U.S. Remote Therapeutic Monitoring (MSK) Market Analysis and Size

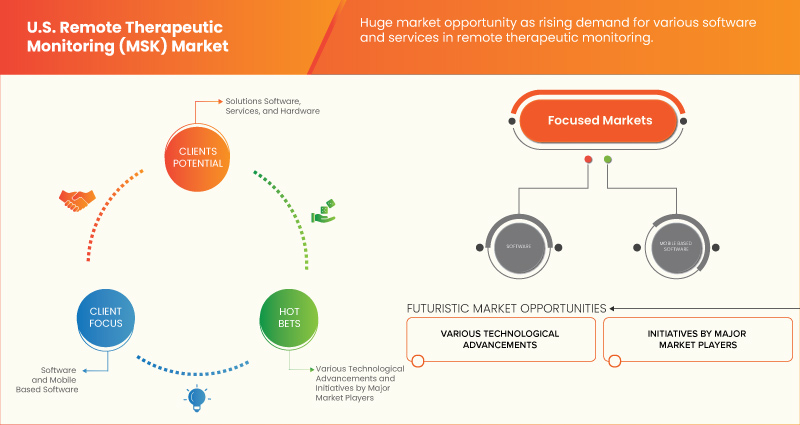

The presence of these companies produces competitive prices for remote therapeutic monitoring across the region. Due to the presence of these players at regional and international levels, suppliers and manufacturers offer products with different specifications and characteristics in all budgets. The rising integration of artificial intelligence and machine learning drives market growth. The rising demand for remote therapeutic monitoring is expected to drive market growth.

Data Bridge Market Research analyzes that the U.S. remote therapeutic monitoring (MSK) market is expected to reach USD 2,350.10 million by 2030, at a CAGR of 18.3% during the forecast period. This market report also covers pricing analysis and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, and Pricing in USD |

|

Segments Covered |

Product (Solutions Software, Services, and Hardware), Deployment Mode (Cloud Based and On Premises), Mode of Access (Mobile Based and Web Based), Codes (98975, 98976, 98977, 98980, and 98981), Type (Continuous Monitoring, Proactive Monitoring, and Intermittent Monitoring), Application (Non Physiological Data and Therapeutic Data), Purchase Mode (Group Purchase and Individual), End Users (Providers, Payers, and Patient), Distribution Channel (Direct Sales and Indirect Sales) |

|

Country Covered |

U.S. |

|

Market Players Covered |

Zimmer Biomet, Omada Health Inc., HealthViewX, Propeller Health, Limber Health Inc., Murata Vios, Owlytics Healthcare, Medistics LLC., INTELLIH INC., HealthArc, CIPHER SKIN INC., Medsien, Inc., Censon Health, and Exer Labs, Inc. |

Market Definition

The remote therapeutic monitoring (RTM) market in the U.S. refers to the segment of the healthcare industry that focuses on remote monitoring and managing musculoskeletal (MSK) conditions using digital technologies. It encompasses telehealth and remote monitoring tools to provide ongoing assessment, monitoring, and support for individuals with MSK conditions, enabling healthcare providers to remotely track and manage their patients' musculoskeletal health.

In the RTM market, healthcare providers leverage wearable devices, mobile applications, telehealth platforms, and remote monitoring software to monitor MSK patients remotely. These tools enable data collection related to patient symptoms, mobility, exercise routines, adherence to treatment plans, and other relevant parameters.

U.S. Remote Therapeutic Monitoring (MSK) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- Rising Technological Advancements

Rapid technological advancements, including wearable devices, mobile apps, and telehealth platforms, have facilitated remote therapeutic monitoring. These technologies provide real-time data collection, transmission, and analysis, allowing healthcare providers to remotely monitor patients' vital signs, medication adherence, and overall health. Technological advancements have led to the development of wearable devices and sensors that can monitor various MSK (musculoskeletal) parameters such as movement, posture, range of motion, muscle activity, and joint pressure. These devices can collect real-time data and provide objective measurements, enabling healthcare providers to monitor patients' MSK conditions and track their progress remotely. Accurate and reliable wearable devices enhance remote therapeutic monitoring for MSK conditions.

