Us Abrasive Market

Market Size in USD Billion

CAGR :

%

USD

3.68 Billion

USD

5.18 Billion

2023

2031

USD

3.68 Billion

USD

5.18 Billion

2023

2031

| 2024 –2031 | |

| USD 3.68 Billion | |

| USD 5.18 Billion | |

|

|

|

U.S. Abrasives Market Analysis and Size

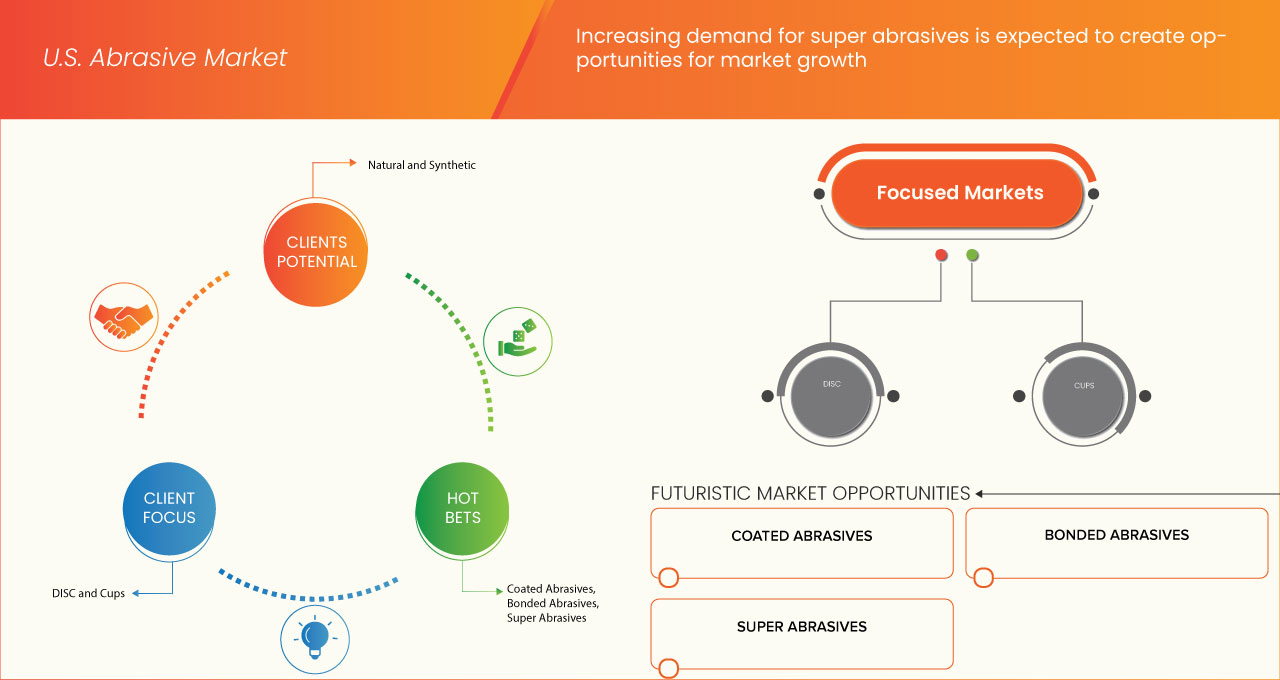

Data Bridge Market Research analyzes that the U.S. abrasives market is expected to grow with a CAGR of 4.4% from 2024 to 2031 and is expected to reach USD 5.18 billion by 2031 from USD 3.68 billion 2023. Rising automotive and aerospace production and increasing metal fabrication activities are expected to drive the market growth.

Increasing activities in manufacturing and construction industries and advancements in abrasives technology and materials are driving the market growth. Stringent regulations and standards regarding abrasives and emerging substitute materials and technologies are potentially restraining the market growth. Growth in electronics and semiconductors industry is projected to challenge the market growth.

