Global Covid 19 Saliva Screening Test Potential Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.13 Billion

USD

5.47 Billion

2024

2032

USD

3.13 Billion

USD

5.47 Billion

2024

2032

| 2025 –2032 | |

| USD 3.13 Billion | |

| USD 5.47 Billion | |

|

|

|

|

Global COVID-19 Saliva Screening Test Potential Market Segmentation, By Location (Travel Stations, Sports Arenas, Entertainment Venues, Corporate Campus Environments, Universities and Colleges, Factories, and Others), Technology (Fluorescence-Labeled Antigen/Antibodies Testing, RT-PCR, and CRISPR-Cas9), Mode (Centralized Testing and Decentralized Testing) – Industry Trends and Forecast to 2032

COVID-19 Saliva Screening Test Potential Market Analysis

The COVID-19 saliva screening test potential market has emerged as a crucial segment in diagnostic testing, driven by advancements in technology and the growing demand for non-invasive, accurate, and rapid diagnostic solutions. Saliva-based testing has gained significant attention due to its ease of collection, reduced reliance on healthcare professionals, and minimal discomfort for patients compared to nasopharyngeal swabs. These features make it an ideal solution for mass testing programs in schools, workplaces, and public venues. Technological innovations, such as CRISPR-based diagnostics and fluorescence-labeled antigen/antibody testing, have further enhanced the accuracy and efficiency of saliva tests. For instance, the U.S.-based firm Fluidigm Corporation developed a saliva RT-PCR assay that offers high sensitivity and rapid results. In addition, collaborations between government agencies and companies, such as BARDA's partnership with Aptitude Medical Systems in 2023, underscore the commitment to expanding access to these diagnostic tools. North America currently leads the market due to its advanced healthcare infrastructure and high adoption of innovative diagnostics. Meanwhile, Europe is poised for rapid growth, fueled by increasing awareness and government support. As testing remains integral to pandemic control, the COVID-19 saliva screening test market is expected to witness sustained growth and innovation.

COVID-19 Saliva Screening Test Potential Market Size

The global COVID-19 saliva screening test potential market size was valued at USD 3.13 billion in 2024 and is projected to reach USD 5.47 billion by 2032, with a CAGR of 7.23% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

COVID-19 Saliva Screening Test Potential Market Trends

“Growing Adoption of Point-of-Care (POC) Testing Solutions”

A significant trend in the COVID-19 saliva screening test potential market is the growing adoption of point-of-care (POC) testing solutions, driven by the need for rapid and accurate diagnostics in decentralized settings. Saliva-based POC tests have become increasingly popular for their convenience, enabling quicker turnaround times compared to traditional lab-based methods. For instance, LumiraDx has developed portable testing platforms that use saliva samples for COVID-19 detection, providing results in under 30 minutes. This innovation is particularly beneficial in high-traffic locations such as airports, schools, and sports arenas, where mass testing is critical to curbing virus transmission. In addition, advancements in CRISPR-based diagnostics have enhanced the accuracy of these POC systems, making them reliable alternatives to RT-PCR. As healthcare systems worldwide emphasize accessibility and efficiency, the integration of saliva-based POC tests into routine COVID-19 screening represents a transformative shift, propelling market growth and setting the stage for widespread adoption.

Report Scope and COVID-19 Saliva Screening Test Potential Market Segmentation

|

Attributes |

COVID-19 Saliva Screening Test Potential Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ARUP Laboratories (U.S.), MOgene (U.S.), Psomagen (U.S.), DxTerity Diagnostics, Inc. (U.S.), Ambry Genetics (U.S.), Standard BioTools (U.S.), Gravity Diagnostics (U.S.), DNA Genotek, Inc. (Canada), QuidelOrtho Corporation (U.S.), Abbott (U.S.), LumiraDX (U.K.), and Fluorotech Group (Canada) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

COVID-19 Saliva Screening Test Potential Market Definition

COVID-19 saliva screening test refers to a diagnostic method that utilizes saliva samples to detect the presence of SARS-CoV-2, the virus responsible for COVID-19. This non-invasive testing approach offers a convenient and patient-friendly alternative to traditional nasopharyngeal swabs, enabling rapid and accurate detection. Saliva-based tests are particularly valuable for large-scale testing in various settings such as schools, workplaces, and public events, as they require minimal medical supervision and reduce the risk of virus transmission during sample collection.