For instance,

- In May 2021, as per ScienceDirect, in the past few years, technology has revolutionized the field of motion capture by introducing wearable and optical sensors to enable an automatic acquisition of reliably accurate movement data for biomechanics analysis along with scientific literature on technology-assisted approaches using RGB-D sensors for musculoskeletal health monitoring have been evolved

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML technologies are being integrated into remote therapeutic monitoring systems for MSK conditions. These technologies can analyze large datasets, identify trends, and provide predictive analytics. AI-powered algorithms can assist in identifying potential exacerbations, predicting flare-ups, and personalizing treatment plans based on individual patient data. Integrating AI and ML enhances the accuracy and efficiency of remote therapeutic monitoring for MSK conditions.

AI and ML algorithms can process large amounts of data collected from remote monitoring devices, wearables, and other sources. These algorithms can analyze data patterns, trends, and correlations to identify potential indicators of MSK conditions, disease progression, and treatment response. By extracting valuable insights from the data, AI and ML enable more accurate and timely decision-making for healthcare providers, leading to improved patient care and outcomes.

Hence, as per the above discussion, the integration of artificial intelligence (AI) and Machine Learning (ML) is driving the market's growth in the forecast period.

OPPORTUNITY

- Growing Expansion of Telehealth in the U.S.

The expansion of telehealth services and the increased adoption of remote consultations contribute to the growth of musculoskeletal remote therapeutic monitoring. Telehealth platforms allow healthcare providers to remotely assess patients, provide guidance, and monitor treatment progress, improving accessibility and convenience for patients with musculoskeletal conditions.

Telehealth allows patients to access healthcare services remotely, eliminating barriers such as geographical distance and limited healthcare infrastructure. As telehealth expands, more patients can benefit from remote therapeutic monitoring, regardless of location. This increased access opens up opportunities for remote monitoring companies to reach a wider patient population and expand their services. Telehealth platforms provide a means for healthcare providers to monitor patients in real-time remotely. Through video consultations, secure messaging, and remote monitoring devices, healthcare professionals can monitor vital signs, track progress, and assess patient conditions without needing in-person visits. Remote therapeutic monitoring can seamlessly integrate into telehealth platforms, allowing continuous monitoring and personalized care management.

For instance,

- In November 2020, as per NCBI, government insurance reimbursement policies, particularly, have been shown to influence telemedicine adoption in the U.S.

Results from the November 2022 study by Cision U.S., Inc. found that over 90% of Americans used telehealth services in the last year and that 90% enjoyed their experience. Some of these services included doctor's appointments, teledentistry, and vision appointments

Hence, it can be concluded that the expansion of the telehealth platform is providing an opportunity for market growth in the forecast period.

RESTRAINT / CHALLENGE

- Data Security and Privacy Concerns

The transmission and storage of patient health data in remote monitoring systems raise concerns about data security and privacy. Ensuring the protection of patient information and compliance with regulations, such as HIPAA, is crucial to building trust and encouraging the adoption of remote monitoring technologies.

Data security and privacy concerns can lead to patient reluctance to adopt remote therapeutic monitoring solutions. Patients may hesitate to share sensitive health information and biometric data if they are unsure how their data will be protected and who will have access to it. Lack of trust in the security measures implemented by remote monitoring platforms and healthcare providers can hinder patient engagement and limit the market growth.

For instance,

- In January 2023, as per SmartClinix, Remote Patient Monitoring (RPM) relies on transmitting sensitive medical data over the internet. Thus, security is a significant concern. It's vulnerable to cyber-attacks, data breaches, and various threats. These threats can compromise patients' integrity, availability, and confidentiality. This can lead to grave consequences for both patients and healthcare providers

Hence, as per the above discussion, data security and privacy concerns may restrain the market growth in the forecast period.

- In April 2022, INTELLIH INC. received a Service Organization Control 2 (SOC 2) Certification after a thorough independent third-party audit of the solution architecture, data security, security practices, and operational processes

- In August 2021, Zimmer Biomet and Canary Medical announced the FDA De Novo classification grant and authorization to market the world's first smart knee implant Persona IQ. This has helped the company to strengthen its product portfolio

U.S. Remote Therapeutic Monitoring (MSK) Market Scope

U.S. remote therapeutic monitoring (MSK) market is segmented into nine notable segments based on product, deployment mode, and mode of access, codes, type, application, purchase mode, end users, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

Product

- Solutions Software

- Services

- Hardware

On the basis of product, U.S. remote therapeutic monitoring (MSK) market is segmented into solutions software, services, and hardware.

Deployment Mode

- Cloud based

- On premises

On the basis of deployment mode, the U.S. remote therapeutic monitoring (MSK) market is segmented into cloud based and on premises.

Mode of Access

- Mobile based

- Web based

On the basis of mode of access, the U.S. remote therapeutic monitoring (MSK) market is segmented into mobile based and web based.

