Market Analysis and Insights

The satellite launch services market is associated with the process and stages of carrying out the satellite via rocket or reusable launch vehicle by satellite launch service providers. It can consists of a series of stages to obtain the final result such as ordering, negotiation between client and service provider, selection of launch facility, stacking and assembly, integration of payload, and launch. The entry of private launch service providers resulted into decrease in the launch cost and new technologies marking a new phase in the market.

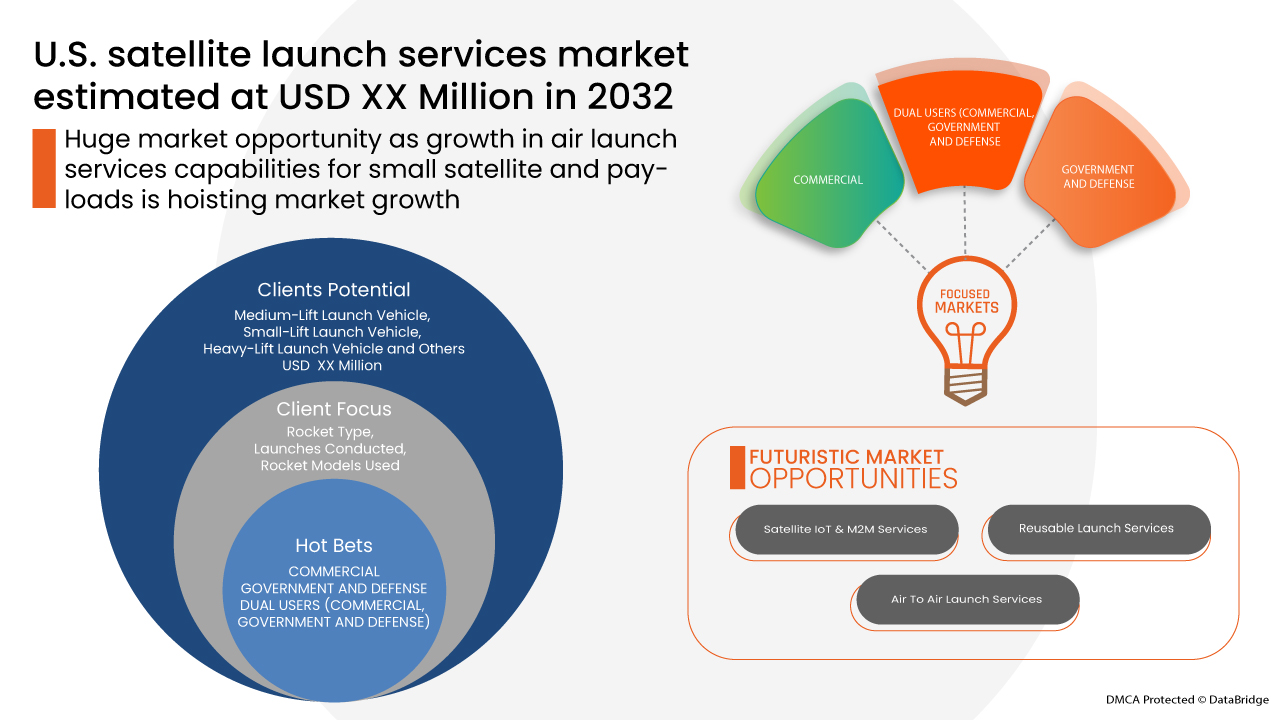

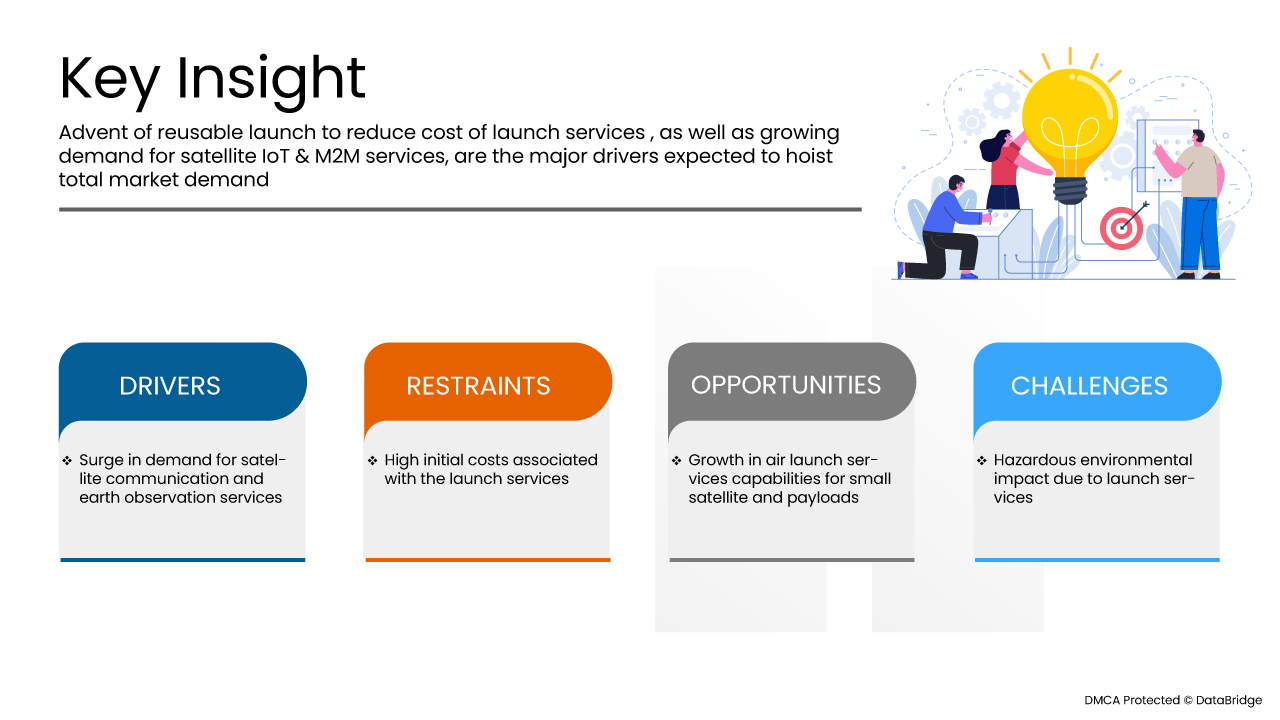

In current times, the importance of satellite launch services has grown drastically and the growth in satellite launch services market has been highly fuelled by the advent of reusable launch vehicles services to reduce overall cost of the launch and the increasing demand in the number of small satellites for application such as communication and earth observation services. Data Bridge Market Research analyses that the satellite launch services market will grow at a CAGR of 16.2% during the forecast period of 2022 to 2032.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2032 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Rocket Type (Small-Lift Launch Vehicle, Medium-Lift Launch Vehicle, Heavy-Lift Launch Vehicle, Others), Form Of Energy (Thermodynamic Rockets, Electrodynamic Rockets), Satellite (CubeSat (0.27–25 U), Small Satellites (1–500 Kg), Medium Satellites (500-2,500 Kg) And Large Satellites (>2,500 Kg)), Application (Communication, Earth Observation And Remote Sensing, Mapping And Navigation, Surveillance And Security, Meteorology, Scientific Research And Exploration, Space Observation, Exploration Of Outer Planets), End User (Commercial, Government And Defence And Dual Users (Commercial, Government And Defence)), Orbit (Into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Earth Orbit (GEO), Beyond Geosynchronous Orbit) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

