Market Definition and Insights

Private label products are manufactured in a unit on a contract or third-party manufacturer and sold under a retailer’s brand name or through a licensing agreement. Often, the retailer specifies everything about the private label goods, including the ingredients, packaging, and label design. The merchant is also responsible for the cost of having the product manufactured and delivered to the store. Buying products from other companies with their brand names is not part of this plan.

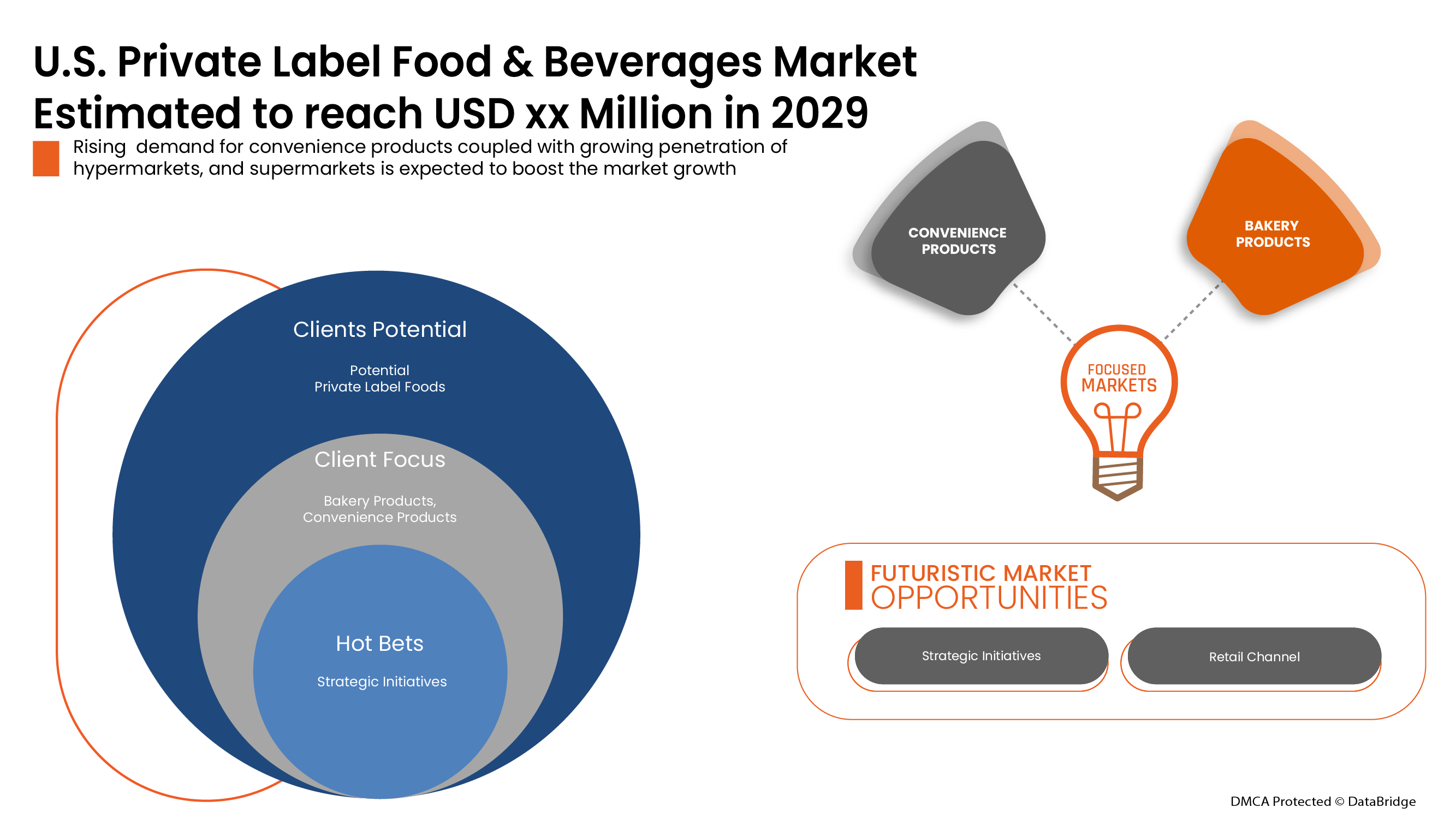

U.S. private label food and beverages market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.4% in the forecast period of 2022 to 2029 and is expected to reach USD 143,186.66 million by 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2020 |

