يمثل سوق تغليف الكرتون المضلع العالمي قطاعًا ديناميكيًا جزءًا لا يتجزأ من صناعة التعبئة والتغليف. يعد الكرتون المضلع، الذي يتميز ببنيته المتينة والمتعددة الاستخدامات، خيارًا شائعًا لحلول التغليف في مختلف القطاعات. يشمل هذا السوق إنتاج وتوزيع واستهلاك عبوات الكرتون المضلع، مما يلبي الاحتياجات المتنوعة للشركات في جميع أنحاء العالم. باعتباره عنصرًا حيويًا في مشهد التعبئة والتغليف، يواصل سوق تغليف الكرتون المضلع العالمي التكيف مع ديناميكيات السوق المتغيرة، مما يدل على المرونة والتنوع في تلبية المتطلبات المتطورة لسلسلة التوريد العالمية.

الوصول إلى التقرير الكامل @ https://www.databridgemarketresearch.com/reports/global-corrugated-board-packaging-market

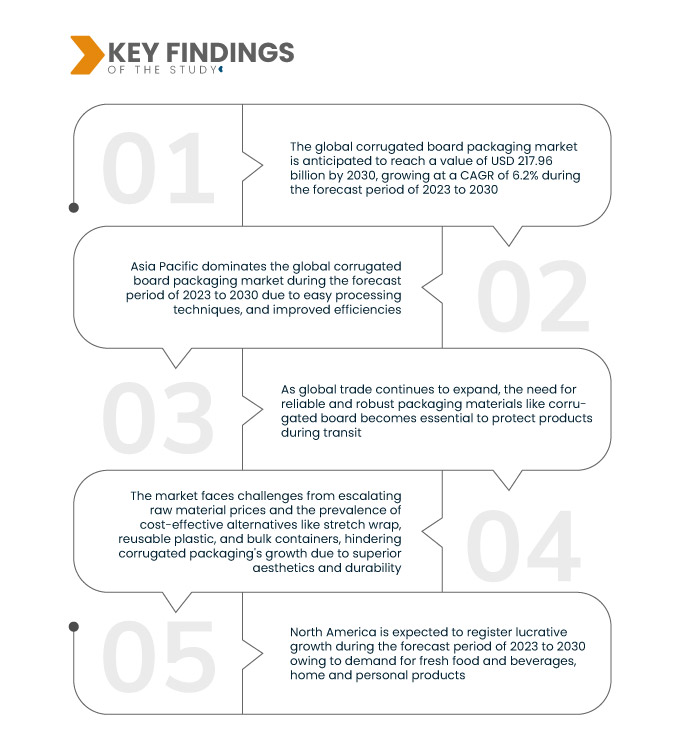

تحلل أبحاث سوق جسر البيانات أن السوق العالمية لتغليف الألواح المموجة، بقيمة 134.7 مليار دولار أمريكي في عام 2022، ستصل إلى 217.96 مليار دولار أمريكي بحلول عام 2030، بمعدل نمو سنوي مركب قدره 6.2٪ خلال الفترة المتوقعة من 2023 إلى 2030. الطفرة في التسوق عبر الإنترنت و التجارة الإلكترونية أدت إلى زيادة الطلب على التغليف القوي، مما يجعل الألواح المموجة هي الحل المفضل نظرًا لقوتها ومتانتها المتأصلة. نظرًا لأن المستهلكين يعتمدون بشكل متزايد على عمليات التسليم، فإن الصفات الوقائية للألواح المموجة تتوافق مع متطلبات نقل المنتج الآمن والمأمون.

النتائج الرئيسية للدراسة

ومن المتوقع أن تؤدي فرص التخصيص والعلامات التجارية إلى دفع معدل نمو السوق

تعمل عبوات الكرتون المضلعة على تمكين الشركات من خلال تصميمات قابلة للتخصيص، مما يتيح التعبير عن هويات العلامات التجارية المميزة. يسهل هذا النهج الشخصي إنشاء عبوات ملفتة للنظر، مما يعزز الميزة التنافسية. ومن خلال دمج الشعارات والألوان وعناصر العلامة التجارية، تعمل الشركات على تعزيز الاعتراف بها وصياغة تجارب لا تُنسى عند فتح العلبة. يعد هذا التركيز على التمايز والاهتمام بالعلامة التجارية عاملاً مقنعًا، مما يزيد من الطلب على عبوات الكرتون المضلع في السوق.

