U.A.E Aesthetics/Cosmetics Market Analysis and Size

The use of minimally invasive procedures has been shifted compared to traditional methods for aesthetic and cosmetic surgeries, including laser and other energy-based devices. For the benefit of surgical or non-surgical procedures, specially designed instruments have been developed for minimally used procedures.

Minimally Invasive Surgery (MIS) is a procedure conducted with the scope of viewing and specially equipped surgical instruments. This is why minimally invasive procedures allow no cuts or minimal cuts with a lesser recovery time, increasing demand and use of minimally invasive procedures.

The reasons for the rising of procedures can be defined by the increasing number of aging people and the requirement for healthcare facilities, including patient-friendly techniques whose medical requirements are maximum, which can further result in a decreased burden on healthcare facilities.

The technological advancements in aesthetics and cosmetic procedures and strategic initiatives by market players are acting as an opportunity for market growth. However, the stringent regulatory framework for performing surgeries, post-surgery complications among the population, and the long approval time associated with product launches are key challenges to market growth.

Data Bridge Market Research analyzes that the U.A.E aesthetics/ cosmetics market is expected to reach a value of USD 427.51 million by 2030, at a CAGR of 8.3% during the forecast period. The type segment accounts for the largest segment in the U.A.E aesthetics/ cosmetics market.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Million Units, and Pricing in USD |

|

Segments Covered |

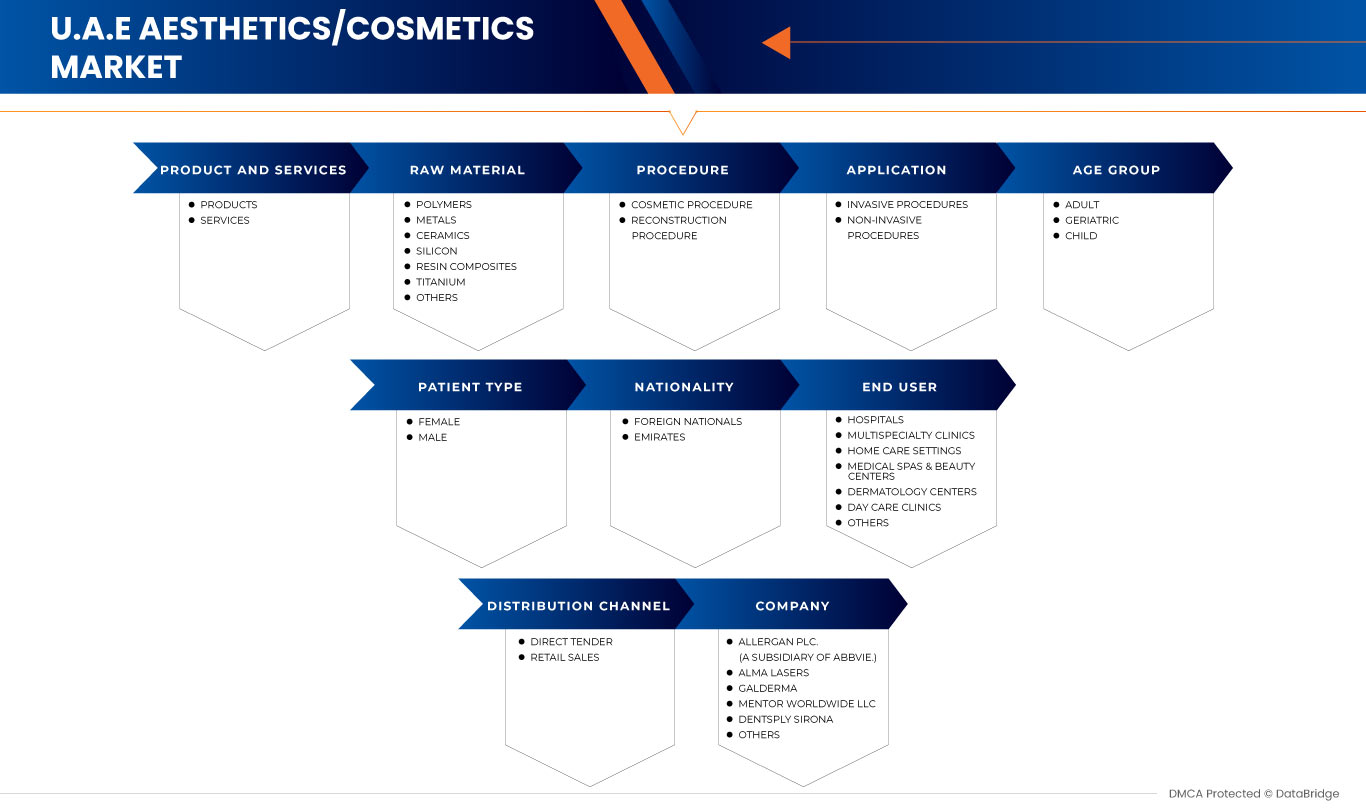

By Product and Services (Products and Services), Raw Material (Polymers, Metals, Ceramics, Resin Composites, Silicon, Titanium, and Others), Procedure (Cosmetic Procedure and Reconstruction Procedure), Application (Invasive Procedures and Non-Invasive Procedures), Age Group (Child, Adult, and Geriatric), Patient Type (Male and Female), Nationality (Foreign Nationals and Emirates), End User (Hospitals, Multispeciality Clinics, Home Care Settings, Medical Spas & Beauty Centers, Dermatology Centers, Day Care Clinics, and Others), Distribution Channel (Direct Tender and Retail Sales) |

