Us Playground Artificial Turf Market

Market Size in USD Thousand

CAGR :

%

USD

210,583.15 Thousand

USD

704,546.46 Thousand

2022

2030

USD

210,583.15 Thousand

USD

704,546.46 Thousand

2022

2030

| 2023 –2030 | |

| USD 210,583.15 Thousand | |

| USD 704,546.46 Thousand | |

|

|

|

U.S. Playground Artificial Turf Market Analysis and Size

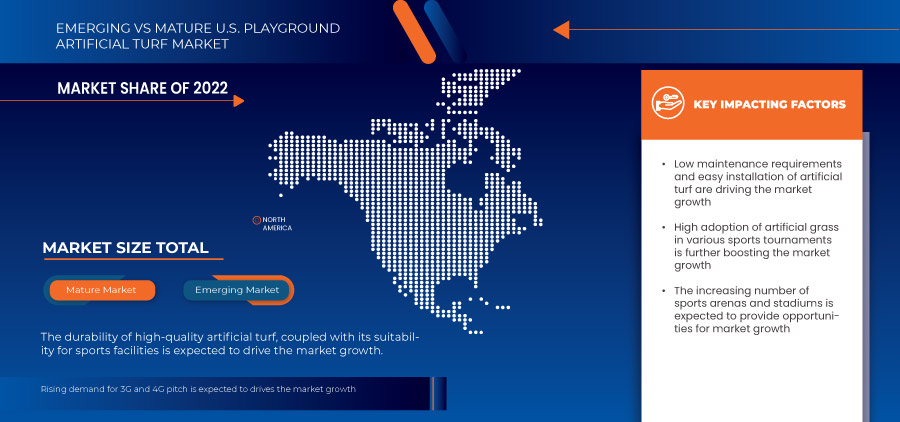

Low maintenance requirements and easy installation of artificial turf are some of the important factors driving the growth of the U.S. playground artificial turf market. Moreover, increasing emphasis on water conservation is expected to boost market growth. However, difficulty in maintaining a high field temperature is expected to challenge market growth.

Data Bridge Market Research analyzes that the U.S. playground artificial turf market is expected to reach USD 704,546.46 thousand by 2030 from USD 210,583.15 thousand in 2022, at a CAGR of 16.4% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Material (Nylon, Polypropylene, Polyethylene, Jute, Rubber, and Others), Infill Materials (Petroleum Based, Organic Infill, Sand (Silica) Infill, and Others), Pile Height (Less than 10 mm, 10-30 mm, 30-50 mm, 50-70 mm, 70-100 mm, and More than 100 mm), Distribution Channel (Store Based Retailers and Non-Store Retailers), Colour (Green, Navy Blue, White, Red, Yellow, and Others), Price Range (Classic, Premium, and Luxury), End-User (Soccer Field, Residential Play Areas, School Playground, Public Playground, Stadium, Daycare Centers, Jogging Tracks, and Others) |

|

Country Covered |

U.S. |

|

Market Players Covered |

The Recreational Group, TargetMarket, MegaGrass, ForeverLawn, Global Syn-Turf Inc., GreenFields bv., Sprinturf, Sport Group, Act Global, Synlawn, Matrix Turf, Practice Sports, Inc., Shawgrass, SpectraTurf (subsidiary of Ecore International), TurfHub, Tarkett and among others |

Market Definition

The U.S. playground artificial turf market specializes in providing synthetic grass surfaces tailored specifically for recreational and play areas. It encompasses the manufacturing, supplying, and installation of child-friendly, durable synthetic turf designed for safety and comfort. It caters to public parks, schools, daycare centers, and residential playgrounds, offering impact-absorbing surfaces, often incorporating foam underlays or cushioning to reduce injuries. It includes various types of artificial turf tailored for specific playground needs, considering factors such as safety standards, vibrant aesthetics, and easy maintenance. The market continuously adapts to evolving safety norms and design preferences for diverse play environments across the industry.

Playground artificial turf is widely used for recreational purposes. In the U.S., artificial turf is more popular than natural grass on the football field of school playgrounds. This is used for many sports facilities, such as bowling, soccer, and baseball field frames.

