Overview

The aftermarket services sector has a significant opportunity for differentiation and the creation of new revenue streams, which is something that manufacturing organizations are constantly working on. End-to-end visibility throughout the aftermarket value chain is necessary to provide effective installation, repair, maintenance, and support services to its customers. Thus, the rapid advancement of data and connection is ushering in a new era for aftermarket services, with prospects for upselling and increased efficiency. Aftermarket services segment encompasses all services associated with a product following its sale to a customer. These services range from operations such as training and communication, maintenance and repairs, including regular inspections and spare parts management to end-of-life management such as upgrading or dismantling. The technologies included in the upcoming generation of tools and procedures allow for the unprecedented capture and transfer of data, which may be used to enhance aftermarket operations. New potential to optimize traditional aftermarket operations with faster, more affordable, and higher-quality aftermarket services, such as better spare parts management and optimized maintenance planning, are made possible by the analysis and ongoing monitoring of acquired data.

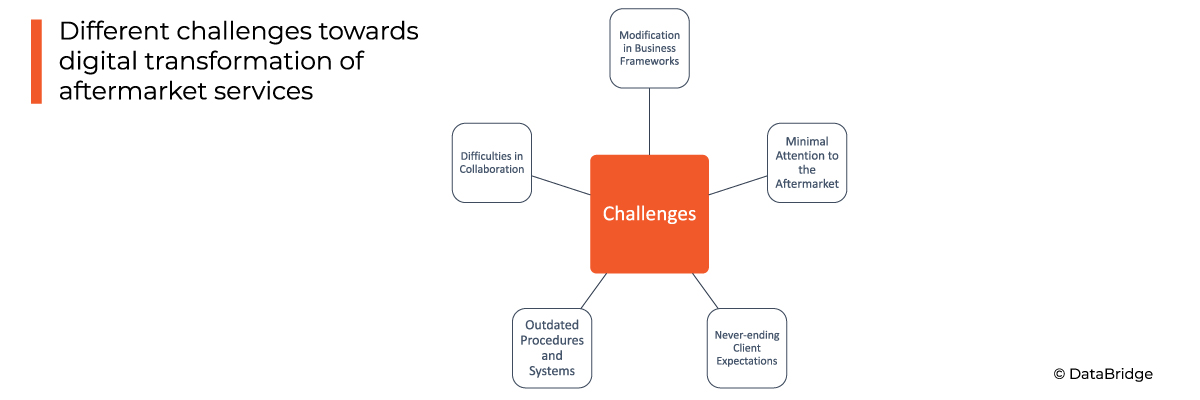

Challenges faced by Original Equipment Manufacturers (OEMs) towards Digital Transformation of Aftermarket Services

Figure 1: Different Challenges towards Digital Transformation of Aftermarket Services

- Modification in Business Frameworks: Many OEMs have had to re-evaluate their plans as a result of the disruption to established business models caused by the wave of digital transformation. However shifting from a product-centric to a service-oriented paradigm necessitates major organizational restructuring and mentality adjustments. OEMs may experience difficulty with internal resistance to change and the requirement for new skill sets in order to properly traverse the digital landscape

- Minimal Attention to the Aftermarket: OEMs have often concentrated on their primary activity, which is producing and marketing new products. When using this strategy, aftermarket services frequently receive less funding and resources. Because of this, OEMs might not have the infrastructure, knowledge, or experience needed to satisfy the increasing needs of the aftermarket's digital transformation

- Never-ending Client Expectations: Customers in the digital age need easy access to information, fast reaction times, and personalized experiences. Regrettably, a lot of OEMs continue to struggle with antiquated customer support procedures and communication methods. OEMs can improve customer satisfaction by focusing on maintenance, repairs, and spare parts through the aftermarket. On the other hand, inadequate digital skills frequently lead to slower reaction times and less insight into the client journey

- Outdated Procedures and Systems: Manufacturers may have intricate legacy procedures and systems that are difficult to convert to digital transformation. Stockpiled data systems and outdated technology infrastructure make it difficult to smoothly adopt new digital solutions. The inability to harness automation, real-time customer information, and advanced analytics is a hindrance to aftermarket operations

