U.S. Compostable Foodservice Packaging Market Analysis and Insights

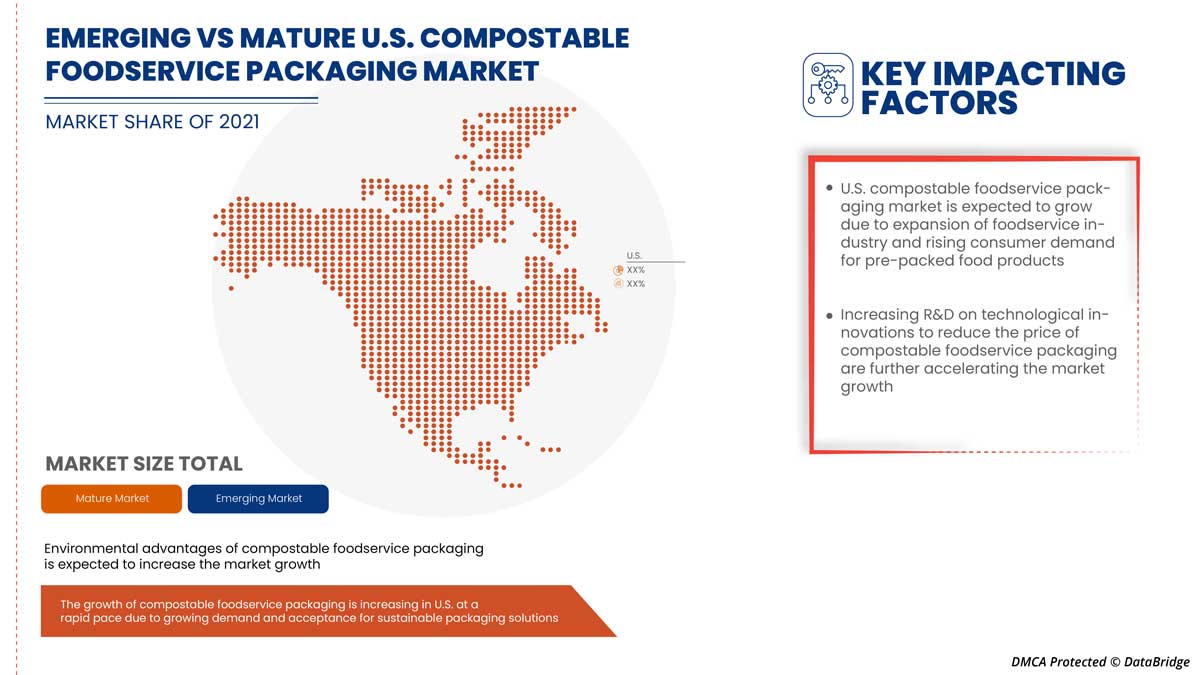

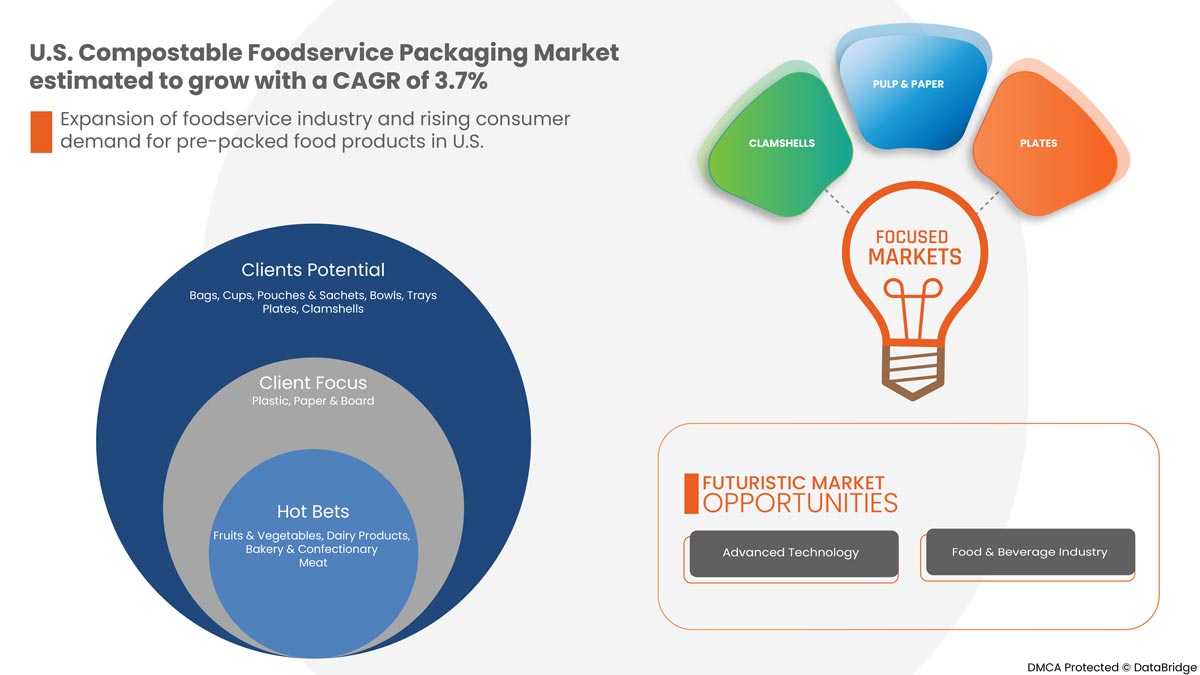

The U.S. compostable foodservice packaging market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.7% in the forecast period of 2022 to 2029 and is expected to reach 712,442.62 Thousand by 2029. The major factor driving the growth of the U.S. compostable foodservice packaging market is high equipment and maintenance costs of sight screens is expected to restrain the growth of the U.S. compostable foodservice packaging market in the forecast period.

Rising awareness regarding the ill-effects of single-use plastics and various materials on the environment and increasing R&D on technological innovations to reduce the price of compostable foodservice packaging are expected to provide the U.S. compostable foodservice packaging market with opportunities. However, inadequate waste management and composting infrastructures and regulations and certifications required for labelling as “compostable” are projected to challenge the U.S. compostable foodservice packaging market growth.

The U.S. compostable foodservice market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Product (Bags, Cups, Pouches & Sachets, Bowls, Trays, Plates, Clamshells, Cutlery, Straws, Lids, Films, Others), Material (Plastic, Paper & Board, Others), Packaging Layer (Primary Packaging, Secondary Packaging, Tertiary Packaging), Distribution Channel (B2B, Supermarkets/Hypermarkets, Convenience Stores, Departmental Stores, Specialty Stores, E-Commerce, Others), End-User (Fruits & Vegetables, Dairy Products, Bakery & Confectionary, Meat, Fish & Poultry, Convenience Food, Sauces, Dressings & Condiments, Others) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

Genpak, LLC, BASF SE, BeGreen Packaging, Dart Container Corporation, Amcor Plc, Huhtamaki, WestRock Company, Karat by Lollicup., Pactiv Evergreen Inc. and Biodegradable Food Service, LLC amongst others |

Market Definition

