U.K. Health Insurance Market Analysis and Size

Health insurance policy consists of several types of features and benefits. It provides financial coverage to policyholders against certain treatments. Health insurance policy offers advantages including cashless hospitalization, coverage of pre and post-hospitalization, reimbursement, and various add-ons. The U.K. health insurance market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market.

Data Bridge Market Research analyses that the U.K. health insurance market is expected to reach a value of USD 134,376.64 million by 2029, at a CAGR of 4.7% during the forecast period. The product segment accounts for the largest offering segment in U.K. health insurance market. The U.K. health insurance market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

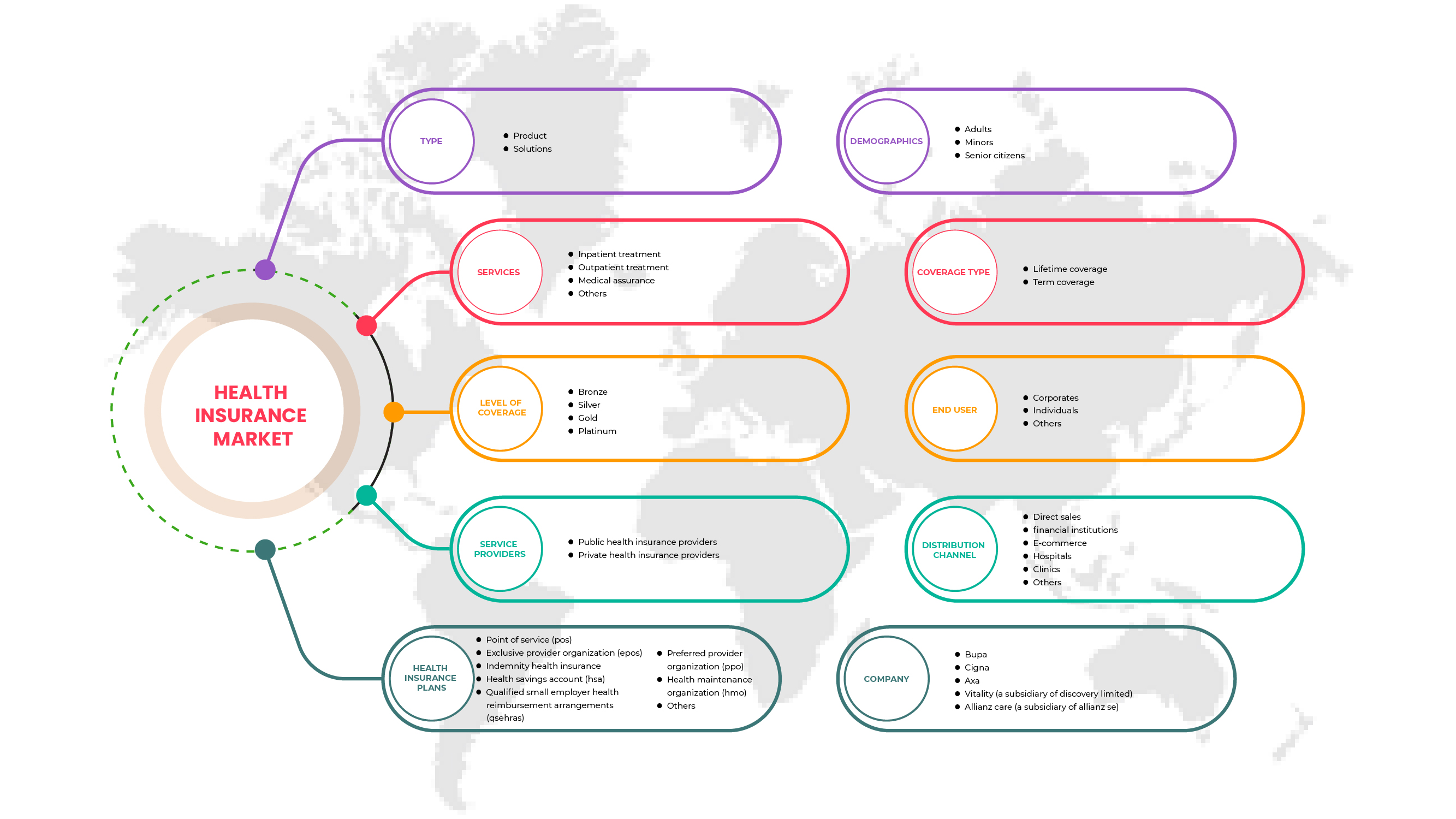

Segments Covered |

By Type (Product, and Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assurance, and Others), Level of Coverage (Bronze, Silver, Gold, and Platinum), Service Providers (Public Health Insurance Providers, Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), and Others), Demographics (Adults, Minors, and Senior Citizens), Coverage Type (Lifetime Coverage, Term Coverage), End User (Corporates, Individuals, and Others) Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics, and Others). |

|

Country Covered |

U.K. |

|

Market Players Covered |

Bupa, Cigna, AXA, Vitality (a subsidiary of Discovery Limited), Allianz Care (a subsidiary of Allianz SE), Aviva, AIA Group Limited, Saga, Exeter Friendly Society Limited, Pru Life UK, Freedom Health Insurance, General and Medical Finance Ltd, and American International Group, Inc. |

Market Definition

Health insurance is a type of insurance that provides coverage for all kinds of surgical expenses as well as medical treatment incurred from an illness or injury. It applies to a comprehensive or limited range of medical services providing the coverage of full or partial costs of specific services. It provides financial support to the policyholder as it covers all the medical expenses when the policyholder is hospitalized for treatment. It also covers pre as well as post-hospitalization expenses.

In the health insurance plan, several types of coverage are available, which is cashless or reimbursement claim. The cashless benefit is available when the policyholder takes treatment from the network hospitals of the insurance company. If the policyholder takes treatment from hospitals that are not in the list network, in that case, the policyholder meets all the medical expenses and then claims the reimbursement from the insurance company by submitting all the medical bills.

