المواد الخافضة للتوتر السطحي هي جزيئات تظهر خصائص محبة للماء (جاذبة للماء) وخواص كارهة للماء (طاردة للماء). تلعب هذه المركبات دورًا حاسمًا في تقليل التوتر السطحي بين السوائل والمواد الصلبة أو السوائل والغازات. في العديد من الصناعات، يتم استخدام المواد الخافضة للتوتر السطحي لتثبيت المستحلبات، وتعزيز ترطيب وانتشار السوائل، وتسهيل إزالة الأوساخ أو الزيت من الأسطح. إن قدرتها على تغيير خصائص السطح البيني تجعل المواد الخافضة للتوتر السطحي جزءًا لا يتجزأ من التطبيقات التي تتراوح من منتجات التنظيف المنزلية إلى التركيبات الصيدلانية والعمليات الصناعية. بشكل عام، تساهم المواد الخافضة للتوتر السطحي في كفاءة وفعالية الأنظمة السائلة المتنوعة من خلال تعديل سطحها وخصائصها البينية.

الوصول إلى التقرير الكامل @https://www.databridgemarketresearch.com/reports/asia-pacific-surfactant-market

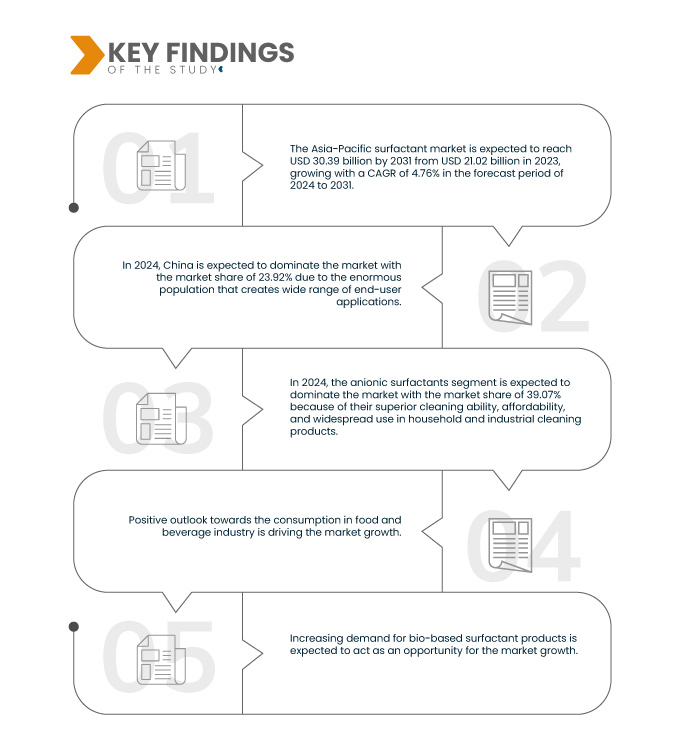

تحلل أبحاث سوق جسر البيانات أن سوق الفاعل بالسطح في آسيا والمحيط الهادئ ومن المتوقع أن تصل إلى 30.39 مليار دولار أمريكي بحلول عام 2031، من 21.02 مليار دولار أمريكي في عام 2023، بمعدل نمو سنوي مركب قدره 4.76٪ في الفترة المتوقعة من 2024 إلى 2031.

النتائج الرئيسية للدراسة

ارتفاع الطلب على المواد الخافضة للتوتر السطحي في منتجات العناية الشخصية والمنتجات الصحية

في صناعة التجميل والعناية الشخصية، تمتلك المواد الخافضة للتوتر السطحي تطبيقات متنوعة مثل الرغوة، والتطهير، والتكثيف، والإذابة، والتأثيرات المضادة للميكروبات، وتعزيز الاختراق، والعديد من التأثيرات الخاصة الأخرى. يعد توافقها مع الزيت والماء سمة أساسية لجزيئات الفاعل بالسطح التي تجعلها مفيدة للغاية مستحضرات التجميل مكونات.

الاتجاه المتزايد نحو المواد الخافضة للتوتر السطحي الحيوية للاستخدام في منتجات العناية الشخصية من المتوقع أن يساعد في النمو في سوق مستحضرات التجميل والعناية الشخصية الشاملة.

من المتوقع أن يؤثر التطبيق المتزايد للمواد الخافضة للتوتر السطحي في الرعاية المنزلية على السوق بشكل إيجابي. وقد ساعد وعي المستهلك المتزايد تجاه النظافة بسبب انتشار الأمراض والفيروسات المختلفة على توسع السوق بمنتجات العناية المنزلية، والتي تشمل المطهرات والمنظفات ومنتجات التنظيف، شامبووغسل اليدين وغير ذلك. ومن المتوقع أن يدعم الطلب الكبير على هذه المنتجات تطور السوق. وبالتالي، فإن الطلب المتزايد على المواد الخافضة للتوتر السطحي يقود نمو السوق.

