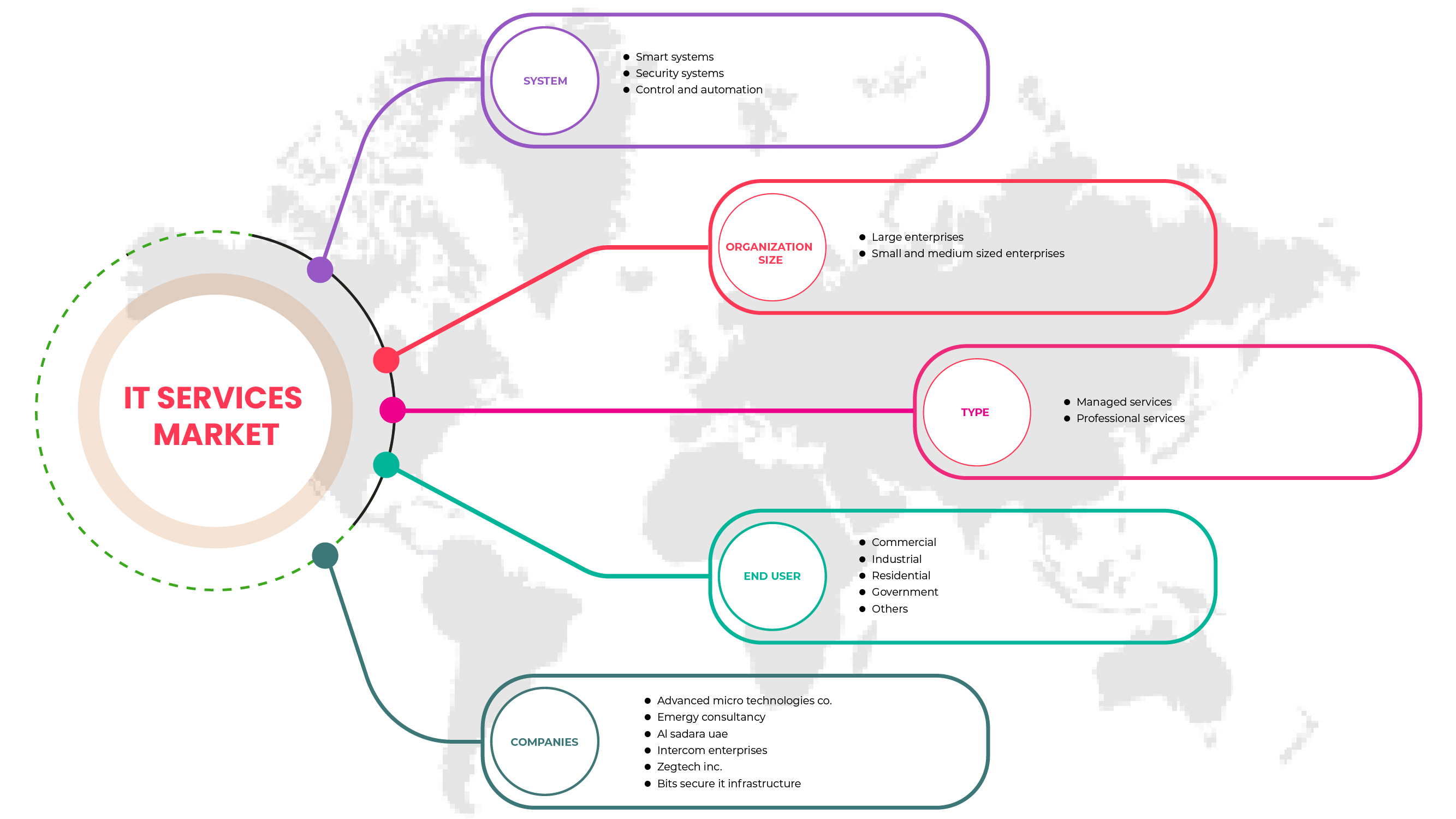

سوق خدمات تكنولوجيا المعلومات في العراق، حسب النظام ( النظام الذكي ، ونظام الأمان ، والتحكم والأتمتة)، النوع ( الخدمات المدارة والخدمات المهنية)، حجم المنظمة (المؤسسات الكبيرة والمؤسسات الصغيرة والمتوسطة الحجم (SMEs))، المستخدم النهائي ( التجاري ، والصناعي، والسكني، والحكومي ، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل وحجم سوق خدمات تكنولوجيا المعلومات في العراق

تُعرف خدمات تكنولوجيا المعلومات بشكل أساسي بأنها مزيج من الخبرة الفنية والتجارية بهدف تزويد المؤسسات بإدارة وإنشاء وتحسين العمليات التجارية. وهي تساعد في توجيه المؤسسات نحو استراتيجية تكنولوجيا المعلومات الشاملة، والتي تشمل السحابة ومركز البيانات ونوع التكنولوجيا والوظائف المطلوبة في سياق بيئات تكنولوجيا المعلومات والأعمال في المؤسسة.

