Spain and Portugal Distributed Antenna System (DAS) Market Analysis and Size

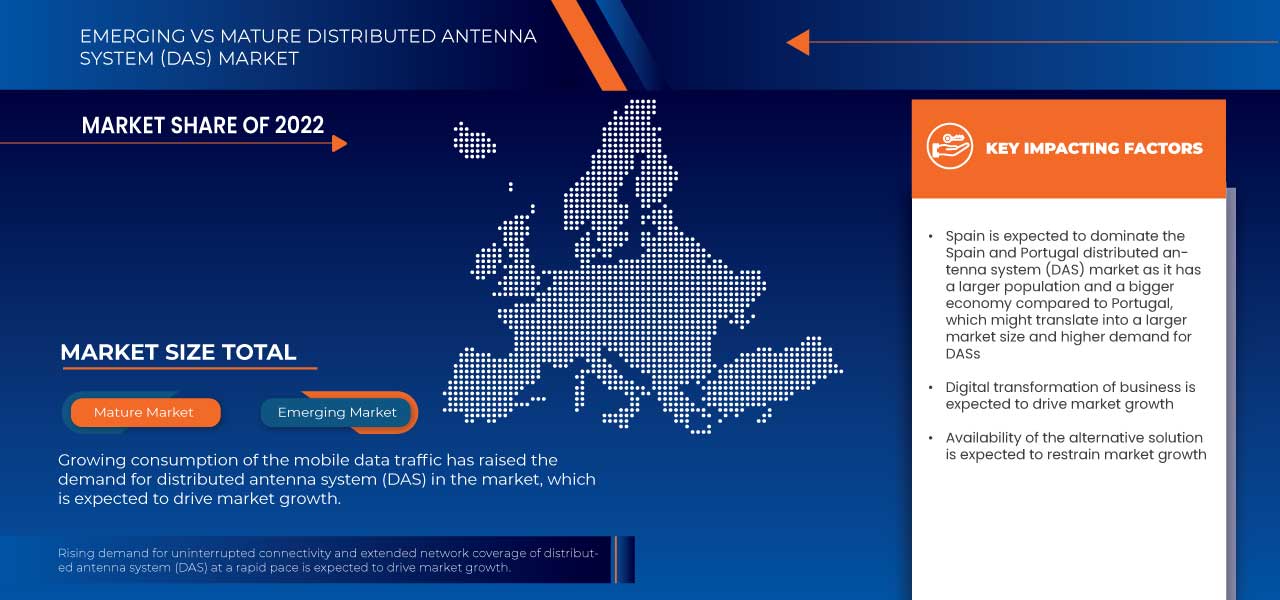

Major factors expected to boost the growth of the distributed antenna system (DAS) market in the forecast period are increasing digitalization, smartphone consumption, and techno savvy population is augmenting the market growth by creating demand for the enhanced network connectivity solution. The rising use of mobile data on devices is driving the market growth to provide advanced service to network providers. Businesses are adopting distributed antennas systems (DAS) which is accelerating the service adoption and penetration of the market globally.

Data Bridge Market Research analyses that Spain distributed antenna system (DAS) market is expected to reach the value of USD 657,839.01 million by 2030, at a CAGR of 11.2% and Portugal distributed antenna system (DAS) market is expected to reach the value of USD 59,434.92 million by 2030, at a CAGR of 8.5% during the forecast period. The distributed antenna system (DAS) market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in Thousand, Pricing in USD |

|

Segments Covered |

Offering (Hardware and Services), Coverage (Indoor and Outdoor), Ownership (Carrier, Neutral Host, and Enterprise), Technology (Carrier WI-FI and Small Cells), User Facility (>500K FT2, 200K-500KFT2, <200K FT2), Vertical (Commercial, Public Safety) |

|

Countries Covered |

Spain and Portugal |

|

Market Players Covered |

TE Connectivity (Switzerland), ATC TRS V LLC. (U.S.), Corning Incorporated. (U.S.), Cellnex (Spain), AT&T (U.S.), Comba Telecom Systems Holdings Ltd (China), HUBER+SUHNER (Switzerland), Anixter Inc. (U.S.), DigitalBridge Group (U.S.), Inc, Axians (Germany), Honeywell International Inc (U.S.), CommScope, Inc. (U.S.), Harris Communications (U.S.), JMA Wireless (U.S.), among others. |