نطاق التقرير وتقسيم السوق

|

تقرير المقياس

|

تفاصيل

|

|

فترة التنبؤ

|

2024 إلى 2031

|

|

سنة الأساس

|

2023

|

|

سنوات تاريخية

|

2022 (قابل للتخصيص حتى 2016-2021)

|

|

الوحدات الكمية

|

الإيرادات بمليار دولار أمريكي والحجم بالكيلو طن

|

|

القطاعات المغطاة

|

النوع (المواد الخافضة للتوتر السطحي الأنيونية، المواد الخافضة للتوتر السطحي غير الأيونية، المواد الخافضة للتوتر السطحي الكاتيونية، المواد الخافضة للتوتر السطحي المذبذبة، المواد الخافضة للتوتر السطحي السيليكون، وغيرها)، الركيزة (المواد الخافضة للتوتر السطحي الاصطناعية والمواد الخافضة للتوتر السطحي ذات الأساس الحيوي)، التطبيق (الصابون والمنظفات المنزلية، العناية الشخصية، معالجة المنسوجات، الصناعية والمؤسسية التنظيف، التعدين، المستحضرات الصيدلانية، الدهانات والطلاءات، كيماويات حقول النفط، تجهيز الأغذية، الكيماويات الزراعية، اللب والورق، صناعة الجلود، بلمرة المستحلب، عوامل الرغوة، مواد التشحيم والمواد المضافة للوقود، البلاستيك واللدائن، المواد اللاصقة، الطلاء الكهربائي، وغيرها)

|

|

البلدان المشمولة

|

الصين والهند واليابان وكوريا الجنوبية وماليزيا وتايلاند وإندونيسيا وأستراليا ونيوزيلندا وسنغافورة والفلبين وفيتنام وتايوان وبقية دول آسيا والمحيط الهادئ

|

|

تغطية لاعبي السوق

|

Dow (الولايات المتحدة)، BASF SE (ألمانيا)، Sasol Ltd. (جنوب أفريقيا)، Evonik Industries AG (ألمانيا)، KLK OLEO (ماليزيا)، Indorama Ventures Public Company Limited (تايلاند)، Kao Corporation (اليابان)، Reliance Industries Limited (الهند)، أركيما (فرنسا)، جودريج للصناعات المحدودة (الهند)، كارجيل إنكوربوريتد (الولايات المتحدة)، كلاريانت (سويسرا)، شركة الصين للبتروكيماويات (الصين)، شركة ستيبان (الولايات المتحدة)، شركة ليون (اليابان)، آرتي للصناعات المحدودة (الهند)، شركة ADEKA (اليابان)، نوريون (هولندا)، شركة لوبريزول (الولايات المتحدة)، لونزا (سويسرا)، سابك (المملكة العربية السعودية)، شركة سوميتومو كيميكال المحدودة (اليابان)، سيبسا (إسبانيا)، Bayer AG (ألمانيا)، SANYO CHEMICAL INDUSTRIES, LTD. (اليابان)، Croda International Plc (المملكة المتحدة)، Zanyu Technology Group (الصين)، Ashland (الولايات المتحدة)، GALAXY (الهند)، EOC Group (بلجيكا)، Lankem (المملكة المتحدة)، DKS Co. Ltd. (اليابان)، TAIWAN NJC CORPORATION (تايوان)، و3M (الولايات المتحدة)، وGEO (الولايات المتحدة)، وFoglaGroup (الهند)، وGoulston (الولايات المتحدة)، وSyensqo (بلجيكا)، وABITEC (الولايات المتحدة)، وMatangi Industries (الهند)، من بين شركات أخرى

|

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الأفكار حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي تنظمها أبحاث سوق Data Bridge أيضًا تحليلًا متعمقًا للخبراء وإنتاجًا ممثلًا جغرافيًا للشركة و القدرة، وتخطيطات شبكة الموزعين والشركاء، وتحليل مفصل ومحدث لاتجاهات الأسعار وتحليل العجز في سلسلة التوريد والطلب

|

تحليل القطاع

يتم تقسيم سوق المواد الخافضة للتوتر السطحي في آسيا والمحيط الهادئ إلى ثلاثة قطاعات بارزة بناءً على النوع والركيزة والتطبيق.