|

Country Covered |

UAE |

|

Market Players Covered |

AESTHETICS INTERNATIONAL, Allergan PLC. (a subsidiary of Abbvie.), Alma Lasers, Al Shunnar Plastic Surgery, Al Zahra Hospital Dubai, American British Surgical & Medical Centre, Bausch Health Companies Inc., BTL Group of Companies, Candela Corporation, Celia Aesthetic Clinic, CYNOSURE, Dentsply Sirona, GALDERMA, Institut Straumann AG, LaseTech Trading LLC., Maria Medical Technology, Mentor Worlwide LLC, Proderma-me, Silkor Laser & Aesthetic Center, The Private Clinic, and ZIMMER GROUP among others |

Market Definition

The word "plastic" is derived from the Greek verb "plastikos", which means "to mold or make". This wonderful surgical specialty is without a doubt the most imaginative of all the surgical specialties. Cosmetic surgery and aesthetic plastic surgery both refer to operations that enhance the appearance of the face and body. They include facelifts, breast augmentation, breast reduction, eyelid surgery, rhinoplasty, stomach tucks (abdominoplasty), and fat removal (liposuction). In order to enhance the patient's appearance and self-esteem, plastic surgery is done to rearrange normal body components. Reconstructive surgery is the practice of doing surgery on defective body structures brought about by birth deformities, developmental flaws, trauma, infection, tumors, or disease. Surgery is typically done to improve function, but it can also be done to more closely resemble a normal appearance.

U.A.E Aesthetics/Cosmetics Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- A Rise in the Awareness of Aesthetic Procedures

Aesthetic procedures represent one of the most frequently performed medical procedures. Such procedures became increasingly popular. Social media is a term used to describe electronic platforms which promote information dissemination to target users. These platforms have a vital function to play in facilitating cosmetic procedures. Historically, surgeons have used their private web accounts, but today modern surgeons are utilizing Instagram, LinkedIn, Snapchat, Twitter, and other social networking sites gradually. Both tools were used to enhance contact, promotion, and awareness for colleagues and the general public.

The necessity of aesthetic treatment is in high demand in order to provide patients and healthcare professionals to remain in contact with the emerging technologically advanced therapeutic treatment option. Thus, increasing awareness of aesthetic surgeries is expected to act as a driver for market growth.

- Beliefs and Trends of Aesthetic Surgery in Young Adults

There has been an observed interest in cosmetic surgery in the Arab world overall, and the U.A.E is no exception. The number of cosmetic surgery and dermatology clinics has been steadily increasing with what seems to be a secure population. These clinics have attracted both sexes and patients of varying ages, and it has been observed that younger people have become more interested in these procedures. It has been observed in adolescents who come with their parents. These factors have led to an interest in exploring the motivations of the young population to undergo these procedures and discover whether they have common factors in their profile. The present study seeks to improve the awareness of the cultural perceptions of beauty, personal views of cosmetic procedures, personal experiences, and society’s perception of cosmetic procedures in the UAE.

Moreover, because of the trends and consciousness for looks, aesthetics and cosmetic surgeries might also be a reason for the attraction of young adults to these procedures.

Opportunities

- Increasing Influence of Social Media

Aesthetic procedures can be influenced by a variety of factors, one of which is social media use. Social media creates an unrealistic beauty standard, causing some people to be self-conscious about their appearance. As a result, they use filters and photoshop to hide their flaws. Most photo filter users in our study considered aesthetic procedures if they did not already have one. Thus, the influence of social media is expected to act as an opportunity for market growth.

Restraints/Challenges

- Post-Surgery Complications

Cosmetic procedures continue to grow in popularity in the U.A.E and across the globe. However, these procedures, even those that are minimally invasive, are not without risks. As a result, as the number of procedures has increased, so have the complications associated with them.

The most concerning part is post-surgery complications related to aesthetics and cosmetics procedures, which threaten the overall health and life of the patient, such as complications involving Hematoma and bruises, seroma formation, nerve damage causing sensory or motor loss, infection, scarring, and blood loss and complications of anesthesia can occur in cosmetics and aesthetics surgery. More serious complications such as Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE) can cause death. Thus, post-surgery complications are expected to act as a challenge to market growth.

- Stringent Regulatory Framework

Medical devices globally are regulated by Federal Act on Medicinal Products and Medical Devices and the Medical Devices Ordinance, which include the Federal Act on research involving human beings, and the Ordinance on clinical trials in human research in order to confirm the effectiveness and safety of ablation devices.