Market Definition

The distributed antenna system (DAS) refers to that encompasses the design, installation, and maintenance of a network of interconnected antennas used to improve wireless communication coverage and capacity in indoor or outdoor environments. A DAS is a network of antennas that are strategically distributed throughout a given area to enhance signal strength and quality for mobile devices, such as smartphones, tablets, and other wireless devices.

DAS technology is commonly employed in various settings where reliable and high-quality wireless connectivity is essential, including large buildings, stadiums, airports, hospitals, shopping malls, campuses, and other public venues. It provides an efficient solution to address challenges related to poor wireless coverage, dead zones, and capacity limitations in congested areas.

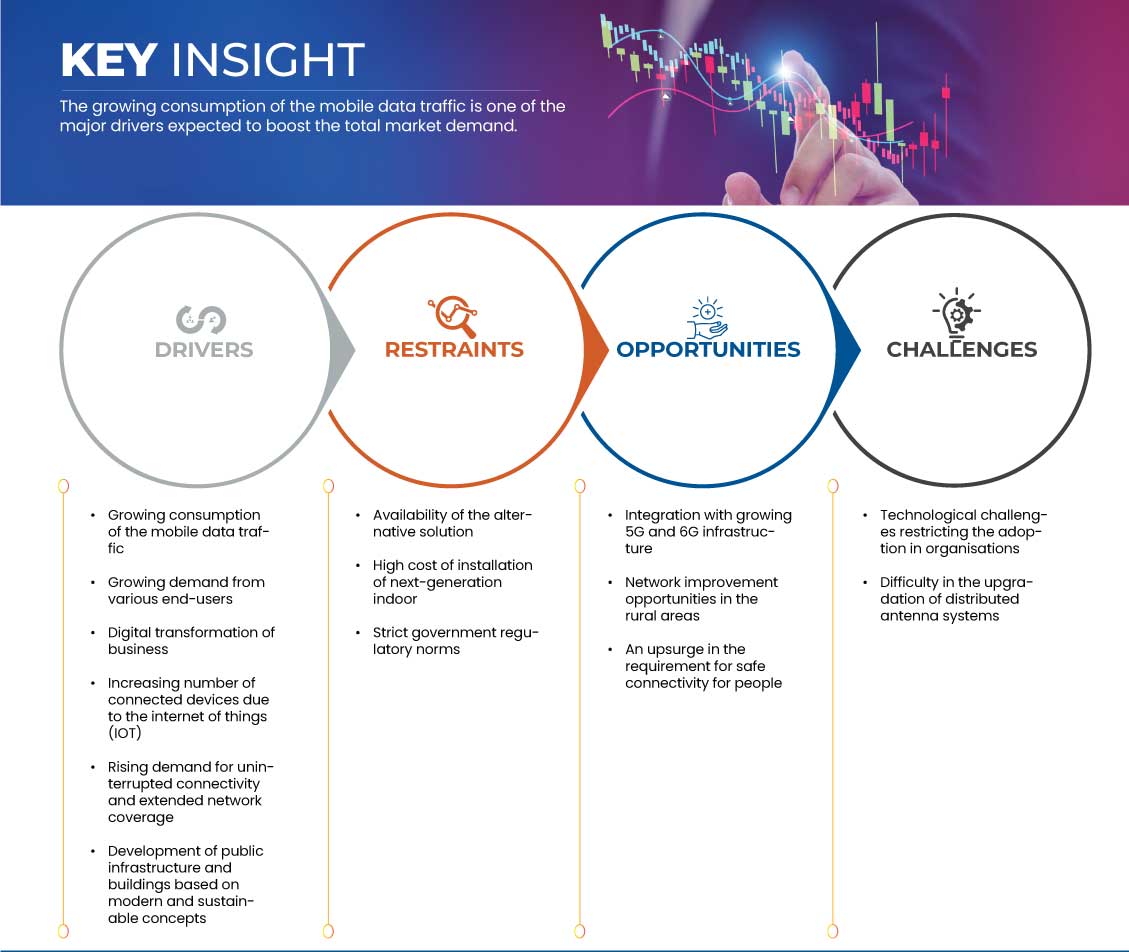

Spain and Portugal Distributed Antenna System (DAS) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growing Demand from the Various End-Users

The growing demand from different types of users is fuelling the expansion of the distributed antenna system (DAS) market in Spain and Portugal. As more people rely on mobile data, industries like telecommunications, businesses, public venues, healthcare facilities, and transportation sectors require better network coverage and capacity. DAS systems provide a solution by improving connectivity in crowded areas and ensuring reliable wireless communication. This increasing demand from diverse users drives the adoption of DAS technology, leading to market growth and improved wireless experiences for everyone.

- Digital Transformation of Business

Transforming the business digitally is becoming the essential trend in the current scenarios as it reduces the process timings, improves the security, and, mainly, the service for customers. Companies are improving their IT infrastructure to meet the emerging need for data analysis, management, and storage. Customers are becoming techno-savvy as technology is offering ease in operations. Businesses are investing in digital technology adoption to meet this emerging need for advanced technology-based services. To ensure safety and security while transforming the business, companies are creating demand for the advanced network connectivity solution for data transfer which is driving market growth. The companies are adopting DAS technology to improve internal communication and connectivity for data transfer.

Opportunity

- Network Improvement Opportunities in the Rural Areas

