Turkey Physical Security Market Analysis and Size

Physical security measures protect buildings and the equipment within. In other words, they barricade trespassers from entering and permit authorized ones to do so. While network and cybersecurity are crucial, guarding against physical security lapses and threats is the only way to ensure the safety of the technology, the data, and any staff or faculty with access to the facility. It offers defense against terrorism, fire, robbery, vandalism, and natural calamities.

Data Bridge Market Research analyses that Turkey physical security market is expected to reach the value of USD 1,610.06 million by 2029, at a CAGR of 9.1% during the forecast period. The physical security market report also comprehensively covers pricing, patent, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Component (Hardware, Services and Software), Authentication (Single-Factor Authentication, Two-Factor Authentication and Three-Factor Authentication), Deployment Model (On-Premise and Cloud), Enterprise Size (Large Sized Enterprises and Small and Medium-Sized Enterprises), End User (Commercial, Government, Industrial and Residential) |

|

Market Players Covered |

Thales, HID Global Corporation, Bosch Sicherheitssysteme GmbH, Hangzhou Hikvision Digital Technology Co., Ltd., Pelco (A Motorolla Solutions Company), Cisco Systems, Inc., Axis Communications AB, Johnson Controls, Aware, Inc., IDEMIA |

Market Definition

Physical security is a security service that aims to protect personnel, hardware, software, networks, and data from physical actions and events that could cause severe loss to an organization, enterprise, agency, or institution. These security services include protection from fire, flood, natural disasters, burglary, theft, vandalism, and terrorism. Security personnel, CCTV cameras, locks, safety barriers, access control protocols, and other similar tools are all included in its various layers, which incorporate interdependent systems.

Turkey Physical Security Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Emergence of smart interconnected building/home

Recently, the popularity of smart homes/buildings has grown among consumers. A smart home/building is a residence that uses internet-connected devices to enable remote monitoring, access control solutions, and management of appliances & systems, such as smart lighting, smart locks, smart biometrics, and others.

Moreover, smart home devices are efficient and energy-saving, reducing energy bill payments. Smart home devices, due to their innovative features, in-built motion detectors, internet connectivity, and control through smartphones, laptops, and other devices, make the consumer feel safe, comfortable, and secure.

- Rapid growth in the importance of physical biometric solutions across all sectors

Biometric-based physical security devices are increasing across all regions of the globe. The fingerprint, physical access control system, video surveillance system, and facial recognition system are integrated with electronic devices such as laptops, mobiles, and other smart handheld devices. The smart approach also uses these access control door locks, security systems, home automation, IoT, automotive, game consoles, and mobile devices.

With an access control door lock, a person can quickly identify and access the house or organization by enhancing security features. The companies are performing many research activities to incorporate the advanced physical biometric system into the devices for security.

Opportunity

- Rise in strategic partnership and acquisition among organizations for physical and cyber security system

Coordinating and investing in projects is essential for achieving sustained improvements in the physical security market. Due to this, the government and other private organizations are striving through partnerships and acquisitions, thereby accelerating the growth of the industries. This helps to build awareness and profit for the organization, thereby creating scope for a new invention in the industry. Also, through partnerships, the company can invest more in advanced technologies to provide more secure and reliable physical security market services and solutions.

Expanding the business could connect more people to the company's products and services. They will be able to convert more clients and boost their sales by expanding the customer base. This helps make awareness, increases the organization's profit, and creates scope for sustainable growth. Furthermore, this allows the company to get recognized in the premium market.

Restraints/Challenges

- Rise in cyber security threat and ransomware in physical and cyber security solutions

Due to COVID-19, cybercrime and cybersecurity issues increased by 600% in 2020. Flaws in network security are a weakness that hackers exploit to perform unauthorized actions within a system. According to Purple Sec L.L.C., in 2018, mobile malware variants for mobile have increased by 54% 2018, out of which 98% of mobile malware target Android devices. 25% of businesses are estimated to have been victims of crypto-jacking. Various companies also include the security industry.