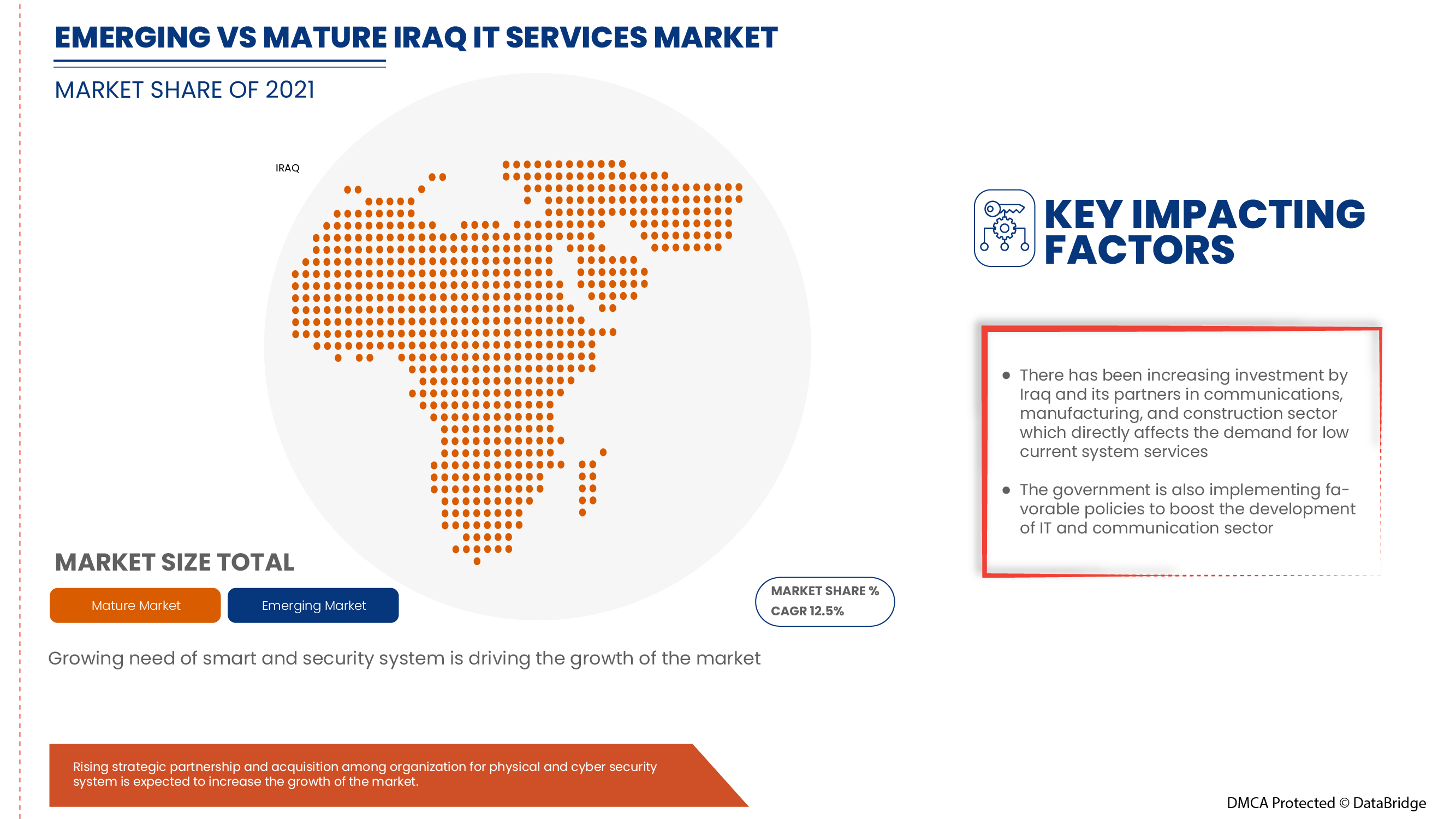

وتشير تحليلات شركة Data Bridge Market Research إلى أن سوق خدمات تكنولوجيا المعلومات في العراق من المتوقع أن يصل إلى قيمة 40.28 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 9.9% خلال الفترة المتوقعة. وتمثل "الأنظمة الذكية" أكبر شريحة مكونات في سوق خدمات تكنولوجيا المعلومات وتوفر مرافق أساسية ومجموعة واسعة من الميزات مع منصات مختلفة.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب النظام (النظام الذكي، ونظام الأمان، والتحكم والأتمتة)، والنوع (الخدمات المهنية، والخدمات المدارة)، وحجم المنظمة (المؤسسات الكبيرة، والمؤسسات الصغيرة والمتوسطة)، والمستخدم النهائي (التجاري، والصناعي، والسكني، والحكومي، وغيرها) |

|

الدول المغطاة |

العراق |

|

الجهات الفاعلة في السوق المشمولة |

Intercom Enterprises، TECO Middle. East، Advanced Micro Technologies Co.، Emirates Dawn.، AL Sadara UAE، Energy Pillars، Mobi EGYPT، Industrial Dimensions Contracting Co.، EMergy Consultancy، BITS secure IT structure.، Guqa IT Team، Zegtech Inc.، BTC NETWORKS، Skies ltd.، ADS، من بين شركات أخرى |