Airbus (U.S.), Lockheed Martin Corporation(U.S.), L3Harris Technologies Inc. (U.S.), Northrop Grumman(U.S.), SPACEX (U.S.), Raytheon Technologies Corporation(U.S.), Sierra Nevada Corporation(U.S.), BLUE ORIGIN (U.S.), VIRGIN ORBIT (U.S.), Spaceflight (U.S.), Rocket Lab USA (U.S.), Mitsubishi Heavy Industry(JAPAN), ILS (U.S.), Honeywell and Boeing (U.S.) |

Satellite Launch Services Market Dynamics

Drivers

- Increase in number of small satellite and testing probe launches

Increase in number of small satellite and testing probe has a positive impact, due to the technological advancement which has made it possible to reduce the size of many devices and equipment, as miniaturisation has affected all industries, including space industry and is hoisting the market growth.

- Growing demand for satellite IOT & M2M services

The Internet of Things (IoT) is described as a devices that are connected through the internet services. Because of pervasive coverage offered by satellites around the globe, satellite data is considered ideal for remote IoT applications and its optimum running which is is providing is one of the huge factor for the market growth.

- Surge in demand for satellite communication and earth observation services

Satellite communication provide operator an advantage to get in contact with any person across the earth and earth observation satellites are specifically designed satellites for monitoring earth, giving upper hand on natural calamities & disasters. This factor is expected to drive the market growth.

