أفلام الفينيل ذاتية اللصق هي مواد مرنة ومتعددة الاستخدامات، مصنوعة من كلوريد البولي فينيل (PVC)، وتتميز بطبقة خلفية لاصقة، مما يسمح لها بالالتصاق بمختلف الأسطح دون الحاجة إلى مواد لاصقة إضافية. تُستخدم هذه الأفلام عادةً في اللافتات، وتغليف المركبات، والملصقات، والمشاريع الحرفية، وتأتي بمجموعة متنوعة من الألوان والتشطيبات والقوام، بما في ذلك المطفي، واللامع، والشفاف. متانتها ومقاومتها للعوامل الجوية تجعلها مناسبة للاستخدامات الداخلية والخارجية. سهولة التركيب والإزالة، بالإضافة إلى خيارات التخصيص، تجعل أفلام الفينيل ذاتية اللصق شائعة بين الشركات وهواة الأعمال اليدوية على حد سواء.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/global-self-adhesive-vinyl-films-market

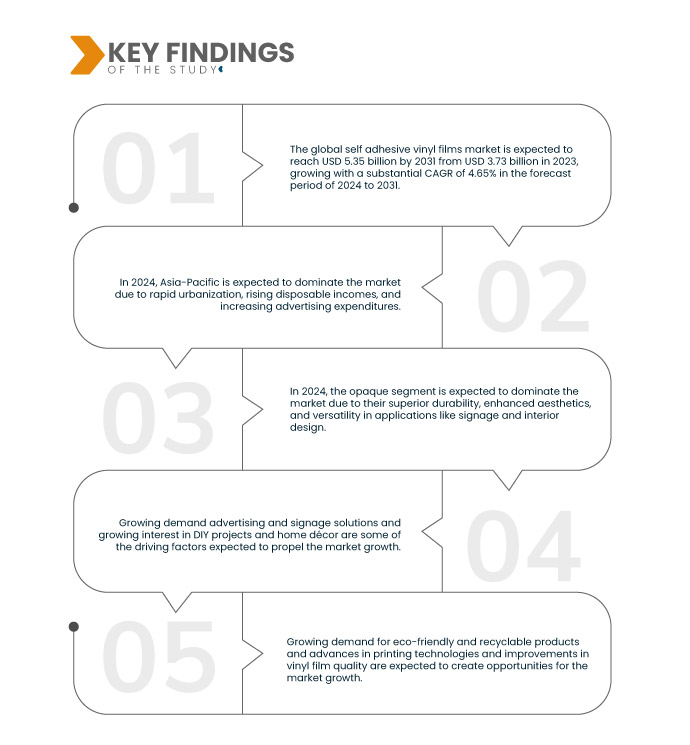

تحلل شركة Data Bridge Market Research أن سوق أفلام الفينيل ذاتية اللصق العالمية من المتوقع أن يصل إلى 5.35 مليار دولار أمريكي بحلول عام 2031 من 3.73 مليار دولار أمريكي في عام 2023، بنمو قدره 4.65٪ في الفترة المتوقعة من 2024 إلى 2031.

النتائج الرئيسية للدراسة

الطلب المتزايد على حلول الإعلان واللافتات

يُعد توسع قطاعي التجزئة والتجارة أحد العوامل الرئيسية التي تُغذي هذا الطلب. يستخدم تجار التجزئة الفينيل ذاتي اللصق في تطبيقات مُختلفة، بما في ذلك واجهات العرض واللافتات الترويجية واللافتات الداخلية، لتعزيز الرؤية وجذب المستهلكين. في ظل بيئة تنافسية، يُمكن للافتات الفعّالة أن تُؤثر بشكل كبير على إقبال العملاء، مما يدفع الشركات إلى الاستثمار في حلول عالية الجودة وجذابة. يُساهم الطلب المتزايد على حلول الإعلانات واللافتات في توسع سوق أفلام الفينيل ذاتية اللصق عالميًا. ومع استمرار الشركات في إعطاء الأولوية للتواصل البصري الفعّال لجذب العملاء، فإن تنوع وجودة واستدامته للفينيل ذاتي اللصق سيكون له دورٌ أساسي في تشكيل نمو السوق المُستقبلي. يُسلط هذا التوجه الضوء على الدور الأساسي لهذه المادة في استراتيجيات الإعلان الحديثة، مُلبيًا الاحتياجات المُتطورة للشركات حول العالم.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالمليار دولار أمريكي

