Растущее использование предоплаченных и подарочных карт играет ключевую роль в стимулировании роста рынка в различных регионах, включая США, Великобританию, ОАЭ, Мексику, Индию и Филиппины. Потребители в этих регионах все чаще обращаются к предоплаченным и подарочным картам из-за их удобства, гибкости и универсальности. Более того, поскольку мир принимает цифровые методы оплаты и переживает всплеск активности в электронной коммерции, происходит естественный сдвиг в сторону цифровых форматов этих карт. Продажи в электронной коммерции значительно выросли после пандемии COVID-19, что обусловлено изменением поведения потребителей в сторону онлайн-покупок из-за карантинов, мер социального дистанцирования и проблем безопасности.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/us-uk-uae-mexico-india-and-philippines-gift-card-market

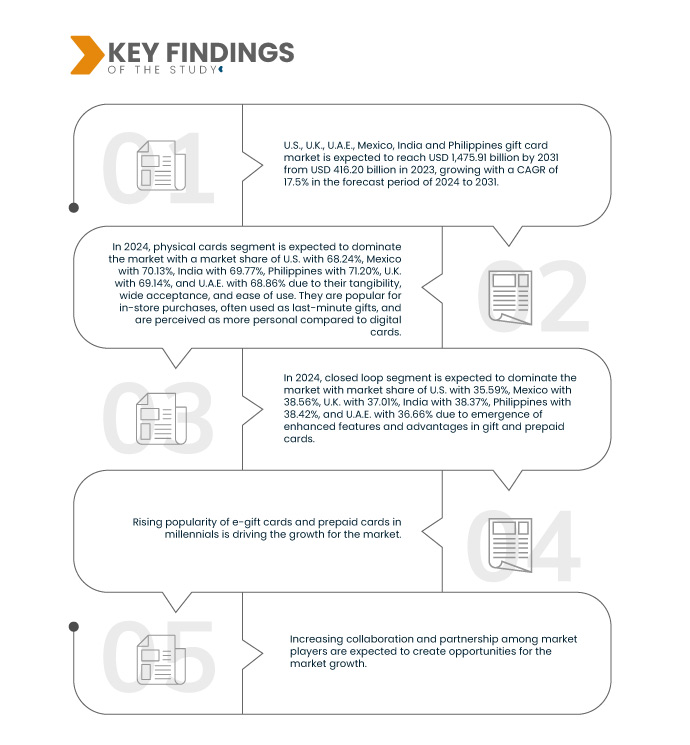

По данным исследования рынка Data Bridge, ожидается, что рынок подарочных карт в США, Великобритании, ОАЭ, Мексике, Индии и на Филиппинах к 2031 году достигнет 1475,91 млрд долларов США по сравнению с 416,20 млрд долларов США в 2023 году, а среднегодовой темп роста составит 17,5% в прогнозируемый период с 2024 по 2031 год.

Основные выводы исследования

Растущая популярность электронных подарочных карт и предоплаченных карт среди миллениалов

Индустрия подарочных карт и цифровой мир взаимосвязаны. Компании привлекают своих клиентов виртуально, используя стратегии цифрового маркетинга и цифровые платформы, поскольку подарочные карты стали распространенными. В последние годы индустрия подарочных карт испытала улучшение отношений с существующими потребителями посредством маркетинга и цифрового продвижения, а не расширения через географические каналы и расширение сети магазинов

Растущая популярность электронных подарочных карт и предоплаченных карт среди миллениалов меняет рынки подарочных карт, поскольку миллениалы отдают предпочтение удобству и цифровым решениям, компании все больше инвестируют в передовые цифровые и мобильные стратегии, чтобы удовлетворить меняющиеся требования потребителей. Этот сдвиг в сторону электронных подарочных карт и предоплаченных карт не только повышает вовлеченность клиентов, но и ускоряет рост рынка, позиционируя компании для извлечения выгоды из новых возможностей в динамичном цифровом ландшафте. Поскольку эта тенденция продолжается, компании, которые адаптируются к этим изменениям, будут иметь хорошие возможности для успеха на развивающемся рынке подарочных карт

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2024-2031

|

Базовый год

|

2023

|

Исторические годы

|

2022 (Можно настроить на 2016-2021)

|

Количественные единицы

|

Доход в млрд долларов США

|

Охваченные сегменты

|

Продукт (физические карты и электронные подарочные карты), Функциональный атрибут (замкнутый цикл, универсальный принятый открытый цикл и электронные подарки), Отраслевая вертикаль (розничная торговля и корпоративные учреждения), Использование ( внутри страны и за рубежом), Тип продавца (розничная торговля и электронная коммерция, рестораны и столовые, развлечения и потоковые сервисы, пополнение счета мобильного телефона и коммунальные услуги и другие)

