Asia Pacific Aligner Sheet Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

66.51 Million

USD

187.09 Million

2024

2032

USD

66.51 Million

USD

187.09 Million

2024

2032

| 2025 –2032 | |

| USD 66.51 Million | |

| USD 187.09 Million | |

|

|

|

تجزئة سوق صفائح المحاذاة في منطقة آسيا والمحيط الهادئ، حسب المادة (البولي يوريثين (PU)، وبولي إيثيلين تيريفثاليت جلايكول (PETG)، وغيرها)، والطبقة (متعددة الطبقات وطبقة واحدة)، والمستخدم النهائي (شركات تصنيع تقويم الأسنان الكبيرة، والشركات المصنعة لتقويم الأسنان المتوسطة، والشركات المصنعة لتقويم الأسنان الصغيرة)، وقناة التوزيع (العطاء المباشر، والقناة عبر الإنترنت، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2032

تحليل سوق صفائح المحاذاة

يشهد سوق صفائح التقويم نموًا كبيرًا، مدفوعًا بالتقدم في تكنولوجيا طب الأسنان والطلب المتزايد على منتجات التقويم الشفاف في جميع أنحاء العالم. تعد هذه الصفائح القابلة للتشكيل الحراري مكونات أساسية في إنتاج التقويمات الشفافة والقوالب والمثبتات، والتي أصبحت مفضلة بشكل متزايد لمزاياها الجمالية والوظيفية مقارنة بالأقواس التقليدية. يركز اللاعبون الرئيسيون في السوق على ابتكار المواد لتعزيز المتانة والمرونة وراحة المريض. لقد أحدثت التطورات التكنولوجية مثل الطباعة ثلاثية الأبعاد والمواد الملكية ثورة في عملية التصنيع، مما مكن من إنتاج أسرع وتحسين الدقة. على سبيل المثال، تضع المواد الأرق والأكثر متانة مثل Reva من uLab Systems معايير جديدة في السوق. بالإضافة إلى ذلك، تُظهر التطورات مثل حلول التقويم في نفس اليوم، مثل تلك التي تقدمها LuxCreo، إمكانية زيادة الكفاءة وخفض التكاليف.

