Market Analysis and Insights

Food service packaging is widely used for packaging processed and semi-processed food products. The food service packaging helps maintain hygiene and quality and enhances the safety of food products. The end-users of the food service packaging are restaurants, catering services, fast-food joints and others. The food packaging also helps enhance the shelf life of the food product and helps keep the food and beverages products fresh for a longer duration. Different materials are used for food packaging, including plastic, paper, wood pulp, glass and others.

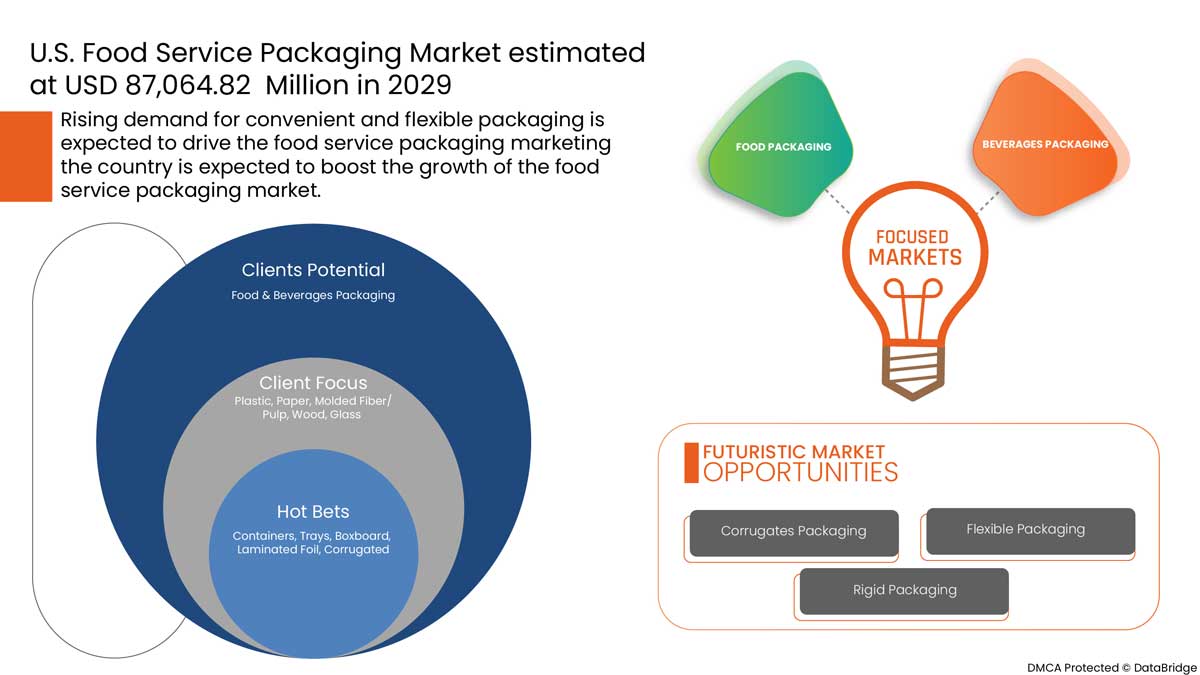

Bags, containers, and boxes made of wood, plastic, paper, and others are widely used for packaging food and beverage products. The growing demand for convenient and flexible packaging significantly impacts the expansion of the market for food service packaging. In line with this, increasing the adoption of eco-friendly and biodegradable products is expected propel the market's growth. However, stringent regulations laid by the governmental bodies regarding packaging materials may be a major restraint on the growth of the food service packaging market.

The growing demand for sustainable packaging solutions coupled with the increasing adoption of modern technology in the packaging industry will create more future opportunities for the food service packaging market. However, maintaining the standard quality of packaging products can challenge the growth of the food service packaging market during the forecast period.