- Complexity associated with the integration of various physical security systems

Integrating security systems involves combining logical and physical security applications, such as biometric identity programs and access control, into a single, all-encompassing plan. For instance, if the access control and intrusion alarm systems are linked, the access control system can be programmed to lock down a facility based on the type of alarm sounds when the system determines an intruder. However, one has to buy all the components from the same vendor. If the vendor provides only minimal support, customers could become saddled with a system that does not meet their needs. Also, redesigning and redeploying web- and mobile-based applications can become exhaustive and time-consuming.

Post-COVID-19 Impact on Turkey Physical Security Market

COVID-19 negatively impacted the physical security market due to lockdown regulations and the shutdown of manufacturing facilities.

The COVID-19 pandemic has impacted the physical security market to an extent positive manner. The surge in demand for video surveillance systems in various industries worldwide has helped the market grow during the pandemic. Also, the growth has been high since the market opened after COVID-19 owing to the increasing adoption of access control protocols in a commercial and industrial environments.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in physical security. With this, the companies will bring advanced technologies to the market. In addition, government initiatives to use automation technology have led to the market's growth.

Recent Developments

- In October 2021, Honeywell and IDEMIA partnered to develop intelligent building offerings. Under the partnership, products had been set for building access which integrated Honeywell security and building management systems with IDEMIA's biometric-based access control systems. This helped the company diversify its product portfolio and gain a new market in the building access control market

- In August 2020, Motorola Solutions acquired Pelco Corporations for USD 110 million. This acquisition aimed to take the video management solution offered by Pelco international. Further, Motorola Solutions made Pelco Corporation one of the principal subsidiaries in the physical security market. Through this, both companies further enhanced their market presence by offering innovative solutions for the consumer

