الاختبار غير الإتلافي (NDT) هو تقنية اختبار وتحليل تستخدمها الصناعة لتقييم خصائص المواد أو المكونات أو الهياكل أو الأنظمة للكشف عن الاختلافات المميزة أو عيوب اللحام وانقطاعات التوصيل دون التسبب في تلف القطعة الأصلية. يُعرف الاختبار غير الإتلافي أيضًا باسم الفحص غير الإتلافي (NDE)، والتفتيش غير الإتلافي (NDI)، والتقييم غير الإتلافي (NDE). تُستخدم هذه الطرق على نطاق واسع في صناعات مثل الفضاء والسيارات والتصنيع لضمان جودة المنتج وسلامته. تُعد أنظمة الفحص بالأشعة السينية عنصرًا أساسيًا في الاختبار غير الإتلافي، إذ توفر كشفًا دقيقًا وموثوقًا للعيوب والملوثات التي قد تؤثر على جودة المنتج وسلامته. تُستخدم الاختبارات غير الإتلافية الحديثة اليوم في التصنيع والتجهيز والفحوصات أثناء الخدمة لضمان سلامة المنتج وموثوقيته، والتحكم في عمليات التصنيع، وخفض تكاليف الإنتاج، والحفاظ على مستوى جودة موحد. تزيد هذه المزايا من الطلب على الاختبارات غير الإتلافية في الصناعات والعمليات، مما يؤثر إيجابًا على سوق الأشعة السينية الصناعية في أمريكا الشمالية.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/north-america-industrial-x-ray-market

تحلل شركة Data Bridge Market Research أن سوق الأشعة السينية الصناعية في أمريكا الشمالية من المتوقع أن يصل إلى 2.03 مليار دولار أمريكي بحلول عام 2031 من 1.09 مليار دولار أمريكي في عام 2023، بنمو قدره 8.1٪ في الفترة المتوقعة من 2024 إلى 2031.

النتائج الرئيسية للدراسة

النمو في لوائح السلامة ومعايير الجودة

تهدف لوائح السلامة إلى ضمان سلامة المنتج أو الحدث أو المادة وعدم خطورتها، وتتبع كل صناعة حول العالم لوائح حكومية وتنظيمية مختلفة للسلامة للمنتج المُسوّق. كما تُعدّ معايير الجودة وثائق تُحدد المتطلبات والمواصفات والمبادئ التوجيهية والخصائص التي يُمكن استخدامها باستمرار لضمان ملاءمة المواد والمنتجات والعمليات والخدمات للغرض المُخصص لها. تفرض الحكومات حول العالم لوائح ومعايير جودة أكثر صرامة على مختلف الصناعات، مثل الأغذية والمشروبات والأدوية والسيارات، لضمان سلامة وجودة منتجاتها. وتتزايد هذه اللوائح الحكومية للسلامة في مناطق مختلفة حول العالم للحد من الآثار الجانبية أو المخاطر التي يُسببها المنتج للإنسان والمواد. ويتزايد اعتماد أنظمة الفحص بالأشعة السينية في هذه الصناعات لتلبية المتطلبات التنظيمية وضمان سلامة وجودة منتجاتها.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالمليار دولار أمريكي

|

القطاعات المغطاة

|

تقنية التصوير (التصوير الشعاعي الرقمي والتصوير الشعاعي بالأفلام)، التطبيق (صناعات الطيران والفضاء، والدفاع والجيش، وتوليد الطاقة، وصناعة السيارات، والتصنيع، وصناعة الأغذية والمشروبات، وغيرها)، النمط (ثنائي الأبعاد، وثلاثي الأبعاد، وهجين)، النطاق (الأشعة السينية ذات التركيز الدقيق، والأشعة السينية عالية الطاقة، وغيرها)، المصدر (الكوبالت-59، والإيريديوم-192، وغيرها)، قناة التوزيع (القناة غير المباشرة والقناة المباشرة)، نوع المنتج (مواد الأشعة السينية، وأجهزة الأشعة السينية، وخدمات الأشعة السينية)

