Изменение климата приводит к увеличению количества экстремальных погодных явлений, необходимость защиты зданий и инфраструктуры от повреждения водой становится первостепенной. Жидкость кровельные работы предлагает универсальное и долговечное решение для гидроизоляции плоских или пологих крыш, что делает его популярным выбором для коммерческого, жилого и промышленного применения. Одной из ключевых причин растущего спроса на жидкую кровлю является ее способность обеспечивать надежную защиту от проникновения воды. В традиционных кровельных материалах, таких как асфальт или металл, со временем могут образовываться швы и стыки, которые могут стать уязвимыми точками для проникновения воды. Жидкая кровля, с другой стороны, образует непрерывную мембрану на поверхности крыши, эффективно изолируя любые потенциальные точки проникновения воды. Эта бесшовная конструкция не только повышает гидроизоляционные характеристики, но также снижает вероятность протечек и последующего повреждения основной конструкции.

Доступ к полному отчету @https://www.databridgemarketresearch.com/reports/europe-liquid-roofing-market

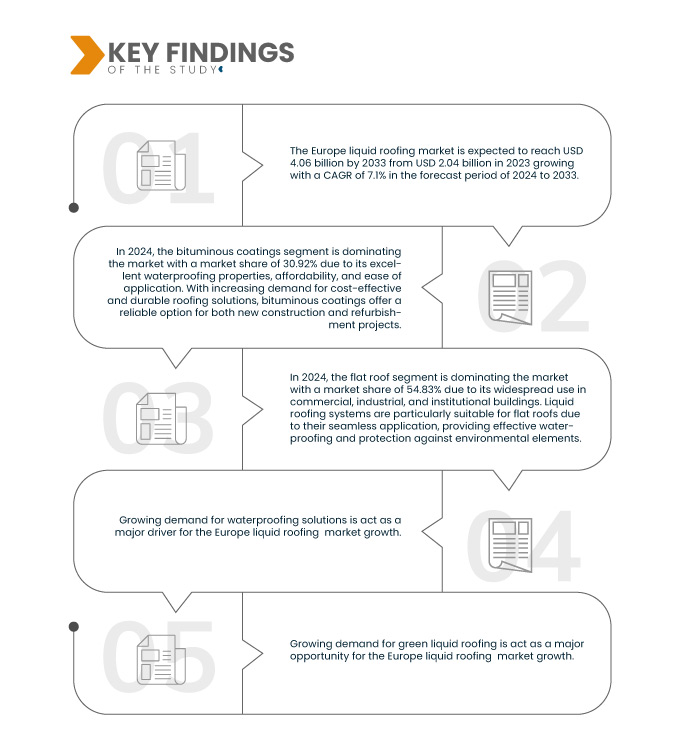

Исследование рынка Data Bridge показывает, что Европейский рынок жидкой кровли ожидается, что к 2031 году он достигнет 3,53 млрд долларов США с 2,04 млрд долларов США в 2023 году, а среднегодовой темп роста составит 7,1% в прогнозируемый период с 2024 по 2031 год.

Ключевые результаты исследования

Повышенное внимание к строительству и развитию инфраструктуры

Как правительства, так и частный сектор вкладывают значительные средства в строительство новых структур и реконструкцию существующих, чтобы удовлетворить потребности растущего населения и урбанизации. Этот всплеск строительной деятельности создает устойчивый спрос на кровельные решения, которые не только долговечны и надежны, но также экономичны и просты в установке – качества, которыми превосходят системы жидкой кровли.

Жидкая кровля имеет ряд преимуществ перед традиционными кровельными материалами, что делает ее привлекательным выбором для различных строительных проектов. Его бесшовное применение обеспечивает водонепроницаемое уплотнение, предотвращая протечки и повреждение водой, что имеет решающее значение для поддержания целостности зданий и инфраструктуры. Кроме того, жидкие кровельные системы можно применять к крышам сложной геометрии и неровным поверхностям, обеспечивая универсальность в проектировании и строительстве. Эти качества делают жидкую кровлю особенно подходящей для крупномасштабных проектов, где скорость, эффективность и долговечность имеют первостепенное значение.