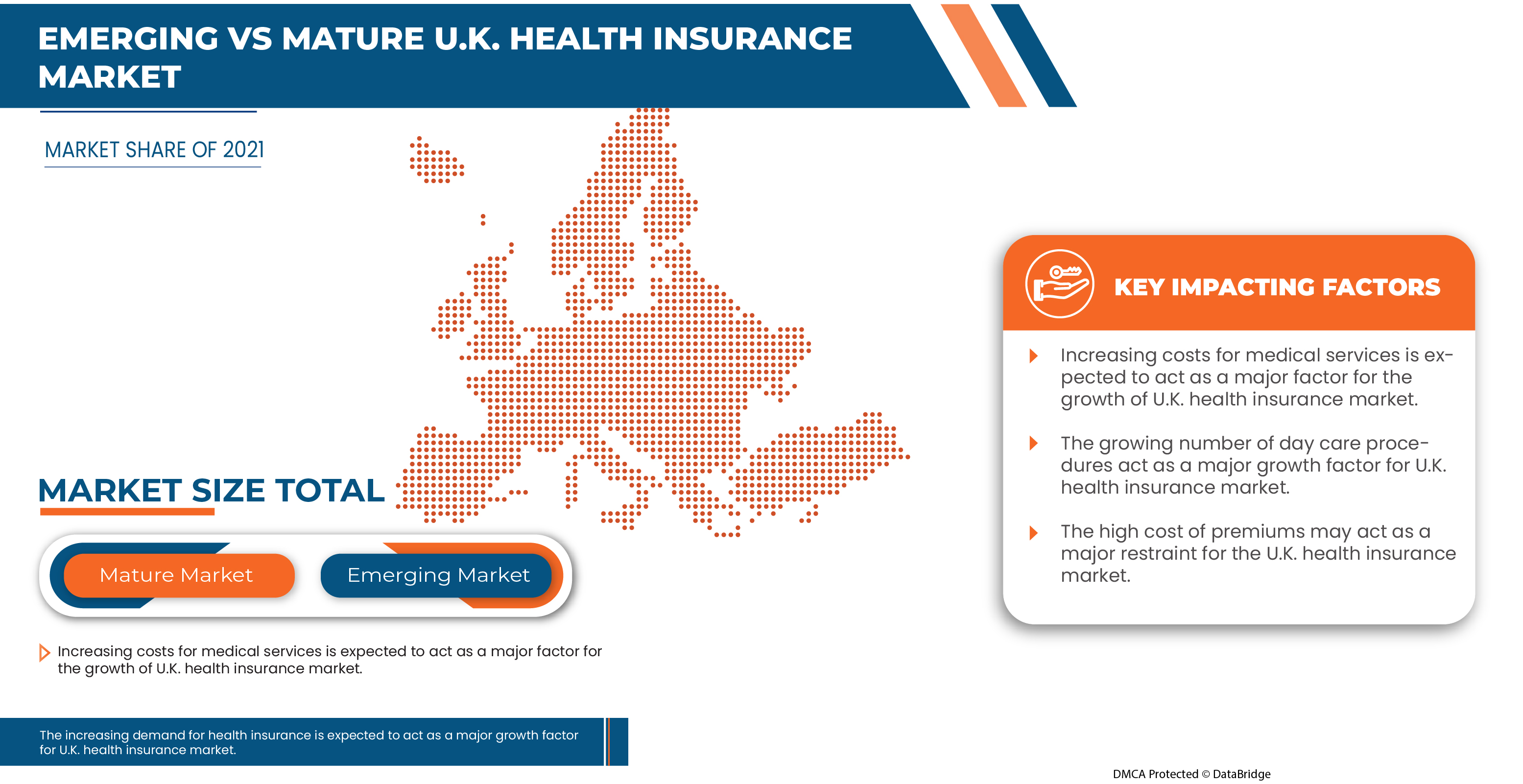

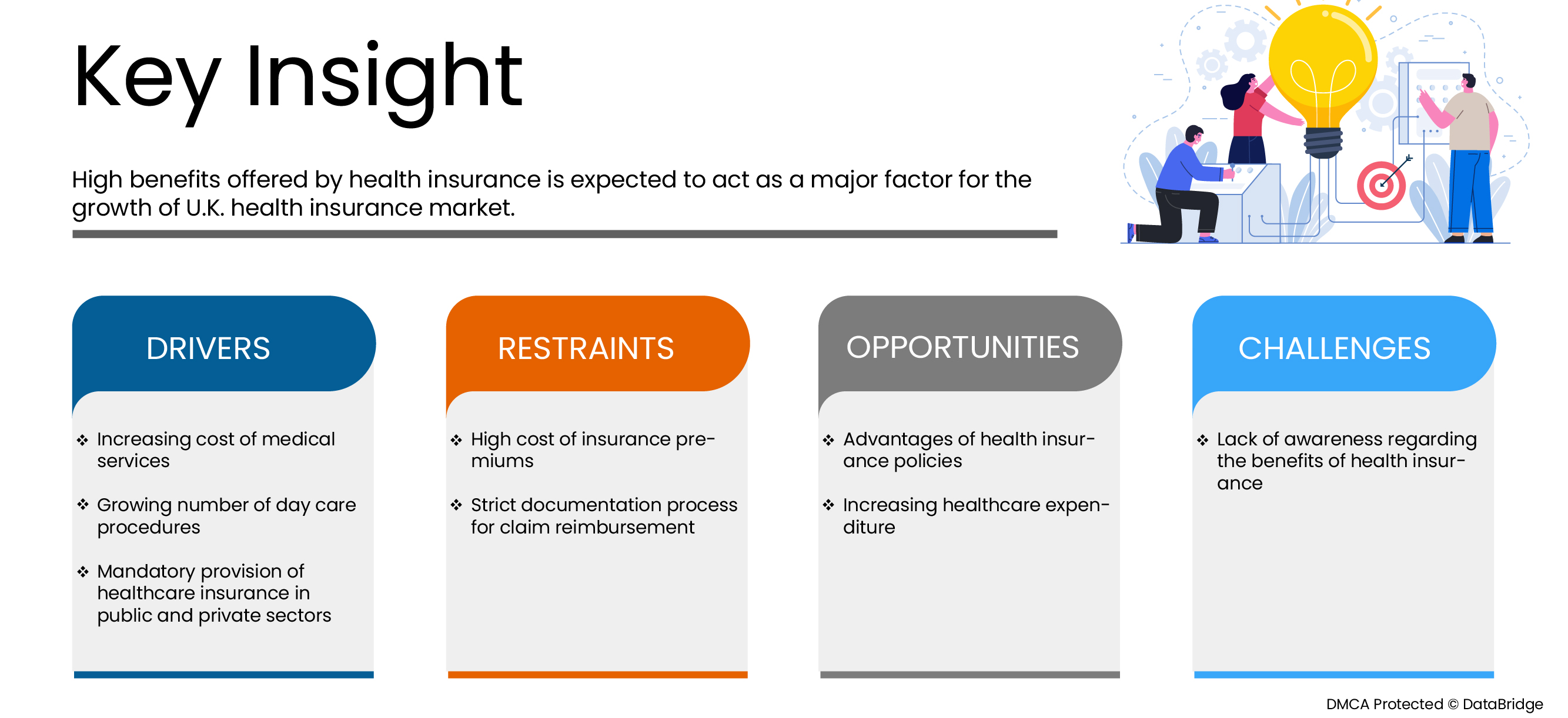

U.K. Health Insurance Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

-

Increasing cost of medical services

A rise in the cost of medical services across the globe and in the U.K. is expected to act as a driver for the U.K. health insurance market. This allows many consumers to take life insurance to cover the medical cost in case of medical needs for consumer health or their family.

-

Growing number of daycare procedures

Most health insurance companies are now covering the procedures of daycare in their insurance plans. For the claim of such types of surgery, there is no compulsion to spend 24 hours in the hospital, which is the minimum stay in the hospital to claim insurance. This has allowed the growing number of daycare procedures to boost the growth of the U.K. health insurance market.

Opportunity

-

Advantages of health insurance policies

In health insurance plans, the policyholder gets reimbursement for their medical expenses, such as hospitalization, surgeries, and treatments arising from the injuries. A health insurance policy is a type of agreement between the policyholder and the insurance company, where the insurance company agrees to guarantee payment for the treatment costs in case of future medical issues, and the policyholder agrees to pay the amount of premium according to the insurance plan. Thus, the increasing advantages of health insurance policies are expected to act as an opportunity for market growth.

Restraint/Challenge

- High cost of insurance premiums