- Difficulties in Collaboration: The aftermarket's digital transformation calls for cooperation from a number of parties, including OEMs, dealers, suppliers, and service providers. A major problem in establishing data exchange and communication channels is that different parties may utilize different systems and have varied levels of digital readiness. The advancement of digital transformation might be hampered by a lack of standardization and interoperability, which can also make it difficult to embrace novel solutions

The Rise of Digital Services

Digitalization has emerged as a key factor in the aftermarket's recent growth. With greater efficiency and convenience than ever before, digital services are revolutionizing how consumers engage with the aftermarket sector. The owners may now readily access a wide range of services, from ordering spare parts to booking maintenance appointments, owing to online platforms and applications.

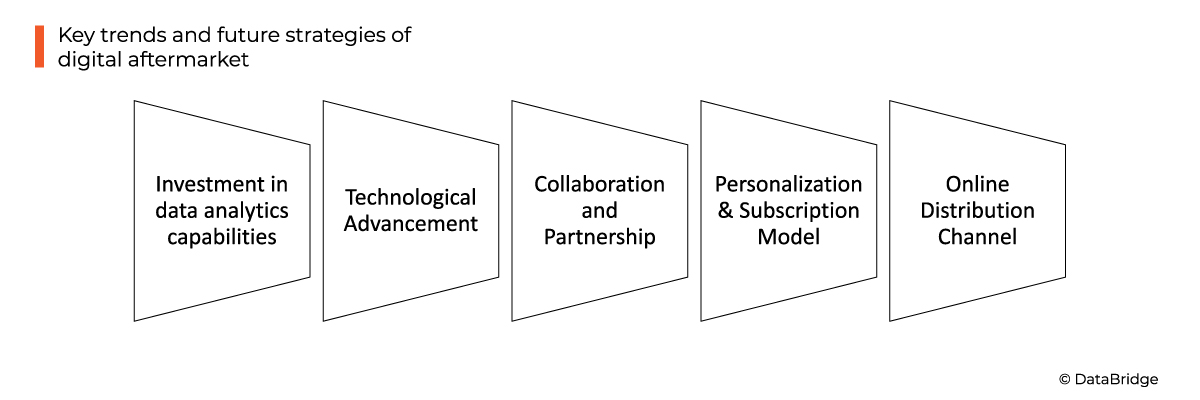

Figure 2: Key Trends and Future Strategies of Digital Aftermarket

Source: DBMR Analysis

- Parts Distribution via E-commerce: The distribution of components has been completely transformed by the rise of e-commerce. The procurement of spare parts has been made easier by online marketplaces and platforms, which is advantageous for both companies and customers. Customers may access a large selection of genuine and aftermarket components, evaluate reviews, and compare costs with only a few clicks to make well-informed purchasing decisions

Predictive analytics and sophisticated inventory management systems have also expedited the supply chain, guaranteeing that the correct parts are on hand when needed. This has minimized downtime, cut down on lead times for parts procurement, and improved customer satisfaction overall

The notion of same-day delivery and effective logistics services has increased customer convenience even further. Customers can now get the necessary parts sent right to their home with just a click of a button, saving them the trouble of physically visiting several locations to find the exact parts.

- Increasing Subscription Model: The aftermarket seamlessly fits into the expanding trend of subscription-based services in this era. The industry recognizes the inherent advantages and values the affordability and practicality of subscription arrangements. This creative method provides clients with a simple and hassle-free experience by providing routine maintenance, required repairs, and even potential upgrades—all for a set monthly fee

In addition to giving customers financial stability, this subscription model fosters enduring relationships between service providers and clients. The adoption of subscription-based services not only accommodates contemporary customer preferences but also lays the groundwork for long-lasting and mutually profitable collaborations within the aftermarket, reflecting a strategic change in the industry

- Collaborating to Achieve Superior Outcomes: Establishing strategic alliances with manufacturers, suppliers, and other service providers is crucial for the industry to foster an ecosystem that is seamless and interconnected. Businesses that cooperate effectively leverage each other's advantages, providing discriminating customers with a wider selection of services. This collaborative mentality not only encourages innovation but also acts as a preventative precaution, guaranteeing that the sector stays at the forefront of satisfying the constantly changing needs of consumers. This collective strategy not only propels each firm forward in the fast-paced automotive aftermarket services scene but it also highlights the industry's dedication to staying adaptable and sensitive to the demands of the contemporary automotive landscape