|

القطاعات المغطاة

|

النوع (غير شفاف، شفاف، وشبه شفاف)، الفئة (قابل للطباعة وغير قابل للطباعة)، العرض (عرض متوسط (حوالي 137 سم)، عرض كبير (152-160 سم)، وعرض صغير (أقل من 110 سم))، عملية التصنيع (أفلام مصبوبة ومقوّمة)، نوع اللاصق (فيلم فينيل ذاتي اللصق قابل للإزالة وفيلم فينيل ذاتي اللصق دائم)، الركيزة (البلاستيك، الزجاج، الأرضيات ، وغيرها) السُمك (رفيع (2-3 مل) وسميك (أكثر من 3 مل))، الاستخدام (رسومات الأسطول، رسومات الأرضيات، رسومات النوافذ، تغليف السيارات، الملصقات والملصقات، المعارض والملصقات، الإعلانات الخارجية، ديكور الأثاث، الإعلانات والعلامات التجارية، ورق الجدران، وغيرها)

|

الدول المغطاة

|

الولايات المتحدة الأمريكية، كندا، والمكسيك، ألمانيا، المملكة المتحدة، إيطاليا، فرنسا، إسبانيا، سويسرا، روسيا، تركيا، بلجيكا، هولندا، بقية أوروبا، اليابان، الصين، كوريا الجنوبية، الهند، أستراليا، سنغافورة، تايلاند، إندونيسيا، ماليزيا، الفلبين، بقية دول آسيا والمحيط الهادئ، البرازيل، الأرجنتين، بقية دول أمريكا الجنوبية، جنوب أفريقيا، مصر، المملكة العربية السعودية، الإمارات العربية المتحدة، إسرائيل، بقية دول الشرق الأوسط وأفريقيا

|

الجهات الفاعلة في السوق المغطاة

|

3M (الولايات المتحدة)، Avery Dennison Corporation (الولايات المتحدة)، LX HAUSYS (كوريا الجنوبية)، ORAFOL Europe GmbH (ألمانيا)، Metamark (المملكة المتحدة)، DRYTAC (الولايات المتحدة)، Achilles USA Inc. (الولايات المتحدة)، Navratan LLP. (الهند)، Brite Coatings Private Limited (الهند)، Shanghai Hanker Industrial Co., Ltd. (الصين)، Shawei Digital (الصين)، ATP Adhesive Systems AG (سويسرا)، Eikon Ltd. a Spandex Group Company (المملكة المتحدة)، Grafityp (بلجيكا)، General Formulasions (الولايات المتحدة)، POLI-TAPE Holding GmbH (ألمانيا)، LINTEC Corporation (اليابان)، UPM (فنلندا)، Fedrigoni SPA (إيطاليا)، HEXIS SAS (فرنسا)، KPMF (هولندا)، Flexcon Company, Inc. (الولايات المتحدة)، Aquabond Ltd. (الولايات المتحدة)، Gardiner Graphics Supplies Europe (المملكة المتحدة)، Decal Adhesive (الولايات المتحدة)، APASpA (إيطاليا)، Great K2 Industry Co., Ltd. (الصين)، و Nekoosa (الولايات المتحدة) وغيرها

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research أيضًا تحليلًا متعمقًا من الخبراء والإنتاج والقدرة التمثيلية الجغرافية للشركة وتخطيطات الشبكة للموزعين والشركاء وتحليل اتجاهات الأسعار التفصيلية والمحدثة وتحليل العجز في سلسلة التوريد والطلب.

|

تحليل القطاعات

يتم تقسيم سوق أفلام الفينيل ذاتية اللصق العالمية إلى ثمانية قطاعات بارزة بناءً على النوع والفئة والعرض وعملية التصنيع ونوع المادة اللاصقة والركيزة والسمك والتطبيق.

- على أساس النوع، يتم تقسيم السوق إلى معتم وشفاف وشبه شفاف

في عام 2024، من المتوقع أن يهيمن القطاع غير الشفاف على السوق

ومن المتوقع أن تهيمن شريحة المواد المعتمة على السوق في عام 2024 بحصة سوقية تبلغ 46.02% بسبب متانتها الفائقة وجمالياتها المحسنة وتعدد استخداماتها في تطبيقات مثل اللافتات والتصميم الداخلي.