حجم سوق صفائح المحاذاة

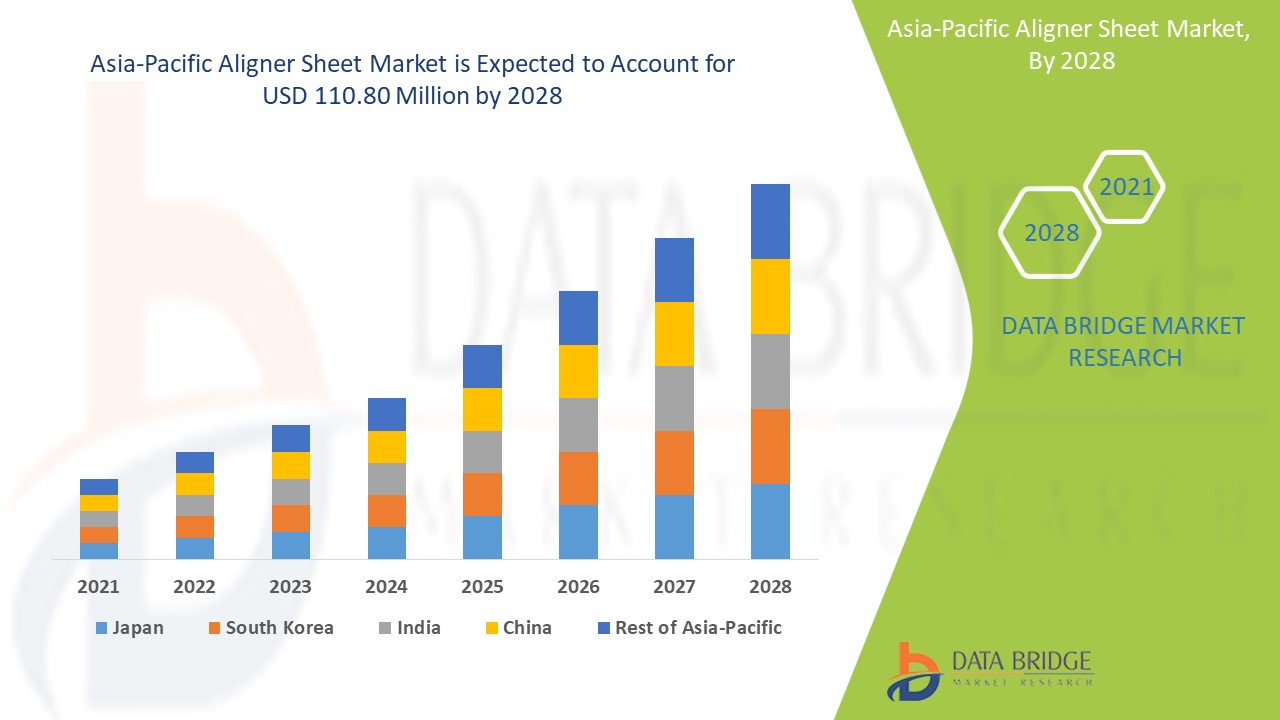

تم تقييم حجم سوق صفائح المحاذاة في منطقة آسيا والمحيط الهادئ بـ 66.51 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 187.09 مليون دولار أمريكي بحلول عام 2032، مع معدل نمو سنوي مركب بنسبة 13.80٪ خلال الفترة المتوقعة من 2025 إلى 2032. بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليل الخبراء المتعمق وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل الأسعار والإطار التنظيمي.

اتجاهات سوق صفائح المحاذاة

" تطوير مواد فائقة الرقة وعالية الأداء"

يشهد سوق صفائح المحاذاة اتجاهًا متزايدًا نحو تطوير مواد فائقة الرقة وعالية الأداء تعمل على تعزيز راحة المريض وكفاءة العلاج. ويعود هذا التحول إلى الطلب المتزايد على المحاذاة الشفافة التي تتميز بالخفة والفعالية. ويستفيد اللاعبون الرئيسيون في الصناعة من التقنيات المتقدمة مثل مواد التشكيل الحراري الملكية والطباعة ثلاثية الأبعاد للبقاء قادرين على المنافسة. على سبيل المثال، فإن مادة Reva من uLab Systems، التي تم طرحها في عام 2024، أرق بنسبة 17% من الخيارات التقليدية مع توفير احتفاظ فائق بالقوة، مما يجعلها بارزة في السوق. يسلط هذا الابتكار الضوء على التركيز على تحسين متانة صفائح المحاذاة ومرونتها ودقتها لتلبية توقعات المستهلكين. وعلاوة على ذلك، فإن التبني المتزايد لحلول إنتاج المحاذاة في نفس اليوم، مثل المحاذاة المطبوعة ثلاثية الأبعاد من LuxCreo، يؤكد على تركيز الصناعة على الكفاءة والفعالية من حيث التكلفة. ومع استمرار التقدم في المواد وعمليات التصنيع، فإن سوق صفائح المحاذاة في وضع يسمح لها بالنمو والابتكار القويين.

نطاق التقرير وتقسيم سوق صفائح المحاذاة

|

صفات |

رؤى أساسية حول سوق صفائح المحاذاة |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك في منطقة آسيا والمحيط الهادئ، ألمانيا، فرنسا، المملكة المتحدة، هولندا، سويسرا، بلجيكا، روسيا، إيطاليا، إسبانيا، تركيا، بقية دول أوروبا في أوروبا، الصين، اليابان، الهند، كوريا الجنوبية، سنغافورة، ماليزيا، أستراليا، تايلاند، إندونيسيا، الفلبين، بقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC)، المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل، بقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من منطقة الشرق الأوسط وأفريقيا (MEA)، البرازيل، الأرجنتين وبقية دول أمريكا الجنوبية كجزء من أمريكا الجنوبية |

|

اللاعبون الرئيسيون في السوق |

MAXFLEX CO, Ltd (كوريا الجنوبية)، Align Technology, Inc. (الولايات المتحدة)، Whitesmile Clear (ألمانيا)، Vedia Solutions (الولايات المتحدة)، وBenQ AB DentCare Corporation (السويد) |

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل التسعير والإطار التنظيمي. |

تعريف سوق صفائح المحاذاة

ورقة المحاذاة هي مادة متخصصة قابلة للتشكيل بالحرارة تستخدم في إنتاج أجهزة المحاذاة الشفافة، وحافظات الأسنان، والقوالب. تم تصميم هذه الأوراق لتوفير المرونة والمتانة والشفافية اللازمة للتطبيقات التقويمية. تلعب دورًا حاسمًا في تقديم علاج تقويمي فعال من خلال الحفاظ على قوة ثابتة مع الحفاظ على السرية الجمالية.