Turkey Physical Security Market Scope

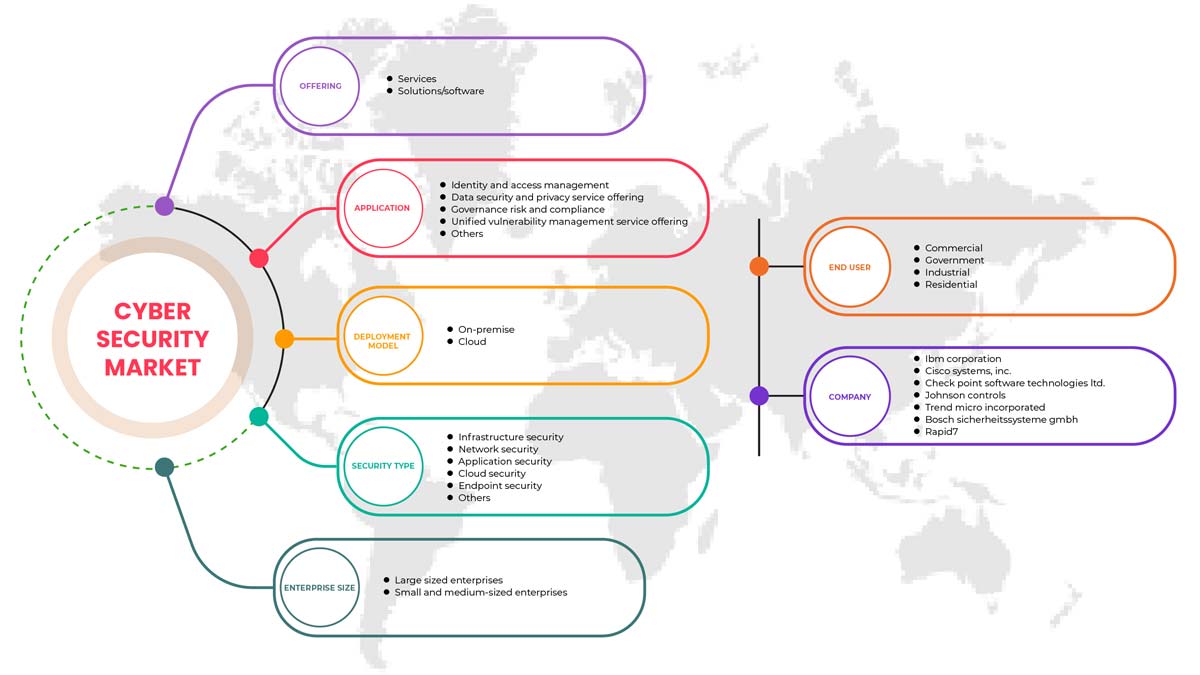

Turkey physical security market is segmented on component, authentication, deployment model, enterprise size, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Services

- Software

On the basis of component, the Turkey physical security market is segmented into hardware, services, and software.

Authentication

- Single-factor authentication

- Two-factor authentication

- Three-factor authentication

On the basis of authentication, the Turkey physical security market has been segmented into single-factor authentication, two-factor authentication, and three-factor authentication.

Deployment Model

- On-premise

- Cloud

On the basis of deployment model, the Turkey physical security market has been segmented into on-premise and cloud.

Enterprise Size

- Large sized enterprises

- Small and medium-sized enterprises

On the basis of enterprise size, the Turkey physical security market has been segmented into large sized enterprises and small and medium-sized enterprises.

End User

- Commercial

- Government

- Industrial

- Residential

On the basis of end user, the Turkey physical security market is segmented into commercial, government, industrial, and residential.

Turkey Physical Security Market Regional Analysis/Insights

Turkey physical security market is analyzed, and market size insights and trends are provided by the country, component, authentication, deployment type, enterprise size, and end user, as referenced above.

The country section of the report also provides individual market impacting factors and changes in market regulation that influence the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Turkey brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Turkey Physical Security Market Share Analysis

Turkey physical security market competitive landscape provides details of competitors. Company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Turkey presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the physical security market.

Some of the major players operating in the Turkey physical security market are Thales, HID Global Corporation, Bosch Sicherheitssysteme GmbH, Hangzhou Hikvision Digital Technology Co., Ltd., Pelco (A Motorolla Solutions Company), Cisco Systems, Inc., Axis Communications AB, Johnson Controls, Aware, Inc., IDEMIA among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF TURKEY PHYSICAL AND CYBER SECURITY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END USER COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 COMPONENT TIMELINE CURVE

2.11 OFFERING TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INVESTMENT POLICY

4.1 CASE STUDY

4.1.1 SECURE SOFTWARE DEVELOPMENT INFRASTRUCTURE

4.1.2 SOC-AS-A-PLATFORM (SOCAAP)

4.1.3 RANSOMWARE & FORENSICS ANALYSIS

4.1.4 WISCONSIN'S DEER DISTRICT SECURITY PLAN

4.1.5 LICENSE PLATE READERS IN SCHOOLS

4.1.6 K-12 SCHOOLS

4.2 VALUE CHAIN ANALYSIS

4.3 PORTERS FIVE FORCES

4.4 PESTLE ANALYSIS

4.5 TECHNOLOGICAL LANDSCAPE

4.5.1 AI AND MACHINE LEARNING

4.5.2 IOT

4.5.3 BLOCKCHAIN

4.6 REGULATORY STANDARDS

4.6.1 CYBER SECURITY

4.6.2 PHYSICAL SECURITY

4.7 LOCAL PLAYERS LIST

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF REMOTE WORKING CULTURE

5.1.2 INCREASE IN CLOUD SERVICES CYBER AND PHYSICAL SECURITY SOLUTIONS

5.1.3 GROWING IMPORTANCE OF PHYSICAL BIOMETRIC SOLUTIONS ACROSS ALL SECTORS

5.1.4 EMERGENCE OF SMART INTERCONNECTED BUILDING/HOME

5.2 RESTRAINTS

5.2.1 RISE IN CYBER SECURITY THREAT AND RANSOMWARE IN PHYSICAL AND CYBER SECURITY SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR PHYSICAL AND CYBER SECURITY SYSTEM