Health insurance covers all types of medical treatment costs. It provides financial support to the policyholder since it covers all the medical expenses when the policyholder is hospitalized for treatment. Health insurance also covers pre as well as post-hospitalization expenses. To purchase health insurance, the policyholder has to pay insurance premiums regularly to keep the health insurance policy active. The cost of insurance premiums is high in most cases based on the insurance plan, which may hamper the market's growth.

COVID-19 Impact on U.K. Health Insurance Market

COVID-19 significantly impacted various industries as almost every country has opted for the shutdown of every facility except the ones dealing in the essential goods segment. The government took some strict actions, such as the shutdown of facilities and the sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. This boosted the U.K. health insurance market, as the consumers were availing of insurance to avoid huge capital payments at hospitals just in case of medical needs. Hence, COVID-19 impacted positively for the U.K. health insurance market.

Recent Developments

- In August 2020, International Medical Group, Inc. (IMG) enhanced its product offerings to support organizations with the necessary planning and research for safe international travel. The company's unique, new assistance services were designed to support clients as they make plans for 2020 and beyond. This development helped the company to sustain and thrive in a pandemic.

- In February 2019, Now Health International announced that they had launched their SimpleCare plans in the international market. The new plans of SimpleCare are designed to provide affordable international health insurance for the cost-conscious person. By launching a new product, the company enhanced its business in the international market, such as the U.K. market, and generated more revenue.

