U.S. Deodorants Market Analysis and Insights

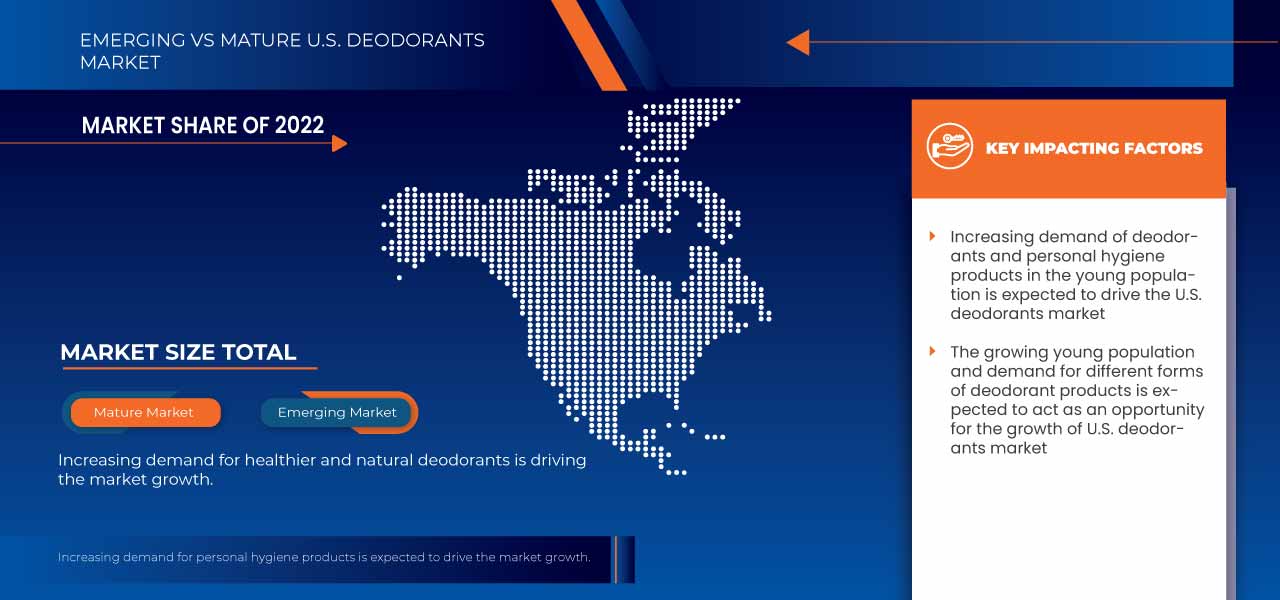

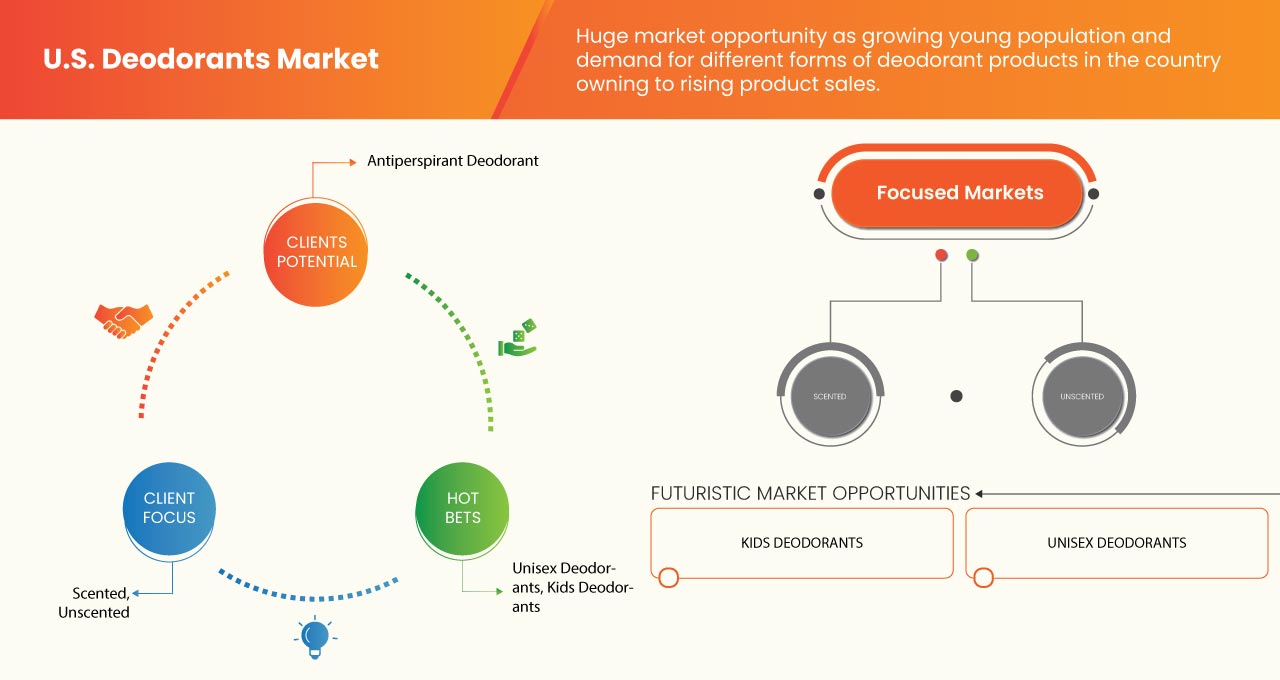

The rising demands for deodorants in the young population has enhanced the demand for the market. In addition, the increase in improved and advanced products has also contributed to the rising demand for the market.

The U.S. deodorants market is expected to grow in the forecast period of 2023 to 2030 due to the increased demand for personal hygiene products. An increase in demand for healthier and natural deodorants is also expected to drive market growth. Along with this, manufacturers are engaged in R&D activity for launching novel products in the market. However, the strict regulatory structure for the usage of deodorant products is expected to restrain market growth. Rising demand for different types of deodorant formulations like stick forms for better efficiency is expected to provide the opportunity for market growth to enhance personal care demands. The growing demand for better quality deodorants and the increase in the young population using the product is expected to boost the market growth. However, the rising concerns regarding the use of toxic ingredients and lack of reliable supply, and shortage of skilled labor are expected to challenge market growth.

Data Bridge Market Research analyzes that the U.S. deodorants market is expected to reach a value of USD 9.331.13 million by 2030, at a CAGR of 5.5% during the forecast period. The type segment accounts for the largest segment in the market due to the rising demand for different product forms of deodorants by consumers. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Type (Antiperspirant Deodorant, Aerosol/ Spray Deodorants, Roll-On Deodorants, Solid Deodorant, Invisible Solid Deodorant, Wipes Deodorant, Gel Deodorant, Crystal Deodorant, and Others), Category (Scented and Unscented), Claims (Alcohol Free, Paraben Free, Sulfate-Free, All of the above Claims, and No Claims), Price Range (Economy, Premium, and Super Premium), Gender (Women, Men, Unisex, and Kids), Distribution Channel (Online and Offline) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

