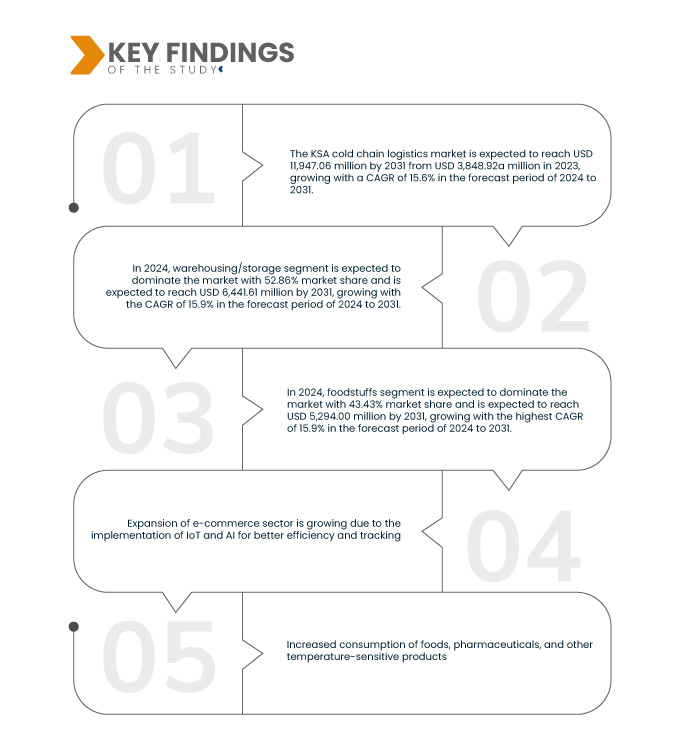

أدى تزايد استهلاك الأغذية والأدوية وغيرها من المنتجات الحساسة للحرارة إلى زيادة الطلب على خدمات لوجستية فعّالة لسلسلة التبريد. يضمن هذا القطاع بقاء هذه السلع القابلة للتلف ضمن نطاقات درجات الحرارة المطلوبة طوال سلسلة التوريد، من الإنتاج إلى التسليم، مما يحافظ على جودتها وسلامتها. ومع تزايد الطلب على هذه المنتجات، يزداد دور خدمات لوجستية سلسلة التبريد في منع التلف وضمان الامتثال لمعايير الصحة والسلامة أهميةً.

احصل على التقرير الكامل على https://www.databridgemarketresearch.com/reports/ksa-cold-chain-logistics-market

تشير تحليلات شركة داتا بريدج لأبحاث السوق إلى أنه من المتوقع أن يصل حجم سوق لوجستيات سلسلة التبريد في المملكة العربية السعودية إلى 11,947.06 مليون دولار أمريكي بحلول عام 2031، مقارنةً بـ 3,848.92 مليون دولار أمريكي في عام 2023، بمعدل نمو سنوي مركب قدره 15.6% خلال الفترة المتوقعة من 2024 إلى 2031. وتُعدّ المبادرات الحكومية والاستثمارات في البنية التحتية اللوجستية أمرًا بالغ الأهمية للنهوض بقطاع لوجستيات سلسلة التبريد. ومن خلال إعطاء الأولوية لتطوير مرافق تخزين حديثة، وتحسين شبكات النقل، وتطبيق أنظمة تتبع متطورة، تهدف هذه الجهود إلى تحسين الكفاءة والموثوقية في التعامل مع المنتجات الحساسة للحرارة. ولا تدعم هذه الاستثمارات نمو الصناعات المعتمدة على لوجستيات سلسلة التبريد فحسب، بل تُعزز أيضًا التنمية الاقتصادية والقدرة التنافسية من خلال ضمان التدفق السلس للبضائع وخفض التكاليف التشغيلية.

