Market Analysis and Insights

The U.S. cannabidiol (CBD) market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 28.6% in the forecast period of 2022 to 2029 and is expected to reach USD 13,655.70 million by 2029. The major factor driving the growth of the cannabidiol market is the growing demand for CBD in health & fitness, improving government approvals & regulations, therapeutic properties of CBD oil, and consumers’ shift towards legally purchasing cannabis, for medical as well as recreational use.

Cannabidiol (CBD) is obtained from the cannabis plant, which can be used for various applications. Also, commonly found in hemp and marijuana plants, the extract is also used for research and development proficiencies. The extract consists of 40% of the entire plant, and does not have any harmful effects on humans. Cannabidiol (CBD) has various health benefits, such as treating health disorders such as Parkinson's disease, Alzheimer’s, and multiple sclerosis. It is effective against stress, reduces acne, and alleviates cancer-related symptoms; thus, it is used in many pharmaceutical applications.

Cannabidiol derived from hemp is anticipated to witness rapid growth owing to increasing demand from the pharmaceutical sector and rising awareness among consumers regarding health.

The increasing acceptance of refined CBD products combined with the increasing legalization of marijuana and marijuana-derived products for various medical applications is expected to drive the growth of the marijuana CBD market.

The U.S. cannabidiol (CBD) market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By CBD Type (Hemp, Marijuana), Product Type (CBD Oil, CBD Concentrates, CBD Isolates, Others), CBD Category (Full-Spectrum, Broad Spectrum), Nature (Organic, Inorganic), Grade (Food, Therapeutic), Application (Food, Beverages, Pharmaceuticals, Topicals, Tincture, Dietary Supplements, Others) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

Cresco Labs., EcoGen Biosciences, Canopy Growth Corporation, The Valens Company, Open Book Extracts, Groff North America Hemplex, Healthy Food Ingredients, LLC, KND Labs, Socati Corp., and Swayer Labs. |

Market Definition

Cannabidiol (CBD) is obtained out from the cannabis plant, which can be used for a wide range of applications. Also, commonly found in hemp and marijuana plants, the extract is also used for research and development proficiencies. The extract consists of forty percent of the entire plant and it doesn’t have any harmful effects on the humans. Cannabidiol (CBD) has various health benefits such as treating health disorders like Parkinson’s disease, Alzheimer and multiple sclerosis. Cannabidiol (CBD) is effective against stress, reduces acne and alleviates cancer-related symptoms and thus, is used in many pharmaceutical applications

US Cannabidiol (CBD) Market Dynamics

Drivers

- Increasing demand for CBD in health and fitness

CBD-based oils also help relieve delayed onset muscle soreness and exercise-induced muscle damage, which naturally occurs after physical activity due to microscopic damage to muscle fibers. Its healing properties reduce muscle pain, body aches, and inflammation. CBD offers numerous benefits as it induces sleep and reduces inflammation, a perfect combination for muscle recovery. If the person is anxious during the gym or any sought of games, CBD can help calm nerves and provide confidence. Thus, widespread use of CBD products and changing consumer opinion have increased the adoption of CBD products, which may propel the demand for the U.S. cannabidiol (CBD) market.

- Improving government approvals and regulations for CBD products

The newfound government policies approved by the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA) support the industry, lower cannabidiol production costs, and upscaling the manufacturing infrastructure and expertise. This is expected to create fierce competition for the U.S. CBD companies, which is expected to drive the U.S. cannabidiol (CBD) market over the coming years.

- Therapeutic properties of CBD oil

Clinical trials finished on CBD have portrayed its efficacy in treating various forms of epilepsy. Based on this development, countries, including the U.S., are seeking to incorporate CBD-based therapeutics, significantly generating demand for the market. Therefore, CBD offers a range of therapeutic benefits, from treating serious problems such as epilepsy to the treatment of anxiety and stress. This is expected to boost the demand for CBD-based products further and, in turn, amplify the growth in the U.S. cannabidiol (CBD) market.

Opportunities

- Increasing investments in the development of new CBD based products

The increasing demand has increased the number of trials to study the impact of CBD on certain health conditions, which is expected to develop new products, in turn providing an opportunity for the rise in the demand in the forthcoming years. Furthermore, many companies procure CBD oils in bulk and manufacture CBD-infused products. In addition, numerous health and wellness retailers are offering CBD-based products, such as Rite Aid, CVS Health, and Walgreens Boots Alliance.

