبريد المبتكرة التي تقلل من استهلاك الطاقة مع الحفاظ على كفاءة تشغيلية عالية

- سيطرت الصين على سوق أنظمة التبريد للحوسبة الحافة في منطقة آسيا والمحيط الهادئ بأكبر حصة من الإيرادات في عام 2024، بدعم من الاستثمارات الضخمة في طرح تقنية الجيل الخامس، وتبني إنترنت الأشياء، ومبادرات المدن الذكية.

- من المتوقع أن تشهد اليابان أعلى معدل نمو سنوي مركب (CAGR) في سوق نظام التبريد للحوسبة الحافة في منطقة آسيا والمحيط الهادئ بسبب الطلب المتزايد على الحوسبة عالية الأداء، والتبني المبكر لتقنيات التبريد السائل، والاستثمارات المتزايدة في تطبيقات الحافة التي تعتمد على الذكاء الاصطناعي وإنترنت الأشياء.

- حقق قطاع أنظمة التبريد الجوي أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل فعاليته من حيث التكلفة، وتوافره الواسع، وسهولة تكامله مع البنية التحتية الحالية. ويظل التبريد الجوي خيارًا مفضلًا لعمليات النشر الطرفية الصغيرة والمتوسطة الحجم حيث تكون متطلبات الكفاءة معتدلة.

نطاق التقرير وتقسيم سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ

|

صفات |

نظام التبريد في منطقة آسيا والمحيط الهادئ للحوسبة الطرفية: رؤى رئيسية حول السوق |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

آسيا والمحيط الهادئ

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم إعدادها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء والإنتاج والقدرة التمثيلية الجغرافية للشركة وتخطيطات الشبكة للموزعين والشركاء وتحليل اتجاهات الأسعار التفصيلية والمحدثة وتحليل العجز في سلسلة التوريد والطلب. |

اتجاهات سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ

اعتماد تقنيات التبريد السائل والتبريد بالغمر

- يُعيد التحول نحو أنظمة التبريد السائل والتبريد بالغمر المتقدمة تشكيل سوق أنظمة التبريد للحوسبة الطرفية، وذلك من خلال معالجة الكثافات الحرارية العالية في البنى التحتية المدمجة. تُمكّن هذه التقنيات من إدارة الحرارة بكفاءة في الحوسبة الطرفية، مما يضمن استمرارية عمل النظام وأدائه حتى في ظل أحمال العمل الثقيلة.

- يُسرّع الطلب المتزايد على أساليب التبريد المستدامة من اعتماد أنظمة تعتمد على السوائل، وهي أنظمة تستهلك طاقة ومياه أقل مقارنةً بالتبريد الهوائي التقليدي. ويبرز هذا التوجه بقوة خاصة في المناطق التي تُطبّق أهدافًا صارمة لخفض انبعاثات الكربون، حيث تُعطى الأولوية للعمليات الموفرة للطاقة.

- إن قابلية التوسع والتصميم المعياري لأنظمة التبريد بالغمر يجعلها مناسبة للاستخدامات الطرفية الصغيرة والمتوسطة، مما يُسهم في خفض تكاليف التشغيل مع إطالة عمر المعدات. كما تُوفر قابلية التكيف ميزة قوية للشركات التي تُوسّع شبكاتها الطرفية في المناطق الحضرية والنائية.

- على سبيل المثال، في عام ٢٠٢٣، نشر العديد من مشغلي الاتصالات وحدات تبريد سائلة معيارية في مراكز البيانات الطرفية، مما أدى إلى انخفاض كبير في استهلاك الطاقة وتحسين موثوقية خدمات الشبكة. هذا لا يُحسّن الأداء فحسب، بل يدعم أيضًا أهداف الاستدامة طويلة المدى.

- في حين أن التبريد السائل والغمر يُمكّنان من كفاءة أعلى وفوائد بيئية أكبر، فإن تأثيرهما الواسع النطاق يعتمد على خفض التكاليف الأولية، وتطوير معايير الصناعة، وتوفير التدريب للمشغلين. يجب على الموردين التركيز على استراتيجيات النشر المحلية لتعظيم الاعتماد عبر بيئات الحافة المتنوعة.