تعريف السوق

خدمات تكنولوجيا المعلومات هي منشأة متطورة تدير أنظمة ومعدات الكمبيوتر ذات الصلة بتكنولوجيا المعلومات. تربط خدمات تكنولوجيا المعلومات معايير البنية الأساسية بمتطلبات البيئة التشغيلية لمختلف صناعات المستخدم النهائي. يتم الاستعانة بخدمات تكنولوجيا المعلومات من العديد من الشركات في جميع أنحاء العالم التي توفر المنشأة بناءً على متطلبات المستخدم النهائي والعميل. أدى التقدم في عمليات تكنولوجيا المعلومات في المنصة المستندة إلى السحابة إلى جعل خدمات تكنولوجيا المعلومات أكثر اعتمادًا على البيانات والعمل في الوقت الفعلي. وهذا يخلق قيمة أكبر للأعمال ويزيد من اكتشاف الفرص التجارية والكفاءة التشغيلية ويوفر تحسين الوصول عن بُعد.

يمكن تصنيف خدمات تكنولوجيا المعلومات إلى نوعين، الخدمات المُدارة والخدمات المهنية. الخدمات المُدارة هي الدعم المستمر لعملائها، واستخدام هذه الخدمات متكرر حيث تحدث عمليات مثل إصلاح الأخطاء وصيانة الخادم بشكل منتظم. الخدمات المهنية هي خدمات تكنولوجيا معلومات عرضية مع عروض مثل تكامل البنية الأساسية والاستشارات والتدريب. في هذا، تكون الخدمات محدودة لفترة زمنية معينة، اعتمادًا على نوع المشروع.