- على أساس النوع، يتم تقسيم سوق المواد الخافضة للتوتر السطحي في آسيا والمحيط الهادئ إلى مواد خافضة للتوتر السطحي أنيونية، ومواد خافضة للتوتر السطحي غير أيونية، ومواد خافضة للتوتر السطحي كاتيونية، ومواد خافضة للتوتر السطحي مذبذبة، ومواد خافضة للتوتر السطحي من السيليكون، وغيرها.

في عام 2024، من المتوقع أن يهيمن قطاع المواد الخافضة للتوتر السطحي الأنيونية على سوق المواد الخافضة للتوتر السطحي في منطقة آسيا والمحيط الهادئ.

في عام 2024، من المتوقع أن يهيمن قطاع المواد الخافضة للتوتر السطحي الأنيونية على السوق بحصة سوقية تبلغ 39.07% بسبب قدرتها الفائقة على التنظيف، والقدرة على تحمل التكاليف، واستخدامها على نطاق واسع في منتجات التنظيف المنزلية والصناعية.

- على أساس الركيزة، يتم تقسيم سوق المواد الخافضة للتوتر السطحي في آسيا والمحيط الهادئ إلى مواد خافضة للتوتر السطحي الاصطناعية ومواد خافضة للتوتر السطحي ذات أساس حيوي.

في عام 2024، من المتوقع أن يهيمن قطاع المواد الخافضة للتوتر السطحي الاصطناعية على سوق المواد الخافضة للتوتر السطحي في منطقة آسيا والمحيط الهادئ.

في عام 2024، من المتوقع أن يهيمن قطاع المواد الخافضة للتوتر السطحي الاصطناعية على السوق بحصة سوقية تبلغ 50.23% حيث تم تصميمها بحيث تتمتع بخصائص محددة، مما يجعلها مناسبة لمجموعة واسعة من التطبيقات في صناعات مثل التنظيف، رعاية شخصيةوالزراعة.

- على أساس التطبيق، يتم تقسيم سوق المواد الخافضة للتوتر السطحي في آسيا والمحيط الهادئ إلى الصابون والمنظفات المنزلية، والعناية الشخصية، ومعالجة المنسوجات، والتنظيف الصناعي والمؤسسي، والتعدين، والأدوية، والدهانات والطلاءات، والمواد الكيميائية لحقول النفط، وتجهيز الأغذية، والمواد الكيميائية الزراعية، ولب الورق صناعة الورق، صناعة الجلود، بلمرة المستحلبات، عوامل الرغوة، مواد التشحيم والمواد المضافة للوقود، البلاستيك والمطاط، المواد اللاصقة، الطلاء الكهربائي، وغيرها. في عام 2024، من المتوقع أن يهيمن قطاع الصابون والمنظفات المنزلية على السوق بحصة سوقية تبلغ 39.30%.

اللاعبين الرئيسيين

تقوم شركة Data Bridge Market Research بتحليل شركة DKS Co. Ltd. (اليابان)، وDow (الولايات المتحدة)، وBASF SE (ألمانيا)، وLion Corporation (اليابان)، وSasol Ltd. (جنوب أفريقيا)، باعتبارها اللاعبين الرئيسيين في المواد الخافضة للتوتر السطحي في منطقة آسيا والمحيط الهادئ. سوق.