5.3.2 EMERGENCE OF VARIOUS DISRUPTIVE TECHNOLOGY SUCH AS IOT AND AI FOR VARIOUS INDUSTRIES

5.3.3 INCREASE IN CASES OF DATA AND SECURITY BREACHES IN VARIOUS ORGANIZATIONS

5.4 CHALLENGES

5.4.1 LACK OF PROFESSIONAL EXPERTISE FOR CYBER SECURITY SYSTEMS

5.4.2 COMPLEXITY ASSOCIATED WITH THE INTEGRATION OF VARIOUS PHYSICAL SECURITY SYSTEMS

6 TURKEY CYBER SECURITY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SERVICES

6.3 SOLUTIONS/SOFTWARE

7 TURKEY PHYSICAL SECURITY MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 VIDEO SURVEILLANCE SYSTEM

7.2.1.1 CAMERAS

7.2.1.2 RECORDERS

7.2.2 PHYSICAL ACCESS CONTROL SYSTEM

7.2.2.1 BIOMETRICS

7.2.2.2 LOCKS

7.2.2.2.1 ELECTRONIC LOCKS

7.3 SERVICES

7.3.1 MANAGED SERVICES

7.3.2 PROFESSIONAL SERVICES

7.4 SOFTWARE

8 TURKEY PHYSICAL SECURITY MARKET, BY AUTHENTICATION

8.1 OVERVIEW

8.2 SINGLE- FACTOR AUTHENTICATION

8.3 TWO- FACTOR AUTHENTICATION

8.4 THREE- FACTOR AUTHENTICATION

9 TURKEY CYBER SECURITY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 IDENTITY AND ACCESS MANAGEMENT

9.3 DATA SECURITY AND PRIVACY SERVICE OFFERING

9.4 GOVERNANCE RISK AND COMPLIANCE

9.5 UNIFIED VULNERABILITY MANAGEMENT SERVICE OFFERING

9.6 OTHERS

10 TURKEY CYBER SECURITY MARKET, BY SECURITY TYPE

10.1 OVERVIEW

10.2 INFRASTRUCTURE SECURITY

10.3 NETWORK SECURITY

10.4 APPLICATION SECURITY

10.5 CLOUD SECURITY

10.6 ENDPOINT SECURITY

10.7 OTHERS

11 TURKEY PHYSICAL AND CYBER SECURITY MARKET, BY DEPLOYMENT MODEL

11.1 OVERVIEW

11.2 ON-PREMISE

11.3 CLOUD

12 TURKEY PHYSICAL AND CYBER SECURITY MARKET, BY ENTERPRISE SIZE

12.1 OVERVIEW

12.2 LARGE SIZED ENTERPRISES

12.3 SMALL AND MEDIUM-SIZED ENTERPRISES

13 TURKEY PHYSICAL AND CYBER SECURITY MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.3 GOVERNMENT

13.4 INDUSTRIAL

13.5 RESIDENTIAL

14 TURKEY CYBER SECURITY MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: TURKEY

15 TURKEY PHYSICAL SECURITY MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: TURKEY

16 SWOT ANALYSIS

16.1 DBMR ANALYSIS

16.1.1 STRENGTH

16.1.2 WEAKNESS

16.1.3 THREATS

16.1.4 OPPORTUNITY

17 COMPANY PROFILE

17.1 THALES GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCTS PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 ACCENTURE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 SERVICE PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 IDEMIA

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENTS

17.5 BAE SYSTEMS

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 SERVICE PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 FORTINET, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 SERVICE PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 PALO ALTO NETWORKS

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 AWARE, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AXIS COMMUNICATIONS AB