- Growing medical applications of CBD

Medical CBD is probably most commonly associated with managing pain related to arthritis and cancer. CBD has also shown effective results in the treatment of topical pain. CBD's ability to cure pain relief makes it a promising replacement for opioids. CBD has also proven its efficacy in treating complex motor disorders, including epilepsy, spasticity and dystonia, and Dravet syndrome. CBD has also shown promising results in treating dementia, cannabis dependence, tobacco and opioid dependence, psychoses and schizophrenia, general social anxiety, post-traumatic stress disorder, anorexia nervosa, attention-deficit hyperactivity disorder, Parkinson's disease, and Tourette's disorder.

Restraints/Challenges

- High cost of CBD products

Additionally, hemp requires more time and labor to grow, and farmers need to inspect their crop closely as it grows. Furthermore, once it is harvested, extracting the cannabidiol is a difficult and expensive process. The processors and extractors of CBD either use ethanol or supercritical carbon dioxide (CO2 extraction) in their extraction process. The extraction and refinement process requires special machinery and takes a long time, which also drives up the CBD cost. Thus, all these factors add up to the costs of CBD products, making them much more costly than other products, which is likely to restrain the market's demand.

- Availability of counterfeit and synthetic products in the market

Such substitute products offer a cheaper variety to consumers while affecting the demand for CBD products. However, owing to such cases of mislabeling and utilization of synthetic marijuana, the FDA worked actively and sent warning letters to many companies after testing their products where no traces of CBD were found in them. FDA does not approve these products for the diagnosis, cure, mitigation, treatment, or prevention of any disease, and consumers should be aware while purchasing and using any such products. Yet, the availability of cheap synthetic alternatives to CBD may hinder the market demand.

- Side effects associated with CBD oil

Further, dietary supplements that contain CBD and a blend of herbal ingredients may not be safe for everyone, as many herbs have the potential to interact with commonly prescribed medications. All these side effects may vary from person to person as minor side effects for some may prove to be serious for others. This may challenge the increasing demand for CBD products in the U.S. cannabidiol (CBD) market.

- Barriers in terms of marketing of CBD

Apart from this, the regulations regarding approval and standardization of CBD-based products are another barrier, which caused hindrance in the market growth. There have been certain regulations that do not allow the sales of these products in the international market and prevent trade activities between the countries. All these barriers are anticipated to challenge the growth of the U.S. cannabidiol (CBD) market.

COVID-19 had a Minimal Impact on U.S. Cannabidiol (CBD) Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. In addition, due to supply chain disruptions in the U.S., the supply of other raw materials has been limited, which is disrupting the manufacturing, and in turn, the supply chain of CBD consumer health products. Amidst the COVID-19 outbreak, investors and manufacturers are pulling back the production and reconsidering investments. This is expected to act as a key headwind for the growth of the U.S. Cannabidiol (CBD) market. However, CBD block SARS-CoV-2 infection at the early stages of infection, and CBD administration is associated with a lower risk of SARS-CoV-2 infection in humans. In addition, the rising acceptance and use of products due to government approvals is a major factor expected to boost the production of CBD-infused products. Due to its healing properties, the demand for cannabidiol (CBD) for health and wellness purposes is high, which is the major factor driving the market growth.

Recent Development

- In March 2022, Cresco Labs and Columbia Care Inc. entered into a definitive arrangement agreement to acquire all of the issued and outstanding shares of Columbia Care. Under the terms of the Agreement, shareholders of Columbia Care will receive 0.5579 of a subordinate voting share of Cresco Labs for each Columbia Care common share.