النتائج الرئيسية للدراسة

توسع قطاع التجارة الإلكترونية

أدى توسع التجارة الإلكترونية إلى دفع عجلة نمو لوجستيات سلسلة التبريد بشكل كبير. ومع تزايد التسوق الإلكتروني، لا سيما للسلع القابلة للتلف، وخاصةً الأغذية الطازجة والأدوية، ازداد الطلب على حلول سلسلة التبريد الفعالة والموثوقة. تتطلب منصات التجارة الإلكترونية لوجستيات سلسلة تبريد متينة لضمان تخزين المنتجات الحساسة للحرارة، ومعالجتها، وتسليمها في ظروف مثالية. وقد أدى ذلك إلى تطورات في البنية التحتية اللوجستية والتكنولوجيا والعمليات، بهدف الحفاظ على جودة المنتج على طول سلسلة التوريد، وتلبية توقعات المستهلكين المتزايدة لمنتجات طازجة وآمنة.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص من 2016 إلى 2021)

|

الوحدات الكمية

|

الإيرادات بالملايين من الدولارات الأمريكية

|

القطاعات المغطاة

|

النوع (التخزين/الخزن، الخدمات اللوجستية (البري)، الخدمات اللوجستية (البحرية)، الخدمات اللوجستية (السكك الحديدية)، الخدمات اللوجستية (الجوية)، الإنجاز والتسليم في الميل الأخير)، نوع البضائع/السمة الأساسية (المواد الغذائية، البضائع العامة (بما في ذلك اللوازم الطبية)، البضائع الخطرة (بما في ذلك المواد الكيميائية الخطرة)، أخرى، التكنولوجيا (التجميد السريع، التبريد التبخيري، ضغط البخار، أنظمة التبريد العميق، وحدة التحكم المنطقية القابلة للبرمجة)، نوع درجة الحرارة (محيطة، مبردة، مجمدة، أخرى)، حجم الحمولة (كبير، متوسط، صغير، صغير جدًا، صغير جدًا)، التشغيل (الخدمات اللوجستية المحلية والدولية/عبر الحدود)، نوع العميل (B2B، B2C، التجارة الإلكترونية والتسليم في الميل الأخير)، نموذج العمل [شركات النقل القائمة على الأصول، الوساطة والخدمات اللوجستية للطرف الثالث (3PL)، الخدمات اللوجستية للطرف الرابع (4PL)]، المسافة (أكثر من 500 ميل، 201 ميل إلى 500 ميل، 101 ميل إلى 200 ميل، 50 ميل إلى 100 ميل، أقل من 50 ميل)

|

الدول المغطاة

|

المملكة العربية السعودية

|

الجهات الفاعلة في السوق المغطاة

|

Cold Chain Packing & Logistics (الرياض، المملكة العربية السعودية)، AP Moller– Maersk (الدنمارك)، CGS (الرياض، المملكة العربية السعودية)، Mosanada Logistics Services (جزء من Naghi & Sons.) (جدة، المملكة العربية السعودية)، Wared Logistics (المملكة العربية السعودية)، شركة NAQEL (جدة، المملكة العربية السعودية)، Agility (الكويت)، IFFCO (الإمارات العربية المتحدة، دبي)، Almajdouie Logistics (الدمام، المملكة العربية السعودية)، Advanced Storage Co (الرياض، المملكة العربية السعودية)، United Group (جدة، المملكة العربية السعودية)، Four Winds، Jones International Transportation (جدة، المملكة العربية السعودية)، SMSA Express Transportation Company Ltd. (المملكة العربية السعودية)، Transcorp (جدة، المملكة العربية السعودية)، Tamer Logistics (جدة، المملكة العربية السعودية)، Flow (جدة، المملكة العربية السعودية)، Starlinks، Binzagr (الرياض، المملكة العربية السعودية)، Mubarrad، Etmam Logistics (شركة تابعة لشركة المراعي)، وأمان لوجستيكس (جدة، المملكة العربية السعودية)، ولوجيكسا (جدة، المملكة العربية السعودية)، من بين الشركات الكبرى العاملة في هذا السوق.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية والجهات الفاعلة في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث سوق Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل المدقة.

|

تحليل القطاعات

يتم تقسيم السوق إلى تسعة قطاعات بارزة بناءً على النوع ونوع البضائع / السمة الحرجة والتكنولوجيا ونوع درجة الحرارة وحجم الحمولة والتشغيل ونوع العميل ونموذج العمل والمسافة.

- على أساس النوع، يتم تقسيم سوق لوجستيات سلسلة التبريد في المملكة العربية السعودية إلى التخزين/المستودعات، والخدمات اللوجستية (الطرق)، والخدمات اللوجستية (البحرية)، والخدمات اللوجستية (السكك الحديدية)، والخدمات اللوجستية (الجوية)، والإنجاز والتسليم في الميل الأخير.