Unilever, Procter & Gamble, Church & Dwight Co., Inc., BEIERSDORF GLOBAL, Henkel AG & Co. KGaA, Natura & Co, Coty Inc, Estee Lauder Inc, Wipro Consumer Care & Lighting, Kao Corporation, CavinKare Group, Hello Products LLC, Om Enterprise, and Alpenglow Skin Care LLC among others |

Market Definition

A deodorant neutralizes the bacteria in sweat and helps with the bad smell. Deodorants typically include antiseptic ingredients that kill or disable bacteria living in the armpit. Deodorants target anti-bacteria while antiperspirants reduce sweat levels with aluminum or zirconium-based chemicals. These react with sweat to form polymer plugs that prevent perspiration from escaping from sweat glands. Body odor develops when bacteria on human skin start to break down sweat using enzymes.

Deodorants are available in two categories that are scented and unscented. Aerosol varieties contain aluminum chlorohydrate whereas most non-aerosol varieties contain an aluminum-zirconium salt. Some people are scent-sensitive and may experience physical symptoms triggered by fragrance ingredients while others can have an allergic reaction to fragrance ingredients. The most common product associated with this type of reaction is scented deodorant.

U.S. Deodorants Market Dynamics

This section deals with the understanding of market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising Demand for Deodorants Among the Young Population

The mindset of the younger population is changing with time as the consciousness towards their personality is increasing. This has increased the usage of deodorants among the young population. It is beneficial to both men and women. They are a part of most people’s daily routine as it eliminates unwanted odor while allowing their body to sweat and cool down the body temperature.

Many trials and numerous studies are being done by various scientists and researchers to develop safe and effective deodorants. The increased use of deodorants for personal hygiene purposes increased the demand for deodorants and the rush to get premium quality. This creates a demand for good quality deodorants and related products. Hence, the rising demand for deodorants in the young population may act as a driver for the U.S. deodorants market growth.

