U.S. Market Analysis and Insights

Microbiota means the microbial taxa associated with humans and microbiome means "the catalog of these microbes and their genes. The aggregation of all the microbiota reside on or within human tissues and bio fluids along with the corresponding anatomical sites in which they reside, including the skin, mammary glands, seminal fluid, uterus, ovarian follicles, lung, saliva, oral mucosa, conjunctiva, biliary tract and others. The human microbiota consists of the 10-100 trillion symbiotic microbial cells harbored by each person, primarily bacteria in the gut. The human microbiome consists of the genes these cells harbor.

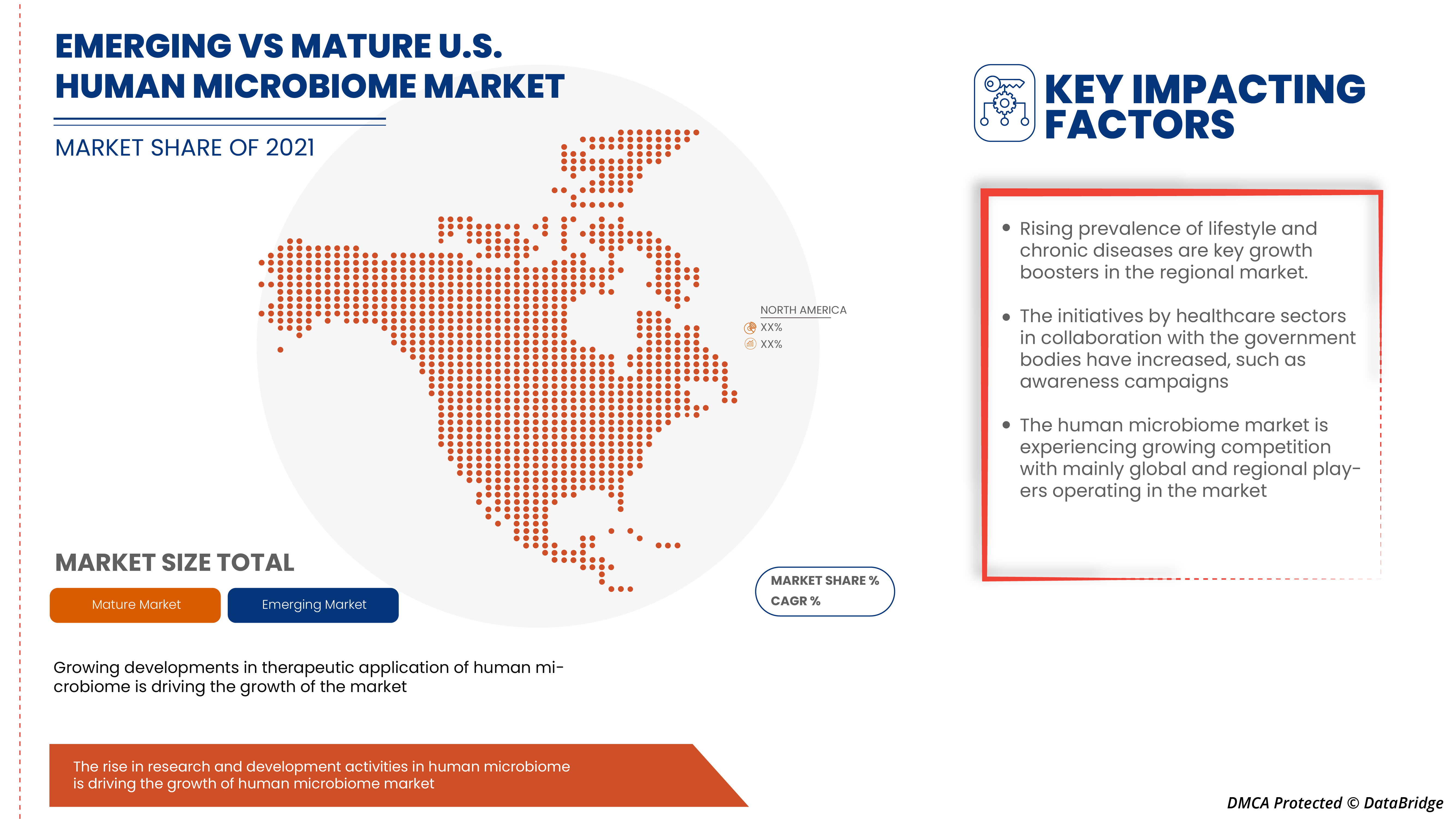

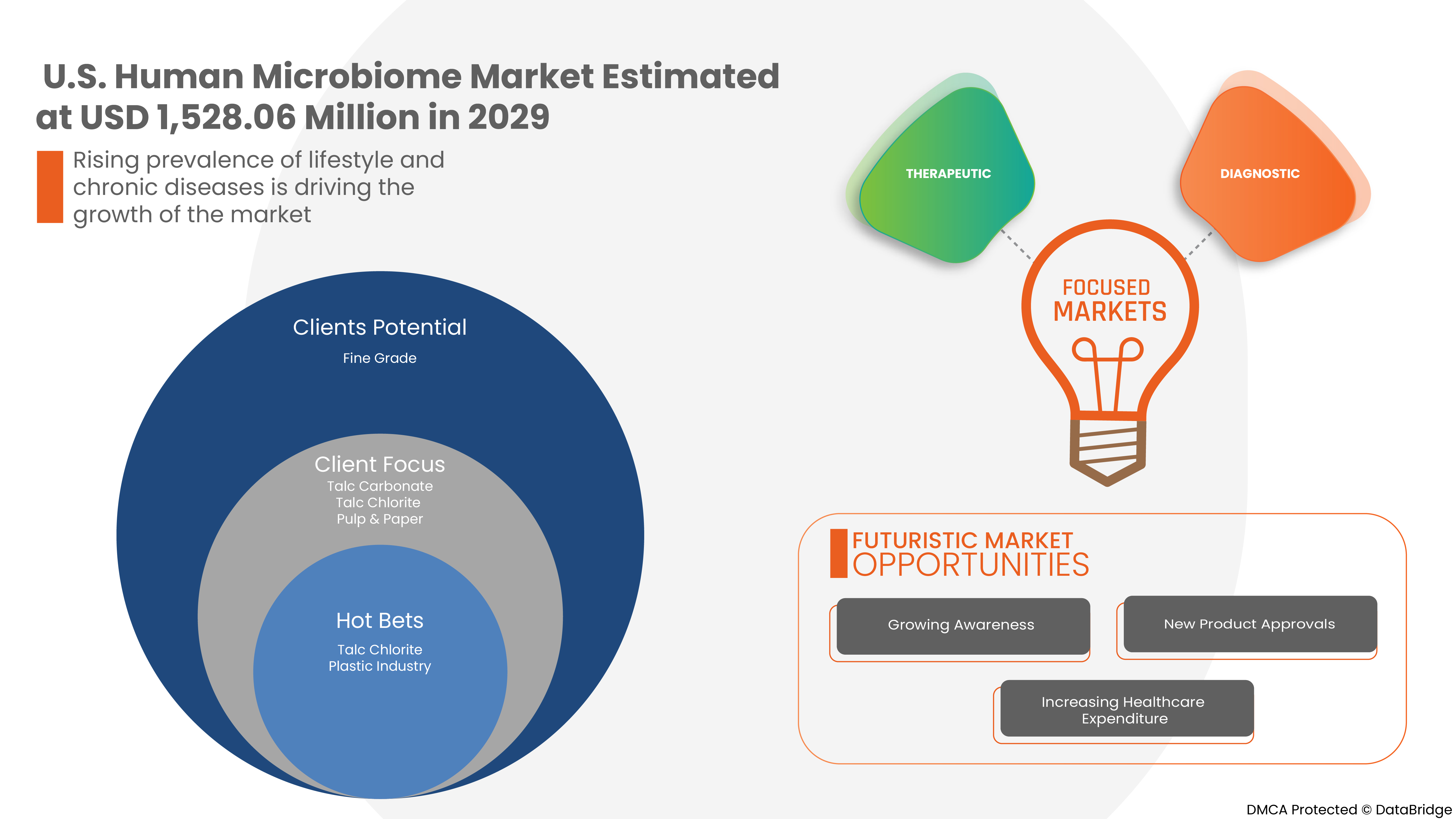

U.S. human microbiome market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 23.9% in the forecast period of 2022 to 2029 and is expected to reach USD 1,528.06 million by 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