The rural area is transforming towards digitalization worldwide, which creates a major opportunity for the market to increase its footprint and presence. The rising adoption of high-speed internet services is opening a tremendous opportunity for the market players to offer advanced solutions. Some of the market players, such as AT & T and corning corporation, is investing strongly in a rural area to enhance network service through distributed antenna systems (DAS). Nextivity is introducing Cel-FI QUATRA, active DAS hybrid technology and others.

Restraints/Challenges

- Availability of the Alternative Solution

Distributed antenna systems (DAS) are attracting the market by offering advanced network connectivity with high speed and wide-range coverage. Although, it has some limitations or restraining factors, such as high cost, owing to which some companies offer new alternative solutions for the customers. New technology developed from the alternative market players, such as signal boosters, next-generation indoor systems and others, are one of the major restraints which are limiting the market growth. The substitute competitors of the market are introducing advanced technology for the customers, which is hampering the market growth.

- Technological Challenges Restricting the Adoption in Organisations

Distributed antenna system (DAS) is gaining popularity owing to the enhanced connectivity offered by the technology, mostly for in-building application. The DAS system offers a powerful solution for the market to improve network connectivity but still has some technical challenges that need to be overcome. Increased numbers of antennas offer great coverage with high-speed bands, but it increases the price and creates a greater visual impact. Market players are offering the solution but have some restrictions or limitations, such as backhaul, upgradeability and others. These technical challenges are incurring the high cost of the system and complexity for the customers.

Recent Developments

- In July 2023, TE Connectivity was named in the top-ten ranking among the 2023 Fast Company Best Workplaces for Innovators, highlighting its global culture designed to empower teams and drive technological advancements. This helped the company solidify its reputation as a global leader in empowering teams and advancing technological trends, attracting top talent and fostering a culture of innovation.

- In June 2023, Cellnex significantly improved its ESG Risk Rating, securing second position in the telecommunications sector and achieving a rating of 11.2 points, indicating lower risk. The company has reduced its ESG risk by 55% since 2018, positioning itself as one of the leading global companies in sustainability. This accomplishment reaffirms Cellnex's commitment to sustainability and consistent efforts to enhance its ESG performance.