U.S. Playground Artificial Turf Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Low Maintenance Requirements and Easy Installation of Artificial Turf

The artificial turf offers the dual benefits of low maintenance and easy installation. Its minimal maintenance requirements mean no mowing, watering, fertilizing, or pest control, saving time and resources. Unlike natural grass, artificial turf maintains a consistent appearance throughout the year, reducing the need for ongoing care.

Artificial turf is widely known for its straightforward installation process. It typically involves site preparation, base installation, securing the turf, adding infill material, and some finishing touches. The installation can be completed relatively quickly, making it an efficient choice for various applications, from residential lawns to sports fields. Its ease of installation, coupled with the low maintenance demands, makes artificial turf a convenient and cost-effective landscaping solution, suitable for regions with water restrictions or those looking to reduce environmental impact while maintaining a green and vibrant appearance.

- Increasing Emphasis on Water Conservation

Water conservation is a critical concern in many parts of the U.S., particularly in regions that frequently face water scarcity and drought conditions. One of the most significant advantages of artificial turf is that it does not require regular irrigation. Natural grass lawns demand a substantial amount of water to stay healthy and maintain their lush appearance. In contrast, artificial turf maintains its vibrant, green look without the need for daily watering, making it an ideal choice in regions where water conservation is a priority. In times of drought or water conservation measures, natural grass lawns are susceptible to water shortages, leading to browning or even death. Conversely, artificial turf remains impervious to water scarcity, retaining both its aesthetic appeal and functionality. This resilience to drought conditions makes it a dependable landscaping solution for regions prone to water shortages.

Opportunities

- Increasing Number of Sports Arena and Stadiums

The sports industry is thriving, encompassing professional leagues, college sports, and amateur competitions. The demand for venues to host these events has led to the construction of new stadiums and the renovation of existing ones. Sports events have a significant economic impact on cities and regions, generating revenue from ticket sales, concessions, and tourism. This economic boost incentivizes the construction of modern sports facilities. The market for playground artificial turf experiences increased exposure and growth as more sports arenas and stadiums opt for artificial turf surfaces. These high-profile installations serve as showcases for the benefits and quality of artificial turf, encouraging adoption in other sports and recreational facilities.

This trend fosters innovation, promoting the development of advanced, eco-friendly products while stimulating growth in maintenance services and local sports facility installations. Moreover, the economic impact on the construction and upkeep of sports facilities broader artificial turf market, ultimately providing a positive opportunity in the market. The proliferation of sports arenas and stadiums in the U.S. presents a lucrative opportunity for market growth.

- Rising Demand for 3G and 4G Pitch

Technological advancements are reshaping the landscape of artificial turf in the U.S. sports industry, offering improved performance, safety, and customization while enhancing the overall experience for athletes, fans, and venue operators. The market for 3D and 4D pitch systems is expected to continue evolving as new innovations and applications emerge.

A sports pitch equipped with third-generation artificial turf technology, often referred to as a 3G pitch, stands out due to its longer synthetic grass, typically ranging from 40 mm to 60 mm. This extended turf length surpasses the older second-generation (2G) pitches. An essential feature of 3G pitches is the infill material, which plays a vital role in maintaining the vertical position of the turf fibers. This infill also serves as a cushion during gameplay, enhancing safety for athletes. Primarily designed for sports such as football and rugby, 3G pitches have seen significant advancements over the years. The state-of-the-art woven systems are at the forefront of this revolution in 3G sports turf technology, surpassing the limitations of traditional tufting techniques. These innovations are not only improving the overall performance and durability of 3G pitches but are also pushing the boundaries of what was previously achievable. This next-generation technology ensures a more realistic and safe playing surface for athletes and is redefining the standards for synthetic sports turf.