U.K. Health Insurance Market Scope

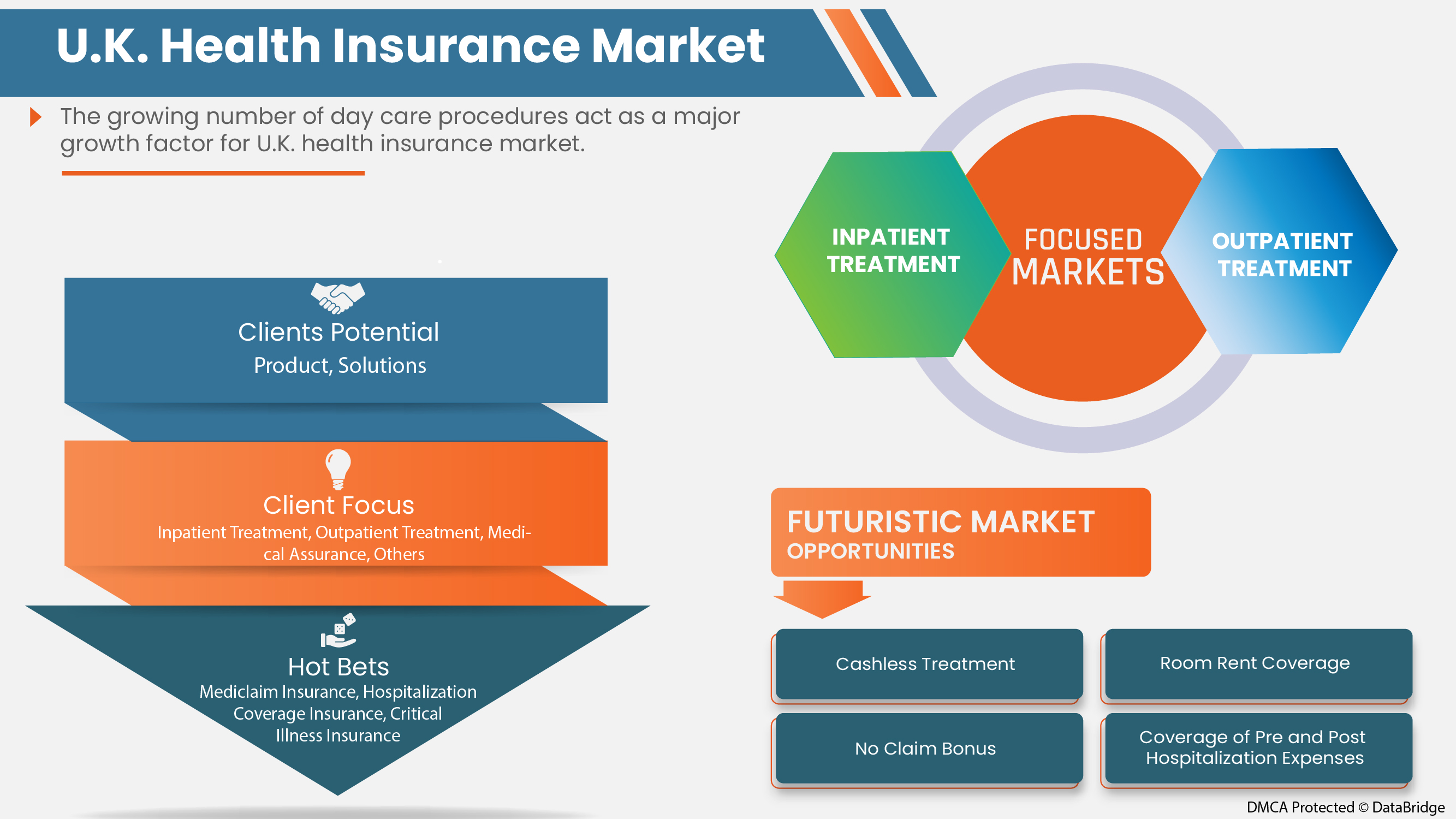

The U.K. health insurance market is segmented on the basis of type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

U.K. Health Insurance Market, By Type

- Product

- Solutions

On the basis of type, the market is segmented into product and solutions.

U.K. Health Insurance Market, By Services

- Inpatient treatment

- Outpatient treatment

- Medical Assurance

- Others

On the basis of services, the market is segmented into inpatient treatment, outpatient treatment, medical assurance, and others.