- Increasing Demand for Personal Hygiene Products

One of the most common forms of personal care products used by the young population is deodorant. Deodorants are prescribed by lifestyle experts though the use of deodorants is not rigorously tested because of governmental restrictions. However, the limited chemical results showed the efficacy of using deodorants to treat body odors. The evidence suggests that deodorants can reduce body odor and prevent bacterial growth. The companies are engaged in the growing, cultivating, processing, and selling of ingredients of deodorants such as aluminum and zinc salts. Personal care includes various products that provide personal hygiene and maintain personal appearance. Along with the rich society, the mid-class societies are also adapting their behavior of dressing and fashion which has increased the consumption of deodorants and personal hygiene products. The growing usage of deodorants leads to the growth of grooming products throughout the U.S. market. The growth of personal hygiene leads to an increase in the use of products that are used to manufacture personal hygiene products. Due to this, the requirement for deodorants is increasing in the market as it attracts consumers and forces them to buy large amount of products.

Opportunity

- Rising Demand for Stick Forms for Better Efficiency

Deodorants come in many different forms including sticks, sprays, roll-ons, and others. High growth in the demand for deodorants has increased the need to come up with better products. This has led many companies to conduct research and development activities to check the improvement strategies for different forms of deodorants. Stick deodorants give long protection from odor and prevent wastage, whereas gaseous deodorants get wasted and have less efficiency. The stick deodorant is applied only on the necessary body parts and is applied in a normal amount, so it can be used for a longer duration and stays for a longer time. Also, it does not leave any stain when it is applied to the body. The other beneficial property of stick deodorants is that it does not get into the eyes or cause any harm; however, spray deodorant can cause eye or skin irritation. The situation presents a very big opportunity for the market players. The improvement in the deodorants increases their usage and may enhance the level of production in the economy in the future. So, the growing usage of stick deodorants provides better usage control with less production of wastage which is expected to act as an opportunity for growth of the U.S. market.

Restraints/ Challenges

- Rising Concerns Regarding the Use of Toxic Ingredients

Companies are getting aware that a significant number of people purchase deodorants with high-quality natural ingredients. They pump up supply to meet the demand which again leads to inflated prices. Therefore, altering demand patterns of consumers has led the deodorant market to attain significant momentum over the past few years. Most consumers and manufacturers have been shifting their preferences towards natural deodorants due to the toxic contents and chemicals used. These synthetic deodorants are expected to have negative health effects on users and the environment. Many synthetic fragrance chemicals are petroleum-based and can cause health issues. In addition, some children and adults have allergic reactions to synthetic chemicals as aluminum is the ingredient in deodorants that clogs pores and prevents sweating. It has been linked with the development of Alzheimer's disease, and high aluminum in the body absorbed through the skin can cause bone diseases or dementia.

- Strict Regulatory Structure for The Usage of Deodorant Products

Deodorant products being a new need of consumers are finding it hard to reach all probable end-users due to some specific regulatory reasons. Since all products are not up to the regulated standards, they can face issues and lawsuits from regulatory bodies. There are benefits to using personal care products. However, harmful chemicals such as sulfates and aluminum can restrict market growth and challenge manufacturers. However, traditional aluminum-based deodorant products are still one of the most widely used when it comes to the U.S. deodorant market. Various types of harmful chemicals are used in the manufacture of the products. Due to the application of chemicals, regulatory bodies issue some regulations and guidelines which may restrict the market from growth. The stringent regulations can delay or prevent the launch of new products, increase the prices of new products, and may lead to product recalls. Therefore, implementing these new regulations and modifying existing regulations may negatively affect market growth. Furthermore, the regulations associated with the trading and manufacturing of deodorants remain highly complex and varied across different states which makes the industry highly regulated. This acts as an obstacle for the companies and hence, a complex regulatory structure for the usage of deodorants may act as a restraint for the U.S. deodorants market growth.

Recent Developments

- In March 2023, Procter & Gamble’s brand Secret Deodorant launched the initiative Empowering Women to achieve financial wellness. The company believes young women with access to in-depth financial courses and training resources developed and led by highly-renowned female financial experts.

- In March 2023, Kao Corporation was included in the World's Most Ethical Companies List for a Record 17th Consecutive Year as a leading consumer goods company. This helped in building motivation and keeping best practices in business ethics and corporate social responsibility.