U.S. Cannabidiol (CBD) Market Scope

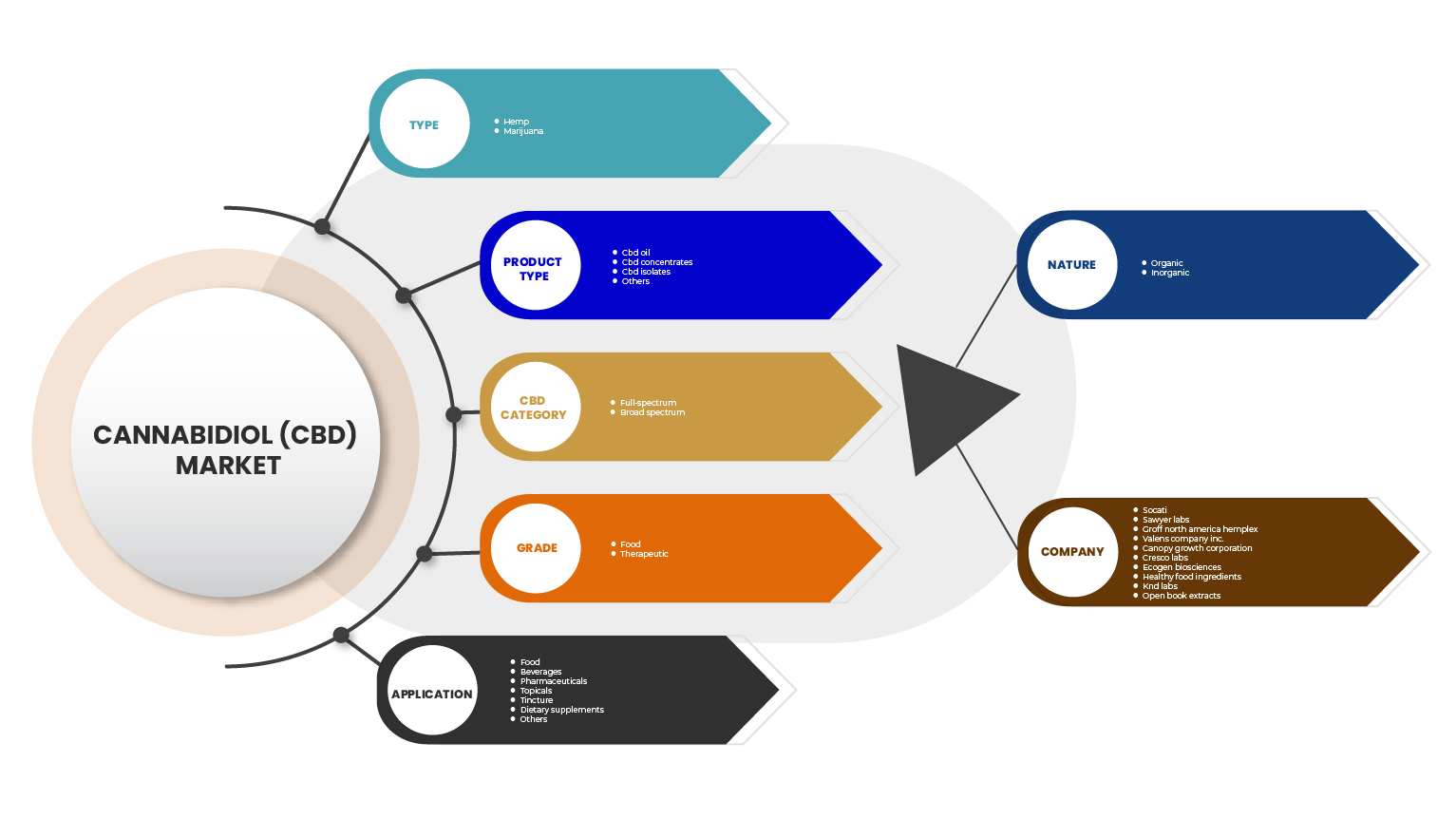

U.S. cannabidiol (CBD) market is categorized based on CBD type, product type, CBD category, grade, application, and nature. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

CBD Type

- Hemp

- Marijuana

On the basis of CBD type, the U.S. cannabidiol (CBD) market is segmented into hemp and marijuana.

Product Type

- CBD Oil

- CBD Isolates

- CBD Concentrates

- Others

On the basis of product type, the U.S. cannabidiol (CBD) market is segmented into CBD oil, CBD isolates, CBD concentrates, and others.

CBD Category

- Full-Spectrum

- Broad Spectrum

On the basis of CBD category, the U.S. cannabidiol (CBD) market is segmented into full-spectrum and broad spectrum.

Grade

- Food

- Therapeutic

On the basis of grade, the U.S. cannabidiol (CBD) market is segmented into food and therapeutic

Application

- Tincture

- Food

- Pharmaceuticals

- Dietary Supplements

- Beverages

- Topicals

- Others

On the basis of application, the U.S. cannabidiol (CBD) market is segmented into tincture, food, pharmaceuticals, dietary supplements, beverages, topicals and others.