ديناميكيات سوق خدمات تكنولوجيا المعلومات في العراق

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

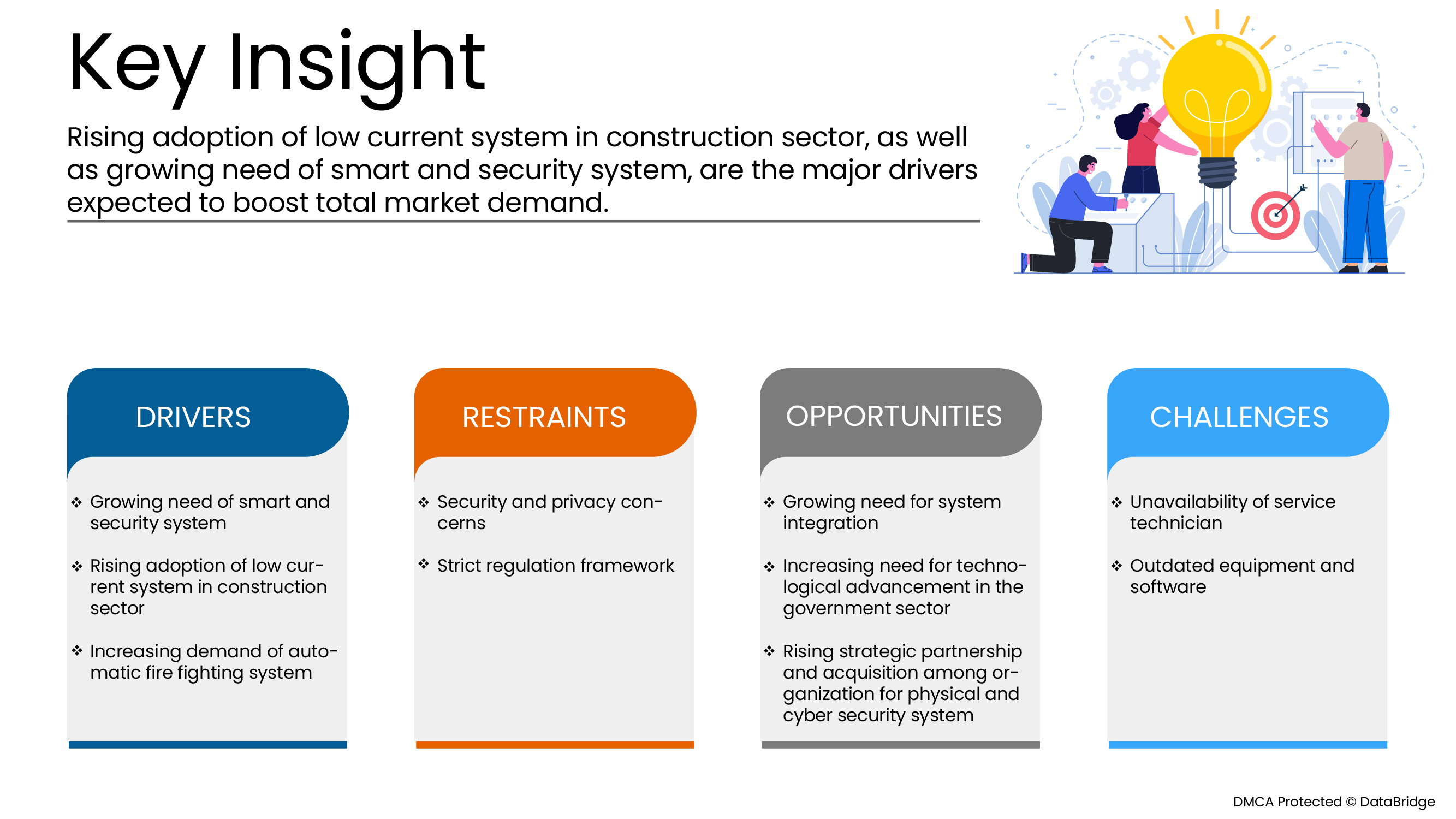

السائقين

- الحاجة المتزايدة إلى الأنظمة الذكية والأمنية

تعمل الأنظمة الذكية والأمنية في الوقت الحاضر بإشارات تيار منخفضة بجهد منخفض للغاية. تشكل البنية التحتية لنظام التيار المنخفض الجزء المركزي لأي بناء جديد سواء كان سكنيًا أو فندقيًا أو تجاريًا أو مجمعات أو حرمًا جامعيًا ذكيًا.

يشتمل عدد من أنظمة الأمان على أنظمة CCTV وأنظمة أتمتة المنزل والتحكم في الإضاءة وأنظمة إنذار الدخلاء وأنظمة الساعة الرئيسية والتلفزيون الذكي وتلفزيون IP والأنظمة السمعية والبصرية ونظام مخاطبة الجمهور ونظام استدعاء الممرضات والشبكة والهاتف عبر IP يتم التحكم فيها بواسطة مكونات التيار المنخفض.

- تزايد استخدام نظام التيار المنخفض في قطاع البناء

تتجه الشركات الصغيرة والمتوسطة نحو التحول الرقمي وبناء البنية التحتية التي تدعمها تكنولوجيا المعلومات. ويتحقق ذلك من خلال الخدمات منخفضة التيار التي يقدمها مقدمو الخدمات. وأصبح من الأسهل على الشركات في العراق اختيار الخدمات منخفضة التيار من خلال الاستعانة بمصادر خارجية للخدمات من طرف ثالث دون توسيع البنية التحتية، وبالتالي تقليل التكلفة الإجمالية. وتختار الشركات الصغيرة والمتوسطة في العراق الخدمات منخفضة التيار لتحسين وتحويل أعمالها، ومن المتوقع أن يعمل هذا كعامل دفع رئيسي للسوق.

- تزايد الطلب على نظام مكافحة الحرائق الأوتوماتيكي

تُستخدم أنظمة مكافحة الحرائق بشكل استثنائي لتجنب المخاطر المرتبطة بالحرائق. ويتم التمييز بين الأنظمة التي يتم تشغيلها تلقائيًا والأنظمة التي يقوم المشغل بتشغيلها. ويتزايد الطلب على أنظمة مكافحة الحرائق الأوتوماتيكية لأن النظام الأوتوماتيكي يتضمن أجهزة استشعار قادرة على اكتشاف الاحتراق وأجهزة إشارات الإنذار ومعدات إطفاء الحرائق وأجهزة بدء وإيقاف ومغذيات لمواد إطفاء الحرائق.

- تزايد الطلب على مرافق العمل والتعلم عن بعد

لقد أحدث الوباء اضطرابًا في التعليم في أكثر من 150 دولة وأثر على 1.6 مليار طالب. وبناءً على ذلك، نفذت العديد من الدول نوعًا من التعلم عن بعد. ركزت استجابة التعليم خلال المرحلة الأولى من COVID-19 على تنفيذ أشكال التعلم عن بعد كاستجابة للأزمة. لكنها لم تكن فعالة في كل الأوقات ولكن مع تطور الوباء، تطورت أيضًا استجابات التعليم.