COVID-19 Saliva Screening Test Potential Market Dynamics

Drivers

- Rising Demand for Ease of Sample Collection

Ease of sample collection is a significant driver for the COVID-19 saliva screening test market, as saliva-based testing is less invasive than traditional nasal or throat swabs, making it a more comfortable and acceptable option for patients. According to a study published in the Journal of Clinical Microbiology, saliva samples for COVID-19 testing have shown similar or even superior accuracy compared to nasal swabs, further validating their effectiveness. This non-invasive method is particularly advantageous in mass testing scenarios, such as in schools, airports, and large events, where minimizing discomfort is crucial for encouraging widespread participation. In addition, it eliminates the need for trained healthcare professionals to collect samples, reducing healthcare system burden and making testing more accessible in community settings. As a result, the simplicity and patient-friendly nature of saliva-based testing contribute to its growing adoption and are key factors driving the market's expansion.

- Increasing Demand for Non-Invasive Diagnostics

The high demand for non-invasive diagnostics has significantly contributed to the rise in saliva-based COVID-19 testing, as it offers a less uncomfortable and simpler alternative to traditional swab tests. A study published in JAMA Network Open found that saliva tests for COVID-19 are comfortable and yield comparable accuracy to nasal swabs, making them ideal for widespread use in public settings. This is particularly important in environments such as schools, airports, and large public events, where quick and easy testing is essential for maintaining safety without creating barriers to participation. The ability to perform self-collection further enhances the appeal of saliva tests, reducing reliance on healthcare workers and streamlining the testing process. With the global push for faster, more accessible diagnostic tools, the growing preference for non-invasive methods is widening opportunities in the market, as it aligns with the increasing demand for efficient, scalable testing solutions in high-traffic areas.

Opportunities

- Increasing Technological Advancements of Saliva-Based COVID-19 Tests

Technological advancements have played a pivotal role in enhancing the accuracy and sensitivity of saliva-based COVID-19 tests, making them increasingly viable for widespread use. Innovations such as CRISPR-based diagnostics and fluorescence-labeled antigen tests have significantly improved the detection capabilities of saliva tests, allowing for quicker, more accurate results with fewer false negatives. For instance, CRISPR technology, which has been utilized in tests such as the Sherlock Biosciences' COVID-19 diagnostic platform, enables highly sensitive detection of the SARS-CoV-2 virus in saliva samples. In addition, the development of fluorescence-labeled antigen tests, such as those used by QuidelOrtho, has increased the speed and reliability of saliva testing, even in decentralized settings. These advancements open up new opportunities for the adoption of saliva tests in various healthcare settings, including hospitals, clinics, and public health initiatives. As these technologies continue to evolve, they provide a promising market opportunity, enhancing the role of saliva tests in the ongoing fight against COVID-19 and similar infectious diseases.

- Increasing Government Support and Investment

Government support and investment have significantly boosted the adoption of saliva-based COVID-19 tests, with many governments and health organizations actively promoting their use to expand testing capacity and streamline pandemic management. For instance, the Biomedical Advanced Research and Development Authority (BARDA) has collaborated with Aptitude Medical Systems to develop and accelerate the distribution of saliva-based diagnostic tests, making them more accessible for mass testing initiatives. These public-private partnerships have led to increased funding and resources, which have helped scale up the production and distribution of saliva testing kits, especially in regions with high infection rates. Governments worldwide, recognizing the importance of efficient and accessible testing solutions, have incentivized the development of rapid, non-invasive diagnostic tools, providing a significant market opportunity for manufacturers. As the demand for quick, reliable, and widespread testing continues, this support from governmental and health bodies further fuels the growth of the saliva testing market, paving the way for enhanced pandemic response strategies and future healthcare innovations.