Compostable products are those products which can biodegrade and disintegrate into natural elements such as biomass, water, and carbon dioxide in a composting environment and leaving no harmful element in the soil. The compostable foodservice packaging material contains plastics, paper & boards and others. These compostable mimic conventional plastic's positive qualities, such as shelf stability, barrier properties, durability with one difference, i.e. these materials are fully compostable. Compostable material is providing nutrients to the earth when it has completely broken down. In order for packaging material and products to qualify as compostable, they must completely decompose and break down into natural elements within a short time after disposal.

COVID-19 had a Minimal Impact on U.S. Compostable Foodservice Packaging Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. The COVID-19 pandemic has driven up demand for food and beverage packaging that is secure, environment friendly and reusable as food safety and security concerns rises. Users emerge from COVID-19; consumers see sustainability as becoming increasingly important. Most consumers’ worldwide claim to be willing to pay more for sustainable packaging which will increasing the growth of U.S. compostable foodservice packaging market.

U.S. Compostable Foodservice Packaging Market Dynamics

Drivers

- Expansion of Foodservice Industry and Rising Consumer Demand for Pre-Packed Food Products

With the growth and expansion of foodservice industry along with rising inclination towards environment friendly packaging materials, the use of compostable packaging materials in foodservice has risen considerably. With the rising concerns towards depletion of natural resources coupled with growing focus towards environment sustainability and zero-waste, the use of compostable form of plant-based material is expected to gain traction in foodservice industry.

- Growing Demand and Acceptance for Sustainable Packaging Solutions

Compostable food service packaging has been identified as a feasible solution, in terms of sustainable packaging solutions. With sustainability and zero-waste gaining fast traction, compostable items made of plant-based material decompose easily along with food waste, and turn into compost, due to which they are gaining widespread attention and acceptance in the foodservice industry. Compostable packaging does not require petroleum during production, as it is made completely from organic matter and has no plastic in it.