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 BOSCH SICHERHEITSSYSTEME GMBH

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCTS PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 CHECK POINT SOFTWARE TECHNOLOGIES LTD.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCTS PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 CISCO SYSTEMS, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCTS PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HEXAGON AB

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 OFFERING PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 HID GLOBAL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 IBM CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCTS PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 JOHNSON CONTROL

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCTS PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 JUNIPER NETWORKS, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCTS PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 MCAFEE, LLC

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCTS PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 MICRO FOCUS

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 MICROSOFT

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 ORACLE

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 SERVICE CATEGORY

17.21.4 RECENT DEVELOPMENT

17.22 PELCO CORPORATIONS

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCTS PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 RAPID7

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 SPLUNK INC.

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCTS PORTFOLIO

17.24.4 RECENT DEVELOPMENT

17.25 TREND MICRO INCORPORATED

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCTS PORTFOLIO

17.25.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 LIST OF LOCAL CYBER SECURITY PLAYERS

TABLE 2 LIST OF LOCAL PHYSICAL SECURITY PLAYERS

TABLE 3 TURKEY CYBER SECURITY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 4 TURKEY SERVICES IN CYBER SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 TURKEY SOLUTIONS/SOFTWARE IN CYBER SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 TURKEY PHYSICAL SECURITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 7 TURKEY HARWARE IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 TURKEY VIDEO SURVEILLANCE SYSTEM IN HARDWRAE PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 TURKEY CAMERAS IN VIDEO SURVEILLANCE SYSTEM PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 TURKEY RECORDERS IN VIDEO SURVEILLANCE SYSTEM PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 TURKEY PHYSICAL ACCESS CONTROL SYSTEM IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 TURKEY BIOMETRICS IN PHYSICAL ACCESS CONTROL SYSTEM PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 TURKEY LOCKS IN PHYSICAL ACCESS CONTROL SYSTEM PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 TURKEY ELECTRONIC LOCKS IN LOCKS PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 TURKEY SERVICES IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 TURKEY MANAGED SERVICES IN SERVICES PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 TURKEY PROFESSIONAL SERVICES IN SERVICES PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 TURKEY SOFTWARE IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 TURKEY PHYSICAL SECURITY MARKET, BY AUTHENTICATION, 2020-2029 (USD MILLION)

TABLE 20 TURKEY CYBER SECURITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 TURKEY CYBER SECURITY MARKET, BY SECURITY TYPE, 2020-2029 (USD MILLION)

TABLE 22 TURKEY PHYSICAL SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 23 TURKEY CYBER SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 24 TURKEY PHYSICAL SECURITY MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 25 TURKEY CYBER SECURITY MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 26 TURKEY LARGE SIZED ENTERPRISES IN PHYSICAL SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 27 TURKEY LARGE SIZED ENTERPRISES IN CYBER SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 28 TURKEY SMALL AND MEDIUM-SIZED ENTERPRISES IN PHYSICAL SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 29 TURKEY SMALL AND MEDIUM-SIZED ENTERPRISES IN CYBER SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 30 TURKEY PHYSICAL SECURITY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 TURKEY CYBER SECURITY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 TURKEY COMMERCIAL IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 TURKEY COMMERCIAL IN CYBER SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 TURKEY INDUSTRIAL IN PHYSICAL SECURITY MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 35 TURKEY INDUSTRIAL IN CYBER SECURITY MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 36 TURKEY RESIDENTIAL IN PHYSICAL SECURITY MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 37 TURKEY RESIDENTIAL IN CYBER SECURITY MARKET, BY TYPE 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 TURKEY PHYSICAL AND CYBER SECURITY MARKET: SEGMENTATION