Moreover, companies involved in the manufacturing of aesthetic devices have to carefully go through the specifications of their product before categorizing their product as per their laws of medical devices with respect to each country's specific norms and regulations.

Hence, strict regulations for the approval of new devices are expected to challenge market growth.

Post-COVID-19 Impact on the U.A.E Aesthetics/Cosmetics Market

COVID-19 has significantly and negatively impacted the market. During this phase, there was a huge drop in the number of non-elective and non-essential surgical procedures and aesthetic and cosmetic surgeries did not make it to the list of essential surgeries. Significant financial losses in this pandemic phase resulted in derailing market growth.

Recent Developments

- In January 2023, GALDERMA announced the launch of FACE by Galderma. FACE is a cutting-edge aesthetic visualization application that simulates the results of injectable treatments in real-time, using digital facial assessment. This application provides advanced wrinkle detection as well as the possible results of 19 injectable treatments.

- In January 2022, Mentor Worldwide LLC (a Johnson & Johnson Medical Devices Company subsidiary) announced that the FDA had approved the MENTOR MemoryGel BOOST breast implant for breast augmentation and reconstruction. This product has helped the company to expand its product portfolio of aesthetics.

U.A.E Aesthetics/Cosmetics Market Scope

The U.A.E aesthetics/ cosmetics market is segmented into nine notable segments based on product and services, raw material, procedure, application, age group, patient type, nationality, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

U.A.E Aesthetics/Cosmetics Market, By Product And Services

- Products

- Services

Based on product and services, the market is segmented into products and services.

U.A.E Aesthetics/Cosmetics Market, By Raw Material

- Polymers

- Metals

- Ceramics

- Resin Composites

- Silicon

- Titanium

- Others

Based on raw material, the market is segmented into polymers, metals, ceramics, resin composites, silicon, titanium, and others.

U.A.E Aesthetics/Cosmetics Market, By Procedure

- Cosmetic Procedure

- Reconstruction Procedure

Based on procedure, the market is segmented into cosmetic procedure and reconstruction procedure.

U.A.E Aesthetics/Cosmetics Market, By Application

- Invasive Procedures

- Non Invasive Procedures

Based on application, the market is segmented into invasive procedures and non-invasive procedures

U.A.E Aesthetics/Cosmetics Market, Age Group

- Child

- Adult

- Geriatric

Based on age group, the market is segmented into child, adult, and geriatric.

U.A.E Aesthetics/Cosmetics Market, By Patient Type

- Male

- Female

Based on patient type, the market is segmented into male and female.

U.A.E Aesthetics/Cosmetics Market, Nationality

- Foreign Nationals

- Emirates

Based on nationality, the market is segmented into foreign nationals and Emirates.

U.A.E Aesthetics/Cosmetics Market, By End User

- Hospitals

- Multi Speciality Clinics

- Home Care Settings

- Medical Spas & Beauty Centers

- Dermatology Centers

- Day Care Clinics

- Others

Based on end user, the market is segmented into hospitals, multispecialty clinics, home care settings, medical spas & beauty centers, dermatology centers, day care clinics, and others.

U.A.E Aesthetics/Cosmetics Market, By Distribution Channel

- Direct Tender

- Retail Sales

Based on distribution channel, the market is segmented into direct tender and retail sales.

Competitive Landscape and U.A.E Aesthetics/Cosmetics Market Share Analysis

The U.A.E aesthetics/cosmetics market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major market players operating in the U.A.E aesthetics/cosmetics market are AESTHETICS INTERNATIONAL, Allergan PLC. (a subsidiary of Abbvie.), Alma Lasers, Al Shunnar Plastic Surgery, Al Zahra Hospital Dubai, American British Surgical & Medical Centre, Bausch Health Companies Inc., BTL Group of Companies, Candela Corporation, Celia Aesthetic Clinic, CYNOSURE, Dentsply Sirona, GALDERMA, Institut Straumann AG, LaseTech Trading LLC., Maria Medical Technology, Mentor Worlwide LLC, Proderma-me, Silkor Laser & Aesthetic Center, The Private Clinic, and ZIMMER GROUP among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 PRODUCT AND SERVICES LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 INDUSTRIAL INSIGHTS

