Thailand Automotive Logistics Market Analysis and Size

Service providers were continuously trying to find out ways to increase the precision of work, enhanced services, safety, and work with growing technology. The requirement for these reasons is being fulfilled through the implementation of automotive logistics as they are used to provide enhanced, uninterrupted free, and timely services at the industrial operations. Automotive logistics in various industries is being used widely due to the rising demand for customer experience. It enables industries to enhance their operations and productivity. automotive logistics help end-users by providing better-automated solutions without human interference and delivering a better driving experience. The Thailand automotive logistics market is in a growth phase rapidly due to the growing demand for electrifications in vehicles which drives the demand for automotive logistics. The companies are even launching new products to gain a larger market share.

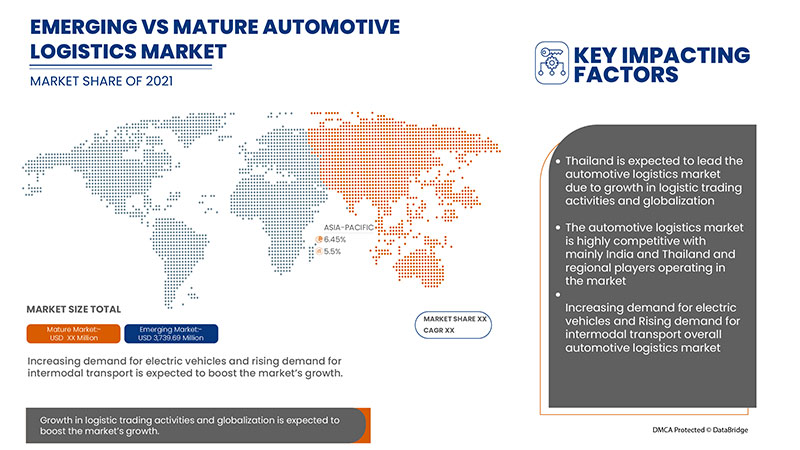

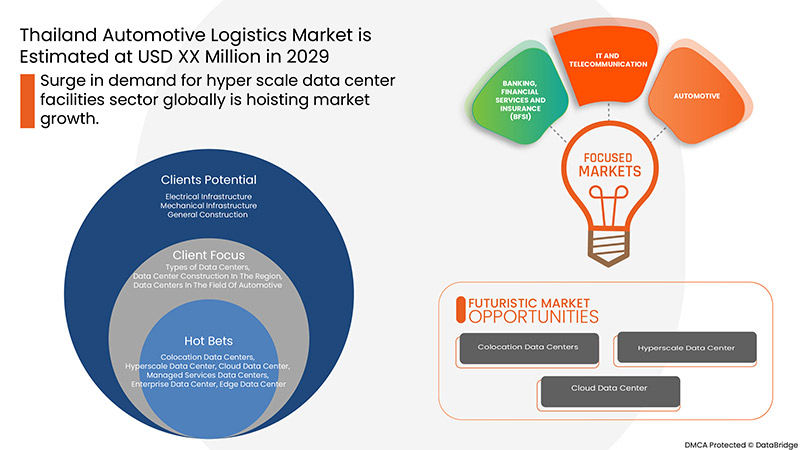

Data Bridge Market Research analyses that the automotive logistics market is expected to reach the value of USD 3,739.69 million by 2029, at a CAGR of 5.5% during the forecast period. Outbound Logistics accounts for the largest offering segment in the automotive logistics market. Thailand service provides accurate information which is utilized to develop high precision IoT networks. The automotive logistics market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Operations (Outbound Logistics, Aftermarket, Integrated Services and Others), Enterprise Size (Large Scale Organization, Semi-Urban Mid-Scale Organizations and Small Scale Organizations), Vehicle Type (Heavy Duty Vehicles, Commercial Vehicles and Passenger Cars), Technology (IoT In Logistics, Artificial Intelligence & Machine Learning, RFID, Analytics & Big Data and Others), Distribution (Domestics, Local and International), Application (Roadways and Railways) |

|

Countries Covered |

Thailand |

|

Market Players Covered |

NYK Line, APL Logistics VASCOR Automotive (PVT) Ltd., TVS Supply Chain Solutions, Mahindra Logistics Ltd, TCI Supply Chain Solutions, V-TRANS, Adani Group, DSV, CEVA Logistics, KERRY LOGISTIC NETWORK LIMITED, Schenker AG, A.P. Moller-Maersk, hellmann WORLDWIDE LOGISTICS among others. |