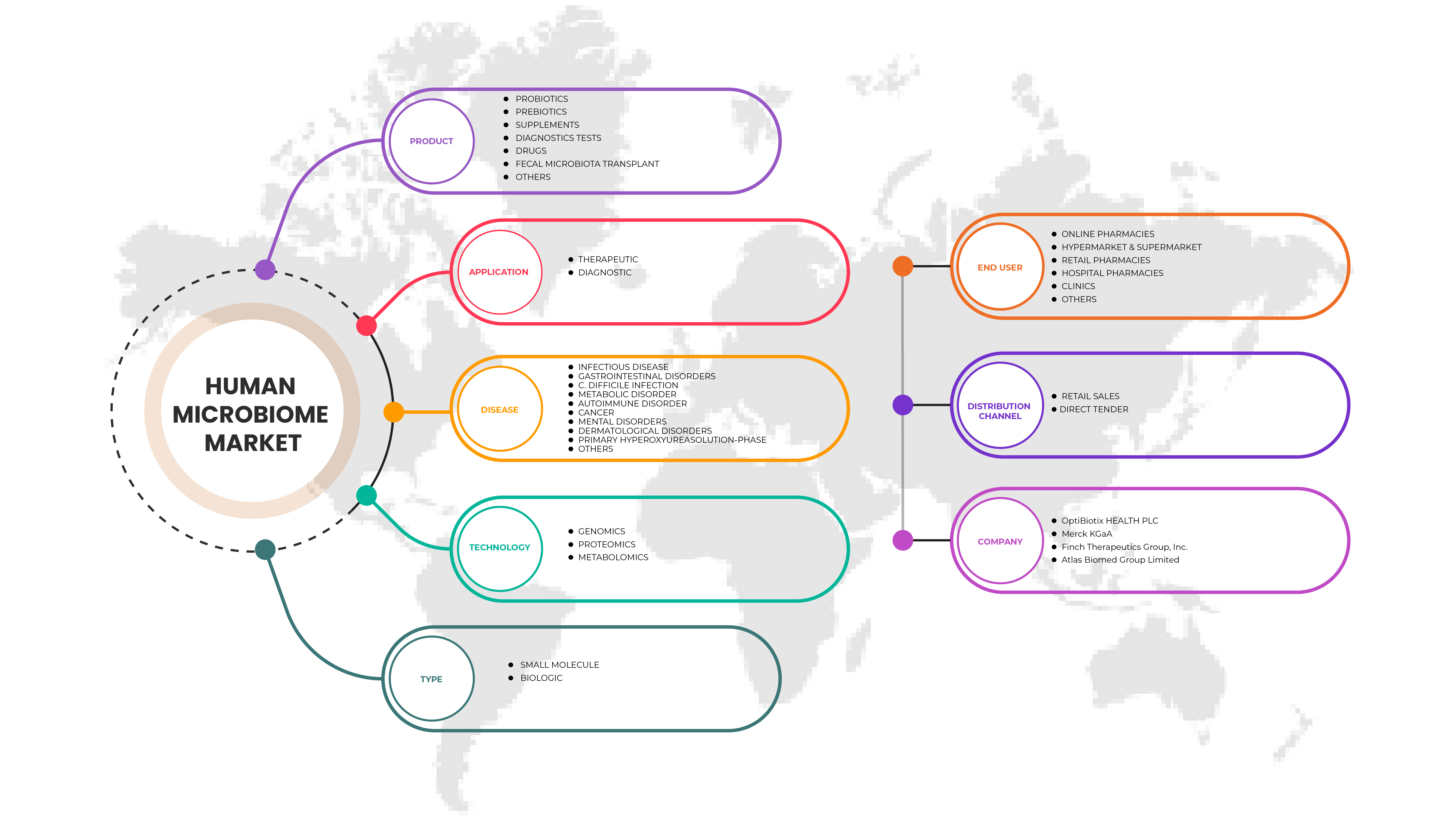

By Product (Probiotics, Prebiotics, Diagnostic Tests, Drugs, Supplements, Fecal Microbiota Transplant, and Others), Application (Therapeutic and Diagnostic), Disease (Infectious Disease, Dermatological Disorders, Autoimmune Disorder, Metabolic Disorder, Gastrointestinal Disorders, Cancer, Mental Disorders, C. Difficile Infection, Primary Hyperoxyureasolution-Phase and Others), Technology (Genomics, Proteomics and Metabolomics), Type (Small Molecule and Biologic), End User (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Hypermarket/Supermarket, Clinics and Others), Distributor (Direct Tender and Retail Sales) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