ديناميكيات سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ

سائق

ارتفاع حركة البيانات والطلب المتزايد على المعالجة منخفضة الكمون

- إن الزيادة الهائلة في حركة البيانات الناتجة عن أجهزة إنترنت الأشياء وشبكات الجيل الخامس وتطبيقات الوقت الفعلي تُلقي بضغط هائل على البنية التحتية للحوسبة الطرفية. وللحفاظ على الأداء وتجنب التوقف، أصبح التبريد الفعال عاملاً أساسياً في نشر الحوسبة الطرفية.

- تزداد وعي الشركات بالمخاطر المالية والتشغيلية المرتبطة بارتفاع درجة الحرارة، بما في ذلك تلف المعدات، وانخفاض كفاءة الطاقة، وانقطاع الخدمة. وقد انعكس هذا الوعي في اعتماد أوسع لأنظمة التبريد من الجيل التالي التي تضمن سلاسة العمليات.

- تدعم الحكومات والهيئات التنظيمية للقطاع تطوير البنية التحتية المتطورة من خلال مبادرات كفاءة الطاقة وسياسات تكنولوجيا المعلومات الخضراء. تشجع هذه الأطر الشركات على الاستثمار في حلول تبريد حديثة تُقلل من البصمة الكربونية وتتوافق مع متطلبات الاستدامة.

- على سبيل المثال، في عام 2022، يتبنى العديد من مشغلي مراكز البيانات بشكل متزايد أنظمة التبريد بالغمر المتقدمة للامتثال لتوجيهات كفاءة الطاقة، مما يعزز الطلب في السوق على تقنيات التبريد عالية الأداء

- في حين أن الطلب على المعالجة ذات زمن الوصول المنخفض هو المحرك الرئيسي، فإن معالجة استهلاك الطاقة وتكامل النظام والتدريب التشغيلي ستكون ضرورية لضمان التبني المستدام لأنظمة التبريد المتقدمة على الحافة

ضبط النفس/التحدي

تكاليف النشر المرتفعة والحواجز التقنية في بيئات الحافة

- لا تزال النفقات الرأسمالية المرتفعة اللازمة لحلول التبريد المتقدمة، مثل الغمر بالسوائل والتبريد المباشر على الشريحة، تُشكل عائقًا رئيسيًا أمام تبنيها، خاصةً للشركات الصغيرة والأسواق الناشئة. ولا تزال العديد من المؤسسات تعتمد على الأنظمة التقليدية نظرًا لقيود التكلفة.

- إن نقص الفنيين المهرة ومحدودية الخبرة في التعامل مع تقنيات التبريد المتخصصة في المواقع النائية أو الموزعة على الأطراف يُعيق نشرها. ويتفاقم هذا التحدي بغياب الممارسات الموحدة والإرشادات الفنية في جميع أنحاء القطاع.

- كما تُعيق تحديات البنية التحتية، بما في ذلك توافر الطاقة وصيانتها في بعض بيئات المحطات الطرفية، انتشارَ السوق. وقد تُؤخر هذه القيود نشر أنظمة تبريد فعّالة، مما يُجبر على الاعتماد على بدائل أقل فعالية.

- على سبيل المثال، في عام 2023، ستستمر العديد من مراكز البيانات الطرفية الصغيرة الحجم في استخدام أنظمة التبريد الهوائية القديمة بسبب التكاليف المرتفعة والتوافر المحدود لتقنيات التبريد السائل المتقدمة

- بينما يواصل الابتكار تحسين كفاءة أنظمة التبريد، يُعدّ التغلب على عقبات التكلفة والبنية التحتية والمهارات أمرًا بالغ الأهمية. يجب على أصحاب المصلحة في السوق الاستثمار في حلول معيارية، فعّالة من حيث التكلفة، وسهلة النشر، لفتح المجال أمام تبني أوسع نطاقًا عبر منظومة الحافة.