Market Definition

Automotive logistics is a complex, elevated distribution network in which all stages are well connected. All transportation businesses across the globe regard it as the most difficult and skilled area. The mechanization and sophistication of the automotive supply chain should be enriched by implementing modern logistical technologies, allowing us to reach our aim of cost management and quality enhancement, resulting in total advantages and increased overall effectiveness. The logistics planning and management activities of the automotive supply chain are integrated from the source of the components to the final user. The automotive supply chain uses organizational structure, with automotive components suppliers and completed automobile manufacturers, car dealers at all tiers, and final consumers all integrated into one system via feedforward and feedback information flow, the flow of capital, and logistical data. The activities relates to the operations of supplying automobile manufacturing companies with raw resources, components, and other supplies. The delivery of raw materials and components from producers until the commencement of automobile manufacturing operation is known as automotive supply logistics. Automotive supply logistics can help keep the manufacturing, transit, and purchase of automobiles moving forward. It is necessary to decrease costs, raise revenue in the supply chain, and maintain the effective management of logistical operations while guaranteeing the availability of materials.

Automotive Logistics Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Growth in logistic trading activities and globalization

Globalization can be referred to as the interdependence of the world’s economies, populations and cultures brought together by cross-border trade in technology, goods, and others. Today, most of the country’s economy is highly dependent on buying and selling of goods in various countries. Asia-Pacific, North America region has been the major players in global trade and has a high volume of trade flow that has increased the requirement of logistics service providers to make the flow of trade more convenient and faster, thus boosting the growth in the logistics market for Asia-Pacific region followed by other regions.

- Increasing demand for electric vehicles

Electric vehicles (EVs) are designed to be a promising technology to achieve sustainable transportation with zero carbon emissions, low noise, and high efficiency. Moreover, electric vehicles were evolve in the 19th century but due to a lack of advancement in technology internal combustion engine vehicles had a huge demand compared to electric vehicles. During the 20th century, technological advancement boosted year over year and resulted from developments and innovations which has helped to reshape electric vehicles.

- Rising logistics and inventory cost

Logistics has complex operational procedures due to fast-growing sales, outsourcing fulfillment operations to a third party logistics (3PL). The two important variables on which the logistics cost depends are time and volume. Information about logistics in transit is important for ensuring higher efficiency and economies of scale are being achieved by any organization or country.

- Shifting companies preference toward outbound logistics

Outbound logistics is the process that connects companies to their customers. The process allows producers to move their products to strategic locations. The figure describes the process involved in outbound logistics. The company buys the product from suppliers in the market and then the products are outbound to customers.

The companies are shifting their preference towards outbound logistics because it has a direct and less complex process for the delivery of products to the consumers. Outbound logistics are being preferred by most companies because for outbound logistics warehouse management and storage are well planned as per the requirement. The inventory is well managed by suppliers, transportation, and last-minute delivery is well planned and managed.

- Increasing penetration of cloud, big data, and Internet of thing (Iot) in the automotive logistic vehicles

Cloud computing has turned out to be a major driving force for digital transformation across logistic industries. Not only does it provide unparalleled agility but also reduces operational and management overheads. Citing this, several governments and businesses are starting to leverage this technology and it is slowly gaining popularity across several verticals. The potential has become so open that the notion of the cloud is limited to only IT functions has completely changed. This is further integrated with other technologies such as Artificial Intelligence (AI), IoT, and edge computing among others.

- High transportation costs for international trade

Logistics are the backbone of any economy, the logistic industry in Thailand is growing rapidly. Logistics has become important as it may lead to a reduction in operational cost, improved delivery performance, and can increase customer satisfaction levels. Logistics that are being traded internationally are important for the management of the flow of products from one place to another.

Post COVID-19 Impact on Automotive Logistics Market

COVID-19 created a major impact on the automotive logistics market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the automotive logistics market is because of the advent of the electric vehicles in recent times due to the promotion by many government organizations for the use of electric vehicles to reduce the emissions. However, the COVID-19 had an adverse effect on the automotive logistics market as the sales and logistic operations of the vehicles and in many countries was on halt and most of the companies had shut their operations temporarily for nearly about months.

Moreover, after the pandemic situation consumer were not willing to buy new vehicles because of the disrupted economy in many countries which directly affected the sales and logistic growth of automotive and resulted impacting the automotive logistics market growth.