Restraint

- Environmental Concerns Regarding the Usage of Artificial Turf

The artificial turf, while providing numerous benefits such as low maintenance and consistent play surfaces, also raises environmental issues, particularly in playgrounds where children's health and safety are paramount. There are concerns about the materials used in artificial turf. Many artificial turf systems incorporate synthetic materials such as polyethylene and polypropylene, which are derived from non-renewable resources and have a notable carbon footprint. The production and disposal of such materials contribute to environmental degradation. Furthermore, the manufacturing process of artificial turf involves energy-intensive procedures, adding to its overall environmental impact. These environmental concerns are heightened in the context of increasing awareness about climate change and sustainability. In addition, the disposal of artificial turf at the end of its lifecycle poses environmental challenges. Artificial turf has a limited lifespan, and when it needs replacement, the disposal of old turf can be problematic. The majority of artificial turf systems are not biodegradable and can end up in landfills, where they do not decompose easily. This not only occupies valuable landfill space but also raises questions about the potential release of hazardous materials over time, which can contaminate groundwater.

Challenge

- Difficulty in Maintaining a High Field Temperature

The artificial turf fields endanger the safety of athletes, the climate, and the budgets of the city. Artificial turf players face risks inherent in this commodity for their safety. Artificial fields of turf are extremely dry, triggering skin loss and warming. The industry has struggled to make them better following a decade of study. Artificial turf is more frequently affected by the toughness of its fabric relative to natural grasses (including ACL tears). It matches sometimes expose themselves to poisonous dust and gasses and heat up the temperature around them.

Artificial turf poses risks to athletes, the climate, and city budgets. It is extremely dry, causing skin loss and warming. The industry struggles to improve them, and they emit Volatile Organic Compounds (VOCs) such as benzothiazole and n-hexadane, particularly at high temperatures. Its particulate matter includes silica, black carbon, plum, arsenic, cadmium, chromium, and other heavy metals, which causes difficulty in maintaining high field temperature, and this can result in skin injuries, burns, and heat exhaustion on direct contact with the turf surface. Therefore, the difficulty in maintaining a high field temperature is expected to pose a challenge to market growth.

Recent Developments

- In April 2023, Tarkett signed a collaboration with Trinity University, U.S., to install the new surfaces for its baseball, softball, and practice football fields. This collaboration helped the company generate huge revenue.

- In April 2020, SYNLAWN, the largest manufacturer and unrivaled innovator of artificial grass in North America, announced that its distributors across the country are offering ProGienics Hard Surface Disinfectant by ProVetLogic. This one-step product is quick and efficient for the battle against the current human coronavirus COVID-19 in 2019 and against certain pathogens, algae, mildew, algae, germs and toxic bacteria. Its disinfectant should be used on commercially and domestically-produced artificial turf. It purifies and disinfects hard, porous surfaces used in classrooms, playgrounds, and livestock fields. This product launch helped the company increase its scope in the market.

- In February 2020, Act Global partnered with West Orange-Stark School. They are committed to bringing the game of baseball to as many people as possible while keeping player safety at the forefront.

- In August 2019, SpectraTurf (a subsidiary of Ecore International) received the Public/Open Space Technology Award of the Westside Community Forum in 2019; situated only North of the Santa Monica Pier, this coastal park is available to young people of all ages and skills. This award helped the company to gain more recognition in the market.

- In August 2019, SYNLAWN announced a new distributor relationship in Sacramento, California. SYNLAWN is the largest artificial grass supplier in the nation. Sacramento's latest agreement includes a constant extension of SYNLawn's home lawn services, business zones, public dog parks, school playgrounds, design lawns and roof decks. The company offered customers high-quality premium turf products and service installations for all synthetic grazing requirements.