نطاق التقرير وتقسيم السوق

|

تقرير المقياس

|

تفاصيل

|

|

فترة التنبؤ

|

2023 إلى 2030

|

|

سنة الأساس

|

2022

|

|

سنوات تاريخية

|

2021 (قابل للتخصيص حتى 2015-2020)

|

|

الوحدات الكمية

|

الإيرادات بمليار دولار أمريكي، الأحجام بالوحدات، التسعير بالدولار الأمريكي

|

|

القطاعات المغطاة

|

المواد الخام (البطانة والمتوسطة)، النمط (صندوق مشقوق، تلسكوبات، مجلدات، صواني، صفائح، طيات مروحية، قطع داخلية مقطوعة بالقالب، وبطانة داخلية مقطوعة بالقالب)، درجة (بطانة اختبار غير مبيضة، بطانة اختبار بيضاء اللون، بطانة كرافت غير مبيضة، أبيض- بطانة كرافت العلوية، والبطانة القائمة على النفايات، والبطانة شبه الكيميائية)، والاستخدام النهائي (الأغذية المصنعة، والرعاية الصحية، والمشروبات، والمواد الكيميائية، المنسوجات، العناية الشخصية، السلع الكهربائية، قطع غيار المركبات، الأواني الزجاجية و سيراميك، منتجات الأخشاب والأخشاب، العناية المنزلية، الفواكه والخضروات، المنتجات الورقية، التبغ وغيرها)

|

|

البلدان المشمولة

|

الولايات المتحدة وكندا والمكسيك والبرازيل والأرجنتين وبقية أمريكا الجنوبية وألمانيا وفرنسا وإيطاليا والمملكة المتحدة وبلجيكا وإسبانيا وروسيا وتركيا وهولندا وسويسرا وبقية أوروبا واليابان والصين والهند وكوريا الجنوبية وأستراليا و نيوزيلندا، وسنغافورة، وماليزيا، وتايلاند، وإندونيسيا، والفلبين، وبقية دول آسيا والمحيط الهادئ، والإمارات العربية المتحدة، والمملكة العربية السعودية، ومصر، وإسرائيل، وجنوب أفريقيا، وبقية دول الشرق الأوسط وأفريقيا

|

|

تغطية لاعبي السوق

|

International Paper (الولايات المتحدة)، Mondi (المملكة المتحدة)، Smurfit Kappa (أيرلندا)، Cascades Inc. (كندا)، شركة WestRock (الولايات المتحدة)، شركة Oji Holdings (الولايات المتحدة)، شركة التغليف الأمريكية (الولايات المتحدة)، Sealed Air (الولايات المتحدة)، شركة Rengo Co., Ltd. (اليابان)، DS Smith (المملكة المتحدة)، NIPPON PAPER INDUSTRIES شركة المحدودة. (اليابان)، وجورجيا والمحيط الهادئ (الولايات المتحدة)، وNeway Packaging (الولايات المتحدة)، وArab Packaging Co LLC (الإمارات العربية المتحدة)، وWertheimer Box Corp. (الولايات المتحدة)، وKlabin SA (البرازيل)، وKlingele Paper and Packaging SE and Co. KG (ألمانيا). )، بي سميث للتغليف المحدودة (المملكة المتحدة)

|

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الأفكار حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي تنظمها أبحاث سوق Data Bridge أيضًا تحليلًا متعمقًا للخبراء وإنتاجًا ممثلًا جغرافيًا للشركة و القدرة، وتخطيطات شبكة الموزعين والشركاء، وتحليل مفصل ومحدث لاتجاهات الأسعار وتحليل العجز في سلسلة التوريد والطلب.

|

تحليل القطاع:

يتم تقسيم سوق تغليف الكرتون المضلع العالمي على أساس المواد الخام والأسلوب والدرجة والاستخدام النهائي.

- على أساس المواد الخام، يتم تقسيم سوق تغليف الألواح المموجة العالمية إلى ألواح بطانة ومتوسطة

- على أساس الأسلوب، يتم تقسيم سوق تغليف الكرتون المضلع العالمي إلى صناديق مشقوقة، وتلسكوبات، ومجلدات، وصواني، وألواح، ومروحة، ونعيم مقطوع بالقالب، وتصميمات داخلية مقطوعة بالقالب.