Recent Development

- In March 2022, CEVA Logistics announced the partnership with Kodiak Robotics, Inc. This partnership will help the company to develop better logistics solution such as Autonomous freight deliveries, and diversifies the company’s solution portfolio and attracts new customers.

In February 2022, A.P. Moller – Maersk announced the acquisition of pilot Freight Services. This acquisition will help the company to extend the integrated logistics offerings and allows new services to evolve which increases cross-selling opportunities

Thailand Automotive Logistics Market Scope

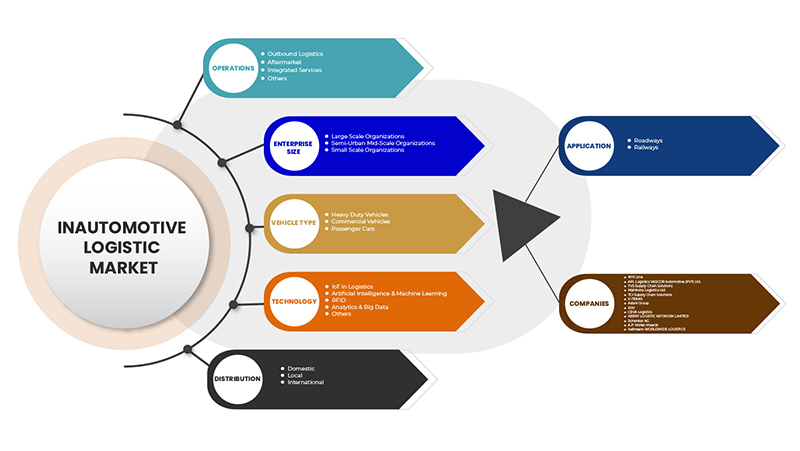

The automotive logistics market is segmented on the basis of operations, enterprise size, vehicle type, technology, distribution, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Operations

- Outbound Logistics

- Aftermarket

- Integrated Services

- Others

On the basis of offering, the Thailand automotive logistics market is segmented into outbound logistics, aftermarket, integrated services and others.

Enterprise Size

- Large Scale Organizations

- Semi-Urban Mid-Scale Organizations

- Small Scale Organizations

On the basis of enterprise size, the Thailand automotive logistics market has been segmented into large scale organization, semi-urban mid-scale organizations and small scale organizations.

Vehicle Type

- Heavy Duty Vehicles

- Commercial Vehicles

- Passenger Cars

On the basis of vehicle type, the Thailand automotive logistics market has been segmented into heavy duty vehicles, commercial vehicles and passenger cars.

Technology

- IoT In Logistics

- Artificial Intelligence & Machine Learning

- RFID

- Analytics & Big Data

- Others

On the basis of technology, the Thailand automotive logistics market has been segmented into IoT in logistics, artificial intelligence & machine learning, RFID, analytics & big data, and others.

Distribution

- Domestic

- Local

- International

On the basis of distribution, the Thailand automotive logistics market has been segmented into domestics, local and international.

Application

- Roadways

- Railways

On the basis of application, the Thailand automotive logistics market has been segmented into roadways and railways.

Competitive Landscape and Automotive Logistics Market Share Analysis

The automotive logistics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Thailand presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive logistics market.

Some of the major players operating in the automotive logistics market are NYK Line, APL Logistics VASCOR Automotive (PVT) Ltd., TVS Supply Chain Solutions, Mahindra Logistics Ltd, TCI Supply Chain Solutions, V-TRANS, Adani Group, DSV, CEVA Logistics, KERRY LOGISTIC NETWORK LIMITED, Schenker AG, A.P. Moller-Maersk, and hellmann WORLDWIDE LOGISTICS among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THAILAND AUTOMOTIVE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OPEARTIONS TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TRENDS FOR FUTURE DOMESTIC SALES AND EXPORT NUMBER

4.1.1 RANKING, SHARE OF LOGISTICS COMPANIES (THAILAND)

4.2 MARKET FREIGHT RATE LEVEL TRANSITION FOR ROAD AND RAIL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN LOGISTIC TRADING ACTIVITIES AND GLOBALIZATION