ديناميكيات سوق صفائح المحاذاة

السائقين

- ارتفاع الطلب على حلول تقويم الأسنان الجمالية

إن الطلب المتزايد على حلول تقويم الأسنان التجميلية هو المحرك الرئيسي لسوق صفائح التقويم. ومع بحث المزيد من المرضى عن بدائل سرية ومريحة لتقويم الأسنان المعدني التقليدي، اكتسبت صفائح التقويم الشفافة شعبية كبيرة. وعلى عكس تقويم الأسنان التقليدي، فإن صفائح التقويم الشفافة شفافة وقابلة للإزالة ومخصصة لتناسب أسنان المريض، مما يجعلها خيارًا جذابًا لكل من المراهقين والبالغين. يؤدي هذا التحول في التفضيل إلى زيادة الحاجة إلى صفائح تقويم الأسنان عالية الجودة التي توفر المرونة والمتانة والاحتفاظ الممتاز بالقوة. على سبيل المثال، تلبي مادة Reva من uLab Systems، والتي تكون أرق بنسبة 17% من مواد التقويم التقليدية، هذا الطلب من خلال توفير راحة وفعالية فائقة. ومع إعطاء المزيد من المستهلكين الأولوية للحلول الجمالية التي لا تتداخل مع حياتهم اليومية، يستمر الطلب على صفائح التقويم المتقدمة في النمو، مما يدفع إلى مزيد من التوسع في السوق. ويؤكد هذا الاتجاه على كيفية تشكيل تفضيلات المرضى المتطورة لتطوير وإنتاج مواد التقويم الشفاف.

- زيادة الوعي بتقويم الأسنان

إن الوعي المتزايد بتقويم الأسنان يشكل محركًا مهمًا للسوق لصناعة صفائح التقويم، وخاصة في الأسواق الناشئة حيث يوجد تركيز متزايد على صحة الفم وطب الأسنان التجميلي . ومع انتشار الوعي بفوائد العلاج التقويمي، يسعى المزيد من الناس إلى حلول تقويم الأسنان مثل التقويمات الشفافة لتحسين ابتساماتهم وصحة أسنانهم بشكل عام. وفي بلدان مثل الهند والبرازيل، تعمل الدخول المتاحة المتزايدة وتأثير وسائل التواصل الاجتماعي على تسريع هذا الاتجاه، حيث تكتسب التقويمات الشفافة شعبية بسبب جاذبيتها الجمالية وراحتها. ومع تزايد وعي المستهلكين بمزايا العلاج التقويمي، مثل تعزيز الثقة وصحة الفم على المدى الطويل، يستمر اعتماد التقويمات الشفافة في الارتفاع، مما يدفع الطلب على صفائح التقويمات عالية الجودة في هذه الأسواق سريعة النمو.

فرص

- زيادة الإنفاق على الرعاية الصحية في منطقة آسيا والمحيط الهادئ

إن زيادة الإنفاق على الرعاية الصحية في منطقة آسيا والمحيط الهادئ تقدم فرصة سوقية كبيرة لصناعة صفائح التقويم. ومع استمرار دول مثل الصين والهند واليابان في الاستثمار بكثافة في البنية التحتية للرعاية الصحية، فإن المزيد من المستهلكين يحصلون على إمكانية الوصول إلى علاجات الأسنان المتقدمة، بما في ذلك التقويمات الشفافة. ويعود هذا الارتفاع في الإنفاق على الرعاية الصحية إلى الطبقة المتوسطة المتنامية، وارتفاع الدخول المتاحة، والتركيز المتزايد على طب الأسنان التجميلي. على سبيل المثال، أعطت حكومة الصين الأولوية لإصلاحات الرعاية الصحية، مما أدى إلى تحسين الوصول إلى الرعاية التقويمية وزيادة الطلب على التقويمات الشفافة. ويفتح هذا التحول فرصًا لمصنعي صفائح التقويم لتوسيع وجودهم وتقديم منتجات مبتكرة مصممة خصيصًا للطلب المتزايد في المنطقة. ومع تزايد عدد الأشخاص في منطقة آسيا والمحيط الهادئ الذين يسعون للحصول على علاجات تقويم الأسنان، وخاصة بين السكان الحضريين، فإن الإنفاق المتزايد على الرعاية الصحية يخلق بيئة واعدة للنمو في سوق صفائح التقويم.

