أدى ازدياد عدد المستثمرين الأفراد في الأسواق المالية إلى نمو سوق تداول الخيارات بشكل ملحوظ. ومع اتساع نطاق المعلومات المالية وإمكانية الوصول إلى منصات تداول متطورة، يتجه المزيد من المستثمرين الأفراد إلى عالم تداول الخيارات. ينجذب هؤلاء المستثمرون إلى الخيارات لقدرتها على الاستفادة من رؤوس أموال أصغر لتحقيق عوائد مجزية. وقد أدى ازدياد مشاركة المستثمرين الأفراد إلى زيادة السيولة وحجم التداول في سوق الخيارات، مما جعله أكثر ديناميكية وجاذبية لشريحة أوسع من المشاركين.

احصل على التقرير الكامل على https://www.databridgemarketresearch.com/reports/north-america-and-europe-options-trading-platform-market

تشير تحليلات شركة داتا بريدج لأبحاث السوق إلى أنه من المتوقع أن تصل قيمة سوق منصات تداول الخيارات في أمريكا الشمالية وأوروبا إلى 2.60 مليار دولار أمريكي بحلول عام 2031، مقارنةً بـ 1.41 مليار دولار أمريكي في عام 2023، بمعدل نمو سنوي مركب قدره 8.1% خلال الفترة المتوقعة من 2024 إلى 2031. وقد مكّن تعميم المعلومات المالية ومنصات التداول المتقدمة المستثمرين الأفراد، مما زاد من السيولة وحجم التداول. كما سهّلت الموارد التعليمية والأدوات سهلة الاستخدام التي توفرها هذه المنصات تداول الخيارات، بينما عززت وسائل التواصل الاجتماعي والمجتمعات الإلكترونية مشاركة الأفراد. وقد أدى هذا النمو في نشاط التجزئة إلى توسيع قاعدة العملاء، وشجع الابتكار، وأدخل منتجات وخدمات تداول جديدة، مما جعل سوق الخيارات أكثر ديناميكية وجاذبية.

