يشهد سوق البولي بروبيلين العالمي نموًا كبيرًا بسبب التطبيقات الواسعة للبولي بروبيلين في مختلف الصناعات. يُعرف البولي بروبيلين، وهو بوليمر لدن بالحرارة، بخفة وزنه ومتانته ومقاومته للمواد الكيميائية وفعاليته من حيث التكلفة. يتم استخدامه على نطاق واسع في قطاعات التعبئة والتغليف والسيارات والبناء والكهرباء والسلع الاستهلاكية. إن الطلب المتزايد على التغليف المرن، وارتفاع إنتاج السيارات، والنمو في أنشطة البناء يقود توسع السوق. بالإضافة إلى ذلك، تساهم التطورات التكنولوجية وابتكارات المنتجات بشكل أكبر في نمو سوق البولي بروبيلين العالمي.

الوصول إلى التقرير الكامل فيhttps://www.databridgemarketresearch.com/reports/global-polypropene-market

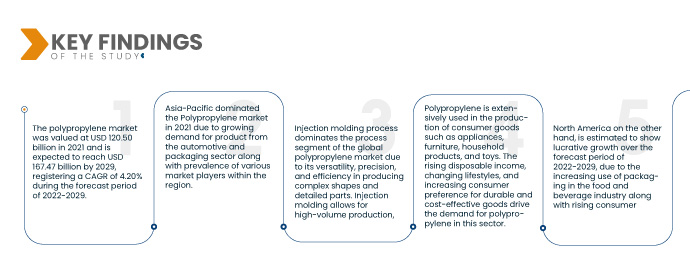

تحلل أبحاث سوق جسر البيانات أن سوق البولي بروبلين بلغت قيمتها 120.50 مليار دولار أمريكي في عام 2021، ومن المتوقع أن تصل إلى 167.47 مليار دولار أمريكي بحلول عام 2029، مسجلة معدل نمو سنوي مركب قدره 4.20٪ خلال الفترة المتوقعة 2022-2029. يؤثر التركيز على المواد المستدامة ومبادرات إعادة التدوير على سوق البولي بروبيلين. يمكن إعادة تدوير مادة البولي بروبيلين، مما يقلل التأثير البيئي ويحقق أهداف الاستدامة التي حددتها الصناعات والحكومات.

النتائج الرئيسية للدراسة

ومن المتوقع أن يؤدي الطلب المتزايد على الأقمشة غير المنسوجة إلى دفع معدل نمو السوق

يعد مادة البولي بروبيلين مادة مفضلة لإنتاج الأقمشة غير المنسوجة نظرًا لخصائصها المرغوبة. توفر الأقمشة غير المنسوجة المصنوعة من مادة البولي بروبيلين قوة ونعومة ومتانة ممتازة. يتم استخدامها على نطاق واسع في منتجات النظافة مثل الحفاضات ومنتجات النظافة النسائية والمناديل المبللة. في المجال الطبي، تُستخدم الأقمشة غير المنسوجة القائمة على مادة البولي بروبيلين في صناعة العباءات الجراحية والأقنعة وضمادات الجروح. تجد المنسوجات الأرضية المصنوعة من مادة البولي بروبيلين تطبيقات في مشاريع البناء والهندسة المدنية، بينما تُستخدم أقمشة الترشيح القائمة على مادة البولي بروبيلين في أنظمة ترشيح الهواء والسائل. يؤدي الطلب المتزايد على تطبيقات الأقمشة غير المنسوجة إلى زيادة الطلب على مادة البولي بروبيلين في السوق.

نطاق التقرير وتقسيم السوق

|

تقرير المقياس

|

تفاصيل

|

|

فترة التنبؤ

|

2022 إلى 2029

|

|

سنة الأساس

|

2021

|

|

سنوات تاريخية

|

2020 (قابل للتخصيص حتى 2014 - 2019)

|

|

الوحدات الكمية

|

الإيرادات بمليار دولار أمريكي، الأحجام بالوحدات، التسعير بالدولار الأمريكي

|

|

القطاعات المغطاة

|

النوع (هوموبوليمر، كوبوليمر)، العملية (قولبة الحقن، قولبة النفخ، البثق، أخرى)، التطبيق (الألياف، الأفلام والصفائح، الرافية، الرغوة، الشريط، أخرى)، التركيب الكيميائي (متساوي التوتر، سينديوتاكتيك، أتاكتيك)، الاستخدام النهائي ( التعبئة والتغليف، البناء والتشييد، السيارات، الأثاث، الأجهزة الكهربائية والإلكترونية، الطبية، المنتجات الاستهلاكية، أخرى)

|

|

البلدان المشمولة

|

الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية وألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية أوروبا في أوروبا والصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا، تايلاند، إندونيسيا، الفلبين، بقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC)، المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل، وبقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA) والبرازيل والأرجنتين وبقية أمريكا الجنوبية كجزء من أمريكا الجنوبية.