- Environmental Advantages of Compostable Food Service Packaging

Compostable food packaging products are made of environment friendly products which are easily disposable. Compostable food packaging is made from plant-based and recycled materials. Growing demand for sustainable packaging solutions and rising Research and Development activities and new product launches are key drivers for the growth of U.S. compostable foodservice packaging market.

Opportunities

- Rising Awareness Regarding the Ill-Effects of Single-Use Plastics and Various Materials On the Environment

A key factor that is expected to act as an opportunity and influence the market growth of the U.S. compostable foodservice packaging market is the rising awareness regarding the ill-effects of single-use plastics and various materials on the environment, which will surge the adoption of foodservice disposables and packaging products.

- Increasing R&D On Technological Innovations to Reduce the Price of Compostable Foodservice Packaging

The increasing focus of the government on recycling packaging helps to improve packaging processes and allows to bring in advancements, which in turn helps in cutting the price of finished products. The food service packaging key industry players are working on eco packaging formats that are made from natural plants and bio-polymers, which can be easily compostable.

Restraints/Challenges

- High Price and Production Cost of Compostable Materials for Packaging as Compared to Conventional Packaging

The price of producing compostable materials for packaging continues to be much higher than the conventional variants which is likely to represent as a threat for the growth of the compostable foodservice packaging market. Compostable plastics are made from plants such as soybeans, corns, and cellulose. Adequate production of biodegradable plastic requires the use of cropland to provide the natural materials required instead of producing food.

- Fluctuations in Availability of Raw Materials for Production of Compostable Packaging

Intense competition, increasing mergers and acquisitions by key players operating in the market along with the changing nature of raw material and volatility lead to continuous fluctuations in the development of U.S. compostable food service packaging market. Also, maintaining long-term relations with distributors and retailers becomes difficult due to these factors. Therefore, manufacturers need to strategically position their products in terms of pricing. In addition, as new players are also entering the business and existing players are expanding production capacity, distributors also demand higher margins, which further shrink’s manufacturers’ net profits.

Recent Development

- In July 2022, Karat by Lollicup established manufacturing and distributing facility in Hawaii to accommodate the constant demand for environmentally friendly products. This warehouse carries all eco-friendly products, making it easily accessible to service businesses on the islands. This has enabled the company to accommodate reduced shipping costs and a faster processing time to local chain owners.

U.S. Compostable Foodservice Packaging Market Scope

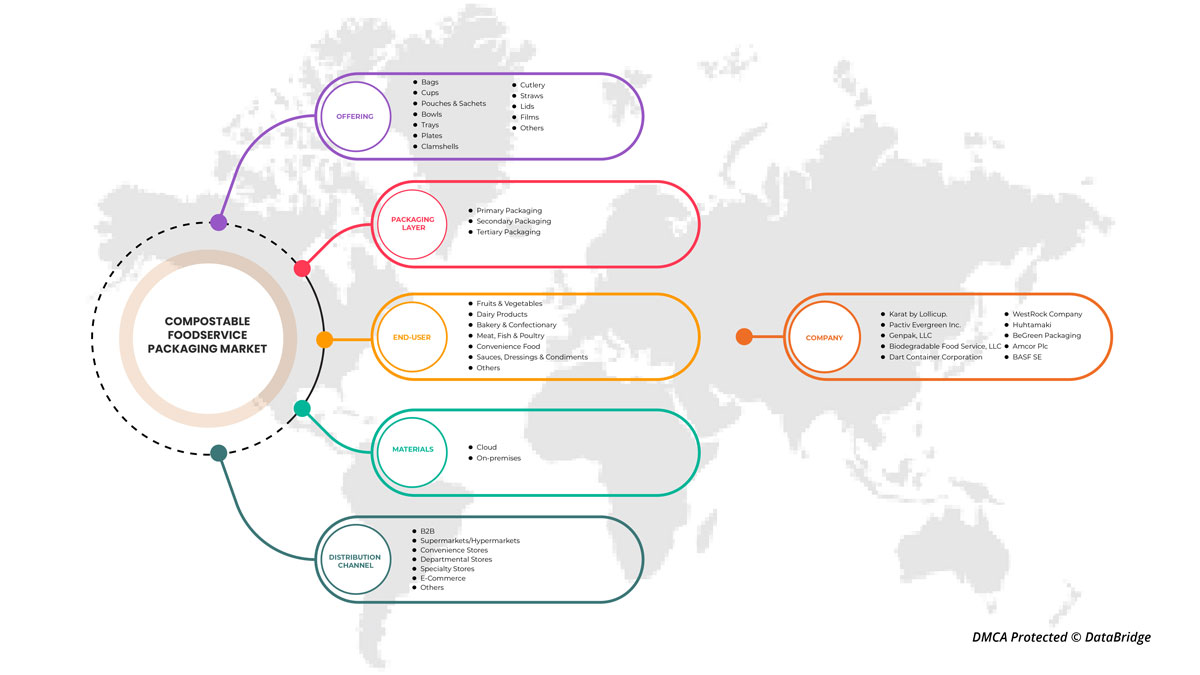

The U.S. compostable foodservice packaging market is categorized based on product, material, packaging layer, distribution channel and end-user.