نطاق سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ

يتم تقسيم السوق على أساس نوع أنظمة التبريد، وسعة التبريد، ونوع النشر، ونظام إدارة التبريد، وطريقة التبريد، والوضع الرأسي.

- حسب نوع أنظمة التبريد

بناءً على نوع أنظمة التبريد، يُقسّم سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ إلى أنظمة هوائية، وأنظمة سائلة، وأنظمة هجينة. وقد استحوذت أنظمة التبريد الهوائية على أكبر حصة من إيرادات السوق في عام 2024، بفضل فعاليتها من حيث التكلفة، وتوافرها الواسع، وسهولة تكاملها مع البنية التحتية الحالية. ويظل التبريد الهوائي خيارًا مفضلًا لعمليات النشر الطرفية الصغيرة والمتوسطة الحجم حيث تكون متطلبات الكفاءة معتدلة.

من المتوقع أن يشهد قطاع أنظمة التبريد السائلة أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بقدرته الفائقة على تبديد الحرارة واعتماده المتزايد في مراكز البيانات الطرفية عالية الكثافة. وتكتسب حلول التبريد السائلة زخمًا متزايدًا لقدرتها على تقليل استهلاك الطاقة ودعم أهداف الاستدامة، مما يجعلها مثالية لبيئات الحوسبة من الجيل التالي.

- حسب سعة التبريد

بناءً على سعة التبريد، يُصنف السوق إلى أنظمة تبريد متوسطة الحجم، وأنظمة تبريد صغيرة الحجم، وأنظمة تبريد كبيرة الحجم (أكثر من 200 كيلوواط). وقد حصد قطاع أنظمة التبريد متوسطة الحجم أكبر حصة من الإيرادات في عام 2024، ويعود ذلك أساسًا إلى اعتماده في المنشآت الإقليمية والهامشية التي تتطلب أحمال تبريد معتدلة.

من المتوقع أن يشهد قطاع أنظمة التبريد واسعة النطاق أسرع معدل نمو بين عامي 2025 و2032، مع توسع الحوسبة الطرفية لتشمل مراكز الاتصالات الكبيرة والمرافق المؤسسية. وتُعد قدرتها على إدارة أحمال العمل المكثفة والحفاظ على موثوقية عالية للنظام خيارًا أساسيًا لشبكات الحافة واسعة النطاق.

- حسب نوع النشر

بناءً على نوع النشر، يُقسّم السوق إلى وحدات تبريد داخل الغرف، ووحدات تبريد داخل الرفوف، ووحدات تبريد خارجية، ووحدات تبريد سائلة مباشرة إلى الشريحة، ووحدات تبريد محمولة، ووحدات تبريد غاطسة. وقد هيمنت وحدات التبريد داخل الغرف على حصة السوق في عام 2024، بفضل استخدامها الراسخ في مرافق الحافة التقليدية ومراكز البيانات.

من المتوقع أن يشهد قطاع وحدات التبريد السائل المباشر إلى الشريحة أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالطلب المتزايد على حلول التبريد الموفرة للطاقة والموفرة للمساحة. توفر هذه الأنظمة إدارةً دقيقةً للحرارة، ويتزايد استخدامها في بيئات الحافة عالية الأداء.

- بواسطة نظام إدارة التبريد

بناءً على أنظمة إدارة التبريد، ينقسم السوق إلى أنظمة إدارة تبريد متكاملة وأنظمة إدارة تبريد مستقلة. وسيستحوذ قطاع أنظمة إدارة التبريد المتكاملة على الحصة الأكبر في عام 2024، حيث تفضل الشركات بشكل متزايد الأنظمة المركزية التي تُعزز المراقبة والأتمتة وتحسين استهلاك الطاقة.

ومن المتوقع أن يشهد قطاع أنظمة إدارة التبريد المستقلة أسرع معدل نمو في الفترة من 2025 إلى 2032، وخاصة بين المرافق الصغيرة والمشغلين الحساسين للتكلفة والذين يفضلون الإعدادات المرنة والمستقلة.