- Advent of reusable launch services to reduce cost

A Reusable Launch can launch a satellite in the space multiple times without been decommissioned to the service. This allow satellite operator to get satellite service at lower cost and because of this the number of satellite launch is and will grow year by year giving a reason to market growth.

Opportunities

- Growth in air launch services capabilities for small satellite and payloads

Air launch is a method of launching payloads into outer space, the improvement in the technology and excellent success rate of air launch system over ground launch which is expected to provide lucrative opportunity for the growth of the market.

Restraints/Challenges

However, the high cost associated with satellite launch and the hidden cost of launch services such as minimizing the extra weight, launch rating cost, government approval, setting up launch location, relaying & enhancing COM systems even after the improvement of technology in satellite system is the biggest concern for operators hence is a major restraining factor for the satellite launch services market. The launch also emit hazardous gases during launching process, carbon dioxide being one of it. Carbon dioxide is a greenhouse gas, responsible for causing climate change by trapping heat, extreme weather, food supply disruptions and increased wildfires. Other than environmental issues, the limitation in the propulsion technology of the rocket system is also limiting the potential of satellite launch service. Thus, above mentioned reasons is hampering the growth of satellite launch services market.

Covid-19 Impact on Satellite Launch Services Market

The COVID-19 has negatively affected the satellite launch services market. Lockdowns and isolation during pandemics has not only complicate the supply chain management, but slowed the rate of testing, development and launching of pre-determined satellite launches. This has led to delay of many mission offered by the launch service providers. But with the betterment of the situation across the globe the testing and development has catch the required phase, yet there is no denial that the satellite launch services market has suffered heavily due to COVID-19.

Recent Developments

- In February 2022, Rocket Lab USA, Inc. has announced the completion of its second orbital launch pad at Launch Complex 1. This is company’s third dedicated pad for its Electron rocket which will provide company an additional arm for commercial launch generating more capital and more project form different global operator. Thus this boost the US satellite launch services market.

- In September 2021, Honeywell International Inc. has launched two new product which are Honeywell’s X Band Downlink Transmitter and Optical Communication Terminal (OCT), to expand its Product Offering for Satellite Launch Services in Rapidly-Growing Small-Satellite Market. These product will boost company potential and in return company will gain more revenue capturing more market portion.