Nature

- Organic

- Inorganic

On the basis of nature, the U.S. cannabidiol (CBD) market is segmented into organic and inorganic.

Competitive Landscape and U.S. Cannabidiol (CBD) Market Share Analysis

U.S. cannabidiol (CBD) market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the U.S. cannabidiol (CBD) market.

Some of the prominent participants operating in the U.S. cannabidiol (CBD) market are Socati, Sawyer Labs, Groff North America Hemplex, Valens Company Inc., Canopy Growth Corporation, Cresco Labs, EcoGen Biosciences, Healthy Food Ingredients, KND Labs, and Open Book Extracts among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. CANNABIDIOL (CBD) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE PRICING ANALYSIS: U.S. CANNABIDIOL (CBD) MARKET

4.2 AVERAGE PRODUCTION/SUPPLY CAPACITY: U.S. CANNABIDIOL (CBD) MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR CBD IN HEALTH AND FITNESS

5.1.2 IMPROVING GOVERNMENT APPROVALS AND REGULATIONS FOR CBD PRODUCTS

5.1.3 THERAPEUTIC PROPERTIES OF CBD OIL

5.1.4 CONSUMERS' SHIFT TOWARDS LEGALLY PURCHASING CANNABIS FOR MEDICAL AND RECREATIONAL USE

5.2 RESTRAINTS

5.2.1 HIGH COST OF CBD PRODUCTS

5.2.2 AVAILABILITY OF COUNTERFEIT AND SYNTHETIC PRODUCTS IN THE MARKET

5.3 OPPORTUNITIES

5.3.1 INCREASING INVESTMENTS IN THE DEVELOPMENT OF NEW CBD BASED PRODUCTS

5.3.2 GROWING MEDICAL APPLICATIONS OF CBD

5.4 CHALLENGES

5.4.1 SIDE EFFECTS ASSOCIATED WITH CBD OIL

5.4.2 BARRIERS IN TERMS OF MARKETING OF CBD

6 U.S. CANNABIDIOL (CBD) MARKET, BY CBD TYPE

6.1 OVERVIEW

6.2 HEMP

6.3 MARIJUANA

7 U.S. CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CBD OIL

7.2.1 CARBON DIOXIDE EXTRACTION

7.2.2 STEAM DISTILLATION

7.2.3 SOLVENT EXTRACTION

7.2.4 OTHERS

7.3 CBD ISOLATES

7.4 CBD CONCENTRATES

7.5 OTHERS

8 U.S. CANNABIDIOL (CBD) MARKET, BY CBD CATEGORY

8.1 OVERVIEW

8.2 FULL-SPECTRUM

8.3 BROAD SPECTRUM

9 U.S. CANNABIDIOL (CBD) MARKET, BY NATURE

9.1 OVERVIEW

9.2 ORGANIC

9.3 INORGANIC

10 U.S. CANNABIDIOL (CBD) MARKET, BY GRADE

10.1 OVERVIEW

10.2 FOOD

10.3 THERAPEUTIC

11 U.S. CANNABIDIOL (CBD) MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 TINCTURE

11.3 FOOD

11.3.1 CHOCOLATE & CONFECTIONARY

11.3.1.1 CANDY

11.3.1.2 CHOCOLATE

11.3.1.3 CHEWS

11.3.1.4 GUMMIES

11.3.1.5 OTHERS

11.3.2 HONEY

11.3.3 DAIRY BASED EDIBLE

11.3.3.1 MILK

11.3.3.2 ICE CREAM

11.3.3.3 OTHERS

11.3.4 SAUCES & SEASONINGS

11.3.5 BAKERY EDIBLE

11.3.5.1 COOKIES & BISCUITS

11.3.5.2 BROWNIES

11.3.5.3 OTHERS

11.3.6 OTHERS

11.4 BEVERAGES

11.4.1 NON-ALCOHOLIC BEVERAGES

11.4.1.1 ENERGY DRINKS

11.4.1.2 SOFT DRINKS

11.4.1.3 RTD COFFEE

11.4.1.4 TEA

11.4.1.5 SPARKLING WATER

11.4.1.6 OTHERS

11.4.2 FLAVORED DRINKS

11.4.2.1 ORANGE

11.4.2.2 LEMON

11.4.2.3 BERRIES

11.4.2.4 COCONUT

11.4.2.5 OTHERS

11.4.3 ALCOHOLIC BEVERAGES

11.4.3.1 BEER

11.4.3.2 WINE

11.4.3.3 OTHERS

11.4.4 OTHERS

11.5 PHARMACEUTICAL

11.5.1 DRAVET SYNDROME

11.5.2 MULTIPLE SCLEROSIS DRUG APPLICATION

11.5.3 NEUROLOGICAL DRUG APPLICATION

11.5.4 CANCER DRUG APPLICATION

11.5.5 OTHERS

11.6 TOPICALS

11.6.1 LOTION

11.6.2 SALVE

11.6.3 LIP BALM

11.6.4 OTHERS

11.7 DIETARY SUPPLEMENTS

11.7.1 CAPSULES

11.7.2 GUMMIES

11.7.3 OTHERS

11.8 OTHERS

12 U.S. CANNABIDIOL (CBD) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

12.2 FACILITY EXPANSION

12.3 PRODUCT LAUNCHES

12.4 FACILITY EXPANSIONS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 CRESCO LABS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 ECOGEN BIOSCIENCES

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT UPDATES

14.3 CANOPY GROWTH CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 VALENS COMPANY INC. (2021)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 OPEN BOOK EXTRACTS