|

Страны, охваченные

|

США, Мексика, Великобритания, Индия, Филиппины и ОАЭ

|

Охваченные участники рынка

|

Starbucks Coffee Company (США), Target Brands, Inc. (США), American Express Company (США), PayPal.com (США), Blackhawk Network (США), Apple Inc. (США), Best Buy (США), Sephora USA, Inc. ( США), Pine Labs (Индия), MUJI Philippines Corp. (Филиппины), Givex Corporation (Канада), Gyft, Inc (США), Tango Card. Inc (США), Plastek Card Solutions, Inc. (США), Huuray A/S (Дания), Diggecard (Норвегия), Duracard Plastic Cards (США), Jigsaw Business Solutions (Великобритания), Stockpile, Inc. (США), Card USA, Inc (США), TransGate Solutions (США), Alltimeprint.com (США), Walmart (США), Under Armour, Inc. (США) и Walgreen Co. (США) и другие

|

Данные, отраженные в отчете

|

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, рыночный отчет, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов.

|

Анализ сегмента

Рынок подарочных карт в США, Великобритании, ОАЭ, Мексике, Индии и на Филиппинах делится на пять основных сегментов, которые основаны на основном продукте, функциональном атрибуте, отраслевой вертикали, использовании и типе продавца.

- По видам продукции рынок подарочных карт в США, Великобритании, ОАЭ, Мексике, Индии и на Филиппинах сегментируется на физические карты и электронные подарочные карты.

Ожидается, что в 2024 году сегмент физических карт будет доминировать на рынке подарочных карт в США, Великобритании, ОАЭ, Мексике, Индии и Филиппинах.

Ожидается, что в 2024 году сегмент физических карт будет доминировать на рынке с долей рынка в США 68,24%, Мексике 70,13%, Индии 69,77%, Филиппинах 71,20%, Великобритании 69,14% и ОАЭ 68,86% из-за их осязаемости, широкого принятия и простоты использования. Они популярны для покупок в магазине, часто используются в качестве подарков в последнюю минуту и воспринимаются как более личные по сравнению с цифровыми картами.

- На основе функциональных характеристик рынок подарочных карт США, Великобритании, ОАЭ, Мексики, Индии и Филиппин сегментируется на закрытый цикл, универсальный открытый цикл и электронные подарки.

Ожидается, что в 2024 году сегмент замкнутого цикла будет доминировать на рынках США, Великобритании, ОАЭ, Мексики, Индии и Филиппин.

Ожидается, что в 2024 году сегмент замкнутого цикла будет доминировать на рынке с долей рынка в США 35,59%, Мексике 38,56%, Великобритании 37,01%, Индии 38,37%, Филиппинах 38,42% и ОАЭ 36,66% за счет появления расширенных функций и преимуществ подарочных и предоплаченных карт.

- На основе отраслевой вертикали рынок подарочных карт США, Великобритании, ОАЭ, Мексики, Индии и Филиппин сегментирован на розничные и корпоративные учреждения. Ожидается, что в 2024 году розничный сегмент будет доминировать на рынке с долей рынка США 57,27%, Мексики 56,19%, Великобритании 55,23%, Индии 56,33%, Филиппин 57,79% и ОАЭ 55,26%.

- На основе использования рынок подарочных карт США, Великобритании, ОАЭ, Мексики, Индии и Филиппин сегментирован на внутренний и трансграничный. Ожидается, что в 2024 году внутренний сегмент будет доминировать на рынке с долей рынка США 88,17%, Мексики 91,42%, Великобритании 90,85%, Индии 91,34%, Филиппин 91,82% и ОАЭ 89,12%.

- На основе типа торговца рынок подарочных карт США, Великобритании, ОАЭ, Мексики, Индии и Филиппин сегментируется на розничную и электронную коммерцию, рестораны и столовые, развлечения и потоковые сервисы, пополнение мобильных счетов и коммунальные услуги и т. д. Ожидается, что в 2024 году сегмент розничной торговли и электронной коммерции будет доминировать на рынке с долей рынка в США 59,48%, Мексики 60,71%, Великобритании 58,29%, Индии 57,10%, Филиппин 58,45% и ОАЭ 59,53%.

Основные игроки

Исследование рынка Data Bridge, в котором основными игроками на рынке являются Target Brands, Inc. (США), Pine Labs (Индия), Starbucks Coffee Company (США), PayPal.com (США), Blackhawk Network (США), Walmart (США), Apple Inc. (США).