5 PROCEDURE TREND ANALYSIS: UAE AESTHETICS/COSMETICS MARKET

5.1 LIPOSUCTION

5.2 TUMMY TUCK

5.3 BREAST AUGMENTATION

5.4 EYELID SURGERY

5.5 FACELIFT SURGERY

5.6 EAR SURGERY

5.7 CHIN SURGERY

5.8 CHEEK AUGMENTATION

5.9 BUCCAL FAT REMOVAL

5.1 BROW LIFT

5.11 RHINOPLASTY

5.12 OTHERS

6 REGULATORY FRAMEWORK

7 REGIONAL SUMMARY

8 MARKET OVERVIEW: UAE AESTHETICS/COSMETICS MARKET

8.1 DRIVERS

8.1.1 THE RISE IN THE AWARENESS OF AESTHETIC PROCEDURES

8.1.2 BELIEFS AND TRENDS OF AESTHETIC SURGERY IN YOUNG ADULTS

8.1.3 RISE IN MEDICAL TOURISM IN UAE

8.1.3.1 GOVERNMENT INITIATIVES IN MEDICAL TOURISM

8.1.3.2 ADVANTAGES OF THE MIDDLE EAST

8.1.4 RISING PREVALENCE OF MINIMALLY INVASIVE PROCEDURES

8.2 RESTRAINTS

8.2.1 SOCIAL STIGMA A BARRIER

8.2.2 STRINGENT REGULATORY FRAMEWORK

8.3 OPPORTUNITIES

8.3.1 TECHNOLOGICAL ADVANCEMENTS IN AESTHETICS AND COSMETICS PROCEDURES

8.3.2 INCREASING INFLUENCE OF SOCIAL MEDIA

8.3.3 INCREASE IN COSMETIC SURGERIES

8.4 CHALLENGES

8.4.1 POST-SURGERY COMPLICATIONS

8.4.2 HIGH COST OF PROCEDURE

9 UAE AESTHETICS/COSMETICS MARKET, BY PRODUCT AND SERVICES

9.1 OVERVIEW

9.2 PRODUCT

9.2.1 NON ENERGY BASED DEVICES

9.2.1.1 FACIAL AESTHETICS PRODUCT

9.2.1.1.1 BOTULINUM TOXIN

9.2.1.1.2 DERMAL FILLERS

9.2.1.1.2.1 NATURAL DERMAL FILLERS

9.2.1.1.2.2 SYNTHETIC DERMAL FILLERS

9.2.1.1.3 FACIAL TONING

9.2.1.1.4 CHEMICAL PEEL

9.2.1.1.4.1 LUNCH TIME PEEL

9.2.1.1.4.2 MEDIUM PEEL

9.2.1.1.4.3 DEEP PEEL

9.2.1.1.5 COLLAGEN INJECTIONS

9.2.1.1.5.1 BOVINE

9.2.1.1.5.2 PORCINE

9.2.1.1.5.3 others

9.2.1.1.6 ELECTROTHERAPY

9.2.1.1.7 MICRODERMABRASION

9.2.1.1.7.1 MICRODERMABRASION MACHINES

9.2.1.1.7.1.1 TABLE TOP

9.2.1.1.7.1.2 HAND HELD

9.2.1.1.7.2 MICRODERMABRASION TIPS

9.2.1.1.7.2.1 DIAMOND TIPS

9.2.1.1.7.2.2 BRISTLE TIPS

9.2.1.1.7.3 MICRODERMABRASION CREAMS AND SCRUBS

9.2.1.1.7.4 MICRODERMABRASION CRYSTALS

9.2.1.1.7.5 ALUMINIUM OXIDE CRYSTALS

9.2.1.1.7.6 SODIUM CHLORIDE CRYSTALS

9.2.1.1.7.7 SODIUM BICARBONATE CRYSTALS

9.2.1.1.8 FRAXEL

9.2.1.1.9 PERMANENT MAKEUP

9.2.1.1.10 COSMETIC ACUPUNCTURE

9.2.1.1.11 OTHERS

9.2.1.2 BODY CONTOURING DEVICES

9.2.1.2.1 NON-SURGICAL FAT REDUCTION DEVICES

9.2.1.2.1.1 LOW LEVEL LASERS

9.2.1.2.1.2 ULTRASOUND

9.2.1.2.1.3 CRYOLIPOLYSIS

9.2.1.2.1.4 OTHERS

9.2.1.2.2 LIPOSUCTION DEVICES

9.2.1.2.2.1 PORTABLE LIPOSUCTION DEVICES

9.2.1.2.2.2 STANDALONE LIPOSUCTION DEVICES

9.2.1.2.3 CELLULITE REDUCTION DEVICES

9.2.1.2.4 OTHERS

9.2.1.3 HAIR REMOVAL DEVICES

9.2.1.3.1 LASER HAIR REMOVAL DEVICES

9.2.1.3.2 INTENSE PULSED LIGHT HAIR REMOVAL DEVICES

9.2.1.4 SKIN AESTHETICS/ COSMETICS

9.2.1.4.1 NON-SURGICAL SKIN TIGHTENING DEVICES

9.2.1.4.2 MICRO NEEDLING PRODUCT

9.2.1.4.3 LIGHT THERAPY DEVICES

9.2.1.4.4 OTHERS

9.2.1.4.4.1 TATTOO REMOVAL DEVICES

9.2.1.4.4.2 NAIL TREATMENT LASER DEVICES

9.2.1.4.4.3 THREAD LIFT PRODUCT