في عام 2024، من المتوقع أن يهيمن قطاع التخزين/التخزين على سوق الخدمات اللوجستية لسلسلة التبريد في المملكة العربية السعودية

من المتوقع أن يهيمن قطاع التخزين/المستودعات على السوق في عام 2024 بحصة سوقية تبلغ 52.86% بسبب زيادة استهلاك الأغذية والأدوية وغيرها من المنتجات الحساسة للحرارة.

- على أساس التكنولوجيا، يتم تقسيم سوق سلسلة التبريد اللوجستية في المملكة العربية السعودية إلى التجميد السريع، والتبريد التبخيري، وضغط البخار، والأنظمة المبردة، ووحدة التحكم المنطقية القابلة للبرمجة، وغيرها.

من المتوقع أن يهيمن قطاع التجميد السريع على سوق الخدمات اللوجستية لسلسلة التبريد في المملكة العربية السعودية في عام 2024

ومن المتوقع أن تهيمن صناعة التجميد السريع على السوق في عام 2024 بحصة سوقية تبلغ 23.69% بسبب المبادرات الحكومية المتزايدة والاستثمارات في الخدمات اللوجستية.

- بناءً على نوع درجة الحرارة، يُقسّم سوق لوجستيات سلسلة التبريد في المملكة العربية السعودية إلى: محيطي، ومبرد، ومجمد، وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع المحيطي على السوق بحصة سوقية تبلغ ٧٢.٣٢٪.

- بناءً على حجم الحمولة، يُقسّم سوق لوجستيات سلسلة التبريد في المملكة العربية السعودية إلى فئات: كبيرة، ومتوسطة، وصغيرة، وصغيرة جدًا، وصغيرة الحجم. ومن المتوقع أن تهيمن فئة الشحنات الكبيرة على السوق بحصة سوقية تبلغ 33.60% في عام 2024.

- بناءً على آلية العمل، يُقسّم سوق لوجستيات سلسلة التبريد في المملكة العربية السعودية إلى لوجستيات محلية ودولية/عابرة للحدود. وفي عام ٢٠٢٤، من المتوقع أن يهيمن القطاع المحلي على السوق بحصة سوقية تبلغ ٧٥.٣٥٪.

- بناءً على نوع العميل، يُقسّم سوق لوجستيات سلسلة التبريد في المملكة العربية السعودية إلى قطاعات B2B وB2C وE-Commerce وتوصيل الأميال الأخيرة. في عام 2024، من المتوقع أن يهيمن قطاع B2B على السوق بحصة سوقية تبلغ 58.26%.

اللاعبون الرئيسيون

تقوم شركة Data Bridge Market Research بتحليل Cold Chain Packing & Logistics، وAP Moller–Maersk (الدنمارك)، وCGS (الرياض، المملكة العربية السعودية)، وMosanada Logistics Services (جزء من Naghi & Sons.) (جدة، المملكة العربية السعودية)، وWared Logistics (المملكة العربية السعودية) باعتبارها اللاعبين الرئيسيين العاملين في سوق الخدمات اللوجستية لسلسلة التبريد في المملكة العربية السعودية.