|

الدول المغطاة

|

الولايات المتحدة وكندا والمكسيك

|

الجهات الفاعلة في السوق المغطاة

|

Teledyne Technologies Incorporated (الولايات المتحدة)، Hamamatsu Photonics KK (اليابان)، General Electric Company (الولايات المتحدة)، Comet Group (ألمانيا)، Varex Imaging (الولايات المتحدة)، Carestream Health (الولايات المتحدة)، Carl Zeiss AG (ألمانيا)، Eastman Kodak Company (الولايات المتحدة)، North Star Imaging Inc. (الولايات المتحدة)، VJ X-Ray (الولايات المتحدة)، Rigaku Corporation (اليابان)، Minebea Intec GmbH (ألمانيا)، PROTEC GmbH & Co. KG (ألمانيا)، Oehm and Rehbein GmbH (ألمانيا)، FUJIFILM Holdings Corporation (اليابان)، Shimadzu Corporation (اليابان)، Lucky Healthcare Co., Ltd. (الصين)، Canon Electron Tubes & Devices Co., Ltd. (اليابان)، Applus+ (إسبانيا)، Hitachi, Ltd. (اليابان)، Avonix Imaging (الولايات المتحدة)، وNordson Corporation (الولايات المتحدة)، وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية والجهات الفاعلة في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث سوق Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل المدقة.

|

تحليل القطاعات

يتم تقسيم سوق الأشعة السينية الصناعية في أمريكا الشمالية إلى سبعة قطاعات بارزة على أساس تقنية التصوير والتطبيق والوسيلة والنطاق والمصدر وقناة التوزيع ونوع المنتج.

- على أساس تقنية التصوير، يتم تقسيم سوق الأشعة السينية الصناعية في أمريكا الشمالية إلى التصوير الشعاعي الرقمي والتصوير الشعاعي القائم على الأفلام

في عام 2024، من المتوقع أن يهيمن قطاع التصوير الشعاعي الرقمي على سوق الأشعة السينية الصناعية في أمريكا الشمالية

في عام 2024، من المتوقع أن ينمو قطاع التصوير الشعاعي الرقمي بنسبة 65.87% في السوق، بفضل جودة صوره الفائقة، وأوقات معالجته السريعة، وانخفاض تعرضه للإشعاع مقارنةً بالتصوير الشعاعي التناظري التقليدي. هذه المزايا تجعل التصوير الشعاعي الرقمي حلاً أكثر كفاءة وفعالية من حيث التكلفة للتطبيقات الصناعية، وخاصةً في الصناعات ذات متطلبات مراقبة الجودة الصارمة.

- على أساس التطبيق، يتم تقسيم سوق الأشعة السينية الصناعية في أمريكا الشمالية إلى صناعات الطيران والفضاء، والدفاع والجيش، وصناعة توليد الطاقة، وصناعة السيارات، وصناعة التصنيع، وصناعة الأغذية والمشروبات، وغيرها

في عام 2024، من المتوقع أن يهيمن قطاع الصناعات الجوية على سوق الأشعة السينية الصناعية في أمريكا الشمالية

من المتوقع أن ينمو قطاع الصناعات الجوية في عام 2024 بنسبة حصة سوقية تبلغ 32.84٪ بسبب لوائح الجودة والسلامة الصارمة التي تفرضها الهيئات الحكومية على مكونات الطيران والطلب المتزايد على المواد خفيفة الوزن وعالية الأداء في تصنيع الطائرات مما يستلزم استخدام تقنيات الفحص غير المدمر المتقدمة مثل الأشعة السينية الصناعية لضمان سلامة وموثوقية هذه المكونات.

- بناءً على طريقة الاستخدام، يُقسّم سوق الأشعة السينية الصناعية في أمريكا الشمالية إلى ثنائي الأبعاد، وثلاثي الأبعاد، وهجين. ومن المتوقع أن ينمو قطاع ثنائي الأبعاد بنسبة 59.47% في عام 2024.

- بناءً على نطاقه، يُقسّم سوق الأشعة السينية الصناعية في أمريكا الشمالية إلى أشعة سينية دقيقة التركيز، وأشعة سينية عالية الطاقة، وغيرها. في عام 2024، من المتوقع أن ينمو قطاع الأشعة السينية الدقيقة التركيز بنسبة 65.37%.