Codes

- 98975

- 98976

- 98977

- 98980

- 98981

On the basis of codes, the U.S. remote therapeutic monitoring (MSK) market is segmented into 98975, 98976, 98977, 98980, and 98981.

Types

- Continuous monitoring

- Proactive monitoring

- Intermittent Monitoring

On the basis of types, the U.S. remote therapeutic monitoring (MSK) market is segmented into continuous monitoring, proactive monitoring, and intermittent monitoring.

Application

- Non physiological data

- Therapeutic data

On the basis of application, the U.S. remote therapeutic monitoring (MSK) market is segmented into non physiological data, and therapeutic data.

Purchase Mode

- Group purchase

- Individual

On the basis of purchase mode, the U.S. remote therapeutic monitoring (MSK) market is segmented into group purchase and individual.

End Users

- Providers

- Payers

- Patient

On the basis of end users, the U.S. remote therapeutic monitoring (MSK) market is segmented into providers, payers, and patient.

Distribution Channel

- Direct Sales

- Indirect Sales

On the basis of distribution channel, the U.S. remote therapeutic monitoring (MSK) market is segmented into direct sales and indirect sales.

Competitive Landscape and U.S. Remote Therapeutic Monitoring (MSK) Market Share Analysis

The U.S. remote therapeutic monitoring (MSK) market competitive landscape provides competitor details. Details include company overview, financials, revenue generated, market potential, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major market players operating in the U.S. remote therapeutic monitoring (MSK) market are Zimmer Biomet, Omada Health Inc., HealthViewX, Propeller Health, Limber Health Inc., Murata Vios, Owlytics Healthcare, Medistics LLC., INTELLIH INC., HealthArc, CIPHER SKIN INC., Medsien, Inc., Censon Health, and Exer Labs, Inc.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 INDUSTRY INSIGHTS

5.1 DEMOGRAPHIC TRENDS

5.2 KEY PRICING STRATEGIES

5.3 KEY PATIENT ENROLLMENT STRATEGIES

6 REIMBURSEMENT SCENARIO FOR REMOTE PATIENT MONITORING

7 REGULATORY FRAMEWORK

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING TECHNOLOGICAL ADVANCEMENTS

8.1.2 INTEGRATION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)

8.1.3 GROWING DEMAND FOR HOME HEALTHCARE

8.1.4 INCREASING PREVALENCE OF MUSCULOSKELETAL DISORDERS

8.2 RESTRAINTS

8.2.1 DATA SECURITY AND PRIVACY CONCERNS

8.2.2 HIGH COST ASSOCIATED WITH ELECTRONIC HEALTH RECORD (EHR) SERVICE

8.3 OPPORTUNITIES

8.3.1 GROWING EXPANSION OF TELEHEALTH IN THE U.S.

8.3.2 IMPROVED PATIENT OUTCOMES AND SELF-MANAGEMENT

8.3.3 RISING HEALTHCARE EXPENDITURE

8.4 CHALLENGES

8.4.1 SOFTWARE INCOMPATIBILITY ISSUES DUE TO VARYING DATA STANDARDS

8.4.2 REGULATORY AND LEGAL CHALLENGES

9 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 SOLUTIONS SOFTWARE

9.3 SERVICES

9.4 HARDWARE

10 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY DEPLOYMENT MODE

10.1 OVERVIEW

10.2 CLOUD BASED

10.3 ON PREMISES

11 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY MODE OF ACCESS

11.1 OVERVIEW

11.2 MOBILE BASED

11.2.1 ANDROID

11.2.2 IOS

11.3 WEB BASED

12 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY CODES

12.1 OVERVIEW

12.2 98975

12.3 98976

12.4 98977

12.5 98980

12.6 98981

13 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY TYPE

13.1 OVERVIEW

13.2 CONTINUOUS MONITORING

13.3 PROACTIVE MONITORING

13.4 INTERMITTENT MONITORING

14 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 NON PHYSIOLOGICAL DATA

14.3 THERAPEUTIC DATA

14.3.1 THERAPY ADHERENCE

14.3.2 THERAPY RESPONSE

15 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY PURCHASE MODE

15.1 OVERVIEW

15.2 GROUP PURCHASE

15.2.1 SOLUTIONS SOFTWARE

15.2.2 SERVICES

15.2.3 HARDWARE

15.3 INDIVIDUAL

15.3.1 SOLUTIONS SOFTWARE

15.3.2 SERVICES

15.3.3 HARDWARE

16 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY END USERS

16.1 OVERVIEW

16.2 PROVIDERS

16.2.1 HOME HEALTH

16.2.2 HOSPITALS

16.2.3 CLINICS

16.2.4 OTHERS

16.3 PAYERS

16.3.1 PRIVATE

16.3.2 PUBLIC

16.4 PATIENT

17 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT SALES

17.3 INDIRECT SALES

18 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: U.S.