5.1.2 INCREASING DEMAND FOR ELECTRIC VEHICLES

5.1.3 RISING DEMAND FOR INTERMODAL TRANSPORT

5.2 RESTRAINTS

5.2.1 RISING LOGISTICS AND INVENTORY COST

5.2.2 POOR TRANSPORTATION INFRASTRUCTURE

5.3 OPPORTUNITIES

5.3.1 SHIFTING COMPANIES PREFERENCE TOWARD OUTBOUND LOGISTICS

5.3.2 INCREASING PENETRATION OF CLOUD, BIG DATA, AND INTERNET OF THING (IOT) IN THE AUTOMOTIVE LOGISTIC VEHICLES

5.3.3 INCREASING DEMAND FOR BLOCKCHAIN TECHNOLOGY IN LOGISTIC OPERATIONS

5.4 CHALLENGES

5.4.1 HIGH TRANSPORTATION COSTS FOR INTERNATIONAL TRADE

5.4.2 STRINGENT GOVERNMENT REGULATIONS FOR LOGISTICS

6 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS

6.1 OVERVIEW

6.2 OUTBOUND LOGISTICS

6.3 ORDER PROCESSING

6.4 PRODUCT PICKING & PACKING

6.5 SHIPMENT DISPATCH

6.6 AFTERMARKET

6.7 INTEGRATED SERVICES

6.8 OTHERS

7 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE

7.1 OVERVIEW

7.2 LARGE SCALE ORGANIZATIONS

7.3 SEMI-URBAN MID SCALE ORGANIZATIONS

7.4 SMALL SCALE ORGANIZATIONS

8 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE

8.1 OVERVIEW

8.2 HEAVY DUTY VEHICLES

8.3 PASSENGER CARS

9 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING

9.3 IOT IN LOGISTICS

9.4 ANALYTICS & BIG DATA

9.5 RFID

9.6 OTHERS

10 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION

10.1 OVERVIEW

10.2 DOMESTIC

10.3 LOCAL

10.4 INTERNATIONAL

11 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ROADWAYS

11.3 RAILWAYS

12 THAILAND

12.1 THAILAND

13 THAILAND AUTOMOTIVE LOGISTICS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: THAILAND

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 DSV

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ADANI GROUP

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 MAHINDRA LOGISTICS LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 NYK LINE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 CEVA LOGISTICS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 A.P. MOLLER - MAERSK

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 APL LOGISTICS VASCOR AUTOMOTIVE (PVT) LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 HELLMANN WORLDWIDE LOGISTICS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 KERRY LOGISTIC NETWORK LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 SCHENKER AG

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 TCI SUPPLY CHAIN SOLUTIONS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 TVS SUPPLY CHAIN SOLUTIONS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 V-TRANS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS, 2020-2029 (USD MILLION)

TABLE 2 THAILAND OUTBOUND LOGISTICS IN AUTOMOTIVE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 4 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 5 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION, 2020-2029 (USD MILLION)

TABLE 7 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS, 2020-2029 (USD MILLION)

TABLE 9 THAILAND OUTBOUND LOGISTICS IN AUTOMOTIVE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 11 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 12 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION, 2020-2029 (USD MILLION)

TABLE 14 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 THAILAND AUTOMOTIVE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 THAILAND AUTOMOTIVE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 THAILAND AUTOMOTIVE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 THAILAND AUTOMOTIVE LOGISTICS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 THAILAND AUTOMOTIVE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THAILAND AUTOMOTIVE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 THAILAND AUTOMOTIVE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 THAILAND AUTOMOTIVE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 THAILAND AUTOMOTIVE LOGISTICS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 THAILAND AUTOMOTIVE LOGISTICS MARKET: SEGMENTATION

FIGURE 11 GROWTH IN LOGISTIC TRADING ACTIVITIES AND GLOBALIZATION IS EXPECTED TO DRIVE THAILAND AUTOMOTIVE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OPERATIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THAILAND AUTOMOTIVE LOGISTICS MARKET IN 2022 & 2029

FIGURE 13 AUTOMOTIVE SALES TREND IN INDIA

FIGURE 14 CAR SALES TREND OF THAILAND IN JANUARY MONTH

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THAILAND AUTOMOTIVE LOGISTICS MARKE

FIGURE 16 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY OPERATIONS, 2021

FIGURE 17 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 18 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE

FIGURE 19 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY TECHNOLOGY, 2021

FIGURE 20 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY DISTRIBUTION, 2021

FIGURE 21 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY APPLICATION, 2021

FIGURE 22 THAILAND AUTOMOTIVE LOGISTICS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.