The major companies which are dealing in the market are 4D pharma plc, Evelo Biosciences, Inc., Viome Life Sciences, Inc., Finch Therapeutics Group, Inc., OptiBiotix HEALTH PLC, BiomX, Sun Genomics, Metabiomics, Osel Inc, Ferring B.V., Merck KGaA, Assembly Biosciences, Inc., Synthetic Biologics, Inc., FlightPath Biosciences, Inc., Vedanta Biosciences, Inc. and Second Genome among others |

Market Definition

Microbiome is the genetic material of all the microbes - bacteria, fungi, protozoa and viruses - that live on and inside the human body. The number of genes in all the microbes in one person's microbiome is 200 times the number of genes in the human genome. The most widely used method of identification of microbiome analysis is 16s rRNA sequencing. Identification and understanding of these microbiotas have led to the application of these microorganisms in the betterment of human health via various products such as probiotics, prebiotics and other associated drugs.

U.S. Human Microbiome Market Dynamics

Drivers

-

Rising prevalence of lifestyle and chronic diseases

Due to global rise of chronic diseases, there is an increase in the demand for effective treatment products which will increase in upcoming years. Therefore, rising incidences are expected to act as a driver for the growth of the market.

-

Increasing technological advancements in metagenomics and next-generation sequencing

Metagenomics is a novel methodology for studying microorganisms obtained from specific environments through functional gene screening. It is focused on microbial diversity, genetic relationships, functional activities and relationships with the environment, whereas sequencing technology is used for the diagnosis or the treatment of disease evolved from shot-gun sequencing, high-throughput, next-generation sequencing and third-generation sequencing. Next generation and third generation sequencing shows the advantage of rapid detection of microorganisms.

Furthermore, improved technology advancement, rising initiatives by public and private organizations to spread awareness and growing government funding are the factors that will drive the growth of the market.

So due to increase in technology advancement in sequencing it will drive the market.

Opportunities

-

Rise in healthcare expenditure

Products associated with the human microbiome, such as probiotics, prebiotics, drugs and supplements, are costly. A normal low-income and middle-income family cannot adequately treat gut-related diseases properly. The government is focusing on increasing healthcare expenditure to access available treatments and new products.

Also, the strategic initiatives by key players and rise in healthcare expenditure will provide structural integrity and future opportunities for the market in the forecast period of 2022-2029.

Restraints/Challenges

- Lack of skilled professionals

However, lack of technology expertise and barriers proving the causal link between dysbiosis and diseases will impede the growth rate of Human Microbiome Market. Additionally, difficulty in specific identification and stringent rules and regulations will further challenge the market in the forecast period mentioned above.

Post COVID-19 Impact on U.S. Human Microbiome Market

COVID-19 has negatively affected the market. Lockdowns and isolation during pandemics complicate the disease management and medication adherence. The lack of access to healthcare facilities for routine treatment and medication administration will further affect the market. Social isolation increases stress, despair and social support, all of which may cause a reduction in medication adherence during the pandemic.

Recent Development

- In March 2020, Optibiotix Health PLC had done LPLDL human intervention study from ProBiotix Health which highlighted promising findings on cholesterol reduction

The U.S. Human Microbiome Market Scope

The U.S. human microbiome market is segmented into product, application, technology, type, disease, end users and distributors. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Probiotics

- Prebiotics

- Diagnostic Tests

- Drugs

- Supplements

- Fecal Microbiota Transplant

- Others

On the basis of product, the market is segmented into probiotics, prebiotics, diagnostic tests, drugs, supplements, fecal microbiota transplant and others.

Application

- Therapeutic

- Diagnostic

On the basis of application, the market is segmented into therapeutic and diagnostic.