- ارتفاع الدخل المتاح

إن ارتفاع الدخل المتاح يشكل فرصة سوقية رئيسية لصناعة صفائح التقويم، حيث أنها تمكن المزيد من المستهلكين من تحمل تكاليف علاجات تقويم الأسنان المتقدمة مثل التقويمات الشفافة. ومع زيادة القوة الشرائية، وخاصة في الاقتصادات الناشئة، يسعى المزيد من الأفراد إلى حلول طب الأسنان التي توفر جاذبية جمالية وفوائد وظيفية. على سبيل المثال، في بلدان مثل الهند وأسواق جنوب شرق آسيا، أصبحت الطبقة المتوسطة المتنامية أكثر ميلاً للاستثمار في علاجات تقويم الأسنان عالية الجودة، بما في ذلك التقويمات الشفافة، نتيجة لقدرتها على تحمل التكاليف وراحتها. ومع استمرار ارتفاع الدخل المتاح، وخاصة في المناطق ذات الاقتصادات النامية بسرعة، من المتوقع أن يتوسع الطلب على إجراءات طب الأسنان التجميلية والتصحيحية. يمكن لمصنعي صفائح التقويم الاستفادة من هذه السوق المتنامية من خلال تقديم منتجات مبتكرة وبأسعار معقولة تلبي احتياجات فئة سكانية أوسع، وبالتالي وضع أنفسهم في وضع يسمح لهم بالاستفادة من اهتمام المستهلكين المتزايد بالتقويمات الشفافة كحل طويل الأمد في متناول الجميع.

القيود/التحديات

- القضايا التنظيمية والامتثالية

تمثل القضايا التنظيمية والامتثالية تحديًا كبيرًا في سوق صفائح التقويم، حيث تخضع صناعة طب الأسنان وتقويم الأسنان لتنظيمات صارمة في مختلف المناطق. في العديد من البلدان، يجب أن تخضع صفائح التقويم لعمليات موافقة صارمة لضمان استيفائها لمعايير السلامة والفعالية، والتي يمكن أن تستغرق وقتًا طويلاً ومكلفة بالنسبة للمصنعين. غالبًا ما تختلف هذه المتطلبات التنظيمية من منطقة إلى أخرى، مما يخلق تعقيدات للشركات التي تتطلع إلى التوسع عالميًا. بالإضافة إلى ذلك، فإن الضغوط المتزايدة للالتزام باللوائح البيئية، مثل الحد من استخدام المواد الكيميائية الضارة أو الانتقال إلى مواد مستدامة، تضيف المزيد من التعقيد إلى التصنيع وتطوير المنتجات. يمكن أن يؤدي هذا المزيج من العقبات التنظيمية إلى إبطاء وقت طرح المنتج في السوق، وزيادة التكاليف التشغيلية، والحد من قدرة اللاعبين الأصغر على المنافسة، مما يجعله تحديًا كبيرًا في السوق.

- مخاوف بشأن فعالية العلاج بعد العلاج

تشكل مخاوف فعالية ما بعد العلاج تحديًا كبيرًا في سوق صفائح التقويم، حيث يعتمد نجاح علاج التقويم بشكل كبير على التزام المريض واستراتيجيات الاحتفاظ طويلة الأمد. في حين يمكن للتقويم أن يقوّم الأسنان بفعالية أثناء مرحلة العلاج، إلا أن العديد من المرضى يعانون من الانتكاس أو تحرك الأسنان بعد إكمال نظام التقويم، خاصة إذا لم يتبعوا تعليمات ما بعد العلاج مثل ارتداء المثبتات. على سبيل المثال، أكدت Align Technology على أهمية الاحتفاظ للحفاظ على النتائج، وقد لا يلتزم بعض المرضى تمامًا باستخدام المثبت، مما يؤدي إلى عدم الرضا عن نتائج العلاج. يؤثر هذا التحدي على التصور العام لعلاج التقويم، حيث يظل العديد من العملاء المحتملين متشككين في فعالية التقويم على المدى الطويل مقارنة بالأقواس التقليدية، حيث يكون الاحتفاظ بعد العلاج أقل تعقيدًا. وبالتالي، تؤثر مخاوف فعالية ما بعد العلاج على رضا العملاء ونمو السوق، حيث قد يتردد المستخدمون المحتملون في الاستثمار في العلاجات القائمة على التقويم بسبب الشكوك حول النتائج الدائمة.

