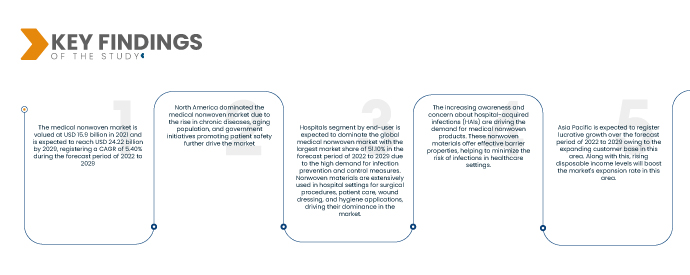

يشهد سوق الأقمشة الطبية غير المنسوجة نموًا سريعًا بسبب التركيز المتزايد على تقليل حالات العدوى المكتسبة من المستشفيات (HAIs). تشكل العدوى المرتبطة بالرعاية الصحية خطرًا كبيرًا على المرضى، مما يؤدي إلى الإصابة بالأمراض والوفيات. أثبتت المنتجات الجراحية غير المنسوجة فعاليتها العالية في الوقاية من العدوى المرتبطة بالرعاية الصحية، مما أدى إلى اعتمادها في أماكن الرعاية الصحية. مع حدوث حوالي 1.7 مليون حالة من حالات الإصابة بالرعاية الصحية (HIS) سنويًا في الولايات المتحدة وحدها، فإن الطلب على الأقمشة الطبية غير المنسوجة آخذ في الارتفاع لمعالجة اهتمامات الرعاية الصحية الحرجة هذه.

الوصول إلى التقرير الكامل فيhttps://www.databridgemarketresearch.com/reports/global-medical-noncloths-market

تحلل أبحاث سوق جسر البيانات أن سوق المنسوجات الطبية تقدر قيمتها بـ 15.9 مليار دولار أمريكي في عام 2021 ومن المتوقع أن تصل إلى 24.22 مليار دولار أمريكي بحلول عام 2029، مسجلة معدل نمو سنوي مركب قدره 5.40٪ خلال الفترة المتوقعة من 2022 إلى 2029. التوسع في مرافق الرعاية الصحية، بما في ذلك المستشفيات والعيادات والمراكز الجراحية المتنقلة، يقود الطلب على المنتجات الطبية غير المنسوجة. تتزايد الحاجة إلى الإمدادات الطبية الصحية التي يمكن التخلص منها مع نمو البنية التحتية للرعاية الصحية.

النتائج الرئيسية للدراسة

ومن المتوقع أن تؤدي زيادة العمليات الجراحية إلى زيادة معدل نمو السوق

يؤدي الانتشار المتزايد للإجراءات الجراحية في جميع أنحاء العالم إلى زيادة الطلب على المنتجات الطبية غير المنسوجة. تعتبر المواد الجراحية غير المنسوجة، المعروفة بخصائصها العازلة العالية وقدرتها على الحفاظ على ظروف معقمة، ضرورية في الوقاية من التهابات الموقع الجراحي. مع استمرار ارتفاع عدد العمليات الجراحية، تتزايد الحاجة إلى منتجات غير منسوجة موثوقة وفعالة، بما في ذلك العباءات والستائر والأقنعة، مما يزيد من توسع سوق الأقمشة الطبية غير المنسوجة.

نطاق التقرير وتقسيم السوق

|

تقرير المقياس

|

تفاصيل

|

|

فترة التنبؤ

|

2022 إلى 2029

|

|

سنة الأساس

|

2021

|

|

سنوات تاريخية

|

2020 (قابل للتخصيص حتى 2014 - 2019)

|

|

الوحدات الكمية

|

الإيرادات بمليار دولار أمريكي، الأحجام بالوحدات، التسعير بالدولار الأمريكي

|

|

القطاعات المغطاة

|

النوع (Spunbond، Spun-melt-spun (SMS)، Drylaid، Wetlaid، Meltblown، أخرى)، نوع المنتج (تكنولوجيا النظافة، منتجات الملابس)، سهولة الاستخدام (للاستعمال مرة واحدة، قابلة لإعادة الاستخدام)، قناة التوزيع (المناقصات المباشرة، البيع بالتجزئة)، النهاية- المستخدم (المستشفيات، العيادات، الرعاية الصحية المنزلية، المختبرات، المراكز الجراحية المتنقلة، آحرون)

|

|

البلدان المشمولة

|

الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية وألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية أوروبا في أوروبا والصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا، تايلاند، إندونيسيا، الفلبين، بقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC)، المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل، وبقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA) والبرازيل والأرجنتين وبقية أمريكا الجنوبية كجزء من أمريكا الجنوبية.