Data Bridge Market Research analyses that the U.S. food service packaging market will grow at a CAGR of 5.2% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in Million, Volumes in Million Units, Pricing in USD |

|

Segments Covered |

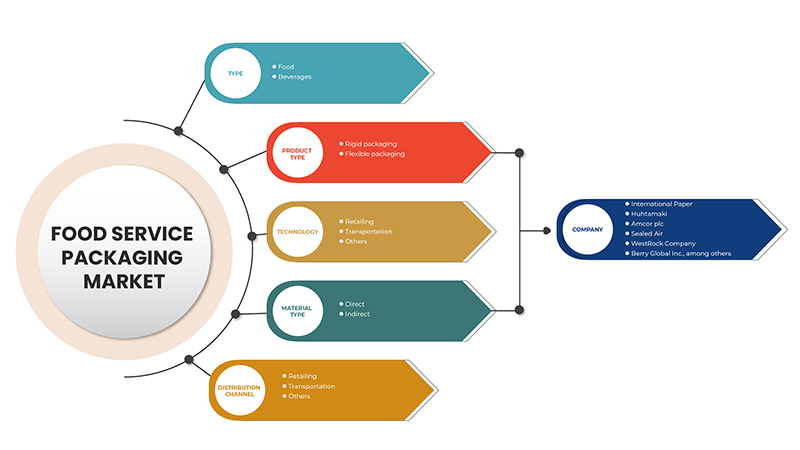

By Type (Food and Beverages), Material Type (Plastic, Paper, Molded Fiber/Pulp, Wood, Glass, and Others), Product Type (Rigid Packaging, Flexible Packaging), Application (Retailing, Transportation and Others), Distribution Channel (Direct and Indirect) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

International Paper, Huhtamaki, Amcor plc, Sealed Air, WestRock Company, Berry Global Inc., Fabri-Kal, Sabert Corporation, Genpak, LLC, Dart Container Corporation |

Market Definition

Food service packaging is widely used for packaging processed and semi-processed food products. It helps in maintaining hygiene and quality, and enhances the safety of food products. The end-users of the food service packaging includes restaurants, catering services, fast-food joints and others. The food packaging also helps in enhancing the shelf life of the food product and helps keep the food and beverages products fresh for a longer duration. Different materials are used for food packaging, including plastic, paper, wood pulp, glass and others.

U.S. Food Service Packaging Market Dynamics

Drivers

-

Growing Demand For Convenient And Flexible Packaging

The demand for convenient and flexible packaging is increasing among food & beverages manufacturers to replace the traditional packaging such as glass jars, metal cans, and others. The increasing demand for flexible packaging is due to its sustainability as it consumes less energy and fewer natural resources and generates less CO2 emissions; results in a higher product-to-package ratio; and requires fewer trucks for transportation, using less fuel and creating fewer emissions. The factor mentioned above is anticipated to propel the market's growth. Moreover, flexible packaging is more convenient, easy to store, recyclable, easy to open or carry, and helps extend the product's shelf life, increasing its demand among food service providers.

-

Increasing Adoption Of Eco-Friendly And Biodegradable Packaging

Packaging plays an important role as foodservice packaging protects foods against environmental, chemical, and physical factors that could contaminate all of the food if not packaged correctly. The essential role of packaging is to protect the product from damage during transit. Food service providers use different types of packaging, including paper, plastic, molded fiber/pulp, glass, wood, and others, to offer their food and beverages products. Recently, the demand for eco-friendly and biodegradable packaging is increasing owing to its low-cost production and can be reused and recycled, which as a result, lowers the production of waste the manufacturers. Moreover, increasing concerns regarding the harmful impact of packaging on the environment are propelling the demand for environmental-friendly and biodegradable packaging. Additionally, raising awareness regarding waste, environmental pollution, and harmful effects of plastic packaging and other packaging are increasing the demand for packaging which are easy to recycle or degrade faster.