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 GROFF NORTH AMERICA HEMPLEX

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 HEALTHY FOOD INGREDIENTS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 KND LABS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 SOCATI

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 SAWYER LABS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF TRUE HEMP "CANNABIS SATIVA L." PROCESSED BUT NOT SPUN; TOW AND WASTE OF HEMP, INCL. YARN; HS CODE - 530290 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TRUE HEMP "CANNABIS SATIVA L." PROCESSED BUT NOT SPUN; TOW AND WASTE OF HEMP, INCL. YARN; HS CODE - 530290 (USD THOUSAND)

TABLE 3 U.S. CANNABIDIOL (CBD) MARKET, BY CBD TYPE, 2020-2029 (USD MILLION)

TABLE 4 U.S. CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.S. CBD OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 6 U.S. CANNABIDIOL (CBD) MARKET, BY CBD CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 U.S. CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 8 U.S. CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 9 U.S. CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION

TABLE 10 U.S. FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 U.S. CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 U.S. DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.S. BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.S. FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.S. ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.S. PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 19 U.S. TOPICALS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 U.S. CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 2 U.S. CANNABIDIOL (CBD) MARKET: DATA TRIANGULATION

FIGURE 3 U.S. CANNABIDIOL (CBD) MARKET: DROC ANALYSIS

FIGURE 4 U.S. CANNABIDIOL (CBD) MARKET: U.S. MARKET ANALYSIS

FIGURE 5 U.S. CANNABIDIOL (CBD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. CANNABIDIOL (CBD) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 U.S. CANNABIDIOL (CBD) MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. CANNABIDIOL (CBD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. CANNABIDIOL (CBD) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. CANNABIDIOL (CBD) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 U.S. CANNABIDIOL (CBD) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 U.S. CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR CBD IN HEALTH AND FITNESS IS EXPECTED TO DRIVE U.S. CANNABIDIOL (CBD) MARKET IN THE FORECAST PERIOD

FIGURE 14 HEMP CBD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. CANNABIDIOL (CBD) MARKET IN 2022 & 2029

FIGURE 15 AVERAGE PRICE ANALYSIS FOR U.S. CANNABIDIOL (CBD) MARKET (USD/KG)

FIGURE 16 AVERAGE PRODUCTION/SUPPLY TREND FOR U.S. CANNABIDIOL (CBD) MARKET (TONS)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF U.S. CANNABIDIOL (CBD) MARKET

FIGURE 18 U.S. CANNABIDIOL (CBD) MARKET: BY CBD TYPE, 2021

FIGURE 19 U.S. CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 20 U.S. CANNABIDIOL (CBD) MARKET: BY CBD CATEGORY, 2021

FIGURE 21 U.S. CANNABIDIOL (CBD) MARKET: BY NATURE, 2021

FIGURE 22 U.S. CANNABIDIOL (CBD) MARKET: BY GRADE, 2021

FIGURE 23 U.S. CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2021

FIGURE 24 U.S. CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

Us Cannabidiol Cbd Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Cannabidiol Cbd Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Cannabidiol Cbd Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.