- Enhanced Interaction with Customers via Customization: In the aftermarket, personalization has grown in importance. Businesses are now able to offer customized services and recommendations that cater to the unique requirements of each consumer due to the use of sophisticated data analytics and CRMs. Businesses are able to foresee client needs and make proactive offers of pertinent products and services by utilizing customer databases and purchase histories. Long-term customer relationships are fostered via personalized marketing initiatives, loyalty programs, and targeted discounts, in addition to improving consumer interaction

Additionally, businesses have been able to learn a great deal about the preferences and problems of their customers owing to the incorporation of online reviews and consumer feedback tools. Businesses may modify their tactics, enhance their products, and give a smooth customer experience by actively listening to consumer feedback

The global automotive aftermarket market witnessed significant growth in recent years due to several factors such as increasing investment and strategic initiatives by different companies, rising automotive sales, growing technological advancement, emergence of online portal & e-commerce sites for proper distribution and lots more.

According to Data Bridge Market Research analysis, the market for global automotive aftermarket market is projected to grow at a compound annual growth rate (CAGR) of 4.75% from 2022- 2029.

To learn more about the study, visit: https://www.databridgemarketresearch.com/reports/global-automotive-aftermarket-market

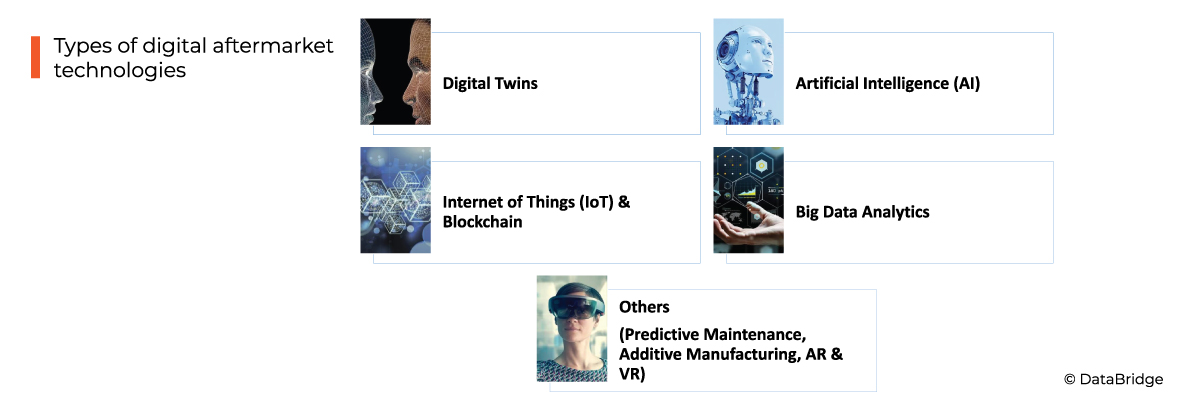

Digital Aftermarket Technologies

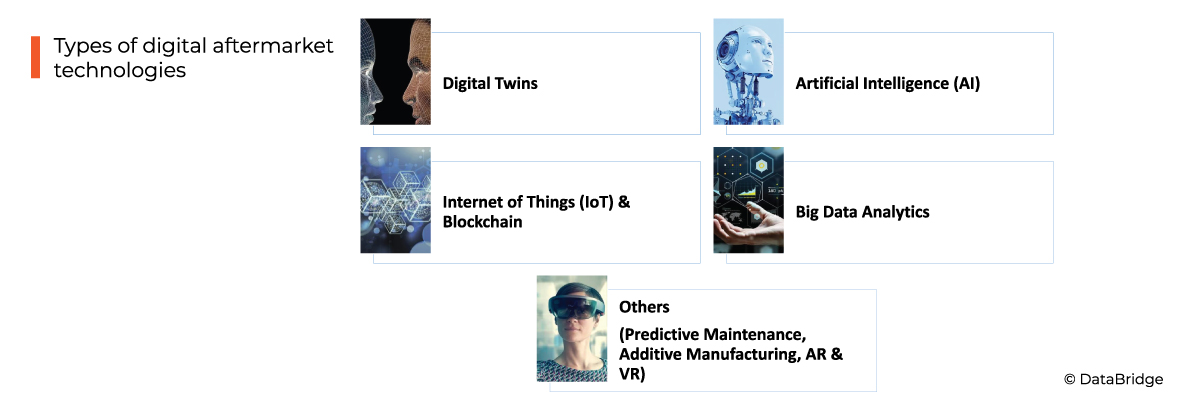

Figure 3: Types of Digital Aftermarket Technologies

Source: DBMR Analysis

Digital Twins: Although digital twin technology has been in the public eye for several decades, significant investments have been made in it more recently. The usage of digital twin technologies to aid with pandemic recovery has increased dramatically in only the last two years. The digital twin has the potential to become a more widely used solution for the management of spare parts. Aftermarket players are able to track component wear and accurately determine when to buy a replacement by using a digital twin system. The virtual counterpart of machinery can capture its physical sibling's service history. As a result, businesses may operate more strategically and effectively owing to detailed knowledge regarding the spare parts type, and its installation.

The digital twin can alert industry participants in real time if a spare part begins to deteriorate. When a necessary part is out of stock, the same thing takes place. Advanced platforms offer rapid access to spare parts lists in addition to real-time warnings. This even results in direct ordering of spare parts. By using a digital twin to monitor machinery in real-time, one can gain insight into the behavior and overall health of the system. The digital twin continuously gathers real-time data from sensors; this data is analyzed for early wear and problem detection by cross-referencing it with past data.