يقدم تقرير السوق هذا تفاصيل عن التطورات الحديثة الجديدة واللوائح التجارية وتحليل الاستيراد والتصدير وتحليل الإنتاج وتحسين سلسلة القيمة وحصة السوق وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وتحليل نمو السوق الاستراتيجي وحجم السوق ونمو سوق الفئات ومنافذ التطبيق والهيمنة وموافقات المنتجات وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول السوق، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

نطاق سوق صفائح المحاذاة

يتم تقسيم السوق على أساس المواد والطبقات والمستخدمين النهائيين وقنوات التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

مادة

- البولي يوريثين (PU)

- بولي إيثيلين تيريفثالات جليكول (PETG)

- آحرون

طبقة

- متعدد الطبقات

- طبقة واحدة

المستخدم النهائي

- الشركات المصنعة لتقويم الأسنان الكبيرة

- الشركات المصنعة لتقويم الأسنان المتوسط

- الشركات المصنعة لتقويم الأسنان الصغيرة

قناة التوزيع

- العطاء المباشر

- قناة على الانترنت

- آحرون

تحليل إقليمي لسوق صفائح المحاذاة

يتم تحليل السوق وتوفير رؤى حول حجم السوق واتجاهاته حسب نوع المنتج والوسيلة والمستخدم النهائي كما هو مذكور أعلاه.

من المتوقع أن تشهد منطقة آسيا والمحيط الهادئ أعلى معدل نمو سنوي مركب (CAGR) خلال الفترة المتوقعة، مدفوعًا بالتحضر السريع والتقدم في أتمتة المختبرات. ومع توسع المراكز الحضرية وارتفاع الدخول المتاحة، يتزايد الطلب على منتجات صفائح المحاذاة بشكل كبير في العديد من البلدان في المنطقة. ومن المتوقع أن تقود الصين، على وجه الخصوص، السوق في منطقة آسيا والمحيط الهادئ، حيث تلعب دورًا رئيسيًا في التبني الواسع النطاق للمحاذاة الشفافة. تساهم الطبقة المتوسطة المتنامية في البلاد والوعي المتزايد بعلاجات تقويم الأسنان في التوسع السريع لسوق صفائح المحاذاة.

يقدم قسم الدولة في التقرير أيضًا عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب والاتجاهات الفنية وتحليل قوى بورتر الخمس ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. أيضًا، يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

حصة سوق صفائح المحاذاة

يوفر المشهد التنافسي للسوق تفاصيل حسب المنافس. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بالسوق.

الشركات الرائدة في سوق صفائح المحاذاة العاملة في السوق هي:

- شركة ماكس فليكس المحدودة (كوريا الجنوبية)

- شركة Align Technology, Inc. (الولايات المتحدة)

- وايت سمايل كلير (ألمانيا)

- حلول فيديا (الولايات المتحدة)

- شركة بنكيو ايه بي لطب الأسنان (السويد)

أحدث التطورات في سوق صفائح المحاذاة

- في سبتمبر 2024، أطلقت شركة uLab Systems مادة Reva، وهي مادة تشكيل حراري مبتكرة مصممة لمنتجات التقويم الشفاف. مادة Reva أرق بنسبة 17% من المواد من الشركات المنافسة الرائدة، مما يجعلها أرق مادة تقويم في السوق. توفر احتفاظًا فائقًا بالقوة وهي متاحة الآن لجميع منتجات التقويم والقوالب والمثبتات من uSmile المصنعة في منشأة uLab في ممفيس بولاية تينيسي

- في يوليو 2023، قدمت شركة Angelalign Technology Inc. أجهزة تقويم الأسنان الشفافة المصممة خصيصًا إلى السوق الأمريكية. وباعتبارها رائدة عالمية في تكنولوجيا تقويم الأسنان الشفافة مع علاج أكثر من مليون ابتسامة، تعمل الشركة على توسيع حضورها وخبرتها في الولايات المتحدة

- في أبريل 2023، كشفت شركة LuxCreo، المتخصصة في الطباعة ثلاثية الأبعاد للأجهزة السنية، عن حل شامل معتمد من إدارة الغذاء والدواء الأمريكية من الفئة الثانية 510(k) لأطباء تقويم الأسنان وأطباء الأسنان. يسمح هذا الابتكار بإنتاج أجهزة تقويم الأسنان الشفافة في نفس اليوم، مما يلغي مراحل النمذجة والتشكيل الحراري التقليدية. يمكن توصيل أجهزة التقويم للمرضى في غضون ساعتين من الفحص الفموي، مما يقلل بشكل كبير من نفقات العمالة ورأس المال

- في أغسطس 2020، قدمت شركة Dentagrafix، بالتعاون مع NBALAB، صفائح بلاستيكية تحمل طابع NBA لتقويم الأسنان والمثبتات. تتميز هذه الصفائح القابلة للتشكيل الحراري والمتوافقة مع إدارة الغذاء والدواء بشعارات وتصميمات مرخصة من فرق NBA مثل Boston Celtics وBrooklyn Nets وGolden State Warriors وHouston Rockets وLos Angeles Clippers وLos Angeles Lakers وMilwaukee Bucks وNew York Knicks وPhiladelphia 76ers

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.