- على أساس الدرجة، يتم تقسيم السوق العالمية لتغليف الألواح المموجة إلى بطانة اختبار غير مبيضة، وبطانة اختبار ذات سطح أبيض، وبطانة كرافت غير مبيضة، وبطانة كرافت ذات سطح أبيض، وبطانة كرافت ذات سطح نفايات، وبطانة شبه كيميائية.

- على أساس الاستخدام النهائي، يتم تقسيم سوق تغليف الكرتون المضلع العالمي إلى الأطعمة المصنعة والرعاية الصحية والمشروبات والمواد الكيميائية والمنسوجات والعناية الشخصية والسلع الكهربائية وقطع غيار المركبات والأواني الزجاجية والسيراميك والخشب والمنتجات الخشبية والرعاية المنزلية والفواكه. والخضروات والمنتجات الورقية والتبغ وغيرها

اللاعبين الرئيسيين

تعترف Data Bridge Market Research بالشركات التالية باعتبارها أكبر اللاعبين العالميين في سوق تغليف الكرتون المضلع في السوق العالمية لتغليف الكرتون المضلع، وهي International Paper (الولايات المتحدة)، وMondi (المملكة المتحدة)، وSmurfit Kappa (أيرلندا)، وCascades inc. (كندا)، شركة WestRock (الولايات المتحدة)، شركة Oji Holdings Corporation (الولايات المتحدة)، شركة Packaging Corporation of America (الولايات المتحدة)، Sealed Air (الولايات المتحدة)، Rengo Co., Ltd. (اليابان)، DS Smith (المملكة المتحدة)

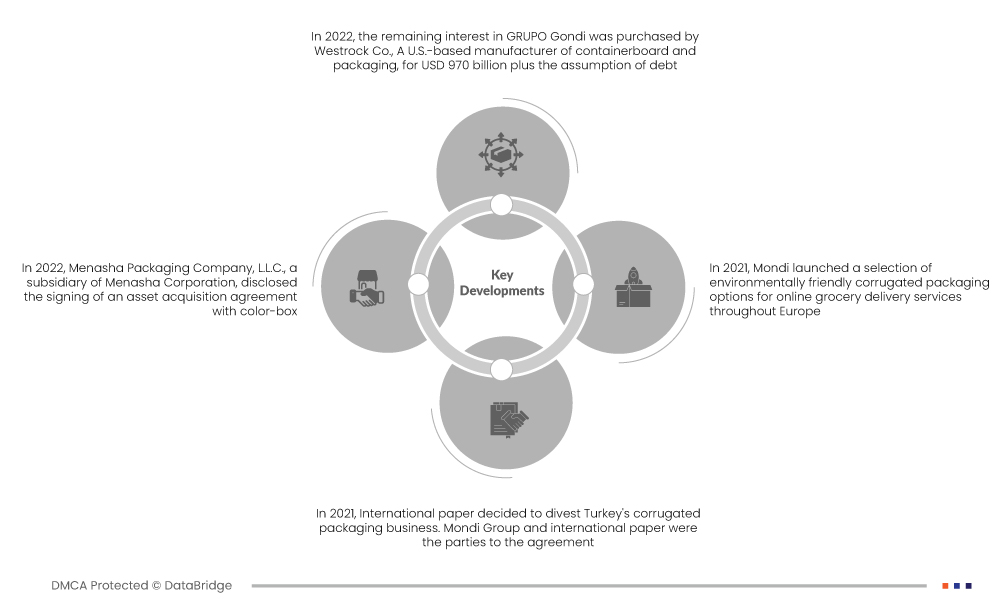

تطورات السوق

- في عام 2022، تم شراء الحصة المتبقية في GRUPO Gondi من قبل شركة Westrock Co.، وهي شركة تصنيع ألواح الحاويات والتغليف ومقرها الولايات المتحدة، مقابل 970 مليار دولار أمريكي بالإضافة إلى تحمل الديون. تدير GRUPO Gondi تسعة مصانع للتغليف المموج وأربعة مصانع للورق وستة مصانع عالية الرسوم في جميع أنحاء المكسيك. وبعد إتمام الصفقة، أفادت التقارير أن الشركة عززت مكانتها في أسواق أمريكا اللاتينية الآخذة في التوسع.

