根据国际糖尿病联合会的数据,2021 年约有 536,600 人患有糖尿病,预计到 2045 年这一数字将上升到 783,700 人。随着数字技术的进步,糖尿病行业预计将看到各种各样的技术,这些技术有可能彻底改变我们管理这种疾病的方式。在过去几年中,可用于疾病管理的智能手机应用程序数量不断增加,网络应用商店中有超过一百种应用程序可以帮助患者监测血糖水平。

访问完整报告: https://databridgemarketresearch.com/reports/global-digital-diabetes-management-market

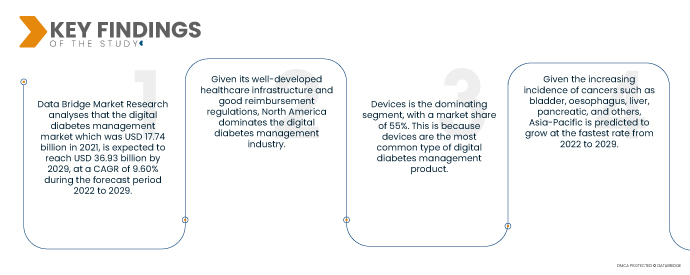

Data Bridge Market Research 分析称, 数字化糖尿病管理市场 2021 年糖尿病市场规模为 177.4 亿美元,预计到 2029 年将达到 369.3 亿美元,2022 年至 2029 年预测期内的复合年增长率为 9.60%。吸烟和饮酒等快速变化的生活方式导致全球糖尿病患者数量增加。此外,肥胖是糖尿病的主要风险因素之一。随着肥胖人口的增加和患者意识的提高,饮食和体重控制应用市场前景广阔。

越来越多的技术进步 预计将推动市场增长率

在预测期内,智能胰岛素笔的新兴创新预计将推动全球数字糖尿病管理市场的发展。对于智能胰岛素笔,iSenz 适配器用于检测胰岛素水平。它提供注射角度以优化糖尿病注射部位。Easylog 是一种连接到互联网的胰岛素笔适配器。它为患有糖尿病等慢性疾病的人提供正确的剂量和更大的舒适度。InsulCheck 是一种适合胰岛素笔的盖子,包括温度和消耗传感器。这些只是加速市场扩张的智能胰岛素笔的几个例子。

报告范围和市场细分

|

报告指标

|

细节

|

|

预测期

|

2022 至 2029 年

|

|

基准年

|

2021年

|

|

历史岁月

|

2020年(可定制为2014-2019年)

|

|

数量单位

|

收入(十亿美元)、销量(单位)、定价(美元)

|

|

涵盖的领域

|

产品和服务(设备、数字糖尿病管理应用程序、数据管理软件和平台、服务)、类型(可穿戴设备、手持设备)、应用程序(糖尿病和血糖跟踪应用程序、肥胖和饮食管理应用程序、数据管理软件和平台、服务)、最终用户(家庭护理机构、糖尿病诊所、学术和研究机构、其他)

|

|

覆盖国家

|

北美的美国、加拿大和墨西哥,德国、法国、英国、荷兰、瑞士、比利时、俄罗斯、意大利、西班牙、土耳其、欧洲其他地区、中国、日本、印度、韩国、新加坡、马来西亚、澳大利亚、泰国、印度尼西亚、菲律宾、亚太地区其他地区 (APAC)、沙特阿拉伯、阿联酋、南非、埃及、以色列、中东和非洲其他地区 (MEA)(中东的一部分)以及非洲 (MEA)、巴西、阿根廷和南美洲其他地区作为南美洲的一部分

|

|

涵盖的市场参与者

|

雅培(美国)、PHC Holdings Corporation(日本)、WellDoc, Inc(印度)、赛诺菲(法国)、Dexcom, Inc(美国)、DarioHealth Corp.(美国)、美敦力(爱尔兰)、B. Braun Melsungen AG(德国)、F. Hoffmann-La Roche Ltd(瑞士)、Insulet Corporation(美国)、Ascensia Diabetes Care Holdings AG(瑞士)、Tidepool(美国)、美敦力(爱尔兰)、Tandem Diabetes Care(美国)、LifeScan(美国)、AgaMatrix(美国)、Glooko Inc.(美国)、DarioHealth(以色列)

|

|

报告中涵盖的数据点

|

除了市场价值、增长率、细分市场、地理覆盖范围、市场参与者和市场情景等市场洞察外,Data Bridge 市场研究团队策划的市场报告还包括深入的专家分析、患者流行病学、渠道分析、定价分析和监管框架

|

细分分析:

数字糖尿病管理市场根据产品和服务、类型和最终用户进行细分。

- 根据产品和服务,市场分为设备、数字糖尿病管理应用程序、数据管理软件和平台以及服务。设备是主导领域,市场份额为 55%。这是因为设备是最常见的数字糖尿病管理产品类型。它们包括胰岛素泵、连续血糖监测仪 (CGM) 和血糖仪。设备允许糖尿病患者跟踪他们的血糖水平并更有效地管理他们的胰岛素治疗。

- 根据类型,市场分为可穿戴设备和手持设备。可穿戴设备是主导细分市场,市场份额为 45%。这是因为可穿戴设备作为跟踪健康数据的一种方式变得越来越流行。它们体积小、隐蔽且易于佩戴,使其成为糖尿病患者的便捷选择。可穿戴设备还提供许多可以帮助糖尿病患者管理病情的功能,例如实时血糖监测和胰岛素输送提醒。

- 根据应用,市场分为糖尿病和血糖跟踪应用程序、肥胖和饮食管理应用程序、数据管理软件和平台以及服务。

应用领域的糖尿病和血糖追踪应用程序在数字糖尿病管理中占据主导地位 市场

糖尿病和血糖追踪应用程序是主导领域,市场份额为 60%。这是因为糖尿病和血糖跟踪应用程序是最常见的数字糖尿病管理应用程序类型。它们允许糖尿病患者跟踪他们的血糖水平,管理他们的胰岛素治疗,并了解糖尿病的自我管理。糖尿病和血糖追踪应用程序适用于 iOS 和 Android 设备,可以免费或收费下载。

- 根据最终用户,市场分为家庭护理环境、糖尿病诊所、学术和研究机构等。

最终用户细分市场的家庭护理设置细分市场在数字糖尿病管理中占据主导地位 市场

家庭护理设施是主导细分市场,市场份额为 65%。这是因为家庭护理环境是大多数糖尿病患者控制病情的地方。家庭护理环境为糖尿病患者提供了许多优势,例如能够更频繁地跟踪血糖水平、更有效地管理胰岛素治疗以及了解糖尿病自我管理。

主要参与者

Data Bridge Market Research 将以下公司视为主要市场参与者:雅培(美国)、PHC Holdings Corporation(日本)、WellDoc, Inc(印度)、赛诺菲(法国)、Dexcom, Inc(美国)、DarioHealth Corp.(美国)、美敦力(爱尔兰)、B. Braun Melsungen AG(德国)、F. Hoffmann-La Roche Ltd(瑞士)、Insulet Corporation(美国)、Ascensia Diabetes Care Holdings AG(瑞士)、Tidepool(美国)、美敦力(爱尔兰)、Tandem Diabetes Care(美国)、LifeScan(美国)、AgaMatrix(美国)、Glooko Inc.(美国)、DarioHealth(以色列)。

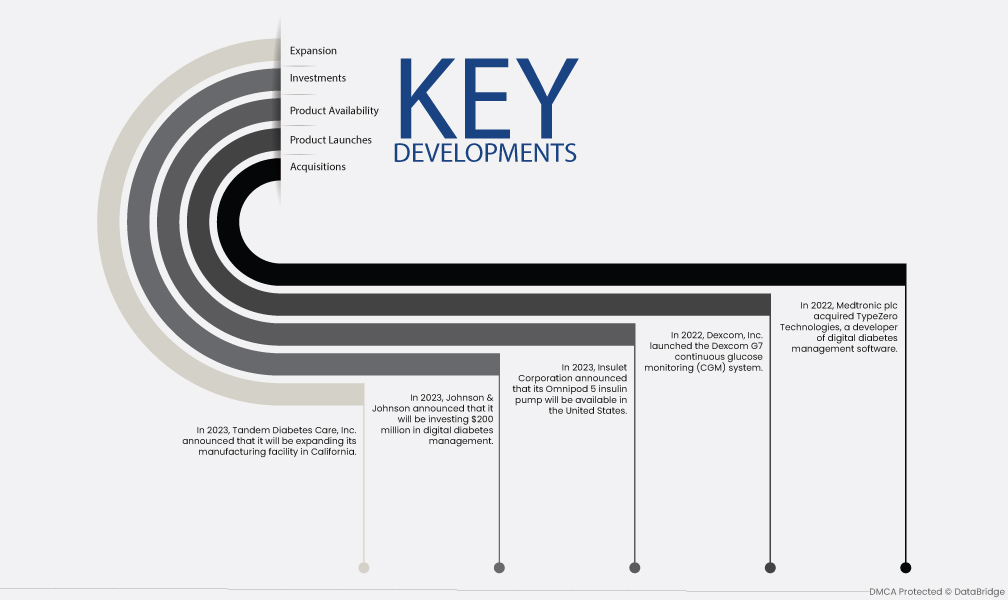

市场发展

- 2022 年,美敦力公司收购了数字糖尿病管理软件开发商 TypeZero Technologies。此次收购将使美敦力扩大其数字糖尿病管理产品和服务组合。美敦力 (Medtronic) 是医疗技术领域的全球领导者,而 TypeZero Technologies 是一家开发糖尿病管理软件的私营公司。此次收购将使美敦力能够获得 TypeZero 在数字糖尿病管理方面的技术和专业知识。这将使美敦力能够开发新产品和服务,帮助糖尿病患者更好地管理他们的病情。