FIGURE 2 TURKEY PHYSICAL AND CYBER SECURITY MARKET: DATA TRIANGULATION

FIGURE 3 TURKEY PHYSICAL AND CYBER SECURITY MARKET: DROC ANALYSIS

FIGURE 4 TURKEY PHYSICAL SECURITY MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 TURKEY CYBER SECURITY MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 6 TURKEY PHYSICAL AND CYBER SECURITY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 TURKEY PHYSICAL AND CYBER SECURITY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 TURKEY PHYSICAL SECURITY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 TURKEY CYBER SECURITY MARKET: DBMR MARKET POSITION GRID

FIGURE 10 TURKEY CYBER SECURITY MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 TURKEY PHYSICAL SECURITY MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 TURKEY PHYSICAL SECURITY MARKET: MARKET END USER COVERAGE GRID

FIGURE 13 TURKEY CYBER SECURITY MARKET: MARKET END USER COVERAGE GRID

FIGURE 14 TURKEY CYBER SECURITY MARKET: SEGMENTATION

FIGURE 15 TURKEY PHYSICAL SECURITY MARKET: SEGMENTATION

FIGURE 16 AN INCREASE IN CLOUD SERVICES CYBER AND PHYSICAL SECURITY SOLUTIONS IS EXPECTED TO DRIVE TURKEY PHYSICAL SECURITY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 17 EMERGENCE OF SMART INTERCONNECTED BUILDING/HOME IS EXPECTED TO DRIVE TRUKEY CYBER SECURITY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 18 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF TURKEY CYBER SECURITY MARKET IN THE FORECASTED PERIOD OF 2022 & 2029

FIGURE 19 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF TURKEY PHYSICAL SECURITY MARKET IN THE FORECASTED PERIOD OF 2022 & 2029

FIGURE 20 VALUE CHAIN FOR PHYSICAL AND CYBER SECURITY MARKET

FIGURE 21 PORTERS FIVE FORCES ANALYSIS FOR PHYSICAL AND CYBER SECURITY MARKET

FIGURE 22 PESTLE ANALYSIS FOR PHYSICAL AND CYBER SECURITY MARKET

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF TURKEY PHYSICAL AND CYBER SECURITY MARKET

FIGURE 24 KEY STATS OF REMOTE WORK

FIGURE 25 GROWING PREVALENCE OF BIOMETRIC SOLUTIONS AMONG CONSUMER

FIGURE 26 TECHNOLOGY AMALGAMATION IN SMART HOME/ BUILDINGS

FIGURE 27 IMPACT OF CYBER SECURITY THREAT

FIGURE 28 PHISHING ATTACKS REPORTED IN RESPECTIVE COUNTRIES IN Q2, 2021

FIGURE 29 TURKEY CYBER SECURITY MARKET, BY OFFERING, 2021

FIGURE 30 TURKEY PHYSICAL SECURITY MARKET, BY COMPONENT, 2021

FIGURE 31 TURKEY PHYSICAL SECURITY MARKET, BY AUTHENTICATION, 2021

FIGURE 32 TURKEY CYBER SECURITY MARKET: BY APPLICATION, 2021

FIGURE 33 TURKEY CYBER SECURITY MARKET: BY SECURITY TYPE, 2021

FIGURE 34 TURKEY PHYSICAL SECURITY MARKET, BY DEPLOYMENT MODEL, 2021

FIGURE 35 TURKEY CYBER SECURITY MARKET, BY DEPLOYMENT MODEL, 2021

FIGURE 36 TURKEY PHYSICAL SECURITY MARKET, BY ENTERPRISE SIZE, 2021

FIGURE 37 TURKEY CYBER SECURITY MARKET, BY ENTERPRISE SIZE, 2021

FIGURE 38 TURKEY PHYSICAL SECURITY MARKET: BY END USER, 2021

FIGURE 39 TURKEY CYBER SECURITY MARKET: BY END USER, 2021

FIGURE 40 TURKEY CYBER SECURITY MARKET: COMPANY SHARE 2021 (%)

FIGURE 41 TURKEY PHYSICAL SECURITY MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.