|

|

تغطية لاعبي السوق

|

شركة ليونديل باسيل للصناعات القابضة بي في (هولندا)، شركة إكسون موبيل (الولايات المتحدة)، سابك (المملكة العربية السعودية)، دوبونت (الولايات المتحدة)، إنيوس إيه جي (سويسرا)، شركة فورموزا للبلاستيك (تايوان)، شركة الصين للبتروكيماويات (الصين)، إل جي كيم (جنوب). كوريا)، شركة إيستمان كيميكال (الولايات المتحدة)، باسف إس إي (ألمانيا)، ريلاينس إندستريز ليمتد (الهند)، ويستليك كيميكال كوربوريشن (الولايات المتحدة)، براسكيم (البرازيل)، هالديا للبتروكيماويات المحدودة (الهند)، ترينسيو (فرنسا)، إتش بي سي إل - ميتال. إنيرجي المحدودة (الهند)، وبراهمابوترا كراكر آند بوليمر المحدودة (BCPL) (الهند)، وSACO AEI Polymers (الولايات المتحدة) وغيرها.

|

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الأفكار حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي تنظمها أبحاث سوق Data Bridge أيضًا تحليلًا متعمقًا للخبراء وإنتاجًا ممثلًا جغرافيًا للشركة و القدرة، وتخطيطات شبكة الموزعين والشركاء، وتحليل مفصل ومحدث لاتجاهات الأسعار وتحليل العجز في سلسلة التوريد والطلب.

|

تحليل القطاع:

يتم تقسيم سوق البولي بروبيلين على أساس النوع والعملية والتركيب الكيميائي والاستخدام النهائي والتطبيق.

- على أساس النوع، يتم تقسيم سوق البولي بروبيلين إلى البوليمر المتجانس والبوليمر المشترك. تهيمن البوليمرات المتجانسة على قطاع النوع في سوق البولي بروبيلين العالمي نظرًا لما تقدمه من خصائص متسقة وسهولة المعالجة وقوة ميكانيكية ممتازة، مما يجعلها مفضلة لمختلف الصناعات مثل التعبئة والتغليف والسيارات والسلع الاستهلاكية بمعدل نمو سنوي مركب قدره 7.2٪ في الفترة المتوقعة. من 2022 إلى 2029.

في عام 2022، ستهيمن البوليمرات المتجانسة على قطاع النوع في سوق البولي بروبيلين العالمي

في عام 2022، ستهيمن البوليمرات المتجانسة على قطاع النوع في سوق البولي بروبيلين العالمي نظرًا لسهولة الاستخدام والقدرة على تحمل التكاليف وتنوع التطبيقات. تُفضل البوليمرات المتجانسة في مجموعة متنوعة من الصناعات، بما في ذلك التعبئة والتغليف والسيارات والسلع الاستهلاكية، نظرًا لخصائصها المتسقة وبساطة المعالجة وقوتها الميكانيكية الممتازة مع معدل نمو سنوي مركب يبلغ 7.2٪ في الفترة المتوقعة من 2022 إلى 2029.

- على أساس العملية، يتم تقسيم سوق البولي بروبيلين إلى قولبة بالحقن، ونفخ، وبثق، وغيرها. تهيمن عملية القولبة بالحقن على قطاع العمليات في سوق البولي بروبيلين العالمي نظرًا لتعدد استخداماتها ودقتها وكفاءتها في إنتاج أشكال معقدة وأجزاء مفصلة. تسمح تقنية الحقن بالإنتاج بكميات كبيرة، مما يجعلها الخيار المفضل لمجموعة واسعة من الصناعات، بما في ذلك السيارات والتعبئة والتغليف والإلكترونيات في الفترة المتوقعة من 2022 إلى 2029

- على أساس التطبيق، يتم تقسيم سوق البولي بروبلين إلى الألياف والأفلام والصفائح والرافية والرغوة والأشرطة وغيرها. يهيمن قطاع الأفلام والألواح على قطاع تطبيقات البولي بروبيلين العالمي نظرًا لتطبيقاته واسعة النطاق في صناعات التعبئة والتغليف والزراعة والبناء والسلع الاستهلاكية بمعدل نمو سنوي مركب يبلغ 10.6٪ في الفترة المتوقعة من 2022 إلى 2029