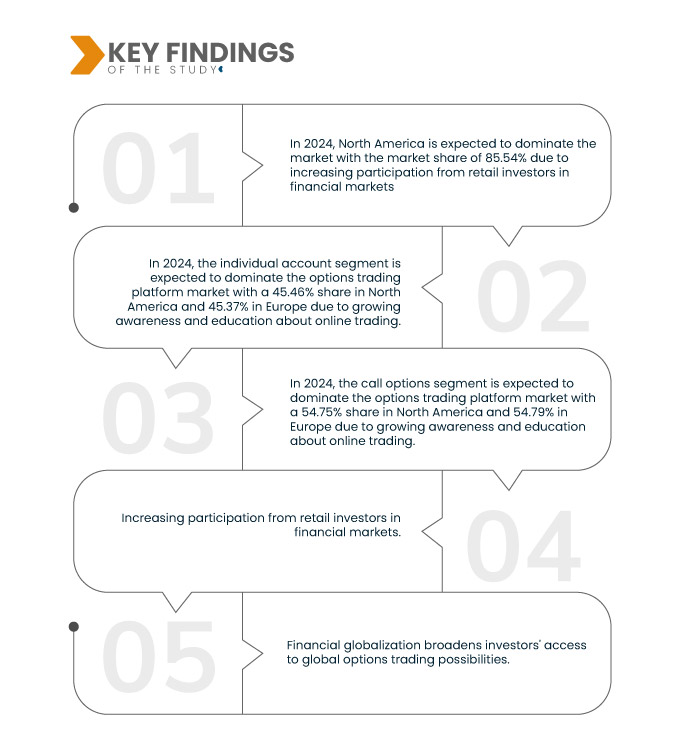

النتائج الرئيسية للدراسة

زيادة الوعي والتثقيف حول التداول عبر الإنترنت

لقد أثّر تزايد الوعي والتثقيف حول التداول عبر الإنترنت بشكل كبير على سوق تداول الخيارات. فمع ازدياد عدد الأفراد الذين يحصلون على موارد التثقيف المالي، يصبحون أكثر قدرة على فهم تعقيدات تداول الخيارات وفوائده المحتملة. تُزوّد المبادرات التعليمية، التي تتراوح بين الدورات التدريبية عبر الإنترنت والندوات الإلكترونية والمنصات التفاعلية، مستثمري التجزئة بالمعرفة اللازمة لاتخاذ قرارات مدروسة. يُقلّل هذا الفهم المتزايد من المخاطر المُتصوّرة المرتبطة بتداول الخيارات، مما يجعله أكثر سهولةً لجمهور أوسع. وبالتالي، من المُرجّح أن يشارك مستثمرون أكثر وعيًا بنشاط في تداول الخيارات، مما يُحفّز نمو السوق. وقد ساهم انتشار منصات التداول عبر الإنترنت التي تُقدّم محتوى تعليميًا شاملًا في تعزيز هذا التوجه. غالبًا ما تتضمن هذه المنصات دروسًا تعليمية، وأدلة استراتيجية، وأدوات محاكاة تُتيح للمستخدمين ممارسة التداول في بيئة خالية من المخاطر. من خلال تبسيط تداول الخيارات وتقديم تجارب تعليمية عملية وعملية، تُمكّن هذه المنصات مستثمري التجزئة من تطوير استراتيجياتهم التداولية وتحسينها. ونتيجةً لذلك، يشعر المزيد من المستثمرين بالثقة في المشاركة في سوق الخيارات، مما يؤدي إلى زيادة أحجام التداول وزيادة سيولة السوق. وتلعب سهولة الوصول إلى هذه الموارد في أي وقت وفي أي مكان أيضًا دورًا حاسمًا في جذب مجموعة متنوعة من المستثمرين، من المبتدئين إلى المتداولين المخضرمين.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالمليار دولار أمريكي

|

القطاعات المغطاة

|

(حساب فردي، حساب IRA، حساب كيان، وحساب مشترك)، نوع الخيارات (خيارات الشراء وخيارات البيع)، نوع المنصة ( تطبيق جوال ، سطح مكتب، وويب)، مستوى إذن التداول (المستوى 1، المستوى 2، المستوى 3، والمستوى 4)، نموذج التسعير (مجاني وقائم على الاشتراك)، عدد الأنماط (الخيار الأمريكي والخيارات الأوروبية)

|

الدول المغطاة

|

الولايات المتحدة، كندا، المكسيك، المملكة المتحدة، ألمانيا، فرنسا، إيطاليا، إسبانيا، روسيا، تركيا، بلجيكا، هولندا، النرويج، فنلندا، سويسرا، الدنمارك، السويد، بولندا وبقية أوروبا

|

الجهات الفاعلة في السوق المغطاة

|

Ally Financial Inc (الولايات المتحدة)، وBank of America Corporation (الولايات المتحدة)، وCharles Schwab & Co., Inc. (الولايات المتحدة)، وInteractive Brokers LLC (الولايات المتحدة)، وRobinhood (الولايات المتحدة)، وE*TRADE من Morgan Stanley (الولايات المتحدة)، وETORO USA LLC.(الولايات المتحدة)، وIG Group Holdings plc (المملكة المتحدة)، وSaxo Capital Markets Pte Ltd (سنغافورة)، وAva Trade Markets Ltd. (كندا)، وTradeStation (الولايات المتحدة)، وtastytrade, Inc.، وSocial Finance, LLC (الولايات المتحدة)، وTickmill (أفريقيا)، وFMR LLC (الولايات المتحدة)، وWebull Financial LLC (الولايات المتحدة)، وMoomoo Financial Inc (الولايات المتحدة)، وPublic Holdings, Inc.(الولايات المتحدة) وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية واللاعبين في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث السوق في Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل المدقة.

|

تحليل القطاعات

يتم تصنيف سوق منصات تداول الخيارات في أمريكا الشمالية وأوروبا إلى ستة قطاعات بارزة تعتمد على نوع الحساب ونوع الخيار ونوع المنصة ومستوى إذن التداول ونموذج التسعير وعدد الأنماط.

- على أساس نوع الحساب، يتم تقسيم السوق إلى حساب فردي وحساب IRA وحساب كيان وحساب مشترك

في عام 2024، من المتوقع أن يهيمن قطاع الحسابات الفردية على سوق منصات تداول الخيارات في أمريكا الشمالية وأوروبا

ومن المتوقع أن تهيمن شريحة الحسابات الفردية على السوق في عام 2024 بحصة تبلغ 45.46% في أمريكا الشمالية و45.37% في أوروبا بسبب مرونة استخدام الحيازات طويلة الأجل كأسهم لتداول الخيارات، مما يسمح بمواقف كبيرة دون استثمار نقدي كبير.

- على أساس نوع الخيار، يتم تقسيم السوق إلى خيارات شراء وخيارات بيع.

في عام 2024، من المتوقع أن يهيمن قطاع خيارات الشراء على سوق منصات تداول الخيارات في أمريكا الشمالية وأوروبا

ومن المتوقع أن تهيمن شريحة خيارات الشراء على السوق في عام 2024 بحصة تبلغ 54.75% في أمريكا الشمالية و54.79% في أوروبا بسبب زيادة مشاركة المستثمرين الأفراد في الأسواق المالية.