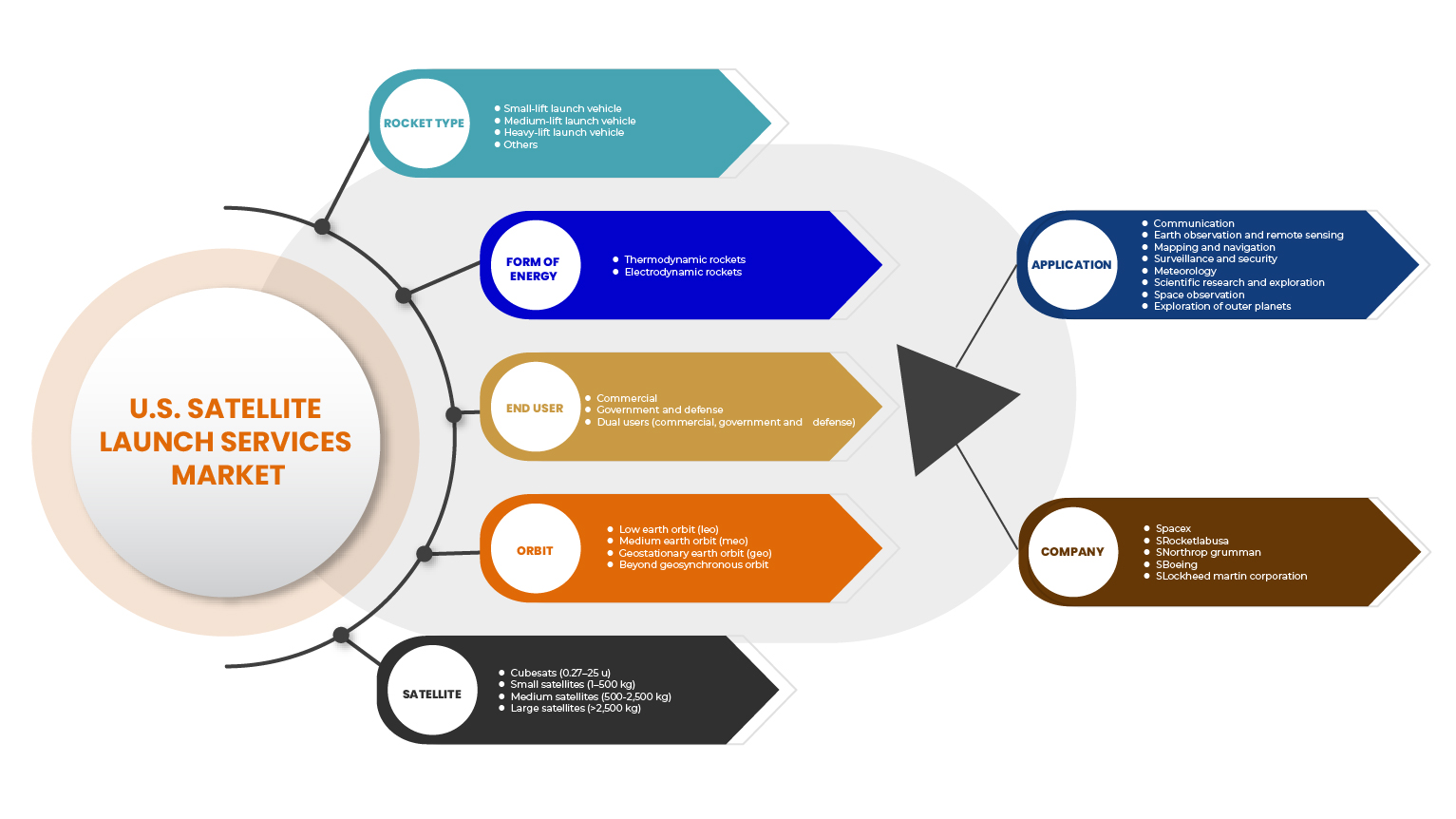

U.S. Satellite Launch Services Market Scope

The satellite launch services market is segmented on the basis of type, form of energy, satellite, application, end user, orbit and country. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Rocket Type

- Small-lift launch vehicle

- Medium-lift launch vehicle

- Heavy-lift launch vehicle

- Others

On the basis of the rocket type, U.S. satellite launch services market is segmented into small-lift launch vehicle, medium-lift launch vehicle, heavy-lift launch vehicle and others.

Form of Energy

- Thermodynamic rockets

- Electrodynamic rockets

On the basis of the form of energy, U.S. satellite launch services market is segmented into thermodynamic rockets and electrodynamic rockets.

Satellite

- Cubesats (0.27–25 U)

- Small Satellites (1–500 KG)

- Medium Satellites (500-2,500 KG)

- Large Satellites (>2,500 KG)

On the basis of the satellite, U.S. satellite launch services market is segmented into cubesats (0.27–25 u), small satellites (1–500 kg), medium satellites (500-2,500 kg) and large satellites (>2,500 kg).

Application

- Communication

- Earth observation and remote sensing

- Mapping and navigation

- Surveillance and security

- Meteorology

- Scientific research and exploration

- Space observation

- Exploration of outer planets

On the basis of the application, U.S. satellite launch services market is segmented into communication, earth observation and remote sensing, mapping and navigation, surveillance and security, meteorology, scientific research and exploration, space observation and exploration of outer planets

End User

- Commercial

- Government and defense

- Dual users (commercial, government and defense)

On the basis of the end user, U.S. satellite launch services market is segmented into commercial, government and defense and dual users (commercial, government and defense).

Orbit

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Earth Orbit (GEO)

- Beyond Geosynchronous Orbit

On the basis of the orbit, U.S. satellite launch services market is segmented into low earth orbit (LEO), medium earth orbit (MEO), geostationary earth orbit (GEO) and beyond geosynchronous orbit.

Competitive Landscape and Satellite Launch Services Market Share Analysis

The satellite launch services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to satellite launch services market.