U.S. Playground Artificial Turf Market Scope

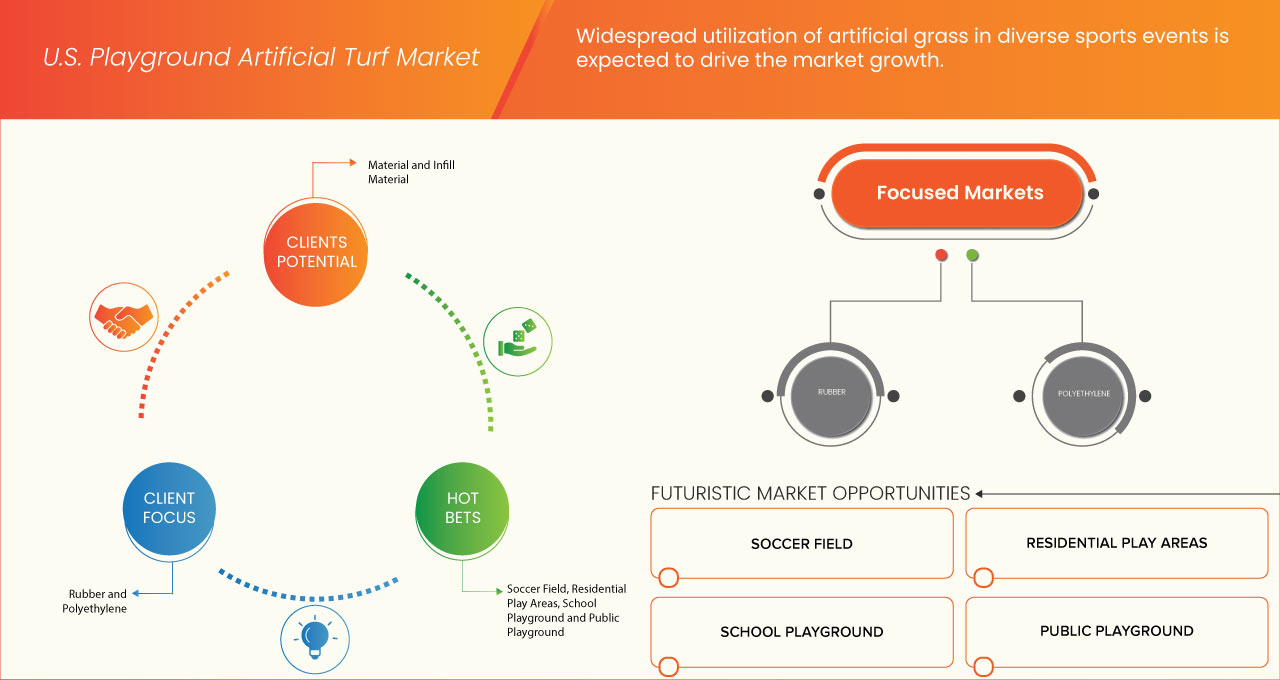

The U.S. playground artificial turf market is segmented into seven notable segments based on material, infill material, pile height, distribution channel, colour, price range, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Nylon

- Polypropylene

- Polyethylene

- Jute

- Rubber

- Others

On the basis of material, the market is segmented into nylon, polypropylene, polyethylene, jute, rubber, and others.

Infill Materials

- Petroleum-Based

- Organic Infill

- Sand (Silica) Infill

- Others

On the basis of infill material, the market is segmented into petroleum-based, organic infill, sand (silica) infill, and others.

Pile Height

- Less than 10 MM

- 10-30 MM

- 30-50 MM

- 50-70 MM

- 70-100 MM

- More than 100 MM

On the basis of pile height, the market is segmented into less than 10 mm, 10-30 mm, 30-50 mm, 50-70 mm, 70-100 mm, and more than 100 mm.

Distribution Channel

- Store Based Retailers

- Non-Store Retailers

On the basis of distribution channel, the market is segmented into store based retailer and non-store retailers.

Colour

- Green

- Navy Blue

- White

- Red

- Yellow

- Others

On the basis of colour, the market is segmented into green, navy blue, white, red, yellow, and others.

Price Range

- Classic

- Premium

- Luxury

On the basis of price range, the market is segmented into classic, premium, and luxury.

End-User

- Soccer Field

- Residential Play Areas

- School Playground

- Public Playground

- Stadium

- Daycare Centers

- Jogging Tracks

- Others

On the basis of end-user, the market is segmented into soccer field, residential play areas, school playground, public playground, stadium, daycare centers, jogging tracks, and others.