- بناءً على نوع المنصة، يُقسّم السوق إلى تطبيقات جوال، وأجهزة سطح مكتب، وويب. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع تطبيقات الجوال على السوق بحصة ٤٨.٤٧٪ في أمريكا الشمالية و٤٩.٢٦٪ في أوروبا.

- على أساس مستوى إذن التداول، يتم تقسيم السوق إلى المستوى 1 والمستوى 2 والمستوى 3 والمستوى 4. في عام 2024، من المتوقع أن يهيمن قطاع المستوى 1 على السوق بحصة 41.65٪ في أمريكا الشمالية وحصة 40.82٪ في أوروبا

- بناءً على نموذج التسعير، يُقسّم السوق إلى مجاني ومدفوع. في عام ٢٠٢٤، من المتوقع أن يهيمن القطاع المجاني على السوق بحصة ٥٥.٣٧٪ في أمريكا الشمالية و٥٥.٤٠٪ في أوروبا.

- بناءً على عدد الأنماط، يُقسّم السوق إلى خيارات النمط الأمريكي وخيارات النمط الأوروبي. في عام ٢٠٢٤، من المتوقع أن تهيمن خيارات النمط الأمريكي على السوق بحصة ٦١.٢٥٪ في أمريكا الشمالية و٦٢.٣٥٪ في أوروبا.

اللاعبون الرئيسيون

قامت شركة Data Bridge Market Research بتحليل شركة Ally Financial Inc (الولايات المتحدة)، وBank of America Corporation (الولايات المتحدة)، وE*TRADE من Morgan Stanley (الولايات المتحدة)، وCharles Schwab & Co., Inc. (الولايات المتحدة)، وRobinhood (الولايات المتحدة)، باعتبارها اللاعبين الرئيسيين العاملين في سوق منصات تداول الخيارات في أمريكا الشمالية.

قامت شركة Data Bridge Market Research بتحليل Interactive Brokers LLC (الولايات المتحدة)، وIG Group Holdings plc (المملكة المتحدة)، وBank of America Corporation (الولايات المتحدة)، وCharles Schwab & Co., Inc. (الولايات المتحدة)، وRobinhood (الولايات المتحدة)، باعتبارها اللاعبين الرئيسيين العاملين في سوق منصات تداول الخيارات في أوروبا.

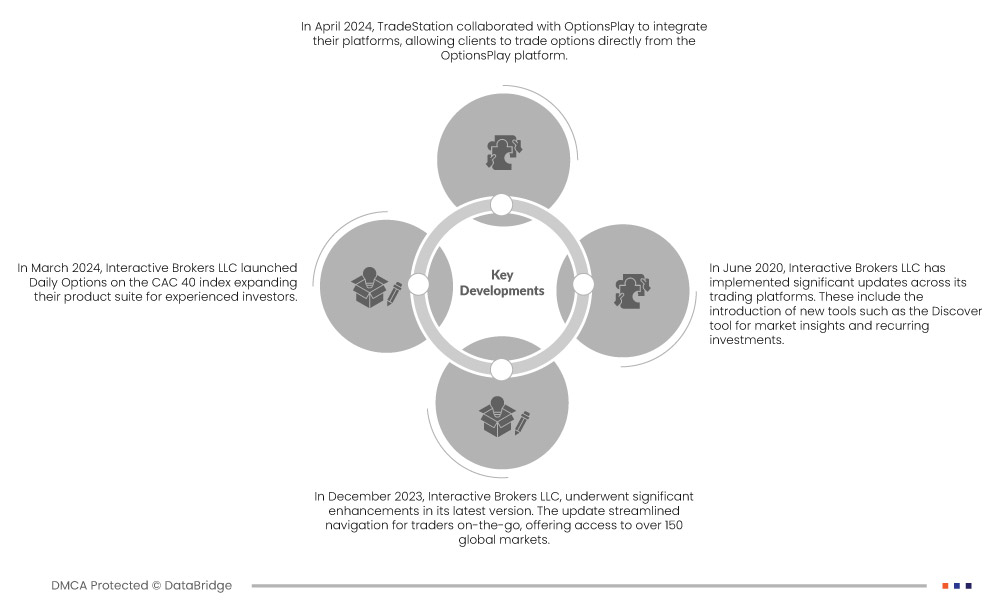

تطوير السوق

- في أبريل 2024، حازت تشارلز شواب على لقب أفضل منصة استثمارية شاملة من مجلة US News & World Report للعام الثاني على التوالي. كما حصلت شواب على لقب أفضل منصة استثمارية لتداول الأسهم والخيارات والفوركس. يعزز هذا التكريم مكانة شواب كوجهة استثمارية رائدة، مما قد يجذب المزيد من المستخدمين، بمن فيهم المهتمون بتداول الخيارات، ويعزز سمعتها في هذا المجال.