Disease

- Infectious Disease

- Dermatological Disorders

- Autoimmune Disorder

- Metabolic Disorder

- Gastrointestinal Disorders

- Cancer

- Mental Disorders

- C. Difficile Infection

- Primary Hyperoxyureasolution-Phase

- Others

On the basis of disease, the market is segmented into infectious disease, dermatological disorders, autoimmune disorder, metabolic disorder, gastrointestinal disorders, cancer, mental disorders, C. difficile infection, primary hyperoxyureasolution-phase and others.

Technology

- Genomics

- Proteomics

- Metabolomics

On the basis of technology, the market is segmented into genomics, proteomics and metabolomics.

Type

- Small Molecule

- Biologic

On the basis of type, the market is segmented into small molecule and biologic.

End User

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Hypermarket/Supermarket

- Clinics

- Others

On the basis of end user, the market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, hypermarket/supermarket, clinics and others

Distributor

-

Direct Tender

-

Retail Sales

On the basis of distributor, the market is segmented into direct tender and retail sales.

U.S. Human Microbiome Market Regional Analysis/Insights

The U.S. human microbiome market is analyzed and market size insights and trends are provided by product, application, disease, technology, type, end users and distributor as referenced above.

The country covered in the U.S. human microbiome market report is the U.S.

U.S. human microbiome market is dominating due to the increasing healthcare expenditure in the U.S.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Human Microbiome Market Share Analysis

The U.S. human microbiome market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the U.S. market are 4D pharma plc, Evelo Biosciences, Inc., Viome Life Sciences, Inc., Finch Therapeutics Group, Inc., OptiBiotix HEALTH PLC, BiomX, Sun Genomics, Metabiomics, Osel Inc., Ferring B.V., Merck KGaA, Assembly Biosciences, Inc., Synthetic Biologics, Inc., FlightPath Biosciences, Inc., Vedanta Biosciences, Inc. and Second Genome among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, U.S. Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. HUMAN MICROBIOME MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 GLOBAL HUMAN MICROBIOME MARKET ANALYSIS