Restraints/Challenges

- Lengthy and Complex Regulatory Approval

Gaining regulatory approval for new diagnostic tests, including saliva-based COVID-19 tests, is a significant challenge due to the lengthy and complex process involved. Regulatory bodies across different regions, such as the U.S. Food and Drug Administration (FDA), have stringent requirements for test validation, which can delay the introduction of new technologies to the market. For instance, the FDA’s Emergency Use Authorization (EUA) for diagnostic tests requires comprehensive clinical trial data to demonstrate accuracy, sensitivity, and specificity, which can take months or even years to obtain. This regulatory delay can slow down the widespread adoption of saliva-based tests, despite their potential for easier, non-invasive screening. Moreover, varying regulatory standards across regions can create inconsistencies in approval timelines, leading to unequal access to testing in different parts of the world. A lack of standardized testing protocols can also result in variability in the results, reducing the overall effectiveness and reliability of saliva-based tests when implemented in large-scale, cross-regional screening programs. These regulatory and standardization issues limit the scalability of saliva tests and pose a significant market challenge in global efforts to combat the COVID-19 pandemic.

- Accuracy and Reliability Issues

One of the major challenges facing saliva-based COVID-19 tests is ensuring their accuracy and reliability, particularly in detecting low viral loads or asymptomatic cases. While saliva tests are more convenient and less invasive than nasal swabs, their sensitivity and specificity have been called into question, especially in scenarios where viral levels are low. If a test produces inaccurate results either by failing to detect the virus when it is present (false negative) or identifying it incorrectly when it isn’t (false positive) it can have serious consequences. False negatives may allow infected individuals to unknowingly spread the virus, while false positives can lead to unnecessary quarantines and disruptions. Ensuring high accuracy across a wide range of viral loads is crucial for the successful deployment of saliva tests in large-scale, population-wide screening programs, such as those required in schools, workplaces, and airports. This challenge of maintaining accuracy, especially when compared to more established testing methods such as PCR swabs, represents a significant market hurdle in the widespread adoption of saliva-based diagnostic solutions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Saliva Screening Test Potential Market Scope

The market is segmented on the basis of location, technology, and mode. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Location

