遠距醫療為個人提供了一個方便、可訪問的平台,讓他們可以在舒適的家中獲得心理健康服務。偏遠或服務不足地區的人們無需長途跋涉即可與心理健康專家聯繫。遠距醫療有助於減少尋求心理健康服務所帶來的恥辱感。有些人可能不願意親自去心理健康診所,但遠距醫療可以提供更私密和謹慎的諮詢。

人們對心理健康問題的認識不斷提高,導致對服務的需求增加。遠距醫療使心理健康專業人員能夠接觸到更廣泛的受眾並滿足日益增長的支援需求。遠距醫療有助於克服心理健康護理的傳統障礙,例如交通挑戰、時間限制以及某些地理區域內心理健康專業人員的可用性。

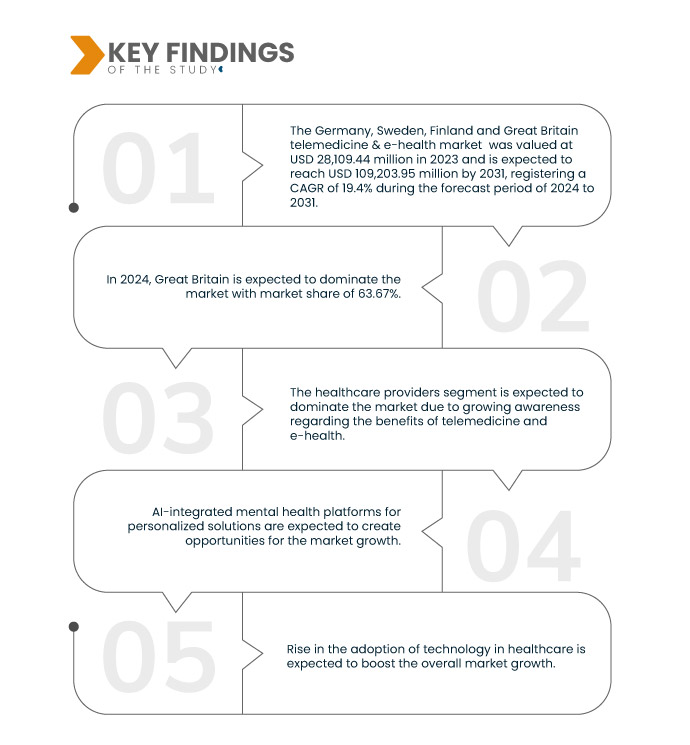

德國、瑞典、芬蘭和英國的遠距醫療和電子健康市場預計將從 2023 年的 281.0944 億美元增長到 2031 年的 1092.0395 億美元,在 2024 年至 2031 年的預測期內,複合年增長率為 19.4%。

研究的主要發現

政府推動先進醫療基礎建設的舉措

世界各國政府都認識到遠距醫療和電子醫療在改善醫療服務可近性和提供方面的潛力。政府將投入資金和激勵措施來建設和加強數位健康基礎設施,包括電信網路、電子健康記錄 (EHR) 和安全資料傳輸系統。各國政府正在製定和修改政策,為遠距醫療的採用創造支持性的監管環境。有關許可、報銷和標準的明確指導方針有助於供應商和技術開發商了解法律環境。確保病患隱私和資料安全的監管框架對於建立對遠距醫療解決方案的信任至關重要。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2024年至2031年

|

基準年

|

2023

|

歷史歲月

|

2022年(依據2016-2021年訂製)

|

定量單位

|

收入(百萬美元)

|

涵蓋的領域

|

類型(電子健康和遠距醫療)、交付模式(基於雲端和本地)、應用(遠距諮詢、慢性病管理、遠端監控、家庭保健、遠距治療和心理健康服務、藥物管理、遠距藥房服務、醫學教育和培訓等)、最終用戶(醫療保健提供者、醫療保健消費者(患者)、老年護理機構、門診手術中心(ASC)、診斷中心等)

|

覆蓋國家

|

德國、瑞典、芬蘭和英國

|

涵蓋的市場參與者

|

Kry International AB(瑞典)、Ada Health GmbH(德國)、Telemedicine Clinic(西班牙)、TeleClinic GmbH(德國)、Avi Medical GmbH(德國)、ORTIVUS AB(瑞典)、Doktorse Nordic AB(瑞典)、everon(英國)、MedKitDoc(瑞典)、Niamed(德國)、德國)、 LABS GMBH(德國)和 arztkonsultation ak GmbH(德國)等

|

報告涵蓋的數據點

|

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge 市場研究策劃的市場報告還包括深度專家分析、病患流行病學、通路分析、定價分析和監管框架

|

細分分析:

德國、瑞典、芬蘭和英國的遠距醫療和電子健康市場根據類型、交付模式、應用和最終用戶分為四個顯著的部分。

- 根據類型,市場細分為電子醫療和遠距醫療

2024 年,電子健康領域預計將主導德國、瑞典、芬蘭和英國的遠距醫療和電子健康市場

到 2024 年,由於監管變化、技術進步和醫療保健提供模式的轉變,電子健康領域預計將佔據最高的市場份額,達到 75.67%。

- 根據交付模式,市場分為基於雲端的和內部部署的。預計到 2024 年,雲端運算領域將佔據主導地位,市場佔有率將達到 82.59%

- 根據應用,市場細分為遠端諮詢、慢性病管理、遠端監控、家庭保健、遠距治療和心理健康服務、藥物管理、遠距藥局服務、醫學教育和培訓等。預計到 2024 年,遠距諮詢領域將佔據主導地位,市場佔有率將達到 36.27%