U.S. Deodorants Market Scope

The U.S. deodorants market is segmented into six notable segments based on type, category, claims, price range, gender, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Type

- Antiperspirant Deodorant

- Aerosol/ Spray Deodorants

- Roll-On Deodorants

- Solid Deodorant

- Invisible Solid Deodorant

- Wipes Deodorant

- Gel Deodorant

- Crystal Deodorant

- Others

Based on type, the market is segmented into antiperspirant deodorant, aerosol/ spray deodorants, roll-on deodorants, solid deodorant, invisible solid deodorant, wipes deodorant, gel deodorant, crystal deodorant, and others.

Category

- Scented

- Unscented

Based on category, the market is segmented into scented and unscented.

Claims

- Alcohol Free

- Paraben Free

- Sulfate-Free

- All of the Above Claims

- No Claims

Based on claims, the market is segmented into alcohol free, paraben free, sulfate-free, all of the above claims, and no claims.

Price Range

- Economy

- Premium

- Super Premium

Based on usage, the market is segmented into economy, premium, and super premium.

Gender

- Women

- Men

- Unisex

- Kids

Based on gender, the market is segmented into women, men, unisex, and kids.

Distribution Channel

- Online

- Offline

Based on distribution channel, the market is segmented into online and offline.

Competitive Landscape and U.S. Deodorants Market Share Analysis

The U.S. deodorants market is segmented into six notable segments based on type, category, claims, price range, gender, and distribution channel.

The U.S. deodorants market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, and technology lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major market players operating in the U.S. deodorants market are Unilever, Procter & Gamble, Church & Dwight Co., Inc., BEIERSDORF GLOBAL, Henkel AG & Co. KGaA, Natura & Co, Coty Inc, Estee Lauder Inc, Wipro Consumer Care & Lighting, Kao Corporation, CavinKare Group, Hello Products LLC, Om Enterprise, and Alpenglow Skin Care LLC among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. DEODORANTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET DISTRIBUTION CHANNEL COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 CONSUMER BUYING BEHAVIOR