Spain and Portugal Distributed Antenna System (DAS) Market Scope

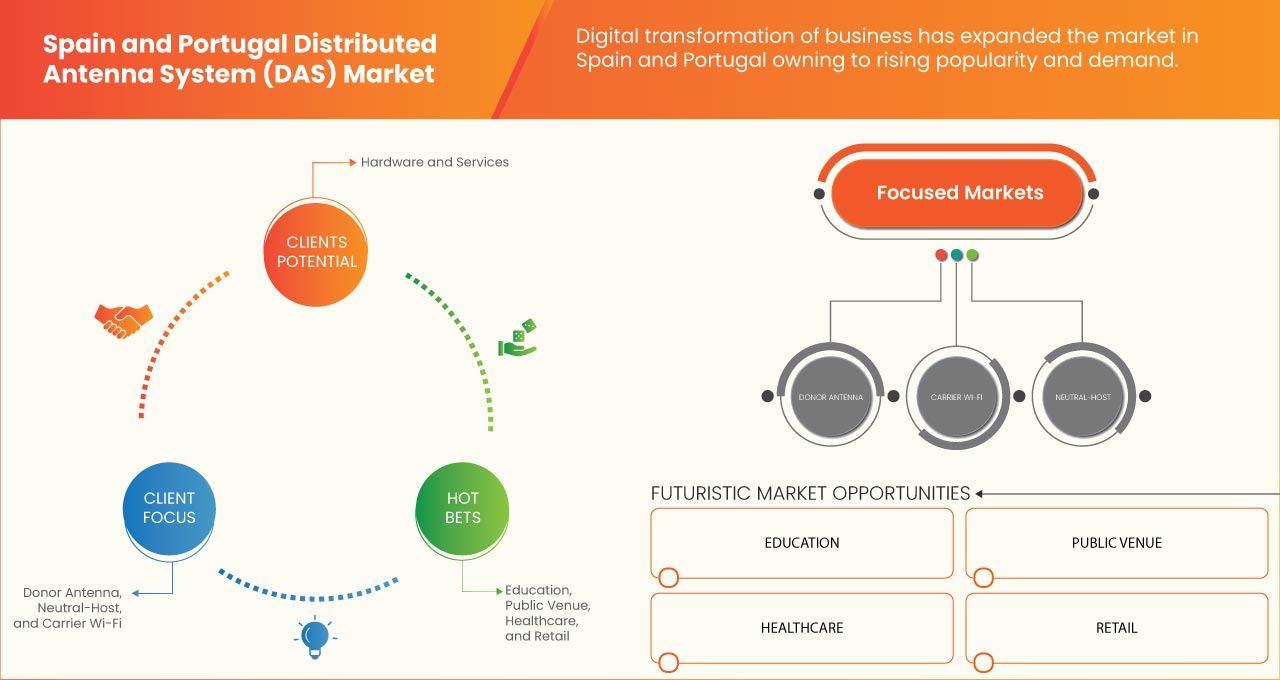

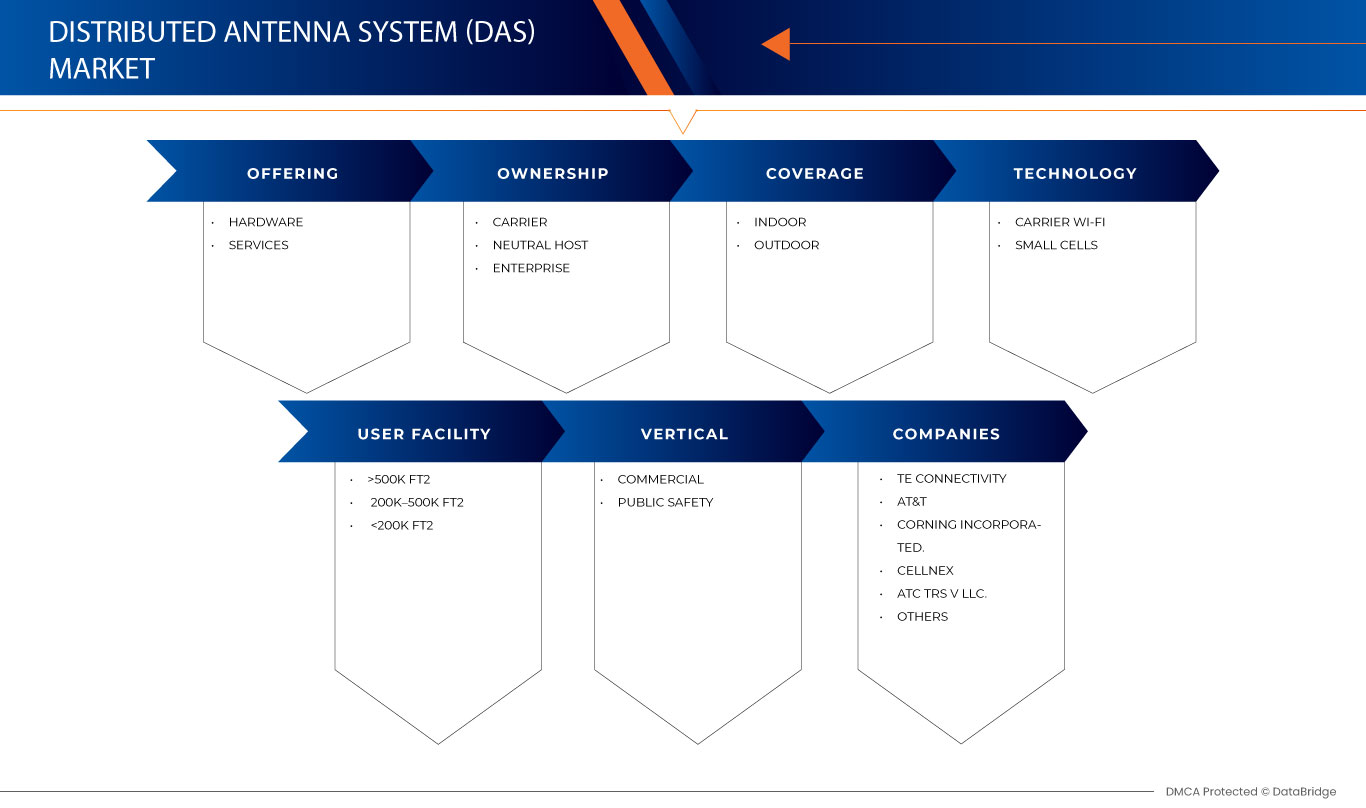

Spain and Portugal distributed antenna system (DAS) market is segmented on the basis of offering, coverage, ownership, technology, user facility and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Hardware

- Services

On the basis of offering, the Spain and Portugal distributed antenna system (DAS) market is segmented into hardware and services.

Coverage

- Indoor

- Outdoor

On the basis of coverage, the Spain and Portugal distributed antenna system (DAS) market is segmented into indoor and outdoor.

Ownership

- Carrier

- Neutral-Host

- Enterprise

On the basis of ownership, the Spain and Portugal distributed antenna system (DAS) market is segmented into carrier, neutral-host and enterprise.

Technology

- Carrier Wi-Fi

- Small Cells

On the basis of technology, the Spain and Portugal distributed antenna system (DAS) market is segmented into carrier Wi-Fi and small cells.

User Facility

- >500K FT2

- 200K–500K FT2

- <200K FT2

On the basis of user facility, the Spain and Portugal distributed antenna system (DAS) market is segmented into >500K FT2, 200K–500K FT2 and <200K FT2.

Vertical

- Commercial

- Public Safety

On the basis of vertical, the Spain and Portugal distributed antenna system (DAS) market is segmented into commercial and public safety.

Spain and Portugal Distributed Antenna System (DAS) Market Analysis/Insights

Spain and Portugal distributed antenna system (DAS) market is analysed, and market size insights and trends are provided by offering, coverage, ownership, technology, user facility and vertical.