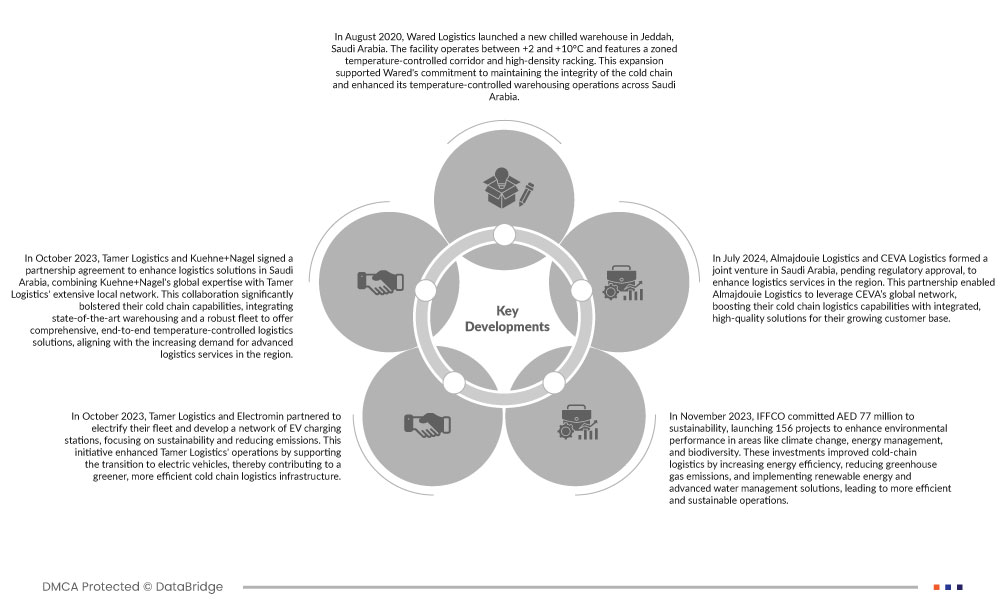

تطوير السوق

- في أغسطس 2020، أطلقت شركة وارد لوجستيكس مستودعًا مبردًا جديدًا في جدة، المملكة العربية السعودية. يعمل المرفق في درجات حرارة تتراوح بين +2 و+10 درجات مئوية، ويتميز بممر مُخصص مُتحكم في درجة حرارته ورفوف عالية الكثافة. وقد دعم هذا التوسع التزام وارد بالحفاظ على سلامة سلسلة التبريد، وعزز عمليات التخزين المُتحكم في درجة حرارتها في جميع أنحاء المملكة العربية السعودية.

- في أكتوبر 2023، وقّعت شركة تامر لوجستيكس وكوين+ناجل اتفاقية شراكة لتعزيز الحلول اللوجستية في المملكة العربية السعودية، وذلك من خلال الجمع بين خبرة كوين+ناجل العالمية وشبكتها المحلية الواسعة. وقد عزز هذا التعاون بشكل كبير قدرات سلسلة التبريد لديهما، حيث دمجا أحدث أنظمة التخزين وأسطولًا قويًا لتقديم حلول لوجستية شاملة ومتكاملة مع أنظمة التحكم في درجة الحرارة، بما يتماشى مع الطلب المتزايد على الخدمات اللوجستية المتقدمة في المنطقة.

- في أكتوبر 2023، دخلت شركة تامر لوجيستكس وإلكترومين في شراكة لتزويد أسطولها بالكهرباء وتطوير شبكة من محطات شحن السيارات الكهربائية، مع التركيز على الاستدامة وتقليل الانبعاثات. عززت هذه المبادرة عمليات تامر لوجيستكس من خلال دعم التحول إلى السيارات الكهربائية، مما ساهم في بناء بنية تحتية لوجستية أكثر خضرة وكفاءة لسلسلة التبريد.

- في نوفمبر 2023، ساهمت شركة IFFCO بمبلغ 77 مليون دولار أمريكي في مجال الاستدامة، بإطلاق 156 مشروعًا لتعزيز الأداء البيئي في مجالات مثل تغير المناخ، وإدارة الطاقة، والتنوع البيولوجي. حسّنت هذه الاستثمارات لوجستيات سلسلة التبريد من خلال زيادة كفاءة الطاقة، وخفض انبعاثات غازات الاحتباس الحراري، وتطبيق حلول الطاقة المتجددة وإدارة المياه المتقدمة، مما أدى إلى عمليات أكثر كفاءة واستدامة.

- في يوليو 2024، أسست المجدوعي للوجستيات وسيڤا لوجستيكس مشروعًا مشتركًا في المملكة العربية السعودية، بانتظار الموافقة التنظيمية، بهدف تعزيز الخدمات اللوجستية في المنطقة. مكّنت هذه الشراكة المجدوعي للوجستيات من الاستفادة من شبكة سيڤا العالمية، وتعزيز قدراتها اللوجستية في سلسلة التبريد من خلال حلول متكاملة وعالية الجودة لقاعدة عملائها المتنامية.

وفقًا لتحليل Data Bridge Market Research:

لمزيد من المعلومات التفصيلية حول تقرير سوق لوجستيات سلسلة التبريد في المملكة العربية السعودية، انقر هنا - https://www.databridgemarketresearch.com/reports/ksa-cold-chain-logistics-market