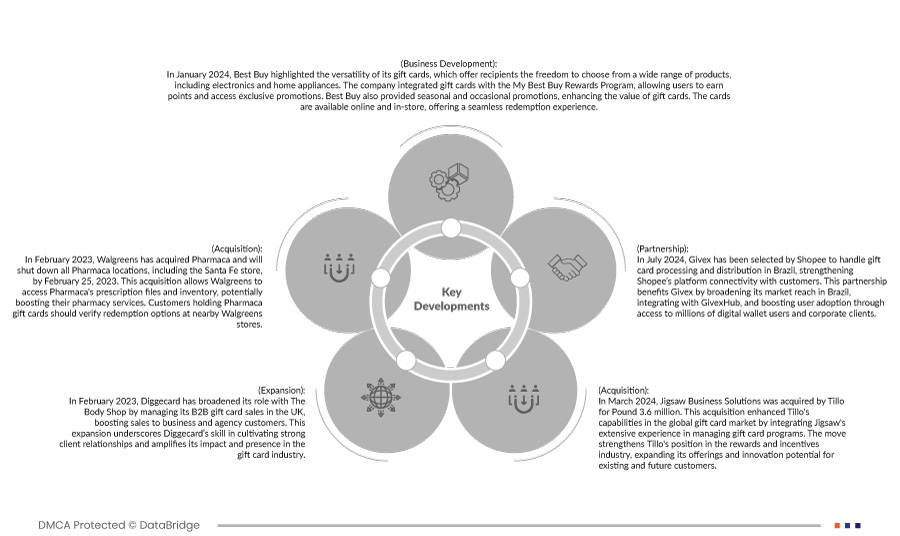

Развитие рынка

- В марте 2023 года Target Brands, Inc. объявила об усовершенствованиях своей программы лояльности Target Circle, запуск которой запланирован на апрель. Обновленная программа представила три новых варианта членства, включая уровень бесплатного присоединения и платное членство с доставкой в тот же день по цене 49 долларов США за первый год. Target также переименовала Target RedCard в Target Circle Card, предлагая дополнительную скидку 5% и увеличенные сроки возврата. Эти изменения направлены на обеспечение более персонализированного и полезного опыта покупок, повышение удовлетворенности клиентов и стимулирование лояльности.

- В мае 2022 года Starbucks Coffee Company сообщила о более чем 1 миллиарде долларов США неиспользованных остатков подарочных карт. Генеральный директор Говард Шульц сообщил, что подарочные карты Starbucks ежегодно используют более 120 миллионов человек. В 2021 году клиенты добавили 11 миллиардов долларов США к этим картам, что внесло значительный вклад в доход компании

- В январе 2024 года Best Buy подчеркнула универсальность своих подарочных карт, которые предоставляют получателям свободу выбора из широкого ассортимента товаров, включая электронику и бытовую технику. Компания интегрировала подарочные карты с программой вознаграждений My Best Buy, что позволяет пользователям зарабатывать баллы и получать доступ к эксклюзивным акциям. Best Buy также проводила сезонные и случайные акции, повышая ценность подарочных карт. Карты доступны как в Интернете, так и в магазине, предлагая бесперебойный процесс погашения

- В октябре 2021 года Best Buy объявила, что все физические подарочные карты полностью сделаны из бумаги и на 100% подлежат вторичной переработке. Этот переход, начатый в 2018 году, помог избежать около 196 тонн пластиковых отходов. Компания поставила себе цель стать углеродно-нейтральной к 2040 году и поддерживает экологически чистые инициативы, включая предложение электронных подарочных карт как варианта без отходов

- Согласно статье, опубликованной Buybox, в ноябре 2023 года в ОАЭ, хотя недавние потрясения повлияли на рынок, самоиспользование начало набирать обороты, поскольку потребители стремились к более осознанным привычкам расходов. Факторы, влияющие на решения о покупке на этих рынках, включали удобство, скидки, вознаграждения за лояльность и культурные установки по отношению к самоподаркам, что подчеркивает разнообразные мотивы, движущие мировым рынком подарочных карт.

Региональный анализ

Географически отчет о рынке подарочных карт в США, Великобритании, ОАЭ, Мексике, Индии и на Филиппинах охватывает следующие страны: США, Мексика, Великобритания, Индия, Филиппины и ОАЭ.

Согласно анализу Data Bridge Market Research:

Ожидается, что США будут доминировать и станут самым быстрорастущим регионом на рынке подарочных карт в США, Великобритании, ОАЭ, Мексике, Индии и Филиппинах.

В 2024 году США будут доминировать на рынке подарочных карт благодаря большой потребительской базе, высокому располагаемому доходу и хорошо налаженным секторам розничной торговли и электронной коммерции. Подарочные карты глубоко интегрированы в потребительскую культуру США и широко распространены в различных отраслях, включая розничную торговлю, рестораны и развлечения. Передовая цифровая инфраструктура страны поддерживает растущую тенденцию электронных подарочных карт, и американские компании часто используют подарочные карты для акций, вознаграждений и корпоративных поощрений, способствуя их широкому принятию и лидерству на рынке.

Для получения более подробной информации о рынке подарочных карт в США, Великобритании, ОАЭ, Мексике, Индии и на Филиппинах нажмите здесь – https://www.databridgemarketresearch.com/reports/us-uk-uae-mexico-india-and-philippines-gift-card-market