U.K. Health Insurance Market, By Level of Coverage

- Bronze

- Silver

- Gold

- Platinum

On the basis of the level of coverage, the market is segmented into bronze, silver, gold, and platinum.

U.K. Health Insurance Market, By Service Providers

- Private health insurance providers

- Public health insurance providers

On the basis of service providers, the market is segmented into private health insurance providers and public health insurance providers.

U.K. Health Insurance Market, By Health Insurance Plans

- Point of service (POS)

- Exclusive provider organization (EPOS)

- Indemnity health insurance

- Health savings account (HSA)

- Qualified small employer health reimbursement arrangements (QSEHRAS)

- Preferred provider organization (PPO)

- Health maintenance organization (HMO)

- Others

On the basis of health insurance plans, the market is segmented into point of service (POS), exclusive provider organization (EPOS), indemnity health insurance, health savings account (HSA), qualified small employer health reimbursement arrangements (QSEHRAS), preferred provider organization (PPO), health maintenance organization (HMO), and others.

By Demographics

- Adults

- Minors

- Senior citizens

On the basis of demographics, the U.K. health insurance market is segmented into adults, minors, and senior citizens.

By Coverage Type

- Lifetime Coverage

- Term Coverage

On the basis of coverage type, the U.K. health insurance market is segmented into lifetime coverage and term coverage.

By End User

- Corporates

- Individuals

- Others

On the basis of end user, the U.K. health insurance market is segmented into corporates, individuals, and others.

By Distribution Channel

- Direct Sales

- Financial Institutions

- E-Commerce

- Hospitals

- Clinics

- Others

On the basis of distribution channel, the U.K. health insurance market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics, and others.

U.K. Health Insurance Market Regional Analysis/Insights

The U.K. health insurance market on the basis of type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel, as referenced above.

In 2022, the U.K. health insurance market is expected to grow due to factors such as the advantages of health insurance policies and increasing healthcare expenditure.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.K. brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and U.K. Health Insurance Market Share Analysis

The analytical laboratory services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, U.K. presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to U.K. health insurance market.

Some of the major companies providing insurance services in the U.K. health insurance market are Bupa, Cigna, AXA, Vitality (a subsidiary of Discovery Limited), Allianz Care (a subsidiary of Allianz SE), Aviva, AIA Group Limited, Saga, Exeter Friendly Society Limited, Pru Life UK, Freedom Health Insurance, general and medical finance ltd, American International Group, Inc. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.K. HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END-USER COVERAGE GRID