|

|

تغطية لاعبي السوق

|

Ahlstrom-Munksjo (فنلندا)، Berry Global Inc. (الولايات المتحدة)، Glatfelter Corporation (الولايات المتحدة)، DuPont (الولايات المتحدة)، Lydall Inc. (الولايات المتحدة)، Fitesa SA (البرازيل)، TWE GmbH & Co. KG (ألمانيا)، Freudenberg Group (ألمانيا)، PFNonwens Holding sro (جمهورية التشيك)، KRATON CORPORATION (الولايات المتحدة)، Owens & Minor (الولايات المتحدة)، PFNonwens as (جمهورية التشيك)، Freudenberg SE (Weinheim)، Dynarex Corporation (نيويورك)، Suominen Corporation (فنلندا) وFibretex منسوجات A/S (الدنمارك)، KCWW (الولايات المتحدة)، Abena A/S (الدنمارك)، Asahi Kasei Corporation (اليابان) وغيرها

|

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الأفكار حول سيناريوهات السوق مثل القيمة السوقية، ومعدل النمو، والتجزئة، والتغطية الجغرافية، واللاعبين الرئيسيين، تتضمن تقارير السوق التي تنظمها Data Bridge Market Research أيضًا تحليل الخبراء المتعمق، وعلم أوبئة المرضى، وتحليل خطوط الأنابيب، وتحليل الأسعار، والإطار التنظيمي.

|

تحليل القطاع:

يتم تقسيم سوق الأقمشة الطبية غير المنسوجة على أساس النوع ونوع المنتج وسهولة الاستخدام وقناة التوزيع والمستخدم النهائي.

- على أساس النوع، يتم تقسيم السوق إلى سندات مغزولة، مغزولة ومذابة مغزولة (SMS)، جافة، ممددة رطبة، مصهورة، وغيرها. من المتوقع أن يهيمن الجزء المغزول على قطاع النوع في السوق العالمية غير المنسوجة الطبية بأكبر حصة سوقية تبلغ 55.54٪ في الفترة المتوقعة من 2022 إلى 2029 بسبب المتانة والتهوية. إن تعدد استخداماتها يجعلها مناسبة لمختلف التطبيقات الطبية، بما في ذلك العباءات الجراحية والستائر والأقنعة الطبية التي تستخدم لمرة واحدة.

في عام 2022، من المتوقع أن يهيمن الجزء المغزول على قطاع النوع في السوق العالمية غير المنسوجة الطبية

في عام 2022، من المتوقع أن يهيمن الجزء المغزول على قطاع النوع في السوق العالمية غير المنسوجة الطبية بسبب القوة والتهوية. بالإضافة إلى ذلك، من خلال قدرته على التكيف، يمكن استخدامه لمجموعة متنوعة من التطبيقات الطبية، مثل العباءات الجراحية والستائر والأقنعة الطبية التي تستخدم لمرة واحدة مع أكبر حصة سوقية تبلغ 55.54٪ في الفترة المتوقعة من 2022 إلى 2029.

- على أساس نوع المنتج، يتم تقسيم السوق إلى تكنولوجيا النظافة ومنتجات الملابس. من المتوقع أن يهيمن قطاع تكنولوجيا النظافة على قطاع أنواع المنتجات في السوق العالمية غير المنسوجة الطبية بمعدل نمو سنوي مركب قدره 7.7٪ في الفترة المتوقعة من 2022 إلى 2029 بسبب استخدامها على نطاق واسع في تصنيع المنتجات مثل الحفاضات ومنتجات النظافة النسائية ومنتجات سلس البول للبالغين. ، والمناديل المبللة بسبب نعومتها وامتصاصها وخصائصها الحاجزة.

- على أساس سهولة الاستخدام، يتم تقسيم السوق إلى القابل للتصرف وقابلة لإعادة الاستخدام. من المتوقع أن يهيمن الجزء القابل للتصرف من حيث سهولة الاستخدام على السوق العالمية غير المنسوجة الطبية بحصة سوقية أكبر تبلغ 78.51٪ في الفترة المتوقعة من 2022 إلى 2029 بسبب النظافة وتقليل مخاطر التلوث المتبادل. يتم استخدامها على نطاق واسع في أماكن الرعاية الصحية لتقليل انتشار العدوى وضمان التخلص الآمن والفعال بعد الاستخدام مرة واحدة، مما يجعلها خيارًا أساسيًا لمتخصصي الرعاية الصحية والمرضى.