9.2.1.4.4.4 PHYSICIAN DISPENSED COSMECEUTICALS AND SKIN LIGHTENERS

9.2.1.4.4.5 PHYSICIAN DISPENSED EYELASH PRODUCT

9.2.1.5 COSMETIC IMPLANTS

9.2.1.5.1 BREAST IMPLANTS

9.2.1.5.1.1 SILICONE IMPLANTS

9.2.1.5.1.2 SALINE IMPLANTS

9.2.1.5.2 DENTAL IMPLANTS

9.2.1.5.2.1 ENDOSTEAL IMPLANTS

9.2.1.5.2.1.1 TITANIUM

9.2.1.5.2.1.2 ZIRCONIUM

9.2.1.5.2.1.3 OTHERS

9.2.1.5.2.1.4 TAPERED

9.2.1.5.2.1.5 Parallel

9.2.1.5.2.2 SUB PERIOSTEAL IMPLANTS

9.2.1.5.2.2.1 TITANIUM

9.2.1.5.2.2.2 ZIRCONIUM

9.2.1.5.2.2.3 OTHERS

9.2.1.5.2.2.4 TAPERED

9.2.1.5.2.2.5 PARALLEL

9.2.1.5.2.3 ZYGOMATIC IMPLANTS

9.2.1.5.2.3.1 TITANIUM

9.2.1.5.2.3.2 ZIRCONIUM

9.2.1.5.2.3.3 OTHERS

9.2.1.5.2.3.4 TAPERED

9.2.1.5.2.3.5 PARALLEL

9.2.1.5.3 BONE REGENERATION GRAFTS

9.2.1.5.3.1 ALLOGRAFT

9.2.1.5.3.1.1 DEMINERALIZED BONE MATRIX

9.2.1.5.3.1.2 OTHERS

9.2.1.5.3.2 AUTOGRAFT

9.2.1.5.3.3 XENOGRAFT

9.2.1.5.3.4 OTHERS

9.2.1.6 IMPLANTS FOR THE BODY

9.2.1.6.1 FACIAL IMPLANTS

9.2.1.6.2 GLUTEAL/BUTTOCK IMPLANTS

9.2.1.6.3 SKIN EXPANDERS

9.2.1.6.4 NASAL STENTS

9.2.1.6.5 PENILE STENTS

9.2.1.6.6 TESTICULAR IMPLANTS

9.2.1.6.7 PECTORAL IMPLANTS

9.2.1.6.8 CALF IMPLANTS

9.2.1.6.9 EAR IMPLANTS

9.2.1.6.10 OTHERS

9.2.1.7 CUSTOM MADE IMPLANTS

9.2.2 ENERGY BASED DEVICES

9.2.2.1 LASER BASED AESTHETIC DEVICES

9.2.2.1.1 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

9.2.2.1.1.1.1 RADIOFREQUENCY

9.2.2.1.1.1.2 FRACTIONAL LASER

9.2.2.1.1.1.3 INTENSE PULSED LIGHT

9.2.2.1.1.1.4 OTHERS

9.2.2.1.2 ABLATIVE SKIN RESURFACING DEVICES

9.2.2.1.2.1 ERBIUM LASER

9.2.2.1.2.2 CO2 LASER

9.2.2.1.2.3 OTHERS

9.2.2.2 ELECTRO SURGERY DEVICES

9.2.2.2.1 BIPOLAR ELECTROSURGICAL INSTRUMENTS

9.2.2.2.1.1 BIPOLAR FORCEPS

9.2.2.2.1.2 ADVANCED VESSEL SEALING INSTRUMENTS

9.2.2.2.2 ELECTROSURGICAL ACCESSORIES

9.2.2.2.3 MONOPOLAR ELECTROSURGICAL INSTRUMENTS

9.2.2.2.3.1 ELECTROSURGICAL PENCILS

9.2.2.2.3.2 ELECTROSURGICAL ELECTRODES

9.2.2.2.3.3 SUCTION COAGULATORS

9.2.2.2.3.4 MONOPOLAR FORCEPS

9.2.2.2.4 OTHERS

9.2.2.3 CRYOSURGERY DEVICES

9.2.2.4 LIGHT BASED AESTHETIC DEVICES

9.2.2.5 ULTRASOUND AESTHETIC DEVICES

9.2.2.6 MICROWAVE DEVICES

9.2.2.7 HARMONIC SCALPEL

9.2.2.8 ELECTROCAUTERY DEVICES

9.2.2.9 OTHERS

9.3 SERVICES

9.3.1 BODY CARE

9.3.1.1 LIPOSUCTION

9.3.1.2 FAT TRANSFER

9.3.1.3 TUMMY TUCK

9.3.1.4 ARM LIFT

9.3.1.5 OTHERS

9.3.2 FACE CARE

9.3.2.1 EYELID

9.3.2.2 NOSE SURGERY

9.3.2.3 FOREHEAD/ BROW LIFT

9.3.2.4 NECK LIFT

9.3.2.5 EAR SURGERY

9.3.2.6 MICROLIFT

9.3.2.7 OTHERS

9.3.3 SKIN CARE

9.3.3.1 SKIN TIGHTENING

9.3.3.2 FACIAL & SKIN REJUVENATION

9.3.3.3 ANTIAGING & WRINKLES

9.3.3.4 PIGMENTED LESION REMOVAL

9.3.3.5 ACNE TREATMENT

9.3.3.6 OTHERS

9.3.4 OTHERS

10 UAE AESTHETICS/ COSMETICS MARKET, BY RAW MATERIAL

10.1 OVERVIEW

10.2 POLYMERS

10.3 METALS

10.4 CERAMICS

10.5 SILICON

10.6 RESIN COMPOSITES