- Travel Stations

- Sports Arenas

- Entertainment Venues

- Corporate Campus Environments

- Universities and Colleges

- Factories

- Others

Technology

- Fluorescence-Labeled Antigen/Antibodies Testing

- RT-PCR

- CRISPR-Cas9

Mode

- Centralized Testing

- Decentralized Testing

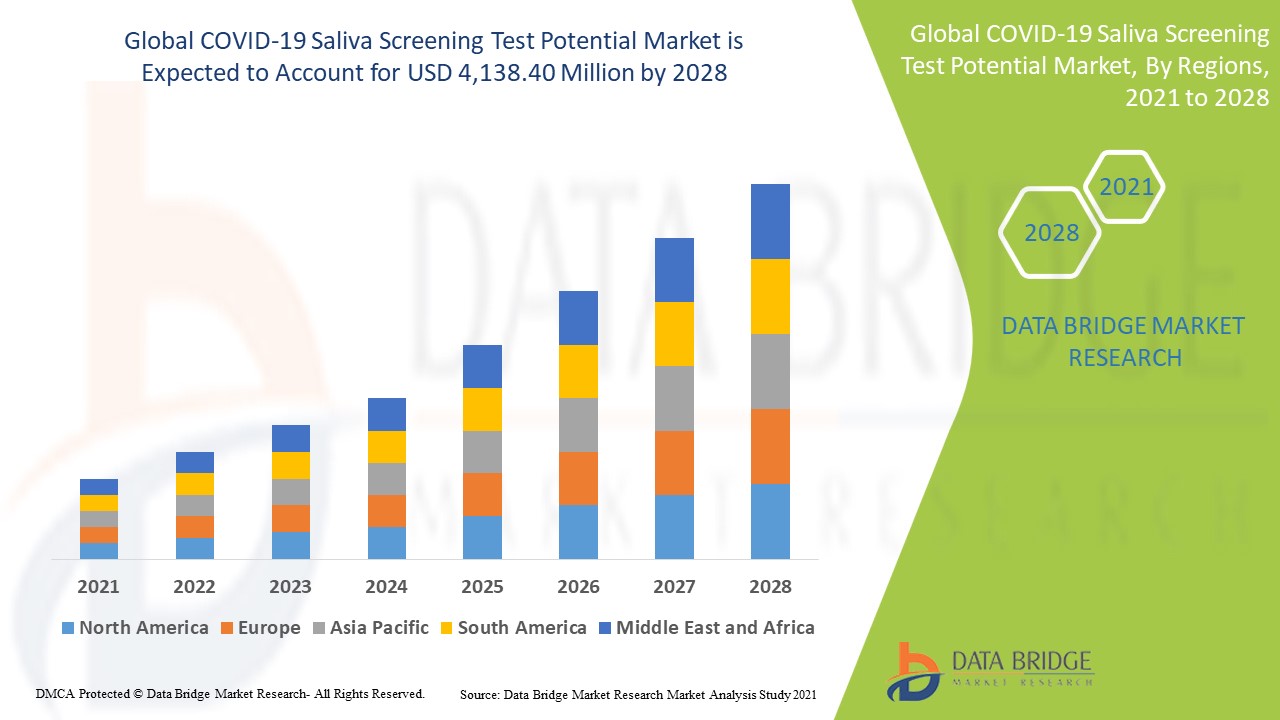

COVID-19 Saliva Screening Test Potential Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, location, technology, and mode as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads in both market share and revenue of the COVID-19 saliva screening test potential market leads in both market share and revenue, with expectations to maintain this dominance throughout the forecast period. This prominence is attributed to the region's strong presence of major industry players, significant healthcare expenditure, and widespread adoption of advanced technological devices in hospitals and diagnostic centers. The region's well-established healthcare infrastructure and robust research and development activities further support the market's growth. In addition, North America’s proactive approach to adopting innovative diagnostic solutions contributes to its leadership in this market segment.

Europe is expected to showcase the highest growth rate during the forecast period of the COVID-19 saliva screening test, driven by several key factors. The increasing awareness of the benefits of saliva-based testing, coupled with a shift toward more health-conscious lifestyles, is boosting demand for these advanced diagnostic solutions. In addition, the region's growing population and the corresponding rise in healthcare needs are creating a favorable environment for market expansion. Europe’s strong focus on public health initiatives and investments in innovative diagnostic technologies further support this anticipated growth trajectory.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

COVID-19 Saliva Screening Test Potential Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

COVID-19 Saliva Screening Test Potential Market Leaders Operating in the Market Are:

- ARUP Laboratories (U.S.)

- MOgene (U.S.)

- Psomagen (U.S.)

- DxTerity Diagnostics, Inc. (U.S.)

- Ambry Genetics (U.S.)

- Standard BioTools (U.S.)

- Gravity Diagnostics (U.S.)

- DNA Genotek, Inc. (Canada)

- QuidelOrtho Corporation (U.S.)

- Abbott (U.S.)

- LumiraDX (U.K.)

- Fluorotech Group (Canada)

Latest Developments in COVID-19 Saliva Screening Test Potential Market

- In April 2023, the Biomedical Advanced Research and Development Authority (BARDA) partnered with Aptitude Medical Systems, Inc. to accelerate the development of molecular diagnostic tests for COVID-19. These Metrix tests use saliva samples as clinical specimens, enhancing accessibility to high-quality diagnostics

- In April 2021, Quidel Corporation entered a distribution agreement with McKesson Corporation to expand the availability of at-home COVID-19 testing services, boosting the market potential for saliva-based screening tests

- In February 2021, George Mason University in Fairfax began COVID-19 testing using Fluidigm Corporation’s Advanta Dx SARS-CoV-2 RT-PCR Assay on the Fluidigm Biomark HD system

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.