4.4 FACTORS AFFECTING BUYING DECISION

4.4.1 ECONOMIC FACTOR

4.4.2 FUNCTIONAL FACTOR

4.5 IMPORT EXPORT SCENARIO

4.6 RAW MATERIAL SOURCING ANALYSIS

4.7 BRAND ANALYSIS

4.8 REGULATION COVERAGE

5 BRAND OUTLOOK GRID

5.1 COMPARATIVE BRAND ANALYSIS

5.2 PRODUCT VS BRAND OVERVIEW

6 SUPPLY CHAIN ANALYSIS

6.1 LOGISTIC COST SCENARIO

6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS–

7 PRODUCTION CAPACITY OUTLOOK

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DEMAND FOR DEODORANTS IN THE YOUNG POPULATION

8.1.2 INCREASING DEMAND FOR PERSONAL HYGIENE PRODUCTS

8.1.3 INCREASING DEMAND FOR HEALTHIER AND NATURAL DEODORANTS

8.2 RESTRAINTS

8.2.1 STRICT REGULATORY STRUCTURE FOR USAGE OF DEODORANTS PRODUCTS

8.2.2 LONG-TERM USE CAN CAUSE ADVERSE EFFECTS

8.3 OPPORTUNITIES

8.3.1 RISING DEMAND FOR STICK FORMS FOR BETTER EFFICIENCY

8.3.2 GROWING YOUNG POPULATION

8.4 CHALLENGES

8.4.1 RISING CONCERNS REGARDING THE USE OF TOXIC INGREDIENTS

8.4.2 LACK OF RELIABLE SUPPLY AND SHORTAGE OF SKILLED LABOURS

9 U.S. DEODORANTS MARKET, BY TYPE

9.1 OVERVIEW

9.2 ANTIPERSPIRANT DEODORANT

9.2.1 ANTIPERSPIRANT DEODORANT, BY CATEGORY

9.2.1.1 SCENTED

9.2.1.2 UNSCENTED

9.3 AEROSOL/SPRAY DEODORANTS

9.3.1 AEROSOL/SPRAY DEODORANTS, BY CATEGORY

9.3.1.1 SCENTED

9.3.1.2 UNSCENTED

9.4 ROLL-ON DEODORANT

9.4.1 ROLL-ON DEODORANTS, BY CATEGORY

9.4.1.1 SCENTED

9.4.1.2 UNSCENTED

9.5 SOLID DEODORANT

9.5.1 SOLID DEODORANT, BY CATEGORY

9.5.1.1 SCENTED

9.5.1.2 UNSCENTED

9.6 INVISBLE SOLID DEODORANT

9.6.1 INVISIBLE SOLID DEODORANT, BY CATEGORY

9.6.1.1 SCENTED

9.6.1.2 UNSCENTED

9.7 WIPES DEODORANT

9.7.1 WIPES DEODORANT, BY CATEGORY

9.7.1.1 SCENTED

9.7.1.2 UNSCENTED

9.8 GEL DEODORANT

9.8.1 GEL DEODORANT, BY CATEGORY

9.8.1.1 SCENTED

9.8.1.2 UNSCENTED

9.9 CRYSTAL DEODORANT

9.9.1 CRYSTAL DEODORANT, BY CATEGORY

9.9.1.1 SCENTED

9.9.1.2 UNSCENTED

9.1 OTHERS

9.10.1 OTHERS, BY CATEGORY

9.10.1.1 SCENTED

9.10.1.2 UNSCENTED

10 U.S. DEODORANTS MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 SCENTED

10.2.1 SCENTED, BY FRAGRANCE NOTE

10.2.1.1 FLORAL NOTE

10.2.1.2 FRUITY NOTE

10.2.1.3 MUSK NOTE

10.2.1.4 WOODY NOTE

10.2.1.5 OTHERS

10.3 UNSCENTED

11 U.S. DEODORANTS MARKET, BY CLAIMS

11.1 OVERVIEW

11.2 ALCOHOL FREE

11.3 PARABEN FREE

11.4 SULFATE -FREE

11.5 ALL OF THE ABOVE CLAIMS

11.6 NO CLAIMS

12 U.S. DEODORANTS MARKET, BY PRICE RANGE

12.1 OVERVIEW

12.2 ECONOMY

12.3 PREMIUM

12.4 SUPER PREMIUM

13 U.S. DEODORANTS MARKET, BY GENDER

13.1 OVERVIEW

13.2 WOMEN

13.2.1 ANTIPERSPIRANT DEODORANT

13.2.2 AEROSOL/ SPRAY DEODORANTS

13.2.3 ROLL-ON DEODORANTS

13.2.4 SOLID DEODORANT

13.2.5 INVISIBLE SOLID DEODORANT

13.2.6 WIPES DEODORANT

13.2.7 GEL DEODORANT

13.2.8 CRYSTAL DEODORANT

13.2.9 OTHERS

13.3 MEN

13.3.1 ANTIPERSPIRANT DEODORANT

13.3.2 AEROSOL/ SPRAY DEODORANTS

13.3.3 ROLL-ON DEODORANTS

13.3.4 SOLID DEODORANT

13.3.5 INVISIBLE SOLID DEODORANT

13.3.6 WIPES DEODORANT

13.3.7 GEL DEODORANT

13.3.8 CRYSTAL DEODORANT

13.3.9 OTHERS

13.4 UNISEX

13.4.1 ANTIPERSPIRANT DEODORANT

13.4.2 AEROSOL/ SPRAY DEODORANTS

13.4.3 ROLL-ON DEODORANTS

13.4.4 SOLID DEODORANT

13.4.5 INVISIBLE SOLID DEODORANT

13.4.6 WIPES DEODORANT

13.4.7 GEL DEODORANT

13.4.8 CRYSTAL DEODORANT

13.4.9 OTHERS

13.5 KIDS

13.5.1 ROLL-ON DEODORANTS

13.5.2 SOLID DEODORANT

13.5.3 INVISIBLE SOLID DEODORANT

13.5.4 CRYSTAL DEODORANT

13.5.5 AEROSOL/ SPRAY DEODORANTS

13.5.6 ANTIPERSPIRANT DEODORANT

13.5.7 WIPES DEODORANT

13.5.8 GEL DEODORANT

13.5.9 OTHERS

14 U.S. DEODORANTS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 ONLINE

14.2.1 E-COMMERCE

14.2.2 COMPANY OWNED

14.3 OFFLINE

14.3.1 SUPERMARKETS/HYPERMARKETS

14.3.2 DEPARTMENTAL STORES

14.3.3 CONVENIENCE STORES

14.3.4 WAREHOUSE CLUBS

14.3.5 OTHERS

15 U.S. DEODORANTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: U.S.

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 UNILEVER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 PROCTER & GAMBLE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 CHURCH & DWIGHT CO. INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 BEIERDORF GLOBAL

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 HENKEL AG & CO. KGAA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 ALPENGLOW SKIN CARE LLC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 CAVINKARE GROUP

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 COTY INC

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ESTEE LAUDER INC

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HELLO PRODUCTS LLC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 KAO CORPORATION