Some of the major players operating in the satellite launch services market are Airbus, Lockheed Martin Corporation, L3Harris Technologies, Inc., Northrop Grumman, SPACEX, Raytheon Technologies Corporation, Sierra Nevada Corporation, BLUE ORIGIN, VIRGIN ORBIT, Spaceflight, Rocket Lab USA, Mitsubishi Heavy Industry, ILS, Honeywell and Boeing among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. SATELLITE LAUNCH SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 ROCKET TYPE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LAUNCH VEHICLE MODELS USED BY COMPANIES

4.2 DETAILED DATA ON THE NUMBER OF LAUNCHES AND THE ROCKET TYPE USED BY COMPANIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE NUMBER OF SMALL SATELLITE AND TESTING PROBE LAUNCHES

5.1.2 GROWING DEMAND FOR SATELLITE IOT & M2M SERVICES

5.1.3 SURGE IN DEMAND FOR SATELLITE COMMUNICATION AND EARTH OBSERVATION SERVICES

5.1.4 ADVENT OF REUSABLE LAUNCH SERVICES TO REDUCE COST

5.2 RESTRAINT

5.2.1 HIGH COSTS ASSOCIATED WITH THE LAUNCH SERVICES

5.3 OPPORTUNITIES

5.3.1 GROWTH IN AIR LAUNCH SERVICES CAPABILITIES FOR SMALL SATELLITES AND PAYLOADS

5.3.2 STRATEGIC PARTNERSHIPS, MERGERS, CONTRACTS, AND ACQUISITIONS IN LAUNCH SERVICES MARKET

5.4 CHALLENGES

5.4.1 HAZARDOUS ENVIRONMENTAL IMPACT DUE TO LAUNCH SERVICES

5.4.2 LIMITATIONS IN THE PROPULSION SYSTEMS AND LOOPHOLES IN REGULATORY FRAMEWORK FOR LAUNCH SERVICES

6 U.S. SATELLITE LAUNCH SERVICES MARKET, BY ROCKET TYPE

6.1 OVERVIEW

6.2 MEDIUM-LIFT LAUNCH VEHICLE

6.3 SMALL-LIFT LAUNCH VEHICLE

6.4 HEAVY-LIFT LAUNCH VEHICLE

6.5 OTHERS

7 U.S. SATELLITE LAUNCH SERVICES MARKET, BY FORM OF ENERGY

7.1 OVERVIEW

7.2 THERMODYNAMIC ROCKETS

7.2.1 SOLID

7.2.2 LIQUID

7.2.3 HYBRID

7.3 ELECTRODYNAMIC ROCKETS

8 U.S. SATELLITE LAUNCH SERVICES MARKET, BY SATELLITE

8.1 OVERVIEW

8.2 SMALL SATELLITES (1–500 KG)

8.2.1 NANOSATELLITES

8.2.2 MICROSATELLITES

8.2.3 MINISATELLITES

8.2.4 OTHERS

8.3 CUBESATS (0.27–25 U)

8.4 MEDIUM SATELLITES (500-2,500 KG)

8.5 LARGE SATELLITES (>2,500 KG)

9 U.S. SATELLITE LAUNCH SERVICES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 COMMUNICATION

9.3 EARTH OBSERVATION AND REMOTE SENSING

9.4 MAPPING & NAVIGATION

9.5 METEOROLOGY

9.6 SPACE OBSERVATION

9.7 SURVEILLANCE & SECURITY

9.8 EXPLORATION OF OUTER PLANETS

9.9 SCIENTIFIC RESEARCH & EXPLORATION

10 U.S. SATELLITE LAUNCH SERVICES MARKET, BY END-USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 MEDIA & ENTERTAINMENT

10.2.2 SATELLITE OPERATORS/OWNERS

10.2.3 SCIENTIFIC RESEARCH & DEVELOPMENT

10.2.4 TRANSPORTATION & LOGISTICS

10.2.5 ENERGY INDUSTRY

10.2.6 OTHERS

10.3 GOVERNMENT & DEFENCE

10.3.1 NATIONAL SPACE AGENCIES

10.3.2 DEPARTMENT OF DEFENCE & INTELLIGENCE AGENCIES

10.3.3 NATIONAL MAPPING & TOPOGRAPHIC AGENCIES

10.3.4 SEARCH & RESCUE ENTITIES

10.3.5 DEPARTMENTS OF ENVIRONMENT & AGRICULTURE

10.3.6 ACADEMIC & RESEARCH INSTITUTIONS

10.4 DUAL USERS (COMMERCIAL, GOVERNMENT & DEFENCE)

11 U.S. SATELLITE LAUNCH SERVICES MARKET, BY ORBIT

11.1 OVERVIEW

11.2 LOW EARTH ORBIT (LEO)

11.3 GEOSTATIONARY EARTH ORBIT (GEO)

11.4 MEDIUM EARTH ORBIT (MEO)

11.5 BEYOND GEOSYNCHRONOUS ORBIT

12 U.S. SATELLITE LAUNCH SERVICES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

13 SWOT

14 COMPANY PROFILES

14.1 SPACEX

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 NORTHROP GRUMMAN

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 RAYTHEON TECHNOLOGIES CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 BOEING