- في مارس 2024، أطلقت شركة إنتراكتيف بروكرز ذ.م.م. خدمة الخيارات اليومية على مؤشر كاك 40، موسعةً بذلك باقة منتجاتها للمستثمرين ذوي الخبرة. تتيح هذه الخدمة للمتداولين تنفيذ استراتيجيات قصيرة الأجل وإدارة استثماراتهم في سوق الأسهم الفرنسية بكفاءة. بفضل مجموعة شاملة من أسواق الخيارات العالمية، وأدوات تداول متقدمة، وأسعار تنافسية، وموارد تعليمية شاملة، تواصل إنتراكتيف بروكرز تزويد المتداولين بحلول شاملة.

- في فبراير 2024، حازت شركة ETRADE التابعة لمورغان ستانلي على لقب أفضل وسيط استثمار عبر الإنترنت من StockBrokers.com، حيث حازت على 15 جائزة "الأفضل في فئتها". يعزز هذا التكريم سمعة ETRADE ومصداقيتها، مما قد يجذب المزيد من المتداولين والمستثمرين إلى منصتها. تؤكد التقييمات الإيجابية على سهولة استخدام E*TRADE، وعمق بحثها، وتنوع أدوات الاستثمار والتداول، مما قد يعزز تفاعل العملاء ونشاط التداول.

- في ديسمبر 2023، وسّعت شركة eToro USA LLC نطاق عروضها في الولايات المتحدة بإضافة ما يقرب من 700 سهم جديد، ليصل إجمالي أصولها إلى 4,790 سهمًا. تُثري هذه الخطوة خيارات الاستثمار المتاحة للمستخدمين، مما يتيح تنويعًا أكبر لمحفظتهم الاستثمارية. تُمكّن سياسة eToro الخالية من العمولة على الأسهم المُضافة حديثًا المستخدمين من التداول دون تكبّد رسوم إضافية، مما يُحسّن من فعالية التكلفة. تُبرهن شراكة الشركة مع Bridgewise لإطلاق Fundamental-AI لتحليل الأسهم المُتقدّم على التزامها بتوظيف التكنولوجيا لمصلحة المستثمرين.

- في يوليو 2023، أعلنت شركة Public Holdings Inc. عن خطوتها الرائدة لمشاركة 50% من عائدات تداول الخيارات مباشرةً مع الأعضاء، بهدف إحداث نقلة نوعية في مشهد التداول. من خلال إعطاء الأولوية للشفافية وتوفير تداول خيارات منخفض التكلفة، تُرسّخ Public مكانتها كمنصة رائدة للمستثمرين. تُفيد هذه المبادرة العملاء من خلال تزويدهم برؤى ثاقبة حول تكاليف التداول والحوافز، مع توفير موارد تعليمية شاملة وتحليلات متقدمة.

التحليل الإقليمي

من الناحية الجغرافية، البلدان التي يغطيها تقرير سوق منصات تداول الخيارات في أمريكا الشمالية وأوروبا هي الولايات المتحدة وكندا والمكسيك والمملكة المتحدة وألمانيا وفرنسا وإيطاليا وإسبانيا وروسيا وتركيا وبلجيكا وهولندا والنرويج وفنلندا وسويسرا والدنمارك والسويد وبولندا وبقية أوروبا.

وفقًا لتحليل Data Bridge Market Research:

من المتوقع أن تهيمن أمريكا الشمالية وأن تصبح المنطقة الأسرع نموًا في سوق منصات تداول الخيارات

تُهيمن أمريكا الشمالية على سوق منصات تداول الخيارات بفضل قيمتها السوقية الأكبر، ولوائحها التنظيمية المُحكمة، وعدد العقود الآجلة والخيارات المتداولة في البورصات. تُسهم هذه العوامل في قوة وتطور البنية التحتية لتداول الخيارات في أمريكا الشمالية، ما يجذب المزيد من المتداولين والاستثمارات مقارنةً بأوروبا.

لمزيد من المعلومات التفصيلية حول سوق منصات تداول الخيارات في أمريكا الشمالية وأوروبا، انقر هنا - https://www.databridgemarketresearch.com/reports/north-america-and-europe-options-trading-platform-market