- في عام 2022، كشفت شركة Menasha Packaging Company, LLC، وهي شركة تابعة لشركة Menasha Corporation، عن توقيع اتفاقية استحواذ على الأصول مع color-box، وهي وحدة أعمال تابعة لشركة Georgia-Pacific, LLC. ومن المتوقع الانتهاء منها في أوائل صيف 2022. ويتخصص كلا الكيانين في التعبئة والتغليف المموج عالي الرسم. تهدف هذه الشراكة الإستراتيجية إلى تعزيز الوجود الجغرافي لميناشا وتزويد العملاء بخيارات موسعة للرسومات والتصميمات والتغليف الهيكلي.

- وفي عام 2021، قررت شركة International Paper تصفية أعمال التغليف المموج في تركيا. وكانت Mondi Group وInternational Paper طرفي الاتفاقية. وقد تم هذا الاتفاق بين الشركتين لخدمة السوق ومنحهم ميزة. ستشهد صناعة التغليف نموًا في السوق.

- في عام 2021، أطلقت Mondi مجموعة مختارة من خيارات التغليف المموج الصديقة للبيئة لخدمات توصيل البقالة عبر الإنترنت في جميع أنحاء أوروبا. سبعة حلول تغليف جديدة تلبي الطلب على حلول تغليف التسليم الجديدة. خلال فترة كوفيد، قدمت الشركة منتجًا جديدًا لأغراض التوصيل. هذه المنتجات سوف تغذي سوق التسليم.

التحليل الإقليمي

جغرافيًا، البلدان المشمولة في تقرير سوق التغليف العالمي للألواح المموجة هي الولايات المتحدة وكندا والمكسيك والبرازيل والأرجنتين وبقية أمريكا الجنوبية وألمانيا وفرنسا وإيطاليا والمملكة المتحدة وبلجيكا وإسبانيا وروسيا وتركيا وهولندا وسويسرا والباقي. أوروبا واليابان والصين والهند وكوريا الجنوبية وأستراليا ونيوزيلندا وسنغافورة وماليزيا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ والإمارات العربية المتحدة والمملكة العربية السعودية ومصر وإسرائيل وجنوب أفريقيا وبقية دول الشرق الأوسط الشرق وأفريقيا

وفقًا لتحليل أبحاث سوق Data Bridge:

آسيا والمحيط الهادئ هي المنطقة المهيمنة في السوق العالمية لتغليف الكرتون المضلع خلال الفترة المتوقعة 2023-2030

تهيمن منطقة آسيا والمحيط الهادئ على السوق العالمية لتغليف الألواح المموجة، ومن المقرر أن تحافظ على اتجاهها نحو الهيمنة. ويعزى ذلك إلى تقنيات المعالجة السهلة والكفاءات المحسنة والاستخدام الواسع النطاق لتغليف الصناديق المموجة في الصناعة الصينية. يؤدي الارتفاع في الطلب على الأطعمة والمشروبات المصنعة في المنطقة إلى زيادة نمو السوق، مما يجعل منطقة آسيا والمحيط الهادئ لاعبًا محوريًا في مشهد التعبئة والتغليف المموج المزدهر خلال الفترة المتوقعة.

أمريكا الشمالية من المقدر أن تكون المنطقة الأسرع نموًا في سوق تغليف الألواح المموجة العالمية خلال الفترة المتوقعة 2023-2030

من المتوقع أن تهيمن أمريكا الشمالية على السوق العالمية لتغليف الكرتون المضلع، حيث ستُظهر أعلى معدل نمو. إن الارتفاع الكبير في الطلب على الأطعمة الطازجة والمشروبات والمنتجات المنزلية والشخصية، إلى جانب ازدهار صناعة التجارة الإلكترونية، يدفع النمو المستمر في التغليف المموج. وتقود الولايات المتحدة، على وجه الخصوص، المنطقة، مدفوعة بزيادة وعي المستهلكين بتفضيل المنتجات الصديقة للبيئة. ويساهم هذا الوعي المتزايد في التوسع القوي لقطاع تعبئة وتغليف الكرتون المضلع في المنطقة.

لمزيد من المعلومات التفصيلية حول التقرير العالمي لسوق عبوات الكرتون المضلع، انقر هنا –https://www.databridgemarketresearch.com/reports/global-corrugated-board-packaging-market