Some businesses see digital twins as being essential for expediting the ordering and identification of parts. Many industry participants are pushing for investments in virtual reality technology to improve the efficacy of teaching new employees in the process of choosing replacement parts for work orders. But predicting the need for spare parts also depends heavily on this technology.

Mentioned below are a few of the examples wherein companies are utilizing digital twin:

- In January 2024, Valeo collaborated with APPLIED INTUITION, INC., a provider of automotive software to introduce a digital twin platform for advanced driver-assistance systems (ADAS) sensor simulation. The digital twin platform will incorporate more Valeo sensors for software-in-the-loop (SIL) and hardware-in-the-loop (HIL) testing after initially concentrating on emulating the company's SCALA 3 LiDAR. Thiscollaboration will accelerate the delivery of autonomous driving features to end users with enhanced safety

- In December 2023, Continental AG collaborated with Synopsys, Inc. to expedite the development and validation of software features and applications for the Software-Defined Vehicle (SDV). Through this, Synopsys industry-leading virtual prototype solutions for virtual Electronic Control Units (vECU) are integrated with Continental's cloud-based development platform, Automotive Edge (CAEdge). As a result, automakers can now develop software more swiftly and accelerate their time to market due to to digital twin capabilities

The digital twin market has witnessed substantial growth due to the upsurge in the demand for efficient product testing and development. Adding to this, increasing focus on cost minimization and efficient performance monitoring also tends to drive the market. According to Data Bridge Market Research analysis, the market for global digital twin market is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2022- 2029.

To learn more about the study, visit: https://www.databridgemarketresearch.com/reports/global-digital-twin-market

Artificial Intelligence (AI): Although AI has many uses and can be quite important, especially for the auto aftermarket. It gives customers the ability to make sure that their operations function smoothly and that the solutions they've installed are scalable and increase productivity. Increasing productivity, maintaining efficiency, and simplifying information retrieval are all made possible by integrating AI into aftermarket software solutions. Enhancing customer service, decreasing errors, making better decisions, and managing inventories more efficiently are just a few benefits we can concentrate on as AI develops.

AI's function in data transformation needs accuracy and quickness. It makes sure that even from a large database, a single search query can produce extremely relevant results. The margin of error can be greatly decreased with AI-enabled indexing and search, increasing the assurance that you are working with up-to-date and accurate data. It improves decision-making and reduces the possibility of mistakes that could result in expensive situations such as downtime.