القيود/التحديات

- المخاوف المتعلقة بالأمن والخصوصية

إن الخدمات والحلول ذات التيار المنخفض مثل الكابلات الهيكلية وحلول CCTV وحلول التحكم في الوصول المتقدمة وحلول الشبكات وأنظمة الهاتف عبر بروتوكول الإنترنت وحلول PABX ونظام PA ونظام VA والساعة الرئيسية والحلول اللاسلكية لها هياكل معقدة. إن المخاطر الأمنية المرتبطة بأجهزة التيار المنخفض هي أن خللًا في أحد المكونات يمكن أن يدمر النظام بأكمله. يمكن أن تتلف البيانات المخزنة في أنظمة CCTV. وبالتالي، فإن مخاوف الأمن هذه قد تعمل كقيد لنمو السوق.

- عدم توفر فنيين الخدمة

قد تواجه الشركات فترات توقف إذا لم يكن الفنيون متاحين لمعالجة المشكلات على الفور. وقد يكون الاحتفاظ بالموظفين ذوي الخبرة والمهارة أمرًا صعبًا بسبب انخفاض توافر فنيي الخدمة الميدانية. إن خدمة الصيانة والإصلاح هي شأن جماعي، وترتبط عمليات الخدمة الميدانية بشكل كبير بالعديد من المهام المتتالية التي تنطوي على العديد من أصحاب المصلحة الذين يجب إدارتهم بطريقة معينة. ويشكل الفنيون نقطة اتصال حاسمة بين المكتب والميدان.

تأثير ما بعد كوفيد-19 على سوق خدمات تكنولوجيا المعلومات في العراق

أحدثت جائحة كوفيد-19 تأثيرًا كبيرًا على سوق خدمات تكنولوجيا المعلومات حيث اختارت كل دولة تقريبًا إغلاق جميع مرافق الإنتاج باستثناء تلك التي تتعامل مع إنتاج السلع الأساسية. اتخذت الحكومة بعض الإجراءات الصارمة مثل إيقاف إنتاج وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير لمنع انتشار كوفيد-19. كانت الشركات الوحيدة التي كانت تتعامل في ظل هذا الوضع الوبائي هي الخدمات الأساسية التي سُمح لها بفتح وتشغيل العمليات.

أثرت جائحة كوفيد-19 على سوق خدمات تكنولوجيا المعلومات في العراق. حيث أعاقت تكاليف الاستثمار المحدودة ونقص الموظفين مبيعات وإنتاج خدمات تكنولوجيا المعلومات. ومع ذلك، تبنت الحكومة والجهات الفاعلة الرئيسية في السوق تدابير أمان جديدة لتطوير الممارسات. وقد أدى التقدم في التكنولوجيا إلى تصعيد معدل نمو سوق خدمات تكنولوجيا المعلومات حيث استهدف الجمهور المناسب. ومن المتوقع أن يستعيد سوق بناء خدمات تكنولوجيا المعلومات وتيرته خلال سيناريو ما بعد الوباء بسبب تخفيف القيود.

التطورات الأخيرة

- في مارس 2019، أطلقت شركة تيكو الشرق الأوسط حلاً لتطبيقات الشركة على أنظمة أندرويد وآبل. يساعد التطبيق عملاءها على متابعة مشاريعهم القادمة والجارية والسرعة في اتخاذ القرار. ساعد هذا التطبيق الشركة على تبسيط عملية عملها بالكامل

- في يونيو 2022، أكملت شركة إنيرجي بيلارز أعمال ترقية الكهرباء للمشروع رقم 2107-717 ITT للمرافق في ميناء زايد. سيساعد هذا المشروع المكتمل الشركة على جذب عملاء جدد وتحسين قيمة العلامة التجارية في السوق