Competitive Landscape and U.S. Playground Artificial Turf Market Share Analysis

The U.S. playground artificial turf market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the U.S. playground artificial turf market are The Recreational Group, TargetMarket, MegaGrass, ForeverLawn, Global Syn-Turf Inc., GreenFields bv., Sprinturf, Sport Group, Act Global, Synlawn, Matrix Turf, Practice Sports, Inc., Shawgrass, SpectraTurf (subsidiary of Ecore International), TurfHub, Tarkett and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. PLAYGROUND ARTIFICIAL TURF MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 LOW MAINTENANCE REQUIREMENTS AND EASY INSTALLATION OF ARTIFICIAL TURF

5.1.2 INCREASING EMPHASIS ON WATER CONSERVATION

5.1.3 ROBUSTNESS OF PREMIUM ARTIFICIAL TURF ALONG WITH ITS APPROPRIATENESS FOR SPORTS VENUES

5.1.4 WIDESPREAD UTILIZATION OF ARTIFICIAL GRASS IN DIVERSE SPORTS EVENTS

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL CONCERNS REGARDING USAGE OF ARTIFICIAL TURF

5.2.2 U.S. STANDARDS AND REGULATIONS REGARDING THE USAGE OF ARTIFICIAL TURF

5.3 OPPORTUNITIES

5.3.1 INCREASING NUMBER OF SPORTS ARENA AND STADIUMS

5.3.2 RISING DEMAND FOR 3G AND 4G PITCH

5.4 CHALLENGES

5.4.1 DIFFICULTY IN MAINTAINING A HIGH FIELD TEMPERATURE

5.4.2 INJURY ASSOCIATED WITH ARTIFICIAL TURFS

6 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 POLYETHYLENE

6.3 POLYPROPYLENE

6.4 NYLON

6.5 RUBBER

6.6 JUTE

6.7 OTHERS

7 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY INFILL MATERIALS

7.1 OVERVIEW

7.2 PETROLEUM BASED

7.2.1 CRUMB RUBBER

7.2.2 COATED RUBBER INFILL

7.2.3 EPDM (ETHYLENE PROPYLENE DIENE MONOMER) INFILL

7.2.4 TPE (THERMO PLASTIC ELASTOMER) INFILL

7.2.5 COATED SILICA SAND INFILL

7.3 SAND (SILICA) INFILL

7.4 ORGANIC INFILL

7.5 OTHERS

8 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY PILE HEIGHT

8.1 OVERVIEW

8.2 10-30 MM

8.3 30-50 MM

8.4 50-70 MM

8.5 LESS THAN 10 MM

8.6 70-100 MM

8.7 MORE THAN 100 MM

9 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 STORE BASED RETAILERS

9.2.1 SPECIALTY STORES

9.2.2 DISCOUNTED STORES

9.2.3 OTHERS

9.3 NON-STORE BASED RETAILERS

9.3.1 E-COMMERCE PORTALS

9.3.2 COMPANY OWNED WEBSITES

10 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY COLOR

10.1 OVERVIEW

10.2 GREEN

10.3 NAVY BLUE

10.4 WHITE

10.5 RED

10.6 YELLOW

10.7 OTHERS

11 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY PRICE RANGE

11.1 OVERVIEW

11.2 CLASSIC

11.3 PREMIUM

11.4 LUXURY

12 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY END-USER

12.1 OVERVIEW

12.2 SOCCER FIELD

12.2.1 POLYETHYLENE

12.2.2 POLYPROPYLENE

12.2.3 NYLON

12.2.4 RUBBER

12.2.5 JUTE

12.2.6 OTHERS

12.3 RESIDENTIAL PLAY AREAS

12.3.1 POLYETHYLENE

12.3.2 POLYPROPYLENE

12.3.3 NYLON

12.3.4 RUBBER

12.3.5 JUTE

12.3.6 OTHERS

12.4 SCHOOL PLAYGROUND

12.4.1 POLYETHYLENE

12.4.2 POLYPROPYLENE

12.4.3 NYLON

12.4.4 RUBBER

12.4.5 JUTE

12.4.6 OTHERS

12.5 PUBLIC PLAYGROUND

12.5.1 POLYETHYLENE

12.5.2 POLYPROPYLENE

12.5.3 NYLON

12.5.4 RUBBER

12.5.5 JUTE

12.5.6 OTHERS

12.6 STADIUM

12.6.1 POLYETHYLENE

12.6.2 POLYPROPYLENE

12.6.3 NYLON

12.6.4 RUBBER

12.6.5 JUTE

12.6.6 OTHERS

12.7 DAYCARE CENTERS

12.7.1 POLYETHYLENE

12.7.2 POLYPROPYLENE

12.7.3 NYLON

12.7.4 RUBBER

12.7.5 JUTE

12.7.6 OTHERS

12.8 JOGGING TRACKS

12.8.1 POLYETHYLENE

12.8.2 POLYPROPYLENE

12.8.3 NYLON

12.8.4 RUBBER

12.8.5 JUTE

12.8.6 OTHERS

12.9 OTHERS

12.9.1 POLYETHYLENE

12.9.2 POLYPROPYLENE

12.9.3 NYLON

12.9.4 RUBBER

12.9.5 JUTE

12.9.6 OTHERS

13 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TARKETT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 SYNLAWN

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENTS

15.3 GREENFIELDS BV.

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 FOREVERLAWN

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 ACT GLOBAL

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 GLOBAL SYN-TURF INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 MATRIX TURF