An AI's Natural Language Processing skills let users easily retrieve information. Consumers can now ask more conversational, human-sounding questions as opposed to using strict search terms or keyword lists. Clients can find information effortlessly and intuitively due to NLP's intelligence and understanding of context and subtleties. It also implies that employing AI-powered solutions improves worker skill levels and streamlines operations.

Below are a few of the initiatives taken by different associations and companies in relation to AI in aftermarket:

- In February 2024, Bosch and Microsoft collaborated to improve automated driving functions' performance. It is anticipated that generative AI will be essential to improving comfort and security in automobiles. The endeavor will benefit greatly from Bosch's access to car sensor data, automotive-specific AI capabilities, and vehicle knowledge

- In January 2024, Impel entered the automotive aftermarket market as a firm that specializes in AI-powered customer lifecycle management for the automobile industry. The company’s entry into the aftermarket has paved its way towards establishing operations in the U.K. and Australia and even into the specialty car market. Impel's generative conversational AI platform is designed to automate customer outreach and engagement for such independent repair shops where there are limited staff and resources

- In November 2023, Kinetic inaugurated its Las Vegas service center to provide digital maintenance and servicing for EVs, AVs, and cars with Advanced Driver Assistance Systems (ADAS). The facility provides AI and robotics-enabled digital services for EVs, AVs, and ADAS vehicles from any manufacturer. Certified technicians from Kinetic man it. The service strategy used by Kinetic is a collaborative approach involving rental companies, automobile dealerships, conventional auto repair shops, and industry partners. Through this, it offers a competitive advantage to dealers which will navigate a complex aftermarket and an increasing demand for digital maintenance and servicing

- In September 2023, MEMA Aftermarket Suppliers, part of MEMA, The Vehicle Suppliers Association, held a conference on AI technological breakthrough in aftermarket at the Genuine Parts Company (GPC) headquartered in Atlanta. To promote innovation and collaboration, the 2023 Aftermarket Technology Conference will bring together important participants from all facets of the aftermarket ecosystem, such as distributors, retailers, suppliers, and technology providers

The global artificial intelligence market is witnessed a substantial growth in recent years owing to the growing demand for enhanced driver convenience and increasing adoption of AI in the value chain and others. Artificial intelligence integration is becoming vital for manufacturing automotive in the future. This has led to the adoption of sustainable technologies by different companies in order to remain competitive. According to Data Bridge Market Research analysis, the market for global artificial intelligence market is projected to grow at a compound annual growth rate (CAGR) of 26.1% from 2021-2028.

To learn more about the study, visit: https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-market

Big Data Analytics: In the current dynamic corporate environment, data analytics has become an essential instrument for promoting expansion and streamlining processes in a range of sectors. The aftermarket sector is no different, with businesses aiming to improve their client experiences and competitive advantage. Data collection, analysis, and interpretation skills can yield insightful information about consumer behavior, industry trends, and operational effectiveness, empowering aftermarket companies to take strategic initiatives and make well-informed decisions.

- Improvement towards Inventory Control: In the aftermarket sector, where products must be easily accessible to satisfy consumer demands, efficient inventory control is essential. Using data analytics to examine past sales, market trends, and seasonality patterns, inventory levels can be optimally managed. Businesses may minimize stockouts, cut down on surplus inventory, and boost overall operational efficiency by precisely estimating demand. To guarantee they have the proper inventory on hand at the right time, an electronics merchant, for example, can utilize data analytics to determine the ideal stocking levels for various product categories

- Simplifying Supply Chain Management: A complicated network of suppliers and distributors is vital to the aftermarket sector. Data analytics, which offer real-time visibility into inventory levels, demand trends, and supplier performance, can facilitate the optimization of supply chain management. Businesses may cut lead times, minimize stockouts, and increase overall operational efficiency by streamlining their supply chain operations

- Enhanced Customer Understanding: By examining consumer preferences, buying trends, and feedback, data analytics helps aftermarket companies get a comprehensive understanding of their clientele. By using this data, businesses may better target their offers to the demands of certain clients, which boosts client happiness and loyalty

- Predictive Maintenance and Service: Data analytics has the potential to completely change how aftermarket companies handle maintenance and service procedures. Businesses may anticipate maintenance requirements, proactively identify equipment faults, and plan repairs before breakdowns occur by evaluating real-time data from linked devices and sensors. Customers will have less downtime as a result, and businesses will be able to better manage their resources and service schedules