نطاق سوق خدمات تكنولوجيا المعلومات في العراق

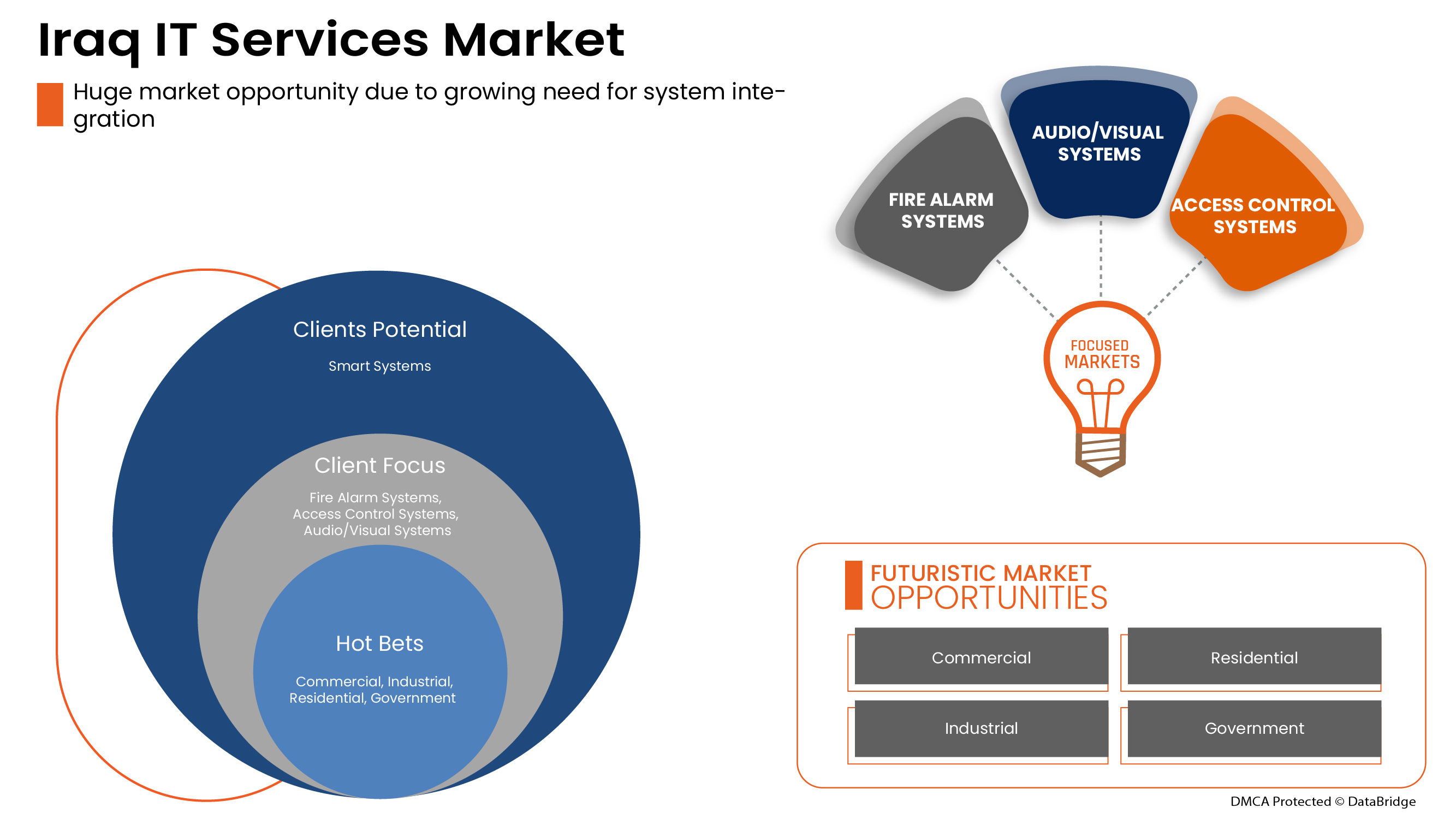

يتم تقسيم سوق خدمات تكنولوجيا المعلومات في العراق على أساس العروض والنوع والمستوى والحجم والتكنولوجيا والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نظام

- نظام ذكي

- نظام الأمان

- التحكم والأتمتة

على أساس النظام، يتم تقسيم سوق خدمات تكنولوجيا المعلومات في العراق إلى نظام ذكي ونظام أمان ونظام تحكم وأتمتة.

يكتب

- الخدمات المهنية

- الخدمات المُدارة

على أساس النوع، يتم تقسيم سوق خدمات تكنولوجيا المعلومات في العراق إلى خدمات مهنية وخدمات مُدارة.

حجم المنظمة

- الشركات الكبيرة

- المؤسسات الصغيرة والمتوسطة

على أساس حجم المنظمة الطبقية، يتم تقسيم سوق خدمات تكنولوجيا المعلومات في العراق إلى شركات كبيرة، وشركات صغيرة ومتوسطة.

المستخدم النهائي

- تجاري

- صناعي

- سكني

- حكومة

- آحرون

على أساس المستخدم النهائي، يتم تقسيم سوق خدمات تكنولوجيا المعلومات في العراق إلى تجاري وصناعي وسكني وحكومي وغيرها.

تحليل/رؤى إقليمية لسوق خدمات تكنولوجيا المعلومات في العراق

يتم تحليل سوق خدمات تكنولوجيا المعلومات في العراق، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والنوع والنوع وحجم المنظمة والنظام والمستخدم النهائي كما هو مذكور أعلاه.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق خدمات تكنولوجيا المعلومات

يقدم المشهد التنافسي لسوق خدمات تكنولوجيا المعلومات في العراق تفاصيل حسب المنافس. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والتواجد الإقليمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق خدمات تكنولوجيا المعلومات في العراق.