- على أساس التركيب الكيميائي، يتم تقسيم سوق البولي بروبيلين إلى متساوي التوتر، متلازمي، غير تكتيكي. يهيمن الجزء متساوي التوتر على قطاع البنية الكيميائية في سوق البولي بروبلين العالمي نظرًا لخصائصه المرغوبة، بما في ذلك التبلور العالي والصلابة والثبات الحراري. يتمتع البولي بروبيلين متساوي التوتر بتركيبة جزيئية منتظمة ومرتبة، مما يؤدي إلى تحسين القوة الميكانيكية وقابلية المعالجة، مما يجعله الخيار المفضل لمختلف التطبيقات في الفترة المتوقعة من 2022 إلى 2029.

- على أساس الاستخدام النهائي، يتم تقسيم سوق البولي بروبلين إلى التعبئة والتغليف والبناء والتشييد والسيارات والأثاث والكهرباء والإلكترونيات والمنتجات الطبية والاستهلاكية وغيرها. يهيمن قطاع التغليف على قطاع الاستخدام النهائي في سوق البولي بروبيلين العالمي بسبب الاستخدام المكثف للبولي بروبيلين في تطبيقات التغليف المختلفة، مثل التغليف المرن والحاويات الصلبة والأفلام. يعتمد الطلب على مادة البولي بروبيلين في صناعة التعبئة والتغليف على خفة وزنه ومتانته وتعدد استخداماته وفعاليته من حيث التكلفة خلال الفترة المتوقعة من 2022 إلى 2029.

في عام 2022، يهيمن قطاع التغليف على قطاع الاستخدام النهائي في سوق البولي بروبيلين العالمي

في عام 2022، سيهيمن قطاع التغليف على قطاع الاستخدام النهائي في سوق البولي بروبيلين العالمي بسبب الاستخدام الواسع النطاق للبولي بروبيلين في مواد التعبئة والتغليف مثل الأفلام والحاويات الصلبة والتعبئة المرنة. يزداد الطلب على مادة البولي بروبيلين في قطاع التعبئة والتغليف بسبب قدرتها على تحمل التكاليف وتعدد الاستخدامات وخفة الوزن في الفترة المتوقعة من 2022 إلى 2029

اللاعبين الرئيسيين

تعترف شركة Data Bridge Market Research بالشركات التالية باعتبارها الشركات الرئيسية في مجال مادة البولي بروبيلين اللاعبون في السوق في سوق البولي بروبيلين هم شركة إكسون موبيل (الولايات المتحدة)، وسابك (المملكة العربية السعودية)، وباسف إس إي (ألمانيا)، وريلاينس إندستريز ليمتد (الهند)، وشركة ويستليك كيميكال (الولايات المتحدة)، وبراسكيم (البرازيل).