4.4 GUT MICROBIOME AND DIAGNOSTIC

5 EPIDEMIOLOGY

5.1 EPIDEMIOLOGY CANCER

5.2 EPIDEMIOLOGY DERMATOLOGICAL DISORDERS

5.3 EPIDEMIOLOGY GASTRIC DISORDERS

5.4 EPIDEMIOLOGY IMMUNE DISORDERS

5.5 EPIDEMIOLOGY METABOLIC DISORDERS

6 INDUSTRY INSIGHTS

6.1 DEMOGRAPHIC TRENDS

6.2 KEY PRICING STRATEGIES

7 INDUSTRY INSIGHT

7.1 PATENT ANALYSIS

7.2 PATENT FLOW DIAGRAM

8 REGULATORY FRAMEWORKS

8.1 UNITED STATES

8.2 EUROPE

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISING PREVALENCE OF LIFESTYLE AND CHRONIC DISEASES

9.1.2 HUMAN MICROBIOME THERAPEUTIC DEVELOPMENT FOR DISEASE TREATMENT

9.1.3 INCREASING TECHNOLOGICAL ADVANCEMENTS IN METAGENOMICS AND NEXT-GENERATION SEQUENCING

9.2 RESTRAINTS

9.2.1 BARRIERS PROVING THE CAUSAL LINK BETWEEN DYSBIOSIS AND DISEASES

9.2.2 LACK OF TECHNOLOGY EXPERTISE

9.3 OPPORTUNITIES

9.3.1 RISE IN HEALTHCARE EXPENDITURE

9.3.2 INCREASING RESEARCH AND DEVELOPMENT

9.4 CHALLENGE

9.4.1 RISK ASSOCIATED WITH HUMAN MICROBIOME PRODUCTS

10 U.S. HUMAN MICROBIOME MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 PROBIOTICS

10.2.1 BRANDED

10.2.1.1 OPTIPAC-PREBIOTICS FIBRE

10.2.1.2 ENZYMEDICA-PREBIOTICS DRINK MIX

10.2.1.3 SWEETBIOTIX

10.2.1.4 OTHERS

10.2.2 GENERICS

10.3 PREBIOTICS

10.3.1 BRANDED

10.3.1.1 BIOM PROBIOTIC

10.3.1.2 BIOM D FEND

10.3.1.3 FLORE GUT MICROBIOME TEST

10.3.1.4 REVITIFY

10.3.1.5 SYMBIOTIC YOGURT

10.3.1.6 SYMBIOTIC

10.3.1.7 LPLDL

10.3.1.8 LPGOS

10.3.1.9 OTHERS

10.3.2 GENERICS

10.4 SUPPLEMENTS

10.4.1 CHOLBIOME

10.4.2 LPGOS

10.4.3 WELL BIOME

10.4.4 FLORE BOOM

10.4.5 FLORE DEFENCE

10.4.6 FLORE BALANCE

10.4.7 BIOM

10.4.8 REVITIFY

10.4.9 FLORE

10.4.10 BIOM D FEND

10.4.11 SLIM BIOME

10.4.12 OTHERS

10.5 DIAGNOSTICS TESTS

10.5.1 FLORE GUT MICROBIOME TEST

10.5.2 FLORE 360

10.5.3 BIOME MICROBIOME TEST

10.5.4 SUPER GUT MICROBIOME HEALTH TEST

10.5.5 HEALTH INTELLIGENCE TEST

10.5.6 GUT INTELLIGENCE TEST

10.5.7 X MARKER

10.5.8 ATLAS MICROBIOME TEST

10.5.9 1TEST 1

10.5.10 LIFE KIT

10.5.11 FOR A

10.5.12 OTHERS

10.6 DRUGS

10.6.1 OXABACT

10.6.2 SINTAX

10.6.3 SYNBIOTIC YOGURT

10.6.4 SYNBIOTIC 7

10.6.5 MICRORX

10.6.6 SLIM BIOME

10.6.7 SLIM BIOME MEDICAL

10.6.8 LPLDL

10.6.9 CHOLBIOME

10.6.10 OTHERS

10.7 FECAL MICROBIOTA TRANSPLANT

10.8 OTHERS

11 U.S. HUMAN MICROBIOME MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 THERAPEUTIC

11.2.1 SINGLE STRAIN OR MULTI-STRAIN CONSORTIA

11.2.2 LIQUID OR DRIED BULK DRUG SUBSTANCE

11.2.3 SOLID ORAL DOSE

11.2.4 OTHERS

11.3 DIAGNOSTIC

11.3.1 IRRITABLE BOWEL SYNDROME

11.3.2 LEAKY GUT SYNDROME

11.3.3 DIABETES

11.3.4 BACTERIAL VAGINOSIS

11.3.5 GINGITIVIS

11.3.6 TRICHOMONIASIS

11.3.7 VAGINAL CANDIDIASIS

12 U.S. HUMAN MICROBIOME MARKET, BY DISEASE

12.1 OVERVIEW

12.2 INFECTIOUS DISEASE

12.2.1 HELICOBACTER PYLORI

12.2.2 C. DIFFICILE INFECTIONS

12.2.3 BACTERIAL VAGINOSIS

12.2.4 OTHERS

12.3 GASTROINTESTINAL DISORDERS

12.4 C. DIFFICILE INFECTION

12.5 METABOLIC DISORDER

12.5.1 DIABETES

12.5.2 OBESITY

12.5.3 ENDOCRINE

12.5.4 NON ALCOHOLIC LIVER DISEASE

12.6 AUTOIMMUNE DISORDER

12.7 CANCER

12.8 MENTAL DISORDER

12.9 DERMATOLOGICAL DISORDERS

12.9.1 ATOPIC DERMATITIS

12.9.2 ROSACEA

12.9.3 ACNE

12.9.4 OTHERS

12.1 PRIMARY HYPEROXYUREASOLUTION-PHASE

12.11 OTHERS

13 U.S. HUMAN MICROBIOME MARKET, BY TECHNOLOGY

13.1 OVERVIEW

13.2 GENOMICS

13.2.1 SEQUENCING

13.2.1.1 16S RRNA SEQUENCING METHOD

13.2.1.2 SHOTGUN METAGENOMICS SEQUENCING

13.2.1.3 WHOLE GENOME SEQUENCING

13.2.1.4 OTHER

13.2.2 POLYMERASE CHAIN REACTION

13.2.3 OTHER GENOMIC TECHNIQUES

13.2.4 ORGAN TRANSPLANTATION

13.2.5 OTHER CLINICAL APPLICATION

13.3 PROTEOMICS

13.3.1 EXPRESSION PROTEOMICS

13.3.2 FUNCTIONAL PROTEOMICS

13.3.3 STRUCTURAL PROTEOMICS

13.4 METABOLIMICS

13.4.1 TARGETED ANALYSIS

13.4.2 METABOLITE PROFILING

13.4.3 METABOLIC FINGERPRINTING

14 U.S. HUMAN MICROBIOME MARKET, BY TYPE

14.1 OVERVIEW

14.2 SMALL MOLECULE

14.3 BIOLOGIC

15 U.S. HUMAN MICROBIOME MARKET, BY END USER

15.1 OVERVIEW

15.2 ONLINE PHARMACIES

15.3 HYPERMARKET & SUPERMARKET