The U.S. abrasives market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion and Volume in Thousand Units and Tons, and Pricing in USD |

|

Segments Covered |

Raw Material (Synthetic, and Natural), Type (Bonded Abrasive, Coated Abrasive, and Super Abrasive), Product (Disc, Cups, Cylinder, and Others), Form (Powdered Form, and Block Form), Application (Grinding, Polishing, Cutting, Finishing, Drilling, and Others), End-Use (Automotive, Building and Construction, Metal Fabrication, Machinery, Aerospace and Defense, Electrical and Electronics, Medical Devices, Oil and Gas, and Others) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

ARC ABRASIVES, INC., Bullard Abrasives, Inc., Engis Corporation, INDASA, Klingspor Abrasives Limited, Osborn, SAK ABRASIVES LIMITED, Tyrolit - Schleifmittelwerke Swarovski AG & Co K.G., Asahi Diamond Industrial Co.,Ltd., CUMI, Hermes Schleifmittel GmbH, Robert Bosch GmbH, SAIT ABRASIVI S.p.A., Mirka USA, Saint-Gobain, 3M, Weiler Abrasives., VSM AG |

Market Definition

Abrasives are materials used for grinding, polishing, cutting, or shaping other materials by wear. These materials can be natural, like sandpaper made from garnet or emery, or synthetic, such as silicon carbide or aluminum oxide. Abrasives find extensive applications across industries like manufacturing, construction, automotive, and electronics. In manufacturing, they are crucial for shaping and finishing metals, ceramics, and composites. In construction, abrasives are used for smoothing surfaces and cutting materials like concrete and stone. In automotive, they aid in metal finishing, rust removal, and paint preparation. Additionally, in electronics, abrasives play a vital role in shaping and polishing delicate components like semiconductors and optical lenses, ensuring precision and quality in production processes.

U.S. Abrasives Market Market Dynamics

Drivers

- Rising Automotive and Aerospace Production

The automotive sector has witnessed a robust expansion with the growing need for electric vehicles and advancements in vehicle manufacturing technologies. Abrasives play a crucial role in shaping, finishing, and polishing various automotive components, contributing to the overall efficiency and quality of production processes.

In addition to the automotive industry, the growth in aerospace sector is also a key driver for the U.S. abrasives market. The aerospace industry demands precision and high-performance materials for the manufacturing and maintenance of aircraft components. Abrasives are an integral component in tasks such as shaping and finishing turbine blades, manufacturing lightweight composite materials, and maintaining the structural integrity of aerospace components. Moreover, the increasing air travel demand and the need for fuel-efficient aircraft have further intensified the use of abrasives in aerospace production. Therefore, advancements in abrasive technologies have aligned with the evolving needs of the automotive and aerospace sectors. Innovations in abrasive materials, such as introduction of super abrasives like diamonds and cubic boron nitride, is contributing to enhanced efficiency and durability in machining processes. Moreover, the development of abrasive coatings and composites add further value by extending tool life and improving overall manufacturing productivity.

The precision requirements in automotive and aerospace sectors, coupled with the continuous advancements in abrasive technologies, underscore the crucial role of abrasives in shaping, finishing, and maintaining the quality of critical components. Thus, rising automotive and aerospace production across the U.S. and neighbouring regions is driving the market growth during the forecast period.

- Increasing Metal Fabrication Activities

The demand for metal fabrication, which is a crucial component of various industries, has witnessed a notable surge with the expansion of industrialization across the globe. Metal fabrication involves cutting, welding, grinding, and polishing processes, all of which heavily rely on abrasives for precision and efficiency. This surge in metal fabrication activities, particularly in sectors such as automotive, construction, and aerospace, is directly translating into heightened demand for abrasives.

The automotive industry, in particular, has been a major contributor to the increased demand for abrasives. With the growing production of vehicles globally, metal fabrication processes like cutting and polishing are integral to manufacturing components with precision. Abrasives play a pivotal role in shaping and refining metal parts, ensuring the quality and durability of automotive components. The expansion of the automotive sector, driven by rising consumer demand and technological advancements, continues to propel the need for abrasives.

This upward trajectory in metal fabrication activities, driven by diverse industries, directly influences the abrasives market. The intricate relationship between the two underscores how the growth in one sector translates into increased demand for abrasives, emphasizing the indispensable role of abrasives in shaping, refining, and enhancing the quality of metal components across various industrial domains. Therefore, increasing metal fabrication activities is driving the market growth.

Opportunity

- Increasing Demand for Superabrasives

Diamond and cubic boron nitride (CBN) are super abrasives that outperform typical abrasives such as aluminum oxide and silicon carbide in terms of hardness and endurance. This exceptional performance makes them perfect for demanding machining and finishing applications in industries such as automotive, aerospace, energy, and medical device manufacture. As these industries grow old and require greater precision, efficiency, and productivity, the demand for advanced abrasive materials such as super abrasives grows.