بعض اللاعبين الرئيسيين العاملين في سوق خدمات تكنولوجيا المعلومات في العراق هم Intercom Enterprises و TECO Middle. East و Advanced Micro Technologies Co. و Emirates Dawn و AL Sadara UAE و Energy Pillars و Mobi EGYPT و Industrial Dimensions Contracting Co. و EMergy Consultancy و BITS secure IT structure و Guqa IT Team و Zegtech Inc. و BTC NETWORKS و Skies ltd و ADS وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF IRAQ IT SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 SYSTEM CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 LEGAL FACTORS

4.2.5 TECHNOLOGICAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 BRAND COMPARATIVE ANALYSIS

4.4 REGULATORY STANDARD:

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 GROWING NEED OF SMART AND SECURITY SYSTEMS

6.1.2 INCREASING DEMAND FOR AUTOMATIC FIRE FIGHTING SYSTEM

6.2 RESTRAINTS

6.2.1 RISING SECURITY AND PRIVACY CONCERNS

6.2.2 STRICT REGULATORY FRAMEWORK

6.3 OPPORTUNITIES

6.3.1 GROWING NEED FOR SYSTEM INTEGRATION

6.3.2 INCREASING NEED FOR TECHNOLOGICAL ADVANCEMENT IN LOW CURRENT DEVICES

6.3.3 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR PHYSICAL AND CYBER SECURITY SYSTEM