في عام 2022، من المتوقع أن يهيمن القطاع القابل للتصرف على قطاع قابلية الاستخدام في السوق العالمية للأقمشة غير المنسوجة الطبية

في عام 2022، من المتوقع أن يهيمن القطاع القابل للتصرف على قطاع قابلية الاستخدام في السوق العالمية غير المنسوجة الطبية بسبب انخفاض مخاطر التلوث المتبادل والنظافة. يتم استخدامها بشكل متكرر في أماكن الرعاية الصحية لمنع انتشار العدوى وضمان التخلص الفعال والآمن بعد الاستخدام مرة واحدة، مما يجعلها خيارًا حاسمًا لكل من المرضى ومتخصصي الرعاية الصحية مع أكبر حصة سوقية تبلغ 78.51٪ في الفترة المتوقعة من 2022 إلى 2029. .

- على أساس قناة التوزيع، يتم تقسيم السوق إلى المناقصات المباشرة والتجزئة. من المتوقع أن يهيمن قطاع المناقصات المباشرة حسب قناة التوزيع على السوق العالمية غير المنسوجة الطبية بأكبر حصة سوقية تبلغ 62.02٪ في الفترة المتوقعة من 2022 إلى 2029 بسبب القناة التي تسمح للمصنعين بالتعامل مباشرة مع مؤسسات الرعاية الصحية والمنظمات الحكومية، مما يضمن تبسيط عملية الشراء، والأسعار التنافسية، وتخصيص المنتجات لتلبية متطلبات محددة.

- على أساس المستخدم النهائي، يتم تقسيم السوق إلى المستشفيات والعيادات والرعاية الصحية المنزلية والمختبرات ومراكز الجراحة المتنقلة وغيرها. من المتوقع أن يهيمن قطاع المستشفيات حسب المستخدم النهائي على السوق العالمية غير المنسوجة الطبية بأكبر حصة سوقية تبلغ 51.10٪ في الفترة المتوقعة من 2022 إلى 2029 بسبب ارتفاع الطلب على تدابير الوقاية من العدوى ومكافحتها. تُستخدم المواد غير المنسوجة على نطاق واسع في المستشفيات لإجراء العمليات الجراحية، ورعاية المرضى، وتضميد الجروح، وتطبيقات النظافة، مما يؤدي إلى هيمنتها في السوق.

اللاعبين الرئيسيين

تعترف Data Bridge Market Research بالشركات التالية باعتبارها الشركات الطبية غير المنسوجة الرئيسية اللاعبون في السوق في السوق غير المنسوجة الطبية هم Owens & Minor, Inc. (الولايات المتحدة)، وشركة Asahi Kasei Corporation (اليابان)، وBerry Global Inc. (الولايات المتحدة)، وKCWW (الولايات المتحدة)

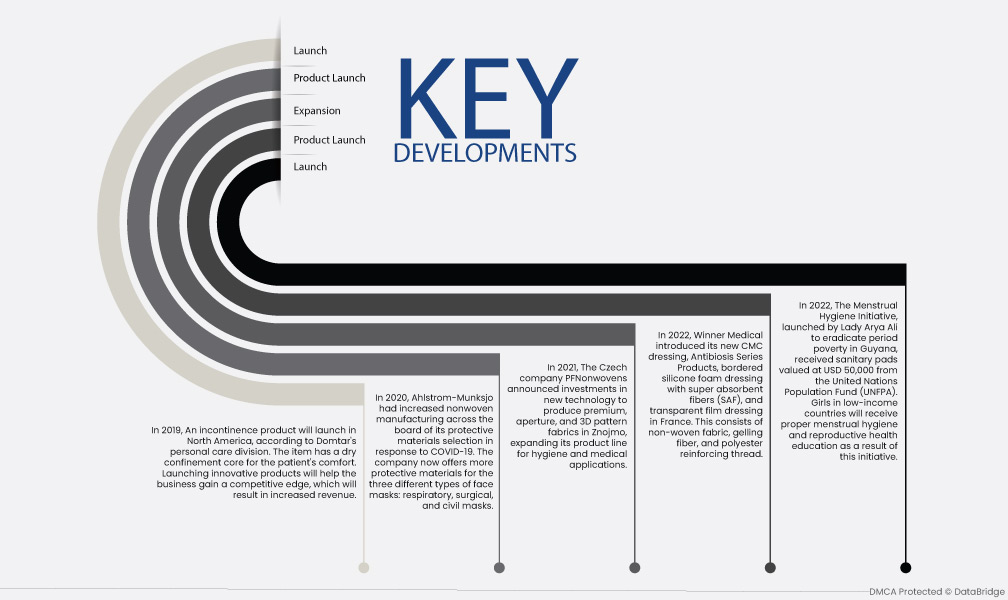

تطوير السوق

- في عام 2022، حصلت مبادرة النظافة أثناء الدورة الشهرية، التي أطلقتها السيدة آريا علي للقضاء على فقر الدورة الشهرية في غيانا، على فوط صحية بقيمة 50 ألف دولار أمريكي من صندوق الأمم المتحدة للسكان (UNFPA). ونتيجة لهذه المبادرة، ستحصل الفتيات في البلدان المنخفضة الدخل على التثقيف المناسب بشأن النظافة الصحية أثناء الدورة الشهرية والصحة الإنجابية.