Technological developments and innovations in super abrasive manufacturing processes have resulted in lower-cost production methods and a wider range of applications. This has resulted in increased use across a variety of industries, pushing up overall demand for super abrasives. For example, advances in chemical vapour deposition (CVD) and high-pressure high-temperature (HPHT) synthesis techniques have made diamond abrasives more accessible and inexpensive, allowing them to be used in applications beyond their usual boundaries.

The inclining trend toward downsizing and high-precision component manufacturing in areas such as electronics, medical devices, and aerospace has increased the demand for superabrasives for precise machining and finishing processes. Super abrasives provide the accuracy and control needed to achieve restricted tolerances, delicate surface finishes, and complicated geometries, allowing manufacturers to meet the changing expectations of their customers. In conclusion, the increasing demand for super abrasives presents a significant opportunity in the U.S. abrasives market, due to their superior performance, expanding applications, and technological advancements.

Restraints/Challenges

- Fluctuating Raw Material Prices

Abrasives are made from a wide range of raw materials, including minerals, synthetic diamonds, and other abrasive grains, as well as bonding agents and additives. Prices for various raw resources fluctuate due to global supply and demand dynamics, geopolitical events, currency exchange rates, and market speculation. Abrasive manufacturers must negotiate unpredictable marketplaces and anticipate price changes in order to properly manage their procurement expenses.

The dependency on scarce and geographically concentrated raw material sources creates supply chain weaknesses and price volatility risk. Disruptions in the supply of critical raw materials, such as natural abrasives like garnet or synthetic diamonds, caused by geopolitical tensions, trade conflicts, or natural disasters, can result in increased costs and shortage. Abrasive manufacturers struggle to find trustworthy raw material sources at consistent costs, which can have an impact on production timelines and product availability.

Energy price variations, particularly those for oil and gas, have an impact on the cost of manufacturing abrasive materials. Grinding, crushing, and sintering are energy-intensive processes that demand large amounts of power and fuel, making abrasive production vulnerable to fluctuations in energy costs. Abrasive manufacturers face margin pressures and operational issues as energy prices rise. To summarize, fluctuating raw material prices pose an extensive challenge to the US abrasives market, affecting manufacturing costs, supply chain adaptability, and overall competitiveness.

- Stringent Regulations and Standards Regarding Abrasives

Regulations are instituted to ensure workplace safety, environmental protection, and the overall well-being of end-users. Regulatory bodies, such as the Occupational Safety and Health Administration (OSHA) in the United States and other regulatory bodies in different regions, mandate compliance with specific standards for the production, handling, and disposal of abrasive materials.

The stringent regulations primarily focus on limiting exposure to hazardous substances present in abrasives, such as crystalline silica, which poses respiratory health risks. Compliance with these standards necessitates extensive testing, documentation, and adherence to strict permissible exposure limits (PELs). This increased regulatory scrutiny adds complexity and costs to the production processes within the abrasives industry. Furthermore, environmental considerations play a pivotal role in shaping regulations related to abrasives. Abrasive materials, when not handled or disposed of properly, can contribute to air and water pollution. Regulatory frameworks, such as the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), aim to mitigate these environmental impacts. Consequently, abrasives manufacturers must invest in eco-friendly production processes and waste management systems, adding another layer of complexity and cost.

Regulatory bodies frequently update guidelines to align with the latest scientific findings and technological advancements. Staying ahead of these changes and implementing necessary modifications further strains the abrasives industry, requiring ongoing investments in research, development, and process upgrades. Therefore, stringent regulations and standards regarding abrasives is restraining the market growth.

Recent Development

- In January 2024, Weiler Abrasives proudly announced that it had been successfully recertified by the Organisation for the Safety of Abrasives (oSa) for 2024. This recertification demonstrates the company's unwavering commitment to maintaining the highest levels of safety and quality in its goods

- In November 2023, VSM AG launched the successor to its successful STEARATE Plus line, VSM ALU-X. ALU-X is a new range of abrasives developed by VSM to fulfill the special grinding requirements of non-ferrous metals, replacing the well-known VSM STEARATE and STEARATE Plus series. The new ALU-X extra layer minimizes chip adhesion that considerably reduces abrasive clogging. This gives the customer a better option for abrasive solution

U.S. Abrasives Market Market Scope

The U.S. abrasives market is segmented into six notable segments based on raw material, type, product, form, application, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

By Raw Material

- Synthetic

- Natural

On the basis of raw material, the market is segmented into synthetic and natural.