The countries covered in the distributed antenna system (DAS) market report is Spain and Portugal.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Spain and Portugal brands and, the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Spain and Portugal Distributed Antenna System (DAS) Market Share Analysis

Spain and Portugal distributed antenna system (DAS) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Spain and Portugal presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Spain and Portugal distributed antenna system (DAS) market.

Some of the major players operating in Spain and Portugal distributed antenna system (DAS) market are TE Connectivity, ATC TRS V LLC., Corning Incorporated., Cellnex , AT&T, Comba Telecom Systems Holdings Ltd, HUBER+SUHNER, Anixter Inc., DigitalBridge Group, Inc, Axians, Honeywell International Inc, CommScope, Inc., Harris Communications, JMA Wireless.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 OFFERING LIFE-LINE CURVE

2.11 MARKET TECHNOLOGY COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET INFORMATION REGARDING MULTI-OPERATOR ACTIVE DAS AND ITS OPPORTUNITIES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC

6.1.2 GROWING DEMAND FROM VARIOUS END-USERS

6.1.3 DIGITAL TRANSFORMATION OF BUSINESS

6.1.4 INCREASING NUMBER OF CONNECTED DEVICES DUE TO THE INTERNET OF THINGS (IOT)

6.1.5 RISING DEMAND FOR UNINTERRUPTED CONNECTIVITY AND EXTENDED NETWORK COVERAGE

6.1.6 DEVELOPMENT OF PUBLIC INFRASTRUCTURE AND BUILDINGS BASED ON MODERN AND SUSTAINABLE CONCEPTS

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF THE ALTERNATIVE SOLUTION

6.2.2 HIGH COST OF INSTALLATION OF NEXT-GENERATION INDOOR

6.2.3 STRICT GOVERNMENT REGULATORY NORMS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION WITH GROWING 5G AND 6G INFRASTRUCTURE

6.3.2 NETWORK IMPROVEMENT OPPORTUNITIES IN THE RURAL AREAS

6.3.3 AN UPSURGE IN THE REQUIREMENT FOR SAFE CONNECTIVITY FOR PEOPLE

6.4 CHALLENGES

6.4.1 TECHNOLOGICAL CHALLENGES RESTRICTING THE ADOPTION IN ORGANISATIONS

6.4.2 DIFFICULTY IN THE UPGRADATION OF DISTRIBUTED ANTENNA SYSTEMS

7 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 ANTENNA NODES/ RADIO NODES

7.2.2 DONOR ANTENNA

7.2.3 BIDIRECTIONAL AMPLIFIERS

7.2.4 RADIO UNITS

7.2.5 HEAD END UNITS

7.2.6 OTHERS

7.3 SERVICES

7.3.1 INSTALLATION SERVICES

7.3.2 PRE-SALES SERVICES

7.3.3 POST-INSTALLATION SERVICES

8 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE

8.1 OVERVIEW

8.2 INDOOR

8.2.1 PASSIVE

8.2.2 ACTIVE

8.2.3 HYBRID

8.2.4 OTHERS

8.3 OUTDOOR

9 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP

9.1 OVERVIEW

9.2 NEUTRAL HOST

9.3 CARRIER

9.4 ENTERPRISE

10 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 CARRIER WI-FI

10.3 SMALL CELLS

11 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY

11.1 OVERVIEW

11.2 >500K FT2

11.3 200K–500K FT2

11.4 <200K FT2

12 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 COMMERCIAL

12.2.1 PUBLIC VENUE

12.2.2 AIRPORTS AND TRANSPORTATION

12.2.3 ENTERPRISES

12.2.3.1 LARGE ENTERPRISES

12.2.3.2 SMALL AND MEDIUM ENTERPRISES

12.2.4 INDUSTRIAL

12.2.5 RETAIL

12.2.6 GOVERNMENT

12.2.7 HOSPITALITY

12.2.8 HEALTHCARE

12.2.9 EDUCATION

12.2.10 SHIPS

12.3 PUBLIC SAFETY

13 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SPAIN

13.2 COMPANY SHARE ANALYSIS: PORTUGAL

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 TE CONNECTIVITY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ATC IP LLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 SERVICE PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 CORNING INCORPORATED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 APPLICATION PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 CELLNEX