15.4 RETAIL PHARMACIES

15.5 HOSPITAL PHARMACIES

15.6 CLINICS

15.7 OTHERS

16 U.S. HUMAN MICROBIOME MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 RETAIL SALES

16.3 DIRECT TENDERS

17 U.S. HUMAN MICROBIOME MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: U.S.

18 COMPANY PROFILE

18.1 OPTIBIOTIX HEALTH PLC

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.2 MERCK KGAA

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENTS

18.3 FINCH THERAPEUTICS GROUP, INC

18.3.1 COMPANY SNAPSHOT

18.3.2 PIPELINE PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 FERRING B.V.

18.4.1 COMPANY SNAPSHOT

18.4.2 PIPELINE PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENTS

18.5 ATLAS BIOMED GROUP LIMITED

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.6 ENTEROME

18.6.1 COMPANY SNAPSHOT

18.6.2 PIPELINE PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 ASSEMBLY BIOSCIENCES, INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PIPELINE PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 BIOMX

18.8.1 COMPANY SNAPSHOT

18.8.2 PIPELINE PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 EMBION TECHNOLOGIES S.A.

18.9.1 COMPANY SNAPSHOT

18.9.2 PIPELINE PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 EVELO BIOSCIENCES, INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PIPELINE PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 FLIGHTPATH BIOSCIENCES, INC.

18.11.1 COMPANY SNAPSHOT

18.11.2 PIPELINE PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 GNUBIOTICS SCIENCES

18.12.1 COMPANY SNAPSHOT

18.12.2 PIPELINE PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 IMMURON

18.13.1 COMPANY SNAPSHOT

18.13.2 PIPELINE PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 LUXIA SCIENTIFIC

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 METABIOMICS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 OSEL INC

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 OXTHERA.

18.17.1 COMPANY SNAPSHOT

18.17.2 PIPELINE PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 SECOND GENOME

18.18.1 COMPANY SNAPSHOT

18.18.2 PIPELINE PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 SERES THERAPEUTICS

18.19.1 COMPANY SNAPSHOT

18.19.2 PIPELINE PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 SUN GENOMICS

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 SYNTHETIC BIOLOGICS, INC..

18.21.1 COMPANY SNAPSHOT

18.21.2 PIPELINE PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 SYNLOGIC

18.22.1 COMPANY SNAPSHOT

18.22.2 PIPELINE PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 VEDANTA BIOSCIENCES, INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 PIPELINE PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 VIOME LIFESCIENCES, US

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 YSOPIA BIOSCIENCE

18.25.1 COMPANY SNAPSHOT

18.25.2 PIPELINE PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 4D PHARMA PLC

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 PATENT ANALYSIS

TABLE 2 U.S. HUMAN MICROBIOME MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 U.S. PROBIOTICS IN HUMAN MICROBIOME MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 U.S. BRANDED IN HUMAN MICROBIOME MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 U.S. PREBIOTICS IN HUMAN MICROBIOME MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 U.S. BRANDED IN HUMAN MICROBIOME MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 U.S. SUPPLEMENTS IN HUMAN MICROBIOME MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 U.S. DIAGNOSTICS TESTS IN HUMAN MICROBIOME MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 U.S. DRUGS IN HUMAN MICROBIOME MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 10 U.S. HUMAN MICROBIOME MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 U.S. THERAPEUTIC IN HUMAN MICROBIOME MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 U.S. DIAGNOSTIC IN HUMAN MICROBIOME MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 U.S. HUMAN MICROBIOME MARKET, BY DISEASE, 2020-2029 (USD MILLION)