By Type

- Bonded Abrasive

- Coated Abrasive

- Super Abrasive

On the basis of type, the market is segmented into bonded abrasive, coated abrasive, and super abrasive.

By Product

- Disc

- Cups

- Cylinder

- Others

On the basis of product, the market is segmented into disc, cups, cylinder, and others.

By Form

- Powdered Form

- Block Form

On the basis of form, the market is segmented into powdered form, and block form.

By Application

- Grinding

- Polishing

- Cutting

- Finishing

- Drilling

- Others

On the basis of application, the market is segmented into grinding, polishing, cutting, finishing, drilling, and others.

By End-Use

- Automotive

- Building and Construction

- Metal Fabrication

- Machinery

- Aerospace and Defense

- Electrical and Electronics

- Medical Devices

- Oil and Gas

- Others

On the basis of end-use, the market is segmented into automotive, building and construction, metal fabrication, machinery, aerospace and defense, electrical and electronics, medical devices, oil and gas, and others.

Competitive Landscape and U.S. Abrasives Market Share Analysis

The U.S. abrasives market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the U.S. abrasives market

Some of the prominent participants operating in the U.S. abrasives market are ARC ABRASIVES, INC., Bullard Abrasives, Inc., Engis Corporation, INDASA, Klingspor Abrasives Limited, Osborn, SAK ABRASIVES LIMITED, Tyrolit - Schleifmittelwerke Swarovski AG & Co K.G., Asahi Diamond Industrial Co.,Ltd., CUMI, Hermes Schleifmittel GmbH, Robert Bosch GmbH, SAIT ABRASIVI S.p.A., Mirka USA, Saint-Gobain, 3M, Weiler Abrasives., VSM AG, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.4.1 QUALITY AND CONSISTENCY

4.4.2 TECHNICAL EXPERTISE

4.4.3 SUPPLY CHAIN RELIABILITY

4.4.4 COMPLIANCE AND SUSTAINABILITY

4.4.5 COST AND PRICING STRUCTURE

4.4.6 FINANCIAL STABILITY

4.4.7 FLEXIBILITY AND CUSTOMIZATION

4.4.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.5 CLIMATE CHANGE SCENARIO

4.6 PRICE TREND ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 LOGISTIC COST SCENARIO

4.7.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9 RAW MATERIAL ANALYSIS

4.9.1 ALUMINUM OXIDE (AL2O3)

4.9.2 SILICON CARBIDE

4.9.3 DIAMOND

4.9.4 CUBIC BORON NITRIDE

4.9.5 GARNET

4.9.6 EMERY

4.9.7 PUMICE

4.9.8 ZIRCONIA ALUMINA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING AUTOMOTIVE AND AEROSPACE PRODUCTION

6.1.2 INCREASING METAL FABRICATION ACTIVITIES

6.1.3 INCREASING ACTIVITIES IN MANUFACTURING AND CONSTRUCTION INDUSTRIES

6.1.4 ADVANCEMENTS IN ABRASIVES TECHNOLOGY AND MATERIALS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS AND STANDARDS REGARDING ABRASIVES