2.9 DBMR MARKET CHALLENGE MATRIX

2.1 TYPE LIFE LINE CURVE

2.11 MULTIVARIATE MODELING

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING HEALTHCARE EXPENDITURE

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

6 U.K. HEALTH INSURANCE MARKET, BY TYPE

6.1 OVERVIEW

6.2 PRODUCT

6.2.1 MEDICLAIM INSURANCE

6.2.2 INDIVIDUAL COVERAGE INSURANCE

6.2.3 FAMILY FLOATER COVERAGE INSURANCE

6.2.4 HOSPITALIZATION COVERAGE INSURANCE

6.2.5 SENIOR CITIZEN COVERAGE INSURANCE

6.2.6 CRITICAL ILLNESS INSURANCE

6.2.7 UNIT LINKED HEALTH PLANS

6.2.8 PERMANENT HEALTH INSURANCE

6.3 SOLUTIONS

6.3.1 LEAD GENERATIONS SOLUTIONS

6.3.2 REVENUE MANAGEMENT & BILLING SOLUTIONS

6.3.3 ROBOTIC PROCESS AUTOMATION

6.3.4 INSURANCE CLOUD SOLUTIONS

6.3.5 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

6.3.6 VALUE-BASED PAYMENTS SOLUTIONS

6.3.7 ARTIFICIAL INTELLIGENCE & BLOCK CHAIN SOLUTIONS

6.3.8 INTELLIGENT CASE MANAGEMENT SOLUTIONS

6.3.9 OTHERS

7 U.K. HEALTH INSURANCE MARKET, BY SERVICES

7.1 OVERVIEW

7.2 INPATIENT TREATMENT

7.3 OUTPATIENT TREATMENT

7.4 MEDICAL ASSURANCE

7.5 OTHERS

8 U.K. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

8.1 OVERVIEW

8.2 BRONZE

8.3 SILVER

8.4 GOLD

8.5 PLATINUM

9 U.K. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS

9.1 OVERVIEW

9.2 PUBLIC HEALTH INSURANCE PROVIDERS

9.3 PRIVATE HEALTH INSURANCE PROVIDERS

10 U.K. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS

10.1 OVERVIEW

10.2 POINT OF SERVICE (POS)

10.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

10.4 PREFERRED PROVIDER ORGANIZATION (PPO)

10.5 INDEMNITY HEALTH INSURANCE

10.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

10.7 HEALTH SAVINGS ACCOUNT (HSA)

10.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

10.9 OTHERS

11 U.K. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULTS

11.3 MINORS

11.4 SENIOR CITIZENS

12 U.K. HEALTH INSURANCE MARKET, BY COVERAGE TYPE

12.1 OVERVIEW

12.2 LIFETIME COVERAGE

12.3 TERM COVERAGE

13 U.K. HEALTH INSURANCE MARKET, BY END-USER

13.1 OVERVIEW

13.2 CORPORATES

13.3 INDIVIDUALS

13.4 OTHERS

14 U.K. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 FINANCIAL INSTITUTIONS

14.4 E-COMMERCE

14.5 HOSPITALS

14.6 CLINICS

14.7 OTHERS

15 U.K. HEALTH INSURANCE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: U.K.

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CIGNA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATE

17.2 AVIVA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 ALLIANZ CARE (A SUBSIDIARY OF ALLIANZ)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATE

17.4 AXA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 BUPA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 AMERICAN INTERNATIONAL GROUP, INC. (2021)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 EXETER FRIENDLY SOCIETY LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 FREEDOM HEALTH INSURANCE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 GENERAL AND MEDICAL FINANCE LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 PRU LIFE UK

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 SAGA (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 VITALITY (A SUBSIDIARY OF DISCOVERY LTD)

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES

TABLE 2 LIST OF DAYCARE PROCEDURES

TABLE 3 AVERAGE EMPLOYEE PREMIUMS IN U.S. (2020)

TABLE 4 U.K. HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.K. PRODUCT IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.K. SOLUTIONS IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 U.K. HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 8 U.K. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 9 U.K. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 10 U.K. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 11 U.K. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 12 U.K. HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.K. HEALTH INSURANCE MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 14 U.K. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 U.K. HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 U.K. HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 U.K. HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 U.K. HEALTH INSURANCE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.K. HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.K. HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.K. HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.K. HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 9 U.K. HEALTH INSURANCE MARKET: CHALLENGE MATRIX

FIGURE 10 U.K. HEALTH INSURANCE MARKET: TYPE LIFE LINE CURVE

FIGURE 11 U.K. HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 12 U.K. HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 INCREASING COST OF MEDICAL SERVICES IS EXPECTED TO DRIVE THE U.K. HEALTH INSURANCE MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.K. HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.K. HEALTH INSURANCE MARKET

FIGURE 16 HEALTH INSURANCE COVERAGE

FIGURE 17 U.K. HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 18 U.K. HEALTH INSURANCE MARKET: BY SERVICES, 2021

FIGURE 19 U.K. HEALTH INSURANCE MARKET: BY LEVEL OF COVERAGE, 2021

FIGURE 20 U.K. HEALTH INSURANCE MARKET: BY SERVICE PROVIDERS, 2021

FIGURE 21 U.K. HEALTH INSURANCE MARKET: BY HEALTH INSURANCE PLANS, 2021

FIGURE 22 U.K. HEALTH INSURANCE MARKET: BY DEMOGRAPHICS, 2021

FIGURE 23 U.K. HEALTH INSURANCE MARKET: BY COVERAGE TYPE, 2021

FIGURE 24 U.K. HEALTH INSURANCE MARKET: BY END-USER, 2021

FIGURE 25 U.K. HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 U.K. HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.