- 2022 年,Dexcom, Inc. 推出了 Dexcom G7 连续血糖监测 (CGM) 系统。Dexcom G7 是一款更小、更用户友好的 CGM 系统,据说比以前的型号更准确。CGM 系统是持续监测血糖水平的设备。它们可以提供有关血糖水平的实时信息,从而帮助糖尿病患者更好地决定治疗方案。Dexcom G7 是最新一代的 CGM 系统,与以前的型号相比,它提供了许多改进。它更小、更隐蔽,佩戴更舒适。它也更准确,提供的读数更接近实际血糖水平。Dexcom G7 也是第一个可以与 Apple Watch 一起使用的 CGM 系统。这使用户可以在手表上查看他们的血糖水平,从而更容易掌握他们的糖尿病管理。

- 2023 年,Insulet Corporation 宣布其 Omnipod 5 胰岛素泵将在美国上市。Omnipod 5 是一款无管胰岛素泵,由智能手机应用程序控制。胰岛素泵是一种根据用户的血糖水平自动输送胰岛素的设备。它们供每天需要多次注射胰岛素的糖尿病患者使用。Omnipod 5 是最新一代的胰岛素泵,与之前的型号相比,它有许多改进。它是无管的,佩戴更舒适,使用更方便。它还由智能手机应用程序控制,允许用户调整胰岛素设置并在手机上查看血糖水平。Omnipod 5 是胰岛素泵技术的重大进步,预计将成为糖尿病患者的宝贵选择。

- 2023年,强生公司宣布将投资2亿美元用于数字化糖尿病管理。这笔投资将用于开发新的数字糖尿病管理产品和服务。强生公司是一家全球医疗保健公司,也是糖尿病市场最大的参与者之一。该公司对数字糖尿病管理的投资反映了其致力于开发创新解决方案,帮助糖尿病患者更好地管理自己的病情。该投资将用于开发使用数字技术的新产品和服务,例如移动应用程序和可穿戴设备。这些产品和服务预计将使糖尿病患者更轻松地跟踪血糖水平、管理胰岛素治疗并选择健康的生活方式。

- 2023 年,Tandem Diabetes Care, Inc. 宣布将扩建其位于加利福尼亚州的制造工厂。此次扩建将使该公司能够提高生产能力,以满足对其胰岛素泵和其他糖尿病管理产品日益增长的需求。Tandem Diabetes Care 是胰岛素泵的领先制造商,近年来取得了显着增长。该公司的扩张是对这种增长的回应,预计将有助于该公司满足客户的需求。此次扩张将在该地区创造新的就业机会,这是该公司对糖尿病社区承诺的标志。

区域分析

从地理上看,市场报告涵盖的国家包括北美洲的美国、加拿大和墨西哥、欧洲的德国、法国、英国、荷兰、瑞士、比利时、俄罗斯、意大利、西班牙、土耳其、欧洲其他地区、亚太地区 (APAC) 的中国、日本、印度、韩国、新加坡、马来西亚、澳大利亚、泰国、印度尼西亚、菲律宾、亚太地区 (APAC) 的其他地区、沙特阿拉伯、阿联酋、南非、埃及、以色列、中东和非洲 (MEA) 的其他地区、南美洲的巴西、阿根廷和南美洲其他地区。

根据 Data Bridge 市场研究分析:

北美是数字化糖尿病管理的主导地区 2022-2029 年预测期内的市场

北美拥有完善的医疗基础设施和良好的报销规定,在数字糖尿病管理行业占据主导地位。此外,美国各地的主要制造商数量众多,也有助于该地区占据主导地位。

亚太 预计是全球增长最快的地区 数字化糖尿病管理 市场 2022-2029 年预测期内

鉴于膀胱癌、食道癌、肝癌、胰腺癌等癌症发病率的不断上升,预计亚太地区将在 2022 年至 2029 年期间以最快的速度增长。此外,技术进步和外国投资的增加正在推动该地区的增长率。

有关数字糖尿病管理的更多详细信息 市场 报告,请点击这里 – https://www.databridgemarketresearch.com/reports/global-digital-diabetes-management-market