|

Historic Years |

2019 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Category (Inorganic and Organic), Product (Private Label Food and Private Label Beverages), Distribution Channel (Store-based retailing and Non-store based retailing), |

|

Countries Covered |

U.S. |

|

Market Players Covered |

The Kroger Co., Walmart, Costco Wholesalers Corporation, Albertsons Companies, Target Brands, Inc., Amazon.com, Inc., and Others |

Private Label Food and Beverages Market Dynamics

Drivers

- Growing demand for convenience products

The rising demand for convenience products such as ready-to-eat meals, soups & sauces, seasoning & dressing, muesli& breakfast cereals, and others are increasing because of changed eating habits, lifestyles, and food preferences, especially among the young generation. The ready-to-eat food includes frozen pizza that requires almost no or little time to prepare. However, these convenience foods save time but have low nutritional value and are more expensive than traditional food.

- Rising penetration of supermarkets/hypermarkets

An increasing number of supermarkets is one of the major drivers for the private label food and beverages market. This has happened in response to several forces, many of them interconnected with rising incomes and urbanization. As the number of supermarkets increases, they tend to introduce private label food and beverages products to fulfill the food and beverages products demand in the market.

Opportunity

- Growing popularity of canned and frozen meat food

Changing lifestyle and busy schedule of individuals have surged the consumption trend towards the canned and frozen meat products. Further, the spread of COVID-19 across the world the demand for canned and frozen food increased as the consumers stockpiled their freezers with longer shelf items during the height of lockdowns.

Restraints/Challenges

- Dominance of multinational brand in the market

Consumers are vital to branded products. Well-established branded products in the market are likely to hamper the growth of private-label food and beverages products. The image of branded products plays a significant role in deciding what to pick for consumption. Major players have well-established networks of distribution and a strong product portfolio with certified quality check products compared to small private label food and beverages manufacturers. As revealed in the survey, people in the U.S., especially the millennium group, are reluctant to buy private label food and beverages because of trust and quality issues.

This U.S. private label food and beverages market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on U.S. private label food and beverages market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Post COVID-19 Impact on U.S. Private Label Food and Beverages Market

The COVID-19 pandemic has highly disrupted the supply chain of raw materials used to manufacture food and beverages products. The rising number of COVID-19 cases, especially in U.S. states, has created fear among consumers and as a result, people were reluctant to move out to buy products; during this time people are only considered about buying essential food and beverages products.

Recent Developments

- In September 2019, Kroger launched a plant-based offshoot of its Simple Truth private brand line, including meatless burgers to plant-based cookie dough. The product launch helped the company expand its private label brand in plant-based categories.

- In April 2021, Amazon.com, Inc. launched a new private label for food products under 'Aplenty'. The product's launch expanded its product portfolio in the private label food segment.

U.S. Private Label Food and Beverages Market Scope

U.S. private label food and beverages market is segmented into category, product and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Category

- Inorganic

- Organic

Based on category, the U.S. private label food and beverages market is segmented into inorganic and organic.

Product

- Private Label Food

- Private Label Beverages

Based on product, the U.S. private label food and beverages market is segmented into private label food and private label beverages.

Distribution Channel

- Store-based Retailing

- Non-Store based Retailing

Based on distribution channel, the U.S. private label food and beverages market is segmented into store-based retailing and non-store based retailing.