- عن طريق طريقة التبريد

بناءً على طريقة التبريد، يُقسّم سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ إلى تبريد بالماء المُبرّد، وتبريد التمدد المباشر (DX)، وتبريد سائل، وغيرها. وقد شكّل قطاع تبريد الماء المُبرّد أكبر حصة من الإيرادات في عام 2024، بفضل موثوقيته وقابليته للتوسع وانتشاره الواسع في مرافق الحوسبة الطرفية المتوسطة والكبيرة.

ومن المتوقع أن يشهد قطاع التبريد السائل أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بكثافة الطاقة المتزايدة على الحافة والحاجة إلى تقنيات تبريد عالية الكفاءة والاستدامة.

- بالعمودي

بناءً على القطاعات، يُقسّم السوق إلى قطاعات تكنولوجيا المعلومات والاتصالات، والتصنيع، والقطاعين الحكومي والعام، والرعاية الصحية، والنقل والخدمات اللوجستية، وتجارة التجزئة والسلع الاستهلاكية، وغيرها. وسيُهيمن قطاع تكنولوجيا المعلومات والاتصالات على السوق في عام 2024، مدفوعًا بالانتشار الواسع لشبكات الجيل الخامس (5G) والطلب المتزايد على مراكز البيانات الطرفية.

ومن المتوقع أن يشهد قطاع الرعاية الصحية أسرع معدل نمو في الفترة من 2025 إلى 2032، حيث أن اعتماد الحوسبة الطرفية في الطب عن بعد والتصوير الطبي ومراقبة المرضى في الوقت الفعلي يدفع الحاجة إلى أنظمة تبريد موثوقة وفعالة من حيث الطاقة.

تحليل إقليمي لسوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ

- سيطرت الصين على سوق أنظمة التبريد للحوسبة الحافة في منطقة آسيا والمحيط الهادئ بأكبر حصة من الإيرادات في عام 2024، بدعم من الاستثمارات الضخمة في طرح تقنية الجيل الخامس، وتبني إنترنت الأشياء، ومبادرات المدن الذكية.

- إن النمو السريع للبنية التحتية الرقمية في البلاد يدفع الطلب على حلول التبريد المتقدمة التي تضمن الكفاءة والاستدامة

- إن الدعم الحكومي القوي وقاعدة التصنيع واسعة النطاق والطلب المتزايد على التطبيقات التي تعتمد على الذكاء الاصطناعي تعمل على تعزيز ريادة الصين في السوق

نظام التبريد الياباني لسوق الحوسبة الطرفية

من المتوقع أن يشهد سوق أنظمة التبريد للحوسبة الطرفية في اليابان أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بزيادة اعتماد الحوسبة الطرفية في قطاعات السيارات والروبوتات والاتصالات. يدفع ارتفاع تكاليف الطاقة والتركيز الوطني على الحياد الكربوني الشركات إلى اعتماد أنظمة تبريد مبتكرة تعتمد على السوائل والغمر. علاوة على ذلك، يُسرّع التعاون بين مُزودي تقنيات التبريد العالميين والمُشغلين المحليين من اعتماد حلول الجيل التالي.

حصة سوق أنظمة التبريد للحوسبة الطرفية في منطقة آسيا والمحيط الهادئ

إن نظام التبريد في منطقة آسيا والمحيط الهادئ لصناعة الحوسبة الحافة يقوده في المقام الأول شركات راسخة، بما في ذلك:

- شركة دايكين للصناعات المحدودة (اليابان)

- شركة ميتسوبيشي إلكتريك (اليابان)

- هواوي تكنولوجيز (الصين)

- شركة فوجيتسو المحدودة (اليابان)

- شركة هيتاشي للتبريد والتدفئة (اليابان)

- جونسون كونترولز-هيتاشي لتكييف الهواء (اليابان)

- دلتا للإلكترونيات (تايوان)

- شركة NEC (اليابان)

- شركة أومرون (اليابان)

- شركة سنغرو لتوريد الطاقة المحدودة (الصين)

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.