The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Bags

- Cups

- Pouches & Sachets

- Bowls

- Trays

- Plates

- Clamshells

- Cutlery

- Straws

- Lids

- Films, Others

Based on product, the market is classified into bags, cups, pouches & sachets, bowls, trays, plates, clamshells, cutlery, straws, lids, films, others

Material

- Plastic

- Paper & Board

- Others

Based on Packaging Layer, the market is classified into plastic, paper & board, others

Packaging Layer

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

Based on the size, the market is classified into primary packaging, secondary packaging & tertiary packaging.

Distribution Channel

- B2B

- Supermarkets/Hypermarkets

- Convenience Stores

- Departmental Stores

- Specialty Stores

- E-Commerce, Others

Based on the distribution channel, the market is classified into B2B, Supermarkets/Hypermarkets, Convenience Stores, Departmental Stores, Specialty Stores, E-Commerce, Others.

End-User

- Fruits & Vegetables

- Dairy Products

- Bakery & Confectionary

- Meat, Fish & Poultry

- Convenience Food

- Sauces, Dressings & Condiments

- Others

Based on the end user, the market is classified into fruits & vegetables, dairy products, bakery & confectionary, meat, fish & poultry, convenience food, sauces, dressings & condiments, others

U.S. Compostable Foodservice Packaging Market Country Analysis/Insights

The U.S. compostable foodservice packaging market is segmented on the basis of product, material, packaging layer, distribution channel and end-user.

The country covered in the sight screens market report is U.S.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.S. brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and U.S. Compostable Foodservice Packaging Market Share Analysis

U.S. compostable foodservice packaging market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the U.S. compostable foodservice packaging market.

Some of the prominent participants operating in the Genpak, LLC, BASF SE, BeGreen Packaging, Dart Container Corporation, Amcor Plc, Huhtamaki, WestRock Company, Karat by Lollicup., Pactiv Evergreen Inc. and Biodegradable Food Service, LLC amongst others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, U.S. Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 COUNTRY & GLOBAL SUMMARY

5.1 GLOBAL

5.2 U.S.

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANSION OF THE FOODSERVICE INDUSTRY AND RISING CONSUMER DEMAND FOR PRE-PACKED FOOD PRODUCTS

6.1.2 GROWING DEMAND AND ACCEPTANCE FOR SUSTAINABLE PACKAGING SOLUTIONS

6.1.3 ENVIRONMENTAL ADVANTAGES OF COMPOSTABLE FOODSERVICE PACKAGING

6.2 RESTRAINTS

6.2.1 HIGH PRICE AND PRODUCTION COST OF COMPOSTABLE MATERIALS FOR PACKAGING AS COMPARED TO CONVENTIONAL PACKAGING

6.2.2 FLUCTUATIONS IN THE AVAILABILITY OF RAW MATERIALS FOR THE PRODUCTION OF COMPOSTABLE PACKAGING

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS REGARDING THE ILL EFFECTS OF SINGLE-USE PLASTICS AND VARIOUS MATERIALS ON THE ENVIRONMENT