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 NATURA & CO

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 OM ENTERPRISE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 WIPRO CONSUMER CARE & LIGHTING

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 TOP 5 COMPANIES - PRODUCTION CAPACITY ANALYSIS

TABLE 2 U.S. DEODORANTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 U.S. ANTIPERSPIRANT DEODORANT IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 4 U.S. AEROSOL/SPRAY DEODORANTS IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 5 U.S. ROLL-ON DEODORANT IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 6 U.S. SOLID DEODORANT IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 7 U.S. INVISIBLE SOLID DEODORANT IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 8 U.S. WIPES DEODORANT IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 9 U.S. GEL DEODORANT IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 10 U.S. CRYSTAL DEODORANT IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 11 U.S. OTHERS IN DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 12 U.S. DEODORANTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 13 U.S. SCENTED IN DEODORANTS MARKET, BY FRAGRANCE NOTE, 2021-2030 (USD MILLION)

TABLE 14 U.S. DEODORANTS MARKET, BY CLAIMS, 2021-2030 (USD MILLION)

TABLE 15 U.S. DEODORANTS MARKET, BY PRICE RANGE, 2021-2030 (USD MILLION)

TABLE 16 U.S. DEODORANTS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 17 U.S. WOMEN IN DEODORANTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. MEN IN DEODORANTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 U.S. UNISEX IN DEODORANTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 U.S. KIDS IN DEODORANTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 U.S. DEODORANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 22 U.S. ONLINE IN DEODORANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 23 U.S. OFFLINE IN DEODORANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 U.S. DEODORANTS MARKET: SEGMENTATION

FIGURE 2 U.S. DEODORANTS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. DEODORANTS MARKET: DROC ANALYSIS

FIGURE 4 U.S. DEODORANTS MARKET: COUNTRY VS. REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. DEODORANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. DEODORANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. DEODORANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. DEODORANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. DEODORANTS MARKET: MARKET DISTRIBUTION CHANNEL COVERAGE GRID

FIGURE 10 U.S. DEODORANTS MARKET: SEGMENTATION

FIGURE 11 RAPID GROWTH IN THE YOUNG POPULATION AND INCREASING AWARENESS TOWARD PERSONAL HYGIENE ARE EXPECTED TO DRIVE THE U.S. DEODORANTS MARKET GROWTH IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 ANTIPERSEPIRANT DEODORANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. DEODORANTS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. DEODORANTS MARKET

FIGURE 14 U.S. DEODORANTS MARKET: BY TYPE, 2022

FIGURE 15 U.S. DEODORANTS MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 16 U.S. DEODORANTS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 17 U.S. DEODORANTS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 U.S. DEODORANTS MARKET: BY CATEGORY, 2022

FIGURE 19 U.S. DEODORANTS MARKET: BY CATEGORY, 2023-2030 (USD MILLION)

FIGURE 20 U.S. DEODORANTS MARKET: BY CATEGORY, CAGR (2023-2030)

FIGURE 21 U.S. DEODORANTS MARKET: BY CATEGORY, LIFELINE CURVE

FIGURE 22 U.S. DEODORANTS MARKET: BY CLAIMS, 2022

FIGURE 23 U.S. DEODORANTS MARKET: BY CLAIMS, 2023-2030 (USD MILLION)

FIGURE 24 U.S. DEODORANTS MARKET: BY CLAIMS, CAGR (2023-2030)

FIGURE 25 U.S. DEODORANTS MARKET: BY CLAIMS, LIFELINE CURVE

FIGURE 26 U.S. DEODORANTS MARKET: BY PRICE RANGE, 2022

FIGURE 27 U.S. DEODORANTS MARKET: BY PRICE RANGE, 2023-2030 (USD MILLION)

FIGURE 28 U.S. DEODORANTS MARKET: BY PRICE RANGE, CAGR (2023-2030)

FIGURE 29 U.S. DEODORANTS MARKET: BY PRICE RANGE, LIFELINE CURVE

FIGURE 30 U.S. DEODORANTS MARKET: BY GENDER, 2022

FIGURE 31 U.S. DEODORANTS MARKET: BY GENDER, 2023-2030 (USD MILLION)

FIGURE 32 U.S. DEODORANTS MARKET: BY GENDER, CAGR (2023-2030)

FIGURE 33 U.S. DEODORANTS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 34 U.S. DEODORANTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 U.S. DEODORANTS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 36 U.S. DEODORANTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 37 U.S. DEODORANTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 U.S. DEODORANTS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.