Opportunity

-

Emphasis On Modern Technologies In The Packaging Industry

The demand for sustainable, reliable, environmentally friendly packaging is increasing among food service providers, encouraging manufacturers to introduce novel and modern technology to manufacture packaging products. The demand for sustainable, high-quality, and attractive packaging materials for food and beverages is increasing, which will create immense opportunities for food service packaging manufacturers. Modern technology offers high-quality and sturdy packaging products, which attracts foodservice manufacturers. The rising demand for reliable and innovative packaging solutions in the food service industry is encouraging manufacturers to introduce modern technologies for manufacturing packaging solutions.

Restraint/Challenge

- Use Of Harmful Additives For Water/Oil Resistance In Food Packaging

Packaging additives are natural or chemical products that can be added to a material to improve the performance of the products. The synthetic chemicals used in the packaging, storage, and processing of food might be harmful to human health in the long term, causing serious health problems to the consumers as most of these substances are not inert and can leach into the food or beverages products.

PFAS (polyfluoroalkyl substances) chemicals are commonly added to bagasse or molded fiber food packaging because it gives the packaging a greater resistance to moisture, oil, and grease. But, there are potential adverse health impacts associated with PFAS exposure, including liver damage, thyroid disease, decreased fertility, high cholesterol, obesity, hormone suppression, and cancer. These chemicals can easily migrate into the air, dust, food, soil and water, causing harmful environmental effects.

Also, several packaging products, including the aluminum can, are often lined with bisphenol A (BPA), which acts as an endocrine disruptor. The packaging companies have voluntarily stopped using BPA in packaging for baby formula and bottles, but it persists in water bottles and food packaging. Endocrine disruptors are linked to breast and prostate cancers, infertility, and metabolic disorders, among other health concerns.

Post COVID-19 Impact on U.S. Food Service Packaging Market

COVID-19 has affected the market to some extent. Due to the lockdown, the food and beverages industry faced a major crisis, which initially decreased the demand for food service packaging. Post-pandemic, the demand for food service packaging has increased due to increasing demand for packaged and prepared food products. Moreover, changing eating habits and more inclination toward on-the-go food & beverages products are increasing the demand for convenient packaging in the food service industry.

Recent Developments

- In January 2022, International Paper announced constructing a new corrugated packaging facility in Pennsylvania, U.S. The aim is to expand its industrial packaging footprints in the country's northeastern part

U.S. Food Service Packaging Market Scope

The U.S. food service packaging market is segmented based on type, material type, product type, application and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Food

- Beverages

Based on type, U.S. food service packaging market is segmented into food and beverages.

Material Type

- Plastic

- Paper

- Molded Fiber/Pulp

- Wood

- Glass

- Others

Based on material type, U.S. food service packaging market is segmented into plastic, paper, molded fiber/pulp, wood, glass, and others.

Product Type

- Rigid Packaging

- Flexible Packaging

Based on product type, U.S. food service packaging market is segmented into rigid packaging and flexible packaging.

Application

- Retailing

- Transportation

- Others

Based on application, U.S. food service packaging market is segmented into retailing, transportation, and others.

Distribution Channel

- Direct

- Indirect

Based on distribution channels, the U.S. food service packaging market is segmented directly and indirectly.

Competitive Landscape and U.S. Food Service Packaging Market Share Analysis

The U.S. food service packaging markets competitive landscape details the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, U.S. presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on U.S. food service packaging market.

Some major players operating in U.S. food service packaging market are International Paper, Huhtamaki, Amcor plc, Sealed Air, WestRock Company, Berry Global Inc., Fabri-Kal, Sabert Corporation, Genpak, LLC, Dart Container Corporation, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, U.S. Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. FOOD SERVICE PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LABELING AND CLAIMS