6.2.2 EMERGING SUBSTITUTE MATERIALS AND TECHNOLOGIES

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR SUPERABRASIVES

6.3.2 GROWTH IN ELECTRONICS AND SEMICONDUCTORS INDUSTRY

6.3.3 RISING FOCUS ON SUSTAINABILITY AND ECO-FRIENDLY ABRASIVES

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES

6.4.2 ENVIRONMENTAL CONCERNS REGARDING ABRASIVE MANUFACTURING PROCESS

7 U.S. ABRASIVES MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 SYNTHETIC

7.3 NATURAL

8 U.S. ABRASIVES MARKET, BY TYPE

8.1 OVERVIEW

8.2 BONDED ABRASIVE

8.3 COATED ABRASIVE

8.4 SUPER ABRASIVE

9 U.S. ABRASIVES MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 DISC

9.3 CUPS

9.4 CYLINDER

9.5 OTHERS

10 U.S. ABRASIVES MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDERED FORM

10.3 BLOCK FORM

11 U.S. ABRASIVES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 GRINDING

11.3 POLISHING

11.4 CUTTING

11.5 FINISHING

11.6 DRILLING

11.7 OTHERS

12 U.S. ABRASIVES MARKET, BY END-USE

12.1 OVERVIEW

12.2 AUTOMOTIVE

12.3 BUILDING AND CONSTRUCTION

12.4 METAL FABRICATION

12.5 MACHINERY

12.6 AEROSPACE AND DEFENCE

12.7 ELECTRICAL AND ELECTRONICS

12.8 MEDICAL DEVICES

12.9 OIL AND GAS

12.1 OTHERS

13 U.S. ABRASIVES MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 3M

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ROBERT BOSCH GMBH

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 SAINT-GOBAIN

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 TYROLIT - SCHLEIFMITTELWERKE SWAROVSKI AG & CO K.G.

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 KLINGSPOR ABRASIVES LIMITED

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ARC ABRASIVES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ASAHI DIAMOND INDUSTRIAL CO., LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BULLARD ABRASIVES, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CUMI

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 ENGIS CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 HERMES SCHLEIFMITTEL GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 INDASA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MIRKA USA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 OSBORN

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 SAIT ABRASIVI S.P.A.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SAK ABRASIVES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 VSM AG

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 WEILER ABRASIVES

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 U.S. ABRASIVES MARKET, BY TYPE, (AVERAGE SELLING PRICE) (USD/THOUSAND UNITS)

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 U.S. ABRASIVES MARKET, BY RAW MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 4 U.S. SYNTHETIC IN ABRASIVES MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 5 U.S. SYNTHETIC IN ABRASIVES MARKET, BY CATEGORY, 2022-2031 (VOLUME)

TABLE 6 U.S. NATURAL IN ABRASIVES MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 7 U.S. NATURAL IN ABRASIVES MARKET, BY CATEGORY, 2022-2031 (VOLUME)

TABLE 8 U.S. ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 U.S. ABRASIVES MARKET, BY TYPE, 2022-2031 (THOUSAND UNITS)

TABLE 10 U.S. BONDED ABRASIVE IN ABRASIVES MARKET, BY BONDING AGENTS, 2022-2031 (USD THOUSAND)

TABLE 11 U.S. ABRASIVES MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 12 U.S. DISC IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 U.S. ABRASIVES MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 14 U.S. ABRASIVES MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 15 U.S. ABRASIVES MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 16 U.S. AUTOMOTIVE IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 U.S. BUILDING AND CONSTRUCTION IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 U.S. METAL FABRICATION IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 U.S. MACHINERY IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 U.S. AEROSPACE AND DEFENCE IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 U.S. ELECTRICAL AND ELECTRONICS IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 U.S. MEDICAL DEVICES IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 U.S. OIL AND GAS IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 U.S. OTHERS IN ABRASIVES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. ABRASIVES MARKET: SEGMENTATION

FIGURE 2 U.S. ABRASIVES MARKET: DATA TRIANGULATION

FIGURE 3 U.S. ABRASIVES MARKET: DROC ANALYSIS

FIGURE 4 U.S. ABRASIVES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. ABRASIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. ABRASIVES MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S. ABRASIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S. ABRASIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. ABRASIVES MARKET: APPLICATION COVERAGE GRID

FIGURE 10 U.S. ABRASIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 U.S. ABRASIVES MARKET: SEGMENTATION

FIGURE 12 RISING AUTOMOTIVE AND AEROSPACE PRODUCTION IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. ABRASIVES MARKET IN THE FORECAST PERIOD

FIGURE 13 THE SYNTHETIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE U.S. ABRASIVES MARKET IN 2024 AND 2031

FIGURE 14 PESTEL ANALYSIS

FIGURE 15 PORTER’S FIVE FORCES

FIGURE 16 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MARKET

FIGURE 19 U.S. ABRASIVES MARKET: BY RAW MATERIAL, 2023

FIGURE 20 U.S. ABRASIVES MARKET: BY TYPE, 2023

FIGURE 21 U.S. ABRASIVES MARKET: BY PRODUCT, 2023

FIGURE 22 U.S. ABRASIVES MARKET: BY FORM, 2023

FIGURE 23 U.S. ABRASIVES MARKET: BY APPLICATION, 2023

FIGURE 24 U.S. ABRASIVES MARKET: BY END-USE, 2023

FIGURE 25 U.S. ABRASIVES MARKET: COMPANY SHARE 2023 (%)

Us Abrasive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Abrasive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Abrasive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.