- بناءً على المصدر، يُقسّم سوق الأشعة السينية الصناعية في أمريكا الشمالية إلى الكوبالت-59 والإيريديوم-192 وغيرها. ومن المتوقع أن ينمو قطاع الكوبالت-59 بنسبة 3.58% في عام 2024.

- بناءً على قنوات التوزيع، يُقسّم سوق الأشعة السينية الصناعية في أمريكا الشمالية إلى قناة غير مباشرة وقناة مباشرة. ومن المتوقع أن ينمو قطاع القنوات غير المباشرة بنسبة 66.13% في عام 2024.

- بناءً على نوع المنتج، يُقسّم سوق الأشعة السينية الصناعية في أمريكا الشمالية إلى أجهزة الأشعة السينية، ومستهلكات الأشعة السينية، وخدمات الأشعة السينية. ومن المتوقع أن ينمو قطاع أجهزة الأشعة السينية بنسبة 53.49% في عام 2024.

اللاعبون الرئيسيون

تعترف شركة Data Bridge Market Research بالشركات التالية باعتبارها اللاعبين الرئيسيين في سوق الأشعة السينية الصناعية في أمريكا الشمالية وهي Teledyne Technologies Incorporated (الولايات المتحدة)، وComet Group (ألمانيا)، وHamamatsu Photonics KK (اليابان)، وCarl Zeiss AG (ألمانيا)، وApplus+ (إسبانيا).

تطورات السوق

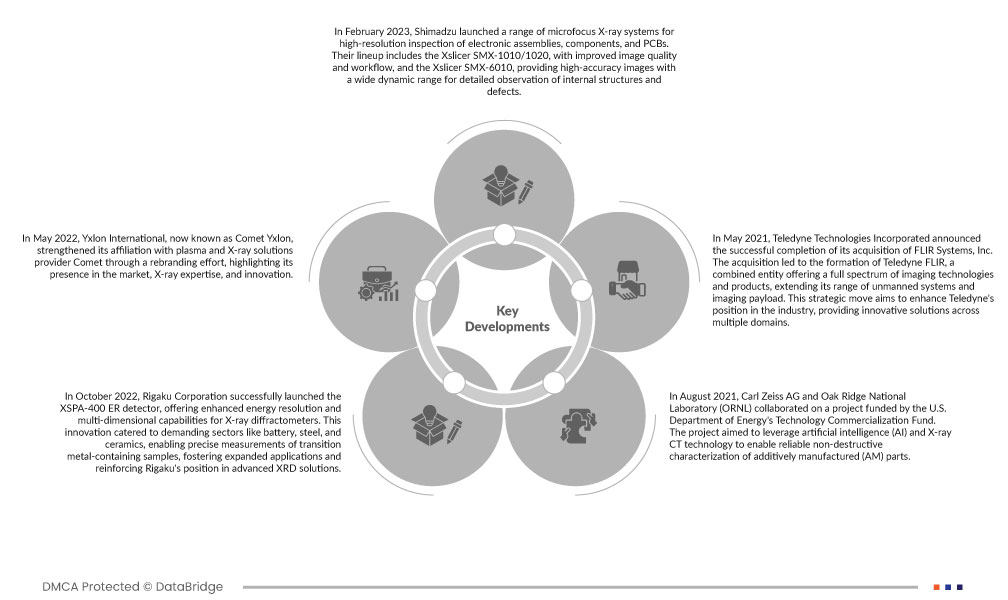

- في أكتوبر 2022، أطلقت شركة Rigaku بنجاح كاشف XSPA-400 ER، الذي يوفر دقة طاقة مُحسّنة وقدرات متعددة الأبعاد لأجهزة قياس حيود الأشعة السينية. وقد لبى هذا الابتكار احتياجات قطاعات مُتطلبة مثل البطاريات والصلب والسيراميك، مما أتاح قياسات دقيقة للعينات التي تحتوي على معادن انتقالية، وعزز التطبيقات المُوسّعة، وعزز مكانة Rigaku في حلول XRD المتقدمة.