4.2 MARKET SHARE OF MOLDED FIBER VS OTHER SUBSTRATES AND ITS PROJECTION

4.3 NEW PRODUCT LAUNCH STRATEGY

4.3.1 OVERVIEW

4.3.2 NUMBER OF PRODUCT LAUNCHES

4.3.2.1 LINE EXTENSION

4.3.2.2 NEW PACKAGING

4.3.2.3 RE-LAUNCHED

4.3.2.4 NEW FORMULATION

4.3.3 DIFFERENTIAL PRODUCT OFFERING

4.3.4 MEETING CONSUMER REQUIREMENT

4.3.5 PACKAGE DESIGNING

4.3.6 PRODUCT POSITIONING

4.3.7 CONCLUSION

4.4 TOP SUPPLIERS INFORMATION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.5.1 FUTURE PERSPECTIVE

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL

4.6.2 PACKAGING TYPE (PROCESSING METHOD)

4.6.2.1 PAPER PACKAGING MANUFACTURING PROCESS

4.6.3 DISTRIBUTION

4.6.4 END-USERS

4.7 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING

6.1.2 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PACKAGING

6.1.3 ON-THE-GO LIFESTYLE IS INCREASING THE DEMAND FOR FOODSERVICE PACKAGING

6.1.4 RISING DEMAND FOR CONVENIENCE AND PREPARED FOOD

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS ON PACKAGING MATERIALS

6.2.2 USE OF HARMFUL ADDITIVES FOR WATER/OIL RESISTANCE IN FOOD PACKAGING

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR SUSTAINABLE PACKAGING SOLUTIONS