19 COMPANY PROFILE

19.1 ZIMMER BIOMET.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 OMADA HEALTH INC.

19.2.1 COMPANY SNAPSHOT

19.2.2 PRODUCT PORTFOLIO

19.2.3 RECENT DEVELOPMENTS

19.3 HEALTHVIEWX.

19.3.1 COMPANY SNAPSHOT

19.3.2 PRODUCT PORTFOLIO

19.3.3 RECENT DEVELOPMENT

19.4 PROPELLER HEALTH.

19.4.1 COMPANY SNAPSHOT

19.4.2 PRODUCT PORTFOLIO

19.4.3 RECENT DEVELOPMENT

19.5 LIMBER HEALTH, INC.

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 RECENT DEVELOPMENTS

19.6 CENSON HEALTH

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 CIPHER SKIN INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 EXER LABS, INC

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 HEALTHARC

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 INTELLIH INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 MEDISTICS LLC.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 MEDSIEN, INC.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 MURATA VIOS.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 OWLYTICS HEALTHCARE.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 3 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY MODE OF ACCESS, 2021-2030 (USD MILLION)

TABLE 4 U.S. MOBILE BASED IN REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY MODE OF ACCESS, 2021-2030 (USD MILLION)

TABLE 5 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY CODES, 2021-2030 (USD MILLION)

TABLE 6 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 U.S. THERAPEUTIC DATA IN REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 9 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY PURCHASE MODE, 2021-2030 (USD MILLION)

TABLE 10 U.S. GROUP PURCHASE IN REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 U.S. INDIVIDUAL IN REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY END USERS, 2021-2030 (USD MILLION)

TABLE 13 U.S. PROVIDERS IN REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 U.S. PAYERS IN REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: SEGMENTATION

FIGURE 2 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: DATA TRIANGULATION

FIGURE 3 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: DROC ANALYSIS

FIGURE 4 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: SEGMENTATION

FIGURE 11 RISING TECHNOLOGICAL ADVANCEMENTS AND INTEGRATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING ARE EXPECTED TO DRIVE THE GROWTH OF THE U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET FROM 2023 TO 2030

FIGURE 12 THE SOLUTIONS SOFTWARE SEGMENT, IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET

FIGURE 14 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY PRODUCT, 2022

FIGURE 15 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 16 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY DEPLOYMENT MODE, 2022

FIGURE 19 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY DEPLOYMENT MODE, 2023-2030 (USD MILLION)

FIGURE 20 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY DEPLOYMENT MODE, CAGR (2023-2030)

FIGURE 21 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY DEPLOYMENT MODE, LIFELINE CURVE

FIGURE 22 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY MODE OF ACCESS, 2022

FIGURE 23 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY MODE OF ACCESS, 2023-2030 (USD MILLION)

FIGURE 24 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY MODE OF ACCESS, CAGR (2023-2030)

FIGURE 25 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY MODE OF ACCESS, LIFELINE CURVE

FIGURE 26 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY CODES, 2022

FIGURE 27 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY CODES, 2020-2029 (USD MILLION)

FIGURE 28 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY CODES, CAGR (2023-2030)

FIGURE 29 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY CODES, LIFELINE CURVE

FIGURE 30 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY TYPE, 2022

FIGURE 31 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 32 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 33 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 34 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY APPLICATION, 2022

FIGURE 35 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 36 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 37 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 38 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY PURCHASE MODE, 2022

FIGURE 39 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY PURCHASE MODE, 2023-2030 (USD MILLION)

FIGURE 40 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY PURCHASE MODE, CAGR (2023-2030)

FIGURE 41 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 42 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY END USERS, 2022

FIGURE 43 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY END USERS, 2023-2030 (USD MILLION)

FIGURE 44 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY END USERS, CAGR (2023-2030)

FIGURE 45 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY END USERS, LIFELINE CURVE

FIGURE 46 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 47 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 48 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 49 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 50 U.S. REMOTE THERAPEUTIC MONITORING (MSK) MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.