TABLE 14 U.S. INFECTIOUS DISEASE IN HUMAN MICROBIOME MARKET, BY DISEASE, 2020-2029 (USD MILLION)

TABLE 15 U.S. METABOLIC DISORDER IN HUMAN MICROBIOME MARKET, BY DISEASE, 2020-2029 (USD MILLION)

TABLE 16 U.S. DERMATOLOGICAL DISORDERS IN HUMAN MICROBIOME MARKET, BY DISEASE, 2020-2029 (USD MILLION)

TABLE 17 U.S. HUMAN MICROBIOME MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 18 U.S. GENOMICS IN HUMAN MICROBIOME MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 19 U.S. SEQUENCING IN HUMAN MICROBIOME MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 20 U.S. PROTEOMICS IN HUMAN MICROBIOME MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 U.S. METABOLOMICS IN HUMAN MICROBIOME MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 22 U.S. HUMAN MICROBIOME MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 U.S. HUMAN MICROBIOME MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 U.S. HUMAN MICROBIOME MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 U.S. HUMAN MICROBIOME MARKET: SEGMENTATION

FIGURE 2 U.S. HUMAN MICROBIOME MARKET: DATA TRIANGULATION

FIGURE 3 U.S. HUMAN MICROBIOME MARKET: DROC ANALYSIS

FIGURE 4 U.S. HUMAN MICROBIOME MARKET: U.S. VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. HUMAN MICROBIOME MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HUMAN MICROBIOME MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. HUMAN MICROBIOME MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. HUMAN MICROBIOME MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 U.S. HUMAN MICROBIOME MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. HUMAN MICROBIOME MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN METAGENOMICS AND NEXT-GENERATION SEQUENCING ARE EXPECTED TO DRIVE THE U.S. HUMAN MICROBIOME MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 12 PROBIOTICS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. HUMAN MICROBIOME MARKET IN 2022 & 2029

FIGURE 13 PATENT FLOW DIAGRAM FOR DRUGS IN THE U.S.

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF U.S. HUMAN MICROBIOME MARKET

FIGURE 15 U.S. HUMAN MICROBIOME MARKET: BY PRODUCT, 2021

FIGURE 16 U.S. HUMAN MICROBIOME MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 17 U.S. HUMAN MICROBIOME MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 U.S. HUMAN MICROBIOME MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 U.S. HUMAN MICROBIOME MARKET: BY APPLICATION, 2021

FIGURE 20 U.S. HUMAN MICROBIOME MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 21 U.S. HUMAN MICROBIOME MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 22 U.S. HUMAN MICROBIOME MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 23 U.S. HUMAN MICROBIOME MARKET: BY DISEASE, 2021

FIGURE 24 U.S. HUMAN MICROBIOME MARKET: BY DISEASE, 2022-2029 (USD MILLION)

FIGURE 25 U.S. HUMAN MICROBIOME MARKET: BY DISEASE, CAGR (2022-2029)

FIGURE 26 U.S. HUMAN MICROBIOME MARKET: BY DISEASE, LIFELINE CURVE

FIGURE 27 U.S. HUMAN MICROBIOME MARKET: BY TECHNOLOGY, 2021

FIGURE 28 U.S. HUMAN MICROBIOME MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 29 U.S. HUMAN MICROBIOME MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 30 U.S. HUMAN MICROBIOME MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 31 U.S. HUMAN MICROBIOME MARKET: BY TYPE, 2021

FIGURE 32 U.S. HUMAN MICROBIOME MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 33 U.S. HUMAN MICROBIOME MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 34 U.S. HUMAN MICROBIOME MARKET: BY TYPE, LIFELINE CURVE

FIGURE 35 U.S. HUMAN MICROBIOME MARKET: BY END USER, 2021

FIGURE 36 U.S. HUMAN MICROBIOME MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 37 U.S. HUMAN MICROBIOME MARKET: BY END USER, CAGR (2022-2029)

FIGURE 38 U.S. HUMAN MICROBIOME MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 U.S. HUMAN MICROBIOME MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 40 U.S. HUMAN MICROBIOME MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 41 U.S. HUMAN MICROBIOME MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 42 U.S. HUMAN MICROBIOME MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 U.S. HUMAN MICROBIOME MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.