6.3.2 INCREASING R&D ON TECHNOLOGICAL INNOVATIONS TO REDUCE THE PRICE OF COMPOSTABLE FOODSERVICE PACKAGING

6.4 CHALLENGES

6.4.1 INADEQUATE WASTE MANAGEMENT AND COMPOSTING INFRASTRUCTURES

6.4.2 REGULATIONS AND CERTIFICATIONS REQUIRED FOR LABELLING AS "COMPOSTABLE"

7 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 BOWLS

7.3 TRAYS

7.3.1 FOOD TRAYS

7.3.2 UTILITY TRAYS

7.4 PLATES

7.5 CUPS

7.6 CLAMSHELLS

7.7 BAGS

7.7.1 OPEN BAG

7.7.2 QUATTRO SEAL BAG

7.7.3 BAR WRAPPER

7.7.4 STANDUP POUCH

7.7.5 RESALABLE FLAP BAG

7.7.6 GUESTED BAG

7.7.7 PILLOW BAG

7.7.8 ZIPPER BAG

7.7.9 OTHERS

7.8 POUCHES & SACHETS

7.9 CULTERY

7.1 STRAWS

7.11 LIDS

7.12 FILMS

7.13 OTHERS

8 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 BIO SOURCED PLASTIC

8.2.1.1 POLY LACTIC ACID (PLA)

8.2.1.2 POLY HYDROXY ALAKONATE (PHA)

8.2.1.3 STARCH BASED PLASTIC

8.2.1.4 BIO POLYBUTYLENE SUCCINATE

8.2.2 NON BIO SOURCED PLASTIC

8.2.2.1 POLY BUTYRATE ADIPATE TEREPHTHALATE

8.2.2.2 POLY HYDROXY ALAKONATE (PHA)

8.2.2.3 POLY BUTYLENE SUCCINATE (PBS) COPOLYESTERS

8.2.2.4 POLYCAPROLACTONE (PBL)

8.2.2.5 OTHERS

8.3 PAPER & PAPERBOARD

8.3.1 COATED UNBLEACHED

8.3.2 MOLDED FIBER

8.3.3 FLEXIBLE PAPER

8.3.4 OTHERS

8.4 OTHERS

9 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY PACKAGING LAYER

9.1 OVERVIEW

9.2 PRIMARY PACKAGING

9.3 SECONDARY PACKAGING

9.4 TERTIARY PACKAGING

10 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 B2B

10.3 CONVENIENCE STORES

10.4 SPECIALITY STORES

10.5 SUPERMARKETS/HYPERMARKETS

10.6 DEPARTMENTAL STORES

10.7 E-COMMERCE

10.8 OTHERS

11 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY END USER

11.1 OVERVIEW

11.2 FRUITS & VEGETABLES

11.3 MEAT, FISH & POULTRY

11.4 CONVENIENCE FOOD

11.5 BAKERY & CONFECTIONARY

11.6 DAIRY PRODUCTS

11.7 SAUCES, DRESSINGS & CONDIMENTS

11.8 OTHERS

12 U.S. COMPOSTABLE FOODSERVICE PACKAGING, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

12.2 MERGER & ACQUISITION

12.3 EXPANSIONS

12.4 NEW PRODUCT DEVELOPMENT

12.5 PARTNERSHIP

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 KARAT BY LOLLICUP.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 PACTIV EVERGREEN INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATES

14.3 GENPAK, LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT UPDATES

14.4 BIODEGRADABLE FOOD SERVICE, LLC

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT UPDATES

14.5 DART CONTAINER CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 WESTROCK COMPANY

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT UPDATES

14.7 HUHTAMAKI

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATES

14.8 BASF SE

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT UPDATES

14.9 AMCOR PLC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATES

14.1 BEGREEN PACKAGING

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF TRAYS, DISHES, PLATES, CUPS, AND THE LIKE, OF PAPER OR PAPERBOARD (EXCLUDING OF BAMBOO PAPER ...; HS CODE - 482369 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TRAYS, DISHES, PLATES, CUPS, AND THE LIKE, OF PAPER OR PAPERBOARD (EXCLUDING OF BAMBOO PAPER ...; HS CODE - 482369 (USD THOUSAND)

TABLE 3 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 5 U.S. TRAYS IN COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 U.S. BAGS IN COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 U.S. PLASTIC IN COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY SOURCED, 2020-2029 (USD THOUSAND)

TABLE 9 U.S. BIO SOURCED PLASTIC COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 U.S. NON-BIO SOURCED PLASTIC COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 U.S. PAPER & PAPERBOARD IN COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY , 2020-2029 (USD THOUSAND)

TABLE 12 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 13 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 14 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: SEGMENTATION

FIGURE 2 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: U.S. MARKET ANALYSIS

FIGURE 5 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: THE PRODUCT TYPE LIFELINE CURVE

FIGURE 7 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: SEGMENTATION

FIGURE 13 EXPANSION OF FOODSERVICE INDUSTRY AND RISING CONSUMER DEMAND FOR PRE-PACKED FOOD PRODUCTS IS EXPECTED TO DRIVE U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET IN THE FORECAST PERIOD

FIGURE 14 BOWLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET

FIGURE 16 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: BY PACKAGING LAYER, 2021

FIGURE 19 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 20 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: BY END USER, 2021

FIGURE 21 U.S. COMPOSTABLE FOODSERVICE PACKAGING MARKET: COMPANY SHARE 2021 (%)

Us Compostable Foodservice Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Compostable Foodservice Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Compostable Foodservice Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.