Competitive Landscape and U.S. Private Label Food and Beverages Market Share Analysis

U.S. private label food and beverages market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, U.S. presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the U.S. private label food and beverages market are Loblaws Inc., Sobey Inc., Metro Richelieu Inc, Walmart, Costco Wholesale Corporation, Amazon.com, Inc. and other.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, U.S. Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SHOPPING BEHAVIOR

4.2 PERCEPTION TOWARDS PRIVATE LABEL

4.3 CONSUMER DEMOGRAPHICS

4.4 REGULATORY FRAMEWORK

4.5 COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR CONVENIENCE PRODUCTS

5.1.2 RISING PENETRATION OF SUPERMARKETS/HYPERMARKETS

5.1.3 RISING DEMAND FOR BEVERAGES PRODUCTS

5.2 RESTRAINTS

5.2.1 DOMINANCE OF MULTINATIONAL BRANDS IN THE MARKET

5.2.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19

5.3 OPPORTUNITIES

5.3.1 GROWING POPULARITY OF CANNED AND FROZEN MEAT FOOD

5.3.2 IMPROVED QUALITY AND DEVELOPMENT OF PREMIUM PRIVATE LABEL BRANDS

5.4 CHALLENGE

5.4.1 STRINGENT GOVERNMENT REGULATIONS

6 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY CATEGORY

6.1 OVERVIEW

6.2 INORGANIC

6.3 ORGANIC

7 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 PRIVATE LABEL FOODS

7.2.1 CONVENIENCE PRODUCTS

7.2.1.1 MUESLI & BREAKFAST CEREALS

7.2.1.2 READY TO EAT MEALS

7.2.1.3 SOUPS & SAUCES

7.2.1.4 JAMS, PRESERVES & MARMALADE

7.2.1.5 SEASONING & DRESSING

7.2.1.6 OTHERS

7.2.2 BAKERY PRODUCTS

7.2.2.1 BREAD

7.2.2.2 DONUTS AND MUFFINS

7.2.2.3 BISCUITS AND COOKIES

7.2.2.4 CAKES & PASTRIES

7.2.2.5 OTHERS

7.2.3 MEAT & POULTRY PRODUCTS

7.2.4 DAIRY AND DAIRY ALTERNATIVE PRODUCTS

7.2.4.1 ICE-CREAM

7.2.4.2 YOGURT

7.2.4.3 FROZEN DESSERT

7.2.4.4 CHEESE

7.2.4.5 OTHERS

7.2.5 CONFECTIONERY PRODUCTS

7.2.5.1 CHOCOLATE

7.2.5.2 CANDIES

7.2.5.3 GUMMIES & MARSHMALLOWS

7.2.5.4 OTHERS

7.2.6 FRUITS AND VEGETABLES

7.2.6.1 APPLE

7.2.6.2 ORANGE

7.2.6.3 GRAPES

7.2.6.4 CAULIFLOWER

7.2.6.5 BROCCOLI

7.2.6.6 OTHERS

7.2.7 EGGS

7.2.8 NUTRITIONAL BARS

7.3 PRIVATE LABEL BEVERAGES

7.3.1 NON-ALCOHOLIC DRINKS

7.3.1.1 SOFT DRINKS

7.3.1.2 FLAVORED DRINKS

7.3.1.3 NATURAL WATER

7.3.1.4 FUNCTIONAL DRINKS

7.3.1.5 JUICES

7.3.1.6 ENERGY DRINKS

7.3.1.7 NATURAL & ORGANIC DRINKS

7.3.1.8 OTHERS

7.3.2 ALCOHOLIC DRINKS

7.3.2.1 VODKA

7.3.2.2 WHISKEY

7.3.2.3 RUM

7.3.2.4 OTHERS

8 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 STORE-BASED RETAILING

8.2.1 SUPERMARKET & HYPERMARKETS

8.2.2 FOOD & DRINKS SPECIALISTS

8.2.3 CONVENIENCE STORES

8.2.4 DEPARTMENT STORES

8.2.5 OTHERS

8.3 NON-STORE-BASED RETAILING

8.3.1 ONLINE

8.3.2 VENDING

9 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY COUNTRY

9.1 U.S.

10 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: U.S.