6.4 CHALLENGES

6.4.1 UNAVAILABILITY OF SERVICE TECHNICIANS

6.4.2 OUTDATED EQUIPMENT AND SOFTWARE

7 IRAQ IT SERVICES MARKET, BY SYSTEM

7.1 OVERVIEW

7.2 SMART SYSTEM

7.2.1 FIRE ALARM SYSTEMS

7.2.2 PUBLIC ADDRESS SYSTEMS

7.2.3 AUDIO/VISUAL SYSTEMS

7.2.4 MASTER CLOCK SYSTEMS

7.2.5 SMATV & IPTV, OTT SYSTEMS

7.2.6 LIGHTING CONTROL

7.2.7 NETWORK AND IP TELEPHONY

7.2.8 HOME AUTOMATION SYSTEMS

7.2.9 INTRUDER ALARM SYSTEMS

7.2.10 NURSE CALL SYSTEM

7.2.11 OTHERS

7.3 SECURITY SYSTEM

7.3.1 CCTV, SECURITY AND SURVEILLANCE SYSTEMS

7.3.2 ACCESS CONTROL SYSTEMS

7.3.2.1 ACCESS DEVICES

7.3.2.1.1 BIOMETRIC AUTHENTICATION

7.3.2.1.2 SMART CARD AND MOBILE ID AUTHENTICATION

7.3.2.2 READERS

7.3.2.3 MAGNETIC AND ELECTRIC LOCKS

7.3.3 INTRUSION DETECTION SYSTEMS

7.3.4 GATES & BARRIERS

7.3.5 OTHERS

7.4 CONTROL AND AUTOMATION

7.4.1 BUILDING MANAGEMENT SYSTEMS (BMS)

7.4.2 FIBER OPTICS CABLE INSTALLATION AND TESTING

7.4.3 SCADA AND AUTOMATION

7.4.4 ACTIVE COMPONENTS

7.4.5 INSTRUMENT EQUIPMENT AND CONTROL

7.4.6 OTHERS

8 IRAQ IT SERVICES MARKET, BY TYPE

8.1 OVERVIEW

8.2 PROFESSIONAL SERVICES

8.2.1 INSTALLATION AND IMPLEMENTATION

8.2.2 DESIGNING

8.2.3 SUPPORT AND MAINTENANCE

8.2.4 UPGRADATION

8.3 MANAGES SERVICES

9 TURKEY IT SERVICES MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM ENTERPRISES

10 IRAQ IT SERVICES MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 BY APPLICATION

10.2.1.1 AIRPORTS

10.2.1.2 RETAIL AND MALLS

10.2.1.3 HOSPITALITY

10.2.1.4 HEALTHCARE

10.2.1.5 BANKING AND FINANCIAL INSTITUTIONS

10.2.1.6 OTHERS

10.2.2 BY SYSTEM

10.2.2.1 SMART SYSTEM

10.2.2.2 SECURITY SYSTEM

10.2.2.3 CONTROL AND AUTOMATION

10.2.3 BY TYPE

10.2.3.1 PROFESSIONAL SERVICES

10.2.3.1.1 INSTALLATION AND IMPLEMENTATION

10.2.3.1.2 DESIGNING

10.2.3.1.3 SUPPORT AND MAINTENANCE

10.2.3.1.4 UPGRADATION

10.2.3.2 MANAGES SERVICES

10.3 INDUSTRIAL

10.3.1 BY APPLICATION

10.3.1.1 OIL & GAS

10.3.1.2 SECURITY

10.3.1.3 TELECOMMUNICATION

10.3.1.4 DATA CENTER

10.3.1.5 MANUFACTURING

10.3.1.6 OTHERS

10.3.2 BY SYSTEM

10.3.2.1 SMART SYSTEM

10.3.2.2 SECURITY SYSTEM

10.3.2.3 CONTROL AND AUTOMATION

10.3.3 BY SYSTEM

10.3.3.1 PROFESSIONAL SERVICES

10.3.3.1.1 INSTALLATION AND IMPLEMENTATION

10.3.3.1.2 DESIGNING

10.3.3.1.3 SUPPORT AND MAINTENANCE

10.3.3.1.4 UPGRADATION

10.3.3.2 MANAGES SERVICES

10.4 RESIDENTIAL

10.4.1 BY APPLICATION

10.4.1.1 MULTI FAMILY HOME

10.4.1.2 SINGLE FAMILY HOME

10.4.1.3 APARTMENTS

10.4.1.4 OTHERS

10.4.2 BY SYSTEM

10.4.2.1 SMART SYSTEM

10.4.2.2 SECURITY SYSTEM

10.4.2.3 CONTROL AND AUTOMATION

10.4.3 BY TYPE

10.4.3.1 PROFESSIONAL SERVICES

10.4.3.1.1 INSTALLATION AND IMPLEMENTATION

10.4.3.1.2 DESIGNING

10.4.3.1.3 SUPPORT AND MAINTENANCE

10.4.3.1.4 UPGRADATION

10.4.3.2 MANAGES SERVICES

10.5 GOVERNMENT

10.5.1 BY SYSTEM

10.5.1.1 SECURITY SYSTEM

10.5.1.2 SMART SYSTEM

10.5.1.3 CONTROL AND AUTOMATION

10.5.2 BY TYPE

10.5.2.1 PROFESSIONAL SERVICES

10.5.2.1.1 INSTALLATION AND IMPLEMENTATION

10.5.2.1.2 DESIGNING

10.5.2.1.3 SUPPORT AND MAINTENANCE

10.5.2.1.4 UPGRADATION

10.5.2.2 MANAGES SERVICES

10.6 OTHERS

11 IRAQ IT SERVICES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: IRAQ

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 MOBI EGYPT

13.1.1 COMPANY PROFILE

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 INTERCOM ENTERPRISES

13.2.1 COMPANY PROFILE

13.2.2 SOLUTION PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 ADVANCED MICRO TECHNOLOGIES CO.

13.3.1 COMPANY PROFILE

13.3.2 SOLUTION PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 EMERGY CONSULTANCY

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 BITS SECURE IT INFRASTRUCTURE

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 ADS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 AL SADARA UAE

13.7.1 COMPANY PROFILE

13.7.2 SERVICES PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 BTC NETWORKS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 EMIRATES DAWN

13.9.1 COMPANY PROFILE

13.9.2 SERVICES PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 ENERGY PILLARS

13.10.1 COMPANY PROFILE

13.10.2 SERVICES PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 GUQA IT TEAM

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 INDUSTRIAL DIMENSIONS CONTRACTING CO.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 SKIES LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 TECO MIDDLE. EAST

13.14.1 COMPANY PROFILE

13.14.2 SERVICE PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 ZEGTECH INC.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IRAQ IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 2 IRAQ SMART SYSTEM IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 IRAQ SECURITY SYSTEM IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 IRAQ ACCESS CONTROL SYSTEMS IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 IRAQ ACCESS DEVICE IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 IRAQ CONTROL AND AUTOMATION IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 IRAQ IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 IRAQ IT SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 10 IRAQ IT SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 11 IRAQ COMMERCIAL IN IT SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 IRAQ COMMERCIAL IN IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 13 IRAQ COMMERCIAL IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 IRAQ INDUSTRIAL IN IT SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 IRAQ INDUSTRIAL IN IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 17 IRAQ INDUSTRIAL IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 IRAQ RESIDENTIAL IN IT SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 IRAQ RESIDENTIAL IN IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 21 IRAQ RESIDENTIAL IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 IRAQ GOVERNMENT IN IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 24 IRAQ GOVERNMENT IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 IRAQ IT SERVICES MARKET: SEGMENTATION

FIGURE 2 IRAQ IT SERVICES MARKET : DATA TRIANGULATION

FIGURE 3 IRAQ IT SERVICES MARKET: DROC ANALYSIS

FIGURE 4 IRAQ IT SERVICES MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 IRAQ IT SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 IRAQ IT SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 IRAQ IT SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 IRAQ IT SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 IRAQ IT SERVICES MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 IRAQ IT SERVICES MARKET: SEGMENTATION

FIGURE 11 GROWING NEED OF SMART AND SECURITY SYSTEM IS EXPECTED TO BE A KEY DRIVER FOR THE IRAQ IT SERVICES MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SMART SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE IRAQ IT SERVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVER, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF IRAQ IT SERVICES MARKET

FIGURE 14 IRAQ IT SERVICES MARKET: BY SYSTEM, 2021

FIGURE 15 IRAQ IT SERVICES MARKET: BY TYPE, 2021

FIGURE 16 IRAQ IT SERVICES MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 17 IRAQ IT SERVICES MARKET: BY END USER, 2021

FIGURE 18 IRAQ IT SERVICES MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.