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 MEGAGRASS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 PRACTICE SPORTS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 SHAWGRASS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 SPECTRATURF (SUBSIDIARY OF ECORE INTERNATIONAL)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 SPORT GROUP HOLDING GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 SPRINTURF

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 TARGETMARKET

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 THE RECREATIONAL GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 TURFHUB

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 THE BASIC DIFFERENCE BETWEEN 3G AND 4G PITCHES IS MENTIONED BELOW:

TABLE 2 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 3 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY INFILL MATERIALS, 2021-2030 (USD THOUSAND)

TABLE 4 U.S. PETROLEUM BASED IN PLAYGROUND ARTIFICIAL TURF MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY PILE HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 6 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 7 U.S. STORE BASED RETAILERS IN PLAYGROUND ARTIFICIAL TURF MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 U.S. NON-STORE BASED RETAILERS IN PLAYGROUND ARTIFICIAL TURF MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY COLOUR, 2021-2030 (USD THOUSAND)

TABLE 10 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY PRICE RANGE, 2021-2030 (USD THOUSAND)

TABLE 11 U.S. PLAYGROUND ARTIFICIAL TURF MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 12 U.S. SOCCER FIELD IN PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 13 U.S. RESIDENTIAL PLAY AREAS IN PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 14 U.S. SCHOOL PLAYGROUND IN PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 15 U.S. PUBLIC PLAYGROUND IN PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 16 U.S. STADIUM IN PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. DAYCARE CENTERS IN PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 18 U.S. JOGGING TRACKS IN PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. OTHERS IN PLAYGROUND ARTIFICIAL TURF MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: SEGMENTATION

FIGURE 2 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: DATA TRIANGULATION

FIGURE 3 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: DROC ANALYSIS

FIGURE 4 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: COUNTRY VS REGIONAL ANALYSIS

FIGURE 5 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MULTIVARIATE MODELLING FOR THE U.S. PLAYGROUND ARTIFICIAL TURF MARKET

FIGURE 7 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 U.S PLAYGROUND ARTIFICIAL TURF MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: SEGMENTATION

FIGURE 12 EASY INSTALLATION, ENVIRONMENT-FRIENDLY, AND LOW MAINTENANCE REQUIREMENTS ARE DRIVERS OF THE U.S. PLAYGROUND ARTIFICIAL TURF MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 POLYETHYLENE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. PLAYGROUND ARTIFICIAL TURF MARKET IN 2023 TO 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. PLAYGROUND ARTIFICIAL TURF MARKET

FIGURE 15 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: BY MATERIAL, 2022

FIGURE 16 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: BY INFILL MATERIALS, 2022

FIGURE 17 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: BY PILE HEIGHT, 2022

FIGURE 18 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 19 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: BY COLOUR, 2022

FIGURE 20 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: BY PRICE RANGE, 2022

FIGURE 21 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: BY END-USER, 2022

FIGURE 22 U.S. PLAYGROUND ARTIFICIAL TURF MARKET: COMPANY SHARE 2022 (%)

Us Playground Artificial Turf Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Playground Artificial Turf Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Playground Artificial Turf Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.