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 THE KROGER CO.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUS ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENTS

12.2 WALMART

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUS ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 COSTCO WHOLESALE CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUS ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 ALBERTSONS COMPANIES

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUS ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 TARGET BRAND, INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUS ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 AMAZON.COM, INC

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUS ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 JAVO BEVERAGE COMPANY, INC

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 DALMAR FOODS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 GIANT EAGLE, INC.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 GRAND RIVER FOODS LTD

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 LOBLAWS INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUS ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENT

12.12 KARLIN FOODS

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATE

12.13 SOBEYS INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 KINGMAKER FOODS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATE

12.15 METRO RICHELIEU INC

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

13 QUESTIONARE:

14 RELATED REPORTS

List of Table

TABLE 1 CONSUMER DEMOGRAPHICS IN THE U.S., 2019-2020, BY HOUSEHOLDS, IN THOUSANDS

TABLE 2 CONSUMER DEMOGRAPHICS IN THE U.S., 2019-2020, BY AGE OF HOUSEHOLDER, IN THOUSANDS

TABLE 3 CONSUMER DEMOGRAPHICS IN THE U.S., 2019-2020, BY EDUCATIONAL ATTAINMENT OF HOUSEHOLDER, IN THOUSANDS

TABLE 4 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 5 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 6 U.S. PRIVATE LABEL FOODS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY-PRODUCTS, 2020-2029 (USD MILLION)

TABLE 7 U.S. CONVENIENCE PRODUCTS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 8 U.S. BAKERY PRODUCTS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 9 U.S. DAIRY AND DAIRY ALTERNATIVE PRODUCTS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 10 U.S. CONFECTIONERY PRODUCTS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 11 U.S. FRUITS & VEGETABLES IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 12 U.S. PRIVATE LABEL BEVERAGES IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 13 U.S. NON-ALCOHOLIC DRINKS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 14 U.S. ALCOHOLIC DRINKS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 15 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 16 U.S. STORE-BASED RETAILING IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 U.S. NON-STORE-BASED RETAILING IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 18 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 20 U.S. PRIVATE LABEL FOODS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 21 U.S. BAKERY PRODUCTS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 22 U.S. FRUIT & VEGETABLES IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS 2020-2029 (USD MILLION)

TABLE 23 U.S. CONFECTIONERY PRODUCTS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 24 U.S. DAIRY AND DAIRY ALTERNATIVES PRODUCTS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 25 U.S. CONVENIENCE PRODUCTS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 26 U.S. PRIVATE LABEL BEVERAGES IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 27 U.S. NON-ALCOHOLIC DRINK IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 28 U.S. ALCOHOLIC DRINKS IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 29 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 U.S. STORE-BASED RETAILING IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 U.S. NON-STORE-BASED RETAILING IN PRIVATE LABEL FOOD AND BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: SEGMENTATION

FIGURE 2 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: DATA TRIANGULATION

FIGURE 3 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: DROC ANALYSIS

FIGURE 4 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: SEGMENTATION

FIGURE 9 GROWING DEMAND FOR CONVENIENCE PRODUCTS IS EXPECTED TO DRIVE THE U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 10 INORGANIC CATEGORY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET IN 2022 & 2029

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET

FIGURE 12 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET: BY CATEGORY, 2021

FIGURE 13 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET: BY PRODUCTS, 2021

FIGURE 14 U.S. PRIVATE LABEL FOOD AND BEVERAGES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 15 U.S. PRIVATE LABEL FOOD AND BEVERAGE MARKET: COMPANY SHARE 2021 (%)

Us Private Label Food And Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Private Label Food And Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Private Label Food And Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.