- في أغسطس 2021، تعاونت شركة كارل زايس إيه جي ومختبر أوك ريدج الوطني (ORNL) في مشروع ممول من صندوق تسويق التكنولوجيا التابع لوزارة الطاقة الأمريكية. يهدف المشروع إلى الاستفادة من الذكاء الاصطناعي وتقنية التصوير المقطعي بالأشعة السينية لتمكين توصيف موثوق وغير مدمر للأجزاء المصنعة بالإضافة (AM). التصنيع الإضافي (AM) هو طريقة تصنيع تُنتج شكلًا ثلاثي الأبعاد من خلال تراكم المواد. ستطور الشراكة منهجية شاملة لتوصيف المسحوق إلى القطعة للتصنيع الإضافي، مما يُحسّن جودة ودقة القياسات، ويُحتمل أن يُحدث نقلة نوعية في الاختبارات غير الإتلافية والمقاييس تتجاوز صناعة التصنيع الإضافي (AM).

- في فبراير 2023، أطلقت شركة شيمادزو مجموعة من أنظمة الأشعة السينية ذات التركيز الدقيق لفحص عالي الدقة للتجمعات الإلكترونية والمكونات ولوحات الدوائر المطبوعة. تشمل مجموعتها جهاز Xslicer SMX-1010/1020، الذي يتميز بجودة صورة وسير عمل مُحسّنين، وجهاز Xslicer SMX-6010، الذي يوفر صورًا عالية الدقة مع نطاق ديناميكي واسع لمراقبة الهياكل الداخلية والعيوب بدقة.

- في مايو 2022، عززت شركة Yxlon International، المعروفة الآن باسم Comet Yxlon، ارتباطها بشركة Comet، الشركة الرائدة في مجال حلول البلازما والأشعة السينية، من خلال إعادة تصميم علامتها التجارية، مما يُبرز حضورها في السوق وخبرتها في مجال الأشعة السينية وابتكارها. تقدم الشركة حلولاً متطورة لأنظمة الأشعة السينية والتصوير المقطعي المحوسب للبيئات الصناعية، مدعومةً بخدمات متكاملة تعتمد على الذكاء الاصطناعي وتحليلات البيانات تحت مظلة مجموعة Comet. يُعزز تغيير علامتها التجارية إلى Comet Yxlon ارتباطها بالشركة الأم، Comet Group، ويعزز مكانة المجموعة كمزود لحلول البلازما والأشعة السينية.

- في مايو 2021، أعلنت شركة تيليداين تكنولوجيز إنكوربوريتد عن إتمام عملية استحواذها بنجاح على شركة فلير سيستمز. وأدى هذا الاستحواذ إلى تأسيس شركة تيليداين فلير، وهي كيان مشترك يقدم مجموعة متكاملة من تقنيات ومنتجات التصوير، مما يوسع نطاق أنظمتها غير المأهولة وحمولات التصوير. تهدف هذه الخطوة الاستراتيجية إلى تعزيز مكانة تيليداين في هذا القطاع، من خلال تقديم حلول مبتكرة في مجالات متعددة.

التحليل الإقليمي

من الناحية الجغرافية، البلدان التي يغطيها تقرير سوق الأشعة السينية الصناعية في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك.

وفقًا لتحليل أبحاث سوق Data Bridge

من المتوقع أن تهيمن الولايات المتحدة على سوق الأشعة السينية الصناعية في أمريكا الشمالية

من المتوقع أن تهيمن الولايات المتحدة على سوق الأشعة السينية الصناعية في أمريكا الشمالية بفضل ريادتها التكنولوجية القوية، وميزانياتها الدفاعية الضخمة، وقطاعها الدفاعي القوي، وظروفها التنظيمية المواتية. تُسهم هذه العوامل مجتمعةً في ترسيخ مكانة الولايات المتحدة كلاعب رئيسي في هذه المنطقة.

لمزيد من المعلومات التفصيلية حول تقرير سوق الأشعة السينية الصناعية في أمريكا الشمالية، انقر هنا - https://www.databridgemarketresearch.com/reports/north-america-industrial-x-ray-market