- 根據最終用戶,市場細分為醫療保健提供者、醫療保健消費者(患者)、老年護理機構、門診手術中心(ASC)、診斷中心等

2024 年,醫療保健提供者部門預計將主導德國、瑞典、芬蘭和英國的遠距醫療和電子健康市場

到 2024 年,隨著人們對遠距醫療和電子健康益處的認識不斷提高,醫療保健提供者部門預計將佔據市場主導地位,市場份額達到 32.32%。

主要參與者

Data Bridge Market Research 分析了 Kry International AB(瑞典)、Ada Health GmbH(德國)、Telemedicine Clinic(西班牙)、TeleClinic GmbH(德國)、Avi Medical GmbH(德國)是該市場的主要市場參與者。

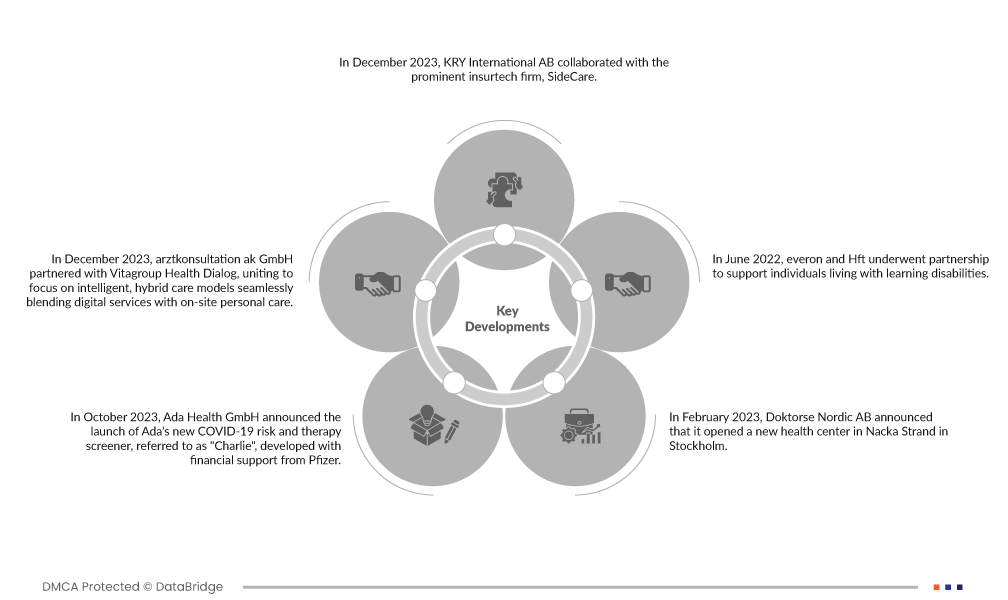

市場發展

- 2023 年 12 月,KRY International AB 與法國著名的保險科技公司 SideCare 合作。這項新的合作關係涉及整合其遠距會診服務,以增強獲得初級保健、專科服務和心理服務的機會。它增強並擴大了他們的市場影響力

- 2023 年 12 月,arztkonsultation ak GmbH 與 Vitagroup Health Dialog 合作,共同專注於智慧混合護理模式,將數位服務與現場個人護理無縫融合。總體目標是為法定和私人健康保險公司提供便捷的數位化途徑,以獲得最佳護理。這將增強和擴大他們的市場影響力

- 2023年10月,Ada Health GmbH宣布推出Ada的新型COVID-19風險和治療篩檢儀,簡稱“Charlie”,該儀器由輝瑞公司提供資金支持開發。 Charlie 這個名字是德語縮寫(COVID-19 Hilfe von Ada zu Risiko sowie leitlinien-basierten, individuellen Eingriffsmöglichkeitenthat),代表 Ada 針對風險和基於指南的個人幹預方案提供的 COVID-19 幫助。這款免費的線上自我評估工具旨在幫助個人根據官方醫療指南確定自己是否面臨發展為嚴重 COVID-19 疾病的風險

- 2023 年 2 月,Doktorse Nordic AB 宣佈在斯德哥爾摩的 Nacka Strand 開設一家新的健康中心。透過新機構的成立,該公司加強了為斯德哥爾摩患者提供更便利、更優質醫療服務的能力。 2022 年 11 月,Bio-Rad Laboratories, Inc 與 NuProbe 簽訂了數位 PCR 應用的獨家授權協議。這將有助於組織創造更多收入

- 2022 年 6 月,everon 和 Hft 建立合作夥伴關係,為患有學習障礙的個人提供支持。 Everon 靈活的數位解決方案正在支持 Hft,這是一個為學習障礙人士提供服務的全國性慈善機構。這有助於該公司加強其遠距醫療平台

區域分析

從地理位置來看,報告涉及的國家包括德國、瑞典、芬蘭和英國。

有關德國、瑞典、芬蘭和英國遠距醫療和電子健康市場的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/germany-sweden-finland-and-great-britain-telemedicine-and-e-health-market