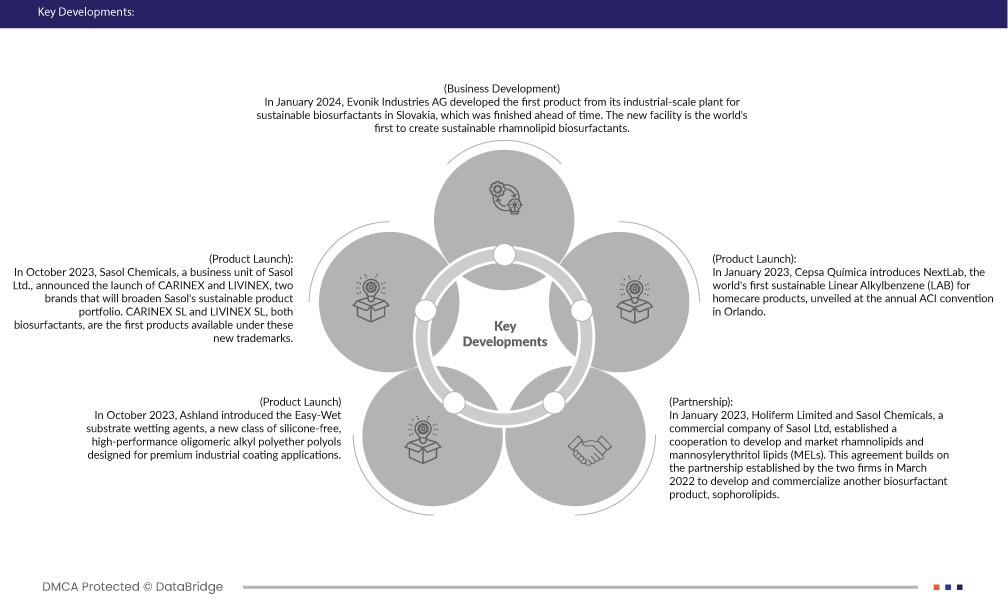

تطورات السوق

- في يناير 2024، طورت شركة Evonik Industries AG أول منتج من مصنعها الصناعي للمواد الخافضة للتوتر السطحي الحيوي المستدام في سلوفاكيا، والذي تم الانتهاء منه مسبقًا. ويعد المرفق الجديد هو الأول من نوعه في العالم الذي ينتج مواد خافضة للتوتر السطحي الحيوية من الرامنوليبيد. تتميز مادة الرامنوليبيدات من شركة Evonik Industires AG بجودة عالية للغاية، وتمنحها عملية التصنيع القائمة على التخمير والمحمية بموجب بروتوكول الإنترنت للشركة ميزة سوقية متميزة

- في أكتوبر 2023، أعلنت شركة ساسول للكيماويات، وهي وحدة أعمال تابعة لشركة ساسول المحدودة، عن إطلاق علامتين تجاريتين CARINEX وLIVINEX، وهما علامتان تجاريتان ستوسعان محفظة منتجات ساسول المستدامة. CARINEX SL وLIVINEX SL، وكلاهما من المواد الخافضة للتوتر السطحي الحيوي، هما المنتجان الأولان المتاحان تحت هذه العلامات التجارية الجديدة

- في أكتوبر 2023، قدمت Ashland عوامل ترطيب الركيزة Easy-Wet، وهي فئة جديدة من بوليولات بولي إيثر ألكيل قليلة القسيم عالية الأداء خالية من السيليكون، مصممة لتطبيقات الطلاء الصناعي المتميزة. وهذا يمكّن الشركة من إنتاج ابتكارات تغير قواعد اللعبة في قطاع الطلاء

- في يناير 2023، أنشأت شركة Holiferm Limited وSasol Chemicals، وهي شركة تجارية تابعة لشركة Sasol Ltd، تعاونًا لتطوير وتسويق دهون الرامنوليبيدات والمانوسيليريثريتول (MELs). وتعتمد هذه الاتفاقية على الشراكة التي أنشأتها الشركتان في مارس 2022 لتطوير وتسويق منتج آخر من المواد الخافضة للتوتر السطحي، وهو "السوفوروليبيدز". ستقوم ساسول وهوليفرم بإنشاء وتسويق تركيبات واستخدامات للمركبات الجديدة

- في يناير 2023، قدمت Cepsa Química NextLab، أول ألكيل بنزين خطي مستدام (LAB) في العالم لمنتجات الرعاية المنزلية، والذي تم الكشف عنه في مؤتمر ACI السنوي في أورلاندو. توفر محفظة NextLab، بما في ذلك NextLab-R، وNextLab Low Carbon، وNextLab-C القادمة، بدائل صديقة للبيئة بخصائص مشابهة لـ LAB التقليدية. وباعتبارها أكبر منتج للـ LAB على مستوى العالم، تهدف Cepsa إلى تقليل البصمة الكربونية مع الحفاظ على المنظفات عالية الأداء. إن NextLab-R وLow Carbon موجودان بالفعل في مرحلة الإنتاج الصناعي، مما يساهم في تقليل انبعاثات الكربون وتحويل الصناعة

التحليل الإقليمي

جغرافيًا، البلدان المشمولة في سوق المواد الخافضة للتوتر السطحي في آسيا والمحيط الهادئ هي الصين والهند واليابان وكوريا الجنوبية وماليزيا وتايلاند وإندونيسيا وأستراليا ونيوزيلندا وسنغافورة والفلبين وفيتنام وتايوان وبقية منطقة آسيا والمحيط الهادئ.

وفقًا لتحليل أبحاث سوق Data Bridge:

الصين ويقدر أن يكون المقاطعة المهيمنة والأسرع نموًا في سوق الفاعل بالسطح في آسيا والمحيط الهادئ

تشير التقديرات إلى أن الصين هي المقاطعة المهيمنة والأسرع نموًا في السوق نظرًا لعدد السكان الهائل الذي يخلق مجموعة واسعة من تطبيقات المستخدم النهائي وميزتها التنافسية في كفاءة الإنتاج وفعالية التكلفة.

لمزيد من المعلومات التفصيلية حول تقرير سوق المواد السطحية في آسيا والمحيط الهادئ، انقر هنا –https://www.databridgemarketresearch.com/reports/asia-pacific-surfactant-market