Объем отчета и сегментация рынка

|

Отчет по метрике

|

Подробности

|

|

Прогнозный период

|

2024–2031 гг.

|

|

Базисный год

|

2023 год

|

|

Исторические годы

|

2022 г. (настраивается на 2016–2021 гг.)

|

|

Количественные единицы

|

Выручка в миллиардах долларов США

|

|

Охваченные сегменты

|

Тип (битумные покрытия, акриловые покрытия, эластомерные мембраны, силиконовые покрытия, полиуретановые / акриловые гибриды, полиуретановые покрытия, эпоксидные покрытия, каучуки EPDM и другие), тип крыши (плоская крыша, скатная крыша, пилообразная и другие), основание ( Бетон, композит, металл и другие), монтаж (кровельные работы, ремонт и новое строительство), конечный пользователь (жилое здание, коммерческое здание, промышленное здание и общественная инфраструктура)

|

|

Охваченные страны

|

Германия, Великобритания, Франция, Италия, Россия, Испания, Турция, Нидерланды, Швейцария, Бельгия и остальные страны Европы.

|

|

Охваченные игроки рынка

|

RPM International Inc. (США), 3M (США), BASF SE (Германия), Henkel Corporation (Германия), Sika AG (Швейцария), BMI Group Holdings UK Limited (Великобритания), SOPREMA (Франция), Saint-Gobain Weber ( Франция), Dow (США), Johns Manville (США), MAPEI SpA (Италия), Akzo Nobel NV (Нидерланды), Henry Company (США), KRATON CORPORATION (США), Pidilite Industries Ltd. (Индия), Garland Industries, Inc. (США), GAF, Inc. (США), HB Fuller Company (США), Triflex (UK) Limited. (Великобритания), Polyroof Products Ltd (Великобритания), Gaco. (США), KEMPER SYSTEM (Германия), Triton Systems. (США), Liquid Roofing Systems Ltd (Великобритания), ALT Europe, LLC (США), Restec Roofing (США) и Widopan Products GmbH (Германия) и других.

|

|

Точки данных, включенные в отчет

|

В дополнение к такой рыночной информации, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта / экспорта, анализ цен, анализ потребления продукции и анализ пестика

|

Сегментный анализ

Европейский рынок жидкой кровли разделен на пять заметных сегментов, которые зависят от типа, типа кровли, основания, установки и конечного пользователя.

- В зависимости от типа рынок сегментирован на битумные покрытия, акриловые покрытия, эластомерные мембраны, силиконовые покрытия, гибриды ПУ/акрил, полиуретановые покрытия, эпоксидные покрытия, каучуки EPDM и другие.

Ожидается, что в 2024 году сегмент битумных покрытий будет доминировать на европейском рынке жидкой кровли.

В 2024 году сегмент битумных покрытий будет доминировать на рынке благодаря своим превосходным гидроизоляция свойства, доступность и простота применения с долей рынка 30,92%

- В зависимости от типа крыши рынок подразделяется на плоскую, скатную, пилообразную и другие. В 2024 году сегмент плоских крыш будет доминировать на рынке с долей рынка 54,83%.

- В зависимости от подложки рынок сегментируется на бетон, композит, металл и другие.

Ожидается, что в 2024 году сегмент бетона будет доминировать на европейском рынке жидкой кровли.

В 2024 году сегмент бетона будет доминировать на рынке благодаря нескольким факторам, таким как преобладание бетонных крыш в различных строительных проектах, в том числе коммерческий, промышленные и жилые здания .с долей рынка 51,67%

- В зависимости от установки рынок сегментирован на замену кровли и ремонт, а также на новое строительство. В 2024 году сегмент замены кровли и ремонта будет доминировать на рынке с долей рынка 74,55%.

- В зависимости от конечного пользователя рынок сегментирован на жилые дома, коммерческие здания, промышленные здания и общественную инфраструктуру. В 2024 году сегмент жилого строительства будет доминировать на рынке с долей рынка 61,60%.

Основные игроки

Data Bridge Market Research анализирует RPM International Inc. (США), 3M (США), BASF SE (Германия), Henkel Corporation (Германия), Sika AG (Швейцария) как основных игроков рынка жидкой кровли в Европе.