10.7 TITANIUM

10.8 OTHERS

11 UAE AESTHETICS/ COSMETICS MARKET, BY PROCEDURE

11.1 OVERVIEW

11.2 COSMETIC PROCEDURE

11.3 RECONSTRUCTION PROCEDURE

12 UAE AESTHETICS/ COSMETICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 INVASIVE PROCEDURES

12.2.1 LIPOSUCTION

12.2.2 BREAST AUGMENTATION

12.2.3 EYELID SURGERY

12.2.4 RHINOPLASTY

12.2.5 FACE LIFT SURGERY

12.2.6 BROW LIFT

12.2.7 EAR SURGERY

12.2.8 TUMMY TUCK

12.2.9 CHEEK AUGMENTATION

12.2.10 CHIN SURGERY

12.2.11 BUCCAL FAT REMOVAL

12.2.12 OTHERS

12.3 NON- INVASIVE PROCEDURES

12.3.1 BOTULINUM TOXINS

12.3.2 SOFT TISSUE FILLERS

12.3.3 CHEMICAL PEEL

12.3.4 LASER HAIR REMOVAL

12.3.5 MICRODERMABRASSION

12.3.6 OTHERS

13 UAE AESTHETICS/ COSMETICS MARKET, BY PATIENT TYPE

13.1 OVERVIEW

13.2 FEMALE

13.3 MALE

14 UAE AESTHETICS/ COSMETICS MARKET, BY AGE GROUP

14.1 OVERVIEW

14.2 ADULT

14.3 GERIATRIC

14.4 CHILD

15 UAE AESTHETICS/COSMETICS MARKET, BY NATIONALITY

15.1 OVERVIEW

15.2 FOREIGN NATIONALS

15.3 EMIRATIS

16 UAE AESTHETICS/COSMETICS MARKET, BY END USER

16.1 OVERVIEW

16.2 DERMATOLOGY CENTERS

16.2.1 INVASIVE PROCEDURES

16.2.2 NON-INVASIVE PROCEDURES

16.3 HOSPITALS

16.3.1 BY PROCEDURE

16.3.1.1 INVASIVE PROCEDURES

16.3.1.2 NON-INVASIVE PROCEDURES

16.3.2 BY TYPE

16.3.2.1 PRIVATE

16.3.2.2 PUBLIC

16.3.3 BY CATEGORY

16.3.3.1 TIER 1

16.3.3.2 TIER 2

16.3.3.3 TIER 3

16.4 MEDICAL SPAS AND BEAUTY CENTERS

16.4.1 INVASIVE PROCEDURES

16.4.2 NON-INVASIVE PROCEDURES

16.5 MULTI-SPECIALTY CLINICS

16.5.1 INVASIVE PROCEDURES

16.5.2 NON-INVASIVE PROCEDURES

16.6 DAY CARE CLINICS

16.6.1 NON-INVASIVE PROCEDURES

16.6.2 INVASIVE PROCEDURES

16.7 HOMECARE SETTINGS

16.7.1 NON-INVASIVE PROCEDURES

16.7.2 INVASIVE PROCEDURES

16.8 OTHERS

17 UAE AESTHETICS/COSMETICS MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDER

17.3 RETAIL SALES

18 UAE AESTHETICS/COSMETICS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: UAE

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 ALLERGEN PLC. (SUBSIDIARY OF ABBVIE.)

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 ALMA LASERS (A SUBSIDIARY OF SISRAM MEDICAL)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.3 GALDERMA

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 RECENT DEVELOPMENT

20.4 MENTOR WORLDWIDE LLC

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 DENTSPLY SIRONA

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENTS

20.6 BTL GROUP OF COMPANIES

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 BAUSCH HEALTH COMPANIES, INC.

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 CYNOSURE

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 CANDELA CORPORATION

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 INSTITUT STRAUMANN AG

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 LASETECH TRADING LLC.