- على أساس الفئة، يتم تقسيم السوق إلى قابلة للطباعة وغير قابلة للطباعة

في عام 2024، من المتوقع أن يهيمن قطاع الطباعة على السوق

ومن المتوقع أن تهيمن المواد المطبوعة على السوق في عام 2024 بحصة سوقية تبلغ 63.50% بفضل خيارات التخصيص والرسومات النابضة بالحياة والقدرة على التكيف مع العلامات التجارية والإعلان والمشاريع الإبداعية.

- بناءً على العرض، يُقسّم السوق إلى عرض متوسط (حوالي ١٣٧ سم)، وعرض كبير (١٥٢-١٦٠ سم)، وعرض صغير (أقل من ١١٠ سم). في عام ٢٠٢٤، من المتوقع أن تهيمن فئة العرض المتوسط (حوالي ١٣٧ سم) على السوق بحصة سوقية تبلغ ٤٩.٦٩٪.

- بناءً على عملية التصنيع، يُقسّم السوق إلى أفلام مُقوّمة وأفلام مصبوبة . في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الأفلام المُقوّمة على السوق بحصة سوقية تبلغ ٧٢.٤٨٪.

- بناءً على نوع اللاصق، يُقسّم السوق إلى أفلام فينيل ذاتية اللصق قابلة للإزالة، وأفلام فينيل ذاتية اللصق دائمة. في عام ٢٠٢٤، من المتوقع أن تهيمن أفلام فينيل ذاتية اللصق قابلة للإزالة على السوق بحصة سوقية تبلغ ٦٤.١٧٪.

- بناءً على الركيزة، يُقسّم السوق إلى بلاستيك، وزجاج، وأرضيات، وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع البلاستيك على السوق بحصة سوقية تبلغ ٤٨.٩٨٪.

- بناءً على السُمك، يُقسّم السوق إلى رقيق (٢-٣ مل) وسميك (أكثر من ٣ مل). في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الرقيق (٢-٣ مل) على السوق بحصة سوقية تبلغ ٥٩.٣٤٪.

- بناءً على التطبيق، يُقسّم السوق إلى: رسومات الأسطول، ورسومات الأرضيات، ورسومات النوافذ، وتغليف السيارات، والملصقات، والمعارض، والإعلانات الخارجية، وديكور الأثاث، والإعلانات والعلامات التجارية، وورق الجدران، وغيرها. في عام 2024، من المتوقع أن يهيمن قطاع رسومات الأسطول على السوق بحصة سوقية تبلغ 22.69%.

اللاعبون الرئيسيون

تحلل أبحاث سوق Data Bridge شركة 3M (الولايات المتحدة)، وشركة Avery Dennison Corporation (الولايات المتحدة)، وشركة LX HAUSYS (كوريا الجنوبية)، وشركة ORAFOL Europe GmbH (ألمانيا)، وشركة LINTEC Corporation (اليابان) باعتبارها اللاعبين الرئيسيين في هذا السوق.