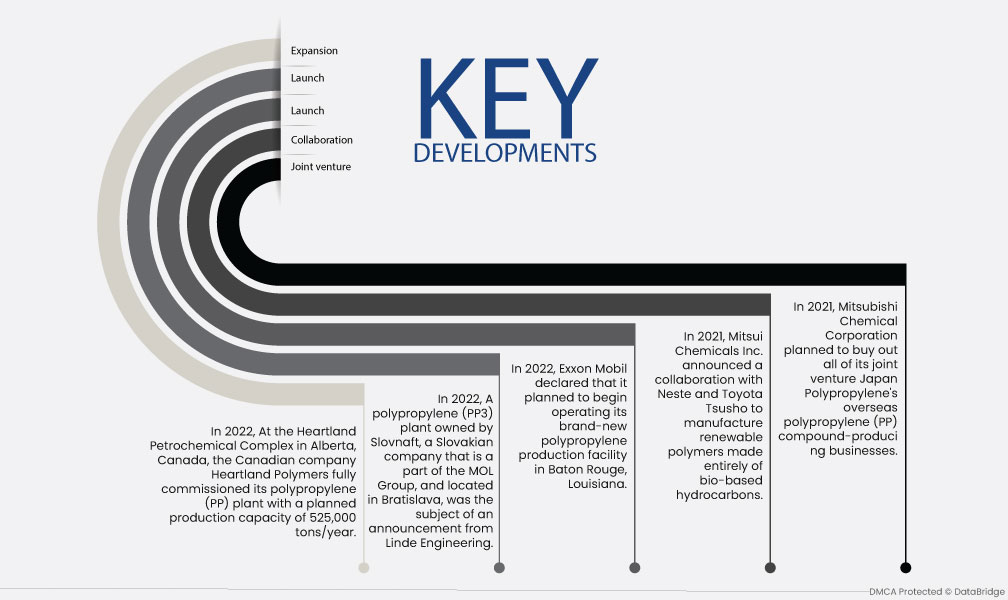

تطوير السوق

- في عام 2022، في مجمع هارتلاند للبتروكيماويات في ألبرتا، كندا، قامت شركة هارتلاند بوليمرز الكندية بتشغيل مصنع البولي بروبيلين (PP) الخاص بها بالكامل بطاقة إنتاجية مخططة تبلغ 525000 طن سنويًا.

- في عام 2022، كان مصنع البولي بروبيلين (PP3) المملوك لشركة Slovnaft، وهي شركة سلوفاكية جزء من مجموعة MOL، ويقع في براتيسلافا، موضوع إعلان من شركة Linde Engineering. وستؤدي عملية التجديد إلى زيادة الطاقة الإنتاجية السنوية للمصنع من مادة البولي بروبيلين بنسبة 18% إلى 300 كيلو طن، وستزيد القدرة الإجمالية لمنشأة التخزين من 45 إلى 61 صومعة.

- في عام 2022، أعلنت شركة إكسون موبيل أنها تخطط لبدء تشغيل منشأة إنتاج البولي بروبيلين الجديدة تمامًا في باتون روج، لويزيانا.

- وفي عام 2021، أعلنت شركة ميتسوي للكيماويات عن تعاون مع شركتي Neste وToyota Tsusho لتصنيع بوليمرات متجددة مصنوعة بالكامل من الهيدروكربونات الحيوية.

- في عام 2021، خططت شركة Mitsubishi Chemical Corporation لشراء جميع الشركات المنتجة لمركبات البولي بروبيلين (PP) في الخارج التابعة لمشروعها المشترك Japan Polypropene.

التحليل الإقليمي

جغرافيًا، البلدان المشمولة في تقرير سوق البولي بروبلين هي الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية وألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية أوروبا في أوروبا والصين واليابان، الهند، كوريا الجنوبية، سنغافورة، ماليزيا، أستراليا، تايلاند، إندونيسيا، الفلبين، بقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC)، المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل، وبقية الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA)، والبرازيل والأرجنتين وبقية أمريكا الجنوبية كجزء من أمريكا الجنوبية.

وفقًا لتحليل أبحاث سوق Data Bridge:

منطقة آسيا والمحيط الهادئ هي المنطقة المهيمنة في سوق البولي بروبلين خلال الفترة المتوقعة 2022-2029

تتمتع منطقة آسيا والمحيط الهادئ بمكانة مهيمنة في سوق البولي بروبيلين، سواء من حيث الحصة السوقية أو الإيرادات. ومن المتوقع أن تستمر هذه الهيمنة خلال فترة التنبؤ. ويمكن أن يعزى النمو في هذه المنطقة إلى الطلب المتزايد على مادة البولي بروبيلين من قطاعي السيارات والتغليف. بالإضافة إلى ذلك، فإن وجود العديد من اللاعبين في السوق داخل المنطقة يساهم بشكل أكبر في هيمنتها المزدهرة على سوق البولي بروبيلين العالمي.

تشير التقديرات إلى أن أمريكا الشمالية هي المنطقة الأسرع نموًا في سوق البولي بروبيلين في الفترة المتوقعة 2022-2029

من المتوقع أن تشهد أمريكا الشمالية نموًا كبيرًا في سوق البولي بروبيلين خلال الفترة المتوقعة. ويمكن أن يعزى النمو في المنطقة إلى الاستخدام المتزايد للبولي بروبيلين في قطاع التعبئة والتغليف، مدفوعًا بصناعة الأغذية والمشروبات. بالإضافة إلى ذلك، هناك طلب متزايد من المستهلكين على مكونات البولي بروبيلين خفيفة الوزن في قطاعي السيارات والإلكترونيات. تساهم هذه العوامل في آفاق النمو المربحة لسوق البولي بروبيلين في أمريكا الشمالية.

لمزيد من المعلومات التفصيلية حول مادة البولي بروبيلين سوق التقرير اضغط هنا – https://www.databridgemarketresearch.com/reports/global-polypropene-market