For Instance,

- In September 2022, Infopro Digital Automotive was presented as a single brand and company at Automechanika 2022 with the launch of a new worldwide website, which unifies the portfolio and improves the linked software and solutions. This incorporates Catalogues and B2B platforms, Business Intelligence and Digital Marketing, Automotive Technical Data and Repair & Maintenance Information and ERPs and Dealer Management Systems

- In November 2019, MAM Software launched a data platform which will allow the examination of fitting and component lookup trends. The solution, which is a component of MAM's catalogue data package, gives users of Autocat catalogue and Autowork Online garage management software anonymous access to data that has been collected from thousands of users. Key performance indicators from the automotive aftermarket are highlighted in a free monthly e-bulletin called "Insights," which is being offered by MAM as part of its service launch. Furthermore, users of a data feed service will have the ability to modify and examine data using external tools

Internet of things (IoT) and Blockchain: The use of IoT in the aftermarket sector is among the most notable developments of recent years. The term Internet of Things (IoT) describes how things and gadgets are connected to the internet so they can trade and gather data. This technology facilitates communication between automobiles and their parts as well as between external systems and the aftermarket industry.

For example, a connected car can communicate to its owner and service providers in real time information on its performance, maintenance requirements, and possible problems. This makes car ownership more enjoyable overall and makes preventive maintenance and more effective servicing possible.

Blockchain technology will be used more and more as the industrial sector develops, particularly in terms of automation and digitization. The aftermarket business is projected to adopt blockchain technology due to key developments including parts authenticity, asset monitoring, modern logistics systems, and the proliferation of financial technology (fintech) influencing the overall industry. The business activities of all major aftermarket stakeholders, including suppliers, distributors, buying groups, retailers, and eventually consumers, will be drastically streamlined and expedited by blockchain technology. For example, blockchain solutions that enable efficiency, security, and time and cost reductions across multiple areas including as leasing, insurance, service and maintenance, refuelling, parking, freight brokering, and safety are projected to have a significant positive impact on shared mobility and fleets. Fleets that use blockchain technology to purchase vehicles have a single platform where all pertinent parties can interact and exchange real-time information.

Given below are a few of the instances in relation with the adoption of IoT and blockchain technology in aftermarket:

- In October 2023, Autentica Car Parts developed an online marketplace for additively manufactured auto parts through blockchain technology. OEMs, which include auto designers and manufacturers, can sell licenced dealers, distributors, and repair facilities spare component designs through this platform. The platform, created in collaboration with Oracle, a cloud computing corporation, and the University of Sheffield Advanced Manufacturing Research Centre (AMRC), provides quick access to replacement auto components, which is an improvement over the twenty-eight-day industry standard. Additionally, this technology lowers transportation's carbon footprint by 40% and non-production costs (such as storage) by 70%

- In March 2023, CAVU Aerospace integrated into the Aviation Blockchain Network of Block Aero. Block Aero will use information from CAVU SmartTags to facilitate the deployment of the ATA Spec 2000 Part Certificate Form and combine CAVU's current digital services with the MRO Manager. Block Aero enables CAVU to enter assets on the blockchain at the time of the aircraft's evacuation, contributing to a rebirth record. A digital trail associated with the part will, therefore, be permanent if these items are kept on the blockchain

Conclusion

In conclusion, the use of digital services and cutting-edge parts distribution strategies is causing a huge transformation in the automobile aftermarket. In the future, convenience, efficiency, and customer happiness will be key factors in the sector as a result of the integration of new technologies, improved consumer involvement, and optimized supply chain operations. In the quickly changing market, businesses must embrace these changes and overcome related obstacles to remain competitive and provide excellent value to their customers. Management should start the worldwide initiative to digitize the aftermarket services with the goal of combining new value-generation targets with optimization in order to take advantage of these prospects. The emergence of subscription models and cooperative collaborations reinforced its flexibility even more. Aftermarket services, which are pioneers in innovation in satisfying customer demands, are not only adapting to change but also actively creating a future characterized by sustainability, creativity, and collaborative excellence.