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENTS

20.12 MARIA MEDICAL TECHNOLOGY

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 PRODERMA-ME

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 SILKOR LASER & AESTHETIC CENTER

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 ZIMMER GROUP

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

21 CASE STUDY COMPANIES

21.1 AMERICAN BRITISH SURGICAL & MEDICAL CENTRE

21.1.1 COMPANY SNAPSHOT

21.1.2 PRODUCT PORTFOLIO

21.1.3 COMPANY OUTLINE

21.2 AESTHETICS INTERNATIONAL

21.2.1 COMPANY SNAPSHOT

21.2.2 PRODUCT PORTFOLIO

21.2.3 COMPANY OUTLINE

21.3 AL ZAHRA HOSPITAL DUBAI

21.3.1 COMPANY SNAPSHOT

21.3.2 PRODUCT PORTFOLIO

21.3.3 COMPANY OUTLINE

21.4 AL SHUNNAR PLASTIC SURGERY

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 COMPANY OUTLINE

21.5 CELIA AESTHETIC CLINIC

21.5.1 COMPANY SNAPSHOT

21.5.2 PRODUCT PORTFOLIO

21.5.3 COMPANY OUTLINE

21.6 THE PRIVATE CLINIC

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 COMPANY OUTLINE

22 QUESTIONNAIRE

23 RELATED REPORTS

List of Table

TABLE 1 STATISTICS OF NON-SURGICAL PROCEDURES IN UAE

TABLE 2 UAE AESTHETICS/COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 UAE PRODUCT IN AESTHETICS/COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 UAE NON ENERGY BASED DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 UAE FACIAL AESTHETICS PRODUCT IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 UAE DERMAL FILLERS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 UAE CHEMICAL PEEL IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 UAE COLLAGEN INJECTIONS IN AESTHETICS/COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 UAE COLLAGEN INJECTIONS IN AESTHETICS/COSMETICS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 10 UAE MICRODERMABRASION IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 UAE MICRODERMABRASION MACHINES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 UAE MICRODERMABRASION MACHINES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 13 UAE MICRODERMABRASION TIPS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 14 UAE MICRODERMABRASION TIPS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 15 UAE MICRODERMABRASION CRYSTALS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 16 UAE MICRODERMABRASION CRYSTALS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 17 UAE BODY CONTOURING IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 18 UAE NON SURGICAL FAT REDUCTION DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 19 UAE NON SURGICAL FAT REDUCTION DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 20 UAE LIPOSUCTION DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 21 UAE LIPOSUCTION DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 22 UAE HAIR REMOVAL DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 23 UAE HAIR REMOVAL DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 24 UAE SKIN AESTHETICS/ COSMETICS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 25 UAE SKIN AESTHETICS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 26 UAE OTHERS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 UAE COSMETIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 UAE BREAST IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 29 UAE BREAST IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 30 UAE DENTAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 31 UAE ENDOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 32 UAE ENDOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (UNIT)

TABLE 33 UAE ENDOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 34 UAE SUB PERIOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 35 UAE SUB PERIOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (UNIT)

TABLE 36 UAE SUB PERIOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 37 UAE ZYGOMATIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 38 UAE ZYGOMATIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (UNIT)

TABLE 39 UAE ZYGOMATIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 40 UAE BONE REGENERATION GRAFTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 41 UAE ZYGOMATIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (UNIT)

TABLE 42 UAE ALLOGRAFT IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 43 UAE IMPLANTS FOR THE BODY IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 44 UAE ENERGY BASED AESTHETIC DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 45 UAE ENERGY BASED AESTHETIC DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 46 UAE LASER BASED AESTHETIC DEVICE IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 47 UAE NON ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 UAE NON ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 UAE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 50 UAE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 51 UAE ELECTROSURGERY DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 52 UAE BIPOLAR ELECTROSURGICAL INSTRUMENTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 53 UAE BIPOLAR ELECTROSURGICAL INSTRUMENTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (MILLION UNIT)

TABLE 54 UAE MONOPOLAR ELECTROSURGICAL INSTRUMENTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 55 UAE MONOPOLAR ELECTROSURGICAL INSTRUMENTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (MILLION UNIT)

TABLE 56 UAE SERVICES IN AESTHETICS/ COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 UAE BODY CARE IN AESTHETICS/ COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 UAE FACE CARE IN AESTHETICS/ COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 UAE SKIN CARE IN AESTHETICS/ COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 UAE AESTHETICS/ COSMETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 61 UAE AESTHETICS/ COSMETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 62 UAE AESTHETICS/ COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 UAE INVASIVE PROCEDURES IN AESTHETICS/ COSMETICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 64 UAE NON- INVASIVE PROCEDURES IN AESTHETICS/ COSMETICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 65 UAE AESTHETICS/ COSMETICS MARKET, BY PATIENT TYPE, 2021-2030 (USD MILLION)

TABLE 66 UAE AESTHETICS/ COSMETICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 67 UAE MEDICAL AESTHETICS MARKET, BY NATIONALITY, 2021-2030 (USD MILLION)