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 LOCKHEED MARTIN CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AIRBUS

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT & SERVICES PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 BLUE ORIGIN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 HONEYWELL INTERNATIONAL INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 ILS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 L3HARRIS TECHNOLOGIES, INC

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MITSUBISHI HEAVY INDUSTRIES LTD

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 ROCKET LAB USA

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 SIERRA NEVADA CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SPACEFLIGHT INC

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICES PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 VIRGIN ORBIT

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 U.S. SATELLITE LAUNCH SERVICES MARKET, BY ROCKET TYPE, 2020-2032 (USD MILLION)

TABLE 2 U.S. SATELLITE LAUNCH SERVICES MARKET, BY FORM OF ENERGY, 2020-2032 (USD MILLION)

TABLE 3 U.S. THERMODYNAMIC ROCKETS IN SATELLITE LAUNCH SERVICES MARKET, BY PROPELLANTS, 2020-2032 (USD MILLION)

TABLE 4 U.S. SATELLITE LAUNCH SERVICES MARKET, BY SATELLITE, 2020-2032 (USD MILLION)

TABLE 5 U.S. SMALL SATELLITES IN SATELLITE LAUNCH SERVICES MARKET, BY TYPE, 2020-2032 (USD MILLION)

TABLE 6 U.S. SATELLITE LAUNCH SERVICES MARKET, BY APPLICATION, 2020-2032 (USD MILLION)

TABLE 7 U.S. SATELLITE LAUNCH SERVICES MARKET, BY END-USER, 2020-2032 (USD MILLION)

TABLE 8 U.S. COMMERCIAL IN SATELLITE LAUNCH SERVICES MARKET, BY TYPE, 2020-2032 (USD MILLION)

TABLE 9 U.S. GOVERNMENT & DEFENSE IN SATELLITE LAUNCH SERVICES MARKET, BY TYPE, 2020-2032 (USD MILLION)

TABLE 10 U.S. SATELLITE LAUNCH SERVICES MARKET, BY ORBIT, 2020-2032 (USD MILLION)

List of Figure

FIGURE 1 U.S. SATELLITE LAUNCH SERVICES MARKET: SEGMENTATION

FIGURE 2 U.S. SATELLITE LAUNCH SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 U.S. SATELLITE LAUNCH SERVICES MARKET: DROC ANALYSIS

FIGURE 4 U.S. SATELLITE LAUNCH SERVICES MARKET: COUNTRY-LEVEL MARKET ANALYSIS

FIGURE 5 U.S. SATELLITE LAUNCH SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. SATELLITE LAUNCH SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. SATELLITE LAUNCH SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. SATELLITE LAUNCH SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.S. SATELLITE LAUNCH SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 U.S. SATELLITE LAUNCH SERVICES MARKET: SEGMENTATION

FIGURE 11 INCREASE IN NUMBER OF SMALL SATELLITES AND TESTING PROBE LAUNCHES IS EXPECTED TO DRIVE U.S. SATELLITE LAUNCH SERVICES MARKET IN THE FORECAST PERIOD

FIGURE 12 MEDIUM-LIFT LAUNCH VEHICLE SEGMENT IS EXPECTED TO ACCOUNT FOR LARGEST SHARE OF U.S. SATELLITE LAUNCH SERVICES MARKET FROM 2022 TO 2032

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF U.S. SATELLITE LAUNCH SERVICES MARKET

FIGURE 14 ORBITAL LAUNCH BY COUNTRY IN 2020

FIGURE 15 TOTAL NUMBER OF ACTIVE COMMERCIAL SATELLITES IN EARTH’S ORBIT

FIGURE 16 U.S. SATELLITE LAUNCH SERVICES MARKET: BY ROCKET TYPE, 2021

FIGURE 17 U.S. SATELLITE LAUNCH SERVICES MARKET: BY FORM OF ENERGY, 2021

FIGURE 18 U.S. SATELLITE LAUNCH SERVICES MARKET: BY SATELLITE, 2021

FIGURE 19 U.S. SATELLITE LAUNCH SERVICES MARKET: BY APPLICATION, 2021

FIGURE 20 U.S. SATELLITE LAUNCH SERVICES MARKET: BY END-USER, 2021

FIGURE 21 U.S. SATELLITE LAUNCH SERVICES MARKET: BY ORBIT, 2021

FIGURE 22 U.S. SATELLITE LAUNCH SERVICES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.