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 AT&T

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ANIXTER INC. (A SUBSIDIARY OF WESCO INTERNATIONAL, INC.)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SOLUTION PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 AXIANS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 COMBA TELECOM SYSTEMS HOLDINGS LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 COMMSCOPE, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 DIGITALBRIDGE GROUP, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 BRAND PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 HARRIS COMMUNICATIONS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HONEYWELL INTERNATIONAL INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 HUBER+SUHNER

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 JMA WIRELESS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 3 SPAIN HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 PORTUGAL HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 SPAIN SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 PORTUGAL SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2021-2030 (USD THOUSAND)

TABLE 8 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2021-2030 (USD THOUSAND)

TABLE 9 SPAIN INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 PORTUGAL INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2021-2030 (USD THOUSAND)

TABLE 12 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2021-2030 (USD THOUSAND)

TABLE 13 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 14 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 15 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2021-2030 (USD THOUSAND)

TABLE 16 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2021-2030 (USD THOUSAND)

TABLE 17 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 18 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 19 SPAIN COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 PORTUGAL COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 SPAIN ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 PORTUGAL ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 2 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DATA TRIANGULATION

FIGURE 3 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DROC ANALYSIS

FIGURE 4 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 6 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET:

FIGURE 11 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET:

FIGURE 12 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MULTIVARIATE MODELLING

FIGURE 13 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: THE OFFERING LIFE-LINE CURVE

FIGURE 14 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: THE OFFERING LIFE-LINE CURVE

FIGURE 15 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET TECHNOLOGY COVERAGE GRID

FIGURE 16 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET TECHNOLOGY COVERAGE GRID

FIGURE 17 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SEGMENTATION

FIGURE 18 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC IS EXPECTED TO DRIVE SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 19 GROWING DEMAND FROM THE VARIOUS END USERS IS EXPECTED TO DRIVE PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 20 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN 2023 AND 2030

FIGURE 21 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF PORTUGUAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN 2023 AND 2030

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 23 EASE OF DOING BUSINESS IN SPAIN DUE TO DIGITAL TRANSFORMATION

FIGURE 24 EASE OF DOING BUSINESS IN PORTUGAL DUE TO DIGITAL TRANSFORMATION

FIGURE 25 INDIVIDUALS USING THE INTERNET (% OF POPULATION) - SPAIN

FIGURE 26 INDIVIDUALS USING THE INTERNET (% OF POPULATION) – PORTUGAL

FIGURE 27 INCREASING URBAN POPULATION– SPAIN

FIGURE 28 INCREASING URBAN POPULATION– PORTUGAL

FIGURE 29 DISTRIBUTED ANTENNA SYSTEM (DAS) COST, USD

FIGURE 30 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING, 2022

FIGURE 31 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING, 2022

FIGURE 32 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COVERAGE, 2022

FIGURE 33 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COVERAGE, 2022

FIGURE 34 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OWNERSHIP, 2022

FIGURE 35 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OWNERSHIP, 2022

FIGURE 36 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY TECHNOLOGY, 2022

FIGURE 37 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY TECHNOLOGY, 2022

FIGURE 38 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY USER FACILITY, 2022

FIGURE 39 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY USER FACILITY, 2022

FIGURE 40 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY VERTICAL, 2022

FIGURE 41 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY VERTICAL, 2022

FIGURE 42 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: 2022 (%)

FIGURE 43 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: 2022 (%)

Spain And Portugal Distributed Antenna System Das Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Spain And Portugal Distributed Antenna System Das Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Spain And Portugal Distributed Antenna System Das Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.