TABLE 68 UAE MEDICAL AESTHETICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 69 UAE DERMATOLOGY CENTERS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 70 UAE HOSPITALS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 71 UAE HOSPITALS IN MEDICAL AESTHETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 UAE HOSPITALS IN MEDICAL AESTHETICS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 73 UAE MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 74 UAE MULTI-SPECIALTY CLINICS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 75 UAE DAY CARE CLINICS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 76 UAE HOMECARE SETTINGS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 77 UAE MEDICAL AESTHETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 UAE AESTHETICS/COSMETICS MARKET: SEGMENTATION

FIGURE 2 UAE AESTHETICS/COSMETICS MARKET: DATA TRIANGULATION

FIGURE 3 UAE AESTHETICS/COSMETICS MARKET: DROC ANALYSIS

FIGURE 4 UAE AESTHETICS/COSMETICS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 UAE AESTHETICS/COSMETICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 UAE AESTHETICS/COSMETICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 UAE AESTHETICS/COSMETICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 UAE AESTHETICS/COSMETICS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 UAE AESTHETICS/COSMETICS MARKET: SEGMENTATION

FIGURE 10 THE RISE IN AWARENESS ABOUT AESTHETIC PROCEDURES AND BELIEF AND TRENDS OF AESTHETIC SURGERY IN YOUNG ADULTS ARE EXPECTED TO DRIVE THE UAE AESTHETICS/COSMETICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE UAE AESTHETICS/COSMETICS MARKET IN 2023 AND 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE UAE AESTHETICS/COSMETICS MARKET

FIGURE 13 TRENDING COSMETIC SURGERIES IN UAE

FIGURE 14 UAE AESTHETICS/COSMETICS MARKET: BY TYPE, 2022

FIGURE 15 UAE AESTHETICS/COSMETICS MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 16 UAE AESTHETICS/COSMETICS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 17 UAE AESTHETICS/COSMETICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 UAE AESTHETICS/ COSMETICS MARKET: BY RAW MATERIAL, 2022

FIGURE 19 UAE AESTHETICS/ COSMETICS MARKET: BY RAW MATERIAL, 2023-2030 (USD MILLION)

FIGURE 20 UAE AESTHETICS/ COSMETICS MARKET: BY RAW MATERIAL, CAGR (2023-2030)

FIGURE 21 UAE AESTHETICS/ COSMETICS MARKET: BY RAW MATERIAL, LIFELINE CURVE

FIGURE 22 UAE AESTHETICS/ COSMETICS MARKET: BY PROCEDURE, 2022

FIGURE 23 UAE AESTHETICS/ COSMETICS MARKET: BY PROCEDURE, 2023-2030 (USD MILLION)

FIGURE 24 UAE AESTHETICS/ COSMETICS MARKET: BY PROCEDURE, CAGR (2023-2030)

FIGURE 25 UAE AESTHETICS/ COSMETICS MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 26 UAE AESTHETICS/ COSMETICS MARKET: BY APPLICATION, 2022

FIGURE 27 UAE AESTHETICS/ COSMETICS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 28 UAE AESTHETICS/ COSMETICS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 29 UAE AESTHETICS/ COSMETICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 UAE AESTHETICS/ COSMETICS MARKET: BY PATIENT TYPE, 2022

FIGURE 31 UAE AESTHETICS/ COSMETICS MARKET: BY PATIENT TYPE, 2023-2030 (USD MILLION)

FIGURE 32 UAE AESTHETICS/ COSMETICS MARKET: BY PATIENT TYPE, CAGR (2023-2030)

FIGURE 33 UAE AESTHETICS/ COSMETICS MARKET: BY PATIENT TYPE, LIFELINE CURVE

FIGURE 34 UAE AESTHETICS/ COSMETICS MARKET: BY AGE GROUP, 2022

FIGURE 35 UAE AESTHETICS/ COSMETICS MARKET: BY AGE GROUP, 2023-2030 (USD MILLION)

FIGURE 36 UAE AESTHETICS/ COSMETICS MARKET: BY AGE GROUP, CAGR (2023-2030)

FIGURE 37 UAE AESTHETICS/ COSMETICS MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 38 UAE AESTHETICS/COSMETICS MARKET: BY NATIONALITY, 2022

FIGURE 39 UAE AESTHETICS/COSMETICS MARKET: BY NATIONALITY, 2023-2030 (USD MILLION)

FIGURE 40 UAE AESTHETICS/COSMETICS MARKET: BY NATIONALITY, CAGR (2023-2030)

FIGURE 41 UAE AESTHETICS/COSMETICS MARKET: BY NATIONALITY, LIFELINE CURVE

FIGURE 42 UAE AESTHETICS/COSMETICS MARKET: BY END USER, 2022

FIGURE 43 UAE AESTHETICS/COSMETICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 44 UAE AESTHETICS/COSMETICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 45 UAE AESTHETICS/COSMETICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 46 UAE AESTHETICS/COSMETICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 47 UAE AESTHETICS/COSMETICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 48 UAE AESTHETICS/COSMETICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 49 UAE AESTHETICS/COSMETICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 50 THE UAE AESTHETICS/COSMETICS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.