6.3.2 EMPHASIS ON MODERN TECHNOLOGIES IN THE PACKAGING INDUSTRY

6.4 CHALLENGES

6.4.1 MANAGING PACKAGING WASTE IS DIFFICULT

6.4.2 MAINTAINING THE STANDARD QUALITY OF PACKAGING PRODUCT

7 U.S. FOOD SERVICE PACKAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 FOOD

7.2.1 CONFECTIONERY PRODUCTS

7.2.2 BAKERY PRODUCTS

7.2.3 DAIRY PRODUCTS

7.2.4 MEAT & POULTRY

7.2.5 FRUITS & VEGETABLES

7.2.6 OTHERS

7.3 BEVERAGES

7.3.1 NON-ALCOHOLIC BEVERAGES

7.3.2 ALCOHOLIC BEVERAGES

8 U.S. FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER

8.3 PLASTIC

8.3.1 POLYETHYLENE TEREPHTHALATE

8.3.2 POLYPROPYLENE (PP)

8.3.3 POLY-VINYL CHLORIDE (PVC)

8.3.4 POLYSTYRENE

8.3.5 ETHYL VINYL ACETATE (EVA)

8.3.6 OTHERS

8.4 MOLDED FIBER / PULP

8.4.1 CARDBOARD

8.4.2 RECYCLED PAPER

8.4.3 NATURAL FIBER

8.4.3.1 SUGARCANE

8.4.3.2 BAMBOO

8.4.3.3 WHEAT STRAW

8.4.3.4 OTHERS

8.4.4 OTHERS

8.5 WOOD

8.6 GLASS

8.7 OTHERS

9 U.S. FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 RIGID PACKAGING

9.2.1 BOXBOARD

9.2.2 CONTAINERS

9.2.3 TRAYS

9.2.4 OTHERS

9.3 FLEXIBLE PACKAGING

9.3.1 CORRUGATED

9.3.2 LAMINATED FOIL

9.3.3 OTHERS

10 U.S. FOOD SERVICE PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TRANSPORTATION

10.2.1 TRANSPORTATION, BY MATERIAL TYPE

10.2.1.1 PLASTIC

10.2.1.2 PAPER

10.2.1.3 MOLDED FIBER/PULP

10.2.1.3.1 MOLDED FIBER/PULP, BY MATERIAL TYPE

10.2.1.3.1.1 RECYCLED PAPER

10.2.1.3.1.2 NATURAL FIBER

10.2.1.3.1.2.1 NATURAL FIBER, BY MATERIAL TYPE

10.2.1.3.1.2.1.1 SUGARCANE

10.2.1.3.1.2.1.2 BAMBOO

10.2.1.3.1.2.1.3 WHEAT STRAW

10.2.1.3.1.2.1.4 OTHERS

10.2.1.4 OTHERS

10.3 RETAILING

10.3.1 RETAILING, BY MATERIAL TYPE

10.3.1.1 PAPER

10.3.1.2 PLASTIC

10.3.1.3 MOLDED FIBER/PULP

10.3.1.3.1 MOLDED FIBER/PULP, BY MATERIAL TYPE

10.3.1.3.1.1 RECYCLED PAPER

10.3.1.3.1.2 NATURAL FIBER

10.3.1.3.1.2.1 NATURAL FIBER, BY MATERIAL TYPE

10.3.1.3.1.2.1.1 BAMBOO

10.3.1.3.1.2.1.2 WHEAT STRAW

10.3.1.3.1.2.1.3 SUGARCANE

10.3.1.3.1.2.1.4 OTHERS

10.3.1.4 OTHERS

10.4 OTHERS

11 U.S. FOOD SERVICE PACKAGING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 U.S. FOOD SERVICE PACKAGING MARKET, COUNTRY ANALYSIS

12.1 U.S.

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY SHARE ANALYSIS

15.1 WESTROCK COMPANY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 INTERNATIONAL PAPER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 DART CONTAINER CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 BERRY GLOBAL INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 SABERT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AMCOR PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 FABRI-KAL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 GENPACK, LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 HUHTAMAKI

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 SEALED AIR

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

16 QUESTIONNAIRES

17 RELATED REPORTS

List of Table

TABLE 1 MARKET SHARE OF MOLDED FIBER VS. OTHER SUBSTRATES

TABLE 2 REVENUE OF SUPPLIERS (USD MILLION) (2021)

TABLE 3 TOP SUPPLIERS INFORMATION (2020)

TABLE 4 U.S. FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.S. FOOD IN FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.S. BEVERAGES IN FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 U.S. FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 8 U.S. FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 9 U.S. PLASTIC IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 10 U.S. MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 11 U.S. NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 U.S. FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. RIGID PACKAGING IN FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.S. FLEXIBLE PACKAGING IN FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. FOOD SERVICE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 U.S. TRANSPORTATION IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.S. MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.S. NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.S. RETAILING IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 21 U.S. NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.S. FOOD SERVICE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 U.S. FOOD SERVICE PACKAGING MARKET: SEGMENTATION

FIGURE 2 U.S. FOOD SERVICE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 U.S. FOOD SERVICE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 U.S. FOOD SERVICE PACKAGING MARKET: U.S. VS. REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. FOOD SERVICE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. FOOD SERVICE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 8 U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 9 U.S. FOOD SERVICE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 U.S. FOOD SERVICE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 11 U.S. FOOD SERVICE PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 U.S. FOOD SERVICE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 U.S. FOOD SERVICE PACKAGING MARKET: SEGMENTATION

FIGURE 14 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PACKAGING IS EXPECTED TO DRIVE THE U.S. FOOD SERVICE PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 15 ON-THE-GO LIFESTYLE IS INCREASING THE DEMAND FOR FOOD SERVICE PACKAGING IS EXPECTED TO DRIVE THE U.S. FOOD SERVICE PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 16 FOOD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. FOOD SERVICE PACKAGING MARKET IN 2022 & 2029

FIGURE 17 FOOD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. FOOD SERVICE PACKAGING MARKET IN 2022 & 2029

FIGURE 18 U.S. FOOD SERVICE PACKAGING MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 19 SUPPLY CHAIN OF U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 20 VALUE CHAIN OF U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 22 U.S. FOOD SERVICE PACKAGING MARKET: BY TYPE, 2021

FIGURE 23 U.S. FOOD SERVICE PACKAGING MARKET: BY MATERIAL TYPE, 2021

FIGURE 24 U.S. FOOD SERVICE PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 25 U.S. FOOD SERVICE PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 26 U.S. FOOD SERVICE PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 U.S. FOODSERVICE PACKAGING MARKET: COMPANY SHARE 2021 (%)

Us Food Service Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Food Service Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Food Service Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.