التطورات الأخيرة

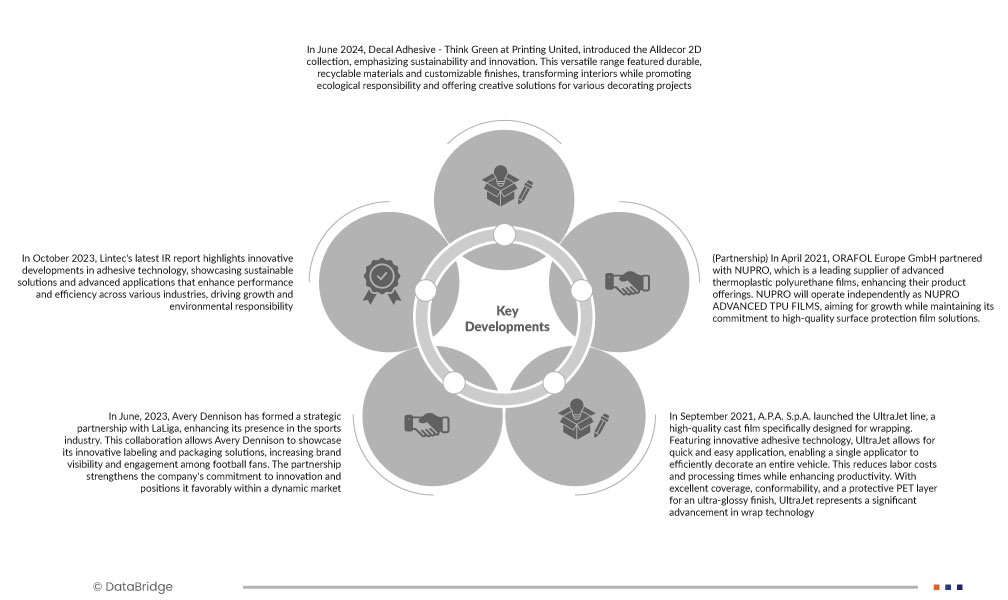

- في يونيو 2024، أطلقت شركة "ديكال أدايز - ثينك جرين" في برينتينغ يونايتد مجموعة Alldecor ثنائية الأبعاد، التي تُركز على الاستدامة والابتكار. تتميز هذه المجموعة متعددة الاستخدامات بمواد متينة وقابلة لإعادة التدوير وتشطيبات قابلة للتخصيص، مما يُحدث نقلة نوعية في التصميمات الداخلية، مع تعزيز المسؤولية البيئية وتقديم حلول إبداعية لمختلف مشاريع الديكور.

- في أكتوبر 2023، يسلط أحدث تقرير صادر عن شركة Lintec حول العلاقات مع المستثمرين الضوء على التطورات المبتكرة في تكنولوجيا المواد اللاصقة، وعرض الحلول المستدامة والتطبيقات المتقدمة التي تعمل على تعزيز الأداء والكفاءة في مختلف الصناعات، مما يدفع النمو والمسؤولية البيئية.

- في يونيو 2023، أقامت شركة أفيري دينيسون شراكة استراتيجية مع رابطة الدوري الإسباني لكرة القدم (LaLiga)، مما عزز حضورها في قطاع الرياضة. يتيح هذا التعاون لشركة أفيري دينيسون عرض حلولها المبتكرة في مجال وضع العلامات والتغليف، مما يزيد من وضوح علامتها التجارية وتفاعلها مع مشجعي كرة القدم. تعزز هذه الشراكة التزام الشركة بالابتكار وتضعها في مكانة مرموقة في سوق ديناميكي.

- في سبتمبر 2021، أطلقت APASpA خط إنتاج UltraJet، وهو غشاء مصبوب عالي الجودة مصمم خصيصًا للتغليف. يتميز UltraJet بتقنية لاصقة مبتكرة، مما يتيح تطبيقًا سريعًا وسهلاً، مما يُمكّن مُطبّقًا واحدًا من تزيين مركبة كاملة بكفاءة. هذا يُقلل من تكاليف العمالة وأوقات المعالجة مع تحسين الإنتاجية. بفضل التغطية الممتازة، والمرونة، وطبقة PET الواقية التي تُضفي لمسة نهائية فائقة اللمعان، يُمثل UltraJet تقدمًا ملحوظًا في تكنولوجيا التغليف.

- في أبريل 2021، دخلت شركة ORAFOL Europe GmbH في شراكة مع شركة NUPRO، وهي مورد رائد لأفلام البولي يوريثان الحراري المتطورة، مما عزز عروض منتجاتها. ستعمل NUPRO بشكل مستقل تحت اسم NUPRO ADVANCED TPU FILMS، بهدف تحقيق النمو مع الحفاظ على التزامها بتقديم حلول أفلام حماية الأسطح عالية الجودة.

التحليل الإقليمي

جغرافيًا، البلدان التي يغطيها السوق هي الولايات المتحدة وكندا والمكسيك وألمانيا والمملكة المتحدة وإيطاليا وفرنسا وإسبانيا وسويسرا وروسيا وتركيا وبلجيكا وهولندا وبقية أوروبا واليابان والصين وكوريا الجنوبية والهند وأستراليا وسنغافورة وتايلاند وإندونيسيا وماليزيا والفلبين وبقية دول آسيا والمحيط الهادئ والبرازيل والأرجنتين وبقية دول أمريكا الجنوبية وجنوب إفريقيا ومصر والمملكة العربية السعودية والإمارات العربية المتحدة وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

وفقًا لتحليل Data Bridge Market Research:

منطقة آسيا والمحيط الهادئ هي الأسرع نموًا ومن المتوقع أن تكون المنطقة المهيمنة في السوق

من المتوقع أن تهيمن منطقة آسيا والمحيط الهادئ على أسرع المناطق نمواً في سوق أفلام الفينيل اللاصقة بسبب التوسع الحضري السريع وارتفاع الدخول المتاحة وزيادة نفقات الإعلان.

لمزيد من المعلومات التفصيلية حول تقرير سوق أفلام الفينيل ذاتية اللصق العالمية، انقر هنا - https://www.databridgemarketresearch.com/reports/global-self-adhesive-vinyl-films-market