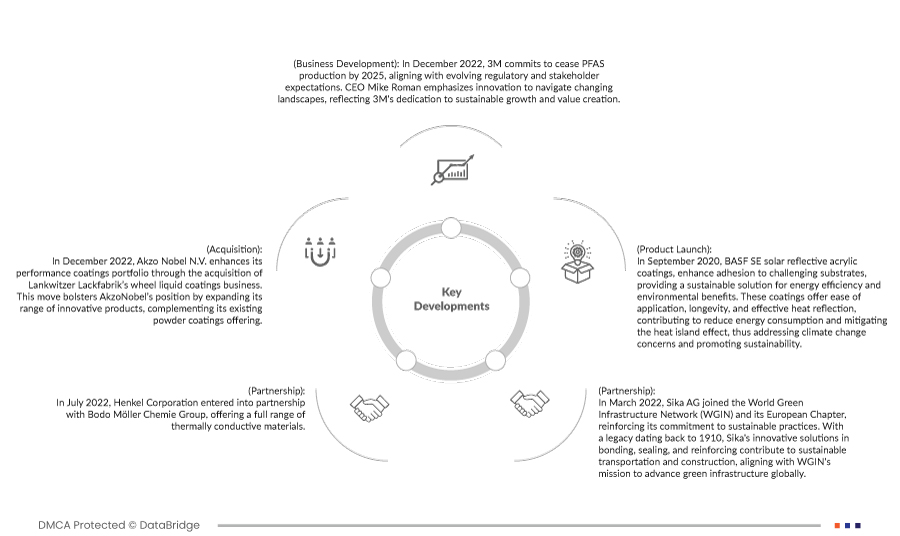

Развитие рынка

- В декабре 2022 года 3M обязуется прекратить производство PFAS к 2025 году, что соответствует меняющимся ожиданиям регулирующих органов и заинтересованных сторон. Генеральный директор Майк Роман делает акцент на инновациях, позволяющих ориентироваться в меняющихся условиях, что отражает приверженность 3M устойчивому росту и созданию ценности. Этот стратегический сдвиг подчеркивает активную позицию 3M в решении экологических проблем и удовлетворении потребностей общества.

- В декабре 2022 года Akzo Nobel NV расширяет свой портфель высокоэффективных покрытий за счет приобретения подразделения Lankwitzer Lackfabrik по производству жидких покрытий для колес. Этот шаг укрепит позиции AkzoNobel за счет расширения ассортимента инновационной продукции, дополняющей существующее предложение порошковых покрытий. В заключение, приобретение укрепляет позиции AkzoNobel в индустрии покрытий, обещая расширенные возможности и разнообразие продукции.

- В июле 2022 года корпорация Henkel заключила партнерство с Bodo Möller Chemie Group, предложив полный спектр теплопроводящих материалов. Решения Henkel Bergquist удовлетворяют растущий спрос, особенно в автомобильном и авиационном секторах, предоставляя комплексный портфель решений из одних рук, что делает их идеальным партнером. Жидкая кровля.

- В марте 2022 года Sika AG присоединилась к Всемирной сети зеленой инфраструктуры (WGIN) и ее европейскому отделению, подтвердив свою приверженность устойчивым практикам. Инновационные решения Sika в области склеивания, герметизации и армирования, основанные в 1910 году, способствуют устойчивому транспорту и строительству, согласуясь с миссией WGIN по развитию зеленой инфраструктуры во всем мире. Это партнерство подчеркивает важность отраслевого сотрудничества в продвижении охраны окружающей среды и построении более зеленого будущего.

- В сентябре 2020 года акриловые покрытия BASF SE, отражающие солнечную энергию, улучшают адгезию к сложным основаниям, обеспечивая устойчивое решение для повышения энергоэффективности и защиты окружающей среды. Эти покрытия обеспечивают простоту нанесения, долговечность и эффективное отражение тепла, что способствует снижению энергопотребления и смягчению эффекта теплового острова, тем самым решая проблемы изменения климата и способствуя устойчивому развитию.

Региональный анализ

Географически страны, охваченные отчетом о европейском рынке менеджеров виртуальной инфраструктуры, — это Германия, Великобритания, Франция, Италия, Россия, Испания, Турция, Нидерланды, Швейцария, Бельгия и остальная часть Европы.

Согласно анализу исследования рынка Data Bridge:

Ожидается, что Германия будет доминировать и станет самым быстрорастущим регионом на европейском рынке жидкой кровли.

Ожидается, что Германия будет доминировать и быть самой быстрорастущей страной на рынке из-за быстрой урбанизации и индустриализации в стране, которые привели к росту строительной деятельности в жилом, коммерческом и промышленном секторах.

Для получения более подробной информации о европейском рынке жидкой кровли отчет, нажмите здесь –https://www.databridgemarketresearch.com/reports/europe-liquid-roofing-market