- في عام 2022، قدمت شركة وينر ميديكال ضمادات CMC الجديدة، ومنتجات سلسلة Antibiosis، وضمادات رغوة السيليكون ذات الحدود مع ألياف فائقة الامتصاص (SAF)، وضمادات غشائية شفافة في فرنسا. ويتكون هذا من قماش غير منسوج، وألياف التبلور، وخيوط تقوية البوليستر.

- في عام 2021، أعلنت الشركة التشيكية PFNonwens عن استثمارات في التكنولوجيا الجديدة لإنتاج أقمشة متميزة ذات فتحات وأنماط ثلاثية الأبعاد في زنويمو، لتوسيع خط إنتاجها للتطبيقات الصحية والطبية.

- في عام 2020، قامت شركة Ahlstrom-Monksjo بزيادة التصنيع غير المنسوج في جميع المجالات لاختيار المواد الواقية استجابةً لـCOVID-19. تقدم الشركة الآن المزيد من المواد الوقائية للأنواع الثلاثة المختلفة من أقنعة الوجه: الأقنعة التنفسية والجراحية والمدنية.

- في عام 2019، سيتم إطلاق منتج لسلس البول في أمريكا الشمالية، وفقًا لقسم العناية الشخصية في شركة دومتار. يحتوي هذا المنتج على قلب حبس جاف لراحة المريض. إن إطلاق المنتجات المبتكرة سيساعد الشركة على اكتساب ميزة تنافسية، مما سيؤدي إلى زيادة الإيرادات.

التحليل الإقليمي

جغرافيًا، البلدان المشمولة في تقرير سوق الأقمشة الطبية غير المنسوجة هي الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية وألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية أوروبا في أوروبا والصين واليابان. والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ (APAC) والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط شرق وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA)، والبرازيل والأرجنتين وبقية أمريكا الجنوبية كجزء من أمريكا الجنوبية.

وفقًا لتحليل أبحاث سوق Data Bridge:

أمريكا الشمالية هي المنطقة المهيمنة في سوق المنسوجات الطبية خلال الفترة المتوقعة 2022 إلى 2029

تهيمن أمريكا الشمالية على السوق غير المنسوجة الطبية بسبب عدة عوامل. تتمتع المنطقة ببنية تحتية راسخة للرعاية الصحية وتركيز كبير على ممارسات مكافحة العدوى، مما يؤدي إلى زيادة الطلب على الأقمشة الطبية غير المنسوجة. بالإضافة إلى ذلك، فإن ارتفاع الأمراض المزمنة، وشيخوخة السكان، والمبادرات الحكومية التي تعزز سلامة المرضى تزيد من دفع السوق. يساهم وجود الشركات المصنعة الكبرى والتقدم التكنولوجي في المنطقة أيضًا في هيمنة أمريكا الشمالية على سوق الأقمشة الطبية غير المنسوجة.

من المقدر أن تكون منطقة آسيا والمحيط الهادئ هي المنطقة الأسرع نموًا في السوق الطبية غير المنسوجة للفترة المتوقعة 2022 إلى 2029

تستعد منطقة آسيا والمحيط الهادئ للنمو في السوق غير المنسوجة الطبية بسبب عدة عوامل. يوفر عدد السكان الكبير والمتزايد في المنطقة قاعدة عملاء كبيرة للمنتجات الطبية غير المنسوجة. علاوة على ذلك، فإن ارتفاع الدخل المتاح في دول مثل الصين والهند يمكّن المستهلكين من تحمل تكاليف خدمات الرعاية الصحية، بما في ذلك تلك التي تنطوي على الأقمشة الطبية غير المنسوجة. ومن المتوقع أن تؤدي هذه العوامل، إلى جانب تحسين البنية التحتية للرعاية الصحية وزيادة الوعي بالوقاية من العدوى، إلى دفع نمو السوق في منطقة آسيا والمحيط الهادئ خلال الفترة المتوقعة.

لمزيد من المعلومات التفصيلية حول الأقمشة الطبية غير المنسوجة سوق التقرير اضغط هنا – https://www.databridgemarketresearch.com/reports/global-medical-noncloths-market